Global Hydrogen Generation Market Size, Share, And Business Benefits By Source (Natural Gas, Coal, Biomass, Water), By Type (Grey Hydrogen, Blue Hydrogen, Green Hydrogen), By Technology (Steam Methane Reforming, Coal Gasification, Electrolysis, Partial Oxidation, Autothermal Reforming), By Delivery Mode (Captive, Merchant), By Application (Chemical and Refinery(Petroleum Refinery, Ammonia Production, Methanol Production, Others), Energy (Power Generation, CHP), Mobility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 54728

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

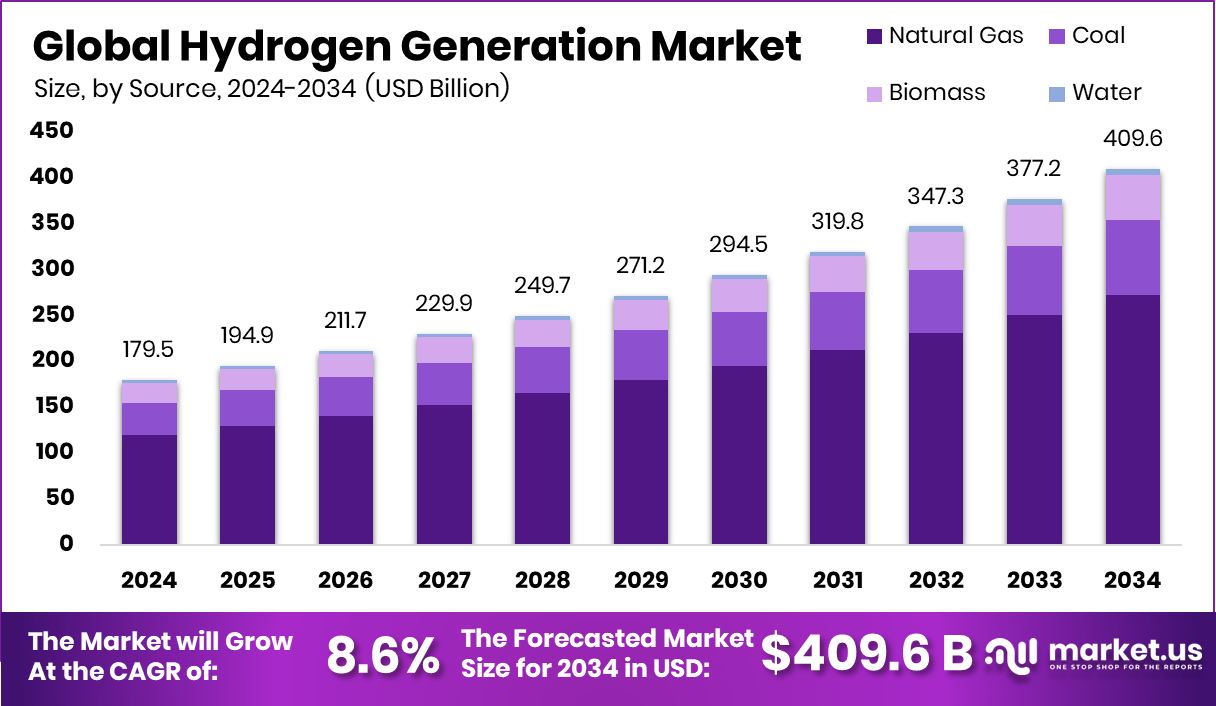

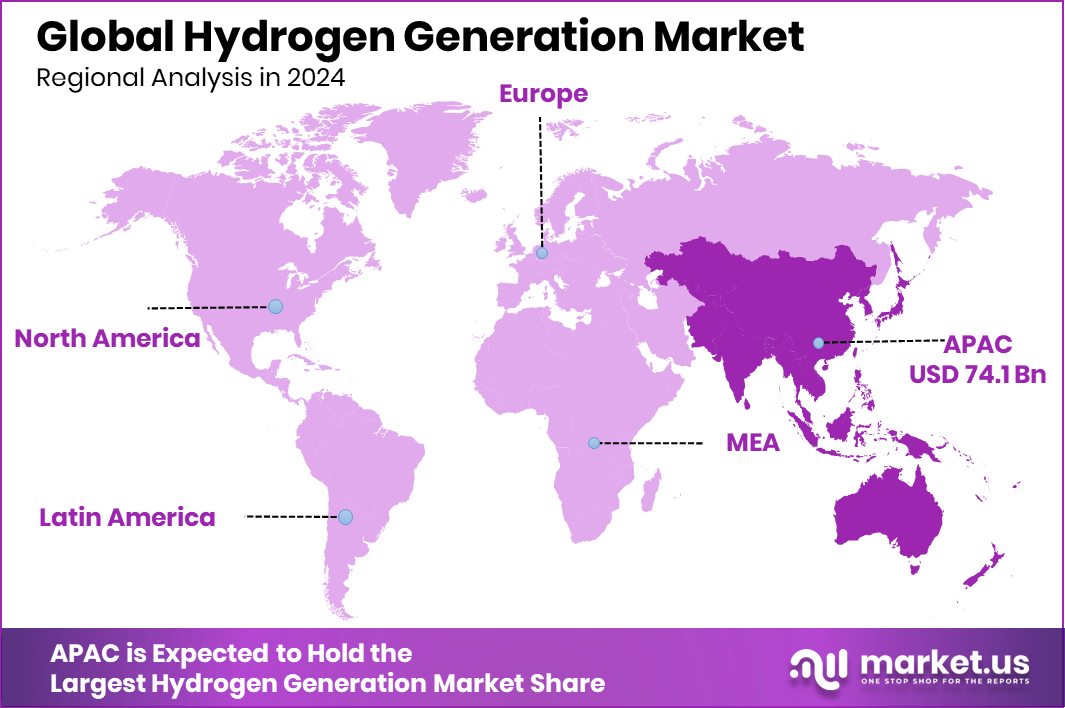

Global Hydrogen Generation Market is expected to be worth around USD 409.6 billion by 2034, up from USD 179.5 billion in 2024, and grow at a CAGR of 8.6% from 2025 to 2034. Hydrogen investments in Asia-Pacific touched USD 74.1 Bn, covering 41.3% market share globally.

Hydrogen generation involves producing hydrogen gas, primarily used as fuel, through various methods, including steam methane reforming, electrolysis, and others. This clean energy source is gaining traction due to its potential for reducing carbon emissions in industries like transportation and manufacturing.

The hydrogen generation market is expanding as the demand for sustainable energy solutions increases globally. This market’s growth is driven by the push toward greener energy sources and the integration of hydrogen technologies in sectors such as automotive, aerospace, and power generation.

The shift toward low-carbon energy sources significantly fuels the hydrogen generation market. Governments worldwide are implementing stricter emission regulations, compelling industries to adopt cleaner energy practices. Additionally, advancements in hydrogen production technologies are making this energy source more accessible and cost-effective.

The demand for hydrogen is skyrocketing, particularly in the transportation sector, where fuel cell vehicles (FCVs) are becoming more popular. Hydrogen’s ability to provide higher energy density and faster refueling times than batteries is a critical factor in its growing adoption.

There is substantial opportunity for growth in developing regions where industrial expansion is coupled with increasing environmental awareness. The development of hydrogen infrastructure, such as refueling stations and pipelines, also presents significant opportunities for investment and development in the hydrogen generation market.

Key Takeaways

- Global Hydrogen Generation Market is expected to be worth around USD 409.6 billion by 2034, up from USD 179.5 billion in 2024, and grow at a CAGR of 8.6% from 2025 to 2034.

- Natural gas dominates the hydrogen generation market source, holding a significant 66.4% share globally.

- Grey hydrogen leads in type within the hydrogen market, accounting for 58.3% of production methods.

- Steam methane reforming is the preferred technology, making up 67.4% of hydrogen generation techniques.

- Captive delivery mode is predominant in hydrogen supply, with a substantial market share of 73.4%.

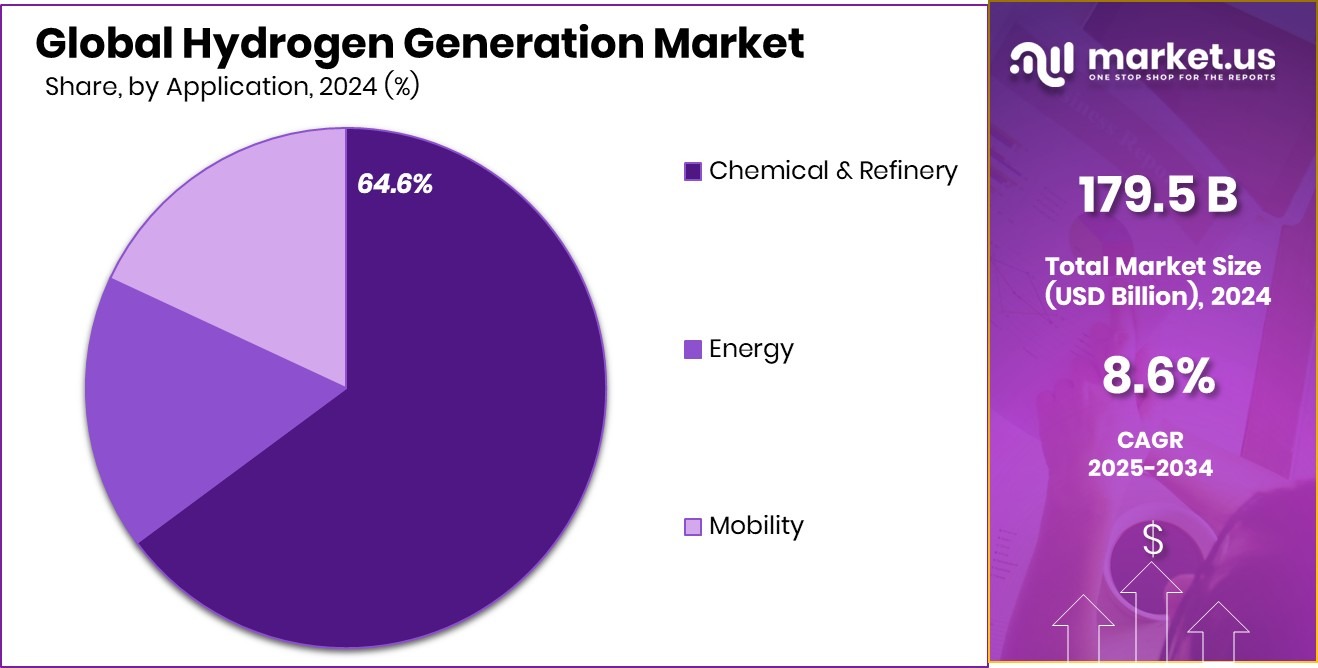

- In the application segment, chemical and refinery industries utilize 64.6% of the generated hydrogen.

- Strong industrial demand helped Asia-Pacific reach 41.3% in Hydrogen Generation Market value.

By Source Analysis

Natural Gas dominates as a source, holding a 66.4% market share.

In 2024, Natural Gas held a dominant market position in the By Source segment of the Hydrogen Generation Market, with a 66.4% share. This high share is mainly due to the widespread infrastructure and lower cost of natural gas compared to other sources.

Natural gas is readily available and compatible with existing steam methane reforming (SMR) technologies, making it a preferred choice for large-scale hydrogen production. The process of extracting hydrogen from natural gas is also well-established, which contributes to lower operational risk and higher production efficiency.

The economic advantages and established industrial processes have driven continued adoption across major hydrogen-consuming sectors, such as refineries and chemical manufacturing. Moreover, the dominance of natural gas aligns with the trend of transitioning industries that require a stable hydrogen supply but are not yet ready for full renewable integration.

By Type Analysis

Grey Hydrogen leads by type with a significant 58.3% market share.

In 2024, Grey Hydrogen held a dominant market position in the By Type segment of the Hydrogen Generation Market, with a 58.3% share. This dominance is primarily attributed to its cost-effectiveness and established production infrastructure. Grey hydrogen is typically produced from natural gas using steam methane reforming (SMR) without carbon capture, which remains the most economical and widely adopted method in many industrial sectors.

Industries such as chemicals, petroleum refining, and fertilizers continue to rely heavily on gray hydrogen due to its consistent supply and lower production cost compared to green or blue hydrogen. Its widespread availability, especially in regions where natural gas is abundant, has further solidified its market lead. Despite growing environmental concerns, the economic benefits of grey hydrogen keep it at the forefront of hydrogen generation technologies.

While environmental regulations are becoming stricter, the transition to low-carbon alternatives like blue and green hydrogen is still evolving. Until these cleaner technologies become more financially viable and scalable, grey hydrogen is expected to maintain a major role in the global hydrogen supply chain.

By Technology Analysis

Steam Methane Reforming technology is preferred, with a 67.4% adoption rate.

In 2024, Steam Methane Reforming held a dominant market position in the By Technology segment of the Hydrogen Generation Market, with a 67.4% share. This leadership is mainly driven by its efficiency, scalability, and compatibility with existing infrastructure. As the most widely used method for producing hydrogen, especially from natural gas, SMR continues to be the backbone of industrial hydrogen generation due to its proven reliability and cost-efficiency.

SMR technology plays a crucial role in meeting the high hydrogen demand across sectors such as petrochemicals, refineries, and ammonia production. Its strong link with grey hydrogen production further supports its market hold as industries continue to prioritize low-cost solutions for large-scale operations. The availability of natural gas as a feedstock also strengthens the use of SMR across developed and developing economies.

By Delivery Mode Analysis

Captive delivery mode is prevalent, capturing a 73.4% segment share.

In 2024, Captive held a dominant market position in the By Delivery Mode segment of the Hydrogen Generation Market, with a 73.4% share. This dominance reflects the strong preference among industrial users to produce hydrogen on-site to meet their specific operational needs. Captive hydrogen generation offers several benefits, including reduced dependency on external suppliers, improved supply reliability, and cost savings on transportation and storage.

Industries such as petroleum refining, ammonia production, and methanol manufacturing often rely on continuous and high-volume hydrogen inputs. For these operations, having an on-site generation system ensures process efficiency and avoids the logistical complexity of delivered hydrogen. Additionally, captive systems are designed to match the exact pressure and purity requirements of the user, which enhances overall productivity.

The widespread adoption of steam methane reforming (SMR) technology further complements the captive model, as it enables cost-effective, large-scale hydrogen production using natural gas. The combination of economic advantage and customization has made captive hydrogen generation the preferred choice for large-scale industrial users.

By Application Analysis

Chemical and refinery applications lead, with a 64.6% market usage rate.

In 2024, Chemical and Refinery held a dominant market position in the By Application segment of the Hydrogen Generation Market, with a 64.6% share. This leading position is driven by the critical role hydrogen plays in refining processes and chemical manufacturing, particularly in hydrocracking, desulfurization, and ammonia production. These industries require large volumes of hydrogen to maintain continuous operations and meet stringent product specifications.

Refineries use hydrogen extensively to remove sulfur and other impurities from fuels, especially in response to global regulations for cleaner fuels. Similarly, the chemical industry, especially ammonia and methanol production, depends heavily on hydrogen as a feedstock. These applications demand a stable and uninterrupted hydrogen supply, making them key drivers of the overall hydrogen generation market.

The use of captive hydrogen generation units within these sectors has also contributed to their market dominance, ensuring reliable and cost-effective hydrogen availability. With existing infrastructure already tailored to accommodate large-scale hydrogen usage, the chemical and refinery industries remain the primary consumers in 2024.

Key Market Segments

By Source

- Natural Gas

- Coal

- Biomass

- Water

By Type

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

By Technology

- Steam Methane Reforming

- Coal Gasification

- Electrolysis

- Partial Oxidation

- Autothermal Reforming

By Delivery Mode

- Captive

- Merchant

By Application

- Chemical and Refinery

- Petroleum Refinery

- Ammonia Production

- Methanol Production

- Others

- Energy

- Power Generation

- CHP

- Mobility

Driving Factors

Growing Demand for Clean Energy Solutions

The need for cleaner, more sustainable energy sources is one of the primary driving factors behind the growth of the hydrogen generation market. As countries strive to reduce their carbon footprints and tackle climate change, the demand for renewable energy sources, including hydrogen, has significantly increased. Hydrogen is seen as a clean energy carrier that can help reduce greenhouse gas emissions in sectors such as transportation, manufacturing, and power generation.

The versatility of hydrogen in replacing traditional fossil fuels, along with its ability to be produced from renewable resources like wind and solar energy, is helping accelerate its adoption worldwide. This growing emphasis on clean energy is a key factor driving the market for hydrogen generation.

Restraining Factors

High Production and Infrastructure Costs

One of the major restraining factors for the hydrogen generation market is the high production and infrastructure costs. Hydrogen production, especially through renewable methods such as electrolysis, requires expensive equipment and technology. The cost of producing hydrogen from water using renewable energy sources like wind or solar remains relatively high compared to conventional energy production methods.

Additionally, the infrastructure needed for storage, transportation, and distribution of hydrogen, such as pipelines and fueling stations, is costly to build and maintain. These high costs can limit the widespread adoption of hydrogen as an energy source, particularly in industries or regions where cost efficiency is a critical factor. This financial barrier hampers the growth potential of the hydrogen market.

Growth Opportunity

Advancements in Electrolysis Technology for Efficiency

A significant growth opportunity in the hydrogen generation market lies in the advancements of electrolysis technology. Electrolysis is a method of producing hydrogen by splitting water into hydrogen and oxygen using electricity. With improvements in electrolyzer efficiency and reduced energy consumption, hydrogen production via electrolysis has become increasingly cost-competitive, especially when powered by renewable energy sources like solar and wind.

As technology continues to evolve, the cost of electrolyzers is expected to decrease, making green hydrogen more accessible and affordable. This growth opportunity offers the potential to boost the use of hydrogen across various sectors, including transportation, industrial applications, and energy storage, further driving the market for hydrogen generation globally.

Latest Trends

Green Hydrogen Scaling Up With Global Government Push

One of the latest trends in the hydrogen generation market is the fast rise of green hydrogen. Countries are now pushing to reduce carbon emissions by producing hydrogen using clean energy like wind and solar. In 2024, several governments announced funding and policy support to boost green hydrogen plants.

For example, India’s National Green Hydrogen Mission and the EU’s Hydrogen Strategy are helping industries switch from fossil fuels to clean hydrogen. This shift is attracting new investors, especially in the transport, steel, and power sectors. As renewable energy becomes cheaper, green hydrogen is expected to become more affordable and widely available, making it a top choice for the future of clean energy.

Regional Analysis

Asia-Pacific dominated the Hydrogen Generation Market with a 41.3% share, worth USD 74.1 Bn.

In 2024, Asia-Pacific held a dominant position in the global Hydrogen Generation Market, capturing 41.3% of the total market share and generating a value of USD 74.1 billion. This leadership is driven by the increasing demand for hydrogen across refining, chemical, and energy sectors, particularly in countries like China, Japan, and South Korea.

North America followed closely, with strong growth supported by clean energy transitions and government-backed hydrogen initiatives aimed at decarbonizing the industrial and transportation sectors. Europe also showed notable traction, fueled by sustainability goals and funding frameworks such as the EU Hydrogen Strategy.

Meanwhile, the Middle East & Africa region is gradually exploring hydrogen as part of energy diversification efforts. Latin America is emerging with small-scale hydrogen pilot projects, especially in Brazil and Chile, but still holds a modest share compared to other regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Linde Plc continued to solidify its position as a global leader in hydrogen generation through strategic infrastructure investments and long-term supply agreements. The company focused heavily on blue and green hydrogen technologies, expanding its network of production plants and collaborating with industrial customers seeking cleaner energy alternatives.

Engie SA maintained a strong presence in the hydrogen market with a sharp focus on green hydrogen projects powered by renewable energy. In 2024, Engie advanced multiple utility-scale electrolysis projects across Europe and the Asia-Pacific, strengthening its position in the clean hydrogen value chain. The company emphasized public-private partnerships and leveraged government support to accelerate its hydrogen infrastructure goals.

Air Products and Chemicals, Inc. remained a dominant player with a robust portfolio of hydrogen generation plants worldwide. In 2024, the company continued investing in large-scale hydrogen facilities, especially in North America and the Middle East. Its focus on blue hydrogen, using carbon capture and storage (CCS), positioned it as a key supplier for industries transitioning to lower emissions.

Top Key Players in the Market

- Linde Plc

- Engie SA

- Air Products and Chemicals, Inc.

- Air Liquide

- INOX Air Products Ltd.

- Messer Group GmbH

- Matheson Tri-Gas, Inc.

- SOL Spa

- Tokyo Gas Chemicals Co., Ltd.

- Iwatani Corporation

- FuelCell Energy, Inc.

- Chevron Corporation

- Cummins Inc.

- BP Plc

- Other Key Players

Recent Developments

- In February 2025, Air Liquide and TotalEnergies announced a joint investment exceeding €1 billion to develop two large-scale, low-carbon hydrogen production plants in the Netherlands. The first is a 200 MW electrolyzer in Rotterdam, expected to commence operations by the end of 2027, powered by TotalEnergies’ offshore wind farms. The second involves a 250 MW electrolyzer in the Zeeland province, developed through an equally held joint venture.

- In August 2024, Linde invested over $2 billion to build and operate a large-scale clean hydrogen and atmospheric gases facility in Alberta, Canada. This facility will supply clean hydrogen to Dow’s Path2Zero project and other industrial clients, aiming to capture over 2 million metric tons of CO₂ annually.

Report Scope

Report Features Description Market Value (2024) USD 179.5 Billion Forecast Revenue (2034) USD 409.6 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Natural Gas, Coal, Biomass, Water), By Type (Grey Hydrogen, Blue Hydrogen, Green Hydrogen), By Technology (Steam Methane Reforming, Coal Gasification, Electrolysis, Partial Oxidation, Autothermal Reforming), By Delivery Mode (Captive, Merchant), By Application (Chemical and Refinery(Petroleum Refinery, Ammonia Production, Methanol Production, Others), Energy (Power Generation, CHP), Mobility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Linde Plc, Engie SA, Air Products and Chemicals, Inc., Air Liquide, INOX Air Products Ltd., Messer Group GmbH, Matheson Tri-Gas, Inc., SOL Spa, Tokyo Gas Chemicals Co., Ltd., Iwatani Corporation, FuelCell Energy, Inc., Chevron Corporation, Cummins Inc., BP Plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrogen Generation MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrogen Generation MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Linde Plc

- Engie SA

- Air Products and Chemicals, Inc.

- Air Liquide

- INOX Air Products Ltd.

- Messer Group GmbH

- Matheson Tri-Gas, Inc.

- SOL Spa

- Tokyo Gas Chemicals Co., Ltd.

- Iwatani Corporation

- FuelCell Energy, Inc.

- Chevron Corporation

- Cummins Inc.

- BP Plc

- Other Key Players