Global Interactive Patient Care Systems Market Analysis By Component (Hardware, Software), By Application (Acute Care, Post-Acute Care, Long-Term Care, Rehabilitation Centers, Home Care), By End-User (Hospitals, Clinics & Specialty Centers, Ambulatory Surgical Centers (ASCs), Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150715

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

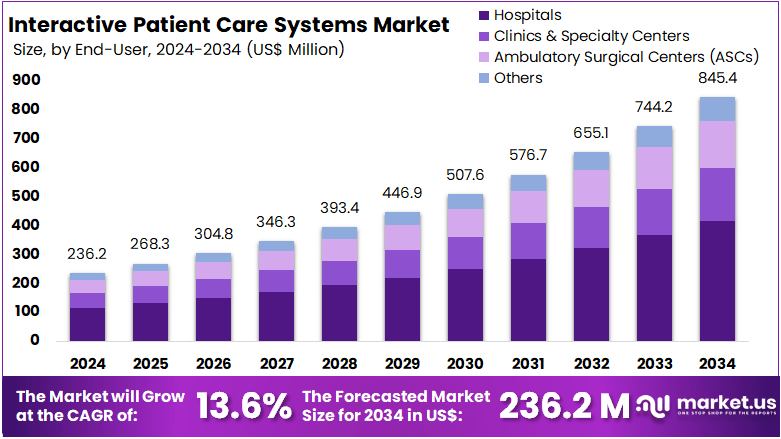

The Global Interactive Patient Care Systems Market size is expected to be worth around US$ 845.4 Million by 2034, from US$ 236.2 Million in 2024, growing at a CAGR of 13.6% during the forecast period from 2025 to 2034.

The Interactive Patient Care (IPC) systems market is experiencing robust growth due to increased digitalization, patient engagement needs, and healthcare transformation strategies. IPC systems integrate entertainment, education, and communication into a single digital interface using bedside terminals, mobile apps, or smart TVs. These tools aim to improve hospital experiences, empower patients with real-time information, and strengthen care coordination. As hospitals focus on quality care, IPC platforms are being widely adopted to support better patient satisfaction and clinical outcomes.

According to the Centers for Disease Control and Prevention (CDC), telemedicine usage in the U.S. surged significantly, from 15.4% in 2019 to 86.5% among physicians in 2021. This was largely driven by the COVID-19 pandemic, which increased the demand for contactless care solutions. Among U.S. adults, 37% had at least one telehealth visit in 2021, with higher utilization among women (42%) than men (31.7%). Older adults aged 65 and above recorded the highest usage at 43.3%. However, the percentage declined to 30.1% in 2022, indicating a shift towards hybrid care models that IPC systems can complement.

The integration of IPC systems with electronic health records (EHRs) is accelerating adoption. For instance, patients can access lab results, medication lists, and discharge instructions through bedside tablets. This digital access improves transparency and treatment adherence. According to the World Health Organization (WHO), digital platforms such as those used in Zambia’s “Be He@lthy, Be Mobile” initiative are helping manage non-communicable diseases through remote support, demonstrating the broader impact of connected health technologies.

Another growth factor is the use of IPC systems to reduce hospital readmissions and shorten length of stay. For example, patients can receive interactive education videos, reminders, and progress checklists during their hospital stay. These features ensure patients are well-prepared for discharge, reducing post-care complications. A CDC study shows that such interventions can lead to cost savings of up to USD 1,814 per patient annually by reducing emergency visits and improving medication adherence.

Remote patient monitoring (RPM) is increasingly integrated with IPC platforms to manage chronic diseases outside the hospital. According to a WHO bulletin, digital health solutions like RPM can generate healthcare savings of up to USD 11 billion in Africa by 2030. IPC systems can sync with wearable devices, enabling clinicians to monitor vital signs and adjust treatments remotely. This capability supports early intervention and self-care, especially in regions with limited healthcare access.

National digital health strategies are also encouraging IPC adoption. For example, Denmark’s unified electronic records and remote care platforms align with WHO’s Global Strategy on Digital Health 2020–2025, aimed at making health systems more efficient and sustainable. Additionally, government support during the COVID-19 pandemic boosted funding and regulatory acceptance of digital tools, laying the groundwork for the continued use of IPC systems in routine care. As healthcare moves towards patient-centric and connected models, IPC platforms are set to play an essential role.

Key Takeaways

- The global Interactive Patient Care Systems market is projected to reach approximately US$ 845.4 million by 2034, growing from US$ 236.2 million in 2024.

- The market is anticipated to grow at a robust CAGR of 13.6% between 2025 and 2034, reflecting strong demand for patient-centered technologies.

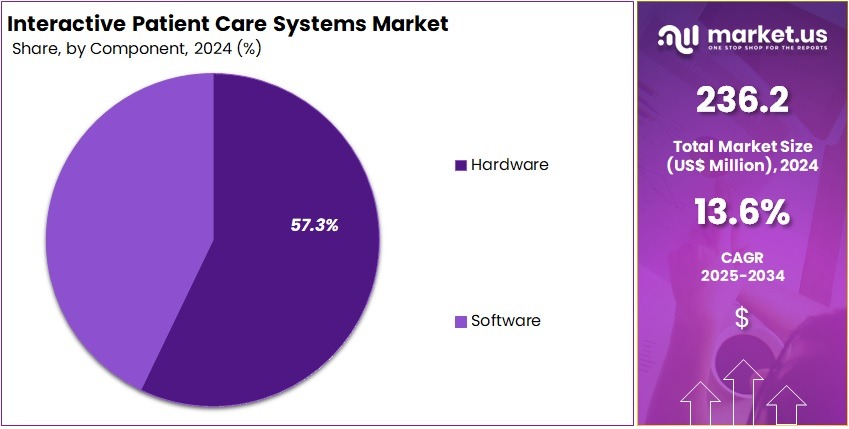

- In 2024, the hardware component dominated the market segment, accounting for more than 57.35% of the overall component share.

- Acute care applications led the application segment in 2024, capturing over 32.4% of the total market share.

- Hospitals were the leading end-user group in 2024, securing a dominant market share of more than 37.5%.

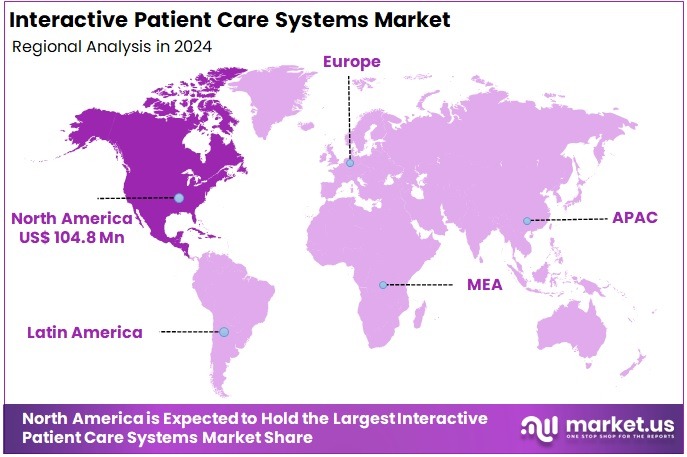

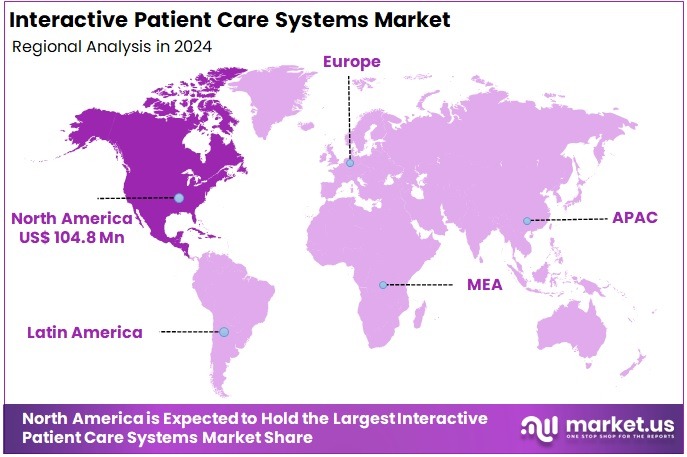

- In 2024, North America held a leading market position with over 44.4% share, valued at approximately US$ 104.8 billion for the year.

Component Analysis

In 2024, the Hardware Section held a dominant market position in the Component Segment of the Interactive Patient Care Systems Market, and captured more than a 57.35% share. This leadership was largely attributed to the increased use of bedside infotainment systems and wall-mounted touchscreens in hospitals. Many healthcare facilities upgraded their physical infrastructure to improve patient experience. Hardware devices served as essential tools for delivering digital content, care instructions, and communication between patients and clinical staff in real time.

The software segment also experienced consistent growth during the same period. This growth was supported by the rising use of digital solutions like patient education tools and interactive feedback systems. Hospitals began integrating electronic health records (EHR) and digital consent forms into patient-facing platforms. These changes helped in streamlining care and boosting patient satisfaction. Although software is gaining momentum, it often functions in support of the core hardware units deployed at the patient’s bedside.

Software offerings became more advanced with the adoption of cloud computing and mobile-based platforms. Several hospitals implemented hospital information systems (HIS) to provide patients access to their health data. Despite these advancements, hardware remained the primary mode for patient interaction. Many organizations emphasized combining smart hardware with efficient software to offer a seamless care experience and enhance engagement outcomes.

Application Analysis

In 2024, the Acute Care section held a dominant market position in the Application segment of the Interactive Patient Care Systems market, and captured more than a 32.4% share. This dominance was attributed to the rapid adoption of digital engagement tools in hospital settings. Acute care hospitals increasingly rely on interactive systems to improve patient communication and experience. These platforms also help in reducing hospital readmissions and enhancing care coordination. The presence of strong clinical infrastructure further supports this widespread usage.

The Post-Acute Care segment gained notable traction following the shift toward extended care solutions. Many facilities have implemented interactive systems to monitor patients after discharge and assist with recovery. These systems help in patient education, medication reminders, and virtual consultations. As healthcare systems focus more on continuity of care, the role of interactive technologies in post-acute care settings has grown. Rehabilitation centers and skilled nursing facilities also benefit from digital tools to ensure better treatment adherence.

Long-Term Care and Home Care segments are steadily expanding their share in the market. In long-term facilities, interactive systems help manage chronic diseases and improve engagement for elderly patients. Home care settings are witnessing growing adoption due to the rise of remote patient monitoring. These tools support virtual check-ins, symptom tracking, and personalized health education. As more care shifts to the home, this segment is likely to see increased integration of digital patient care solutions.

End-User Analysis

In 2024, the Hospitals section held a dominant market position in the end-user segment of the Interactive Patient Care Systems market and captured more than a 37.5% share. This dominance can be attributed to the widespread deployment of digital health platforms and smart bedside terminals across inpatient settings. Hospitals have increasingly invested in integrated systems that enhance patient engagement, reduce readmission rates, and improve satisfaction scores. The demand is further supported by government mandates to promote patient-centered care and real-time communication within hospital settings.

Clinics and specialty centers also contributed significantly to market revenue in 2024. These facilities are adopting interactive platforms to offer tailored educational content, symptom tracking tools, and multilingual support services. Their adoption is growing in areas such as oncology, orthopedics, and chronic disease management, where patient education and shared decision-making are critical. Cost-effective deployment models and cloud-based interfaces are driving uptake across mid-sized clinics.

Ambulatory Surgical Centers (ASCs) are emerging as a promising segment. These centers focus on outpatient surgeries and rely on interactive systems to provide preoperative instructions, postoperative care plans, and satisfaction surveys. The growth of minimally invasive procedures and same-day discharges has increased the importance of efficient communication. Other end-users, such as rehabilitation centers and long-term care facilities, are also showing gradual interest in deploying patient-facing digital tools.

Key Market Segments

By Component

- Hardware

- Software

By Application

- Acute Care

- Post-Acute Care

- Long-Term Care

- Rehabilitation Centers

- Home Care

By End-User

- Hospitals

- Clinics & Specialty Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Drivers

Emphasis on Patient Engagement and Value-Based Care

The increasing emphasis on patient engagement is transforming the healthcare delivery model. Healthcare providers are shifting away from traditional reactive care and adopting proactive, patient-centered approaches. Interactive Patient Care (IPC) systems support this transition by delivering tailored educational content, real-time feedback mechanisms, and communication tools. These features allow patients to better understand their health conditions and treatment pathways. As a result, hospitals are witnessing improved patient compliance, reduced readmission rates, and stronger alignment with clinical care objectives.

Value-based care models are becoming central to healthcare systems worldwide. These models focus on improving outcomes while controlling costs. IPC systems contribute directly to this goal by enhancing patient experience and clinical outcomes through personalized care plans, remote monitoring, and digital education. Such functionalities support providers in meeting quality metrics required for performance-based reimbursement. Hospitals and clinics adopting IPC technologies can thus ensure both economic and care-related efficiency, driving wider deployment across healthcare ecosystems.

Additionally, the integration of telehealth and digital entertainment within IPC platforms increases patient satisfaction and engagement during hospital stays. These systems help reduce patient anxiety, promote participation in care decisions, and facilitate better communication with care teams. This holistic engagement not only improves recovery times but also strengthens hospital ratings and patient loyalty, reinforcing the push toward IPC adoption.

Restraints

High Infrastructure Costs and Limited Technological Readiness

The implementation of Interactive Patient Care (IPC) Systems demands substantial infrastructure investment. Hospitals must install bedside devices, smart TVs, secure data servers, and integrate systems with existing EHR platforms. These components require upfront capital and long-term maintenance costs. In many healthcare facilities, especially those operating on tight budgets, such investments are not feasible. As a result, the adoption of IPC systems is often delayed or deprioritized in favor of more immediate clinical needs, creating a barrier to large-scale deployment.

Moreover, the successful operation of IPC systems relies heavily on robust and secure internet connectivity. Real-time communication, patient education modules, and digital engagement tools depend on high-speed networks. However, many hospitals—particularly in rural or resource-limited regions—lack the necessary digital infrastructure. Poor bandwidth, data security issues, and unreliable connectivity can cause performance failures, reducing the system’s effectiveness and discouraging further adoption across institutions with limited IT capabilities.

Technological readiness also plays a critical role in IPC system uptake. Integration with hospital information systems, staff training, and system interoperability present significant challenges. Many legacy systems in healthcare settings are not compatible with modern IPC platforms. Additionally, staff may lack the digital skills required to manage these technologies effectively, leading to underutilization. This digital divide acts as a major limiting factor in the widespread implementation of IPC solutions.

Opportunities

Growth Potential Through Remote Patient Monitoring and Telehealth Integration

The expansion of remote patient monitoring (RPM) and telehealth is creating a significant opportunity for the Interactive Patient Care (IPC) Systems market. This shift is being driven by the rising demand for accessible care delivery beyond traditional healthcare settings. COVID-19 played a pivotal role in accelerating the adoption of virtual care, which has now become an integral part of the care continuum. IPC systems, when embedded within mobile and tablet platforms, are enabling providers to connect with patients at home, enhancing engagement and care outcomes.

By integrating with wearable devices, IPC systems can capture real-time patient health data. These systems can monitor vital signs, activity levels, and treatment adherence. This enables clinicians to provide timely interventions without requiring physical hospital visits. Such integration not only enhances patient safety but also supports proactive care models. It extends the scope of IPC systems from hospital-based environments to home-based settings. As a result, healthcare providers can optimize resource use while maintaining continuity of care.

Additionally, IPC systems embedded with AI and linked to electronic health records (EHRs) can analyze data for predictive insights. This enables early detection of health risks and helps tailor interventions based on patient-specific needs. Such capabilities support value-based care strategies and open up new revenue streams. As the global shift toward decentralized care continues, IPC systems are expected to play a critical role in digital health transformation.

Trends

Shift from Bedside TVs to AI-Driven, Multi-Channel Patient Engagement Platforms

The Interactive Patient Care (IPC) Systems market is undergoing a significant transition. Traditional bedside televisions are being replaced by advanced, multi-channel engagement platforms. These platforms include smart TVs, mobile applications, patient portals, and voice-assisted technologies. This transformation is driven by the demand for more personalized, accessible, and interactive care experiences. Hospitals and health systems are increasingly seeking flexible systems that support both inpatient and post-discharge engagement. This shift marks a move toward digitized and decentralized care experiences within modern healthcare infrastructure.

These new IPC platforms are not limited to passive entertainment. They now support two-way communication, remote consultations, and real-time health updates. By integrating AI and edge computing, these systems deliver predictive analytics that anticipate patient needs. Features such as automated alerts, educational content, and customized recovery plans enhance clinical outcomes. The emphasis is on delivering patient-centric care that aligns with current digital health expectations. This technological advancement also reduces staff burden and improves workflow efficiency.

Furthermore, the continuity of care from hospital to home is being streamlined through these intelligent platforms. Mobile apps allow patients to track progress, receive follow-up reminders, and access care plans even after discharge. This ensures sustained engagement, better adherence to treatment, and lower readmission rates. IPC systems are thus evolving into essential components of connected healthcare ecosystems.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 44.4% share and holds US$ 104.8 billion market value for the year. This strong position was supported by the region’s robust healthcare infrastructure. Hospitals and clinics across the United States and Canada were early adopters of interactive patient care systems. These tools were widely used to enhance communication between patients and providers, and to improve satisfaction during hospital stays.

A key factor driving growth in North America was the widespread adoption of electronic health records (EHRs). Healthcare facilities increasingly integrated patient portals and interactive displays into clinical workflows. This allowed real-time access to medical data, boosting patient awareness and engagement. Government initiatives also encouraged the use of digital tools to improve outcomes and reduce healthcare costs. These policy efforts further fueled market expansion in the region.

Digital literacy levels in North America were relatively high, supporting the use of smart technologies in patient care. Patients showed greater comfort in using touch-based systems, in-room entertainment, and educational resources. Hospitals also focused on using these systems to deliver tailored care plans. Such personalization helped reduce anxiety, promote faster recovery, and increased compliance with medical instructions.

Rising investments in smart hospital infrastructure further enhanced the adoption of interactive systems. Major health systems across the U.S. allocated budgets to upgrade rooms with bedside terminals and mobile integration platforms. These tools helped streamline care coordination and offered patients greater control over their care experience. As these projects scaled, North America’s leadership in the market became more pronounced.

The region also benefited from strong collaboration between healthcare providers and health-tech firms. Innovation in interactive solutions, such as AI-based communication tools and multi-language interfaces, supported inclusivity and accessibility. These efforts resulted in better patient outcomes and stronger satisfaction scores. With continued advancements and policy support, North America is expected to retain its top position in the global Interactive Patient Care Systems Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Interactive Patient Care Systems market features a diverse mix of players, including healthcare IT firms, device manufacturers, and digital startups. These companies are prioritizing modular software platforms, cloud-based solutions, and content tailored to patient needs. Market consolidation is ongoing through acquisitions and licensing agreements, aiming to deliver integrated care communication. This evolving landscape reflects the shift from fragmented tools to unified systems that support engagement, education, and health outcomes. The competitive environment encourages innovation and broader adoption across acute, post-acute, and outpatient care settings.

GetWellNetwork Inc. holds a strong presence as a leader in patient engagement technology. Its platform, GetWell Inpatient™, is designed to support real-time interaction between patients and care teams. The company emphasizes care coordination, feedback mechanisms, and personalized education. Strategic alliances with healthcare providers have enhanced its reach, particularly in North America. Through digital platform investments, GetWellNetwork continues to expand its impact across the care continuum. Its focus remains on improving patient satisfaction, adherence, and communication during hospital stays and transitions of care.

Epic Systems Corporation contributes significantly through its MyChart Bedside™ platform. This solution integrates seamlessly with its electronic health record (EHR) system to support clinical communication and patient engagement. Patients can access lab results, educational content, and messages within a single digital environment. Epic’s widespread EHR adoption provides a competitive edge, especially in integrated health systems. By enhancing mobile engagement and user experience, Epic strengthens its market position. The company’s consistent innovation in patient-facing technologies supports growing demand for connected, responsive care delivery models.

SONIFI Health and Advantech Co., Ltd. bring complementary strengths to the market. SONIFI Health leverages its legacy in media systems to deliver patient infotainment and clinical tools. Its solutions enhance satisfaction in high-traffic hospital environments. Advantech, meanwhile, specializes in medical-grade hardware like bedside terminals and tablets. These tools promote real-time interaction and are used widely in digitally connected hospitals. Sentrics, focused on post-acute and senior living care, uses AI-powered analytics to personalize engagement. Through its E3 platform, it leads in long-term care innovations, providing value-added safety and experience tracking.

Market Key Players

- GetWellNetwork Inc.

- Epic Systems Corporation

- SONIFI Health Incorporated

- Advantech Co. Ltd.

- Sentrics

- Evideon

- Aceso Interactive Inc

- PDi Communication Systems Inc.

- Lincor

- InterSystems Corporation

- Hopitel Inc

- Oneview Healthcare

Recent Developments

- In July 2024: Enterprise AI investor SAIGroup acquired digital patient engagement leader Get Well, which serves over 10 million patients annually at more than 1,000 healthcare organizations. As part of the acquisition, SAIGroup planned to integrate its predictive and generative AI platform (Eureka AI) into Get Well’s offerings—positioning the combined entity as a precision care platform to drive patient and clinician engagement across hospital and ambulatory settings.

- In January 2022: Hopitel Inc. highlighted the rapid scaling and global deployment of its cloud-based patient engagement and hospital workflow solutions, specifically through its PATIENTlOGIX™ platform. Leveraging Microsoft Azure, Hopitel expanded the availability of health education media services in the cloud, enabling patients to access educational resources from various regions worldwide. This development underscores Hopitel’s commitment to improving patient engagement and healthcare outcomes by providing flexible, scalable, and cost-effective digital solutions for hospitals and patients.

Report Scope

Report Features Description Market Value (2024) US$ 236.2 Million Forecast Revenue (2034) US$ 845.4 Million CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software), By Application (Acute Care, Post-Acute Care, Long-Term Care, Rehabilitation Centers, Home Care), By End-User (Hospitals, Clinics & Specialty Centers, Ambulatory Surgical Centers (ASCs), Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GetWellNetwork Inc., Epic Systems Corporation, SONIFI Health Incorporated, Advantech Co. Ltd., Sentrics, Evideon, Aceso Interactive Inc, PDi Communication Systems Inc., Lincor, InterSystems Corporation, Hopitel Inc, Oneview Healthcare Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Interactive Patient Care Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Interactive Patient Care Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GetWellNetwork Inc.

- Epic Systems Corporation

- SONIFI Health Incorporated

- Advantech Co. Ltd.

- Sentrics

- Evideon

- Aceso Interactive Inc

- PDi Communication Systems Inc.

- Lincor

- InterSystems Corporation

- Hopitel Inc

- Oneview Healthcare