Global Implantable Infusion Pump Market By Product Type (Fixed-rate pumps, Programmable pumps) By Application (Chronic pain management, Spasticity treatment, Cancer-related therapy Others) By End-User (Hospitals, Specialty clinics, Ambulatory Surgical Centres, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167082

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

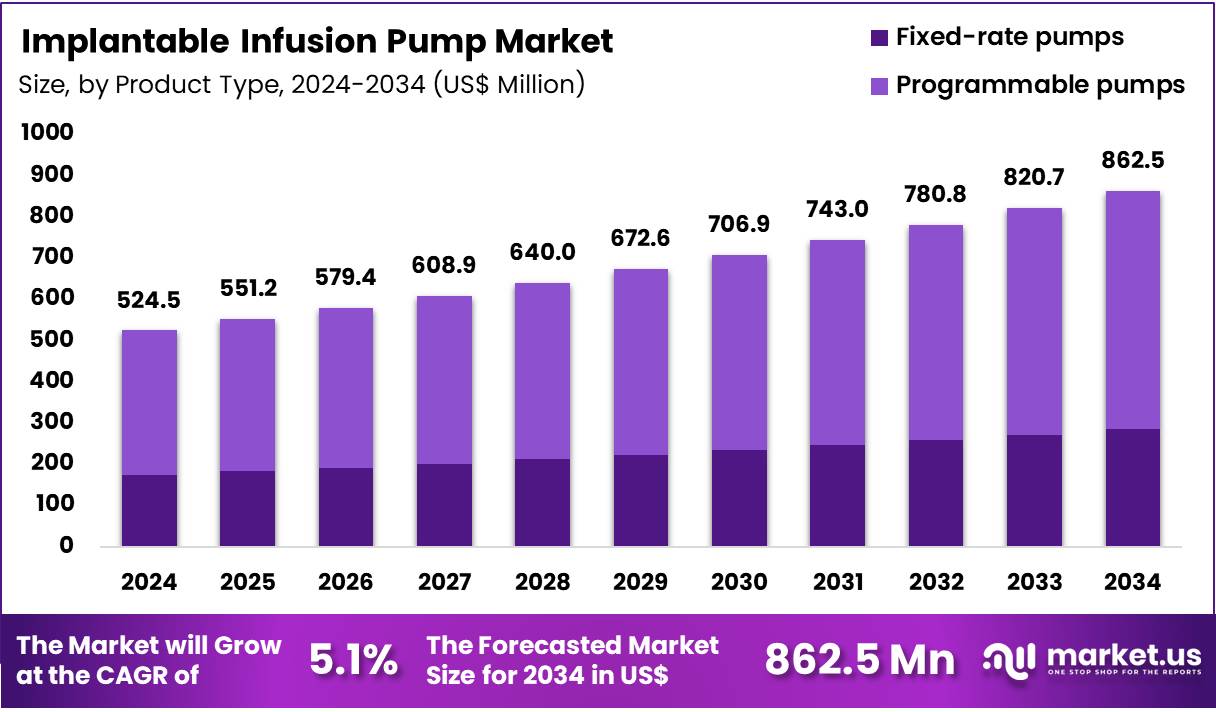

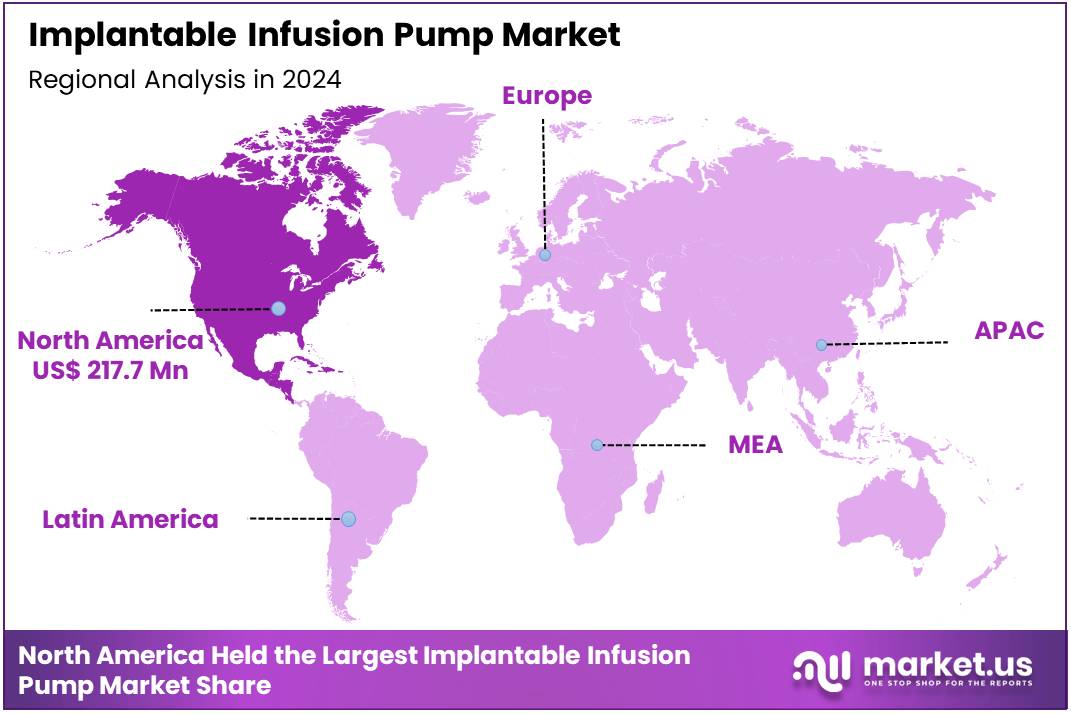

Global Implantable Infusion Pump Market size is expected to be worth around US$ 862.5 Million by 2034 from US$ 524.5 Million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 217.7 Million.

An overview of the implantable infusion pump market reflects a steadily expanding landscape driven by demographic, epidemiologic, and clinical factors. The global rise in noncommunicable diseases has been a primary catalyst. According to the World Health Organization, these conditions account for approximately 74% of all global deaths, resulting in more than 43 million deaths in 2021.

Many affected individuals require long-term pharmacologic management for pain, spasticity, and related symptoms, and the ability of implantable pumps to deliver continuous and targeted therapy directly into the body has strengthened their clinical relevance. As the noncommunicable disease burden grows, the corresponding expansion of the target patient population is evident.

Cancer epidemiology is exerting additional pressure on demand. WHO has reported 20 million new cancer cases and 9.7 million deaths in 2022, with new cases expected to rise by about 77% to more than 35 million by 2050. Pain is experienced by more than half of patients undergoing cancer treatment and by almost two-thirds of individuals with advanced disease. Implantable pumps support intrathecal opioid delivery and, in some cases, targeted chemotherapy, enabling more effective symptom control and reinforcing adoption in oncology and palliative care.

Population ageing remains another structural driver. WHO projects that by 2030, one in six people globally will be aged 60 years or older, with this group increasing from 1 billion in 2020 to 1.4 billion, and further to 2.1 billion by 2050. The number of individuals aged 80 years or above is expected to reach 426 million, nearly tripling. Ageing populations exhibit higher rates of cancer, chronic pain, and neurodegenerative conditions, making them strong candidates for long-term drug delivery systems.

The rising burden of chronic pain contributes significantly to market expansion. Data from the U.S. CDC indicate that in 2023 approximately 24.3% of adults lived with chronic pain, while 8.5% experienced high-impact chronic pain. Prevalence increases to about 36% among older adults, reaffirming the need for advanced therapies.

Policy emphasis on palliative care, with 56.8 million people requiring such services annually, and continued WHO support for opioid access further strengthens demand. Combined with advances in programmable, precise drug-delivery technologies, and broader health-system efforts to manage long-term conditions more efficiently, these factors collectively support sustained growth in the implantable infusion pump market.

Key Takeaways

- Market Size: Global Implantable Infusion Pump Market size is expected to be worth around US$ 862.5 Million by 2034 from US$ 524.5 Million in 2024.

- Market Growth: The market growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Product Type Analysis: Programmable pumps accounted for 66.9% of the global market in 2024, and their dominance has been supported by the increasing need for precise, adjustable drug delivery in chronic and complex therapeutic conditions.

- Application Analysis: Chronic pain management accounted for 47.1% of the global market share in 2024.

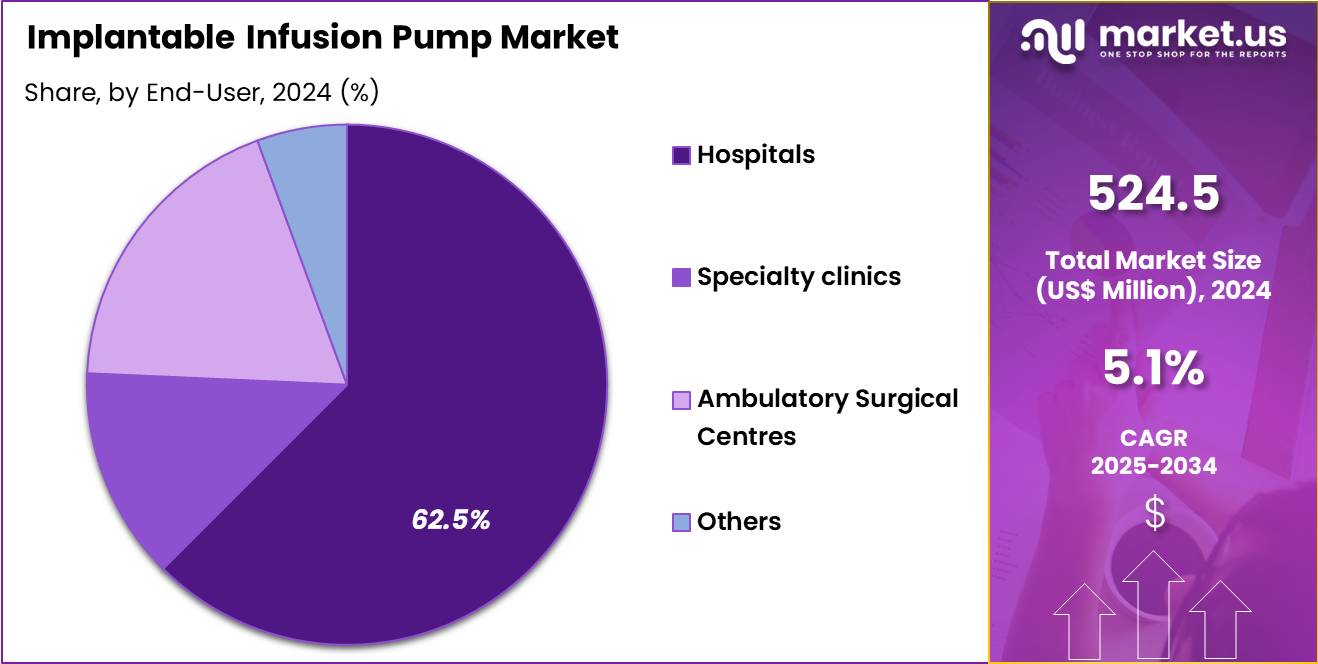

- End-Use Analysis: Hospitals accounted for 62.5% of the global market share in 2024, and this dominance has been supported by the high volume of complex surgical procedures, availability of skilled specialists, and access to advanced monitoring systems.

- Regional Analysis: In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 217.7 Million.

Product Type Analysis

The product landscape of implantable infusion pumps is characterized by two primary categories: programmable pumps and fixed-rate pumps. Programmable pumps accounted for 66.9% of the global market in 2024, and their dominance has been supported by the increasing need for precise, adjustable drug delivery in chronic and complex therapeutic conditions.

The adoption of these systems has been accelerated by their ability to optimize dosage profiles, reduce medication errors, and support personalized treatment regimens. Their widespread use in oncology, pain management, and neurology has further strengthened their market position, as these specialties demand flexible dosing capabilities and long-term infusion reliability.

Fixed-rate pumps represented the remaining share of the market. Their adoption has been sustained by the requirement for simple, maintenance-efficient, and cost-effective infusion systems. The utilization of these devices has been observed in cases where consistent drug delivery is adequate and clinical variability is minimal.

Although technological advancement continues to favor programmable variants, fixed-rate pumps maintain relevance in settings with limited infrastructure or budget constraints. Overall, the segmentation indicates a steady transition toward programmable platforms as healthcare providers prioritize precision, treatment adaptability, and improved patient outcomes.

Application Analysis

The application spectrum of implantable infusion pumps is largely shaped by the increasing prevalence of long-term conditions requiring continuous and controlled drug delivery. Chronic pain management accounted for 47.1% of the global market share in 2024, and this dominance has been attributed to the rising incidence of refractory pain disorders and the growing clinical preference for targeted intrathecal therapies. The use of implantable pumps in this segment has been strengthened by their capacity to reduce systemic opioid exposure, improve functional outcomes, and maintain steady analgesic levels in patients with complex pain profiles.

The spasticity treatment segment has contributed significantly to overall demand, supported by the expanding utilization of intrathecal baclofen therapy in patients with cerebral palsy, multiple sclerosis, and spinal cord injuries. The requirement for sustained muscle-tone control and reduced hospitalization rates has reinforced the adoption of infusion systems in this category.

The cancer-related therapy segment has been driven by the need for localized chemotherapeutic delivery and palliative pain control, providing clinicians with a method to enhance drug efficacy while minimizing systemic toxicity. The others segment, which includes conditions such as pulmonary hypertension and metabolic disorders, continues to grow moderately as clinical indications broaden and device reliability improves across diverse therapeutic areas.

End-User Analysis

The end-user landscape of implantable infusion pumps is primarily concentrated within major healthcare delivery settings where advanced therapeutic interventions are routinely performed. Hospitals accounted for 62.5% of the global market share in 2024, and this dominance has been supported by the high volume of complex surgical procedures, availability of skilled specialists, and access to advanced monitoring systems. The adoption within hospitals has also been reinforced by the growing need for integrated care pathways for chronic pain, oncology, and neurology patients who require long-term infusion therapies and postoperative supervision.

Specialty clinics represented a substantial share of the market, driven by the increasing shift toward focused care centers offering targeted treatments such as pain management, neurology services, and spasticity control. These facilities have benefited from reduced waiting times and personalized consultation models, encouraging wider acceptance of implantable pump procedures.

Ambulatory surgical centres (ASCs) witnessed steady growth due to the rising preference for minimally invasive procedures in cost-efficient settings. The expansion of outpatient surgeries and improvements in device implantation techniques have supported the segment’s progression. The others category, which includes research institutions and rehabilitation centers, continues to grow gradually as clinical applications diversify and long-term infusion technologies become more accessible across various care environments.

Key Market Segments

By Product Type

- Fixed-rate pumps

- Programmable pumps

By Application

- Chronic pain management

- Spasticity treatment

- Cancer-related therapy

- Others

By End-User

- Hospitals

- Specialty clinics

- Ambulatory Surgical Centres

- Others

Driving Factors

The increasing global burden of chronic diseases constitutes a major driver of the implantable infusion pump market. Non-communicable diseases (NCDs) account for over 75 % of global deaths, and they often require controlled, long-term drug delivery. For example, the U.S. Food & Drug Administration (FDA) has approved fully implantable infusion systems such as the “Implantable System for Remodulin” for continuous intravenous delivery of Treprostinil in pulmonary arterial hypertension.

Moreover, improvements in chronically debilitating conditions (e.g., severe pain, spasticity, oncology therapies) have increased the demand for implantable devices that support targeted, sustained infusion. Technological enabling factors—such as micro-electromechanical systems (MEMS) for miniaturisation and patient-centric designs have further augmented adoption.

Policy and reimbursement frameworks in certain jurisdictions also support advanced long-term device therapies: for instance, in the United States the Medicare local coverage determination for “Implantable Infusion Pump (L33461)” covers intrathecal infusions under certain criteria. Collectively, these factors mean that healthcare systems are increasingly seeking durable, precise drug-delivery platforms, thereby propelling growth in the implantable infusion pump segment.

Trending Factors

A prominent trend within the implantable infusion pump market is the shift toward smart, connected and minimally invasive systems that integrate real-time monitoring, programmability and wireless communication. Advances in MEMS-based micropumps, implantable sensor elements and wireless telemetry are enabling more sophisticated therapies.

For example, research on implantable wireless micropumps demonstrates the ability to administer chronic drug therapy with remote control. Parallelly, regulatory authorities have heightened focus on device safety: the FDA’s “Infusion Pump Improvement Initiative” addresses software defects, user interface issues and mechanical failures in infusion pumps.

Additionally, market dynamics show increasing deployment of implantable infusion pumps in home or ambulatory settings, reflecting a broader healthcare shift towards patient-centric care and reduced hospital stays. This trend implies that device manufacturers are incorporating remote refill capability, telemetry-driven alerts and adherence monitoring. The convergence of digital health and implantable drug-delivery thus underpins a key structural evolution in the market.

Restraining Factors

The implantable infusion pump market is constrained by significant regulatory, clinical safety and technological risks that slow uptake. From a regulatory standpoint, devices are subject to stringent controls: for example, in the U.S., infusion pumps fall under Class II regulation (§ 880.5725) with specific performance and validation requirements.

The FDA reports that many adverse events have arisen from design deficiencies—software defects, UI errors and mechanical/electrical failures—leading to a marked improvement initiative. Clinically, implantable pumps carry risks such as device malfunction, infection at implant site, and complications around MRI safety (the FDA issued a safety communication on MRI use with implantable infusion pumps).

Technologically, miniaturisation, battery longevity, biocompatibility and integration with telemetry systems remain complex. The cost of development, the need for surgical implantation and the requirement for maintenance/refill cycles further limit broad uptake, especially in resource-constrained settings. These hurdles increase duration to market and dampen near-term adoption.

Opportunity

Significant opportunities exist for the implantable infusion pump market, especially through geographic expansion, novel therapeutic applications and integration with digital health ecosystems. Emerging economies—particularly in Asia Pacific and India—are enhancing medical-device manufacturing and infrastructure, supported by government-led initiatives (for example, India’s Department of Pharmaceuticals “Boosting the Indian Medical Devices Industry” report includes infusion pumps).

In terms of application, there is strong scope for implantable pumps in areas such as oncology, chronic pain management, diabetes (insulin delivery) and neurology, where sustained and precise delivery confers clinical advantages. Advances in technology—MEMS, smart sensors, microfluidic reservoirs are expected to permit next-generation implants that offer more customizable therapy and patient autonomy.

Furthermore, the shift towards value-based care models favours devices that enable outpatient or home-based management, thereby reducing hospitalisation costs and freeing capacity. For device manufacturers and healthcare providers, leveraging these opportunities by aligning product innovation, regulatory strategy and service delivery partnerships can unlock growth in this specialised but expanding segment.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 41.5% share and holding a market value of US$ 217.7 million for the year. This leadership was supported by strong healthcare infrastructure, early adoption of advanced infusion technologies, and a steady rise in chronic disease prevalence.

North America demonstrated consistent growth in the implantable infusion pump landscape. The presence of well-established hospitals and specialty clinics increased the use of long-term infusion therapies. These facilities prioritized precision-based drug delivery systems, which strengthened regional demand. The high usage of pain management therapies and chemotherapy infusion solutions further contributed to market expansion.

Reimbursement structures across the region remained favorable. Insurance coverage for implantable infusion procedures improved patient access. This structure also supported wider clinical adoption. The high awareness of infusion therapy benefits encouraged clinicians to recommend advanced implantable devices.

Technological innovation remained a major driver. Continuous product improvements enhanced device safety and accuracy. Integration of programmable infusion systems increased the preference for implantable pumps over conventional methods. The presence of strong research activities in neurology, oncology, and pain management also supported the use of implantable infusion technologies.

Regulatory clarity in the United States provided a stable environment for product approvals. This clarity reduced uncertainty for manufacturers and encouraged steady product launches. Clinical trials in the region created confidence in the safety and long-term efficacy of implantable infusion pumps.

The growth of the market in North America can be attributed to rising chronic disease incidence. Conditions such as cancer, severe pain, and spasticity required sustained drug delivery. Implantable infusion pumps were considered reliable for managing such conditions. As a result, healthcare providers increasingly adopted these systems for complex therapeutic needs.

Training programs for healthcare professionals improved device handling skills. This enhanced treatment outcomes and reduced complications. The improvement in patient management protocols encouraged wider device usage across healthcare settings.

The population with long-term care needs continued to expand. This shift increased the demand for targeted and continuous drug delivery. As a result, implantable infusion pumps gained importance in palliative care and chronic disease support.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the implantable infusion pump market is shaped by a group of established manufacturers and emerging innovators whose strategies emphasize safety, precision, and long-term therapy reliability. Market leadership has been reinforced through continuous investments in miniaturization, programmable delivery systems, and biocompatible materials.

The growth of the sector has been supported by companies expanding product portfolios toward oncology, chronic pain, and metabolic disorder applications. Strategic collaborations with healthcare institutions have been used to strengthen clinical evidence and improve regulatory clearances.

Increasing focus on software integration, remote monitoring, and cybersecurity has driven differentiation in premium segments. New entrants have concentrated on cost-effective pump designs to address rising demand in developing regions. Overall, competition has been characterized by technological advancement, geographic expansion, and the optimization of long-term implant performance.

Market Key Players

- Medtronic plc

- Tricumed Medizintechnik GmbH

- Eitan Medical

- Flowonix Medical, Inc.

- Johnson & Johnson

Recent Developments

- Medtronic plc Apr 2025: Medtronic submitted a 510(k) application to the U.S. Food & Drug Administration (FDA) for an interoperable insulin pump in partnership with Abbott Laboratories’s CGM sensor, signalling expansion of its pump ecosystem.

- Medtronic Sep 2025: The FDA cleared the MiniMed 780G system to integrate with Abbott’s CGM and for use in type 2 diabetes, broadening its pump system indications.

- Eitan MedicalOct 2025: Eitan Medical was awarded a “Merit Awards 2025 Technology Winner” recognition, underscoring its infusion-management platform’s innovation.

- Johnson & Johnson Dec 2024: A subsidiary’s implanted infusion-pump product (MedStream) received a Class I recall by the FDA, signalling regulatory risk in implantable infusion systems.

Report Scope

Report Features Description Market Value (2024) US$ 524.5 Million Forecast Revenue (2034) US$ 862.5 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fixed-rate pumps, Programmable pumps) By Application (Chronic pain management, Spasticity treatment, Cancer-related therapy Others) By End-User (Hospitals, Specialty clinics, Ambulatory Surgical Centres, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic plc, Tricumed Medizintechnik GmbH, Eitan Medical, Flowonix Medical, Inc., Johnson & Johnson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Implantable Infusion Pump MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Implantable Infusion Pump MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic plc

- Tricumed Medizintechnik GmbH

- Eitan Medical

- Flowonix Medical, Inc.

- Johnson & Johnson