Global Hydrogen Peroxide Market By Function (Disinfectant, Bleaching, Oxidant, Others), By Application (Pulp And Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food And Beverages, Personal Care, Healthcare, Textiles, Others) , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023–2033

- Published date: April 2024

- Report ID: 15270

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

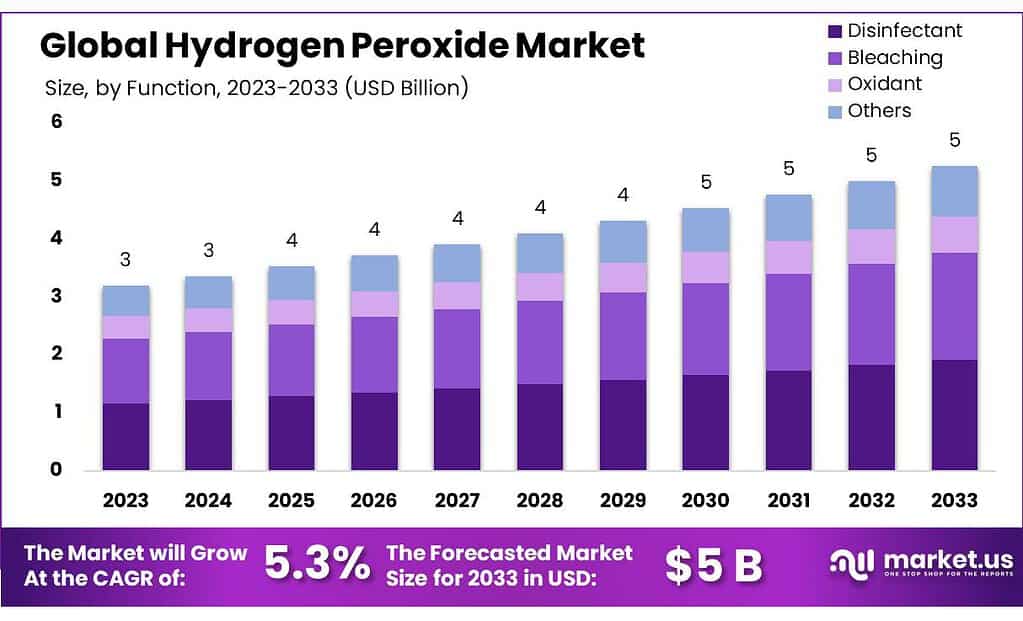

The Global Hydrogen Peroxide Market size was valued at USD 3 Billion in 2023 and is projected to grow at a 5.3% CAGR, between 2023-2033. It is expected to reach USD 5 Billion in the forecast period.

Antiseptic is highly desired in the healthcare sector. This product is traditionally used on cuts and bruises to prevent infection. It can also be used to rinse the mouth, as it can soothe irritations or reduce mucus. It releases oxygen, which results in foaming on the skin, eventually leading to the effective removal of dead skin.

Key Takeaways

- Market Size and Growth Projection: The Hydrogen Peroxide Market The expected market value by 2033 is USD 5 Billion and is estimated to grow at a CAGR of 5.3%.

- Functions Driving Market Demand: Bleaching Dominance Holds a 36.4% market share, extensively used in medical, pulp and paper, and textile industries.

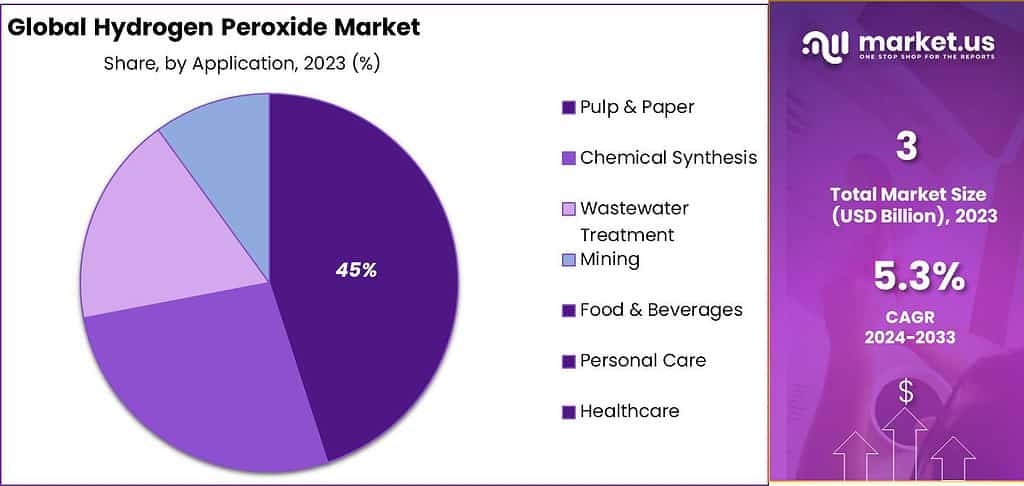

- Applications Driving Usage: Pulp and Paper Industry Accounts for 34.2% in the market due to its chlorine-free properties, enhancing paper quality and lowering production costs.

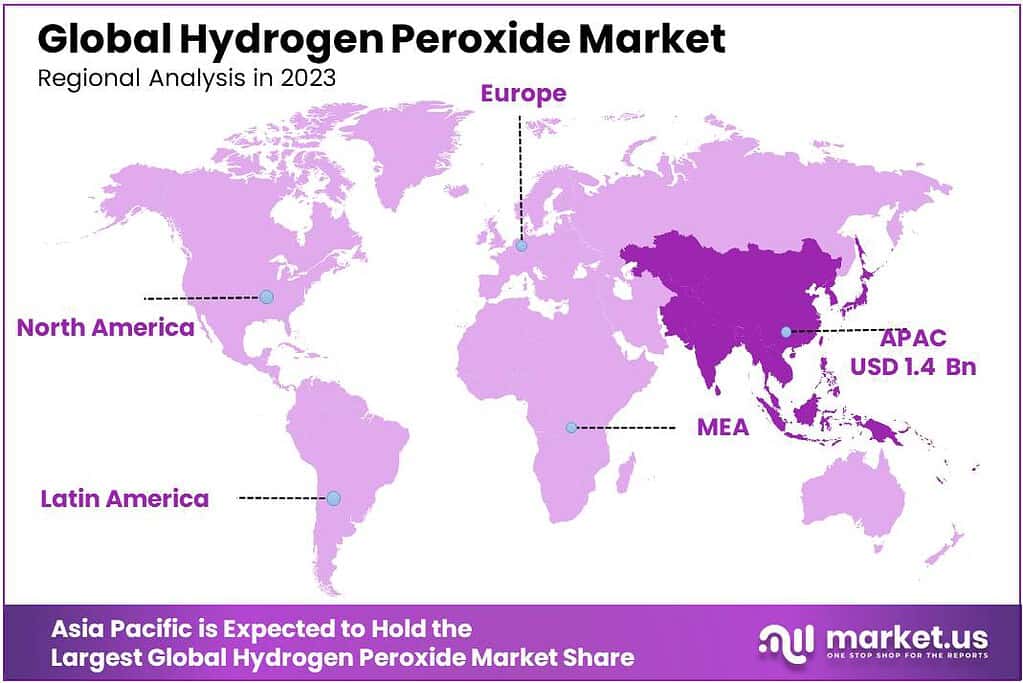

- Regional Market Insights: Asia-Pacific: Holds the largest market share (46.5%), attributed to increased penetration in chemical formulators and personal-care products.

Function Analysis

With a market share of 36.4%, the bleaching segment led the market in volume. The product is widely used as a bleaching agent in many industries including medical, pulp and paper, and textiles. It is extremely useful in the medical sector as a dental bleach, mouthwash, hair bleach, and for maintaining good oral hygiene.

The textile sector uses a greater amount of the substance to bleach. This is because it can be used to brighten clothes and remove stains from natural and synthetic fibers, as well as to remove them. It can also be used to improve mechanical properties and fabric manufacturing.

In terms of volume, the disinfectant segment will grow at the fastest CAGR over the forecast period. This is due to the fact that disinfectants are used in the formulation of multiple cleaning agents and hygiene products. The demand for this function increased significantly in the first quarter of 2023 following the outbreak of the flu virus worldwide.

It also boosted the production of many disinfectant products such as floor cleaners, outdoor and indoor cleaners, as well as hand sanitizers. These events led to an increase in hydrogen peroxide being used as a disinfectant around the globe. The trend is expected to continue in the future.

Application Analysis

The pulp and paper application segment dominated in terms of quantities, holding a market share of 34.2%. This material, often known as bleach, is a crucial component for the pulp and paper industry worldwide because it doesn’t contain any chlorine. It can be used to raise brightness and enhance the mechanical, chemical, and paper quality. As it lowers production costs, offers better quality, is simple to use, and is environmentally benign, it has created a rising demand in the business.

Over the forecast period, the healthcare application segment will experience the highest volume growth rate at a CAGR of 4.6%. Due to the rapid manufacturing of disinfectant and sanitizing products by many multinationals, this is due to the large demand. These products will see significant demand worldwide due to the increasing awareness about the importance these healthcare essentials have in our day-to-day lives.

The high demand for wastewater treatment is a key sector. This is largely due to the product’s ability to reduce the Chemical Oxygen Demand (COD), and Biological Oxygen Demand (BOD) levels. Chemical oxidation results in the removal of toxic substances from water. Its ability to remove harmful chemicals from the water makes it safe for consumption. There are many ways to get rid of toxic elements in water with hydrogen peroxide. This includes direct chemical oxygenation, enhanced separation of COD, and BOD, as well as using the product for supplemental oxygen.

The substance’s chemical and biological properties and biodegradability have made it a popular ingredient in the food and drink processing industry. Evonik is working to improve its product properties so that they can be used in a wider range of food processing sectors. For example, the product could be used to whiten the food and protect it from microbial degradation for a longer time.

Key Market Segments

Function

- Disinfectant

- Oxidant

- Bleaching

- Others

Application

- Pulp & Paper

- Wastewater Treatment

- Chemical Synthesis

- Food & Beverages

- Mining

- Healthcare

- Personal Care

- Textiles

- Others

Driver

Increasing demand for surface disinfectants

Hydrogen peroxide stands as a potent disinfectant that dismantles crucial components within germs, rendering them inactive against a broad spectrum of microorganisms encompassing bacteria, viruses, fungi, and spores. The increased recognition of the significance of sanitation, health, and safety has fueled the growth of surface disinfectants.

Infectious diseases, often stemming from poor hygiene, significantly contribute to global mortality rates, underscoring the criticality of routine cleaning and disinfection. Healthcare facilities, particularly susceptible to disease transmission, face a pressing need for rigorous sanitization practices.

The Centers for Disease Control and Prevention (CDC) approximates that Hospital-Acquired Infections (HAIs) result in 1.7 million infections and 99,000 deaths annually in the US. These infections span across urinary tract infections, surgical site infections, and pneumonia. A diverse array of products boasting varying compositions flood the market, aiming to curtail the occurrence and diffusion of HAIs and other infectious ailments.

Yet, impediments like the inadequate execution of standardized disinfection protocols impede market growth. Furthermore, while the burgeoning demand for disinfectants in emerging markets presents opportunities, the market grapples with challenges like the availability of alternative solutions and the potential environmental and health risks posed by excessive disinfectant use. Innovations in disinfection products could potentially offset these challenges.

Overall, while the market for surface disinfectants witnesses substantial growth propelled by various factors, it simultaneously navigates through obstacles such as environmental concerns and the need for stricter adherence to standardized disinfection practices.

Restraint

Exposure of eyes to concentrations of 5% or more could result in permanent loss of vision

Hydrogen peroxide can lead to irritation of the eyes, skin, and mucous membranes upon exposure. Concentrations of 5% or higher, particularly when in contact with the eyes, have the potential to cause permanent vision impairment.

Research conducted by the American International Agency on Cancer Research (IARC) on animals revealed carcinogenic properties associated with hydrogen peroxide. Multiple tests have indicated its mutagenic nature, capable of causing damage to DNA.

Inhalation of excessive amounts of hydrogen peroxide can result in lung irritation, while skin exposure may cause painful blisters, burns, and skin discoloration. Organs such as the lungs, intestines, thymus, liver, and kidneys are particularly vulnerable to the effects of hydrogen peroxide.

Opportunity

Emerging applications in semiconductor, mining & metal extraction, and agriculture industries

In the semiconductor manufacturing process, maintaining stringent cleanliness standards is crucial to achieving expected yield levels. Hydrogen peroxide, among other chemicals, in high-purity grades, finds application in RCA Clean (SC1, SC2), SPM (Piranha bath), and CMP slurries.

Recent studies emphasize the necessity of minimizing contamination during production, advocating the use of high-purity chemicals like hydrogen peroxide. This strategy not only enhances the market value of hydrogen peroxide in semiconductor manufacturing but also aids chip manufacturers in achieving optimal yield while minimizing environmental impact.

Moreover, hydrogen peroxide plays a pivotal role in addressing an enduring challenge in mining, particularly in copper extraction. The Froth flotation process, commonly utilized in mining base metals like copper, involves a sequence where ore is mixed with water and finely ground, boosting copper content from 0.5% to 2.5% in the ore to 15% to 30% in the concentrate.

Introducing a minute quantity of hydrogen peroxide at a specific concentration and stage in this process elevates the yield by an additional 10% while mitigating the problematic pyrite content in the concentrate. Consequently, the mining and metal extraction industries are increasingly adopting hydrogen peroxide to augment copper extraction yields.

Challenge

Increasing raw material prices and operating costs

Over the past five years, hydrogen peroxide prices have seen a consistent upward trend and are anticipated to continue climbing due to several contributing factors. The escalation in raw material costs, manufacturing expenses, labor, packaging, and transportation costs collectively propels this increase.

Notably, Arkema SA executed a 15% price hike for hydrogen peroxide in Europe, a move aimed at restoring profitability, particularly in its high-performance materials division.

The storage and transportation of hydrogen peroxide necessitate specialized conditions encompassing temperature regulation, contamination prevention, pressure management, and stringent quality control measures. These requirements significantly drive up the costs associated with establishing and maintaining storage facilities. Moreover, transportation expenses further contribute to the overall cost burden.

Additives such as flame retardants, antioxidants, and stabilizers are commonly incorporated into hydrogen peroxide to bolster stability. However, the surge in prices of these additives has subsequently translated into amplified hydrogen peroxide costs. This collective increase in various cost components continues to exert upward pressure on hydrogen peroxide pricing trends.

Regional Analysis

The Asia Pacific was the largest market and held a 46.5% stake in global revenue for 2023. This is due to the increased penetration of chemical formulators, personal-care products, and the medical industries in the region. Because of the lower prices of land, increased availability, and trade balance, China, India, and South Korea have been major hubs where multinationals are able to establish business practices in these areas.

Due to the persistent water-borne illnesses in North America, North America leads the wastewater treatment industry. The U.S. processes more than 34 million gallons of toxic drinking water daily for safe consumption. One of the most important requirements in the United States is to remove phosphorus and other toxic elements from water sources. Additionally, the wastewater must be oxidized. This has resulted in a large consumption of hydrogen peroxide in the industry.

The growing demand for personal hygiene products in Europe has resulted in an increase in hydrogen peroxide use. The product’s antimicrobial and oxidizing properties are the main reasons for increasing demand in this area. The popularity of cosmetics and personal care products like haircare formulations, skin care creams, and lotions have increased in countries like the U.K. France, Italy, and Germany. This is due in large part to the increased penetration by cosmetic producers in these markets to tap the potential market.

The majority of cosmetic and personal care product producers are located in Europe. Numerous multinational corporations, like Estella’s, L’Oréal, Procter & Gamble (Deutsche GmbH), Beiersdorf AG, and Unilever, have long-standing business activities in the major European economies. As the global center of fashion, Paris has attracted a large number of textile businesses as well as cosmetic producers. As a result, hydrogen peroxide use has significantly increased throughout Europe.

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

From a global perspective, the market has been marked by fierce competition due to the presence of a number of well-known brands. Rising competition has resulted in several product launches. Then came process reforms by multinationals, patented technology, and project expansions.

To establish long-term relationships with regional healthcare, textile, and chemical manufacturing companies and to increase their market share and sustain local businesses, the majority of industry participants involved in manufacturing this product have been observed to have signed long-term agreements.

Key Market Players

- Evonik Industries AG

- Taekwang Industrial, CO., LTD.

- Arkema

- Grupa Azoty

- Solvay

- Akzo Nobel N.V.

- Gujarat Alkalies & Chemicals Ltd.

- National Peroxide Limited

- OCI Company Ltd.

- Airedale Chemical

Recent Developments

In September 2022, Arkema announced a price increase of hydrogen peroxide in Europe. This step was taken to manage the increasing energy prices in Europe.

In July 2022, Solvay announced the building of high-grade production facilities for electronic-grade hydrogen peroxide in Arizona, United States. The production is likely to begin in 2023.

Report Scope

Report Features Description Market Value (2023) USD 3 Billion Forecast Revenue (2033) USD 5 Billion CAGR (2024-2033) 5.3 % Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Disinfectant, Bleaching, Oxidant, Others), By Application (Pulp And Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food And Beverages, Personal Care, Healthcare, Textiles, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Evonik Industries AG, Taekwang Industrial, CO., LTD., Arkema, Grupa Azoty, Solvay, Akzo Nobel N.V., Gujarat Alkalies & Chemicals Ltd., National Peroxide Limited, OCI Company Ltd., Airedale Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is hydrogen peroxide used for?Hydrogen peroxide is a versatile chemical used for various purposes. It's commonly employed as a disinfectant, bleaching agent, and in industrial processes like electronics manufacturing and mining.

What factors influence the price of hydrogen peroxide?The price of hydrogen peroxide is influenced by various factors including raw material costs, energy prices, manufacturing expenses, transportation costs, and demand-supply dynamics in the market.

Is hydrogen peroxide environmentally friendly?Hydrogen peroxide can break down into water and oxygen, making it an environmentally friendly option compared to some other chemicals. However, its production and handling require careful consideration to minimize environmental impact.

-

-

-

- Evonik Industries AG

- Taekwang Industrial, CO., LTD.

- Arkema

- Grupa Azoty

- Solvay

- Akzo Nobel N.V.

- Gujarat Alkalies & Chemicals Ltd.

- National Peroxide Limited

- OCI Company Ltd.

- Airedale Chemical

-