Global Inhalation And Nasal Spray Generic Drugs Market By Drug Class (Inhaled corticosteroids, Short-acting and long-acting bronchodilators, Combination medications, Antihistamine, Decongestant, Others) By Indication(Asthma, COPD, Allergic rhinitis, Others) By Age Group (Pediatric, Adult, Geriatric) By Distribution Channel (Retail pharmacies, Hospital pharmacies, Online pharmacies) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165767

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

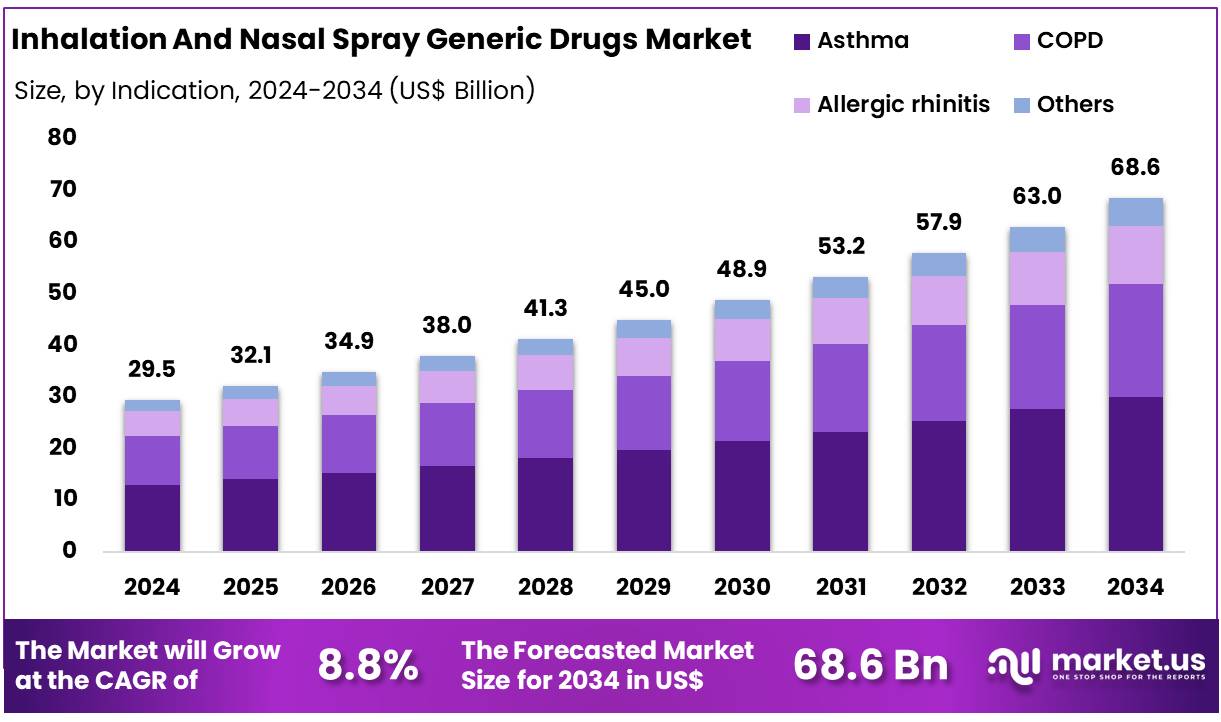

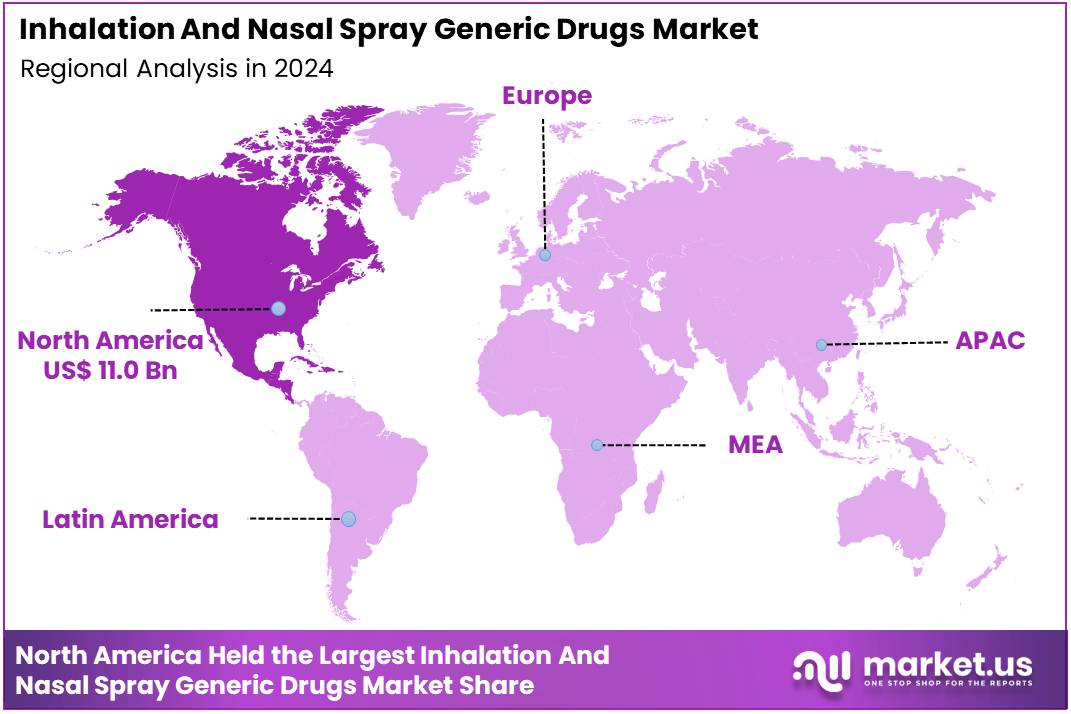

Global Inhalation And Nasal Spray Generic Drugs Market size is expected to be worth around US$ 68.6 Billion by 2034 from US$ 29.5 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 37.3% share with a revenue of US$ 11.0 Billion.

The global market for inhalation and nasal spray generic drugs is being shaped by a sustained and high burden of chronic respiratory diseases, demographic transitions, and strong policy support for cost-effective treatment alternatives. The prevalence of asthma and chronic obstructive pulmonary disease (COPD) remains a dominant factor influencing market expansion.

According to the World Health Organization, asthma affected approximately 262 million individuals and caused 455,000 deaths in 2019. COPD continues to represent one of the leading global causes of mortality, with an estimated 3.5 million deaths reported in 2021. WHO-linked studies indicate COPD prevalence among adults at roughly 12%, with higher levels observed in specific regions. As these diseases rely heavily on inhaled therapies and nasal formulations, the demand for affordable generic substitutes continues to grow in parallel with clinical need.

The widespread occurrence of allergic rhinitis further reinforces market growth potential. More than 400 million people worldwide are estimated to be affected, with adult prevalence ranging from 10% to 30%. Long-term management of allergic rhinitis frequently requires nasal corticosteroid sprays and antihistamine sprays. As healthcare payers seek to reduce recurring treatment costs for chronic conditions, the adoption of lower-priced generic nasal sprays is increasing steadily.

Tobacco exposure continues to elevate the global respiratory disease burden. Despite gradual declines in smoking rates, WHO reports that about 1.2 billion people still used tobacco in 2024, with more than 7 million deaths annually attributable to tobacco use, including 1.6 million deaths among non-smokers due to second-hand smoke. These patterns maintain high demand for inhalation therapies, reinforcing the need for accessible and lower-cost generic inhalers and sprays.

Demographic aging further intensifies market requirements. Older populations exhibit higher rates of COPD, asthma–COPD overlap, and chronic rhinosinusitis. Research indicates that 15–30% of patients experience overlapping features of asthma and COPD, which necessitates prolonged and often complex inhaled treatment regimens. The high lifetime cost associated with these therapies prompts payers to promote generic substitution across inhaled corticosteroids, bronchodilators, and nasal spray categories.

In addition, cost-containment strategies and favorable regulatory frameworks are accelerating market entry for generics. The U.S. FDA has issued detailed guidance on chemistry, manufacturing, bioequivalence, and device performance for nasal sprays and inhalation products, creating clearer development pathways. Similar frameworks in Europe and emerging markets support predictable approval environments that encourage investment.

Improved healthcare access in Asia-Pacific, Latin America, and the Middle East and Africa, combined with rising disease awareness and expanding primary care infrastructure, is expected to strengthen generic uptake. Parallel shifts toward home-based management, telemedicine, and patient self-care further promote stable, affordable treatment options, supporting sustained market growth in inhalation and nasal spray generics.

Key Takeaways

- Market Size: Global Inhalation And Nasal Spray Generic Drugs Market size is expected to be worth around US$ 68.6 Billion by 2034 from US$ 29.5 Billion in 2024.

- Market Growth: The market growing at a CAGR of 8.8% during the forecast period from 2025 to 2034.

- Drug Class Analysis: Short-acting and long-acting bronchodilators accounted for a dominant 32.6% share in 2024.

- Indication Analysis: Asthma accounted for a dominant 43.8% share in 2024, and this leadership has been supported by the high global prevalence of the condition, increasing diagnosis rates, and the strong reliance.

- Age Group Anlaysis: Adults accounted for a dominant 39.5% share in 2024, and this prominence has been supported by heightened exposure to environmental pollutants, occupational hazards.

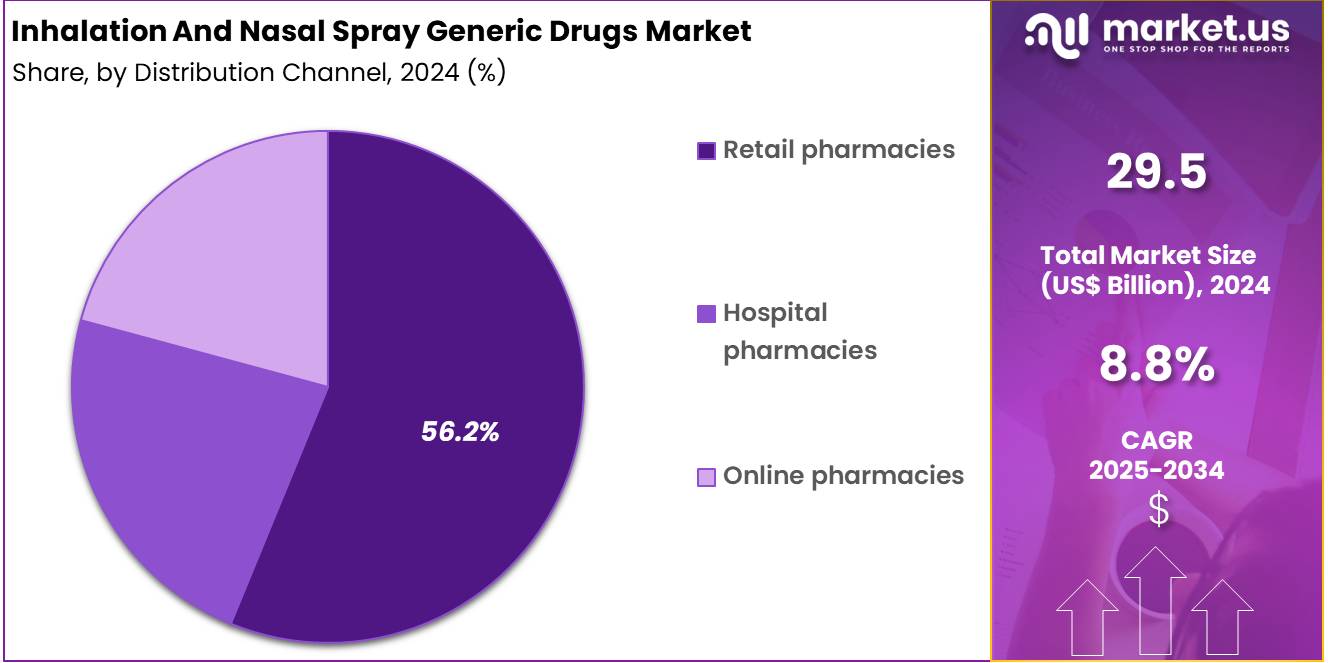

- Distrubution Channel Analysis: In 2024, retail pharmacies are estimated to dominate the market with 56.2% share, driven by their widespread presence and strong patient preference for in-person consultations.

- Regional Analysis: In 2024, North America led the market, achieving over 37.3% share with a revenue of US$ 11.0 Billion.

Drug Class Analysis

The market has been segmented by drug class, and a diversified therapeutic mix has been observed across inhalation and nasal spray generic products. Short-acting and long-acting bronchodilators accounted for a dominant 32.6% share in 2024, and this leadership has been attributed to their widespread use in the management of asthma and chronic obstructive pulmonary disease. High prescription volume, rapid onset of action, and strong clinical acceptance have reinforced their position in the treatment landscape.

Inhaled corticosteroids formed another major segment, supported by their established role in controlling airway inflammation and preventing exacerbations. The adoption of cost-efficient generic formulations has contributed to steady utilization. Combination medications, which integrate corticosteroids with bronchodilators, have reported rising preference due to improved therapeutic outcomes and patient convenience.

Antihistamine nasal sprays were used extensively for allergic rhinitis, and demand has been maintained by the growing prevalence of seasonal and perennial allergies. Decongestant sprays continued to address acute nasal congestion, although usage remained regulated due to safety considerations and recommended short-term application. The “Others” category included anticholinergic agents and emerging formulations, and moderate growth has been evident as product approvals and generic penetration increased within niche respiratory indications.

Indication Analysis

The market has been segmented by indication, and a clear concentration of demand has been observed in major respiratory disorders. Asthma accounted for a dominant 43.8% share in 2024, and this leadership has been supported by the high global prevalence of the condition, increasing diagnosis rates, and the strong reliance on inhaled and nasal generic therapies for long-term disease control. The widespread use of bronchodilators and inhaled corticosteroids in routine asthma management has reinforced sustained product consumption across both developed and emerging markets.

Chronic obstructive pulmonary disease (COPD) represented the second major indication. Its burden has been increasing due to aging populations, persistent exposure to air pollutants, and tobacco use. The uptake of generic long-acting bronchodilators and combination therapies has contributed to stable market growth within this segment.

Allergic rhinitis demonstrated significant utilization of nasal antihistamines and corticosteroid sprays, driven by rising environmental allergens and expanding self-medication trends. The availability of low-cost generic options has further encouraged demand. The “Others” category encompassed conditions such as sinusitis and respiratory infections, and moderate growth has been recorded as broader access to generic formulations and evolving treatment guidelines continued to shape prescription patterns.

Age Group Anlaysis

The market has been segmented by age group, and usage patterns reflect the varying prevalence of respiratory disorders across population cohorts. Adults accounted for a dominant 39.5% share in 2024, and this prominence has been supported by heightened exposure to environmental pollutants, occupational hazards, lifestyle-related triggers, and rising cases of asthma, COPD, and allergic rhinitis within working-age populations. The widespread use of inhaled bronchodilators, corticosteroids, and nasal antihistamines among adults has reinforced strong and consistent demand for generic formulations due to their affordability and therapeutic reliability.

The pediatric segment represented a significant share as respiratory conditions such as asthma and allergic rhinitis are commonly diagnosed in children. Increased awareness among caregivers, improvements in early diagnosis, and the availability of age-appropriate delivery devices have supported steady adoption of inhalation and nasal spray generics in this group. Growth has also been influenced by the preference for safe and low-dose formulations.

The geriatric population formed another important segment, driven by the high burden of chronic respiratory diseases and age-related decline in lung function. The utilization of long-acting bronchodilators and combination therapies has been widespread, and demand has been sustained by improved access to low-cost generics and the growing global elderly population.

Distrubution Channel Analysis

The distribution structure for inhalation and nasal spray generic drugs is shaped by accessibility, cost efficiency, and patient purchasing behavior. In 2024, retail pharmacies are estimated to dominate the market with 56.2% share, driven by their widespread presence and strong patient preference for in-person consultations.

The growth of this segment has been attributed to the high volume of prescriptions for respiratory and allergy-related therapies and the trust established through pharmacist-guided dispensing. Retail outlets continue to serve as the primary point of sale for maintenance medications, enabling steady product turnover and broad consumer reach.

Hospital pharmacies represent the second major channel. Their role has been supported by increased hospitalization rates for chronic respiratory disorders and the reliance on institutional formularies for acute treatment needs. The demand within this channel is concentrated in specialized therapies, emergency care, and post-discharge medication support, contributing to stable procurement volumes.

Online pharmacies are gaining traction due to rising digital adoption and cost-sensitive consumers. Growth within this channel has been facilitated by the expansion of e-prescription frameworks and home-delivery models. Although still smaller in scale, the segment is expected to expand as convenience-centric purchasing behavior strengthens across key markets.

Key Market Segments

By Drug Class

- Inhaled corticosteroids

- Short-acting and long-acting bronchodilators

- Combination medications

- Antihistamine

- Decongestant

- Others

By Indication

- Asthma

- COPD

- Allergic rhinitis

- Others

By Age Group

- Pediatric

- Adult

- Geriatric

By Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

Driving Factors

The growth of the inhalation and nasal spray generic-drugs market is strongly driven by the rising global burden of chronic respiratory diseases. For example, World Health Organization (WHO) reports that asthma affects an estimated 262 million people and caused about 455 000 deaths in 2019. As such, demand for inhaled and nasal therapies is significant. Generic alternatives offer cost savings, making them attractive in healthcare settings aiming to reduce expenditure.

Moreover, regulatory initiatives (such as guidance by U.S. Food & Drug Administration FDA) for inhalation and nasal product development facilitate faster market access for generics. These factors collectively boost the adoption of generic inhalation and nasal spray drugs across regions.

Trending Factors

A prominent trend within the inhalation and nasal spray generics market is the increasing complexity of generic delivery-device combinations and formulation technologies. The FDA’s guidance on nasal spray and inhalation suspension products emphasises the need for robust chemistry, manufacturing and controls documentation for these formats.

Further, regulatory commentary identifies that generic orally inhaled and nasal drug products (OIDPs) require advanced in-vitro/in-vivo equivalence testing beyond the standard generic pathway. Together, these reflect a trend: generic manufacturers are investing in enhanced device-drug platforms and regulatory-compliant development strategies to mirror branded products’ performance, thereby expanding the generics’ share within the inhalation/nasal segment.

Restraining Factors

One key restraint in the market for inhalation and nasal spray generics is the regulatory and technical complexity associated with these dosage forms. Specifically, generic inhalation/nasal products must satisfy rigorous standards for device-drug compatibility, particle/droplet size distribution, dose delivery performance and bioequivalence as described by the FDA’s industry guidance.

These requirements extend development timelines and increase costs, which can deter entry of some manufacturers. Additionally, the differentiated nature of some branded inhalation/nasal therapies (including proprietary delivery systems) adds competitive barriers for generics. Such hurdles restrict the speed and volume of generic launches in this market segment.

Opportunity

An opportunity exists in expanding access to affordable inhalation and nasal spray generics in emerging-markets where respiratory disease prevalence is rising and branded drug cost burden is high. WHO highlights that the majority of asthma-related deaths occur in low- and middle-income countries, attributed to underdiagnosis and limited access to quality medications.

By introducing lower-cost generic inhalation and nasal products, healthcare systems may achieve improved treatment coverage and adherence. Furthermore, as many branded inhalation therapies face patent expiry, generic manufacturers have a window to capture market share by launching high-quality alternatives. Regulatory frameworks evolving to support complex generics amplify this opportunity for growth.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.3% share and holds US$ 11.0 Billion market value for the year.

The region’s growth was supported by strong demand for cost-effective respiratory therapies. A large patient base with asthma, COPD, and allergic rhinitis created sustained consumption. The adoption of generic inhalation and nasal spray products increased as healthcare systems continued to encourage substitution for high-cost branded formulations. Reimbursement structures also favored generics, which strengthened overall market penetration.

Regional Dynamics

North America benefited from an advanced regulatory framework. The approval pathway for inhalation and nasal spray generics became more structured, which reduced entry barriers. The presence of established manufacturing facilities supported consistent product supply. High awareness among patients and healthcare providers further accelerated generic uptake. The shift toward outpatient and home-based treatment also contributed to steady demand.Factors Supporting Dominance

The stability of healthcare expenditure played a key role. The growth of the market was attributed to the expansion of insurance coverage for respiratory care. Generic drug utilization programs improved access and affordability. The increasing burden of chronic respiratory diseases created long-term market opportunities for inhaled and intranasal formulations.Outlook for the Region

A positive trajectory is expected as generic companies continue to develop advanced formulations and device technologies. The demand for efficient drug-delivery systems is projected to rise. This reinforces North America’s strong influence within the global inhalation and nasal spray generic drugs landscape.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key participants in the inhalation and nasal spray generic drugs market have been characterized by diversified portfolios, strong regulatory compliance, and extensive manufacturing capabilities. Market expansion has been supported by investments in advanced delivery technologies, including metered-dose systems, dry-powder formulations, and sterile nasal devices.

Competitive positioning has been influenced by consistent approvals for respiratory therapies, cost-efficient production, and robust supply chain networks. Companies active in this space have emphasized strategic collaborations with contract manufacturers, expansion into emerging regions, and the development of bioequivalent versions of complex respiratory brands.

Growth has also been driven by continuous process optimization, adherence to quality standards, and the ability to scale production rapidly during periods of demand fluctuation. Rising focus on chronic respiratory diseases, affordability trends, and patent expirations has further strengthened the competitive landscape and enabled steady market penetration.

Market Key Players

- Teva Pharmaceutical Industries Ltd.

- Sandoz International GmbH

- Viatris Inc.

- Cipla Ltd.

- Apotex Inc.

- Hikma Pharmaceuticals PLC

- Sun Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals Ltd.

- Lupin Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma Ltd.

- Perrigo Company

- Akorn

- Amneal Pharma

- Chiesi Farmaceutici

Recent Developments

- Teva Pharmaceutical Industries Ltd.(October 2025): Teva agreed to pay US $35 million to settle an antitrust class-action alleging delays in generic versions of its QVAR inhaler (beclomethasone HFA) and will withdraw six patents listed for QVAR to facilitate generic competition.

- Sandoz International GmbH (4 November 2025): Sandoz signed a deal to acquire Just Evotec Biologics (continuous-manufacturing capability) valued at ~US $350 m to enhance its generics & biosimilars manufacturing footprint.

- Viatris Inc.(October 2025): Viatris completed the acquisition of Aculys Pharma, Inc. (clinical-stage firm) gaining exclusive rights to pitolisant and Spydia® in Japan/Asia-Pacific, enhancing its portfolio beyond generics.

- Lupin Ltd.(July 2025): Lupin launched a generic nasal-spray formulation of ipratropium bromide (generic of Atrovent® Nasal) in the U.S. market, aimed at rhinorrhoea treatments.

Report Scope

Report Features Description Market Value (2024) US$ 29.5 Billion Forecast Revenue (2034) US$ 68.6 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Inhaled corticosteroids, Short-acting and long-acting bronchodilators, Combination medications, Antihistamine, Decongestant, Others) By Indication(Asthma, COPD, Allergic rhinitis, Others) By Age Group (Pediatric, Adult, Geriatric) By Distribution Channel (Retail pharmacies, Hospital pharmacies, Online pharmacies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Teva Pharmaceutical Industries Ltd., Sandoz International GmbH, Viatris Inc., Cipla Ltd., Apotex Inc., Hikma Pharmaceuticals PLC, Sun Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals Ltd., Lupin Ltd., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma Ltd., Perrigo Company, Akorn, Amneal Pharma, Chiesi Farmaceutici Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Inhalation And Nasal Spray Generic Drugs MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Inhalation And Nasal Spray Generic Drugs MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teva Pharmaceutical Industries Ltd.

- Sandoz International GmbH

- Viatris Inc.

- Cipla Ltd.

- Apotex Inc.

- Hikma Pharmaceuticals PLC

- Sun Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals Ltd.

- Lupin Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma Ltd.

- Perrigo Company

- Akorn

- Amneal Pharma

- Chiesi Farmaceutici