Intravenous Immunoglobulin Market By Product Type (Liquid and Lyophilized), By Application (Primary Immunodeficiency, Multifocal Motor Neuropathy (MMN), Immune Thrombocytopenic Purpura (ITP), Guillain-Barré Syndrome (GBS), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), and Others), By End-user (Hospitals, Clinics, and Homecare), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 101568

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

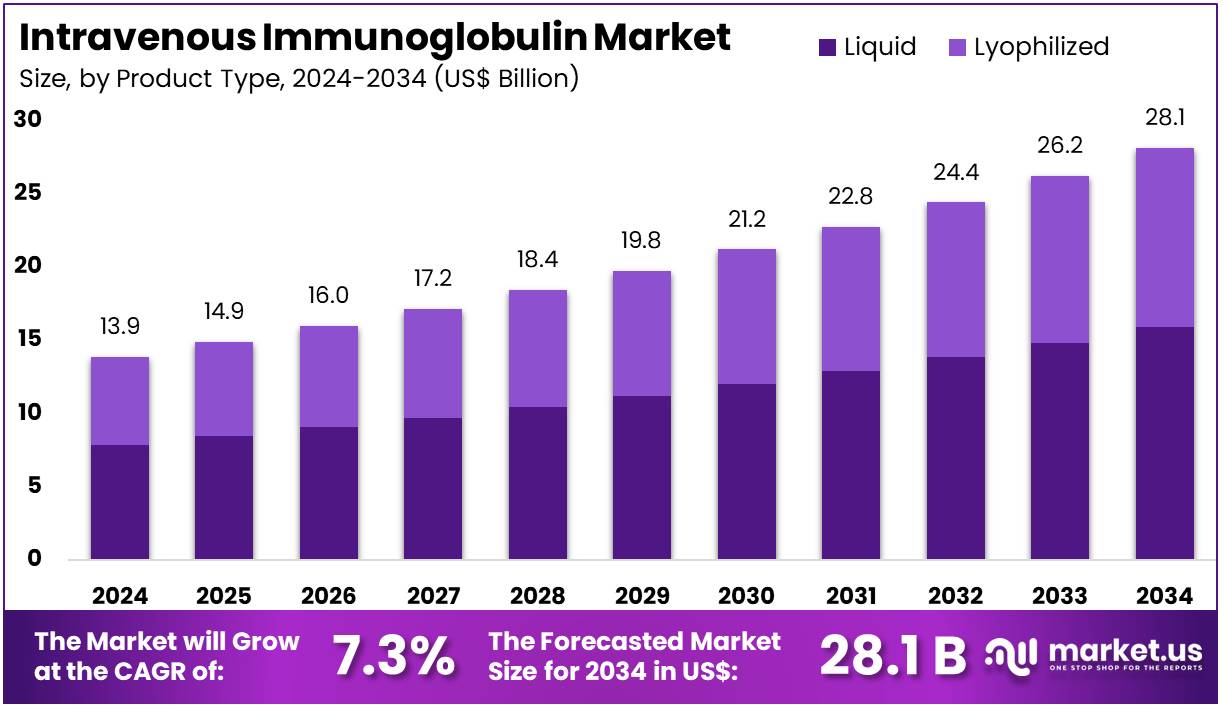

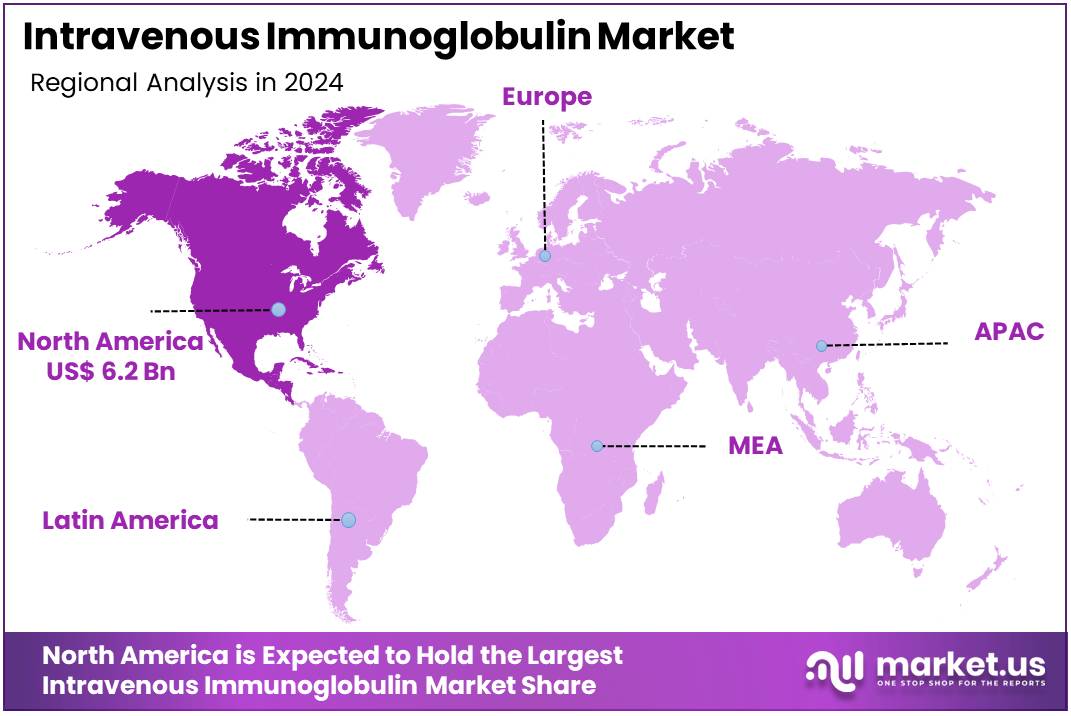

The Intravenous Immunoglobulin Market size is expected to be worth around US$ 28.1 billion by 2034 from US$ 13.9 billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 44.8% share and holds US$ 6.2 Billion market value for the year.

Increasing prevalence of autoimmune and immunodeficiency disorders propels the Intravenous Immunoglobulin market, as physicians rely on polyclonal antibody replacement to restore immune balance and prevent recurrent infections. Pharmaceutical companies refine fractionation processes that yield high-purity, pathogen-safe products suitable for both replacement and immunomodulatory roles.

Clinicians administer IVIG for primary immunodeficiency syndromes through regular maintenance dosing, Kawasaki disease to prevent coronary aneurysms, Guillain-Barré syndrome for rapid neurological recovery, and multifocal motor neuropathy as a first-line maintenance therapy.

Expanding indications in rare autoimmune conditions create opportunities for combination regimens that enhance efficacy while reducing steroid dependence. Argenx received authorization in March 2024 from Japan’s health ministry for its IV formulation of VYVGART in immune thrombocytopenia, intensifying clinical focus on platelet disorders and sustaining IVIG utilization as a proven, complementary option. This regulatory advancement reinforces steady demand across overlapping autoimmune indications.

Growing recognition of IVIG efficacy in chronic neuromuscular diseases accelerates the Intravenous Immunoglobulin market, as neurologists incorporate evidence-based protocols into long-term management strategies. Manufacturers develop subcutaneous alternatives while preserving intravenous formulations for acute and high-dose requirements. These therapies address chronic inflammatory demyelinating polyneuropathy through sustained nerve conduction improvement, myasthenia gravis exacerbations via acetylcholine receptor antibody modulation, dermatomyositis with muscle enzyme normalization, and stiff-person syndrome for GABAergic inhibition restoration.

Regulatory approvals that validate clinical benefit secure reimbursement pathways and encourage guideline inclusion. The FDA approved GAMMAGARD LIQUID in January 2024 specifically for chronic inflammatory demyelinating polyneuropathy, solidifying physician confidence and ensuring consistent prescribing in maintenance regimens. This milestone directly bolsters baseline IVIG consumption in neuromuscular medicine.

Rising consolidation among plasma fractionators invigorates the Intravenous Immunoglobulin market, as leading players secure raw material supply and expand production footprints to meet escalating therapeutic needs. Strategic acquisitions integrate plasma collection networks with state-of-the-art manufacturing facilities for enhanced yield and product diversity. IVIG finds critical applications in allogeneic bone marrow transplant support against graft-versus-host disease, hemolytic disease of the newborn via anti-D prophylaxis, severe autoimmune neutropenia for infection prophylaxis, and post-exposure rabies prophylaxis when combined with vaccine.

Vertical integration opportunities stabilize pricing and reduce supply chain vulnerabilities during demand surges. Grifols completed its acquisition of Biotest in April 2022, substantially increasing plasma throughput and immunoglobulin production capacity to improve global availability and distribution reliability. This move fortifies the entire market infrastructure and supports uninterrupted patient access to life-saving therapies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 13.9 billion, with a CAGR of 7.3%, and is expected to reach US$ 28.1 billion by the year 2034.

- The product type segment is divided into liquid and lyophilized, with liquid taking the lead in 2024 with a market share of 56.7%.

- Considering application, the market is divided into primary immunodeficiency, MMN, ITP, GBS, CIDP, and others. Among these, primary immunodeficiency held a significant share of 38.4%.

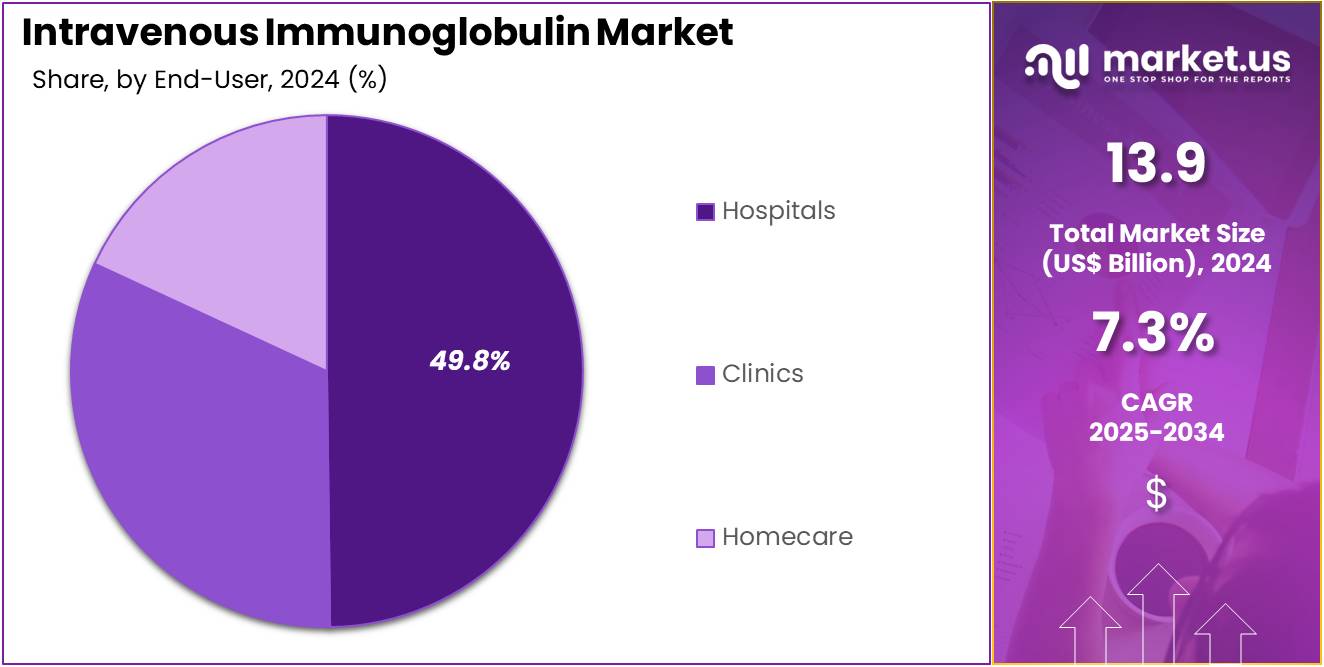

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, and homecare. The hospitals sector stands out as the dominant player, holding the largest revenue share of 49.8% in the market.

- North America led the market by securing a market share of 44.8% in 2024.

Product Type Analysis

Liquid formulations account for 56.7% of the Intravenous Immunoglobulin (IVIG) market, and this dominance is expected to strengthen as physicians increasingly prefer ready-to-infuse preparations. This segment grows because liquid IVIG offers faster preparation, reduced handling errors, and minimal reconstitution time in acute-care environments. Manufacturers focus on improving formulation stability and reducing infusion-related reactions, attracting broader clinical adoption.

The growing burden of immune deficiencies, autoimmune disorders, and neurological conditions is increasing procedural volumes in hospitals and specialty infusion centers. Rising demand for high-concentration liquid preparations is anticipated to streamline administration for patients requiring frequent therapy. Biopharmaceutical companies invest in advanced purification technologies that reduce impurities, enhancing safety profiles. The expansion of home-based infusion programs is likely to boost demand for user-friendly liquid formulations.

Liquid IVIG remains integral for treating rapidly progressing conditions where immediate infusion supports better outcomes. The increasing global prevalence of chronic inflammatory demyelinating polyneuropathy and immune thrombocytopenia is stimulating long-term utilization. Healthcare providers adopt liquid IVIG to support standardized dosing protocols across diverse patient groups. Continued product innovations, such as stabilized formulations and improved packaging, are expected to keep liquid IVIG central to the market’s growth trajectory.

Application Analysis

Primary immunodeficiency accounts for 38.4% of the IVIG market, and this segment is projected to expand steadily as diagnostic rates rise worldwide. Governments and medical organizations promote newborn screening and awareness programs, enabling early identification of immune deficiencies. IVIG remains the cornerstone therapy for patients requiring regular immunoglobulin replacement to prevent severe infections.

Advances in genetic testing are increasing the detection of rare immunodeficiency conditions, further strengthening clinical demand. The rise in survival rates among pediatric patients boosts long-term treatment needs, expanding recurring consumption. Hospitals and specialty clinics adopt standardized immunoglobulin therapy protocols to improve patient outcomes, reinforcing utilization patterns. Growing investments in specialized immunology centers enhance access to testing and lifelong treatment.

Increased publication of clinical guidelines encourages physicians to prioritize IVIG over alternative treatments for specific immune defects. Patient advocacy groups promote adherence to regular infusions, supporting stable market growth. As global healthcare systems improve early diagnosis and chronic disease management, the use of IVIG for primary immunodeficiency is anticipated to remain the most significant driver of market expansion.

End-User Analysis

Hospitals represent 49.8% of the IVIG market and are expected to maintain dominance due to their capability to manage complex infusion protocols and severe immunological or neurological cases. These facilities treat high-acuity conditions such as Guillain-Barré syndrome, chronic inflammatory demyelinating polyneuropathy, and immune thrombocytopenia, all of which require structured IVIG administration. Hospitals benefit from multidisciplinary teams, enabling comprehensive monitoring of infusion reactions and real-time dose adjustments.

Increasing emergency admissions for acute autoimmune flare-ups is projected to strengthen the hospital segment further. Hospitals increasingly expand infusion suites to accommodate both inpatient and outpatient IVIG administration. Technological advancements in infusion pumps and safety monitoring systems enhance treatment precision and attract larger patient volumes.

Reimbursement frameworks in many countries favor hospital-based administrations, supporting continued growth. Complex neurological and hematological cases are often referred directly to tertiary hospitals, reinforcing their procedural dominance. As clinical guidelines prioritize supervised infusions for high-risk patients, hospital-based administration remains essential. Growing emphasis on rapid diagnosis and immediate intervention for immune disorders ensures that hospitals continue to serve as the primary hub for IVIG therapy.

Key Market Segments

By Product Type

- Liquid

- Lyophilized

By Application

- Primary Immunodeficiency

- Multifocal Motor Neuropathy (MMN)

- Immune Thrombocytopenic Purpura (ITP)

- Guillain-Barré Syndrome (GBS)

- Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

- Others

By End-user

- Hospitals

- Clinics

- Homecare

Drivers

Increasing Prevalence of Primary Immunodeficiencies is Driving the Market

The rising prevalence of primary immunodeficiencies worldwide has positioned it as a central driver for the intravenous immunoglobulin market, as these genetic disorders necessitate lifelong replacement therapy to bolster immune function and prevent recurrent infections. This condition affects a significant portion of the population, prompting healthcare systems to prioritize accessible immunoglobulin supplies for prophylactic use. Diagnostic advancements in newborn screening have led to earlier identifications, expanding the pool of patients requiring regular infusions.

Pharmaceutical manufacturers are enhancing production capacities to meet this sustained demand, focusing on high-purity formulations that minimize adverse reactions. Regulatory agencies facilitate expedited reviews for immunoglobulin variants tailored to pediatric and adult profiles. Collaborative networks between patient registries and suppliers ensure equitable distribution, mitigating regional disparities. The economic model supports market stability, as preventive dosing averts costly hospitalizations from opportunistic pathogens.

Clinical guidelines from immunology societies endorse immunoglobulin as first-line therapy, embedding it within standard care protocols. This driver encourages research into adjunctive therapies, yet underscores immunoglobulin’s irreplaceable role in immune reconstitution. Educational initiatives for providers amplify utilization rates, fostering adherence in home-based settings. The prevalence of primary immunodeficiencies in the United States is estimated to be 1 in 1,200 individuals. Consequently, this epidemiological factor propels consistent revenue growth and innovation imperatives.

Restraints

Ongoing Supply Shortages are Restraining the Market

Persistent shortages of intravenous immunoglobulin products have emerged as a substantial restraint on the market, disrupting treatment continuity for vulnerable patient cohorts and eroding provider confidence. These disruptions stem from manufacturing constraints, raw plasma sourcing limitations, and heightened post-pandemic demand surges. Affected patients face delayed infusions, heightening risks of severe infections and hospitalizations. Suppliers contend with stringent quality controls that prolong resolution timelines, exacerbating allocation challenges in high-need regions.

Regulatory notifications mandate rationing protocols, yet implementation varies, leading to inequities in access. This restraint inflates secondary costs, as alternatives like subcutaneous routes prove insufficient for acute scenarios. Global plasma donation campaigns aim to alleviate pressures, but collection volumes lag behind consumption rates. Manufacturers invest in diversification strategies, including synthetic analogs, to circumvent biological dependencies.

The overall impact tempers market forecasting, as unpredictable availability deters long-term contracts. Healthcare economics analyses highlight opportunity losses from untreated exacerbations. As of October 2024, Immune Globulin Intravenous (Human) remains in ongoing shortage according to the U.S. Food and Drug Administration. Mitigating these bottlenecks requires coordinated international efforts to stabilize supply chains.

Opportunities

Expanded Indications for Subcutaneous Immunoglobulin are Creating Growth Opportunities

The broadening of subcutaneous immunoglobulin approvals to encompass higher dosing regimens presents formidable growth opportunities within the intravenous immunoglobulin market, offering flexible alternatives that enhance patient autonomy. These expansions target primary immunodeficiencies with optimized pharmacokinetics, reducing infusion frequencies and clinic dependencies. Developers capitalize by reformulating products for self-administration, appealing to ambulatory care models.

Regulatory endorsements validate safety profiles for escalated weekly doses, unlocking larger eligible populations. Partnerships with home healthcare providers facilitate training and reimbursement integrations, streamlining adoption. This shift diversifies portfolios beyond intravenous exclusivity, mitigating capacity strains on hospital resources. Economic evaluations demonstrate cost efficiencies from decreased adverse events and travel burdens.

International harmonization of labels accelerates exports to emerging markets with similar unmet needs. These opportunities spur investments in user-friendly delivery devices, fostering innovation ecosystems. Patient-reported outcomes emphasize improved quality of life, bolstering evidence for payer negotiations. In July 2024, Grifols received U.S. Food and Drug Administration approval for an expanded label of XEMBIFY (immune globulin subcutaneous, human-klhw) to include dosing up to 800 mg/kg per week for primary immunodeficiency. Such advancements herald a paradigm of decentralized therapy delivery.

Impact of Macroeconomic / Geopolitical Factors

Economic headwinds and soaring plasma collection costs push healthcare payers to enforce stricter prior authorizations for intravenous immunoglobulin therapy, trimming non-essential utilization in cash-strapped systems. Rising prevalence of primary immunodeficiencies and neurology approvals, however, lock in steady prescription growth as clinicians defend IVIG as a cornerstone treatment across specialties.

Geopolitical instability in traditional donor hotspots disrupts steady plasma inflows, triggering temporary shortages and upward price spirals for fractionation facilities worldwide. These interruptions, on the other hand, ignite fresh donor recruitment campaigns in untapped markets and spur next-generation subcutaneous alternatives that ease supply pressure. The U.S. 100% tariff on imported finished IVIG products, effective since October 2025, sharply raises landed costs for non-domestic brands and forces payers to rethink preferred supplier lists.

Leading manufacturers respond decisively by ramping up American fractionation capacity and securing tariff-exclusion pathways through local partnerships. While near-term friction tests every link in the chain, these forces ultimately strengthen domestic infrastructure and treatment accessibility. The intravenous immunoglobulin sector moves forward with renewed focus, delivering life-changing therapy more reliably than ever to patients who need it most.

Latest Trends

Launch of Innovative IVIG Formulations is a Recent Trend

The introduction of novel intravenous immunoglobulin formulations with enhanced stability and tolerability has defined a prominent trend in the market during 2024, reflecting advancements in purification technologies for broader therapeutic applicability. These innovations prioritize liquid, ready-to-use presentations that expedite preparation and reduce contamination risks in clinical environments.

Manufacturers emphasize immunoglobulin subtypes with minimized excipients, addressing tolerability issues in sensitive populations. This trend aligns with precision dosing requirements, incorporating biomarkers for individualized regimens.

Supply chain optimizations ensure consistent batch quality, countering prior variability concerns. Clinical incorporations into neurology and rheumatology protocols validate expanded utilities beyond immunodeficiencies. Competitive launches stimulate pricing dynamics, benefiting cost-conscious health systems. Global distribution networks adapt to these formulations, enhancing penetration in ambulatory infusion centers. The emphasis on sustainability incorporates eco-friendly packaging, appealing to regulatory incentives.

Patient-centric designs incorporate ergonomic infusion sets for comfort. Grifols Biotest received U.S. Food and Drug Administration approval for Yimmugo (immune globulin intravenous, human-dira) on June 13, 2024, for the treatment of primary immunodeficiencies in patients 2 years of age and older, with U.S. launch in the second half of 2024. This development exemplifies the trend’s focus on efficacious, patient-optimized solutions.

Regional Analysis

North America is leading the Intravenous Immunoglobulin Market

The Intravenous Immunoglobulin market in North America captured 44.8% of the global share in 2024, underpinned by robust demand for immunomodulatory therapies in managing autoimmune disorders and primary immunodeficiencies amid an aging demographic. Biopharmaceutical leaders such as Grifols and Octapharma enhanced production capacities through facility expansions in Puerto Rico and North Carolina, ensuring supply stability for high-dose regimens in neurology and hematology applications.

The National Institutes of Health escalated extramural funding for investigator-initiated studies exploring IVIG’s role in long COVID sequelae and chronic inflammatory demyelinating polyneuropathy, fostering evidence-based expansions. Integrated delivery networks in states like California and Florida optimized infusion protocols via electronic prior authorization systems, streamlining access and reducing administrative burdens for prescribers.

Philanthropic endowments supported patient assistance programs, mitigating out-of-pocket costs for uninsured individuals reliant on monthly infusions. Regulatory harmonization with the European Medicines Agency facilitated reciprocal data acceptance, accelerating post-marketing surveillance for adverse events. Specialized centers at institutions like Johns Hopkins advanced precision dosing algorithms incorporating pharmacogenomic profiles, tailoring administrations to minimize renal risks. Legislative advocacy culminated in enhanced orphan drug incentives, prioritizing rare disease indications like multifocal motor neuropathy.

Collaborative biorepositories aggregated real-world outcomes, informing payer negotiations for broader formulary inclusions. The Centers for Medicare & Medicaid Services reported that approximately 1,900 Medicare fee-for-service beneficiaries with primary immune deficiency diseases received in-home intravenous immunoglobulin therapy annually on average from 2015 to 2022, illustrating sustained utilization trends extending into 2024 with permanent benefit implementation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the plasma-derived therapeutics sector in Asia Pacific to expand markedly during the forecast period, as regulatory agencies accelerate approvals for domestic formulations to address escalating neurological and rheumatological burdens. China invigorates its National Medical Products Administration pathways, subsidizing large-scale manufacturing in Shanghai to support Kawasaki disease treatments in pediatric cohorts.

Japan allocates Japan Agency for Medical Research and Development grants for adjunctive applications in Guillain-Barré syndrome, integrating advanced filtration technologies for purer isolates. India bolsters its Central Drugs Standard Control Organization validations, equipping district hospitals with ready-to-use vials for postpartum hemorrhage prophylaxis in maternal health programs.

South Korea directs Korea Food and Drug Safety resources toward bioequivalence studies for biosimilar entrants, targeting myasthenia gravis management in urban clinics. Governments introduce volume-based procurement models in Indonesia and Vietnam, slashing costs by 25% to enhance affordability in endemic infection hotspots. Innovation districts in Singapore pioneer liquid-stable variants resistant to tropical humidity, drawing multinational licensing deals.

Regional pharmacovigilance networks under ASEAN frameworks standardize reporting, enabling pooled safety analyses for off-label expansions. Educational campaigns by health ministries elevate prescriber awareness, embedding IVIG into national essential medicines lists. The Marketing Research Bureau documented that total plasma collection in the Asia Pacific region reached 14.5 million liters in 2022, establishing a vital supply base for intensified immunoglobulin fractionation and distribution.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading manufacturers in the Intravenous Immunoglobulin market drive sustained expansion by introducing high-concentration, hyaluronidase-facilitated products that shorten administration time and enable weekly home dosing, thereby shifting volume from clinic-based to self-administered regimens and improving patient retention. They lock in raw material security through proprietary plasma collection centers and long-term donor incentive programs, while pursuing label extensions into high-value autoimmune encephalitis and myasthenia gravis indications via registrational studies.

Executives consolidate smaller fractionators to gain immediate capacity and geographic reach, simultaneously optimizing downstream chromatography to boost overall yield per liter of source plasma. CSL Behring, the King of Prussia-headquartered powerhouse within CSL Limited, maintains undisputed leadership in the Intravenous Immunoglobulin market with its flagship Privigen and Hizentra franchises—delivering proline-stabilized intravenous and recombinant-hyaluronidase-enabled subcutaneous options that set the global benchmark for purity, tolerability, and supply continuity across immunodeficiency, neurology, and dermatology applications.

Top Key Players in the Intravenous Immunoglobulin Market

- Octapharma AG

- LFB

- Kedrion

- Grifols SA

- CSL

- China Biologics Products Inc.

- Biotest AG

- BDI Pharma Inc.

- Baxter

- Argenx SE

Recent Developments

- In November 2024: ICU Medical and Otsuka Pharmaceutical Factory announced a joint venture valued at USD 200 million to expand the production of IV solutions to more than a billion units per year. This scale-up strengthens the reliability of infusion supplies, which are the backbone of IVIG administration. With fewer risks of shortages in basic infusion fluids, hospitals can run IVIG treatment programs more smoothly, supporting higher patient volumes and reducing delays in therapy.

- In October 2024: GigaGen received a major BARDA award worth USD 135.2 million to advance recombinant polyclonal drug development for toxin-related illnesses. Although these recombinant products differ from traditional plasma-derived IVIG, the investment pushes the entire antibody-based therapy ecosystem forward. As innovation accelerates in adjacent modalities, manufacturers of conventional IVIG are encouraged to upgrade production capacity and adopt more advanced technologies, indirectly stimulating market expansion.

Report Scope

Report Features Description Market Value (2024) US$ 13.9 billion Forecast Revenue (2034) US$ 28.1 billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid and Lyophilized), By Application (Primary Immunodeficiency, Multifocal Motor Neuropathy (MMN), Immune Thrombocytopenic Purpura (ITP), Guillain-Barré Syndrome (GBS), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), and Others), By End-user (Hospitals, Clinics, and Homecare) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Octapharma AG, LFB, Kedrion, Grifols SA, CSL, China Biologics Products Inc., Biotest AG, BDI Pharma Inc., Baxter, Argenx SE. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intravenous Immunoglobulin MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Intravenous Immunoglobulin MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Octapharma AG

- LFB

- Kedrion

- Grifols SA

- CSL

- China Biologics Products Inc.

- Biotest AG

- BDI Pharma Inc.

- Baxter

- Argenx SE