Fructosamine Test Market By Disease Indication (Diabetes I, Diabetes II, and Gestational Diabetes), By Application (Clinical Diagnostics for Animals, Clinical Diagnostics for Human, and Research Use), By End-user (Hospitals, Specialty Clinics, Diagnostic Laboratories, Veterinary Hospitals, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133582

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Fructosamine Test Market Size is expected to be worth around US$ 400.4 Million by 2033, from US$ 273.1 Million in 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033.

Rising awareness of diabetes management and the increasing demand for effective diagnostic tools are driving the growth of the fructosamine test market. The fructosamine test plays a vital role in assessing short-term blood glucose control, offering healthcare providers a valuable tool in managing diabetes, particularly in patients who may not be well-suited for standard HbA1c tests.

This test is increasingly utilized in diagnosing and monitoring both type 1 and type 2 diabetes, including those with fluctuations in blood glucose levels or those with conditions like anemia, which can interfere with HbA1c measurements. According to the World Health Organization’s data published on November 14, 2024, over 95% of people with diabetes have type 2 diabetes, a condition once considered predominantly adult-onset, but now frequently diagnosed in children as well. This demographic shift further underscores the need for reliable and accessible diagnostic options.

Additionally, the fructosamine test has applications beyond diabetes, such as evaluating the effectiveness of treatments and assessing glucose control in pregnant women with gestational diabetes. Growing trends towards preventive healthcare and personalized medicine also create substantial opportunities for market expansion, as healthcare providers increasingly seek tools to monitor and tailor individual patient care. The advent of innovative technologies and advancements in laboratory testing are expected to enhance the accuracy, affordability, and accessibility of fructosamine tests, creating new avenues for growth.

Key Takeaways

- In 2023, the market for fructosamine test generated a revenue of US$ 273.1 million, with a CAGR of 3.9%, and is expected to reach US$ 400.4 million by the year 2033.

- The disease indication segment is divided into diabetes I, diabetes II, and gestational diabetes, with diabetes II taking the lead in 2023 with a market share of 55.1%.

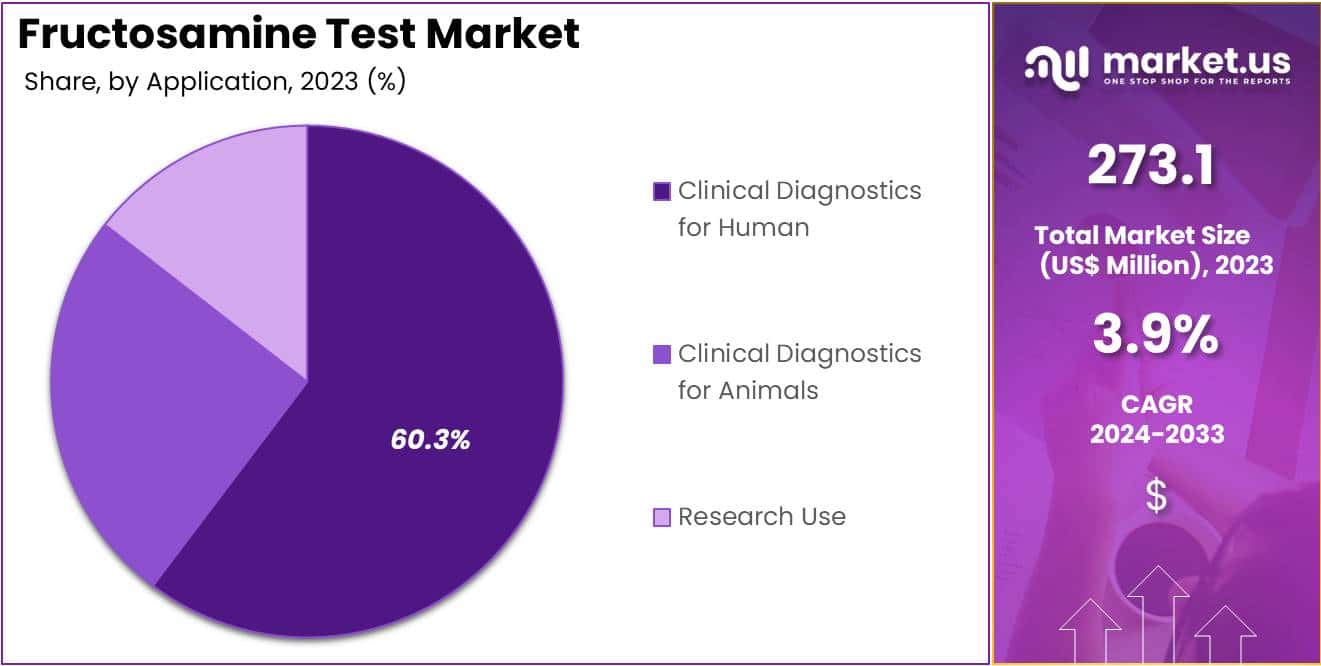

- Considering application, the market is divided into clinical diagnostics for animals, clinical diagnostics for human, and research use. Among these, clinical diagnostics for human held a significant share of 60.3%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, diagnostic laboratories, veterinary hospitals, and academic & research institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 50.4% in the fructosamine test market.

- North America led the market by securing a market share of 40.3% in 2023.

Disease Indication Analysis

The diabetes II segment led in 2023, claiming a market share of 55.1% owing to the rising prevalence of diabetes worldwide. The growing number of people with type II diabetes is anticipated to increase the demand for accurate monitoring of blood glucose levels and glycemic control, a need addressed by the fructosamine test.

Factors such as sedentary lifestyles, poor dietary habits, and obesity are contributing to the increasing incidence of type II diabetes, prompting a surge in the use of diagnostic tests. Additionally, the increasing adoption of fructosamine tests for monitoring long-term glycemic control, especially in patients with type II diabetes, is projected to further accelerate market growth.

The test’s ability to provide a quicker alternative to HbA1c testing, particularly for patients with fluctuating blood sugar levels, is likely to drive its demand. Enhanced awareness of the importance of early diabetes detection and personalized treatment plans is also expected to positively influence market dynamics.

Application Analysis

The clinical diagnostics for human held a significant share of 60.3% due to the growing need for accurate and timely diagnosis of metabolic disorders in humans. Rising awareness of chronic diseases such as diabetes and the increasing emphasis on preventive healthcare are anticipated to drive demand for diagnostic tools like the fructosamine test.

Furthermore, the shift towards early detection and continuous monitoring of glucose levels in clinical settings is projected to support market growth. With healthcare systems worldwide focusing on improving patient outcomes through efficient and accurate diagnostics, the use of fructosamine testing is expected to expand in hospitals, specialized clinics, and outpatient care centers.

The segment’s growth is also likely to be fueled by advancements in diagnostic technologies, enabling the integration of fructosamine testing into routine clinical practice. In addition, the increased prevalence of comorbidities such as hypertension and cardiovascular diseases, often associated with diabetes, is projected to further elevate demand.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 50.4% owing to the increasing adoption of the test in clinical diagnostics. Hospitals are expected to account for the largest share of the market as they continue to serve as primary healthcare providers, offering diagnostic services to a broad patient base.

With rising hospital admissions due to diabetes-related complications, the demand for precise blood glucose monitoring is likely to increase. Additionally, advancements in hospital-based diagnostic laboratories, which are now equipped with faster and more efficient testing tools, are expected to improve patient outcomes and reduce diagnostic turnaround times.

The increasing preference for fructosamine testing over alternative methods such as HbA1c is likely to contribute to the segment’s growth, as hospitals seek to offer more effective and timely diagnostic solutions. Furthermore, hospitals are anticipated to continue their investment in patient-centric services, further promoting the utilization of fructosamine testing for diabetic and metabolic disorder management.

Key Market Segments

By Disease Indication

- Diabetes I

- Diabetes II

- Gestational Diabetes

By Application

- Clinical Diagnostics for Animals

- Clinical Diagnostics for Human

- Research Use

By End-user

- Hospitals

- Specialty Clinics

- Diagnostic Laboratories

- Veterinary Hospitals

- Academic & Research Institutes

Drivers

Increasing Prevalence of Diabetes and the Need for Glycemic Control Monitoring

The global prevalence of diabetes has been rising steadily. The International Diabetes Federation (IDF) reported that, in 2021, approximately 537 million adults aged 20–79 were living with diabetes. By 2030, this number is projected to increase to 643 million and reach 783 million by 2045. This significant increase in diabetes prevalence underlines the growing demand for effective diabetes management tools, including fructosamine testing.

Fructosamine tests, which provide short-term measures of glycemic control (over a 2-3 week period), are particularly useful for patients who cannot undergo HbA1c testing, such as those with anemia or other conditions affecting red blood cell turnover. As the number of people with diabetes rises globally, the need for reliable monitoring solutions like fructosamine testing also grows.

Restraints

High Cost of Fructosamine Testing in Some Regions

The affordability of fructosamine testing can be a significant barrier, especially in low- and middle-income countries. According to the World Health Organization (WHO), diabetes care requires substantial healthcare spending, which may not be sustainable in resource-constrained regions. While fructosamine testing is widely available in high-income countries, the costs can still be prohibitive for some patients due to out-of-pocket expenses or lack of insurance coverage.

In low- and middle-income regions, healthcare budgets often allocate limited resources to diabetes care, making it challenging to introduce more specialized tests like fructosamine on a widespread scale. This disparity in healthcare access affects the adoption of advanced diagnostic tools, hindering global access to effective diabetes management.

Opportunities

Growing Demand for Point-of-Care (POC) Testing

Point-of-care (POC) testing is expanding rapidly, driven by the increasing demand for accessible and efficient diagnostic solutions. The American Diabetes Association (ADA) highlights that POC testing is particularly beneficial in the management of chronic diseases like diabetes, where real-time monitoring can lead to more timely treatment adjustments.

By 2027, the global market for point-of-care testing is expected to grow significantly. The ADA emphasizes the importance of near-instant diagnostic results in diabetes care, and portable devices that provide rapid testing for markers like fructosamine are becoming more widely available. As healthcare systems focus on decentralizing care and providing accessible testing, the demand for POC solutions will continue to increase.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant influence on the market for fructosamine testing, with both positive and negative outcomes. Economic downturns, for instance, often lead to reduced healthcare spending, which can negatively affect the adoption of diagnostic tests, including those used for managing diabetes and other metabolic conditions.

In contrast, during periods of economic growth, higher disposable incomes and increased access to healthcare services contribute to greater demand for these diagnostic tools. Geopolitical instability, such as trade disruptions or healthcare policy changes, may also pose challenges by restricting access to essential testing equipment or raw materials, resulting in potential supply chain issues.

However, growing global awareness of diabetes and chronic diseases, coupled with supportive healthcare reforms in emerging markets, can drive demand for accurate and affordable diagnostic solutions. Additionally, advancements in technology and an increasing focus on preventive healthcare improve the overall market outlook, fostering growth in the long term.

Trends

Technological Advancements in Fructosamine Testing

Technological advancements in diabetes monitoring are making fructosamine testing more accessible and efficient. The integration of mobile health technologies, portable diagnostic devices, and artificial intelligence (AI) is streamlining the testing process. According to a 2023 study published by the National Institutes of Health (NIH), AI-driven tools for interpreting diabetes-related tests, including fructosamine, are improving diagnostic accuracy and decision-making in real-time.

These innovations in mobile health (mHealth) and point-of-care devices are expected to reduce the cost and time associated with testing, making it more accessible, especially in remote or underserved regions. As these technologies evolve, they are expected to expand the use of fructosamine testing in both clinical and home settings.

Regional Analysis

North America is leading the Fructosamine Test Market

North America dominated the market with the highest revenue share of 40.3% owing to the increasing prevalence of diabetes and the rising awareness of diabetes management tools. The adoption of fructosamine testing as a reliable method for monitoring short-term glycemic control has gained traction due to its advantages over traditional HbA1c testing, particularly in patients with conditions that affect hemoglobin (e.g., anemia).

According to the Centers for Disease Control and Prevention (CDC), approximately 37.3 million people in the U.S. were living with diabetes in 2021, contributing to an expanding demand for effective monitoring solutions. The North American market also benefitted from the growing preference for point-of-care diagnostics, which enables rapid testing and immediate clinical decisions.

Technological advancements in the development of non-invasive testing methods and the increasing availability of home testing kits are further expected to drive market growth. Additionally, regulatory support and reimbursement policies in the region have bolstered the accessibility and affordability of such diagnostic services, particularly in the U.S. This combination of factors is projected to sustain the upward trajectory of the market in North America over the near term.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the fructosamine test market is expected to witness significant expansion from 2024 onward. Rising diabetes prevalence, especially in countries such as China and India, plays a pivotal role in the anticipated market growth. The International Diabetes Federation (IDF) reports that approximately 90 million adults in China and over 70 million in India were living with diabetes in 2021, numbers expected to grow substantially in the coming years.

The increasing adoption of diabetes management practices, especially in urbanized areas, is expected to drive demand for monitoring tools like fructosamine tests. Moreover, improvements in healthcare infrastructure and expanding healthcare access in emerging economies are anticipated to bolster the market. Government initiatives aimed at enhancing awareness of diabetes and promoting early detection are also likely to support market growth.

Additionally, the rising prevalence of lifestyle-related conditions and the growing emphasis on preventive healthcare across the region are expected to positively influence the uptake of advanced diagnostic methods like fructosamine testing. This trend aligns with projections for sustained growth in Asia Pacific’s medical diagnostics sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the fructosamine test market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the fructosamine test market employ a range of strategies to drive growth, including product innovation, strategic partnerships, and geographic expansion.

Companies focus on enhancing the accuracy and convenience of testing devices, catering to the increasing demand for non-invasive diagnostic solutions. Investment in research and development (R&D) enables the introduction of advanced technologies, while partnerships with healthcare providers ensure wider distribution. Additionally, companies are leveraging digital platforms to facilitate remote testing and result sharing, thus improving accessibility.

Market penetration in emerging regions, where diabetes prevalence is rising, also represents a critical growth strategy. One of the key players in the market is Abbott Laboratories, a global healthcare company specializing in diagnostics, medical devices, and nutritional products.

Abbott’s diagnostics division focuses on providing a wide array of innovative testing solutions, including those for diabetes management. The company’s strategy centers on expanding its portfolio through strategic acquisitions, advancing technology integration in its testing systems, and enhancing customer engagement through digital platforms and telemedicine services.

Top Key Players in the Fructosamine Test Market

- Weldon Biotech, Inc.

- KAMIYA BIOMEDICAL COMPANY

- Fortress Diagnostics

- F. Hoffmann-La Roche Ltd

- Eurolyser Diagnostica GmbH

- Asahi Kasei Pharma Corporation

- Abbexa

Recent Developments

- In October 2022: Beckman Coulter acquired StoCastic, LLC, a leading provider of artificial intelligence (AI)-driven decision support solutions for hospital emergency departments (ED). This acquisition is significant for the growth of the fructosamine test market, as it positions Beckman Coulter to incorporate AI technologies into its diagnostic systems, improving the accuracy and efficiency of tests such as fructosamine. By enhancing decision-making capabilities in clinical settings, Beckman Coulter can provide healthcare providers with more reliable and timely data, thereby boosting the adoption of fructosamine testing for diabetes management.

- In October 2023: Abbexa appointed NuLife Consultants & Distributors (Pvt.) Ltd. as its distributor in India for a range of life science products, including proteins, antibodies, and ELISA kits. This strategic partnership is significant for the fructosamine test market as it expands Abbexa’s presence in India, a region with a growing demand for advanced diagnostic tools. By increasing the distribution of its diagnostic products, including those related to diabetes testing, Abbexa aims to address the rising need for accurate and accessible testing solutions, such as fructosamine assays, thereby supporting market growth in this rapidly expanding healthcare market.

Report Scope

Report Features Description Market Value (2023) US$ 273.1 million Forecast Revenue (2033) US$ 400.4 million CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Disease Indication (Diabetes I, Diabetes II, and Gestational Diabetes), By Application (Clinical Diagnostics for Animals, Clinical Diagnostics for Human, and Research Use), By End-user (Hospitals, Specialty Clinics, Diagnostic Laboratories, Veterinary Hospitals, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Weldon Biotech, Inc., KAMIYA BIOMEDICAL COMPANY, Fortress Diagnostics, F. Hoffmann-La Roche Ltd, Eurolyser Diagnostica GmbH, Asahi Kasei Pharma Corporation, and Abbexa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-