Global Hospital Services Market By Hospital Type (State Owned hospital, Private hospital, Public hospital), By Service type (Outpatient, Inpatient), By Service Area (Cardiovascular, Acute care, Cancer care, Diagnostics & Imaging, Neurohabilitation, Psychiatry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116493

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Hospital Services Market was valued at the USD 13.1 Trillion in 2023, and is projected to reach substantial market growth of the USD 24.1 Trillion by 2033, with a 6.3% CAGR.

Hospital services encompass diverse services provided by hospitals and related healthcare facilities to patients, including both inpatient and outpatient services such as diagnostic tests, maternity care, mental health services, surgeries, emergency care and rehabilitation services. In addition, the services also comprise the provision of pharmacy, imaging and laboratory testing services. There are improvements in disease detection and terminal disease care including cancer by virtue of advanced medical tools increasing affordability and recognition among people.

The market for hospital services is heavily saturated with both private and public hospitals contending for market revenue share. The availability of first-rate services and superior patient upshots leads private hospitals to boost at increasing high rate in recent years. On a contrary, public hospitals serve an outstanding role in dispensing healthcare services to impoverished population.

Hospital services market is heavily driven by aging population coupled with scaling of chronic illnesses across the globe. Older people being more prone to cardiovascular diseases, diabetes, orthopedic issues and cancer, necessitates advanced hospital services including surgeries and medical interventions. Many investments are made by healthcare product manufacturers in terms of both revenue and marketing strategies, promoting product and services among hsopitals. Hence, hospital sectors are notably affected by these strategic decisions, improving the overall reach of the market.

- According to Ernst and Young, hospitals and health tech start-ups are surrounded by investments provided by healthcare sectors. A majority share exceeding 62% of all PE/VC investments in healthcare is received by hospitals followed closely by health tech with a 23% share.

Key Takeaways

- Based on hospital type, public hospital segment captured a remarkable market share of 38.4% owing to the provision of specialized medical procedures at comparatively minimal expense.

- Based on service type, inpatient segment accompanied a major market portion due to long stays of patients in hospitals.

- Based on service area analysis, a measurable market share of 26.3% is commanded by cardiovascular segment owing to the rising prevelance of cardiovascular illnesses across the globe.

- The market experiences an everlasting growth by virtue of growing elderly population being more prone to chronic illness.

- High cost of treatments and limited reimbursement policies may cause hindrance in market expansion.

- North America is accounted to hold an invaluable market presence, accounting an impressive market share of 54.8% in the year 2023

Hospital Type Analysis

Public hospitals overshadow tha hospital service market

Based on type of hospital, the market is fragmented into State Owned hospital, Private hospital and Public hospital segments. Public hospital segment accounted for largest market share of 48.4% in the year 2023. Following closely, state owned hospitals accounted for second largest market share. Such significant share occupied by these segments Is by virtue of existing superspeciality hospitals procedures leading to the increase in footfall of the patients. In addition to this, the segment is further leveraged comprising hefty number of patient beds catering to various medical conditions. Public hospitals are significantly promoted by crowd-funded communities, corporations and philanthropist organizations.

- According to Central Bureau of Health Intelligence (CBHI), there are around 23,581 government hospitals and 22 Central government hospitals in India including All India Institute of Medical Sciences in the country.

On a contrary, fastest market growth is anticipated by private hospital segment owing to specialized catering towards critical patients dealing with chronic diseases such as cancer and diabetes. This provision makes the segment to up scale to a large extent promising vigorous growth during the forecast period.

Service Type Analysis

Long hospital stays makes inpatient segment supreme

Based on service type, the market is bifurcated into outpatient and inpatient segment, with inpatient services accounting a commendable market revenue share of 60.1% in the year 2023. The inpatient segment dominates the hospital service market mainly due to hospitalization procedures requiring prolonged hospital stays. However, the segment is at risk to fall by virtue of expensive inpatient services combined with limited insurance coverage, allowing the patients to opt outpatient services in the foreseeable days.

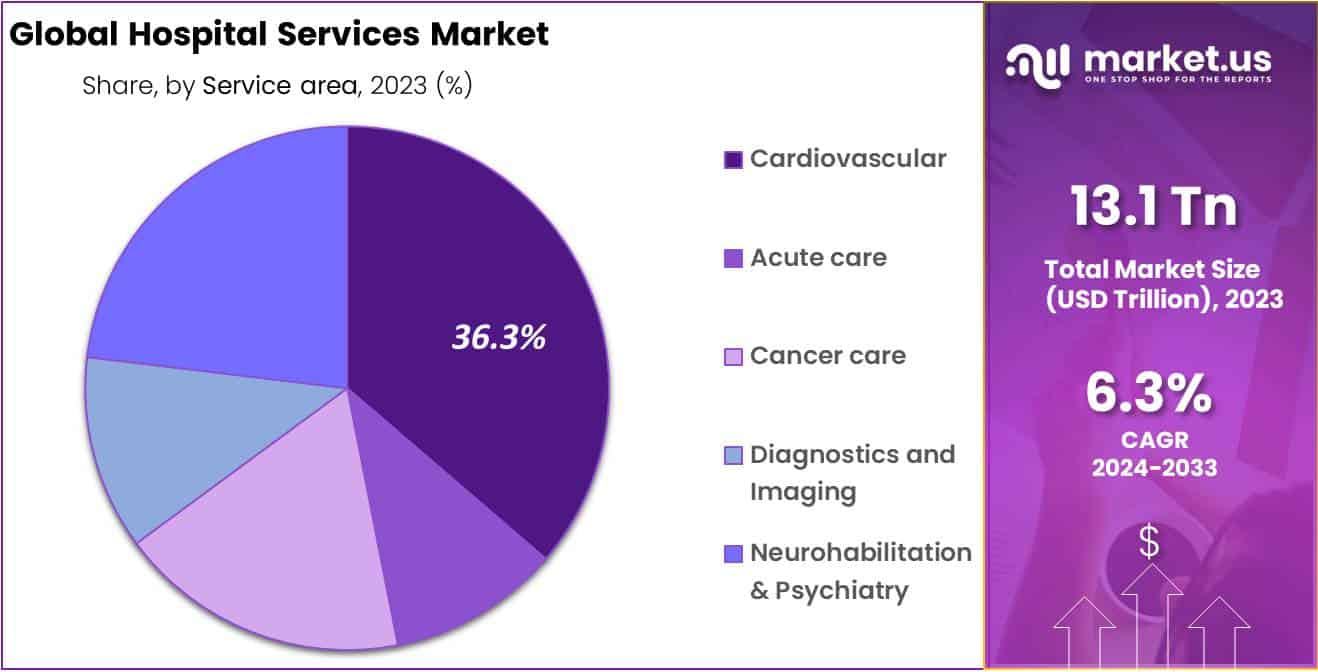

Service Area Analysis

Cardiovascular segment is at forefront

Based on service area, the market is broadly categorized into Cardiovascular, Acute care, Cancer care, Diagnostics & Imaging, Neurohabilitation and Psychiatry segments. Amongst all the segments, a pivotal role is played by cardiovascular segment accounting a renowned market share of 36.3% in the year 2023. Following closely, a significant revenue share of 23.1% is withheld by neurohabilitation and psychiatry segment owing to the growing recognition regarding mental health among patients and healthcare providers.

Moreover, second fastest growth is projected to be witnessed by cancer care segment predominatly by virtue of rising pervasiveness of cancer, particularly among female population.

- According to World Health Federation (WFH), deaths from cardiovascular illnesses raised from 12.1 million in 1990 to 20.5 million in 2021 across the globe, becoming a leading cause of death worldwide, with 4 in 6 CVD deaths occurring in low and middle income countries.

Key Market Segments

By Hospital type

- State Owned hospital

- Private hospital

- Public hospital

By Service type

- Inpatient

- Outpatient

By Service area

- Cardiovascular

- Acute care

- Cancer care

- Diagnostics & Imaging

- Neurohabilitation and Psychiatry

Market Drivers

Advancements in technology

Hospital services market thrives in recent years due to heightening cases of knee-replacement surgeries and accessibility towards cutting edge treatments. The advanced diagnostic technologies assists the healthcare providers to detect onset stage diseases appropriately. In addition, advances in medical technologies makes them more affordable allowing a large population to opt for vital operations in an emergency.

Rising healthcare awareness and insurance coverages

The growing recognition regarding these technologies and its benefits further pulls the markets’ trajectory upward. The rising healthcare insurance adds a plus point to low budget families, thus forming an integral and prioritized sector of healthcare industry, further bolstering the market position.

Market Restraints

High cost of medical procedures combined with limited reimbursement policies

The market for hospital services is at the risk of impediment due to the hefty costs of medical facilities, constraining the market expansion. Private hospitals may face declining footfall, resulting them to stand at the backstage of growth. This footfall arise due to the provision of subsidized or free healthcare services by many federal and state governments to the citizens. The provision of high quality healthcare service at reduced cost or for free, attract a large patient pool, reducing the market for private healthcare service providers.

- In United States, heart disease and stroke costs total $363 billion per year, that split between $216 billion in direct medical costs and $147 billion in lost productivity.

Opportunities

Geriatric population forms a cornerstone in market growth

Sky reaching opportunities are gained by hospital services market nowadays due to high pervasiveness of chronic illnesses such as diabetes, cardiovascular illnesses, orthopedic issues and cancer. The market further gains popularity due to heavy increase in geriatric population being more prone to chronic illnesses. The scale in geriatric population dealing with such critical diseases necessitates an ultimatum for advanced surgeries and medical interventions. This in turn pressurize the healthcare sectors to expand its dimensions resulting in provision of satisfactory outcomes.

Thus, state-of-art diagnostic tools, telemedicine solutions and surgical equipments are provided to the patient under need, contributing to hospitals’ comprehensive revenue growth.

- According to Centre for Disease Control and Prevention and National Cancer Institute, cancer will continue to be one of the leading causes of death in the US., with 1.7 million americans diagnosed with cancer every year and another 600,000 die from the disease.

Impact of Macoeconomic Factors

A significant impact is imposed on hospital services market by fluctuations in government healthcare expenditures including Medicare and Medicaid services. The downfall of these spendings throws a concern, impacting hospitals’ reimbursement rates, thereby rises overall ultimatum for services. Hospitals may come across restraints in investing in new emerging technologies and facilities by virtue of changes in interest rates coupled with financing costs. More the interest rate, high is the borrowing costs for hospitals, hence impeding their ability for infrastructure upgradation.

In addition, patients find healthcare services affordable directly proportionating the level of employment and income in the country.

Latest Trends

Several advancements are incorpated into healthcare facilities making the industry ever-growing in a broader picture. Some of the advancements include:

Digital Transformation: In order to modernize infrastructure and processes, many hospitals are engaged in digital transformations. This modernization include, implementation of electronic health records, integration of digital tools to streamline vital workflow and upgradation of information technology platforms for efficient interoperability.

Telemedicine and Remote care: There is improvisation in virtual consultations and remote monitoring due to scaling investments in telehealth foundation. The demand for remote care services and telemedicine expedited post COVID 19 pandemic.

Data analytics and Artificial Intelligence: The integration of artificial intelligence and data analytics ameliorates patient care, decision making processes and optimization of operations. To detect diseases at the onset stage and personalize treatment plans, predictive analytics is heavily employed by healthcare facilities.

Regional Analysis

North America spreads dominance in 2023

In 2023, a praiseworthy market presence is showcased by North America, accounting a significant market share of 54.8%. The regions’ supremacy speaks about its rising cancer cases coupled with heightening healthcare expenditures in the region. The existence of medical facilities and improved infrastructure further propels the regions leadership during the projection period.

The emerging medical centres and healthcare facilities combined with the presence of major market players such as Mato Clinic, HCA Healthcare, Ascension Health and Tenet Healthcare Corporation expedites the market presense in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Developing key players are concentrated on various strategies to develop their particular companies in foreign markets. Several hospital services companies are concentrating on growing their R&D facilities and existing operations. Furthermore, businesses in the hospital services market are developing a portfolio and new product expansion strategies through mergers, investments, and acquisitions.

In addition, numerous key players are now concentrating on different marketing strategies, such as increasing awareness about advanced features, which is expanding the growth of target products.

Market Key Players

With many local and regional players, the market for global Hospital Services is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

Listed below are some of the most prominent hospital services market players.

- HCA Healthcare

- Cleveland Clinic

- Fortis Healthcare

- Ramsay Healthcare

- Community Health Systems, Inc.

- Johns Hopkins Medicines

- Providence Health and Services

- Stanford Healthcare

- Northwestern Memorial Healthcare

- University of Texas MD Anderson Cancer Centre

- Banner Health

- Massachusetts General Hospital

- Advent Health

Recent Developments

- In April 2023: A leading hospital chain, ‘Tenet Healthcare’ acquired a seven hospital system in Mashachussets and New Hampshire, resulting in extention of Tenet Healthcare’s presence in Northeast bolstering its position in the market.

- In June 2023: A leading academic medical centre, ‘Cleveland Clinic’, announced a partnership with AWS to develop and deliver cloud based healthcare solutions. This partnership allow AWS to help Cleveland Clinic in improving operational efficiency and patient care.

- In March 2023: Psychiatric Solutions was acquired by UHS, a leading behavioral health company. This helped UHS to expand its portfolio of behavioral health services, thereby strengthening its position in the market.

Report Scope

Report Features Description Market Value (2023) USD 13.1 Trillion Forecast Revenue (2033) USD 24.1 Trillion CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Hospital Type (State Owned hospital, Private hospital, Public hospital), By Service type (Outpatient, Inpatient), By Service Area (Cardiovascular, Acute care, Cancer care, Diagnostics & Imaging, Neurohabilitation, Psychiatry) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape HCA Healthcare, Cleveland Clinic, Fortis Healthcare, Ramsay Healthcare, Community Health Systems, Inc., Johns Hopkins Medicines, Providence Health and Services, Stanford Healthcare, Northwestern Memorial Healthcare, University of Texas MD Anderson Cancer Centre, Banner Health, Massachusetts General Hospital, Advent Health Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Hospital Services Market?The Hospital Services Market encompasses a broad range of services provided by hospitals to patients, including diagnostic, therapeutic, and supportive care.

How big is the Hospital Services Market?The global Hospital Services Market size was estimated at USD 13.1 Trillion in 2023 and is expected to reach USD 24.1 Trillion in 2033.

What is the Hospital Services Market growth?The global Hospital Services Market is expected to grow at a compound annual growth rate of 6.3%. From 2024 To 2033

Who are the key companies/players in the Hospital Services Market?Some of the key players in the Hospital Services Markets are By Hospital Type (State Owned hospital, Private hospital, Public hospital), By Service type (Outpatient, Inpatient), By Service Area (Cardiovascular, Acute care, Cancer care, Diagnostics & Imaging, Neurohabilitation, Psychiatry).

What factors are driving the growth of the Hospital Services Market?The growth of the Hospital Services Market can be attributed to various factors such as increasing prevalence of chronic diseases, advancements in medical technology, growing aging population, and rising healthcare expenditure.

What are the key services offered in the Hospital Services Market?Key services offered in the Hospital Services Market include inpatient care, outpatient care, emergency services, diagnostic imaging, laboratory services, surgical services, and rehabilitation services.

-

-

- HCA Healthcare

- Cleveland Clinic

- Fortis Healthcare

- Ramsay Healthcare

- Community Health Systems, Inc.

- Johns Hopkins Medicines

- Providence Health and Services

- Stanford Healthcare

- Northwestern Memorial Healthcare

- University of Texas MD Anderson Cancer Centre

- Banner Health

- Massachusetts General Hospital

- Advent Health