Global Hummus Market Size, Share, Growth Analysis By Product (Classic Hummus, Roasted Garlic Hummus, White Bean Hummus, Black Olive Hummus, Others), By Packaging ( Tubs and Cups, Jars and Bottles, Others), By End User (Households, Food Service Industry, Retail Outlets), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158148

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

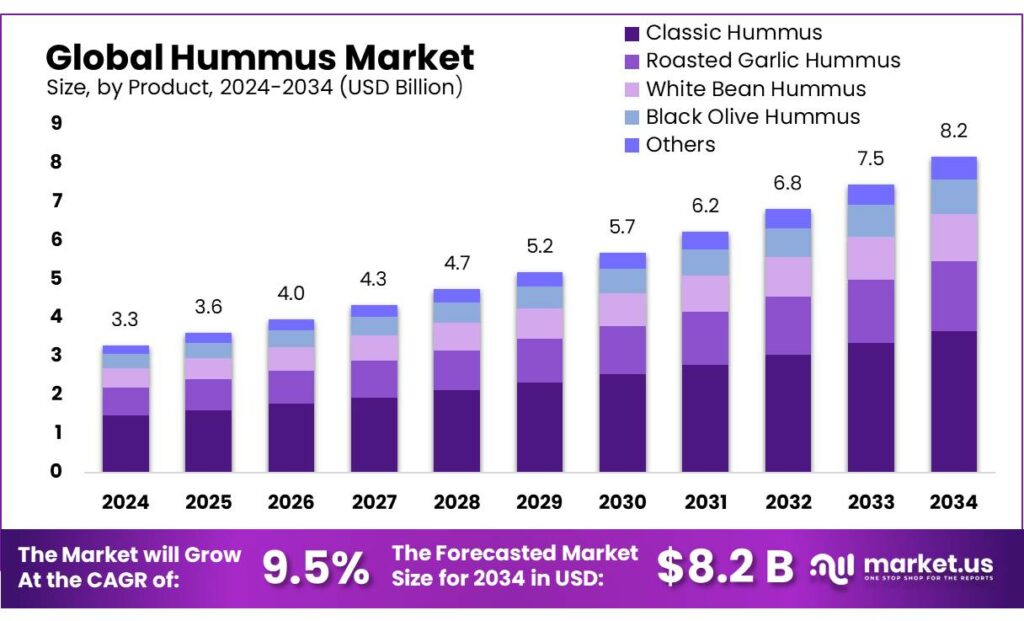

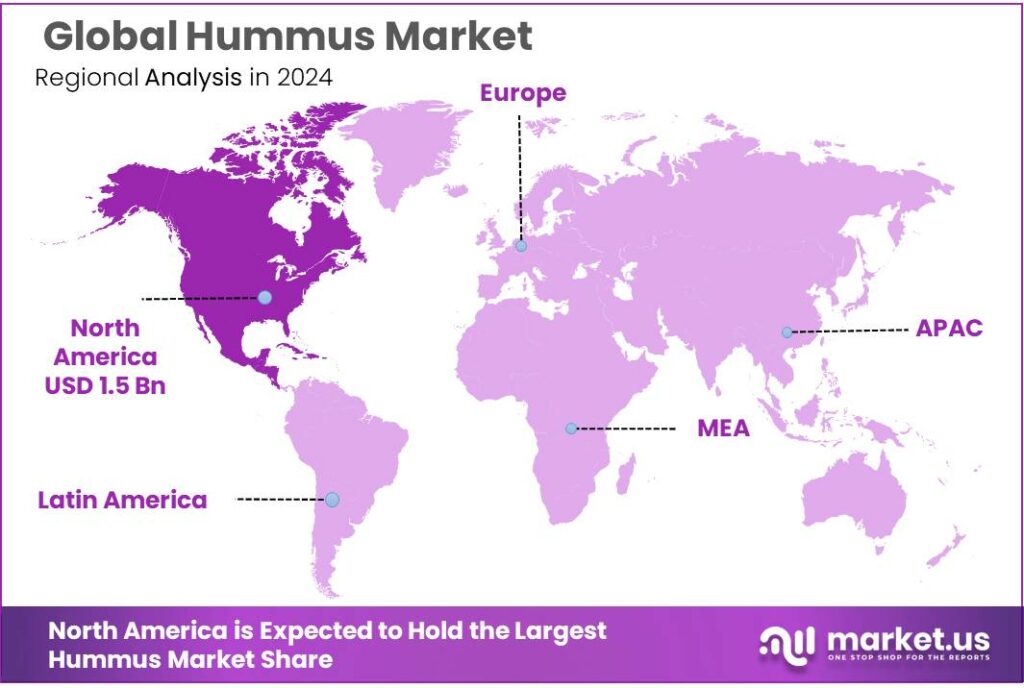

The Global Hummus Market size is expected to be worth around USD 8.2 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 9.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 47.5% share, holding USD 1.5 Billion in revenue.

Hummus, primarily made from chickpeas, aligns with these dietary trends due to its high protein content and low saturated fat. Secondly, the increasing urbanization and busy lifestyles are propelling the demand for ready-to-eat and easy-to-prepare food products, with hummus serving as a convenient and healthy option. Additionally, the influence of social media and food bloggers has heightened awareness and popularity of Middle Eastern and Mediterranean cuisines, further boosting the consumption of hummus.

One such initiative is the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, which provides financial assistance to micro food processing units. Under this scheme, individual units can avail of a 35% capital subsidy on project costs up to ₹10 lakh. For group units, such as Farmer Producer Organizations (FPOs), Self-Help Groups (SHGs), and cooperative societies, similar subsidies are available. In the financial year 2024-25, Bihar successfully implemented the PMFME scheme, granting loans to 10,296 applicants, with 6,589 units receiving disbursements, accounting for 63% of total approved applicants.

The surge in demand for hummus is attributed to several factors. The increasing prevalence of lifestyle diseases has led consumers to seek healthier dietary options. Additionally, the growing vegan population, which has increased by 300% globally, has further boosted the demand for plant-based protein sources like hummus. Innovations in product offerings, such as flavored and organic hummus varieties, have also contributed to market expansion.

These government initiatives are complemented by the establishment of Mega Food Parks, which aim to create modern infrastructure and efficient supply chains for food processing industries. The Mega Food Park scheme provides grants up to ₹50 crore for each food park to a consortium of companies, with the objective of enhancing farmer income and reducing post-harvest losses.

Government initiatives and industry support have further facilitated the growth of the hummus market. In the United States, the expansion of production facilities by leading hummus manufacturers underscores the industry’s potential.

- For instance, Sabra Dipping Company, the world’s largest producer of hummus, operates a state-of-the-art plant in Chesterfield County, Virginia, capable of producing 10,000 tons of hummus monthly. Similarly, Little Sesame, a Washington, D.C.-based hummus company, secured b million in funding to support the development of a new 23,000-square-foot production facility in Maryland, aiming to produce 400,000 pounds of hummus weekly.

Key Takeaways

- Hummus Market size is expected to be worth around USD 8.2 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 9.5%.

- Classic Hummus held a dominant market position, capturing more than a 44.8% share of the hummus market.

- Tubs & Cups held a dominant market position, capturing more than a 61.3% share of the hummus packaging market.

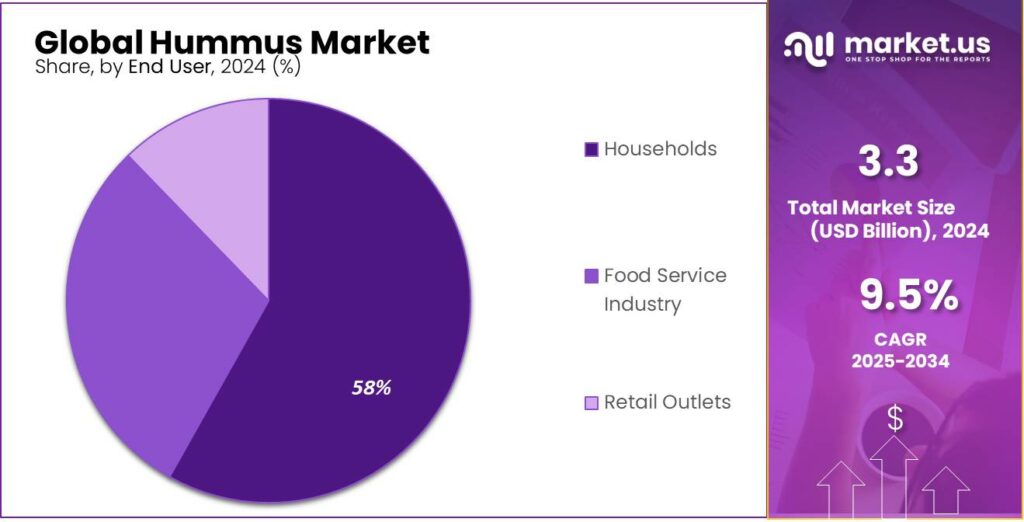

- Households held a dominant market position, capturing more than a 58.1% share of the hummus market.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 48.4% share of the hummus market.

- North America dominated the global hummus market, capturing a significant share of 47.5%, translating to approximately USD 1.5 billion.

By Product Analysis

Classic Hummus Dominates with 44.8% Market Share

In 2024, Classic Hummus held a dominant market position, capturing more than a 44.8% share of the hummus market. This segment remains the most popular due to its traditional flavor, which appeals to a wide range of consumers. Classic Hummus has become a staple in households and foodservice establishments, offering a versatile dip that pairs well with a variety of foods like vegetables, pita bread, and crackers. Its strong market presence can be attributed to its longstanding popularity and its association with health-conscious eating, as it is rich in plant-based protein and fiber.

As consumer preferences continue to shift towards healthier and plant-based options, Classic Hummus remains the go-to choice for many. The product’s simplicity and accessibility have helped it maintain its leadership, and it continues to enjoy strong demand across different regions. Despite the rise of flavored variants, Classic Hummus still commands a significant share due to its established brand loyalty and familiarity. In the coming years, it is expected to retain its market dominance, with steady growth forecasted through 2025 as it adapts to emerging trends while staying true to its roots.

By Packaging Analysis

Tubs & Cups Lead the Market with 61.3% Share

In 2024, Tubs & Cups held a dominant market position, capturing more than a 61.3% share of the hummus packaging market. This packaging format remains the preferred choice for both consumers and retailers due to its convenience and ability to preserve freshness. Tubs and cups are easy to handle, store, and use, making them ideal for both individual and family consumption. The wide availability of hummus in these packaging formats across supermarkets and hypermarkets further supports their dominance.

Tubs & Cups have a strong presence in the retail sector, with a high demand for single-serving or family-sized options. In addition, the packaging’s airtight design helps maintain the product’s shelf life, contributing to its popularity in the market. As consumers continue to seek easy-to-use and on-the-go food options, the demand for hummus in tubs and cups is expected to grow steadily through 2025. The packaging format’s ability to cater to different portion sizes, coupled with its practicality, ensures that Tubs & Cups will continue to lead the hummus packaging segment in the foreseeable future.

By End User Analysis

Households Dominate the Market with 58.1% Share

In 2024, Households held a dominant market position, capturing more than a 58.1% share of the hummus market. The increasing trend of health-conscious eating and the growing popularity of plant-based diets have made hummus a staple in many households. As consumers become more aware of the nutritional benefits of hummus, such as its high protein and fiber content, it has become a go-to snack or meal addition for families.

The convenience of hummus as a ready-to-eat, nutritious option fits well with the fast-paced lifestyles of modern households. As more people turn to healthier and vegetarian food choices, the demand for hummus continues to rise. This trend is expected to continue through 2025, with households remaining the largest consumer segment for hummus. With the availability of various packaging sizes catering to different household needs, hummus is likely to maintain its strong position in the market for years to come.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Lead with 48.4% Market Share

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 48.4% share of the hummus market. This distribution channel continues to be the primary avenue for consumers to purchase hummus, owing to its wide reach and convenience. Supermarkets and hypermarkets offer a broad variety of hummus brands and packaging options, making it easy for customers to find their preferred products.

The large-scale availability of hummus in these retail stores ensures that it remains a top choice for consumers, particularly those who prefer to shop in-store for fresh and familiar products. As supermarkets and hypermarkets continue to expand their healthy food sections, the availability of hummus is expected to increase, driving further growth in the segment. This trend is anticipated to continue into 2025, with Supermarkets & Hypermarkets maintaining a strong presence as the leading distribution channel for hummus.

Key Market Segments

By Product

- Classic Hummus

- Roasted Garlic Hummus

- White Bean Hummus

- Black Olive Hummus

- Others

By Packaging

- Tubs & Cups

- Jars & Bottles

- Others

By End User

- Households

- Food Service Industry

- Retail Outlets

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Grocery Stores

- Online Retailers

- Others

Emerging Trends

Innovative Flavors and Global Fusion

A significant trend in the hummus market is the introduction of innovative flavors and global fusion varieties. As consumers seek diverse taste experiences, brands are expanding their product lines to include unique and culturally inspired hummus options. For instance, Sabra has launched new flavors such as Chimichurri Hummus and Falafel Style Hummus, drawing inspiration from Argentine and Middle Eastern cuisines, respectively. These offerings aim to cater to adventurous palates and provide a novel twist on the traditional hummus experience.

In the United Kingdom, supermarkets like Waitrose and Marks & Spencer have introduced gourmet and globally inspired hummus varieties. Waitrose, for example, launched a truffle hummus topped with truffle chickpeas, while Marks & Spencer offered a “Fully Loaded Indian Style Dip,” combining elements of Indian cuisine with traditional hummus. These innovations reflect the growing consumer interest in exploring international flavors and integrating them into familiar products.

Drivers

Health-Conscious Eating Driving Hummus Popularity

One of the primary factors propelling the growth of the hummus market is the increasing consumer shift towards health-conscious eating habits. As individuals become more aware of the nutritional content of their food, there is a marked preference for products that offer health benefits without compromising on taste. Hummus, traditionally a Middle Eastern dip made from chickpeas, tahini, lemon juice, and garlic, has gained global popularity due to its alignment with these health trends.

Hummus is recognized for its high protein and fiber content, essential for muscle repair and digestive health, respectively. Additionally, it contains healthy fats, particularly unsaturated fats from tahini, which are beneficial for heart health. These nutritional attributes make hummus an attractive alternative to traditional spreads and dips, which may be higher in unhealthy fats and preservatives.

The versatility of hummus further contributes to its appeal. It serves not only as a dip for vegetables and pita bread but also as a spread for sandwiches and wraps, and even as a base for salad dressings and sauces. This adaptability allows consumers to incorporate hummus into various meals, enhancing its role in a balanced diet.

Government initiatives and public health campaigns have also played a role in promoting healthier eating habits. In the United States, for example, the Dietary Guidelines for Americans emphasize the consumption of plant-based foods, including legumes, as part of a healthy eating pattern. Such endorsements align with the growing consumer interest in plant-based diets and contribute to the increased consumption of products like hummus.

Restraints

Short Shelf Life and Spoilage Risks

Hummus, a perishable product made primarily from chickpeas, tahini, lemon juice, and garlic, is highly susceptible to microbial growth due to its high moisture content and neutral pH. These conditions create an environment conducive to the proliferation of bacteria such as Salmonella and Listeria monocytogenes. A study by the U.S. Food and Drug Administration (FDA) found Salmonella in one hummus sample and Listeria monocytogenes in three dip and cheese spread samples, leading to recalls and highlighting the food safety risks associated with ready-to-eat dips and spreads.

The shelf life of hummus varies depending on whether it is homemade or commercially produced. Homemade hummus typically lasts between 3 to 4 days when stored in the refrigerator, whereas store-bought varieties, which often contain preservatives, can last up to 7 days after opening. However, even with preservatives, the product’s freshness diminishes over time, leading to potential spoilage.

To mitigate these risks, manufacturers have explored various preservation techniques. High-pressure processing (HPP) has been shown to extend the shelf life of hummus to 28 days when stored at 4°C, without the need for chemical preservatives. Additionally, pasteurization can extend the shelf life to up to 6 weeks under chilled storage conditions. These methods help reduce the microbial load and slow down the spoilage process, thereby enhancing product safety and longevity.

Despite these advancements, the inherent perishability of hummus remains a challenge for the industry. Consumers are advised to adhere strictly to storage guidelines, such as refrigerating hummus promptly after purchase, consuming it within the recommended time frame, and discarding it if there are signs of spoilage, including off smells, discoloration, or mold growth. Proper handling and storage are crucial to minimize health risks associated with the consumption of spoiled hummus.

Opportunity

Expanding into Emerging Markets

A significant growth opportunity for the hummus industry lies in expanding into emerging markets, particularly in regions like Asia-Pacific, Latin America, and parts of Africa. While hummus has traditionally been popular in the Middle East, Mediterranean countries, and North America, its presence in these emerging markets remains limited, offering substantial untapped potential.

Similarly, in Latin America, the hummus market is witnessing gradual growth. Countries such as Brazil and Mexico are beginning to embrace plant-based diets, influenced by global health trends and the increasing availability of international cuisines. While the market size remains modest, the growing interest in healthy eating presents an opportunity for hummus producers to introduce their products and expand their reach.

In Africa, particularly in North African countries with historical ties to hummus, there is potential to revitalize and modernize traditional consumption patterns. By introducing innovative flavors, convenient packaging, and positioning hummus as a nutritious snack option, companies can tap into the existing cultural affinity for the product and drive its consumption among younger demographics.

To capitalize on these emerging markets, companies can adopt strategies such as localization of flavors to cater to regional tastes, partnerships with local distributors to enhance market penetration, and educational campaigns to raise awareness about the health benefits of hummus. Additionally, leveraging e-commerce platforms can facilitate access to remote areas and cater to the growing trend of online grocery shopping.

Regional Insights

In 2024, North America dominated the global hummus market, capturing a significant share of 47.5%, translating to approximately USD 1.5 billion in market value. This robust performance underscores the region’s strong preference for plant-based, protein-rich foods and reflects a growing inclination towards Mediterranean-inspired diets.

The United States, in particular, stands out as the largest contributor to this market, holding a substantial share of 79.23% in 2022. This dominance is attributed to several factors, including a well-established food and beverage industry, heightened consumer awareness, and the widespread availability of hummus products across various retail channels. The increasing adoption of plant-based diets and the rising demand for healthy, convenient snack options have further propelled the growth of the hummus market in the U.S.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in 1991, Daphne’s California Greek is a fast-casual restaurant chain based in Carlsbad, California. The company offers a Mediterranean-inspired menu featuring dishes like gyros, kabobs, and salads. After acquiring the brand out of bankruptcy in 2010, Daphne’s underwent a rebranding to emphasize healthier, California-meets-Mediterranean cuisine. As of April 2024, the company operates six locations in Southern California and the Sacramento area.

Established in 1966, Ziyad Brothers Importing is a leading distributor of Middle Eastern and Mediterranean food products in the United States. The company offers over 3,000 items, including hummus, pita bread, and spices, sourced from more than 15 countries. With distribution centers in Illinois, New Jersey, and California, Ziyad Brothers serves retailers across North America, Central America, and the Caribbean.

Lantana Foods, founded in 2011, is a producer of bean-based hummus located in Austin, Texas. The company offers unique flavors such as roasted garlic, sriracha carrot, and yellow lentil, using a variety of beans beyond traditional chickpeas. Lantana Foods focuses on creating innovative, plant-based products that cater to diverse dietary preferences. In 2024, the company rebranded its hummus line and introduced new sustainable packaging.

Top Key Players Outlook

- Daphne’s California Greek

- Ziyad Brothers Importing

- Hope Foods

- Tribe Hummus

- Lantana Foods

- Athenos

- Baba Foods

- Sabra Dipping Company

- Simply 7 Snacks

- Hummus & Pita Co.

Recent Industry Developments

In 2024 Tribe Hummus, reported a revenue of approximately $150 million, reflecting its strong presence in the industry.

In 2024 Hope Foods, reported an estimated annual revenue of $4.2 million, reflecting its niche yet growing presence in the industry.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Bn Forecast Revenue (2034) USD 8.2 Bn CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Classic Hummus, Roasted Garlic Hummus, White Bean Hummus, Black Olive Hummus, Others), By Packaging ( Tubs and Cups, Jars and Bottles, Others), By End User (Households, Food Service Industry, Retail Outlets), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Daphne’s California Greek, Ziyad Brothers Importing, Hope Foods, Tribe Hummus, Lantana Foods, Athenos, Baba Foods, Sabra Dipping Company, Simply 7 Snacks, Hummus & Pita Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Daphne's California Greek

- Ziyad Brothers Importing

- Hope Foods

- Tribe Hummus

- Lantana Foods

- Athenos

- Baba Foods

- Sabra Dipping Company

- Simply 7 Snacks

- Hummus & Pita Co.