Global Intelligent Battery Sensor Market Size, Share, Growth Analysis By Sensor Type (Integrated Sensors, Temperature Sensors, Voltage Sensors, Current Sensors), By Sales Channel (OEM, Aftermarket), By Application (Battery Management Systems (BMS), Telematics, Start-Stop Systems), By Vehicle Type (Passenger Vehicle, Commercial Vehicle, Electric Vehicles), By End Use (Automotive Manufacturers, Aerospace & Defense, Fleet Operators, Consumer Electronics, Telecommunications Companies, Renewable Energy Providers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151293

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

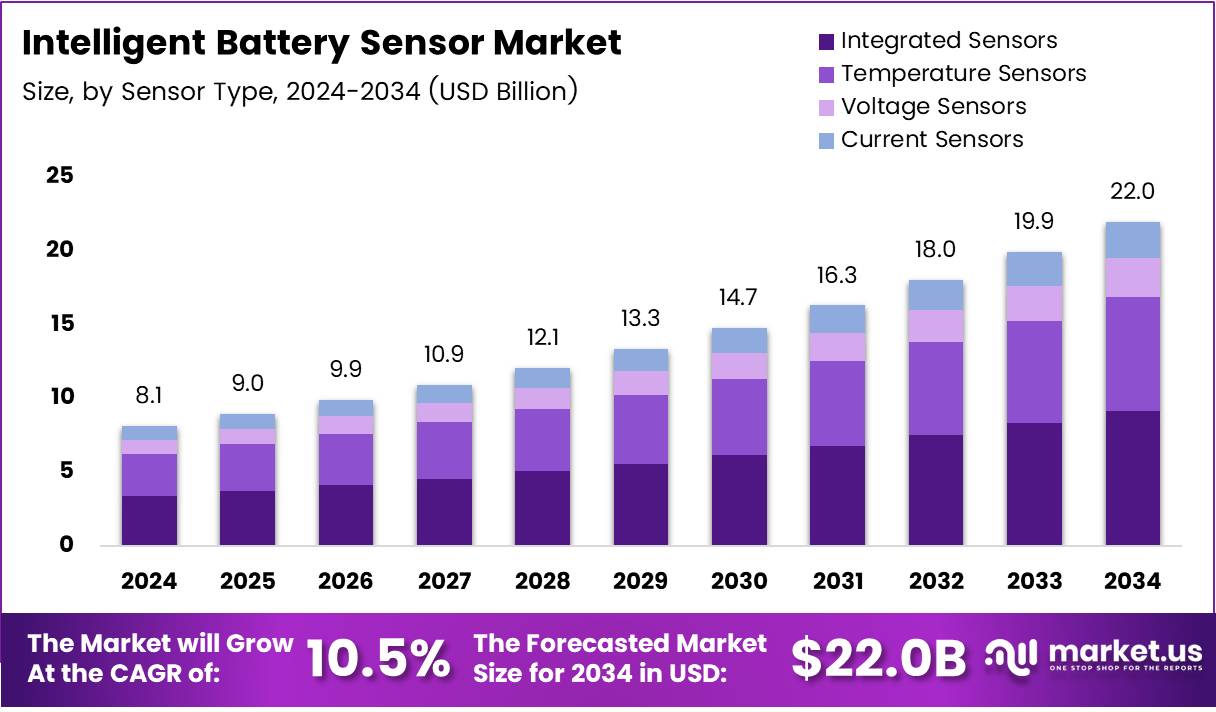

The Global Intelligent Battery Sensor Market size is expected to be worth around USD 22.0 Billion by 2034, from USD 8.1 Billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034.

The Intelligent Battery Sensor (IBS) market is emerging as a vital component in advanced battery management systems. These sensors monitor key parameters such as voltage, current, temperature, and state-of-charge, ensuring efficient battery operation across automotive, renewable energy, and industrial applications. As electrification expands, IBS solutions are becoming integral to extending battery life and optimizing performance.

With rising adoption of electric vehicles (EVs), the demand for accurate battery health monitoring intensifies. According to Geotab, analysis of over 10,000 EVs in 2024 revealed battery degradation averaged 1.8% per year, a notable improvement from 2.3% per year recorded in 2019. This trend highlights the growing efficiency of battery systems, partly attributed to innovations like intelligent battery sensors that provide real-time diagnostics.

Governments worldwide are investing heavily in electrification and clean energy transitions. Regulatory mandates promoting fuel economy, emission reductions, and safety standards further propel the IBS market forward. For instance, stringent EU regulations on CO2 emissions drive automotive OEMs to integrate advanced battery monitoring solutions, including intelligent sensors, ensuring compliance and improved vehicle efficiency.

Moreover, the integration of artificial intelligence (AI) in IBS technology enhances predictive maintenance capabilities. According to Arxiv, a Bayesian Neural Network model achieved an average 13.9% error rate in end-of-life (EoL) predictions, with accuracy improving to 2.9% for certain batteries, and providing a 66% gain in prediction certainty. This advancement underscores the potential of AI-driven IBS systems in minimizing unexpected failures and extending battery service life.

Simultaneously, the growing focus on renewable energy storage systems amplifies market opportunities. As solar and wind installations expand, intelligent battery sensors are essential for managing large-scale battery storage units, preventing overcharging, overheating, and ensuring grid stability. Their ability to optimize energy utilization directly supports the global shift towards sustainable energy infrastructures.

In parallel, the industrial sector is adopting IBS technology to enhance the reliability of backup power systems, forklifts, and automated guided vehicles (AGVs). Industries prioritize consistent power supply, and IBS solutions enable precise monitoring, thereby reducing maintenance costs and operational downtimes.

Despite promising growth, challenges remain. High initial costs of intelligent sensor systems and integration complexities can deter smaller manufacturers. However, ongoing R&D investments aim to reduce costs and simplify deployment, broadening accessibility across multiple industries.

Strategically, partnerships between automotive manufacturers, sensor developers, and software firms are accelerating IBS innovation. Collaboration fosters the development of integrated platforms that combine hardware precision with software intelligence, enhancing end-user value and driving market adoption across both established and emerging economies.

Looking ahead, government support remains critical. Subsidies for EV adoption, grants for renewable energy projects, and regulations favoring energy efficiency will continue to fuel IBS market expansion. The continuous advancement in AI and machine learning will further refine sensor accuracy, transforming battery management systems into intelligent, predictive platforms.

Key Takeaways

- The Global Intelligent Battery Sensor Market is projected to reach USD 22.0 Billion by 2034, growing from USD 8.1 Billion in 2024 at a CAGR of 10.5%.

- Integrated Sensors led the sensor type segment in 2024, capturing 42.3% of the market share.

- OEM dominated the sales channel segment in 2024 due to advantages of early integration into vehicles.

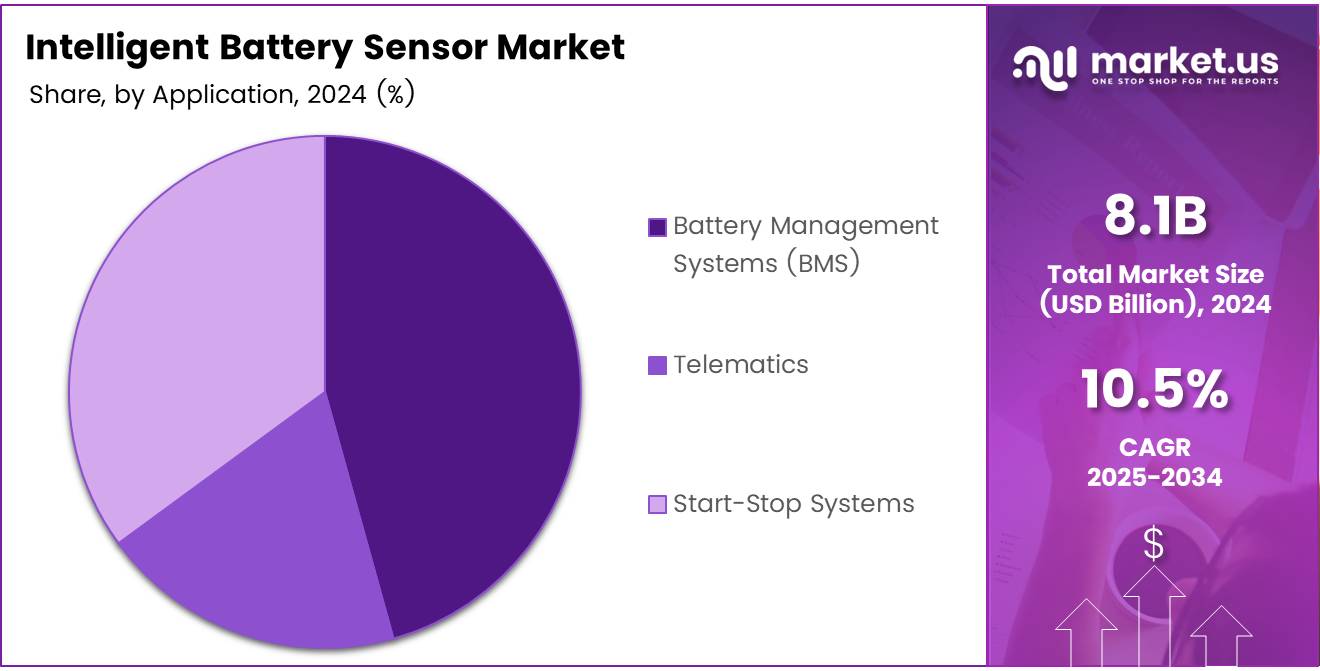

- Battery Management Systems (BMS) held the top position in the application segment in 2024 by extensively leveraging intelligent sensors.

- Passenger Vehicle segment led the vehicle type analysis in 2024, driven by rising demand for fuel-efficient and advanced cars.

- Automotive Manufacturers were the leading end users in 2024, fueled by the surge in electric and hybrid vehicle production.

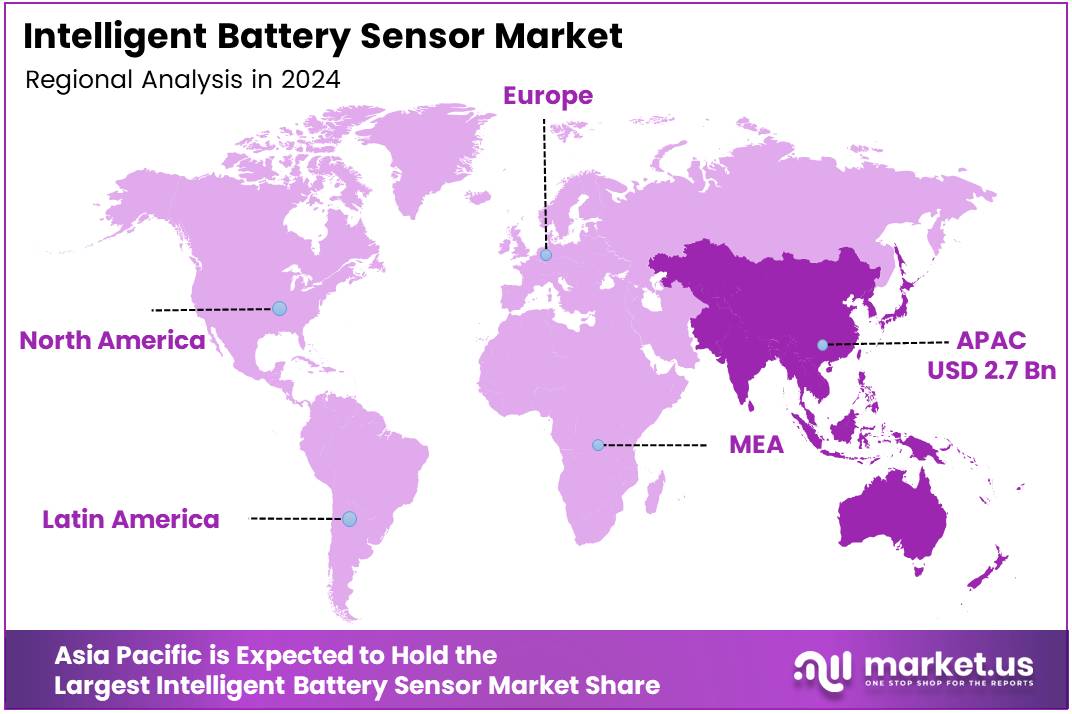

- Asia Pacific dominated the regional market with 34.1% share, valued at USD 2.7 Billion in 2024, supported by EV adoption and strong government policies.

Sensor Type Analysis

Integrated Sensors dominate with 42.3% due to their multifunctional efficiency and compact design.

In 2024, Integrated Sensors held a dominant market position in By Sensor Type Analysis segment of Intelligent Battery Sensor Market, with a 42.3% share. Their ability to combine multiple sensing functions in a single unit has made them highly preferred in modern battery systems.

Temperature Sensors continue to gain steady demand due to their essential role in monitoring battery health and preventing overheating. Their importance grows as battery technologies become more energy-dense and sensitive to thermal variations.

Voltage Sensors are widely adopted for their precision in tracking battery charge levels, ensuring optimal performance and extending battery lifespan. Their growing integration into electric vehicles further supports their market expansion.

Current Sensors play a crucial role in real-time monitoring of charging and discharging cycles. Their application supports improved safety and efficient energy management across diverse automotive and industrial battery applications.

Sales Channel Analysis

OEM dominates due to strong integration into original manufacturing processes and rising EV production.

In 2024, OEM held a dominant market position in By Sales Channel Analysis segment of Intelligent Battery Sensor Market. OEMs benefit from early integration of intelligent battery sensors into vehicle manufacturing, ensuring optimal compatibility and advanced battery management.

Aftermarket sales remain robust, driven by replacement demand and upgrades in existing vehicles. As battery technologies advance, vehicle owners and fleet managers increasingly turn to aftermarket solutions to extend battery life and improve performance.

Application Analysis

Battery Management Systems (BMS) dominate due to their central role in maintaining battery health and efficiency.

In 2024, Battery Management Systems (BMS) held a dominant market position in By Application Analysis segment of Intelligent Battery Sensor Market. BMS utilizes intelligent sensors extensively to monitor, control, and optimize battery operation, ensuring safety and longevity.

Telematics applications are witnessing steady growth as they enable real-time remote monitoring of battery status, improving predictive maintenance and fleet management capabilities.

Start-Stop Systems continue to adopt intelligent battery sensors to optimize engine restarts, enhance fuel efficiency, and reduce emissions, especially in urban driving conditions.

Vehicle Type Analysis

Passenger Vehicle dominates due to the widespread adoption of intelligent battery sensors in personal mobility solutions.

In 2024, Passenger Vehicle held a dominant market position in By Vehicle Type Analysis segment of Intelligent Battery Sensor Market. The rising demand for fuel-efficient, safe, and technologically advanced passenger cars has driven higher integration of intelligent sensors.

Commercial Vehicles increasingly deploy intelligent battery sensors to ensure reliability, minimize downtime, and reduce operational costs across logistics, transportation, and industrial sectors.

Electric Vehicles (EVs) represent a fast-growing segment where intelligent battery sensors are critical to managing complex battery systems, ensuring optimal performance and safety as EV adoption accelerates globally.

End Use Analysis

Automotive Manufacturers dominate due to increasing adoption of advanced battery management solutions in modern vehicles.

In 2024, Automotive Manufacturers held a dominant market position in By End Use Analysis segment of Intelligent Battery Sensor Market. The surging demand for electric and hybrid vehicles has driven manufacturers to integrate intelligent battery sensors for enhanced safety, efficiency, and performance monitoring.

Aerospace & Defense sectors are increasingly adopting intelligent battery sensors to support high-reliability applications where continuous power monitoring is crucial for mission-critical operations and safety compliance.

Fleet Operators leverage intelligent battery sensors to optimize vehicle performance, extend battery life, and reduce maintenance costs, particularly in logistics, transportation, and delivery services with large vehicle inventories.

Consumer Electronics manufacturers integrate intelligent battery sensors in devices to ensure efficient power usage, prevent overheating, and improve overall device reliability, catering to the growing demand for portable and wearable technologies.

Telecommunications Companies rely on these sensors for maintaining uninterrupted power supply in data centers and communication networks, ensuring operational stability even during power fluctuations or outages.

Renewable Energy Providers adopt intelligent battery sensors to manage energy storage systems effectively, ensuring optimal charge-discharge cycles in solar, wind, and hybrid power installations.

Others segment includes emerging industries and specialized applications where intelligent battery sensors are becoming essential for ensuring system reliability, energy efficiency, and operational safety across varied industrial environments.

Key Market Segments

By Sensor Type

- Integrated Sensors

- Temperature Sensors

- Voltage Sensors

- Current Sensors

By Sales Channel

- OEM

- Aftermarket

By Application

- Battery Management Systems (BMS)

- Telematics

- Start-Stop Systems

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicles

By End Use

- Automotive Manufacturers

- Aerospace & Defense

- Fleet Operators

- Consumer Electronics

- Telecommunications Companies

- Renewable Energy Providers

- Others

Drivers

Growing Adoption of Vehicle Electrification and Advanced Battery Management Systems Drives Market Growth

The increasing shift towards vehicle electrification is a major factor driving the intelligent battery sensor (IBS) market. As electric vehicles (EVs) become more popular globally, automakers are prioritizing precise battery management systems to ensure safety and efficiency. Intelligent battery sensors help monitor critical parameters, enhancing the overall battery performance and longevity.

Beyond automobiles, industries are adopting IBS technology for real-time battery health monitoring in various industrial equipment. Heavy machinery, forklifts, and automated guided vehicles rely on continuous power supply, making real-time data on battery conditions crucial for uninterrupted operations. IBS devices play a key role by detecting potential failures before they cause costly downtime.

Another factor accelerating the market growth is the integration of IBS with IoT and cloud-based analytics platforms. By connecting sensors to cloud systems, companies can analyze large volumes of battery data to optimize usage patterns, improve predictive maintenance, and extend battery lifespan. This combination of hardware and advanced software is making IBS systems indispensable across several industries.

Restraints

High Initial Cost of Advanced Intelligent Battery Sensors for OEM Integration Restrains Market Growth

The high upfront cost of advanced intelligent battery sensors poses a significant challenge, particularly for original equipment manufacturers (OEMs). Integrating these sensors into vehicles or industrial equipment requires substantial investment in both hardware and supporting electronics, often increasing the overall production cost and limiting adoption in price-sensitive markets.

Moreover, integrating IBS in multi-battery systems brings technical complexities. Each battery may behave differently under varying conditions, making calibration difficult. Ensuring accuracy across multiple interconnected batteries requires advanced calibration algorithms, which adds complexity to system design and maintenance.

Additionally, manufacturers face difficulties in scaling production while maintaining precision and reliability of IBS units. As demand grows, ensuring consistent quality across mass-produced sensors becomes challenging, potentially delaying broader deployment, especially in developing regions where cost-effective solutions are preferred.

Growth Factors

Expansion of Autonomous Vehicle Fleets Requires Advanced Power Monitoring

The rising deployment of autonomous vehicles is creating significant growth opportunities for the IBS market. These vehicles demand uninterrupted and optimized power management to support advanced navigation, computing, and communication systems. Intelligent battery sensors ensure these high-energy systems operate reliably by continuously monitoring battery performance.

In addition, the growing adoption of IBS technology in renewable energy storage solutions is opening new avenues. With the global push towards clean energy, efficient energy storage becomes critical. Intelligent sensors monitor battery health in solar and wind storage systems, optimizing performance and extending service life.

The miniaturization trend is also generating demand for compact IBS devices in consumer electronics and drones. Portable gadgets and aerial drones rely on small yet powerful batteries. Advanced IBS technology helps in managing these compact energy sources efficiently, improving product safety and user experience.

Emerging Trends

AI-Powered Algorithms for Enhanced Battery Lifespan Prediction Drive Market Trends

Artificial intelligence (AI) is playing an increasingly important role in enhancing IBS capabilities. By applying AI-powered algorithms, manufacturers can predict battery lifespan more accurately based on real-time data. This predictive ability allows businesses to schedule maintenance proactively, reducing unexpected failures and optimizing asset utilization.

Simultaneously, the market is witnessing a trend towards wireless IBS technologies, which allow remote monitoring without extensive wiring. This flexibility is especially valuable in large-scale industrial settings and fleet management, where remote access to battery data helps streamline operations and reduce manual inspections.

The development of solid-state battery technologies is further influencing the IBS market. Solid-state batteries, known for higher energy densities and improved safety, require advanced monitoring solutions. Intelligent sensors adapted for solid-state configurations are becoming essential to ensure the safe and efficient operation of these next-generation power sources.

Regional Analysis

Asia Pacific Dominates the Intelligent Battery Sensor Market with a Market Share of 34.1%, Valued at USD 2.7 Billion

Asia Pacific leads the intelligent battery sensor market, accounting for a significant share of 34.1%, valued at USD 2.7 Billion. The region benefits from strong growth in electric vehicle adoption, particularly in countries like China, Japan, and South Korea, coupled with rising investments in battery management technologies. Supportive government policies for clean energy and expanding automotive manufacturing infrastructure are further propelling market expansion.

North America Intelligent Battery Sensor Market Trends

North America exhibits steady growth driven by technological innovations and widespread adoption of advanced battery management systems in electric and hybrid vehicles. Growing emphasis on real-time battery monitoring in industrial applications and increasing integration with IoT-based platforms is strengthening market demand. The U.S. remains a key contributor due to its robust automotive sector and strong R&D investments.

Europe Intelligent Battery Sensor Market Trends

Europe’s market is expanding due to strict environmental regulations and the strong push for electrification across the transportation sector. The European Union’s focus on achieving carbon neutrality has accelerated demand for intelligent battery sensors in electric mobility and renewable energy storage. Increased collaborations between automotive OEMs and technology providers are also contributing to market development.

Middle East and Africa Intelligent Battery Sensor Market Trends

The Middle East and Africa are witnessing gradual growth, primarily supported by initiatives to diversify energy sources and integrate advanced technologies into industrial operations. While adoption in the automotive sector is still emerging, growing interest in energy storage solutions and government-led smart city projects are offering new opportunities for intelligent battery sensor deployment.

Latin America Intelligent Battery Sensor Market Trends

Latin America’s market shows moderate progress, with growing awareness of battery efficiency and rising investments in electric mobility infrastructure. Countries such as Brazil and Mexico are gradually enhancing their automotive production capabilities and embracing sustainable energy solutions, which is fostering demand for advanced battery sensing technologies in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Intelligent Battery Sensor Company Insights

The global Intelligent Battery Sensor market in 2024 has witnessed dynamic contributions from several leading players driving innovation and technological advancements.

Valence Technology, Inc. continues to strengthen its position through its expertise in lithium phosphate energy storage solutions, offering enhanced safety and reliability features that align with the growing demand for precise battery monitoring across electric vehicles and industrial applications.

Analog Devices, Inc. has made significant strides by leveraging its advanced signal processing capabilities, which enable more accurate measurement of key battery parameters such as state-of-charge and state-of-health. Their focus on high-precision sensing solutions positions them as a critical enabler for OEMs integrating intelligent battery management systems.

Eberspaecher Vecture Inc. remains a vital contributor through its comprehensive battery management systems, emphasizing modularity and flexibility. Its ability to cater to various battery chemistries and configurations allows it to serve a broad customer base across the automotive, medical, and industrial sectors, reinforcing its market relevance.

DENSO Corporation continues to play a pivotal role in the intelligent battery sensor space, capitalizing on its deep automotive industry presence. By integrating intelligent sensors into broader vehicle electrification and powertrain management systems, DENSO supports OEMs in achieving greater fuel efficiency, extended battery life, and real-time monitoring capabilities essential for modern hybrid and electric vehicles.

These companies collectively contribute to shaping a highly competitive and evolving market, driven by rising electrification, demand for real-time diagnostics, and continuous innovation in sensor technologies.

Top Key Players in the Market

- Valence Technology, Inc.

- Analog Devices, Inc.

- Eberspaecher Vecture Inc.

- DENSO Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Murata Manufacturing Co., Ltd.

- Current Ways Inc.

- Texas Instruments Inc.

- Midtronics, Inc.

- Infineon Technologies AG

- HELLA GmbH & Co. KGaA

- TE Connectivity Ltd.

Recent Developments

- In May 2025, EVident Battery secured $3.2 million in funding to accelerate the development of its advanced electric vehicle battery inspection technology. This investment aims to enhance battery safety, performance, and reliability in the growing EV market.

- In August 2024, Butlr raised $38 million in Series B funding to scale its AI-powered sensor technology that transforms buildings into safer, more energy-efficient, and collaborative spaces for both work and living environments.

- In January 2025, Forge Battery received $100 million in funding from the DOE to support its next-generation battery manufacturing and innovation efforts, focusing on enhancing energy storage capabilities and supporting the transition to clean energy.

- In June 2024, Innatera secured $21 million in funding to advance its ultra-low-power AI chips, which are designed to deliver real-time intelligence while significantly reducing energy consumption across edge computing applications.

Report Scope

Report Features Description Market Value (2024) USD 8.1 Billion Forecast Revenue (2034) USD 22.0 Billion CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sensor Type (Integrated Sensors, Temperature Sensors, Voltage Sensors, Current Sensors), By Sales Channel (OEM, Aftermarket), By Application (Battery Management Systems (BMS), Telematics, Start-Stop Systems), By Vehicle Type (Passenger Vehicle, Commercial Vehicle, Electric Vehicles), By End Use (Automotive Manufacturers, Aerospace & Defense, Fleet Operators, Consumer Electronics, Telecommunications Companies, Renewable Energy Providers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Valence Technology, Inc., Analog Devices, Inc., Eberspaecher Vecture Inc., DENSO Corporation, NXP Semiconductors N.V., Robert Bosch GmbH, Murata Manufacturing Co., Ltd., Current Ways Inc., Texas Instruments Inc., Midtronics, Inc., Infineon Technologies AG, HELLA GmbH & Co. KGaA, TE Connectivity Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Battery Sensor MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Intelligent Battery Sensor MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Valence Technology, Inc.

- Analog Devices, Inc.

- Eberspaecher Vecture Inc.

- DENSO Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Murata Manufacturing Co., Ltd.

- Current Ways Inc.

- Texas Instruments Inc.

- Midtronics, Inc.

- Infineon Technologies AG

- HELLA GmbH & Co. KGaA

- TE Connectivity Ltd.