Global Hyperspectral Imaging Systems Market By Product Type (Camera and Accessories), By Technology (Snapshot, Push Broom, and Others), By Applications (Manufacturing, Process Control, Quality Assurance, Remote Sensing, Military Surveillance, and Others), By Distribution Channel (Food & Beverage, Defense, Healthcare & Pharmaceutical, Chemical, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145056

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

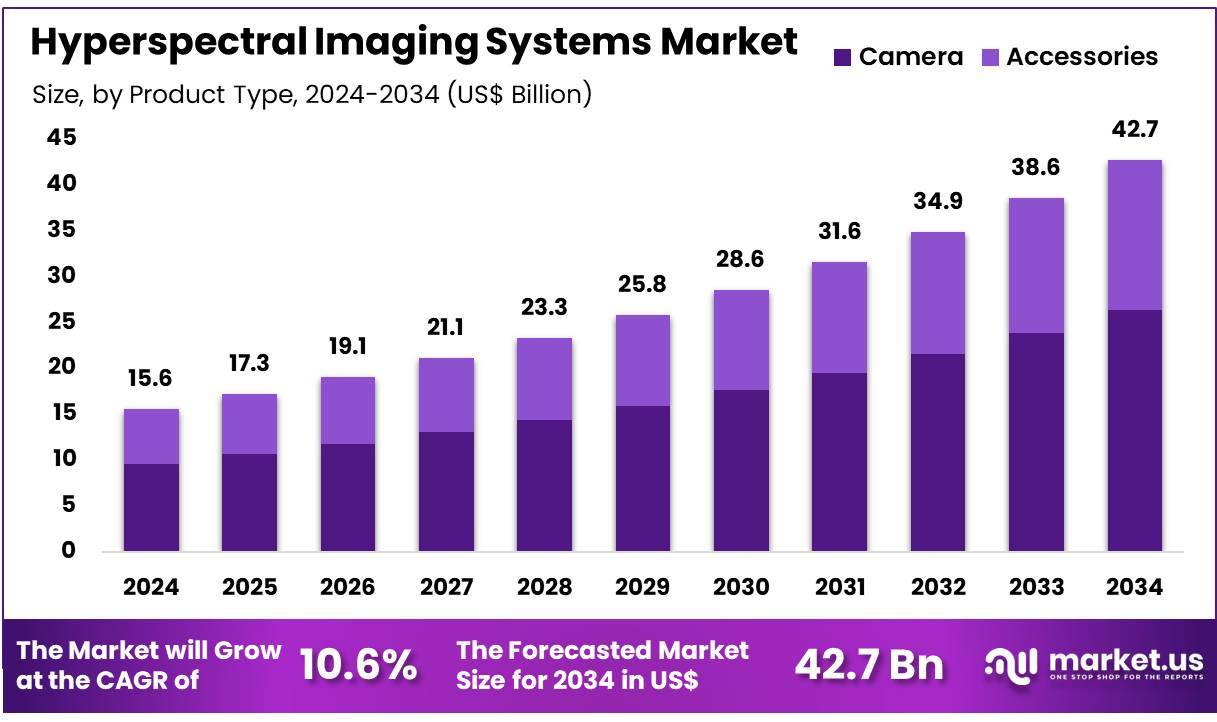

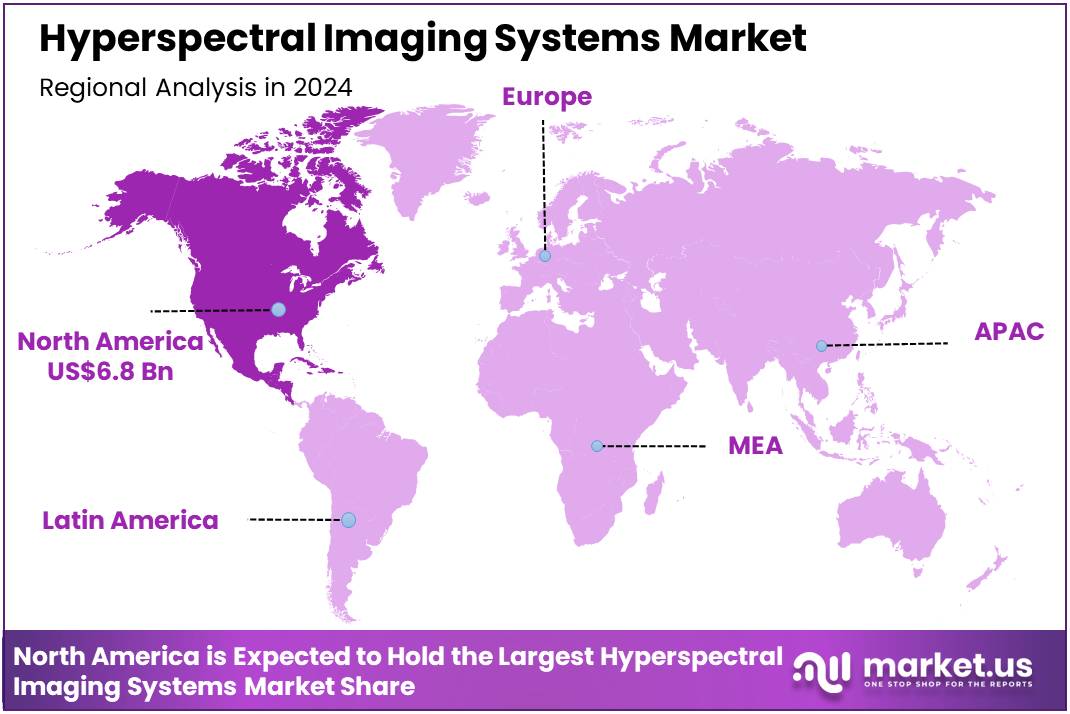

Global Hyperspectral Imaging Systems Market size is expected to be worth around US$ 42.7 billion by 2034 from US$ 15.6 billion in 2024, growing at a CAGR of 10.6% during the forecast period 2025 to 2034. North America led the market by securing a market share of 43.5% in 2024.

Increasing demand for advanced imaging systems is driving the growth of the hyperspectral imaging systems market. These systems provide detailed spectral data across a wide range of wavelengths, offering valuable insights for a variety of industries, including healthcare, agriculture, environmental monitoring, and security. Hyperspectral imaging enables precise analysis of materials, making it ideal for applications such as remote sensing, diagnostics, and food quality control.

In June 2022, Resonon Inc. unveiled its Pika IR-L and IR-L+ hyperspectral cameras, designed to operate within the 925-1700 nm wavelength range. These high-performance cameras offer exceptional spectral and spatial resolution, making them perfect for UAV-based applications in remote sensing, environmental monitoring, and scientific research. Their combination of portability and advanced imaging capabilities presents significant opportunities for industries that require high-quality, real-time data.

The growing adoption of drones and UAVs in scientific research further fuels the market, as these technologies enhance the capabilities of hyperspectral imaging. Additionally, advancements in machine learning and artificial intelligence are enabling more efficient processing and analysis of hyperspectral data, contributing to the expansion of the market.

Key Takeaways

- In 2024, the market for hyperspectral imaging systems generated a revenue of US$ 15.6 billion, with a CAGR of 10.6%, and is expected to reach US$ 42.7 billion by the year 2034.

- The product type segment is divided into camera and accessories, with camera taking the lead in 2024 with a market share of 61.7%.

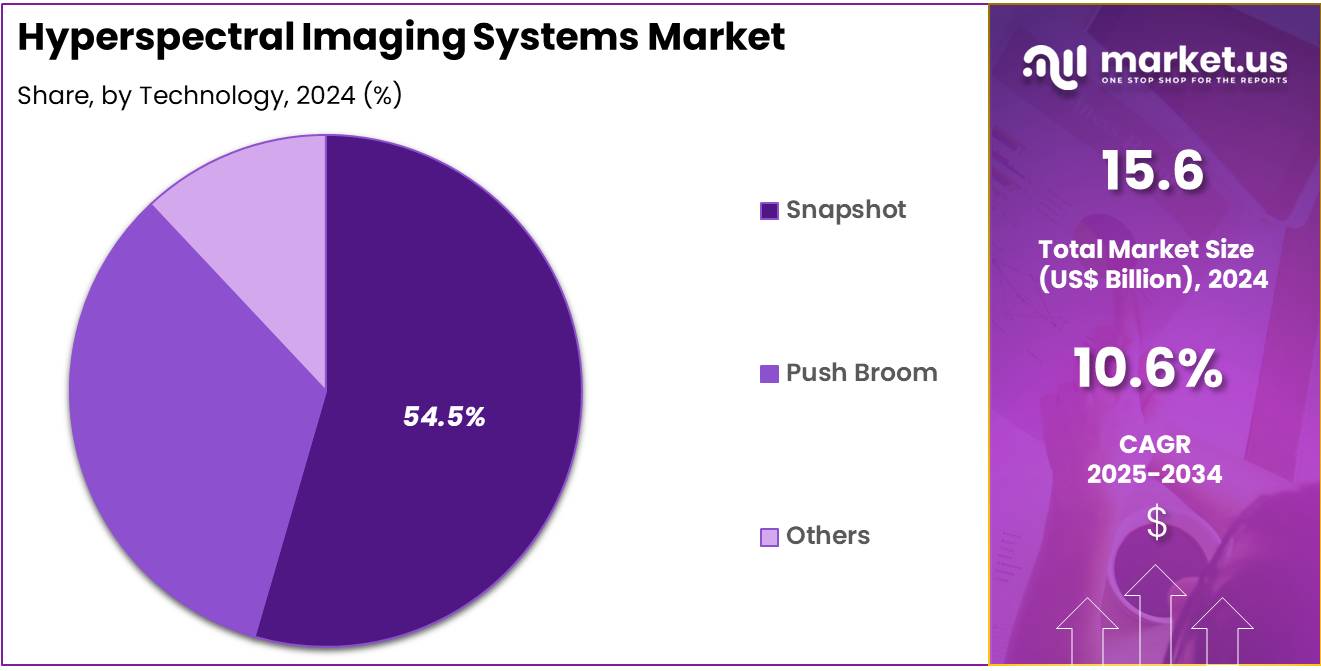

- Considering technology, the market is divided into snapshot, push broom, and others. Among these, snapshot held a significant share of 54.5%.

- Furthermore, concerning the applications segment, the market is segregated into manufacturing, process control, quality assurance, remote sensing, military surveillance, and others. The manufacturing sector stands out as the dominant player, holding the largest revenue share of 42.5% in the hyperspectral imaging systems market.

- The distribution channel segment is segregated into food & beverage, defense, healthcare & pharmaceutical, chemical, and others, with the food & beverage segment leading the market, holding a revenue share of 47.2%.

- North America led the market by securing a market share of 43.5% in 2024.

Product Type Analysis

The camera segment led in 2024, claiming a market share of 61.7% as the demand for high-resolution imaging systems increases across various industries. Cameras used in hyperspectral imaging systems allow for precise data collection across a broad spectrum of wavelengths, making them essential for applications such as environmental monitoring, agriculture, and security.

As industries continue to explore advanced imaging technologies to enhance their operations, the demand for hyperspectral cameras is anticipated to rise. Additionally, innovations in camera technology, such as miniaturization and enhanced spectral resolution, are likely to drive further adoption, expanding the camera segment within the market.

Technology Analysis

The snapshot held a significant share of 54.5% due to its ability to capture full spectral information of a scene in a single snapshot. This technology is particularly advantageous in applications that require real-time imaging, such as precision agriculture and remote sensing.

The growing need for faster data acquisition, especially in large-scale imaging and surveillance, is expected to drive the demand for snapshot hyperspectral imaging systems. Additionally, as industries such as environmental monitoring and defense increasingly rely on high-speed and efficient imaging technologies, the snapshot segment is likely to see broader adoption and growth.

Application Analysis

The manufacturing segment had a tremendous growth rate, with a revenue share of 42.5% owing to the increasing adoption of hyperspectral imaging for process control and quality assurance in manufacturing environments. Hyperspectral imaging systems allow for real-time, non-destructive analysis of products on production lines, providing insights into product composition, surface defects, and contamination.

As manufacturing industries, including electronics and automotive, strive to improve production efficiency and ensure high-quality outputs, the use of hyperspectral imaging systems is likely to expand. The ability to optimize manufacturing processes and reduce defects with precise imaging is anticipated to contribute to the growth of the manufacturing segment.

Distribution Channel Analysis

The food & beverage segment grew at a substantial rate, generating a revenue portion of 47.2% due to the increasing demand for quality control and food safety in the food processing industry. Hyperspectral imaging systems are expected to play a key role in detecting contaminants, assessing food quality, and ensuring compliance with safety regulations.

As the food industry faces growing consumer demand for safe, high-quality products and increasing pressure for compliance with stringent food safety standards, the use of hyperspectral imaging systems is likely to rise. Furthermore, as automation in food processing increases, the adoption of hyperspectral imaging systems for real-time monitoring and analysis is expected to further fuel the growth of this segment.

Key Market Segments

Product Type

- Camera

- Accessories

Technology

- Snapshot

- Push Broom

- Others

Applications

- Manufacturing

- Process Control

- Quality Assurance

- Remote Sensing

- Military Surveillance

- Others

Distribution Channel

- Food & Beverage

- Defense

- Healthcare & Pharmaceutical

- Chemical

- Others

Drivers

Increasing Demand for Remote Sensing Applications is Driving the Market

The growing adoption of hyperspectral imaging systems in remote sensing applications is a key driver for the market. These systems are widely used in environmental monitoring, agriculture, and defense sectors due to their ability to capture detailed spectral information. For instance, the agricultural sector leverages this technology for precision farming, enabling farmers to monitor crop health and optimize resource usage.

Key players like Headwall Photonics and Specim have reported increased demand for their products in 2023, particularly in North America and Europe, where governments are investing heavily in sustainable agriculture and environmental conservation. The US Department of Agriculture has also emphasized the role of advanced imaging technologies in improving crop yields, further boosting market growth.

Restraints

High Costs and Complexity are Restraining the Market

The high cost and technical complexity of hyperspectral imaging systems act as significant restraints to market growth. These systems require sophisticated hardware and software, making them expensive to develop and maintain. Small and medium-sized enterprises (SMEs) often find it challenging to afford these systems, limiting their widespread adoption. The average cost of a hyperspectral camera ranges from US$20,000 to US$50,000, depending on the specifications.

Additionally, the lack of skilled professionals capable of operating these advanced systems further hampers market growth. For example, in 2023, Teledyne Technologies reported that the complexity of their hyperspectral imaging systems contributed to slower adoption rates in emerging markets, despite their advanced capabilities. These financial and operational challenges present barriers to broader market penetration, particularly in resource-constrained regions.

Opportunities

Expansion in Healthcare Applications is Creating Growth Opportunities

The healthcare sector presents significant growth opportunities for hyperspectral imaging systems. These systems are increasingly being used for medical diagnostics, including cancer detection and tissue analysis, due to their ability to provide detailed spectral data. In 2023, a study highlighted the potential of hyperspectral imaging in early cancer detection, with a reported accuracy rate of over 90%.

Companies like Cubert GmbH and BaySpec have been actively developing cost-effective solutions tailored for medical applications. The healthcare segment is expected to grow significantly, driven by increasing investments in medical imaging technologies. Governments and private institutions are also funding research to explore new applications in healthcare, further propelling market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the hyperspectral imaging systems market. Economic growth in emerging markets, such as India and China, has increased investments in advanced technologies, driving demand for these systems. However, rising inflation and supply chain disruptions, exacerbated by geopolitical tensions, have led to increased production costs and delayed deliveries.

For instance, the Russia-Ukraine conflict disrupted the supply of critical components like sensors and lenses in 2022, impacting manufacturers globally. On the positive side, government initiatives in North America and Europe, such as the European Green Deal, have boosted funding for environmental monitoring projects, creating new opportunities. Despite challenges, the market remains resilient, with technological advancements and strategic collaborations ensuring sustained growth.

Latest Trends

Integration of AI and Machine Learning is a Recent Trend

The integration of artificial intelligence and machine learning with hyperspectral imaging systems is a prominent trend in the market. AI and ML algorithms enhance the data processing capabilities of these systems, enabling faster and more accurate analysis. Companies like Resonon and IMEC are leveraging AI to improve the efficiency of their imaging systems.

For instance, IMEC reported a 30% reduction in data processing time by incorporating AI into their hyperspectral cameras. This trend is particularly significant in industries like agriculture and defense, where real-time data analysis is critical. A significant portion of manufacturers are investing in AI-driven solutions to stay competitive and meet the growing demand for advanced imaging technologies.

Regional Analysis

North America is leading the Hyperspectral Imaging Systems Market

North America dominated the market with the highest revenue share of 43.5% owing to advancements in remote sensing, agriculture, and defense applications. The US Department of Agriculture (USDA) reported a 15% increase in the adoption of precision agriculture technologies, including hyperspectral imaging, in 2023, as farmers sought to optimize crop yields and reduce resource usage. Additionally, the National Aeronautics and Space Administration (NASA) expanded its use of hyperspectral imaging for Earth observation missions, with a 20% increase in funding allocated to such technologies in 2023.

The US Department of Defense also contributed to this growth, investing US$150 million in hyperspectral imaging for surveillance and reconnaissance in 2022, as highlighted in their annual budget report. Furthermore, the Canadian Space Agency (CSA) launched new initiatives in 2023 to integrate hyperspectral imaging into environmental monitoring, with a US$50 million investment. These developments, supported by government funding and technological innovation, have solidified North America’s position as a leader in the hyperspectral imaging market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing applications in agriculture, mining, and environmental monitoring. The Indian Space Research Organisation (ISRO) announced a 25% increase in funding for hyperspectral imaging projects in 2023, focusing on crop assessment and disaster management. Similarly, the Chinese Academy of Sciences (CAS) reported a 30% rise in the deployment of hyperspectral imaging for mineral exploration in 2022, as part of their national resource optimization strategy.

Japan’s Ministry of Agriculture, Forestry, and Fisheries (MAFF) allocated US$40 million in 2023 to integrate hyperspectral imaging into precision farming practices, aiming to enhance food security. Additionally, the Australian Government’s Department of Industry, Science, Energy, and Resources invested US$40 million in 2023 to integrate hyperspectral imaging into precision farming practices, aiming to enhance food security.

These investments, coupled with rapid technological advancements and growing awareness of the benefits of hyperspectral imaging, are expected to propel the market’s expansion across the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the hyperspectral imaging systems market focus on technological advancements, expanding applications, and strategic partnerships to drive growth. They invest in developing more precise, faster, and cost-effective imaging systems with applications spanning agriculture, healthcare, and environmental monitoring.

Companies also target emerging markets by offering tailored solutions that address specific industry needs, such as food safety and environmental quality analysis. Collaborations with research institutions and government organizations help expand the adoption of these systems. Additionally, continuous innovation in software for data processing and analysis supports the growth of the market.

Headwall Photonics, headquartered in Bolton, Massachusetts, is a leading provider of hyperspectral imaging solutions. The company specializes in developing advanced hyperspectral cameras and systems that capture high-resolution data for a variety of industries, including defense, healthcare, and agriculture. Headwall focuses on delivering cutting-edge imaging technologies that enable precise analysis and decision-making. With a strong commitment to innovation and research, the company continues to strengthen its market position by offering customized solutions to meet the unique needs of different sectors.

Top Key Players

- XIMEA GmbH

- Telops

- Surface Optics Corporation

- Spectral Imaging Ltd

- Specim

- Norsk Elektro Optikk

- Headwall Photonics

- HAIP Solutions GmbH

Recent Developments

- In January 2024, Specim forged a strategic collaboration with GEONA Hyperspectral, designating GEONA as the preferred partner for processing solutions. This partnership aims to optimize the capabilities of Specim’s airborne hyperspectral sensors, offering a comprehensive solution for data analysis and imaging in various environmental and industrial applications.

- In April 2023, Headwall Photonics and K8 entered into a distribution agreement with Aermatica3D Srl, appointing them as an official reseller for their remote sensing products across Italy. By leveraging Aermatica3D’s expertise in engineering, the collaboration aims to provide customized remote sensing solutions to a broad range of industries and research organizations.

Report Scope

Report Features Description Market Value (2024) US$ 15.6 billion Forecast Revenue (2034) US$ 42.7 billion CAGR (2025-2034) 10.6% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Camera and Accessories), By Technology (Snapshot, Push Broom, and Others), By Applications (Manufacturing, Process Control, Quality Assurance, Remote Sensing, Military Surveillance, and Others), By Distribution Channel (Food & Beverage, Defense, Healthcare & Pharmaceutical, Chemical, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape XIMEA GmbH, Telops, Surface Optics Corporation, Spectral Imaging Ltd, Specim, Norsk Elektro Optikk, Headwall Photonics, and HAIP Solutions GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hyperspectral Imaging Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Hyperspectral Imaging Systems MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- XIMEA GmbH

- Telops

- Surface Optics Corporation

- Spectral Imaging Ltd

- Specim

- Norsk Elektro Optikk

- Headwall Photonics

- HAIP Solutions GmbH