Global Industrial Connectivity Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Deployment (On-premise, Cloud-based), By Network Connectivity (Wired, Wireless), By End Use (Aerospace & Defense, Automotive, Chemical, Energy & Utilities, Food & Beverage, Healthcare, Manufacturing, Mining & Metal, Oil & Gas, Transportation, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158421

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business Benefits

- Government-Led Investments

- By Component

- By Deployment

- By Network Connectivity

- By End Use

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Regional Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

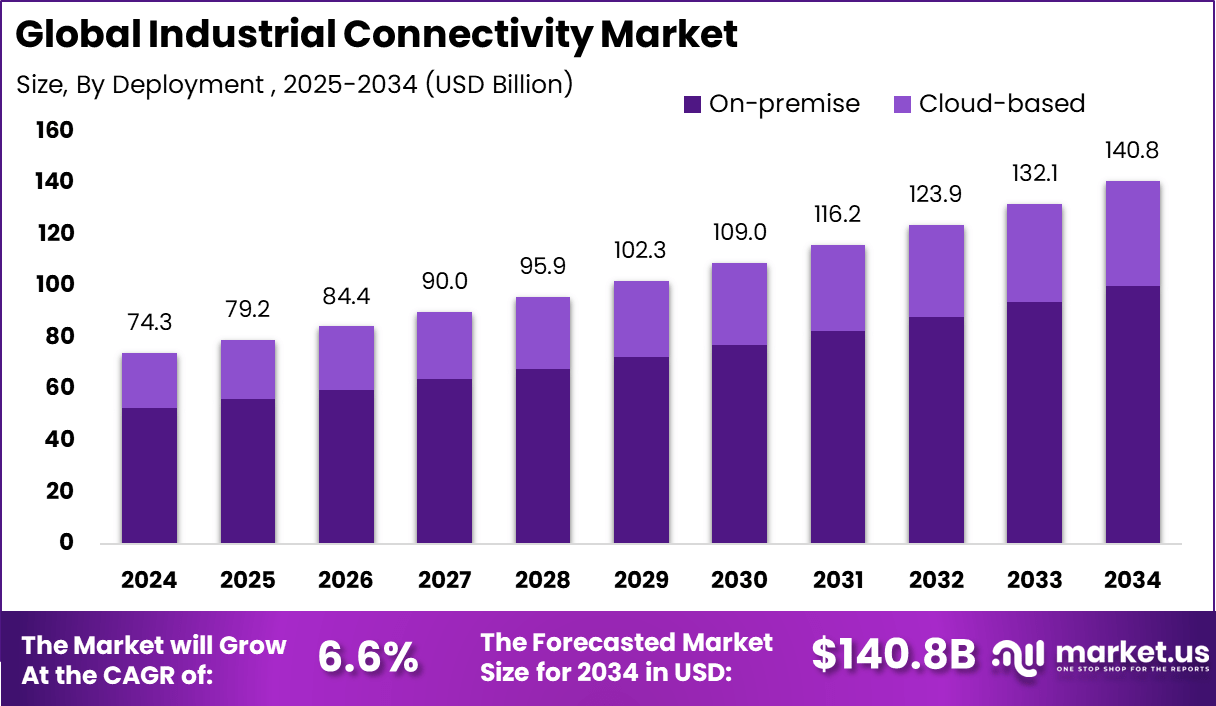

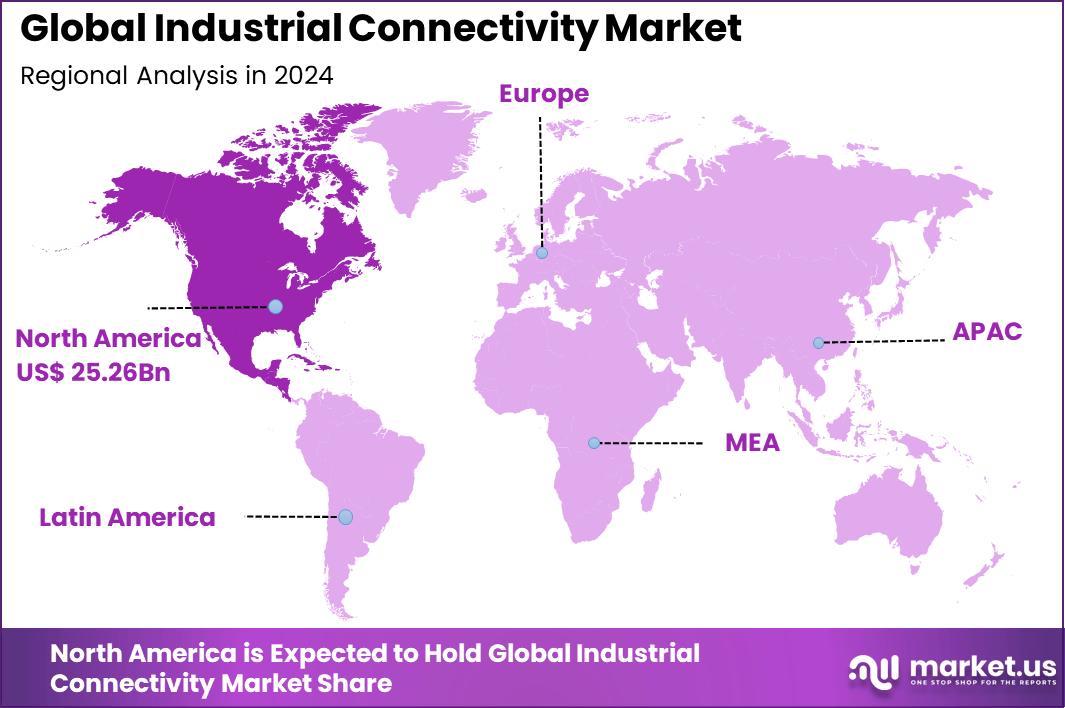

The Global Industrial Connectivity Market size is expected to be worth around USD 140.8 Billion By 2034, from USD 74.3 billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 34% share, holding USD 25.26 Billion revenue.

The Industrial Connectivity Market refers to the systems, devices, and technologies that enable communication and data exchange across industrial equipment, processes, and platforms. It involves wired and wireless networking solutions, industrial Ethernet, fieldbus systems, sensors, gateways, and communication protocols that connect machines, controllers, and enterprise systems.

Top driving factors fueling the growth of the industrial connectivity market include rising demands for operational efficiency, real-time data analytics, and automation across industries such as manufacturing, automotive, and energy. The global manufacturing sector alone is projected to experience steady growth with a 4% increase in workforce demands over the next decade, amplifying the need for connected operations.

The growth of connected industrial devices is also accelerating, with estimates suggesting tens of billions of devices worldwide by the mid-2020s. This extensive device network drives the demand for robust connectivity solutions capable of handling high data volumes and low latency requirements, while addressing cybersecurity concerns.

The increasing adoption of technologies like 5G, IIoT, cloud computing, and advanced wireless networks are pivotal in the industrial connectivity ecosystem. These technologies offer higher bandwidth, reliable low-latency communication, and scalability essential for modern manufacturing environments. The push towards Ethernet-based industrial networks is notable, with Ethernet connections accounting for more than 75% of new industrial nodes in recent years.

Key Insight Summary

- By component, Hardware dominated the Industrial Connectivity market, accounting for 53.2% share, driven by strong demand for routers, gateways, and edge devices.

- By deployment, the On-Premises segment led the market with 71% share, reflecting continued reliance on localized infrastructure for secure industrial operations.

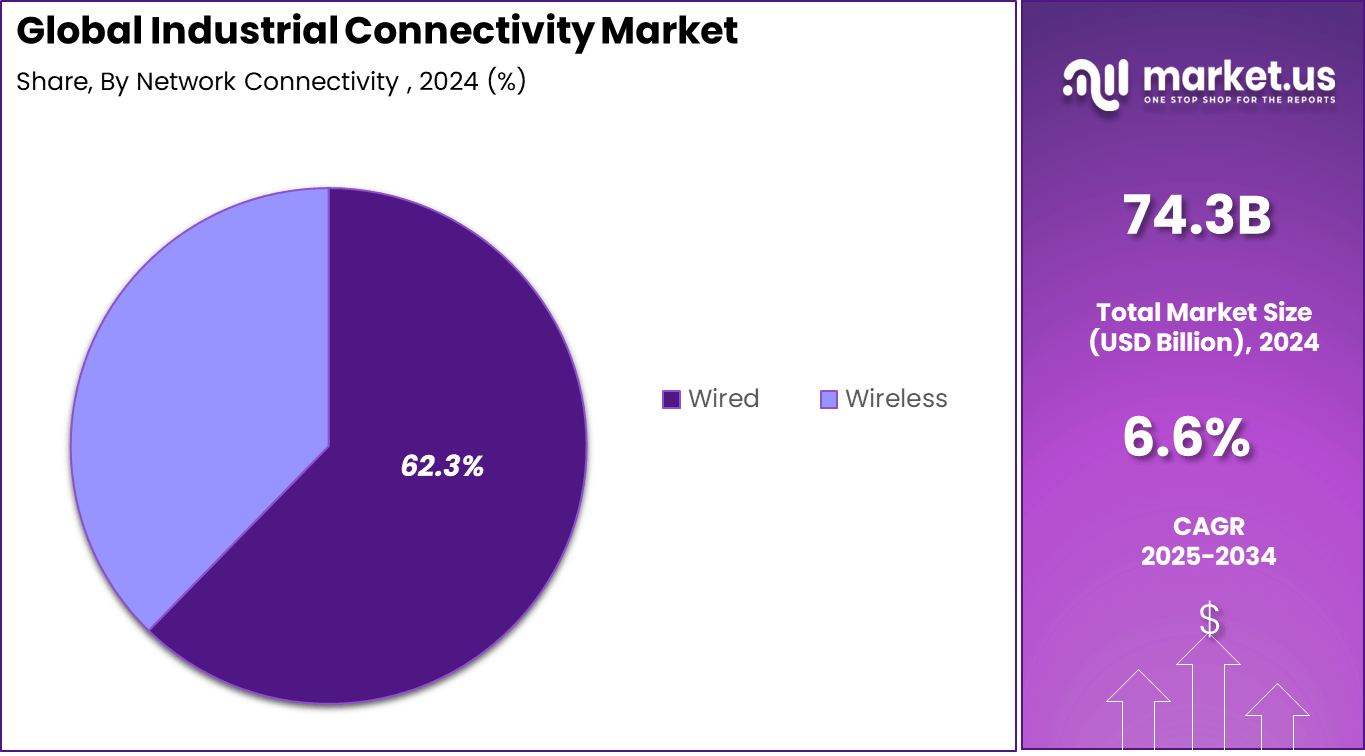

- By network connectivity, the Wired segment held a commanding 62.3% share, supported by its reliability and low latency in critical manufacturing processes.

- By end use, the Manufacturing sector captured 33.7% share, highlighting its role as the largest adopter of industrial connectivity solutions for smart factories and automation.

Analysts’ Viewpoint

The market is witnessing rapid adoption of technologies such as industrial Ethernet, wireless communication (Wi-Fi, Bluetooth, LPWAN, and 5G), and advanced fieldbus protocols. Edge computing is being integrated with connectivity solutions to enable real-time data processing closer to devices. Cloud connectivity is also expanding, allowing centralized monitoring and analytics across global facilities.

Cybersecurity technologies are becoming a core part of industrial connectivity to protect networks from growing digital threats. AI and machine learning are further enhancing predictive capabilities in connected systems. Organizations adopt industrial connectivity to achieve higher efficiency, reduce downtime, and support advanced automation. Real-time data exchange improves decision-making and process optimization.

Connected systems reduce operational risks by providing better monitoring of equipment health and environmental conditions. Adoption also enables scalability, allowing industries to integrate new technologies without completely overhauling existing infrastructure. For many companies, connectivity is essential to remain competitive in global markets.

Investment and Business Benefits

There are strong investment opportunities in wireless industrial communication, edge-to-cloud connectivity platforms, and cybersecurity solutions. Companies developing interoperable protocols and solutions that simplify integration with legacy systems are attracting significant interest. Growth in emerging markets presents opportunities for infrastructure upgrades, particularly in manufacturing and energy sectors.

Partnerships between telecom operators, industrial automation providers, and cloud service firms are creating new revenue streams. Industrial connectivity provides measurable business benefits, including improved productivity, optimized resource use, and greater operational flexibility.

Predictive maintenance supported by connected devices reduces equipment failures and repair costs. Integration with analytics platforms allows businesses to identify inefficiencies and improve output quality. For supply chains, connectivity enhances visibility and reduces disruptions. Over time, connected operations also support sustainability goals by improving energy efficiency and reducing waste.

Government-Led Investments

Governments globally are investing heavily in industrial connectivity as part of broader infrastructure and manufacturing modernization plans. For example, in 2024-25, India’s industrial sector grew at around 6.2%, boosted by improvements in logistics such as a reduction in container turnaround time at major ports from 48.1 hours to 30.4 hours.

National industrial corridor projects and production-linked incentive schemes emphasize upgrading digital infrastructure including fiber optics and 5G networks. Governments are also implementing policies that strengthen data sovereignty and cybersecurity frameworks critical to industrial data flows. These public investments underscore a commitment to supporting digital industrial ecosystems to enhance productivity and export potential.

By Component

In 2024, Hardware forms the backbone of industrial connectivity, accounting for 53.2% of the market. This share reflects the essential role of routers, switches, gateways, and communication modules that enable seamless connection across industrial networks.

Hardware remains critical in ensuring reliable data exchange between machines, sensors, and control systems, especially in environments where high-speed and stable communication is necessary. While software solutions are gaining importance for network management, the reliance on physical devices continues to dominate because of their direct role in building connectivity infrastructure.

By Deployment

In 2024, On-premises deployment represents 71% of the market, highlighting the strong preference of industries to maintain control over their networks within their facilities. This model is particularly valued for handling sensitive operational data and reducing exposure to external risks.

For sectors like energy, chemicals, and critical manufacturing, on-premises setups offer the security and regulatory compliance that cloud deployments cannot always guarantee. Although cloud-based models are steadily adopted for scalability, the dominance of on-premises connectivity indicates that many organizations still prioritize control and data sovereignty over flexibility.

By Network Connectivity

In 2024, Wired connections capture 62.3% of the market, showing the continued dependence on stable and secure data transmission for industrial setups. Wired networks are favored in production floors, warehouses, and large plants where uninterrupted connectivity is essential to keep operations running without latency or interference.

Despite the rapid progress of wireless technologies, wired systems remain indispensable for applications requiring reliability and high bandwidth, such as robotics, process automation, and real-time control systems. This balance demonstrates how industries are investing in steady yet scalable network infrastructure.

By End Use

In 2024, Manufacturing leads the industrial connectivity market with 33.7% share, reflecting the sector’s intensive use of connected devices and integrated systems. Smart factories increasingly rely on connected sensors, automated machinery, and monitoring equipment to optimize productivity and reduce downtime.

The wide adoption of industrial connectivity here is driven by the demand for efficiency, predictive maintenance, and seamless machine-to-machine communication. Manufacturing’s large share also signals how critical connectivity has become for shaping the next phase of industrial automation.

Emerging Trends

The industrial connectivity landscape is rapidly advancing with key technological shifts. By 2025, Time-Sensitive Networking (TSN) is crucial for enabling real-time data transport across converged networks, supporting both high data rates and mission-critical controls in smart factories.

5G adoption is accelerating, promising ultra-reliable low-latency connections that can support millions of devices per square kilometer – making it ideal for dense IIoT deployments. Wireless standards like Wi-Fi 6 complement these efforts by improving network performance in congested environments.

Additionally, Single Pair Ethernet simplifies sensor and actuator integration, cutting installation times while enhancing flexibility. These trends highlight hyperconnectivity, interoperability, and security as pillars of industrial connectivity advancement.

Growth Factors

Several data points illustrate the growth momentum in industrial connectivity. The enterprise IoT sector alone is forecasted to represent 72% of market revenue by 2028, up from 70% in 2023, signaling strong ongoing adoption.

Growth is primarily driven by Industry 4.0 initiatives, real-time data demands, and increased use of predictive maintenance. Furthermore, regulatory and cybersecurity demands push innovation within connectivity infrastructure.

Cost-effective and scalable networking solutions continue to enable expansion in industries such as automotive, aerospace, and energy. the reports emphasize ongoing digital transformation efforts in Asia Pacific as a key factor behind regional industrial connectivity expansion.

Key Market Segments

Industrial Connectivity Component

- Hardware

- Software

- Services

Industrial Connectivity Deployment

- On-premise

- Cloud-based

Network Connectivity

- Wired

- Wireless

Industrial Connectivity End Use

- Aerospace & Defense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Others

Driver Analysis

Increasing Adoption of Industry 4.0 Technologies

One key driver for the industrial connectivity market is the growing adoption of Industry 4.0 technologies. Industries are increasingly moving towards smart manufacturing processes that rely heavily on connected devices to optimize and automate operations. This shift helps improve production efficiency and enhances real-time decision-making by providing seamless data exchange across devices and systems.

For instance, manufacturers deploying Industry 4.0 solutions report significant productivity gains because connected systems allow for better monitoring and predictive maintenance, reducing downtime. The demand for real-time data access and analytics is pushing industries to embrace advanced connectivity solutions such as IoT, 5G, and cloud computing.

This integration enables manufacturers to gather vast amounts of data from sensors and machines for improved asset utilization and operational performance. The transition to smart factories powered by such connectivity solutions will continue driving market growth as more sectors adopt these technologies to stay competitive and improve efficiency.

Restraint Analysis

High Implementation Costs

A major restraint in industrial connectivity adoption is the high initial investment cost. Implementing complex connectivity infrastructure, including hardware, software, and network upgrades, requires significant capital expenditure. Many companies, especially small and medium-sized enterprises, struggle to justify or afford these upfront costs, which can slow down market penetration and technology adoption.

Beyond equipment costs, businesses must also invest in specialized expertise to design, implement, and maintain these connectivity solutions. The need for integration with existing legacy systems adds further complexity and expense. Upgrading to industrial connectivity requires new hardware, staff training, and network changes, creating major financial and operational challenges.

Opportunity Analysis

Growth of Cloud-Based Connectivity Solutions

The rise in cloud-based industrial connectivity solutions presents a significant market opportunity. Cloud platforms offer scalable, flexible, and cost-efficient options for managing industrial data and connectivity across multiple facilities and geographies. This approach reduces the dependency on costly on-premise infrastructure and enables remote monitoring, management, and data analytics.

Cloud connectivity also speeds up deployment and supports integration of new technologies like edge computing and AI, which are essential for advanced industrial applications. For instance, manufacturers using cloud-based systems can more easily apply machine learning models to predict equipment failures or optimize processes. These benefits are driving demand for cloud solutions and open the door for providers to expand offerings and reach new customers.

Challenge Analysis

Cybersecurity Risks

Cybersecurity remains a critical challenge for industrial connectivity. As industrial networks become more connected and open, they face increasing vulnerability to cyberattacks that can disrupt operations or lead to data breaches. Protecting industrial systems, which often run critical infrastructure, requires robust security measures tailored for both IT and operational technology environments.

For example, industrial control systems that lack adequate security safeguards are vulnerable to ransomware attacks or intrusions that could halt production. The complexity of integrating heterogeneous devices and legacy systems further complicates security management. Addressing cybersecurity involves ongoing investment in secure protocols, monitoring, and incident response, making it a persistent challenge for widespread adoption of industrial connectivity.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than 34% share and generating USD 25.26 billion in revenue in the industrial connectivity market. The region’s leadership is mainly driven by the rapid digital transformation of manufacturing, energy, logistics, and other industrial sectors.

The strong presence of Industry 4.0 initiatives, coupled with widespread deployment of IoT, cloud, and edge computing solutions, has fueled the adoption of advanced connectivity technologies. In the United States and Canada, enterprises are investing heavily in connected infrastructure to improve efficiency, enable predictive maintenance, and ensure seamless data flow across operations.

North America’s dominance is also supported by its robust technology ecosystem and high R&D spending from both private companies and government initiatives. The region has been at the forefront of integrating 5G networks into industrial environments, enabling faster communication and real-time data analytics. Demand for secure and scalable connectivity is strongest in aerospace, automotive, and healthcare, where reliability and performance are critical.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

In the industrial connectivity market, Cisco Systems, Siemens, ABB, and Schneider Electric are recognized as leading players. Their strong expertise in networking, automation, and industrial control systems enables them to deliver secure and scalable connectivity solutions. These companies support critical sectors including manufacturing, energy, and transportation with advanced platforms that integrate IT and OT environments.

Honeywell International, General Electric, Rockwell Automation, and Emerson Electric strengthen the market with automation software, control systems, and remote monitoring solutions. Their offerings enable predictive maintenance, real-time visibility, and process optimization across industrial environments. By combining data analytics with connectivity, they help organizations improve efficiency and reduce downtime.

Other contributors such as Advantech, Huawei Technologies, Mitsubishi Electric, and Nokia bring specialized strengths in industrial IoT hardware, wireless networks, and edge computing. Their solutions focus on enhancing machine-to-machine communication, 5G-enabled industrial applications, and flexible connectivity for factories.

Top Key Players in the Market

- Cisco Systems, Inc.

- Siemens

- ABB

- Schneider Electric

- Honeywell International Inc.

- General Electric Company

- Rockwell Automation

- Advantech Co., Ltd.

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Nokia

Recent Developments

- In July 2025, ABB launched the ACS380-E machinery drive, a solution built for industrial connectivity. The drive integrates built-in Ethernet ports that support major industrial protocols, along with robust cybersecurity features. Combined with ABB’s Drive Composer software, it enables simplified monitoring, adaptive programming, and fast offline configuration, representing a key step toward stronger industrial network integration.

- In June 2025, Cisco Systems introduced a new network architecture aimed at advancing industrial environments. This innovation brings unified management, next-generation devices optimized for AI workloads, and embedded security features, helping industries achieve higher levels of operational simplicity and resilience.

- In June 2025, Honeywell International unveiled AI-driven digital technologies to accelerate the transition from automation to autonomy. These include AI-enabled cybersecurity defenses and an enhanced Digital Prime platform, designed to protect operational technology (OT) systems while improving efficiency and safety.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Bn Forecast Revenue (2034) USD 8.8 Bn CAGR(2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Sensors and Detectors, Command and Control (C2) Systems, Communication Infrastructure, Trigger Mechanisms, Weapon Platforms, Others), By Platform (Land-Based, Naval-Based, Air-Based), By End-User (National Strategic Forces, Defense Ministries & Intelligence Agencies, Defense Contractors & System Integrators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, Intel Corporation, Nvidia Corporation, AT&T, China Mobile, Deutsche Telekom, Telefónica, SK Telecom, Verizon, Vodafone, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Connectivity MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Connectivity MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Siemens

- ABB

- Schneider Electric

- Honeywell International Inc.

- General Electric Company

- Rockwell Automation

- Advantech Co., Ltd.

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Mitsubishi Electric Corporation

- Nokia