Global IoT in Manufacturing Market Size, Share Report By Component (Hardware, Software Service), By Connectivity (Satellite Network, Cellular Network, Radio-Frequency Identification (RFID), Near-Field Communication (NFC), Others), By Application (Predictive Maintenance, Supply Chain Management, Quality Monitoring & Control, Asset Management, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154021

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

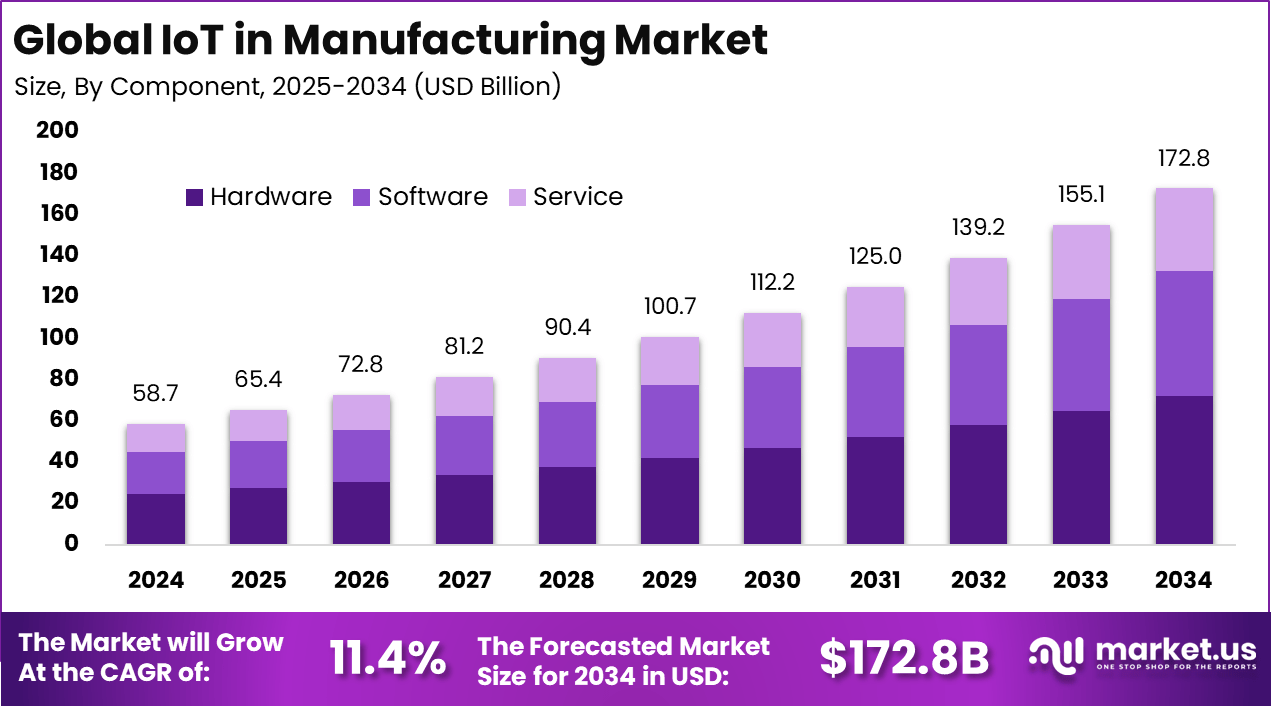

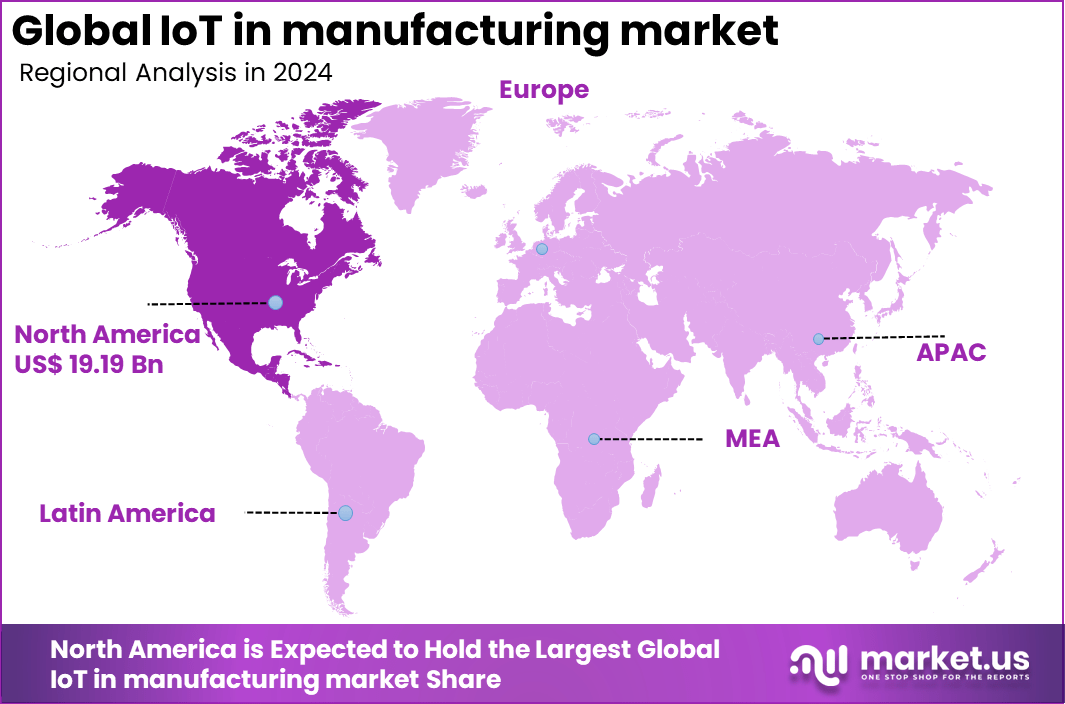

The Global IoT in manufacturing market size is expected to be worth around USD 172.8 billion by 2034, from USD 58.7 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.7% share, holding USD 19.19 billion in revenue.

IoT in manufacturing refers to the integration of connected sensors, devices, and industrial systems that communicate with analytics and cloud or edge computing platforms to support smart factory operations. This environment supports improved monitoring, control, and automation across production lines. IoT‑enabled cyber‑physical systems enable real‑time data flow from machines, enabling rapid decision making, operational responsiveness, and adaptation to production needs.

Demand is primarily emerging from the need to reduce unplanned maintenance costs through predictive maintenance, enhance asset management, and streamline production. A recent industry survey revealed that approximately 62 % of manufacturers have adopted IoT in some form within manufacturing or assembly lines, reflecting a steady increase in uptake

Market Size and Growth

Report Features Description Market Value (2024) USD 58.7 Bn Forecast Revenue (2034) USD 172.8 Bn CAGR(2025-2034) 11.4% Leading Segment Cellular Network: 43.5% Largest Market North America [32.7% Market Share] Largest Country US: USD 17.3 Bn Market Revenue, CAGR: 30.7% The growth of IoT adoption in manufacturing can be attributed to the pressure on firms to improve operational efficiency and automate tasks in response to global competition and rising complexity. Real‑time data insights allow firms to detect inefficiencies and reduce downtime. The push for resource optimisation, adaptability to customer demands, and leaner processes are primary motivational drivers.

For instance, in March 2025, CyberArk, Device Authority, and Microsoft announced a collaborative solution to enhance IoT security for manufacturers. By integrating Zero Trust principles, the platform automates secure device onboarding, identity credentialing, and encryption, reducing cyber risks associated with connected devices on factory floors and edge environments.

Key Takeaway

- In 2024, the global IoT in manufacturing market was valued at USD 58.7 billion and is projected to reach USD 172.8 billion by 2034, growing at a CAGR of 11.4% from 2025 to 2034.

- By component, hardware led the market with a 41.7% revenue share in 2024.

- By connectivity, the cellular network segment dominated with a 43.5% share.

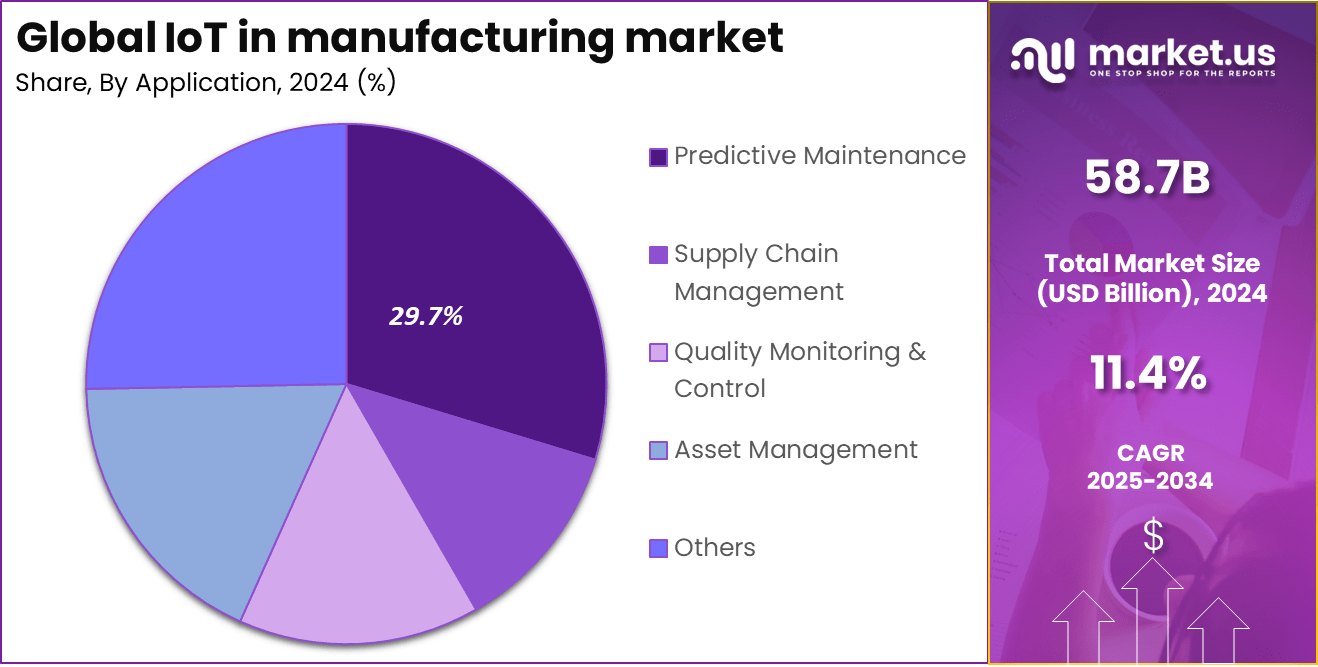

- By application, predictive maintenance accounted for 29.7% of the market share in 2024.

- North America held a dominant position with a 32.7% market share in 2024, generating USD 19.19 billion in revenue.

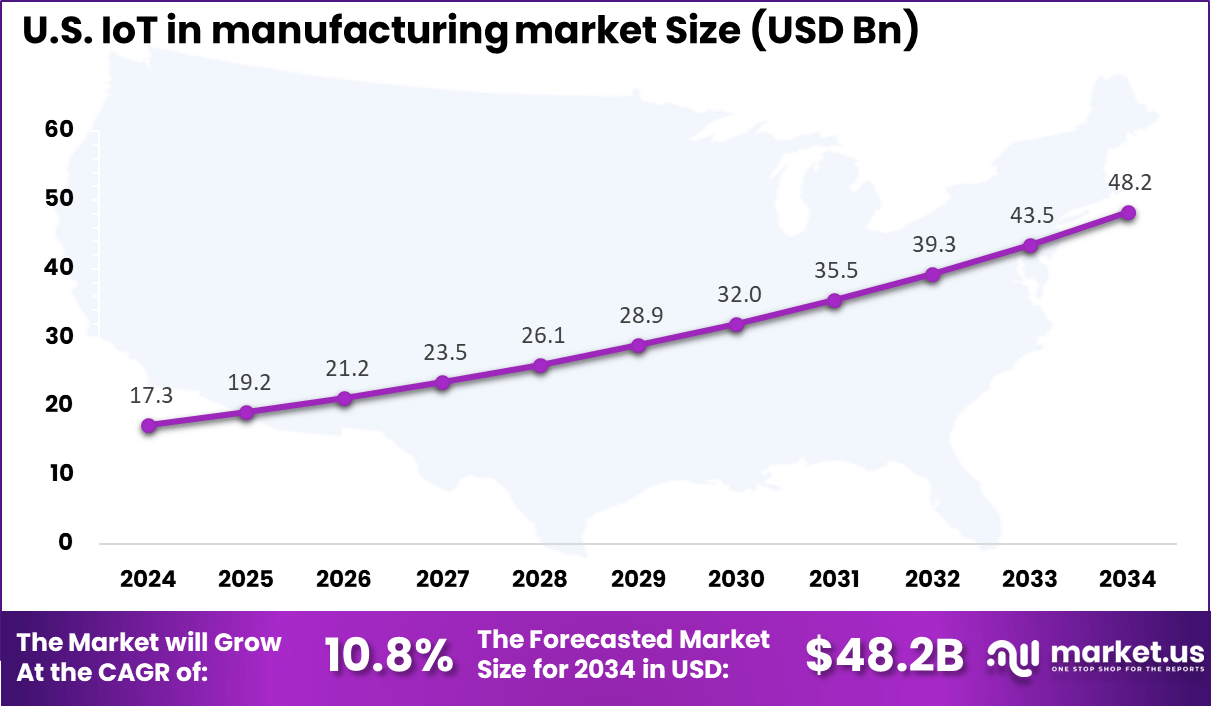

- The United States contributed USD 17.3 billion in 2024, with a projected CAGR of 10.8%.

Analysts’ Viewpoint

Investment opportunities in the U.S. IoT manufacturing market are growing, especially in areas like sensor networks, edge-to-cloud analytics, digital twins, and secure connectivity. Capital is also targeting sustainability applications, energy optimization, and smart asset tracking. New models such as private industrial 5G and Equipment-as-a-Service are creating fresh avenues for long-term returns.

The business benefits of IoT integration are clear. Companies have reported an 18% drop in energy use, 22% less downtime, and 15% better resource utilization. Predictive maintenance helps reduce breakdowns and can lower maintenance costs by up to 30%, while boosting equipment effectiveness.

Regulations around industrial IoT are still developing. Cybersecurity and data privacy rules are being shaped at national and global levels. Standards from IEEE, OPC Foundation, and others guide device communication and interoperability. While consumer IoT faces stricter oversight, industrial IoT policies are now beginning to address secure design and data protection.

United States Market Outlook

The U.S. IoT in manufacturing market is witnessing strong growth, currently valued at USD 17.3 billion with a projected CAGR of 10.8%. This expansion is driven by the growing need for automation and enhanced operational efficiency across production environments.

Manufacturers are increasingly adopting IoT solutions to streamline processes, cut costs, and enable real-time decision-making through advancements in 5G and edge computing technologies. U.S. manufacturing plants are leading in the adoption of smart technologies, shifting toward connected and data-driven systems. This transition supports greater productivity, energy efficiency, and sustainability, aligned with broader digital transformation strategies.

For instance, in August 2024, Cisco and TD SYNNEX joined MxD (Manufacturing x Digital), a U.S.-based digital manufacturing and cybersecurity institute, to foster technology innovation in manufacturing. They established a collaborative space within MxD’s 22,000-square-foot research factory in Chicago, where they, alongside Intel, will showcase market-ready AI and IoT solutions.

In 2024, North America held a dominant market position in the Global IoT in manufacturing market, capturing more than a 32.7% share, holding USD 19.19 billion in revenue. This dominance is due to the growing demand for smart devices and ongoing research into AI and machine learning-based IoT solutions.

The adoption of industrial IoT for real-time data analytics, automation, and production optimization is accelerating. Additionally, government initiatives supporting smart infrastructure and the presence of key industry players enhance market growth. The region’s advanced infrastructure and strong focus on digital transformation in manufacturing drive operational efficiency and innovation, reinforcing its dominance in the market.

For instance, in June 2020, Hitachi and Microsoft announced a strategic alliance aimed at accelerating digital transformation in manufacturing and logistics across North America, Southeast Asia, and Japan. This collaboration integrates Hitachi’s Lumada IoT platform and HX Series industrial controllers with Microsoft’s Azure, Dynamics 365, and Microsoft 365, enabling predictive maintenance, process automation, and enhanced workforce productivity.

Component Analysis

In 2024, the Hardware segment held a dominant market position, capturing a 41.7% share of the Global IoT in manufacturing market. This dominance is due to the essential role hardware components play in enabling IoT connectivity, such as sensors, devices, and networking equipment.

These components are critical for real-time data collection, monitoring, and automation in manufacturing processes. The growing demand for smart manufacturing and automation has further fueled the need for advanced hardware, ensuring its continued market leadership.

For Instance, in September 2024, Intel and Amazon Web Services (AWS) announced a significant expansion of their partnership to co-develop custom AI chips tailored for AWS’s cloud infrastructure. The collaboration also highlights a growing trend of tech giants investing in specialized hardware to meet the increasing demands of AI-driven applications in various industries, including manufacturing.

Connectivity Analysis

In 2024, the Cellular Network segment held a dominant market position, capturing a 43.5% share of the Global IoT in manufacturing market. The demand is due to the rising need for reliable, high-speed communication across vast and dispersed manufacturing environments.

Cellular networks, including 5G, offer robust connectivity for real-time data transmission, supporting applications such as remote monitoring, predictive maintenance, and automation. The growing reliance on mobile and connected devices in smart manufacturing has further accelerated the adoption of cellular networks in the sector.

For instance, in June 2024, HPE introduced the HPE Aruba Networking Enterprise Private 5G, a comprehensive solution designed to simplify the deployment and management of private 5G networks. This innovation aims to provide reliable wireless coverage across expansive campuses and industrial environments, addressing the growing demand for high-performance connectivity in sectors such as manufacturing, healthcare, public venues, and education.

Application Analysis

In 2024, the Predictive Maintenance segment held a dominant market position, capturing a 29.7% share of the Global IoT in manufacturing market. This dominance is due to the increasing need for manufacturers to reduce unplanned downtime and extend the lifespan of their equipment.

IoT-enabled predictive maintenance uses real-time data and analytics to forecast equipment failures before they occur, allowing manufacturers to schedule repairs and replacements proactively. It helps optimize asset utilization, enhance operational efficiency, and extend the lifespan of critical machinery, driving its widespread adoption in the industry.

For Instance, In March 2023, Volvo Group deployed a new IoT network at its Lyon manufacturing plant in France to boost predictive maintenance and operational efficiency. The system extended beyond AGV tracking to include sensors for temperature, humidity, and pressure differences, helping monitor painting conditions and filter clogging. This upgrade improved overall manufacturing quality and performance.

Growth Factors

Key points Description Demand for Automation Manufacturers want to automate processes to cut costs, increase productivity, and reduce errors. Operational Efficiency Real-time monitoring and analysis helps companies streamline operations and improve output quality. Advancements in Technology Growth in 5G, artificial intelligence, and edge computing makes IoT implementation faster and more reliable. Predictive Maintenance IoT enables quick detection of equipment issues, minimizing unexpected downtime. Digital Transformation & Smart Factories Companies are shifting to new, data-driven ways of working with the help of IoT-enabled smart factories. Key Features and Latest Trends

Feature / Trend Description Real-Time Data IoT sensors provide live data on machines, products, and resources for faster decisions. Edge Computing Data is processed near the source, supporting real-time analytics and less reliance on cloud. AI and Machine Learning AI helps analyze IoT data for smarter automation, predictive maintenance, and quality control. Connected Workers IoT tools boost worker safety, training, and productivity by connecting people and devices. Digital Twins Virtual replicas of equipment or plants help monitor, simulate, and optimize production. Quality Control Automated inspection with IoT sensors reduces defects and product recalls. Drivers

Increased Automation

IoT accelerates automation in manufacturing by interconnecting machines, sensors, and devices within a unified network. This connection facilitates the immediate occurrence of changes and monitoring, which greatly enhances how things function.

Automated systems can replace manual labor in repetitive tasks, which reduces the need for human staff and decreases human error. Manufacturers can improve their processes, increase output, and complete tasks faster, resulting in more flexible and cost-effective operations.

For instance, In May 2024, Zebra Technologies highlighted its industrial automation innovations at Automate 2024, focusing on connected factory advancements. The company unveiled the Zebra FS42 scanner for complex tasks such as deep learning OCR and introduced the 3S Series 3D sensors, which use parallel structured light for precise 3D sensing of both stationary and moving objects.

Restraint

Fragmented Standards and Interoperability Issues

A major barrier limiting the restricting IoT adoption in manufacturing is the absence of universal communication standards. IoT devices often operate on different protocols, making system integration complex and slowing the creation of unified networks. This lack of standardization hampers seamless data exchange and delays measurable returns on investment.

Interoperability issues also raise concerns about vendor lock-in and future upgrade costs. Manufacturers are cautious about adopting technologies that may not align with existing or future systems, leading to fragmented architectures and inefficient data flows across platforms.

Opportunities

Smart Manufacturing

The rise of IoT presents a transformative opportunity for smart manufacturing. IoT enables the creation of smart factories, where machines and systems can autonomously monitor, adjust, and optimize production processes. The use of automation enables work to be done more quickly, products are better, and resources are utilized more efficiently due to the absence of the need for people to watch everything closely.

As IoT devices continuously collect data, manufacturers gain valuable insights that enable predictive maintenance, reduced downtime, and more precise control over production, fostering innovation and operational excellence.

For instance, in April 2025, Pegatron inaugurated its AI and 5G-powered smart manufacturing facility in Batam, Indonesia, marking a significant step in the country’s digital industrial transformation. This facility, operated by PT Pegaunihan Technology Indonesia, integrates advanced AI, automation, and 5G connectivity to enhance production efficiency and adaptability.

Challenges

Data Management

Handling the massive volumes of real-time data generated by IoT devices presents a significant challenge for manufacturers. Effective data management requires robust cloud infrastructure and advanced analytics capabilities to process and extract actionable insights.

Without the proper tools to manage this data influx, manufacturers risk experiencing delays, inefficiencies, and missed opportunities for optimization. The need for scalable, high-performance data systems is essential to leverage IoT’s full potential while ensuring that manufacturers can make informed, data-driven decisions.

For instance, In January 2025, IBM underscored the transformative impact of IoT on industry innovation, noting that traditional data centers face limitations in managing the volume and speed of IoT data. To overcome this, IBM promoted edge computing as a solution, enabling data processing near the source to reduce latency and improve real-time application performance.

Key Market Segments

By Component

- Hardware

- Software

- Service

By Connectivity

- Satellite Network

- Cellular Network

- Radio-Frequency Identification (RFID)

- Near-Field Communication (NFC)

- Others

By Application

- Predictive Maintenance

- Supply Chain Management

- Quality Monitoring & Control

- Asset Management

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The IoT in Manufacturing market is supported by key players who are actively driving digital transformation across industrial ecosystems. Companies like SAP SE, NEC Corporation, and IBM Corporation are leading in software solutions and cloud-based platforms that enable real-time analytics, predictive maintenance, and production optimization. These firms have leveraged AI and machine learning integration to increase operational efficiency.

In the hardware and automation segment, Zebra Technologies, General Electric, Intel Corporation, and Hewlett Packard Enterprise are advancing edge computing, data acquisition devices, and industrial sensors. Their contributions are crucial in building connected factory environments. By providing IoT-enabled equipment, these players ensure seamless communication between machines and systems.

A group of globally recognized manufacturers, including Honeywell International Inc., Huawei Technologies Co. Ltd., Dell Inc., Hitachi Ltd., Bosch Software Innovations GmbH, ABB Ltd., and Cisco Systems Inc., continue to expand their presence in the IoT in Manufacturing landscape. Their portfolios include industrial routers, robotics, automation software, and security solutions.

Top Key Players in the Market

- SAP SE

- NEC Corporation

- IBM Corporation

- Zebra Technologies

- General Electric

- Intel Corporation

- Hewlett Packard Enterprise

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Dell Inc.

- Hitachi Ltd.

- Bosch Software Innovations GmbH

- ABB Ltd.

- Cisco Systems Inc.

- Other Major Players

Recent Developments

- Samsara Inc. made headlines in June 2025 with the launch of its connected safety wearable for industrial workers. This smart device features over a year of battery life and is capable of detecting falls or accidents in real time, instantly notifying supervisors through Samsara’s cloud platform. With the wearable, Samsara extends digital protection to workers, especially in hazardous or remote environments.

- Honeywell introduced a new AI-driven smart building management platform in June 2025, designed to optimize energy use in large manufacturing facilities. This platform leverages advanced IoT and AI to enable real-time monitoring and intelligent control, helping manufacturers curb operational costs and improve sustainability.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software Service), By Connectivity (Satellite Network, Cellular Network, Radio-Frequency Identification (RFID), Near-Field Communication (NFC), Others), By Application (Predictive Maintenance, Supply Chain Management, Quality Monitoring & Control, Asset Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, NEC Corporation, IBM Corporation, Zebra Technologies, General Electric, Intel Corporation, Hewlett Packard Enterprise, Honeywell International Inc., Huawei Technologies Co. Ltd., Dell Inc., Hitachi Ltd., Bosch Software Innovations GmbH, ABB Ltd., Cisco Systems Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IoT in Manufacturing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

IoT in Manufacturing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- NEC Corporation

- IBM Corporation

- Zebra Technologies

- General Electric

- Intel Corporation

- Hewlett Packard Enterprise

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Dell Inc.

- Hitachi Ltd.

- Bosch Software Innovations GmbH

- ABB Ltd.

- Cisco Systems Inc.

- Other Major Players