Global Infertility Treatment Market By Product Type (Equipment, Consumables, Software & Services, Accessories) By Procedure (Assisted Reproductive Technology (ART), Artificial Insemination, Fertility Surgeries, Medications & Hormone Therapy, Other Procedures) By Gender (Male, Female) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150720

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

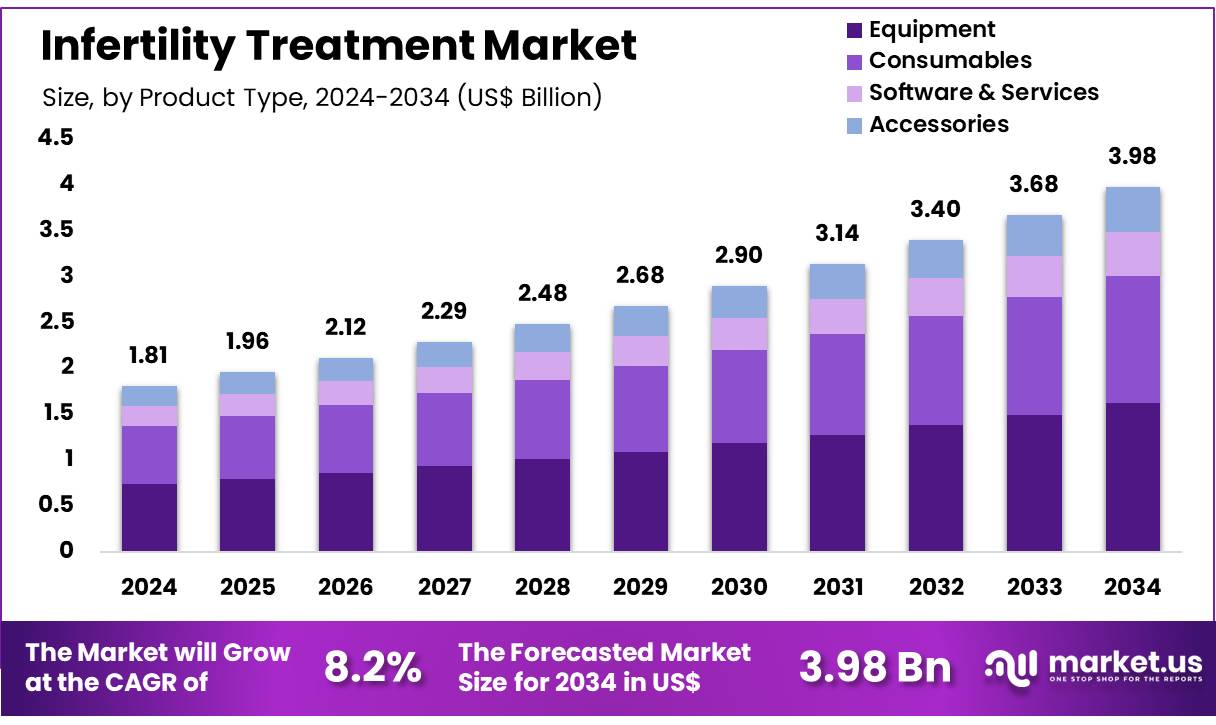

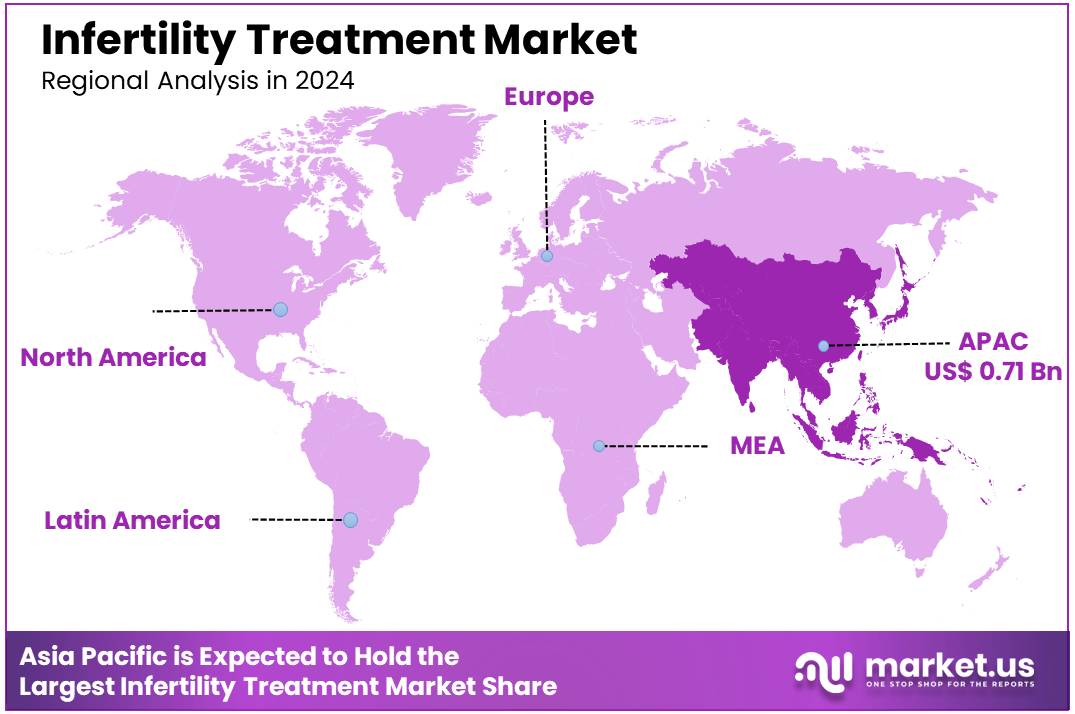

Global Infertility Treatment Market size is expected to be worth around US$ 3.98 Billion by 2034 from US$ 1.81 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, Asia Pacific led the market, achieving over 39.2% share with a revenue of US$ 0.71 Billion.

Infertility treatment market is experiencing significant growth, driven by increasing awareness, technological advancements, and supportive government initiatives. Approximately 28 million couples in India face infertility challenges, with both male and female factors contributing to this issue.

The Assisted Reproductive Technology (ART) sector, encompassing treatments like In-Vitro Fertilisation (IVF), is expanding rapidly. India currently conducts around 250,000 to 300,000 IVF cycles annually, with projections indicating a continued growth rate of 15–20% over the next five years . This growth is attributed to factors such as delayed marriages, lifestyle changes, and increased accessibility to fertility services.

The Indian Council of Medical Research (ICMR) has established the National Guidelines for Accreditation, Supervision, and Regulation of ART Clinics in India to ensure ethical practices and quality standards in fertility treatments . Additionally, the Assisted Reproductive Technology (Regulation) Rules, 2022, aim to regulate and supervise ART clinics and banks, preventing misuse and ensuring safe and ethical services.

Government initiatives, such as the establishment of IVF units in public healthcare institutions, are making fertility treatments more accessible and affordable. For instance, the Goa state government has set up India’s first IVF treatment unit in a public healthcare institution, covering the entire cost of treatment under the public insurance scheme for state residents.

With a supportive regulatory framework and increasing public awareness, India’s infertility treatment market is poised for continued growth, offering hope to millions of couples aspiring to build families.

Key Takeaways

- Market Size: Global Infertility Treatment Market size is expected to be worth around US$ 3.98 Billion by 2034 from US$ 1.81 Billion in 2024.

- Market Growth: The market growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

- Product Analysis: In 2024, the Equipment segment held a leading share of 36.4%.

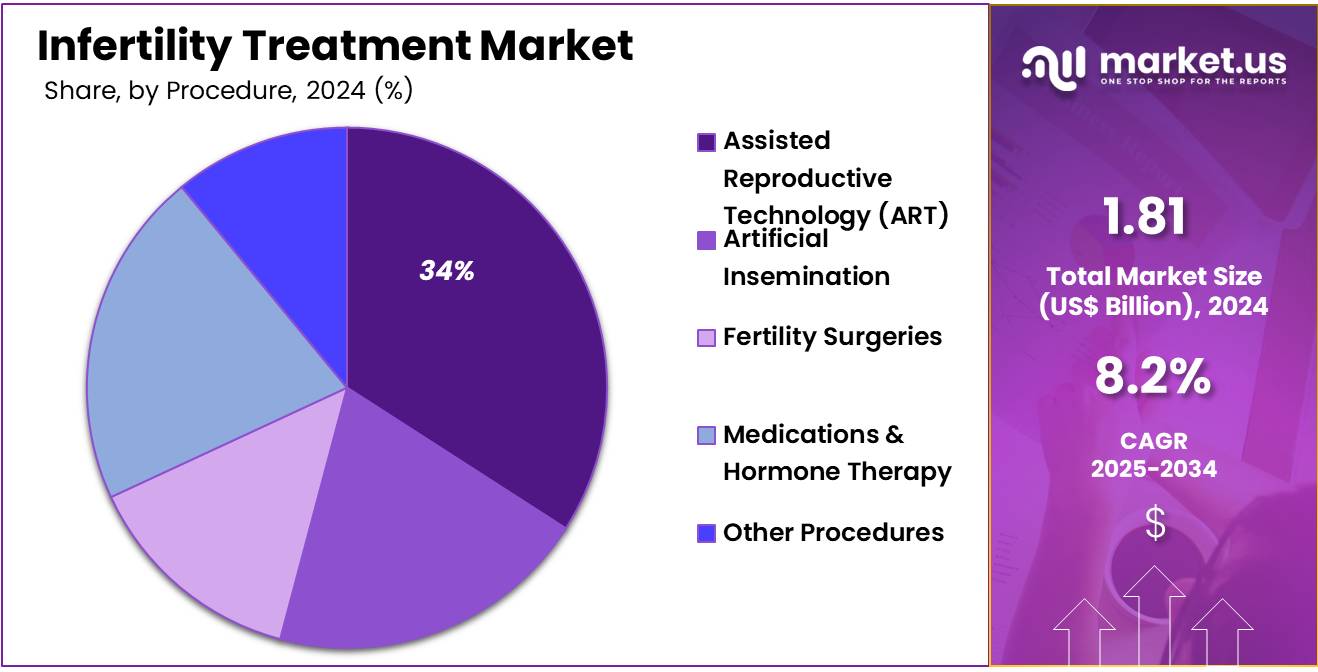

- Procedure Analysis: The ART segment dominated with a 34% share of total revenues, reflecting widespread adoption of laboratory-based fertilization techniques.

- Gender Analysis: In 2024, the gender segmentation of the Infertility Treatment Market saw the female segment dominate with a 34% share of total revenues.

- Regional Analysis: In 2024, Asia Pacific led the market, achieving over 39.2% share with a revenue of US$ 0.71 Billion.

Product Type Analysis

The Infertility Treatment Market can be segmented by product type into Equipment, Consumables, Software & Services, and Accessories. In 2024, the Equipment segment held a leading share of 36.4%. This dominance reflects high demand for advanced IVF and cryopreservation hardware in fertility clinics. The Consumables segment accounted for approximately 30.0% of the market. It includes culture media, sperm processing reagents, and embryo transfer media vital to ART procedures.

Software & Services contributed around 20.0% to the total. Adoption of digital patient management systems and telehealth solutions is driving growth in this category. Accessories comprised the remaining 13.6%. This segment covers single-use items such as catheters, needles, and petri dishes. These components ensure sterility and procedural efficiency in fertility treatments.

The segmentation distribution underscores the critical role of equipment expenditure alongside ongoing consumable and service investments in driving market expansion in 2024. Rising infertility rates and wider insurance coverage are further supporting equipment investments. Regional variations influence procurement patterns.

Procedure Analysis

In 2024, the Infertility Treatment Market was segmented by procedure into Assisted Reproductive Technology (ART), Artificial Insemination, Fertility Surgeries, Medications & Hormone Therapy, and Other Procedures. The ART segment dominated with a 34% share of total revenues, reflecting widespread adoption of laboratory-based fertilization techniques.

ART procedures involve egg retrieval, in-vitro fertilization, embryo culture, and transfer, as well as cryopreservation of gametes and embryos. The segment’s leadership can be attributed to higher per-cycle revenues and growing clinical success rates.

Artificial Insemination (commonly IUI) remains a less-invasive option, often chosen when male factor infertility is present. According to the CDC, IUI can yield success rates up to 20% per cycle, driving its continued utilization despite lower unit pricing. Fertility Surgeries including laparoscopy and hysteroscopy to correct tubal blockages account for mid-single-digit share, supported by advancements in minimally invasive techniques.

Medications & Hormone Therapy encompass ovulation-inducing agents such as clomiphene citrate and gonadotropins, which underpin cycle synchronization and represent roughly one-fifth of market value. Other Procedures such as experimental mitochondrial replacement and novel cryostorage methods are emerging but comprise under 10% of market revenues.

Gender Analysis

In 2024, the gender segmentation of the Infertility Treatment Market saw the female segment dominate with a 34% share of total revenues. This share reflects treatments addressing female factor infertility, including assisted reproductive technologies such as in-vitro fertilization (IVF), ovulation-inducing hormone therapies, and corrective laparoscopic surgeries. According to the NIH, approximately one-third of infertility cases are attributed solely to female reproductive issues.

The male segment increasing the market revenues recently. It encompasses interventions for male factor infertility, including intracytoplasmic sperm injection (ICSI), varicocele repair, hormonal therapies with FSH and LH analogs, and diagnostic semen analyses.

The NIH reports that one-third of infertility cases are due to male reproductive issues, with combined or unexplained factors comprising the balance. Growth of this segment is anticipated to accelerate as clinical guidelines increasingly recommend routine male fertility assessment during initial evaluations. Additionally, 12.2% of women ages 15–49 have used infertility services, underscoring broad access to female-focused treatments.

Combined and unexplained infertility factors reflecting cases where both partners or unknown causes are involved continue to support demand across both gender segments.

Key Market Segments

By Product Type

- Equipment

- Consumables

- Software & Services

- Accessories

By Procedure

- Assisted Reproductive Technology (ART)

- Artificial Insemination

- Fertility Surgeries

- Medications & Hormone Therapy

- Other Procedures

By Gender

- Male

- Female

Driver

The growth of the infertility treatment market can be attributed to the rising burden of infertility worldwide. According to the World Health Organization, approximately 17.5% of adults around one in six people of reproductive age experience infertility during their lifetimes. Delayed childbearing, lifestyle factors, and increasing prevalence of conditions such as polycystic ovary syndrome have compounded demand for diagnostic and therapeutic interventions.

As awareness of infertility as a disease has risen, health systems have been prompted to expand fertility services, including assisted reproductive technologies (ART) and hormone therapies. This heightened demand has stimulated investment in treatment infrastructure and research, thereby driving market expansion across both developed and emerging regions.

Trend

A key trend in the infertility treatment market is the accelerated adoption of assisted reproductive technologies. While ART techniques have existed for over three decades, their utilization has been steadily increasing, with an estimated 1.6 million ART cycles performed annually worldwide and over 400,000 infants born via these methods each year.

Technological advances such as preimplantation genetic screening, intracytoplasmic sperm injection, and vitrification have enhanced success rates and safety profiles, making ART more acceptable to patients and clinicians alike. Integration of digital health platforms has further enabled remote monitoring and personalized treatment protocols, reinforcing ART’s prominence and fostering its continued market penetration.

Restraint

High treatment costs remain a significant restraint on market growth. In the United States, median per-person expenditure for a single in-vitro fertilization cycle has been reported at approximately US$ 24,373, excluding ancillary expenses such as genetic testing and multiple cycles.

Such financial barriers limit access to care, particularly in populations lacking comprehensive insurance coverage or government support. Additionally, regulatory complexities and variable reimbursement policies across regions contribute to inconsistent market uptake. As a result, many couples opt for lower-intensity therapies or defer treatment altogether, constraining overall market expansion despite rising demand.

Opportunity

Significant opportunities exist for market expansion in low- and middle-income countries (LMICs), where access to infertility care remains limited. The WHO estimates that between 42 million and 180 million individuals globally experience infertility, with many lacking affordable treatment options. Initiatives to integrate fertility services within public health systems and the development of low-cost ART protocols can unlock substantial unmet need.

Moreover, telemedicine platforms and mobile health applications present avenues for remote consultation, patient education, and adherence monitoring. By leveraging these innovations and fostering partnerships with governmental bodies, industry stakeholders can capture new growth segments and improve health equity in fertility care.

Regional Analysis

In 2024, Asia Pacific held a dominant market position, capturing more than a 39.2% share and holds US$ 0.71 billion market value for the year. The growth in this region is driven by rising infertility rates due to late pregnancies, lifestyle changes, and environmental factors. Urbanization and work-related stress have also contributed to increased demand for reproductive health services.

Governments across countries like India, China, and Japan are investing in fertility awareness and treatment access. Public health campaigns and subsidies for assisted reproductive technologies (ART) have supported market growth. In addition, increased insurance coverage and rising awareness of infertility treatment options have encouraged more patients to seek medical help.

The availability of advanced healthcare infrastructure and skilled professionals has accelerated the adoption of IVF and ICSI procedures. Countries such as South Korea and Singapore have emerged as medical tourism hubs for fertility care, attracting patients from neighboring regions.

Population density, declining fertility rates, and social acceptance of ART are key drivers in Asia Pacific. Furthermore, support from regional health ministries and reproductive health programs has strengthened the treatment ecosystem.

Overall, the region’s large population base, evolving healthcare policies, and affordability of procedures continue to support Asia Pacific’s leadership in the infertility treatment market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The infertility treatment market is characterized by the presence of a diverse range of players offering specialized technologies, services, and equipment. These include providers of assisted reproductive technologies, hormone therapies, diagnostic devices, and fertility support tools. Key players focus on expanding their geographic reach, upgrading laboratory capabilities, and integrating digital health solutions.

Strategic collaborations with hospitals and fertility clinics are commonly adopted to enhance service delivery. Many firms are also investing in research to improve IVF success rates and reduce treatment costs. The competitive landscape is shaped by innovation, regulatory compliance, and growing demand for personalized fertility care across global markets.

Market Key Players

- Merck & Co.

- Bayer AG

- Ferring Pharmaceuticals

- Thermo Fisher Scientific Inc.

- CooperSurgical Fertility Company

- Vitrolife

- Cook Medical

- FUJIFILM Irvine Scientific

- Hamilton Thorne Ltd.

- Esco Micro Pte Ltd.

- Mankind Pharma

- Indira IVF

- Prelude Fertility

- Genetics & IVF Institutes

- Bourn Hall Clinic

Recent Developments

- Merck & Co.July 2024: Merck KGaA (EMD Serono in the U.S. and Canada) finalized its acquisition of Mirus Bio LLC, a U.S. life-science company specializing in transfection reagents used for viral vector manufacturing. The cash transaction was valued at US $617 million and aims to integrate Mirus’s TransIT-VirusGEN® technology across Merck’s Life Science segment.

- Bayer AG November 2023: Bayer entered into a strategic alliance with Impli, a med-tech start-up developing a subdermal biosensor that continuously measures fertility-related hormones. The implantable device leverages NFC-enabled wireless communication to deliver real-time hormone readings, supporting more precise egg retrieval and OHSS risk management in IVF programs.

- CooperSurgical Fertility Company June 2024: CooperSurgical (a unit of The Cooper Companies) completed the purchase of ZyMōt Fertility, the developer of a patented sperm separation device. The acquisition broadens CooperSurgical’s ART portfolio by integrating ZyMōt® Sperm Separation Devices, which improve motile sperm recovery and support higher IVF success rates

Report Scope

Report Features Description Market Value (2024) US$ 1.81 Billion Forecast Revenue (2034) US$ 3.98 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment, Consumables, Software & Services, Accessories) By Procedure (Assisted Reproductive Technology (ART), Artificial Insemination, Fertility Surgeries, Medications & Hormone Therapy, Other Procedures) By Gender (Male, Female) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Merck & Co., Bayer AG, Ferring Pharmaceuticals, Thermo Fisher Scientific Inc., CooperSurgical Fertility Company, Vitrolife, Cook Medical, FUJIFILM Irvine Scientific, Hamilton Thorne Ltd., Esco Micro Pte Ltd., Mankind Pharma, Indira IVF, Prelude Fertility, Genetics & IVF Institutes, Bourn Hall Clinic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infertility Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Infertility Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck & Co.

- Bayer AG

- Ferring Pharmaceuticals

- Thermo Fisher Scientific Inc.

- CooperSurgical Fertility Company

- Vitrolife

- Cook Medical

- FUJIFILM Irvine Scientific

- Hamilton Thorne Ltd.

- Esco Micro Pte Ltd.

- Mankind Pharma

- Indira IVF

- Prelude Fertility

- Genetics & IVF Institutes

- Bourn Hall Clinic