Global Interactive KIOSK Market Size, Share, Trends Analysis Report By Type (Automated Teller Machines (ATMs), Self-Service Kiosks, Vending Kiosk, Check-in kiosk and Others), By End-Use (BFSI Sector, Retail Sector, Food & Beverage, Travel Industries & Tourism, Healthcare Sector, Government Sector, Shopping Malls, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 19488

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

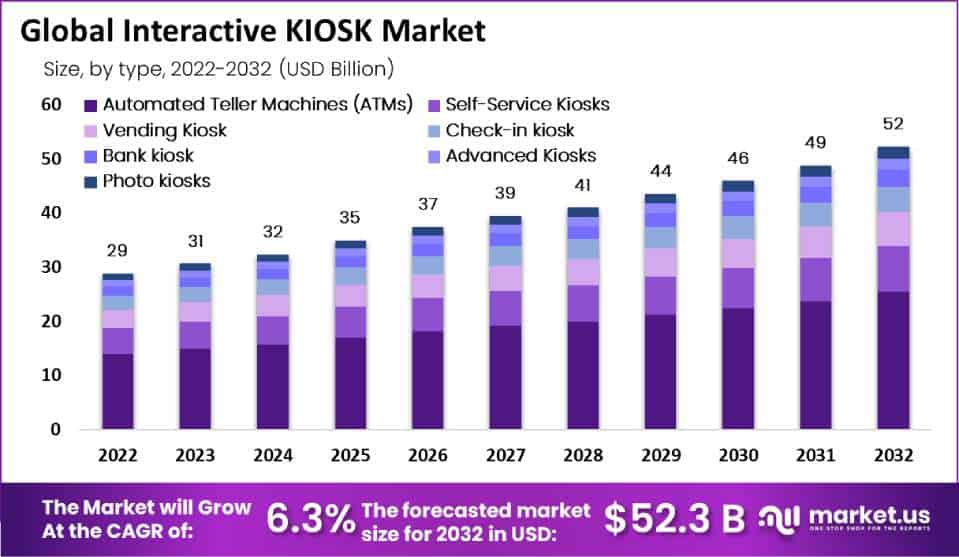

The Global Interactive KIOSK Market size is expected to be worth around USD 52 Billion By 2032, from USD 31 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2023 to 2032.

An interactive kiosk is a standalone device designed for public use that provides information and access to services through an electronic interface. Typically, these kiosks feature touchscreens, though other interfaces can also be used. They enable users to perform a variety of self-service tasks such as ticket purchasing, information retrieval, and making payments. These systems are commonly found in retail settings, airports, hotel lobbies, and other public areas where streamlined service processes are beneficial.

The interactive kiosk market has been expanding due to the widespread adoption of self-service technology across various industries. Retail, healthcare, hospitality, and transportation sectors increasingly rely on these kiosks to streamline operations and enhance customer experience. The market is characterized by innovations that integrate advanced technologies such as AI, biometrics, and wireless connectivity to make kiosks more interactive and efficient.

The interactive kiosk market’s growth is primarily fueled by the rising consumer preference for fast and convenient access to information and services. The integration of advanced technologies such as touch interfaces, payment functions, and multimedia systems has made these kiosks more appealing across different industries. Additionally, the shift towards digital and automated solutions in customer service to reduce operational costs and improve service efficiency is propelling market expansion.

Market demand for interactive kiosks is surging due to their ability to enhance customer experience and manage high customer traffic effectively. The adoption of interactive kiosks in the hospitality and retail sectors, in particular, is increasing as these sectors seek to offer customers control over their purchasing and service interactions. This trend is evident in initiatives like IKEA’s rollout of self-service kiosks across its stores to improve shopping experiences.

Technological advancements are significantly shaping the interactive kiosk market. Recent innovations include the integration of AI-driven facial recognition for better security and personalized service, advanced touch display technologies for enhanced user interaction, and robust data analytics capabilities to glean insights from user interactions. These technologies are making kiosks smarter and more capable of handling complex tasks, thus expanding their applicability across various industries

The interactive kiosk market is ripe with opportunities, particularly in developing regions such as Asia-Pacific, where rapid urbanization and high population density are increasing the demand for efficient, accessible services. The market is also seeing a rise in investments in smart city projects where interactive kiosks play a crucial role in public service delivery.

Key Takeaways

- The Global Interactive Kiosk Market is poised for substantial growth over the next decade. By 2032, the market is projected to reach a value of approximately USD 52 Billion, up from USD 31 Billion in 2023. This represents a steady annual growth rate of 6.3% from 2023 to 2032.

- In a closer look at the segments within this market, Automated Teller Machines (ATMs) stand out as a key driver of growth. In 2022, ATMs accounted for a significant portion of the market, holding about 48.6% of the total market share. This dominant position highlights the ongoing reliance on and importance of ATMs in providing automated services to customers across various regions.

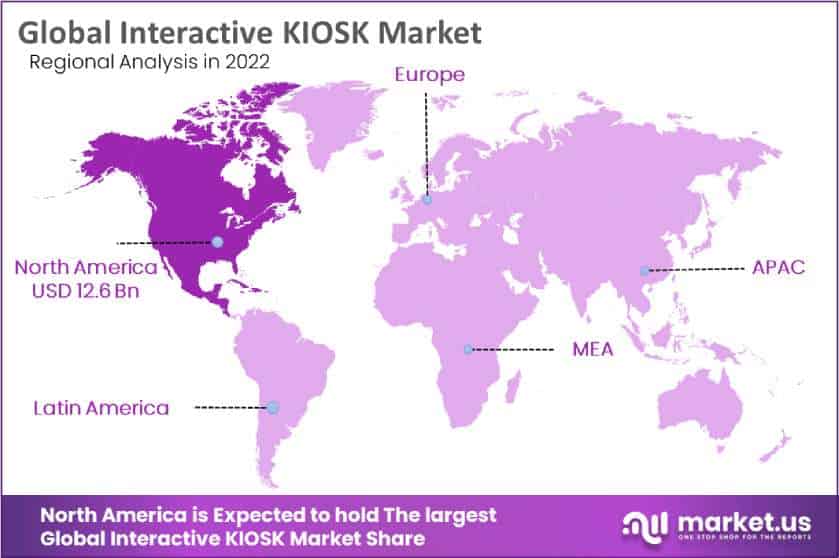

- Geographically, North America continues to lead the global interactive kiosk industry. In 2022, this region generated revenues of USD 12.6 billion, representing more than 44% of the global market. This strong performance is supported by advanced technology infrastructure and a high adoption rate of self-service solutions across industries.

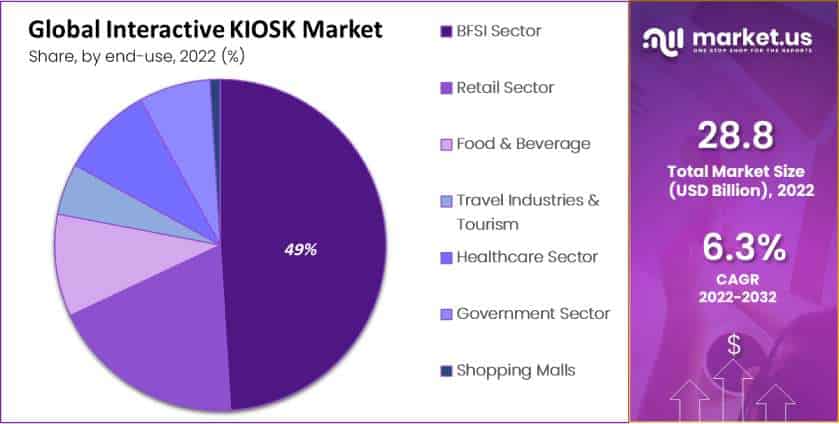

- In terms of industry applications, the BFSI sector (Banking, Financial Services, and Insurance) remains the largest user of interactive kiosks. With more than 49% of the market share in 2022.

Type Analysis

In 2022, the Automated Teller Machine (ATM) segment held a dominant position in the interactive kiosk market, capturing more than a 48.6% share. This substantial market share is largely attributed to the indispensable role that ATMs play in daily financial transactions globally.

ATMs offer unparalleled convenience in banking services, allowing users to perform various transactions such as cash withdrawals, deposits, and account inquiries without the need for teller interaction. This convenience factor, combined with the widespread deployment of ATMs across diverse locations from banks to shopping centers, underpins their dominance.

The dominance of the ATM segment is further bolstered by continuous technological advancements that enhance security and user experience. Modern ATMs are equipped with sophisticated features like biometric authentication and touchless operations, making them more secure and appealing to tech-savvy consumers.

Additionally, financial institutions have been actively upgrading their ATM units to include more complex functions such as currency conversion, bill payments, and even purchasing financial products directly through the machine. Furthermore, the growth of the ATM segment is supported by the banking sector’s push towards digitalization.

Banks are expanding their ATM networks to provide 24/7 services to meet customer expectations for anytime, anywhere banking. This strategy not only enhances customer satisfaction but also helps banks reduce operational costs associated with traditional brick-and-mortar branches. The ongoing integration of AI and IoT technologies into ATMs is expected to drive further innovations, making this segment a key area of growth within the interactive kiosk market.

End-User Analysis

In 2022, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the interactive kiosk industry, capturing more than a 49% share. This leadership stems primarily from the extensive use of interactive kiosks in banking and financial institutions to enhance customer service and streamline operations.

Interactive kiosks provide a range of services such as account management, bill payments, and financial product information, which are critical for customer convenience and operational efficiency in banks and financial institutions.

The prevalence of interactive kiosks in the BFSI sector is also driven by the significant push towards digital transformation within the industry. Financial institutions are continuously looking for ways to reduce operational costs and enhance service efficiency, and interactive kiosks serve this need effectively. They reduce the workload on human staff and minimize wait times for customers, which in turn improves the overall customer experience.

Additionally, the integration of advanced technologies such as biometric scanners, NFC, and card readers into kiosks has increased their functionality, making them more secure and capable of handling sensitive transactions. This technological advancement supports compliance with stringent security regulations in the financial sector and increases customer trust in using these automated systems.

Moreover, the expansion of services offered through kiosks, including sophisticated functions like loan applications and instant card issuance, continues to propel their adoption in the BFSI sector. As banks expand their reach to underserved areas, kiosks provide a viable solution to deliver banking services efficiently and cost-effectively.

Thus, the BFSI sector’s reliance on interactive kiosks is expected to grow, maintaining its dominance in the market due to the ongoing innovation and strategic importance of these systems in customer service strategies.

Key Market Segments

By Type

- Automated Teller Machines (ATMs)

- Self-Service Kiosks

- Vending Kiosk

- Check-in kiosk

- Bank kiosk

- Advanced Kiosks

- Photo kiosks

- Mobile kiosk

- Indoor kiosks

- Outdoor kiosks

- Patient information kiosks

By End-Use

- BFSI Sector

- Retail Sector

- Food & Beverage

- Travel Industries & Tourism

- Healthcare Sector

- Government Sector

- Shopping Malls

- Other End-Uses

Driver

Increased Demand for Customer Self-Service Options

One of the primary drivers propelling the interactive kiosk market is the increased demand for self-service options across various industries. The deployment of interactive kiosks significantly enhances the customer experience by offering convenient and efficient service delivery options.

These kiosks allow customers to perform numerous transactions independently, without waiting for assistance, which is particularly valued in high-traffic environments such as retail stores, airports, and hospitality venues.

The movement towards digital transformation has further accelerated the adoption of these self-service technologies as businesses strive to modernize their operations and cater to the digital-savvy consumer. As a result, interactive kiosks have become vital tools for companies looking to improve operational efficiency and customer satisfaction simultaneously.

Restraint

High Initial Investment and Maintenance Costs

The expansion of the interactive kiosk market is significantly restrained by the high costs associated with the initial setup and ongoing maintenance. Implementing sophisticated kiosk systems often requires substantial upfront investment in hardware, software, and integration services.

Additionally, these systems need regular updates and maintenance to ensure efficient operation, which adds to the overall cost. For small and medium-sized enterprises (SMEs), these costs can be particularly prohibitive, limiting their ability to adopt this technology despite the potential benefits. This financial barrier is a major restraint, slowing down the widespread adoption of interactive kiosks across all sectors.

Opportunity

Integration of Advanced Technologies

There’s a significant opportunity in the integration of advanced technologies such as artificial intelligence (AI) and touchless interfaces within interactive kiosks. AI can provide personalized customer interactions and enhanced analytics, improving the user experience.

Touchless technology, which has gained importance due to health and safety concerns from the COVID-19 pandemic, allows users to interact with kiosks without physical contact, making services more hygienic and appealing.

The adoption of these technologies can transform traditional kiosk systems into more dynamic, responsive, and user-friendly solutions, thus expanding their applicability and attractiveness to a broader range of industries.

Challenge

Keeping Up with Technological Advances and Consumer Expectations

A significant challenge facing the interactive kiosk market is keeping pace with rapid technological advancements and evolving consumer expectations. As technology continues to advance, kiosks must constantly be updated with the latest hardware and software to remain effective and secure.

Furthermore, consumers increasingly expect intuitive, fast, and reliable services from self-service technologies. Meeting these expectations requires ongoing investment in technology upgrades and system improvements, which can be costly and resource-intensive. Businesses must balance these demands with operational capabilities and budget constraints, making it challenging to maintain competitiveness and relevance in a fast-evolving market.

Growth Factors

Driving the Interactive Kiosk Market Forward

The interactive kiosk market is experiencing robust growth, driven primarily by the increasing demand for self-service solutions across various sectors. As industries aim to enhance customer experiences and streamline operations, the adoption of interactive kiosks has become more prevalent. These kiosks facilitate efficient, user-centric service delivery, allowing users to access services independently, which is particularly advantageous in high-traffic environments like retail stores, airports, and food service areas.

The push towards digital transformation further accelerates this trend, as businesses leverage technology to modernize interactions and improve operational efficiency. This growth is supported by continuous advancements in kiosk technology, including more sophisticated software and hardware that can handle a diverse array of functions, from payment processing to complex information queries.

Emerging Trends

Shaping the Future of Interactive Kiosks

Interactive kiosks are rapidly evolving, incorporating cutting-edge technologies to meet changing consumer expectations and business needs. A significant trend in this space is the integration of artificial intelligence (AI), which enhances the personalization and efficiency of services offered by kiosks. AI enables kiosks to provide tailored recommendations and support, improving user engagement and satisfaction.

Another notable trend is the shift towards touchless interfaces, prompted by heightened health and safety standards due to the COVID-19 pandemic. These innovations are making kiosks more adaptable and appealing, ensuring they remain relevant in a digital-first consumer environment. The growth of AI and touchless technology underscores a broader move towards more interactive, safe, and intelligent self-service solutions.

Business Benefits

The Advantages of Implementing Interactive Kiosks

Implementing interactive kiosks presents numerous benefits for businesses, including enhanced customer service, reduced operational costs, and increased sales. Kiosks provide a consistent, reliable customer service experience, reducing the burden on staff and allowing them to focus on more complex customer service tasks. This can lead to significant cost savings, particularly in labor-intensive sectors such as retail and hospitality.

Additionally, kiosks improve the customer experience by reducing wait times and providing 24/7 service availability, which can help boost customer satisfaction and loyalty. The ability to cross-sell and up-sell through interactive displays and personalized user prompts can also lead to increased revenue streams.

Regional Analysis

In 2022, North America held a dominant market position in the interactive kiosk industry, capturing more than a 44% share with a revenue of USD 12.6 billion. This leadership is primarily due to the widespread adoption of self-service technologies across various sectors such as retail, healthcare, and financial services in the region.

North America’s pioneering role in technological innovation and early adoption of digital solutions significantly contribute to this dominance. The region is home to some of the key players in the kiosk market, which drives continuous development and deployment of advanced kiosk technologies.

Moreover, the high consumer preference for convenience and fast service solutions in North America further fuels the demand for interactive kiosks. The retail and transportation sectors, in particular, have seen a significant increase in the deployment of these kiosks to improve customer experience and operational efficiency.

For example, airports in North America are increasingly integrating kiosk solutions for check-ins and information services to streamline passenger handling and reduce wait times. The robust IT infrastructure and strong focus on enhancing customer engagement through technological means also support the high penetration of interactive kiosks in the North American market.

With the integration of AI, IoT, and touchless technologies, interactive kiosks in North America are becoming more sophisticated, offering businesses and consumers enhanced interactive experiences that are secure, efficient, and user-friendly.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The interactive kiosk market features a range of key players who are pivotal in shaping the industry’s landscape through innovative technologies and extensive market reach. Companies like NCR Corporation and Diebold Nixdorf are prominent in this sector, known for their robust offerings in advanced self-service kiosk solutions. These companies not only provide kiosks but also deliver comprehensive software and services that cater to a variety of business needs across retail, banking, and healthcare sectors.

Additionally, KIOSK Information Systems and Meridian are influential in driving forward the technological capabilities of interactive kiosks. They focus on custom solutions that integrate seamlessly with client operations, enhancing user experience and operational efficiency. Olea Kiosks stands out for its design-forward approach, offering aesthetically pleasing and highly functional kiosks for high-traffic customer service environments.

These companies are continuously evolving through strategic partnerships, acquisitions, and global expansion to meet the growing demand for automated and interactive solutions. Their efforts are pivotal in driving the adoption of kiosks in new markets and sectors, reflecting a dynamic and rapidly advancing industry landscape.

Top Key Players in the Market

- Meridian Kiosks

- KIOSK Information Systems

- Olea Kiosks Inc.

- NCR Corporation

- GLORY Ltd.

- Diebold Nixdorf

- REDYREF Interactive Kiosks

- Hitachi Ltd.

- Frank Mayer

- Advantech Co., Ltd.

- Aila Technologies, Inc.

- Diebold Nixdorf AG

- Diebold Nixdorf Inc.

- DynaTouch Corporation

- Other Key Players

Recent Developments

- In December 2023, REDYREF acquired Livewire Digital, a provider of interactive kiosk software and services. This strategic partnership aims to enhance customer engagement solutions across various industries.

- In November 2023, Advantech launched an interactive kiosk platform with integrated AI capabilities for personalized customer engagement and targeted advertising.

- In July 2023, Aila Technologies partnered with a leading retail chain to deploy interactive kiosks for product information, self-checkout, and loyalty program management.

Report Scope

Report Features Description Market Value (2023) USD 31 Bn Forecast Revenue (2032) USD 52.3 Bn CAGR (2023-2032) 6.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type: Automated Teller Machines (ATMs), Self-Service Kiosks, Vending Kiosk, Check-in kiosk, Bank kiosk, Advanced Kiosks, Photo kiosks, Mobile kiosk, Indoor kiosks, Outdoor kiosks, and Patient information kiosks; By End-Use: BFSI Sector, Retail Sector, Food & Beverage, Travel Industries & Tourism, Healthcare Sector, Government Sector, Shopping malls, and Other End-Uses Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Meridian Kiosks, KIOSK Information Systems, Olea Kiosks Inc., NCR Corporation, GLORY Ltd., Diebold Nixdorf, REDYREF Interactive Kiosks, Hitachi Ltd., Frank Mayer, Advantech Co., Ltd., Aila Technologies, Inc., Diebold Nixdorf AG, Diebold Nixdorf Inc., DynaTouch Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size of Interactive Kiosk from 2023 to 2032?The Global Interactive Kiosk Market size is expected to be worth around USD 52.3 billion by 2032 from USD 28.8 billion in 2022.

What is the CAGR of interactive kiosk market from 2023-2032?The interactive kiosk market is growing at a CAGR(compound annual growth rate) of 6.30% during the forecast period from 2022 to 2032.

What are the key segments by type in interactive kiosk market?The key market segment by type in interactive kiosk are Automated Teller Machines (ATMs), Self-Service Kiosks, Vending Kiosk, Check-in kiosk, Bank kiosk, Advanced Kiosks, Photo kiosks, Mobile kiosk, Indoor kiosks, Outdoor kiosks, Patient information kiosks.

What are the key segment by end use in interactive kiosk market?The key segments of interactive kiosk market by End-Use are BFSI Sector, Retail Sector, Food & Beverage, Travel Industries & Tourism, Healthcare Sector, Government Sector, Shopping Malls, Other End-Uses.

-

-

- Meridian Kiosks

- KIOSK Information Systems

- Olea Kiosks Inc.

- NCR Corporation

- GLORY Ltd.

- Diebold Nixdorf

- REDYREF Interactive Kiosks

- Hitachi Ltd.

- Frank Mayer

- Advantech Co., Ltd.

- Aila Technologies, Inc.

- Diebold Nixdorf AG

- Diebold Nixdorf Inc.

- DynaTouch Corporation

- Other Key Players