Global Insurance Telematics Market Size, Share, Industry Analysis Report By Component (Hardware Software, Services), By Vehicle(Passenger cars, Commercial vehicles), By Deployment Mode (Cloud-based, On-premises), By Enterprise Size (SME, Large enterprises), By Insurance (Usage-Based Insurance (UBI), Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Distance-based insurance, Behavior-based insurance, On-demand insurance), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157657

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of Generative AI

- Analysts’ Viewpoint

- Investment and Business Benefits

- Emerging Trends

- Growth Factors

- By Component

- By Vehicle

- By Deployment Mode

- By Enterprise Size

- By Insurance Type

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

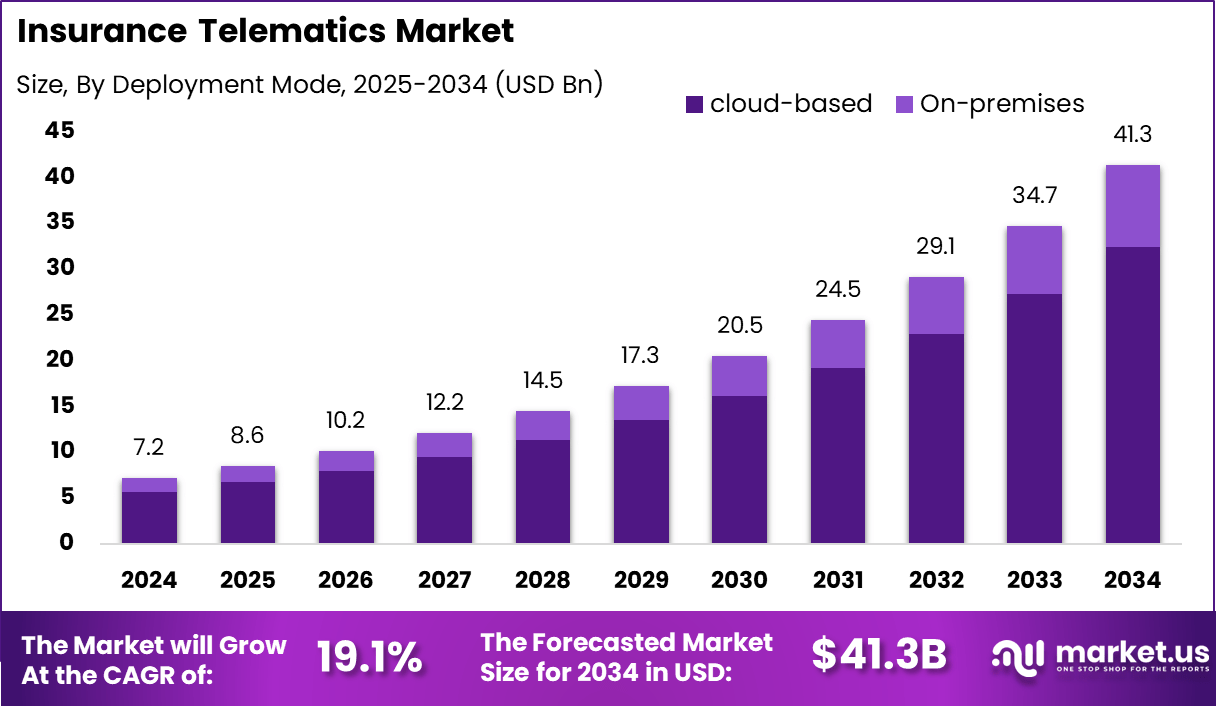

The Global Insurance Telematics Market size is expected to be worth around USD 41.3 Billion By 2034, from USD 7.2 billion in 2024, growing at a CAGR of 19.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 39.76% share, holding USD 2.8 Billion revenue.

The Insurance Telematics Market refers to the use of telecommunication and information technology in the insurance industry to monitor and analyze driving behavior through data collection devices and software. Insurers use this real-time data on vehicle usage, speed, braking, and mileage to provide personalized insurance premiums based on actual driving habits rather than traditional demographic factors.

One of the top driving factors behind the growth of the insurance telematics market is the rising adoption of usage-based insurance (UBI) models. These models reward safe drivers with lower premiums and offer personalized pricing by linking premiums directly to driving behavior. Increasing awareness about connected vehicles and evolving government regulations around driver safety also push the uptake of telematics solutions.

Demand for insurance telematics is growing among both insurers and consumers. Insurers benefit from reduced claim fraud, better risk pricing, and enhanced customer engagement. Consumers are drawn to the potential for lower premiums and more personalized coverage. Fleets and commercial vehicle operators are significant users due to their need to monitor driver performance and optimize operations.

Key Insight Summary

- By component, the Hardware segment dominated with 54.6% share.

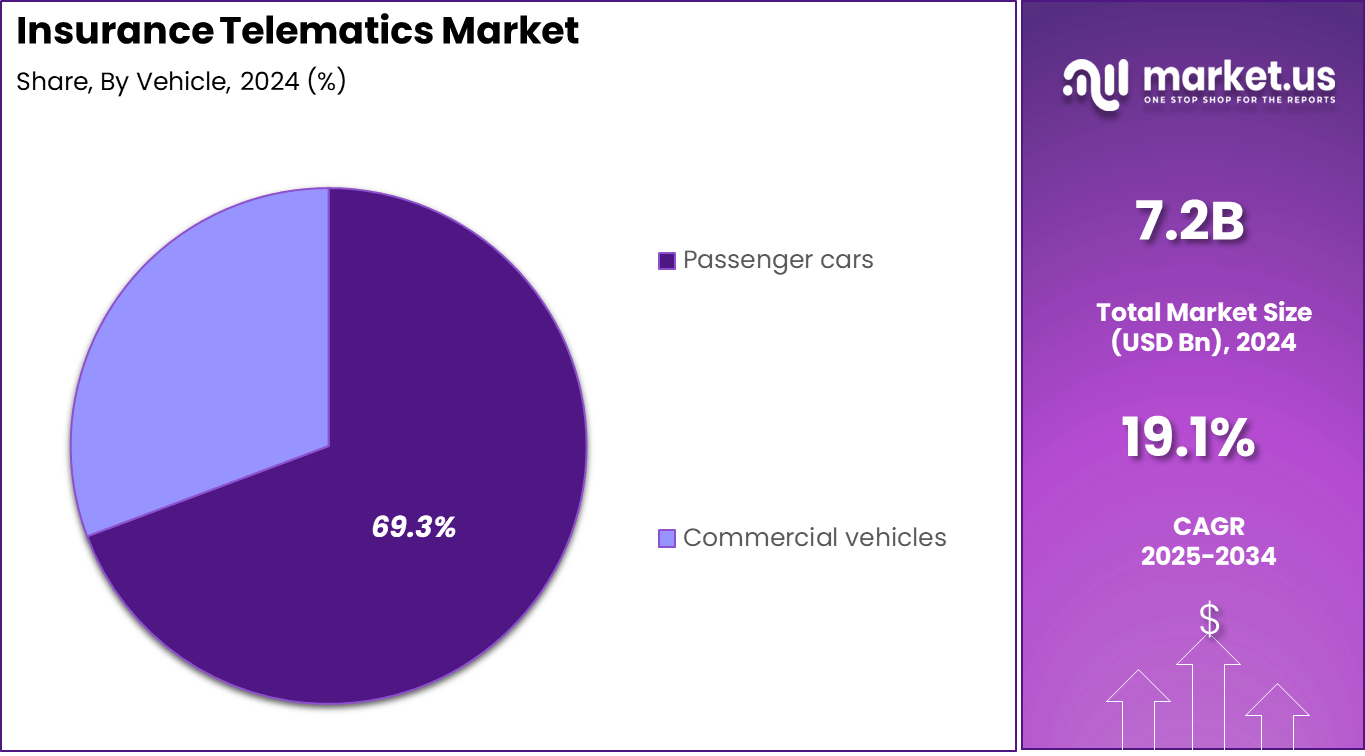

- By vehicle type, Passenger Cars led the market, accounting for 69.3% share.

- Cloud-based deployment was the preferred mode, holding 78.5% share.

- By enterprise size, Large Enterprises were the main adopters, representing 70% share.

- By insurance type, Pay-How-You-Drive (PHYD) policies captured 46.8% share.

- Regionally, North America led the market with a 39.76% share.

Role of Generative AI

Key Points Description Granular Data Analysis Generative AI analyzes large and diverse datasets, uncovering hidden patterns to help insurers understand individual risk better. Fraud Reduction AI helps identify unusual claim patterns to detect and prevent fraudulent activities early. Precise Pricing AI-driven analysis of telematics data enables insurers to set premiums closely aligned with driver risk profiles. Streamlined Claims Processing AI accelerates claims handling by automating data extraction and decision-making workflows. Personalized Customer Interaction Virtual assistants and AI-powered communication enhance customer support and engagement. Analysts’ Viewpoint

Recent developments in machine learning, cloud computing, and the Internet of Things are enhancing the capabilities of insurance telematics. Devices have become smaller, more cost-effective, and capable of collecting more granular data. Insurers are integrating these technologies to create real-time risk profiles, provide instant feedback to drivers, and support faster claims processing.

Smartphone-based telematics applications are becoming more popular as they eliminate the need for dedicated hardware. Insurers adopt telematics to improve underwriting accuracy, reduce claim losses, and promote safer driving behavior. Real-time data allows insurers to design flexible policies and incentivize responsible driving.

For policyholders, these solutions offer the possibility of cost savings and access to value-added services such as emergency assistance and vehicle diagnostics. In fleet management, telematics is also used to monitor vehicle usage, reduce fuel consumption, and improve compliance with safety standards.

Investment and Business Benefits

The market presents significant opportunities for technology providers, insurers, and data analytics firms. Startups offering telematics-as-a-service and app-based insurance models are attracting investments. There is also strong interest in expanding these solutions to new segments such as motorcycles, electric vehicles, and shared mobility platforms.

As regulatory support increases and technology becomes more accessible, investment in end-to-end telematics ecosystems is expected to rise. Adoption of insurance telematics brings measurable business benefits, including improved loss ratios, higher customer retention, and lower operational costs. Real-time monitoring and data-driven insights help insurers detect fraudulent claims more efficiently.

By offering personalized pricing, insurers can better segment their customer base and build long-term relationships. Telematics also enables more proactive customer engagement, helping insurers provide driver coaching and timely support. The regulatory framework surrounding insurance telematics varies across regions. Key concerns include data privacy, consent, and transparency.

Many jurisdictions require insurers to inform customers about what data is collected, how it is stored, and how it will be used. Regulators are increasingly focusing on the ethical use of driving data and consumer rights. In some markets, governments are encouraging the adoption of telematics to reduce road accidents and promote traffic safety.

Emerging Trends

Key Trends Description IoT and Telematics Adoption Real-time data from connected devices enables usage-based insurance and smarter underwriting. Composable Cloud-Native Ecosystems Cloud infrastructure allows insurers to scale and personalize policies with agility. Agentic AI Workflows AI automates complex insurance processes like policy comparisons and document management. Climate-Responsive Insurance Predictive analytics model natural disasters to adjust premiums and encourage sustainability. Cybersecurity and Privacy-First Operations AI enhances fraud detection and ensures data privacy compliance amid expanding digital platforms. Growth Factors

Key Factors Description Rising Road Safety Awareness Growing concerns about traffic safety increase demand for monitoring and risk mitigation. Declining Cost of Sensors & Analytics Cheaper telematics devices and analytics technologies fuel wider adoption. Smartphone Integration Use of smartphones for vehicle telemetry data collection enhances accessibility. Regulatory Support Policies encouraging telematics for fair pricing and loss prevention drive market growth. Partnerships with Telematics Providers Collaborations reduce complexity in data handling and analytics deployment for insurers. By Component

The hardware segment led the insurance telematics market in 2024 with a significant market share of 54.6%. This dominance is driven by the critical role hardware devices such as onboard diagnostics (OBD) units, GPS trackers, and black boxes play in capturing real-time data on vehicle performance and driver behavior. These devices enable insurers to collect accurate and reliable driving data, which forms the foundation for telematics-based insurance models, including usage-based insurance (UBI).

Hardware solutions provide a tangible and direct method to gather critical metrics such as speed, braking patterns, and mileage, empowering insurers to offer personalized premiums based on actual driving habits. Moreover, advancements in IoT sensors and connectivity technologies are enhancing the capabilities of telematics hardware, making devices more compact, energy-efficient, and accurate.

The continuous innovation in hardware fosters a stronger data-driven ecosystem within the insurance telematics market. These devices also facilitate real-time feedback to drivers to encourage safer driving behaviors, thereby reducing accident risks and claims, which contributes to the growth and widespread adoption of hardware-centric telematics solutions.

By Vehicle

The passenger cars segment dominated the vehicle category with a commanding 69.3% share of the insurance telematics market in 2024. This predominance is attributed to the large volume of passenger cars globally and the increasing adoption of telematics technologies within this segment.

Passenger cars represent the primary insurance target, with policy structures increasingly leveraging telematics data to assess risk, reward safe driving, and optimize premiums. The wider availability and affordability of telematics devices in passenger vehicles have accelerated market penetration.

Additionally, regulatory pushes and changing consumer preferences towards personalized insurance policies favor the passenger car segment’s growth. These vehicles often serve as the initial deployment focus for telematics programs aimed at reducing accidents and increasing road safety.

By Deployment Mode

Cloud-based deployment led the insurance telematics market with a dominant share of 78.5% in 2024. Cloud platforms provide insurers with scalable, flexible, and cost-effective infrastructure to store, process, and analyze large volumes of telematics data generated by connected vehicles.

The dynamic scalability of cloud services allows insurers to efficiently manage fluctuating data loads and rapidly deploy analytics tools and AI-driven insights that enhance risk assessment and policy personalization.

Beyond scalability, cloud deployments facilitate seamless integration with other digital insurance ecosystem components, supporting real-time data accessibility for underwriting, claims management, and customer engagement.

Furthermore, cloud services offer enhanced security features and compliance protocols to protect sensitive driver and vehicle data. The growing appetite for data-driven decision-making and digital transformation among insurance enterprises drives the preference for cloud-based telematics solutions across the market.

By Enterprise Size

Large enterprises occupied the largest share of 70% in the insurance telematics market in 2024. These companies leverage telematics to improve risk management and optimize their insurance portfolios across large fleets or customer bases.

The ability to deploy advanced telematics solutions across diverse and geographically dispersed operations enables large enterprises to gain comprehensive insights into driver behavior patterns and vehicle usage trends, facilitating precise pricing and underwriting.

Moreover, large insurers typically have robust IT infrastructure and greater capital to invest in cutting-edge telematics innovations, including AI and machine learning analytics. This supports improved customer segmentation, risk prediction, and fraud detection capabilities, reinforcing their leadership position.

By Insurance Type

The pay-how-you-drive (PHYD) insurance segment accounted for 46.8% of the market in 2024. PHYD insurance policies allow insurers to price premiums based on actual driving behavior rather than estimated mileage alone, promoting safer driving habits through personalized incentives.

This model provides insurers with detailed behavioral data such as acceleration, braking, and cornering dynamics, enabling a more granular risk assessment and better alignment of premiums with driver risk profiles. PHYD policies encourage safer driving by providing real-time feedback and rewards, reducing accident rates and claims costs for insurers.

This model appeals to risk-conscious drivers seeking to lower premiums by demonstrating responsible driving. The increasing consumer awareness and acceptance of usage-based insurance (UBI) models underpin the growing PHYD segment, making it a critical driver in the evolution of insurance telematics.

Key Market Segments

By Component

- Hardware

- On-board Diagnostic (OBD) devices

- Black box

- Smartphones

- OEM embedded devices

- Software

- Telematics data analytics platforms

- Behavior scoring engines

- Mobile telematics applications

- Policy management & risk assessment tools

- Dashboards & visualization tools

- Services

- Professional

- Managed

By Vehicle

- Passenger cars

- Sedans

- Hatchbacks

- SUV

- Commercial vehicles

- Light duty

- Medium duty

- Heavy duty

By Deployment mode

- Cloud-based

- On-premises

By Enterprise Size

- SME

- Large enterprises

By Insurance

- Usage-Based Insurance (UBI)

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Distance-based insurance

- Behavior-based insurance

- On-demand insurance

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Usage-Based Insurance (UBI)

The increasing preference for personalized insurance policies based on actual driving behavior is a major driver for the insurance telematics market. Usage-Based Insurance (UBI) uses telematics devices to monitor factors like speed, braking, and mileage, allowing insurers to calculate premiums aligned with individual risk profiles.

This approach promotes safe driving habits, reduces accident risks, and enables fairer premium pricing, which appeals strongly to cost-conscious and safety-aware consumers. Moreover, with growing awareness about connected vehicles and advancements in mobile telematics technologies, more drivers are accepting UBI models as these policies offer potential discounts and more transparency.

Insurance companies benefit from reduced claims and better risk management. This growing adoption in developed economies like North America and Europe significantly boosts market expansion by pushing insurers to integrate telematics into their offerings for competitive advantage.

Restraint Analysis

Faulty Data Collection Affecting Premium Accuracy

A significant restraint on the adoption of telematics-based insurance is the risk of inaccurate data collected by telematics devices. Sometimes these devices malfunction or continue tracking mileage after a vehicle is off, leading to inflated or incorrect data.

Erroneous recording of driving behavior such as harsh braking or speeding can cause premiums to be calculated unfairly high, damaging customer trust. Besides technical glitches, inconsistencies in data validation negatively impact risk assessments and pricing models.

Consumers may feel distrustful if they pay more due to faulty data, which could restrict market demand. Insurers need to ensure regular device calibration and maintenance to minimize these errors and maintain transparency in policy pricing, or else face rejection of telematics usage by policyholders.

Opportunity Analysis

Expansion Beyond Auto Insurance

Insurance telematics is expanding its reach beyond just auto insurance, presenting a significant growth opportunity in sectors like health, home, and life insurance. For instance, telematics-enabled wearable devices for health monitoring help insurers offer personalized wellness programs and adjust life insurance premiums based on real-time health data.

Similarly, smart home sensors reduce risks related to fire, theft, or leaks, allowing insurers to offer more precise property risk assessments and incentivize preventive behavior. This broader application of telematics technology allows insurance companies to innovate their offerings and capture new market segments, diversifying revenue streams and improving customer engagement.

Challenge Analysis

Privacy and Security Concerns

Privacy and data security concerns pose a major challenge to insurance telematics growth. Collecting personal driving and health-related data raises fears about unauthorized access, hacking, and misuse of sensitive information. Consumers worry that connected devices and telematics systems could expose them to cyberattacks or breach their privacy.

These concerns are heightened by the potential vulnerabilities in telematics hardware, such as On-Board Diagnostics (OBD-II) devices, which might be exploited remotely. Insurers must invest heavily in robust encryption, transparent data usage policies, and compliance with regulations to build trust. Overcoming these security challenges is critical for wider telematics adoption and acceptance among cautious customers.

Competitive Analysis

Agero, Inc. and Aplicom play a central role in shaping the Insurance Telematics Market. They provide advanced platforms for accident management, roadside assistance, and driver monitoring. Their focus on improving connectivity and data collection has helped insurers adopt telematics for accurate risk assessment and claims reduction.

Trak Global Solutions Holdings, Masternaut Limited, and META SYSTEM S.P.A. contribute by offering fleet telematics and predictive analytics. Their solutions help insurers build driver risk profiles, track behavior, and design usage-based insurance models. By addressing road safety and premium optimization, these companies have secured widespread adoption across markets.

MiX by Powerfleet, Octo Group S.p.A, Bridgestone Mobility Solutions, Trimble, and Sierra Wireless are driving innovation through IoT integration and connected mobility services. Octo has strong expertise in usage-based models, while Bridgestone and Trimble bring proven experience in mobility and location solutions. Sierra Wireless ensures reliable connectivity for seamless telematics operations.

Top Key Players in the Market

- Agero, Inc.

- Aplicom

- Trak Global Solutions Holdings (Canada) Inc.

- Masternaut Limited

- META SYSTEM S.P.A.

- MiX by Powerfleet

- Octo Group S.p.A

- Bridgestone Mobility Solutions B.V.

- Trimble

- Sierra Wireless S.A.

Recent Developments

- In April 2025, GEICO strengthened its telematics program by adding AI-driven driver behavior analytics within its mobile app. This update provided real-time risk scores and tailored feedback, helping policyholders reduce accidents while improving the accuracy of premium pricing.

- In March 2025, Allstate Insurance advanced its usage-based insurance model through partnerships with telematics providers. By combining in-vehicle devices and smartphone sensors, the company enabled smooth data capture, faster claims handling, and AI-based fraud detection for more efficient workflows.

- In February 2025, Cambridge Mobile Telematics upgraded its SDK with better sensor fusion and machine learning. The update allowed insurers to detect risky behavior like distracted driving and deliver coaching alerts, improving driver safety and lowering claim volumes.

- In January 2025, Progressive expanded its Snapshot program with cloud-edge hybrid analytics. This approach allowed continuous monitoring even in low connectivity, syncing seamlessly with insurer systems to support flexible premium adjustments for both individual and fleet customers.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 41.3 Bn CAGR(2025-2034) 19.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware Software, Services), By Vehicle(Passenger cars, Commercial vehicles), By Deployment Mode (Cloud-based, On-premises), By Enterprise Size (SME, Large enterprises), By Insurance (Usage-Based Insurance (UBI), Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Distance-based insurance, Behavior-based insurance, On-demand insurance) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agero, Inc., Aplicom, Trak Global Solutions Holdings (Canada) Inc., Masternaut Limited, META SYSTEM S.P.A., MiX by Powerfleet, Octo Group S.p.A, Bridgestone Mobility Solutions B.V., Trimble, Sierra Wireless S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insurance Telematics MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Insurance Telematics MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-