Global IoT-Enabled ERP Platforms Market Size, Share Analysis Report By Component (Software, Services), By Deployment Model (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By End-User Industry (Manufacturing, Healthcare, Retail, Logistics and Transportation, Energy and Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152572

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

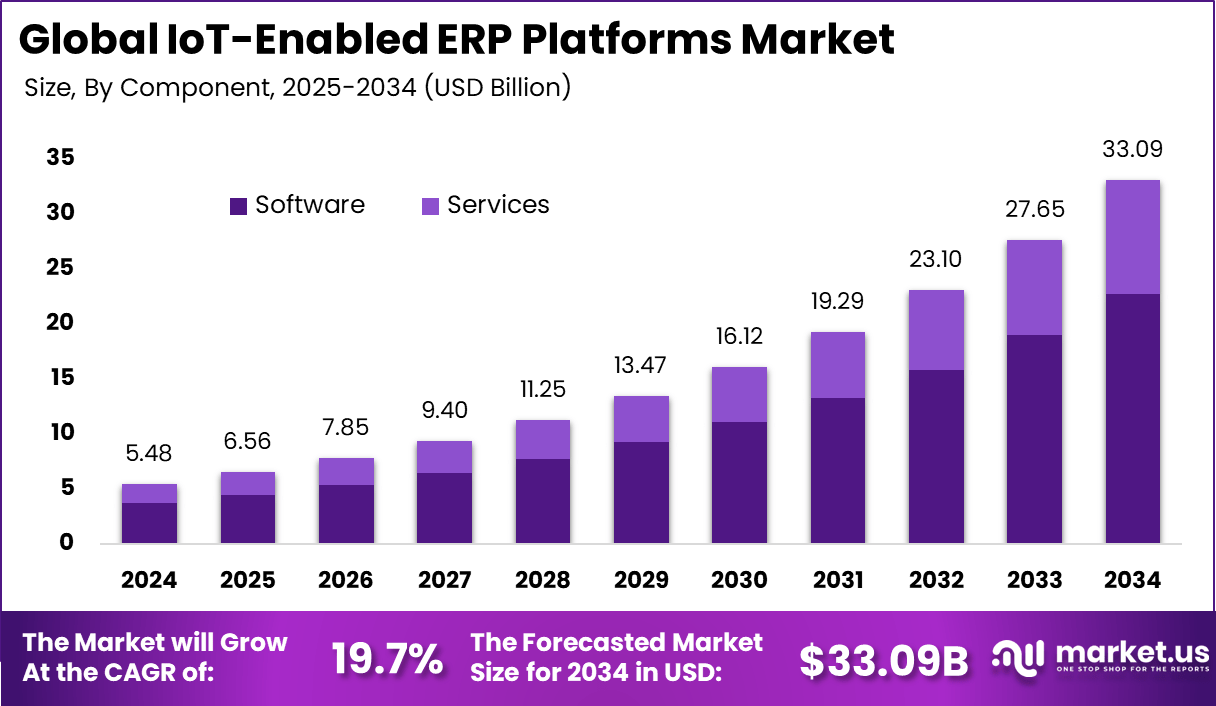

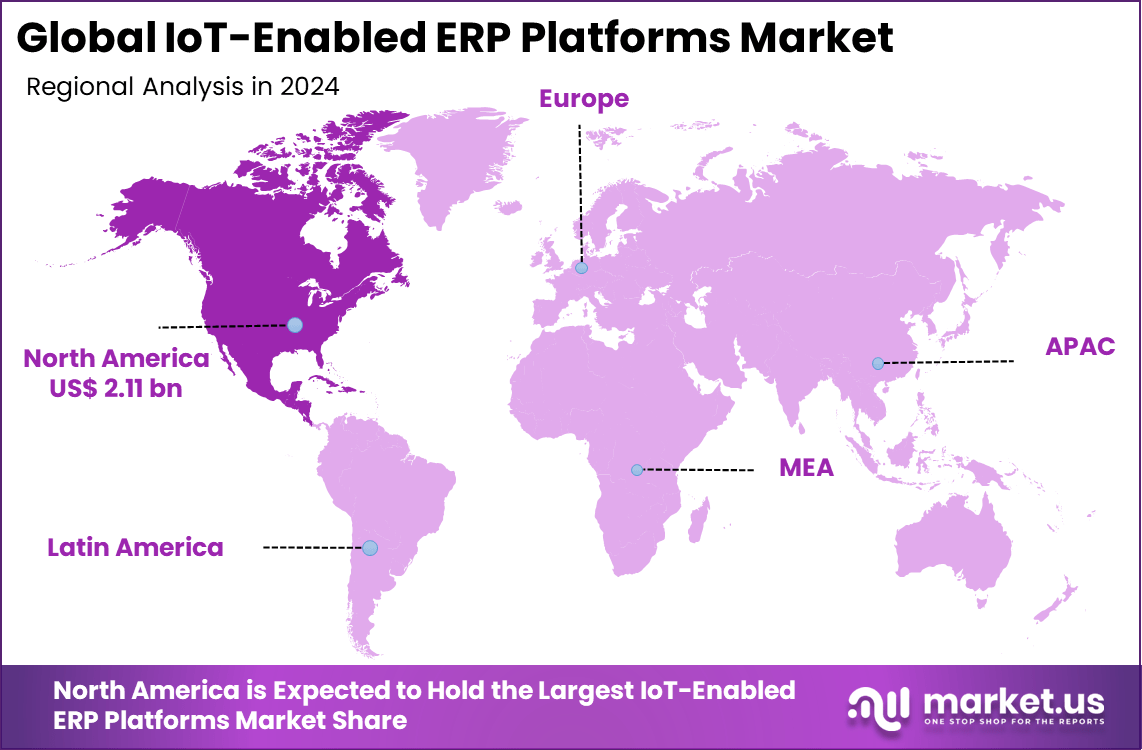

The Global IoT-Enabled ERP Platforms Market size is expected to be worth around USD 33.09 billion by 2034, from USD 5.48 billion in 2024, growing at a CAGR of 19.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.6% share, holding USD 2.11 billion in revenue.

The IoT‑Enabled ERP Platforms market represents the integration of connected device data into enterprise resource planning systems, enabling organizations to utilize real time operational insights. This integration allows sensor driven inputs such as machine performance, inventory levels, or environmental conditions to feed directly into ERP systems, enhancing transparency, automation, and responsiveness across manufacturing, logistics, and other industries.

According to Market.us’s research, The Internet of Things (IoT) Market is projected to experience remarkable growth, reaching nearly USD 3,454.2 Billion by 2033, a sharp rise from approximately USD 492.7 Billion in 2023. This robust expansion reflects a sustained CAGR of 21.5% over the forecast period from 2024 to 2033.

Simultaneously, the AI in ERP Market is gaining significant traction and is expected to reach around USD 46.5 Billion by 2033, up from nearly USD 4.5 Billion in 2023. This reflects a strong CAGR of 26.30% during the forecast period from 2024 to 2033.

A key driving factor is the rising need for real time decision making. Organizations aim to minimize downtime, improve asset utilization, and adapt quickly to operational changes. IoT data enables ERP systems to trigger automated workflows and predictive maintenance before failures occur. Additionally, digital transformation efforts under Industry 4.0 are further boosting the demand for ERP platforms capable of processing streaming device data and linking edge environments with centralized analytics.

Scope and Forecast

Report Features Description Market Value (2024) USD 5.48 Bn Forecast Revenue (2034) USD 33.09 Bn CAGR (2025-2034) 19.7% Largest market in 2024 North America [38.6% market share] For instance, in May 2025, IntelliDocX introduced an industry-first solution: Applied Artificial Intelligence (AI) for SAP ERP Business Content. This innovation enables enterprises to automate and enhance document-centric processes within their SAP systems by leveraging AI capabilities. By integrating AI, businesses can achieve improved efficiency, accuracy, and decision-making in managing their SAP business content.

Increasing adoption technologies include RFID, edge computing, industrial sensors, and cloud-based data storage. When embedded into ERP workflows, these technologies enable companies to process data from production lines, warehouses, and vehicle fleets. The integration is designed to ensure quick responses to real-world events, reduce latency in operations, and drive just-in-time manufacturing decisions.

Key reasons for adopting such platforms are improved efficiency, proactive asset management, and deeper operational intelligence. Businesses are also motivated by the ability to make quicker decisions based on live operational inputs. The automation of routine tasks and error reduction through real-time feedback loops further adds to their appeal.

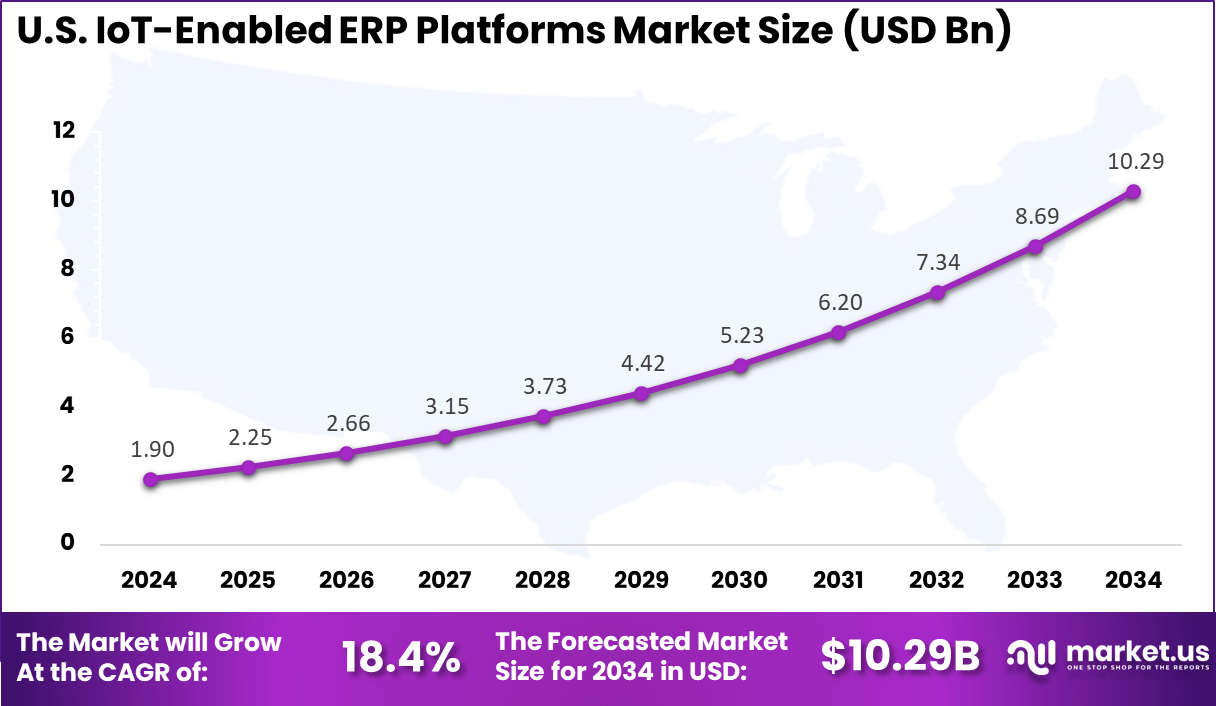

U.S. Market Size

The market for IoT-Enabled ERP Platforms within the U.S. is growing tremendously and is currently valued at USD 1.90 billion, the market has a projected CAGR of 18.4%. The growth of the IoT-enabled ERP market in the U.S. is driven by advancements in connectivity, sensor technology, and data analytics, enabling seamless integration of IoT with ERP systems for real-time data collection and analysis.

The country’s strong digital infrastructure, high internet penetration, and adoption of advanced network technologies support this expansion. U.S. businesses are increasingly adopting IoT to enhance efficiency, automate processes, and gain insights, further fueled by government initiatives and the presence of major technology players driving innovation in cloud, AI, and edge computing.

For instance, in June 2025, IoT-enabled ERP platforms are revolutionizing educational institutions across the U.S. by integrating IoT technologies with ERP systems. This integration streamlines campus management, automates administrative processes, and enhances student engagement. Leading players are reshaping how educational institutions manage operations, improve resource use, and create more responsive learning environments.

In 2024, North America held a dominant market position in the Global IoT-Enabled ERP Platforms Market, capturing more than a 38.6% share, holding USD 2.11 billion in revenue. This dominance is due to its advanced digital infrastructure, high internet penetration, and early adoption of IoT, AI, and cloud technologies.

The U.S. plays a pivotal role, benefiting from a mature technology ecosystem, substantial investments in digital transformation, and strong government support. Industries like manufacturing, healthcare, and automotive are seeing significant IoT integration, fueled by ongoing research, development, and a culture of innovation. These factors collectively position North America as a leader in the growth and innovation of the IoT-enabled ERP market.

For instance, in July 2025, Dileep Reddy Cheguri is spearheading transformative data integration initiatives in North America by combining Microsoft Dynamics 365 with Internet of Things (IoT) technologies and Snowflake’s advanced cloud architecture. His innovative approach enables real-time operational intelligence, predictive analytics, and seamless data interoperability across various business functions.

Emerging Trend

Real-Time ERP Visibility via IoT Integration

IoT-enabled ERP platforms are rapidly evolving to deliver real-time operational visibility across various business functions. By connecting physical assets such as machinery, vehicles, and sensors directly to ERP systems, organizations gain live insights into production status, inventory levels, and logistics movement.

This transformation allows decision-makers to act on data as it occurs, resulting in quicker interventions and more informed strategies. The convergence of IoT with ERP has also led to improvements in process automation and system intelligence.

As connected devices stream continuous data, ERP systems are being equipped with analytics capabilities that support demand forecasting, dynamic scheduling, and workflow optimization. These enhancements allow enterprises to operate with greater efficiency and responsiveness, particularly in manufacturing and supply chain environments.

Component Analysis

In 2024, Software segment held a dominant market position, capturing a 68.7% share of the Global IoT-Enabled ERP Platforms Market. This dominance can be attributed to the growing demand for advanced ERP software solutions that integrate IoT capabilities, enabling real-time data processing, automation, and enhanced decision-making.

IoT integration enables ERP software to offer accurate monitoring, predictive maintenance, and proactive decision-making, optimizing business operations. Furthermore, the growing adoption of cloud-based ERP platforms has made these solutions more accessible and scalable, contributing to the continued growth of the market.

For Instance, in September 2024, Zoho launched its low-code IoT platform, Zoho IoT, enabling businesses in North America to easily develop and deploy IoT solutions. The platform integrates seamlessly with ERP systems, offering real-time data collection, predictive analytics, and automation. Zoho IoT improves efficiency and aids digital transformation by seamlessly integrating IoT with ERP through industry-specific tools and an intuitive interface.

Deployment Model Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 58.4% share of the Global IoT-Enabled ERP Platforms Market. The demand has been driven primarily by their scalability, cost-effectiveness, and flexibility.

Businesses benefit from accessing real-time information, improving operations, and saving money on IT infrastructure expenses with the help of cloud-based services. Furthermore, the rise of remote work and digital transformation in various fields has accelerated the adoption of cloud ERP systems, providing organizations with more flexibility to expand and innovate.

For instance, in March 2021, SAP emphasized the pivotal role of IoT-enabled cloud ERP systems in enhancing business resilience. By integrating Internet of Things (IoT) technologies with Enterprise Resource Planning (ERP) platforms, organizations can achieve real-time data processing, predictive analytics, and proactive decision-making.

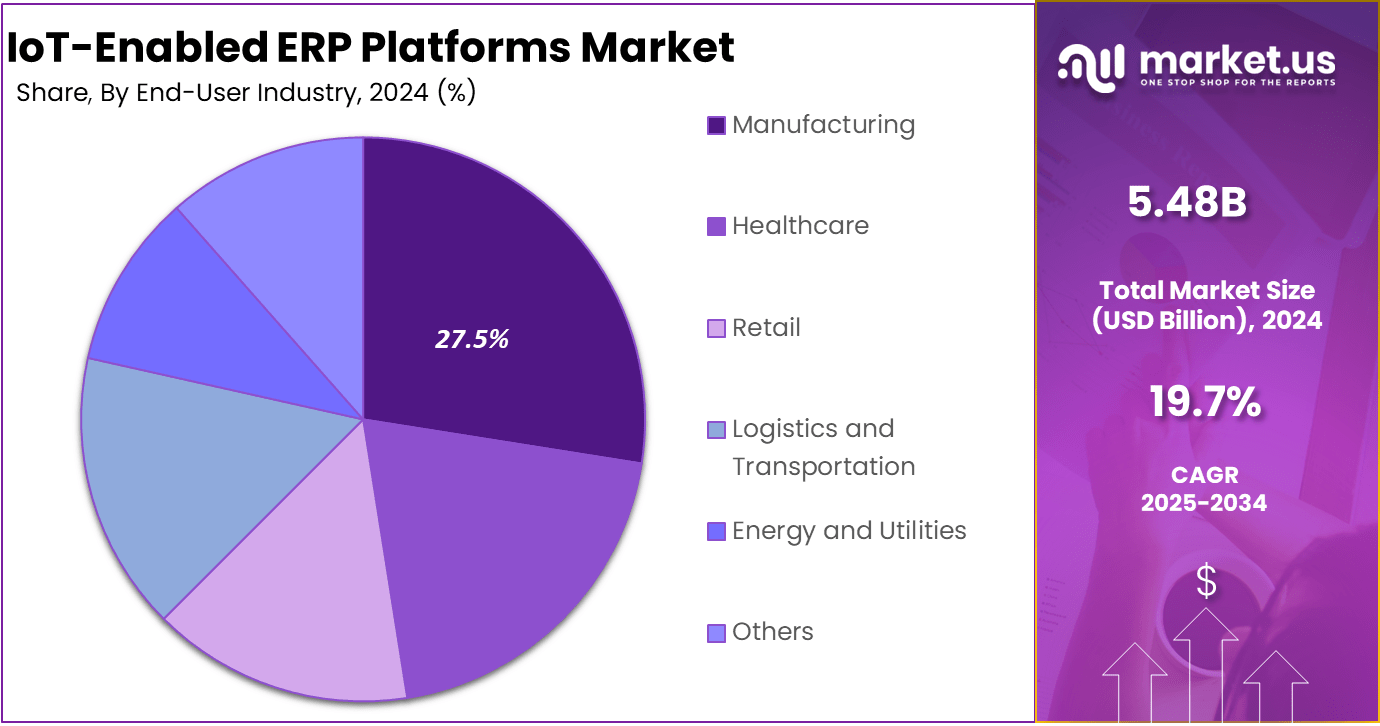

End-User Industry Analysis

In 2024, Manufacturing segment held a dominant market position, capturing a 27.5% share of the Global IoT-Enabled ERP Platforms Market. This dominance is due to manufacturers’ focus on digital transformation, process automation, and the adoption of Industry 4.0 practices.

IoT-enabled ERP systems provide real-time insights into production processes, equipment health, and supply chain performance, enabling predictive maintenance, minimizing downtime, and optimizing resource allocation.

To enhance operational efficiency, maintain quality, and swiftly respond to market shifts, manufacturers have made significant investments in IoT-ERP solutions, strengthening the segment’s prominent position in the market.

For Instance, in March 2025, Microsoft highlighted how Dynamics 365 is transforming manufacturing through the integration of Internet of Things (IoT) technologies. By embedding IoT sensors into production equipment, manufacturers can collect real-time data on machine performance, energy consumption, and operational efficiency. Dynamics 365 processes this data to enable predictive maintenance, better resource allocation, and smarter decision-making.

Key Market Segments

By Component

- Software

- Services

By Deployment Model

- Cloud-Based

- On-Premises

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-User Industry

- Manufacturing

- Healthcare

- Retail

- Logistics and Transportation

- Energy and Utilities

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Process Automation and Predictive Control

The demand for automated business operations is a key driver accelerating the adoption of IoT-enabled ERP platforms. As companies aim to minimize manual intervention, the integration of sensors with ERP systems helps monitor performance metrics and environmental conditions.

This leads to early identification of potential equipment issues and supports automation in maintenance scheduling, production planning, and inventory management. Another important factor is the growing need for predictive control in enterprise functions.

IoT-connected assets generate historical and real-time data that ERP systems use to identify patterns and predict future outcomes. This empowers businesses to avoid costly disruptions, allocate resources more efficiently, and respond proactively to operational risks.

Restraint

Cybersecurity Risks and Integration Complexities

A critical restraint for this market lies in the increased cybersecurity risks that come with connected devices. IoT sensors often operate outside traditional IT infrastructure, making them vulnerable to unauthorized access, data breaches, and malicious control.

When these devices are linked to ERP systems, the risk extends to core financial and operational data, heightening the potential for system-wide exposure. In addition to security issues, integration with legacy equipment remains a major challenge.

Many organizations operate with older machinery that lacks native IoT support. Retrofitting such assets with compatible sensors or gateway devices requires time, investment, and technical alignment. These limitations often delay implementation timelines and raise the total cost of ownership.

Market Opportunity

Smart Asset Monitoring and Remote Management

A notable opportunity in the IoT-enabled ERP market lies in smart asset monitoring. Enterprises can use IoT data to monitor the status of their machinery, fleet, or facilities remotely. This capability supports real-time decision-making and allows organizations to maximize asset utilization, schedule timely repairs, and extend equipment lifespan without physically inspecting each unit.

Furthermore, remote management has become increasingly important in a post-pandemic work environment. IoT-linked ERP systems provide visibility into distributed operations, allowing supervisors and executives to manage tasks, monitor compliance, and coordinate teams across different locations. This flexibility supports hybrid work models and enhances business continuity during disruptions.

Challenge

Lack of Standards and Data Governance Complexity

One of the significant challenges in this space is the lack of universal standards across IoT devices. Different communication protocols, hardware configurations, and data formats make it difficult for ERP systems to consistently interpret and utilize incoming data.

This interoperability issue often necessitates the use of middleware, custom connectors, or vendor-specific APIs, which adds complexity to system architecture. Another major challenge is the growing complexity of data governance. As IoT sensors generate vast volumes of operational data, organizations must implement policies on who can access, process, and store this information.

Without strong governance frameworks, the risk of data silos, inconsistencies, or regulatory violations increases. Clear policies and centralized data management systems are essential to ensure trust and control over enterprise-wide IoT-ERP ecosystems.

Key Players Analysis

SAP, Microsoft, and Oracle lead the IoT-enabled ERP platforms market by offering scalable, cloud-based solutions with real-time data and process automation. IBM strengthens its position with AI-driven analytics and secure connectivity, supporting smart manufacturing and optimized supply chains. Their focus on integration and operational efficiency makes them preferred choices across industries.

PTC, Siemens, and Bosch deliver industry-focused platforms with predictive maintenance, digital twins, and real-time monitoring. GE Digital enhances asset performance through industrial IoT expertise. These players emphasize interoperability and digital transformation to address complex industrial needs effectively.

AWS, Cisco, and other key players offer flexible, cloud-native ERP platforms embedded with IoT capabilities. AWS ensures secure scalability, while Cisco’s network solutions support connected operations. Emerging players target niche areas like energy and logistics, driving innovation and meeting diverse enterprise demands for agile, IoT-driven ERP systems.

Top Key Players in the Market

- SAP SE

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- PTC Inc.

- Siemens AG

- Bosch Software Innovations

- GE Digital

- Amazon Web Services (AWS)

- Cisco Systems, Inc.

- Other Major Players

Recent Developments

- In January 2024, Synopsys made headlines by announcing its acquisition of Ansys for a staggering $35 billion. This deal, one of the largest in the IoT and ERP space, was approved by Ansys stockholders in May 2024 and is expected to close in the first half of 2025.

- September 2024 saw Honeywell introduce a suite of IoT-enabled sensors for its ERP platform. These sensors are designed to provide real-time monitoring of environmental conditions and asset performance, giving companies immediate insights into potential supply chain disruptions.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Model (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs), By End-User Industry (Manufacturing, Healthcare, Retail, Logistics and Transportation, Energy and Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Microsoft Corporation, Oracle Corporation, IBM Corporation, PTC Inc., Siemens AG, Bosch Software Innovations, GE Digital, Amazon Web Services (AWS), Cisco Systems, Inc., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IoT-Enabled ERP Platforms MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

IoT-Enabled ERP Platforms MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- PTC Inc.

- Siemens AG

- Bosch Software Innovations

- GE Digital

- Amazon Web Services (AWS)

- Cisco Systems, Inc.

- Other Major Players