Global Ionic Liquid Market By Grade (High Purity and Commercial Grade) By Type (Glycoside-Based Ionic liquids, Thiazolium аnd Веnzоthіаzоlіum ionic liquids, 1,2,3-trіаzоlіum ionic liquids and Ionic liquids from (Meth) Acrylic Compound) By End-Use Industry (Solvents & Catalysts, Plastics, Energy Storage, Electrochemistry & Batteries, Bio-Refineries, Extractions & Separations and Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2019–2028

- Published date: Jan 2024

- Report ID: 24071

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

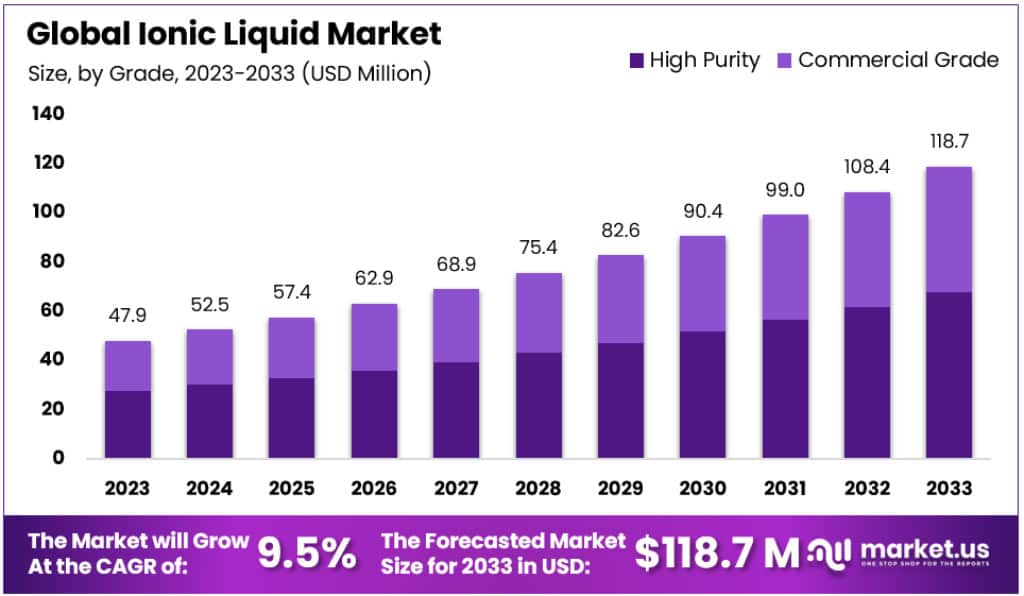

The Global Ionic liquid Market size is expected to be worth around USD 118.7 Million by 2033, from USD 47.9 Million in 2023, growing at a CAGR of 9.5% during the forecast period from 2024 to 2033.

Ionic liquids are salts in the liquid state at ambient conditions, with melting points below 100°C. They are composed solely of ions, making them purely ionic and salt-like materials. Ionic liquid have a wide range of properties that can be tailored for different applications, such as electrochemical, catalytic, and biological systems.

Due to the increasing use of ionic liquids in solvents, the market is expected to grow substantially over the forecast period. With the combination of cations and anions, Ionic liquids are a class of solvents. The demand for this product is expected to rise due to growing environmental awareness and green chemistry.

Ionic liquids are used extensively in the manufacture of liquid solvents and catalysts. The industry is expected to grow due to the rising demand for extractions and separations applications over the forecast period.

Key Takeaways

- In 2023, the global Ionic Liquid Market was valued at USD 47.9 million.

- By 2033, the market is expected to reach approximately USD 118.7 million.

- The market is projected to grow at a CAGR of 9.5% during the forecast period from 2024 to 2033.

- Commercial Grade Ionic liquids held over 52% of the market share in 2023.

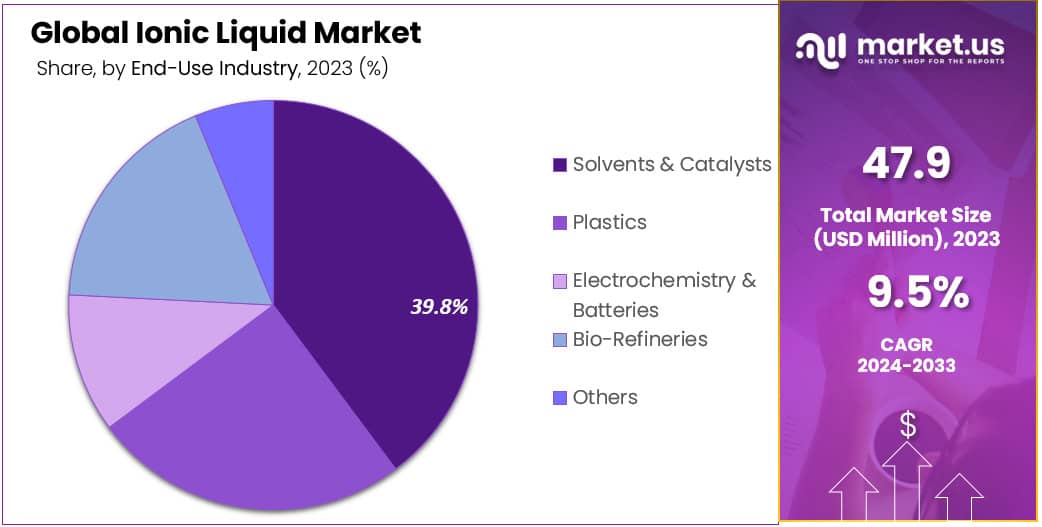

- In 2023, the Solvents & Catalysts segment accounted for 38.9% of the Ionic Liquid Market.

- The Asia-Pacific region led the market in 2023, with a 45.3% share, equivalent to USD 21.7 million.

Grade Analysis

In 2023, the Commercial Grade segment of the ionic liquid market held a dominant position, capturing more than a significant 52% share. This notable market share is attributable to several pragmatic factors. Commercial Grade ionic liquids, known for their relatively lower purity compared to their High Purity counterparts, have garnered widespread preference across a range of industrial applications. The appeal of Commercial Grade ionic liquids lies in their cost-effectiveness, making them a more viable option for large-scale industrial use where the highest purity levels are not a stringent requirement.

The affordability of commercial-grade ionic liquids is a critical factor driving their widespread adoption. Industries seeking cost-efficient yet effective solutions tend to opt for these variants, particularly when the application doesn’t necessitate the highest purity standards. This is especially relevant in sectors like pharmaceuticals, chemical synthesis, and materials processing, where ionic liquids are utilized as solvents, catalysts, and process aids. Their versatility and efficacy in enhancing various production processes further cement their position in the market.

Moreover, the ongoing research and development activities in the field of ionic liquids, aimed at broadening their applications, also contribute to the dominance of the Commercial Grade segment. Innovations in formulation and usage continue to open new avenues for application, solidifying the segment’s market position.

End-Use Industry Analysis

In 2023, the Solvents & Catalysts segment in the ionic liquid market has established a strong foothold, capturing a significant 38.9% market share. This dominance in the market can be attributed to the unique properties of ionic liquids that make them highly suitable for various solvent and catalytic applications. These properties include high polarity, low volatility, and excellent thermal stability, which are essential for efficient chemical processes.

The use of ionic liquids as solvents and catalysts is particularly prevalent in industries such as pharmaceuticals, petrochemicals, and fine chemicals. Their ability to dissolve a wide range of materials and catalyze various reactions makes them invaluable in these sectors. Additionally, their environmental benefits over traditional organic solvents, such as reduced emissions and lower toxicity, align well with the global shift towards sustainable and green chemistry.

The increasing demand in the pharmaceutical industry, where ionic liquids are used to enhance drug solubility and stability, plays a significant role in driving the growth of this segment. Furthermore, in petrochemical applications, ionic liquids are being used to improve refining processes and catalyze reactions more efficiently, contributing to the overall growth of the segment.

Moreover, advancements in research and development activities are continuously expanding the potential applications of ionic liquids in solvents and catalysts. This ongoing innovation not only strengthens the segment’s market position but also opens up new opportunities for its growth.

Кеу Маrkеt Ѕеgmеntѕ

By Grade

- High Purity

- Commercial Grade

By Type

- Glycoside-Based Ionic liquids

- Thiazolium аnd Веnzоthіаzоlіum ionic liquids

- 1,2,3-trіаzоlіum ionic liquids

- Ionic liquids from (Meth) Acrylic Compound

By End-Use Industry

- Solvents & Catalysts

- Plastics

- Energy storage

- Electrochemistry & Batteries

- Bio-Refineries

- Extractions & Separations

- Others

Drivers

- Environmental Sustainability: The shift towards eco-friendly processes in various industries is a major driver. This trend, supported by environmental regulations from agencies like the EPA and the EU, is propelling the use of ionic liquids, particularly in green solvents and biomass conversions.

- Versatile Applications: Ionic liquids are increasingly used in diverse sectors, including electronics, pharmaceuticals, and automotive, due to their unique properties like low volatility and high thermal stability. This versatility is significantly boosting their demand globally.

Restraints

- High Production Costs: The cost of producing ionic liquids, often done on a smaller scale, remains a significant barrier to their broader adoption. This factor, coupled with the ongoing assessment of their environmental and health impacts, presents challenges to market growth.

Opportunities

- Rising Demand in Solvents and Catalysts: The growing applications in solvents, catalysts, and extractions sectors offer substantial opportunities. The unique properties of ionic liquids make them suitable for these applications, and increasing environmental awareness is likely to further drive their demand.

Challenges

- Raw Material Costs and Fluctuating Exchange Rates: The high cost of raw materials and instability in exchange rates are predicted to limit market expansion. Producing high-quality and cost-effective ionic liquids remains a key challenge.

Trends

- Dominance in Solvents and Catalysts: The solvent and catalyst segment is dominating the market due to stringent regulations that encourage the use of ionic liquids for energy conservation and operational efficiency. Their beneficial properties, such as low combustibility and good solvating properties, make them ideal for boosting performance in various industries.

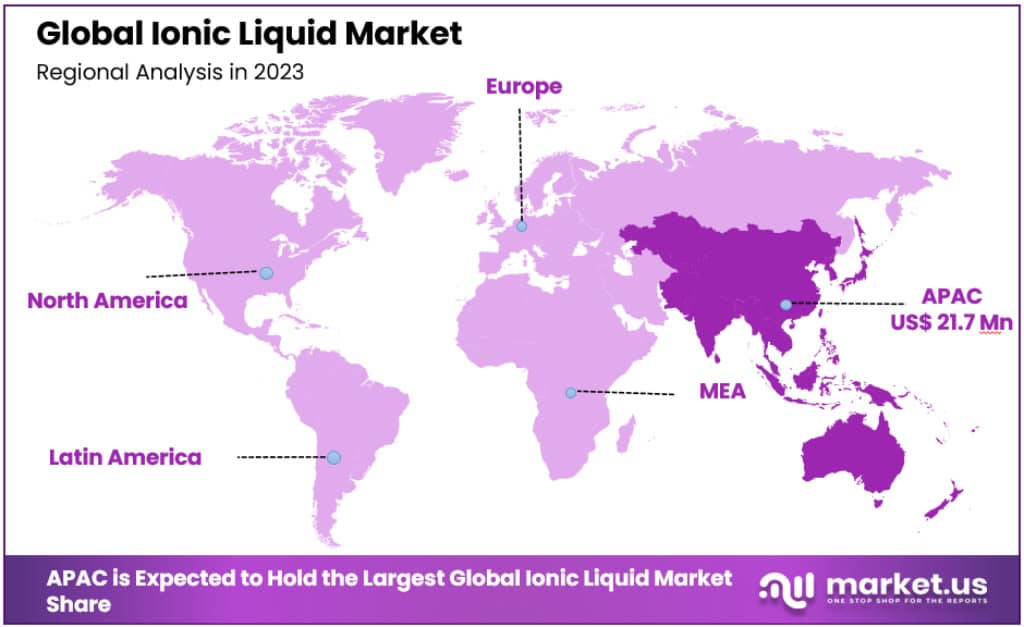

Regional Analysis

In the ionic liquid market, the Asia-Pacific region is showing remarkable growth and is currently leading the market with a significant 45.3% share, translating to a market value of USD 21.7 Million in 2023.

Several factors contribute to the Asia-Pacific region’s dominance in the ionic liquid market. These include the rising consumption of electronic goods and the region’s attractiveness to manufacturing companies due to lower labor costs. The diverse industrial applications of ionic liquids, such as heat transfer fluids, lubricants, electrolytes, and in electronic battery applications, further propel the market growth. Countries like India, Indonesia, Japan, and Vietnam also play significant roles in driving the demand for ionic liquids.

China, in particular, is a major contributor to this growth, holding the position as both the largest and fastest-growing market for ionic liquids in the Asia-Pacific region. The country’s rapid adoption of new technologies related to ionic liquids is a key factor in this expansion. Major chemical producers in China play a crucial role in the development of the local market, which in turn influences the global ionic liquid market.

The shift in consumer perception towards adopting environment-friendly and green solvents, noted for their chemically safe nature and low toxicity, is also contributing to the market’s growth in the Asia-Pacific region. Furthermore, the rapid increase in renewable energy storage and the escalating consumption of electronic goods in this region foster the growth of the global ionic liquid market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Due to the presence of many manufacturers with both a regional and global presence, the global industry is fragmented. BASF SE and Evonik Industries are among the companies that make ionic liquids. These companies produce ionic liquids for different purposes, such as solvents and catalysts, extractions, & separations, energy storage, etc.

Ionic Liquids Technologies GmbH and Reinste Nanoventure are also key players in this industry. This industry is dominated by Tokyo Chemical Industry Co.; Ltd., solvionic SA, some of the companies that operate in this sector.

Маrkеt Kеу Рlауеrѕ

- BASF SE

- Evonik Industries

- Ionic Liquids Technologies GmbH

- Reinstate Nanoventure

- Tokyo Chemical Industry Co. Ltd.

- Dupont

- Linde

- The 3M Company

- Lonza Group

- Cytec

- Celanese Corporation

- CoorsTek Specialty Chemicals

- SABIC

- Avient

- Dow

- Ensinger

- KANEKA Corporation

- Toray Industries

- Mitsubishi Engineering-Plastics Corporation

- LANXESS

- Imerys

- HELLA GmbH & Co. KGaA

- Covestro AG

- PolyOne Corporation

- Saint-Gobain

- Huntsman International LLC.

- Others

Recent Developments

Investments:

- Ionic Materials secures $45 million in Series B funding: This investment aims to scale up their production of high-performance ionic liquids for energy storage applications.

- Arkema announces €12 million investment in ionic liquids R&D: The chemical giant plans to develop next-generation ionic liquids for use in sustainable lubricants and catalysts.

Innovation:

- Researchers at MIT unveil a new class of ionic liquids with enhanced biodegradability: This breakthrough could address a major environmental concern surrounding traditional ionic liquids.

- BASF patents novel ionic liquid-based CO2 capture technology: This technology promises efficient and economical capture of carbon dioxide from industrial emissions.

Acquisitions & Partnerships:

- Solvay acquires Ionic Liquids Technologies: This acquisition strengthens Solvay’s position in the specialty chemicals market and expands their ionic liquids portfolio.

- Lanzatech partners with Global Bioenergies to develop sustainable ionic liquids for biofuel production: This collaboration will leverage both companies’ expertise to optimize biofuel production processes.

Agreements & Expansions

- U.S. Department of Energy awards $8 million grant for ionic liquids research consortium: This funding will support the development of next-generation ionic liquids for advanced materials and energy applications.

- BASF expands production capacity for its BASIL ionic liquid technology: This move will meet the growing demand for this innovative acid separation technology.

Report Scope

Report Features Description Market Value (2023) USD 47.9 Million Forecast Revenue (2033) USD 118.7 Million CAGR (2023-2032) 9.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (High Purity and Commercial Grade) By Type (Glycoside-Based Ionic liquids, Thiazolium аnd Веnzоthіаzоlіum ionic liquids, 1,2,3-trіаzоlіum ionic liquids and Ionic liquids from (Meth) Acrylic Compound) By End-Use Industry (Solvents & Catalysts, Plastics, Energy Storage, Electrochemistry & Batteries, Bio-Refineries, Extractions & Separations and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Evonik Industries, Ionic Liquids Technologies GmbH, Reinstate Nanoventure, Tokyo Chemical Industry Co. Ltd., Dupont, Linde, The 3M Company, Lonza Group, Cytec, Celanese Corporation, CoorsTek Specialty Chemicals, SABIC, Avient, Dow, Ensinger, KANEKA Corporation, Toray Industries, Mitsubishi Engineering-Plastics Corporation, LANXESS, Imerys, HELLA GmbH & Co. KGaA, Covestro AG, PolyOne Corporation, Saint-Gobain, Huntsman International LLC., Others and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Ionic liquid market in 2023?The market size is estimated to be USD 47.9 Million in 2023.

What is the projected CAGR at which the Ionic liquids market is expected to grow at?The Ionic liquids market is expected to grow at a CAGR of 9.5% from 2024 to 2033.

List the key industry players of the Ionic liquids market?BASF SE, Evonik Industries, Ionic Liquids Technologies GmbH, Reinstate Nanoventure, Tokyo Chemical Industry Co. Ltd., Dupont, Linde, The 3M Company, Lonza Group, Cytec, Celanese Corporation, CoorsTek Specialty Chemicals, SABIC, Avient, Dow, Ensinger, KANEKA Corporation, Toray Industries, Mitsubishi Engineering-Plastics Corporation, LANXESS, Imerys, HELLA GmbH & Co. KGaA, Covestro AG, PolyOne Corporation, Saint-Gobain, Huntsman International LLC., Others and Other Key Players are the key vendors in the Ionic Liquids market.

-

-

- BASF SE

- Evonik Industries

- Ionic Liquids Technologies GmbH

- Reinstate Nanoventure

- Tokyo Chemical Industry Co. Ltd.

- Dupont

- Linde

- The 3M Company

- Lonza Group

- Cytec

- Celanese Corporation

- CoorsTek Specialty Chemicals

- SABIC

- Avient

- Dow

- Ensinger

- KANEKA Corporation

- Toray Industries

- Mitsubishi Engineering-Plastics Corporation

- LANXESS

- Imerys

- HELLA GmbH & Co. KGaA

- Covestro AG

- PolyOne Corporation

- Saint-Gobain

- Huntsman International LLC.

- Others