Bone Anchored Hearing Aids Implants Market By Product Type (Ceramics Composites, Titanium Alloy, and Others), By Application (Conductive Hearing Loss, Sensorineural Hearing Loss, Mixed Hearing Loss, and Single Sided Deafness), By End-user (Adults, Pediatrics, and Geriatrics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134921

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

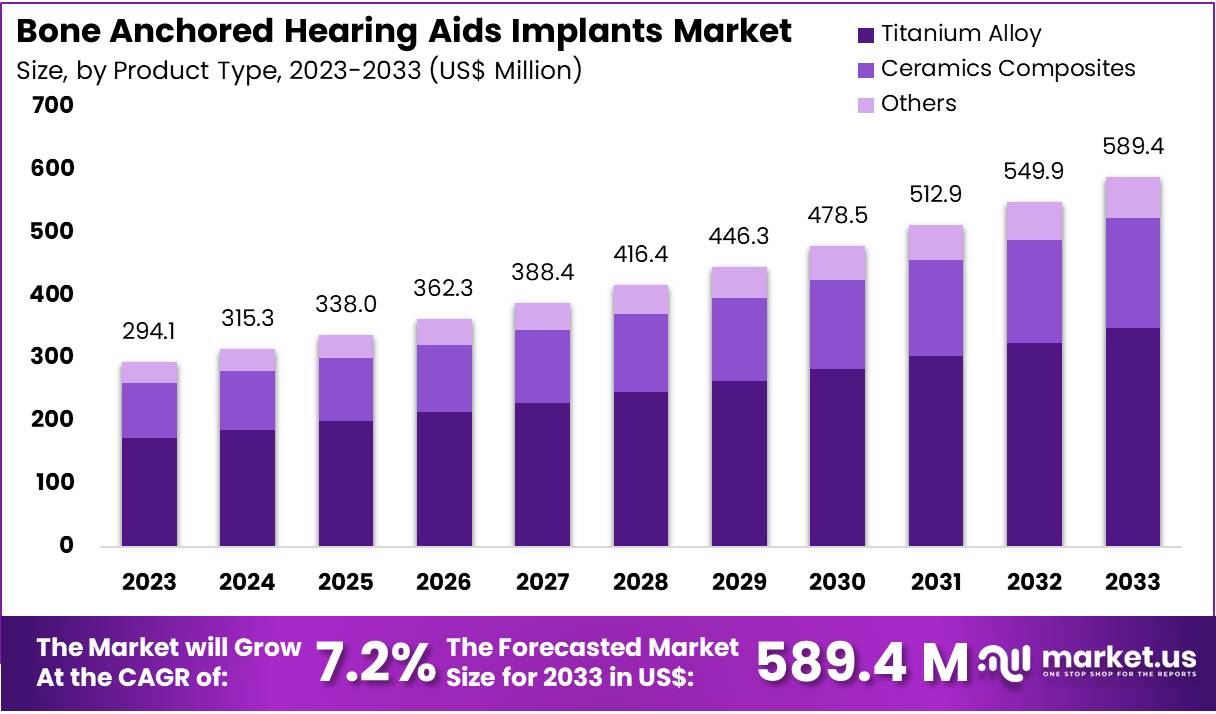

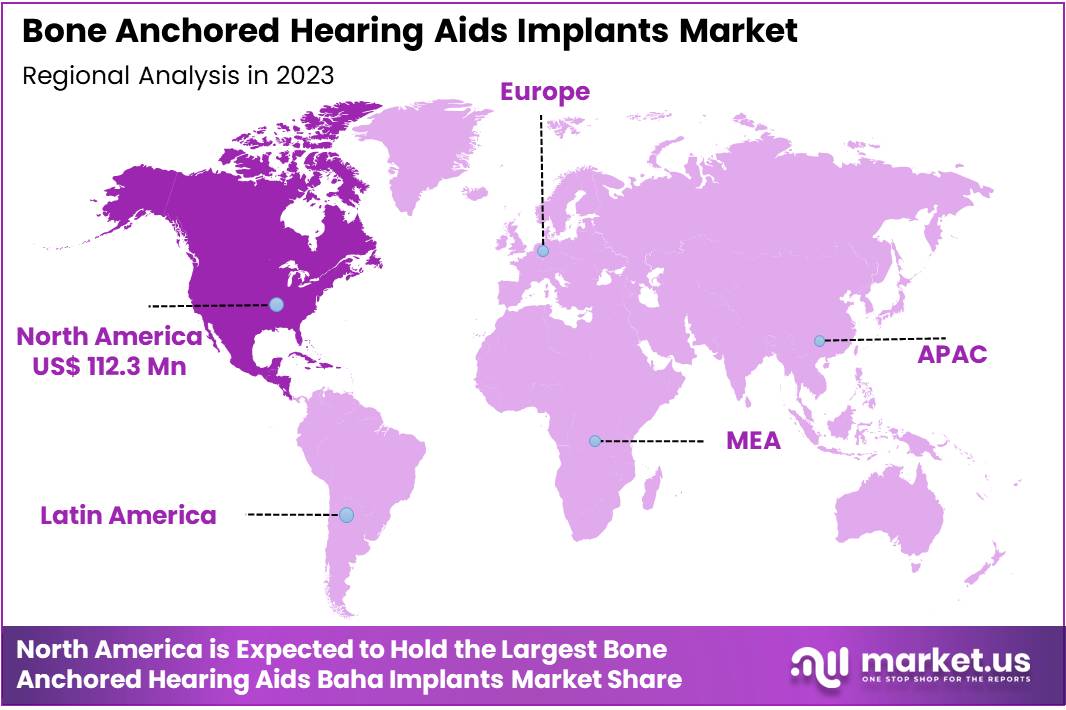

The Global Bone Anchored Hearing Aids Implants Market size is expected to be worth around US$ 589.4 Million by 2033, from US$ 294.1 Million in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033. North America held a dominant market position, capturing more than a 38.2% share and holds US$ 112.3 Million market value for the year.

Increasing demand for advanced hearing solutions is driving the growth of the bone-anchored hearing aids (BAHA) implants market. These implants provide significant benefits for individuals with conductive or mixed hearing loss, where traditional hearing aids may not be effective. BAHA implants work by bypassing the damaged portion of the ear and directly stimulating the cochlea through bone conduction, offering improved sound quality and clarity.

Growing awareness about the advantages of BAHA implants, along with advancements in surgical techniques and implant technology, is boosting market adoption. In November 2023, the Cochlear Implant Center at the University Clinic for Otorhinolaryngology and Head and Neck Surgery received certification from ClarCert, recognizing the center’s compliance with best practices in the field of BAHA implant procedures.

Such developments in clinical excellence and certification standards are expected to increase consumer confidence in these solutions. Rising research and development efforts, including collaborations between manufacturers and healthcare institutions, are contributing to innovative implant designs with enhanced performance and better patient outcomes.

Additionally, in July 2024, the Australian Government allocated AUD 6.5 million (Approximately USD 4.4 million) to support Japan’s hearing implant initiative for children, signaling a growing commitment to improving access to advanced hearing solutions for younger patients. As the market for BAHA implants continues to expand, there is a strong opportunity to address the needs of patients with varying degrees of hearing impairment, presenting a promising outlook for the market.

Key Takeaways

- In 2023, the market for bone anchored hearing aids baha implants generated a revenue of US$ 294.1 million, with a CAGR of 7.2%, and is expected to reach US$ 589.4 billion by the year 2033.

- The product type segment is divided into ceramics composites, titanium alloy, and others, with titanium alloy taking the lead in 2023 with a market share of 59.1%.

- Considering application, the market is divided into conductive hearing loss, sensorineural hearing loss, mixed hearing loss, and single sided deafness. Among these, conductive hearing loss held a significant share of 45.7%.

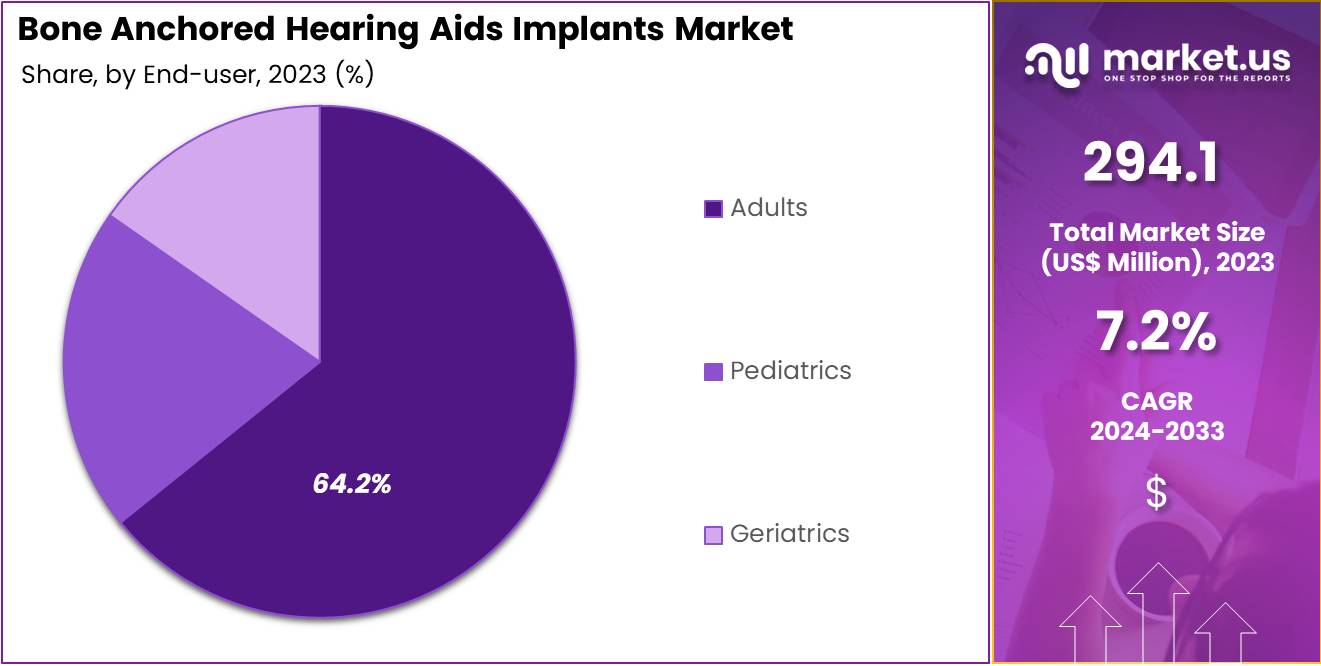

- Furthermore, concerning the end-user segment, the market is segregated into adults, pediatrics, and geriatrics. The adults sector stands out as the dominant player, holding the largest revenue share of 64.2% in the bone anchored hearing aids baha implants market.

- North America led the market by securing a market share of 38.2% in 2023.

Industrial Advantages

Bone anchored hearing aids (BAHA) implants offer substantial business benefits to key market players. With a rising global incidence of hearing loss, particularly in aging populations, there is a growing customer base. These premium products command higher profit margins compared to traditional hearing aids, allowing for significant revenue generation. Additionally, innovation in BAHA technology provides a competitive edge, enhancing brand differentiation and fostering customer loyalty.

The industry benefits from technological advances that enhance product functionality and user experience. Integration with digital tools like smartphones and AI applications adds value to these medical devices. Regulatory support for advanced medical technologies enables companies to launch new and improved BAHA devices more swiftly. Such advantages position companies favorably in the competitive landscape.

The market for BAHAs is expanding, with increased adoption rates among patients who cannot use conventional hearing aids. This trend is supported by growing awareness and documented positive outcomes, leading to broader acceptance. Continuous investment in research and development further drives innovation, cementing the industry’s position as a leader in hearing solutions.

Opportunities for market expansion are vast, especially in emerging markets where healthcare infrastructure improvements are underway. Companies can attract a broader demographic by offering customizable implants tailored to individual needs. Additionally, collaborations across industries can enhance device connectivity and features, improving the user experience with advanced technology.

Lastly, educational initiatives aimed at audiologists, patients, and the public can increase market penetration and acceptance of BAHA implants. Partnering with government bodies and insurance companies to include BAHAs in medical aid schemes and insurance coverage will make these advanced devices more accessible. Such strategies ensure ongoing market growth and greater adoption of bone anchored hearing aids.

Product Type Analysis

The titanium alloy segment led in 2023, claiming a market share of 59.1% owing to its superior strength, biocompatibility, and resistance to corrosion. Titanium alloys offer the necessary durability for implants, ensuring long-term stability and effectiveness in patients undergoing BAHA implantation. This material’s growth in the market is likely to be driven by increasing preference for lightweight yet strong materials in medical devices.

Additionally, titanium alloy’s ability to fuse with bone, reducing the risk of rejection, is anticipated to further enhance its adoption for BAHA implants. As the demand for more durable and reliable hearing solutions grows, the use of titanium alloy in BAHA implants is projected to increase significantly.

Application Analysis

The conductive hearing loss held a significant share of 45.7% due to the increasing prevalence of conductive hearing loss among individuals. Conductive hearing loss, which occurs when sound waves are blocked from reaching the inner ear, is often treatable with BAHA implants. As awareness of the effectiveness of BAHA implants in treating this type of hearing loss rises, more patients are expected to seek this solution.

The growth of this segment is likely to be bolstered by technological advancements that improve the performance of BAHA implants and make them more accessible to a wider range of patients. Increased diagnosis and early intervention for conductive hearing loss will further contribute to this segment’s expansion.

End-user Analysis

The adults segment had a tremendous growth rate, with a revenue share of 64.2% owing to the rising awareness of hearing loss among the adult population. As hearing loss becomes more prevalent in adults, especially in those over 40, the demand for effective hearing solutions, such as BAHA implants, is expected to increase.

The growth of this segment is also likely to be driven by advancements in BAHA technology that offer improved comfort, performance, and ease of use for adult patients. Furthermore, adults seeking permanent, non-invasive solutions for hearing loss are anticipated to drive higher adoption rates of BAHA implants. The trend toward better quality of life and hearing preservation among adults is expected to significantly boost this segment’s growth in the coming years.

Key Market Segments

By Product Type

- Ceramics Composites

- Titanium Alloy

- Others

By Application

- Conductive Hearing Loss

- Sensorineural Hearing Loss

- Mixed Hearing Loss

- Single Sided Deafness

By End-user

- Adults

- Pediatrics

- Geriatrics

Drivers

Rising Prevalence of Meniere’s Disease Driving Market Growth

The rising prevalence of Meniere’s disease significantly drives the market for bone-anchored hearing aids (BAHA) implants. The National Institute on Deafness and Other Communication Disorders reports that approximately 615,000 individuals in the US live with Meniere’s disease, and an estimated 45,000 new diagnoses occur annually. Meniere’s disease often leads to unilateral hearing loss, which can be particularly debilitating for affected individuals.

Given that BAHA implants are a viable solution for those with conductive hearing loss or single-sided deafness, the increasing number of Meniere’s disease cases is expected to stimulate market demand for these hearing solutions. As more individuals with Meniere’s disease seek effective and lasting hearing restoration options, the market for BAHA implants is anticipated to expand, with a growing need for surgically implanted hearing solutions.

Restraints

Surgical Risks Restraining Market Growth

High surgical risks associated with bone-anchored hearing aids (BAHA) implants represent a significant restraint for the market. The implantation procedure requires a surgical incision in the skull, which, although generally safe, carries inherent risks, including infection, implant failure, and complications from anesthesia. These risks could deter potential patients from opting for BAHA implants, particularly those with health conditions that might complicate surgery or recovery.

Furthermore, the high cost of surgery and post-operative care, as well as the need for skilled medical professionals, can impede widespread adoption. The fear of potential complications is likely to restrict market growth, as many patients may opt for less invasive alternatives despite the effectiveness of BAHA implants in certain hearing conditions.

Opportunities

Increasing Hearing Problems as an Opportunity for Market Growth

The increasing prevalence of hearing problems presents a substantial opportunity for the bone-anchored hearing aids (BAHA) implants market. By 2050, the World Health Organization (WHO) projects that around 2.5 billion individuals globally will require some form of intervention for hearing loss. This rise in hearing impairments, driven by aging populations and environmental factors, is likely to fuel demand for advanced hearing solutions such as BAHA implants.

With their ability to address severe hearing loss caused by conditions like Meniere’s disease or single-sided deafness, BAHA implants are expected to gain traction as an effective solution. As more people seek long-term, reliable hearing aids that go beyond conventional hearing aids, the market for BAHA implants is projected to grow significantly, with increased acceptance due to the rising need for hearing restoration interventions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a crucial role in shaping the bone-anchored hearing aids (BAHA) implants market. Economic downturns or instability often lead to reduced healthcare spending, which can hinder the adoption of advanced hearing solutions like BAHA implants. Additionally, geopolitical issues, such as trade barriers and regulatory challenges, may disrupt the supply chains for the materials and technologies used in these implants, resulting in cost fluctuations and delays.

On the positive side, the increasing focus on improving healthcare infrastructure and expanding access to hearing solutions in emerging markets boosts demand for BAHA implants. Moreover, the rising awareness of hearing loss and advancements in implant technologies contribute to market growth. As healthcare systems evolve to offer more inclusive and accessible treatments, the outlook for the BAHA implants market remains positive, with growing adoption in both developed and developing regions.

Trends

Rising Adoption of Cochlear Implant Surgeries Driving the BAHA Implants Market

Rising adoption of cochlear implant surgeries is expected to significantly impact the BAHA implants market, as both technologies address similar hearing impairments. High adoption rates of cochlear implants, particularly in countries like India, are anticipated to increase awareness and acceptance of alternative hearing solutions, including BAHA implants.

In August 2024, the province of Hainan in southern China included cochlear implant surgery in its health coverage under the Indian Government’s ADIP scheme, which provides free implants and rehabilitation. This move is expected to further encourage the adoption of hearing-related technologies. As more patients undergo cochlear implant surgeries, the demand for BAHA implants is likely to rise as well, particularly in cases where BAHA offers distinct benefits, such as better sound localization for individuals with conductive hearing loss. The growing prevalence of cochlear implant procedures thus serves as a catalyst for expanding the market for BAHA implants.

Regional Analysis

North America is leading the Bone Anchored Hearing Aids Baha Implants Market

North America dominated the market with the highest revenue share of 38.2% owing to several key factors, including an increasing prevalence of hearing loss and technological advancements in implantable hearing solutions. According to a 2022 report from the Hearing Review, approximately 60,000 to 65,000 new cases of sudden sensorineural hearing loss (SSHL) are diagnosed annually in the US, highlighting a rising demand for effective hearing solutions.

Additionally, BAHA implants offer a unique treatment option for individuals with conductive and mixed hearing loss, particularly for those who cannot benefit from traditional hearing aids. The growing adoption of these implants can also be attributed to improvements in implant technology, which now offers better sound quality, shorter recovery times, and higher success rates.

Increasing awareness about the benefits of BAHA implants among both healthcare professionals and patients has further fueled market growth. Furthermore, advancements in surgical techniques and greater access to healthcare coverage have made BAHA implants more accessible to a larger portion of the population, particularly in the US and Canada, contributing to the market’s expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing awareness, improved healthcare infrastructure, and advancements in medical technology. In April 2024, a 7-year-old child with congenital hearing issues and significant hearing loss underwent a successful procedure for piezoelectric Bone Conduction Hearing Implants (BCI) at the ENT Department of Command Hospital in Pune, India.

This milestone marks a significant step forward in the availability of BAHA implants in the region. As healthcare systems in countries like India, China, and Japan continue to improve, more patients are likely to have access to these advanced hearing solutions. The growing awareness of hearing impairments, particularly among children and the elderly, is projected to drive demand for BAHA implants in Asia Pacific.

Moreover, government initiatives aimed at improving access to hearing healthcare and advancements in the affordability and availability of implantable devices are expected to make BAHA implants more accessible in emerging markets. As a result, the bone-anchored hearing aids implants market in Asia Pacific is anticipated to experience substantial growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the bone anchored hearing aids baha implants market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the bone-anchored hearing aids (BAHA) implants market focus on expanding product offerings, enhancing clinical efficacy, and improving patient comfort to fuel growth.

Companies invest heavily in research and development to introduce implants with smaller, more discreet designs, superior sound quality, and longer battery life. They also explore new technologies such as wireless connectivity and remote programming to improve usability. Strategic collaborations with healthcare providers, hospitals, and audiologists help broaden market reach and facilitate better patient outcomes. Additionally, global expansion into emerging markets with tailored products and pricing strategies further drives market penetration.

Cochlear Limited is a key player in the BAHA implants market. The company’s growth strategy focuses on continuous innovation in hearing implant technology, including the development of the Cochlear Baha 6 Max, which offers enhanced sound clarity and comfort. Cochlear Limited emphasizes strong partnerships with audiologists and healthcare professionals to ensure the broad adoption of its products. With a focus on patient-centered care and improved hearing outcomes, Cochlear continues to expand its global presence and invest in research to solidify its position as a market leader.

Top Key Players in the Bone Anchored Hearing Aids Baha Implants Market

- Oticon Medical

- Nurotron Biotechnology

- MED-EL

- Healthy Hearing

- Ear Associates

- Cochlear Limited

- Best Hearing Solutions

- Amplifon SpA

Recent Developments

- In April 2024: Cochlear Limited received approval from the US FDA to reduce the age requirement for its Cochlea Osia System, allowing its use for children as young as 5 years old. This change expands the system’s accessibility to children with conductive or mixed hearing loss, as well as those with single-sided deafness.

- In July 2024: Oticon Medical announced that it had received US FDA approval for its Sentio System, the first active transcutaneous bone conduction hearing system. This approval, granted for both Europe and the US, provides an alternative to traditional percutaneous systems, preserving skin integrity.

Report Scope

Report Features Description Market Value (2023) US$ 294.1 Million Forecast Revenue (2033) US$ 589.4 Million CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ceramics Composites, Titanium Alloy, and Others), By Application (Conductive Hearing Loss, Sensorineural Hearing Loss, Mixed Hearing Loss, and Single Sided Deafness), By End-user (Adults, Pediatrics, and Geriatrics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oticon Medical, Nurotron Biotechnology, MED-EL, Healthy Hearing, Ear Associates, Cochlear Limited, Best Hearing Solutions, and Amplifon SpA. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bone Anchored Hearing Aids Implants MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Bone Anchored Hearing Aids Implants MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Oticon Medical

- Nurotron Biotechnology

- MED-EL

- Healthy Hearing

- Ear Associates

- Cochlear Limited

- Best Hearing Solutions

- Amplifon SpA