Global Hospital Logistics Robots Market By Type (Hospital Robots, Care Robots, Imaging Assistance, Others) By End-use(Hospitals, Ambulatory Surgical Centers, Rehabilitation Centers, Research Institutes, Others) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 58121

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

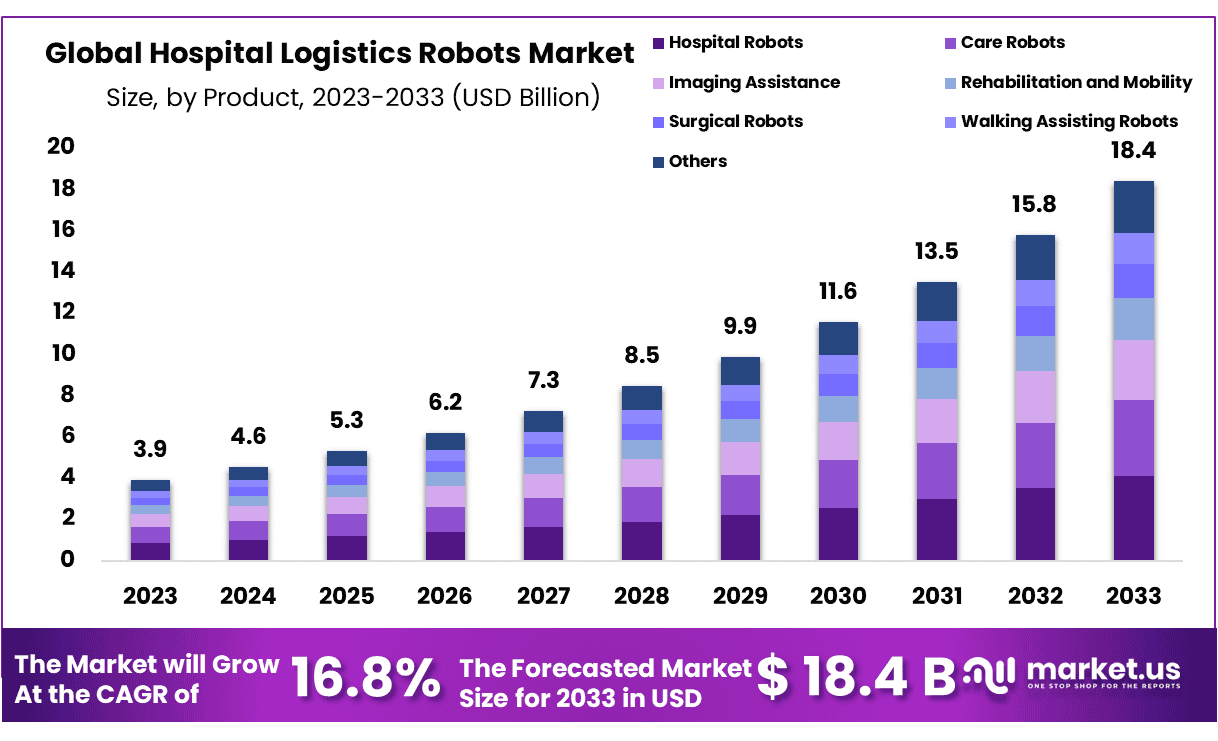

The Global Hospital Logistics Robots Market size is expected to be worth around USD 18.4 Billion by 2033 from USD 3.9 Billion in 2023, growing at a CAGR of 16.8% during the forecast period from 2024 to 2033.

Hospital logistics robots typically comprise autonomous guided vehicles (AGV) and mobile robot platforms are used for goods flow management such as environmental waste, food, hospital premises laundry, pharmaceuticals, and laboratory samples. The healthcare services mostly depend on healthcare staff, so there is a need to improvise the workflow process of the healthcare staff in these facilities. Henceforth, the incorporation of an automated mobile base helps to improve the productivity of logistics tasks in the hospital, such as delivery and collection.

Upgrading such logistic tasks will ultimately help the healthcare personnel to emphasize other tasks to assist the community adequately. Logistic services such as lab samples, moving food, prescriptions, and several others on which hospitals are dependent. Logistics is the key resource-demanding service in a hospital. Hospital administrators have replaced the old methods or options of moving items with cost-effective and convenient robotic-based options. Hospitals were the first to implement mobile robotics for their logistic problems.

Nowadays, several hospitals are looking forward to adapting the simulation techniques in order to optimize workflow. As the material flow in a hospital is also extreme, the robotic system for automating hospital logistics has to be reliable, versatile, and scalable. Logistics is one of the prominent and usually underrated support services in hospitals. The crucial task of a hospital logistics service is to organize and maintain the material flow in the hospital. A wide variety of materials are necessarily needed in a hospital, which often results in complex transportation systems and complicated materials flow.

Key Takeaways

- Market Size & Growth: Hospital Logistics Robots Market size is expected to be worth around USD 18.4 Billion by 2033 from USD 3.9 Billion in 2023, growing at a CAGR of 16.8%.

- Type Analysis: hospital robotics had captured 22.02% of revenue share.

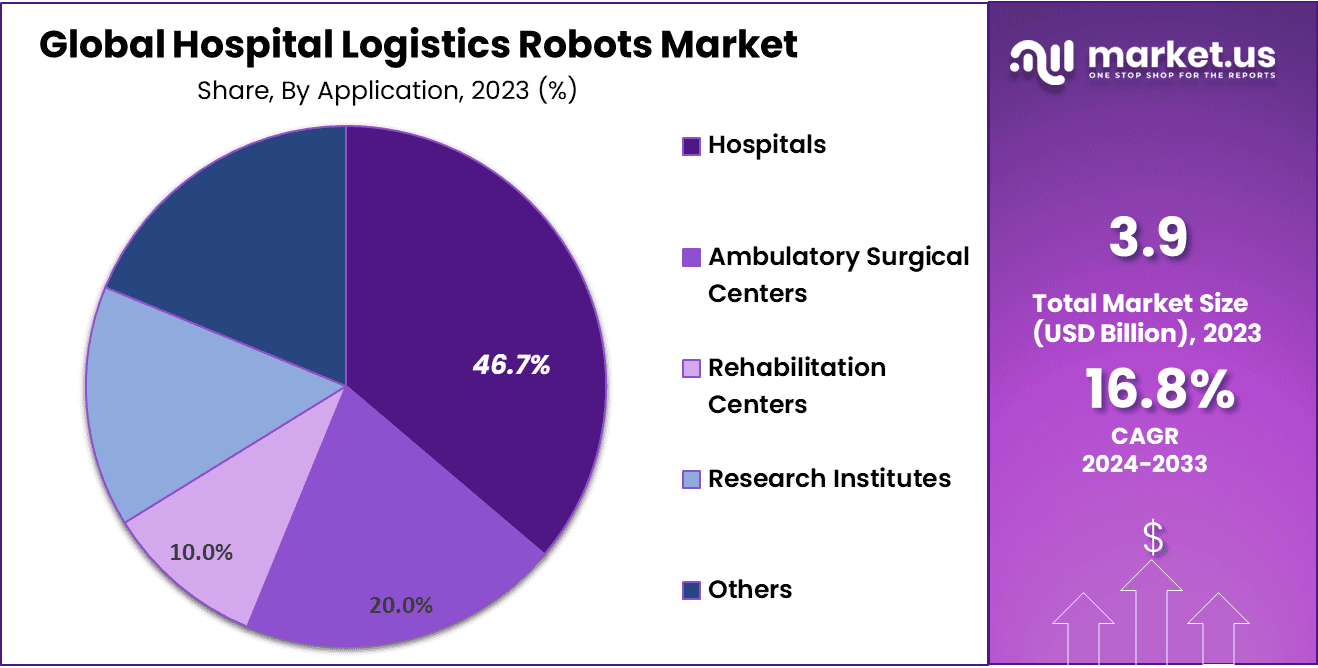

- End-Use Analysis: hospitals held the highest end-use revenue share at 36.2% and projected to experience the highest CAGR in forecast years.

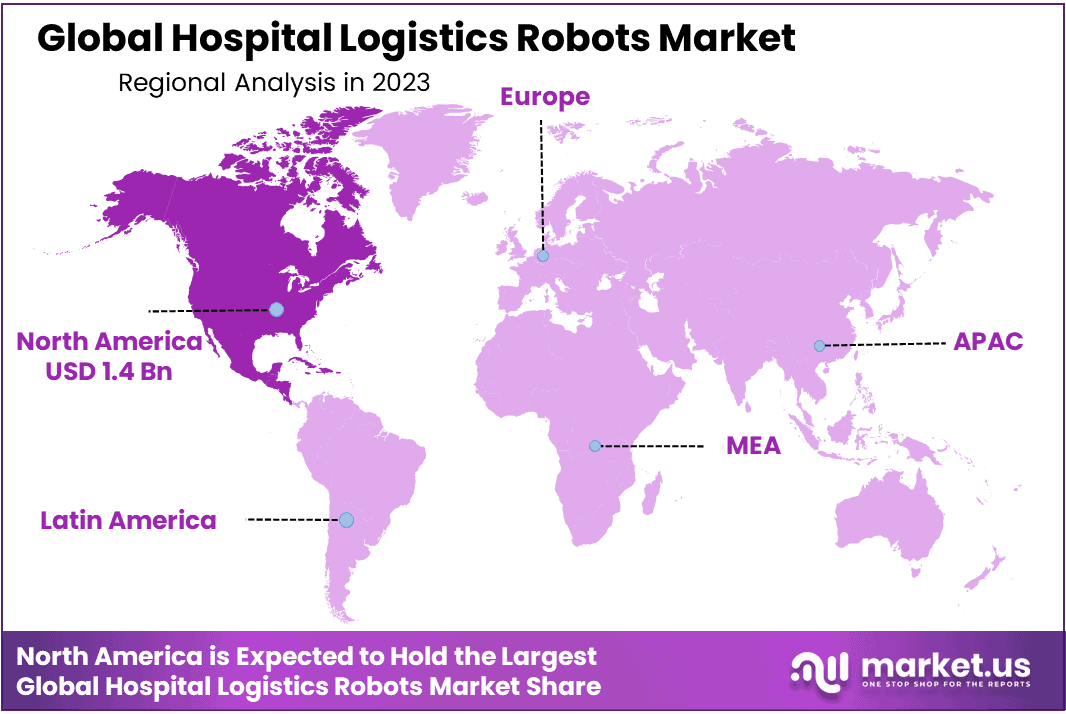

- Regional Analysis: North America held the 41.3% market share and holding USD 1.4 Bn revenue in 2023.

- Key Market Trends: The development of autonomous mobile robots (AMRs) and humanoid robots is gaining traction, enabling more complex tasks and navigation in challenging environments.

- Future Outlook: The hospital logistics robots market is poised for continued growth, driven by the aforementioned factors and technological advancements.

Type Analysis

By 2023, hospital robotics had captured 22.02% of revenue share. Hospital robots play an increasingly critical role in hospitals by efficiently carrying out various hospital-related tasks like medication distribution, equipment transportation and providing patients with assistance. Hospital robots can contribute significantly to the successful running of hospitals by performing mundane tasks more efficiently – automating delivery of supplies, moving specimens and managing logistics improve efficiency in the hospital and are beneficial to staff as well as patients alike. Furthermore, using Hospital robots may dramatically lower risks associated with hospital acquired illnesses by performing tasks requiring less human contact.

The robotics and care industry is projected to experience the highest compound annual growth rate at 18.6 percent during its forecast time. Reason being: the world population’s ageing trend and consequent need for elder care services as well as assisted living solutions. Care robots play an invaluable role in daily activities and medication reminders. Furthermore, care robots serve as companionship for elderly residents while contributing to overall health improvement and independence gains. For instance, Intuition Robotics’ ElliQ, developed to support elderly individuals during their transition to independent ageing while alleviating problems of loneliness and isolation was developed specifically with this purpose in mind.

End-user Analysis

By 2023, hospitals held the highest end-use revenue share at 36.2% and projected to experience the highest compound annual growth rate over its projected timeframe at 17.5% CAGR. Hospital environments are complex environments, necessitating efficient execution of multiple tasks. Mobile robots have proven adept at successfully navigating these complexities to complete tasks such as patient transport and supply management. Your capabilities extend to improving patient care by managing routine and non-clinical responsibilities for healthcare professionals, freeing them up to focus on direct interactions with patients and critical medical procedures.

Robots contribute significantly to hospital operations by managing tasks such as material transport, waste disposal and sterilization on an autonomous basis. This proactive approach reduces operational bottlenecks while simultaneously improving overall efficiency.

Key Market Segments

Type

- Hospital Robots

- Care Robots

- Imaging Assistance

- Rehabilitation and Mobility

- Surgical Robots

- Walking Assisting Robots

- Others

End-use

- Hospitals

- Ambulatory Surgical Centers

- Rehabilitation Centers

- Research Institutes

- Others

Drivers

Rising Demand for Automation in Healthcare Operations

Hospital logistics robots markets have seen tremendous growth over recent years as hospitals strive to enhance efficiency, reduce errors, and optimize resource use. Robots play an integral part in automating tasks such as material handling, supply chain management, inventory control – thus helping hospitals increase operational efficiencies through improved overall operational efficiencies.

Shortage of Healthcare Staff and Rising Workload

This shortage, combined with rising workload levels in hospitals, is driving adoption of hospital logistics robots. Healthcare professionals may become overburdened with administrative or logistical tasks which distract their focus away from direct patient care; robotic hospital delivery robots allow healthcare staff to focus more efficiently on providing direct patient care by automating tedious repetitive tasks like transporting medical supplies – relieving their burden while improving care by making certain all supplies needed are always readily available when required. This not only alleviates healthcare worker burden but enhances care as patient needs can ensured promptly available when required!

Trends

Integration of Artificial Intelligence (AI) and Machine Learning (ML) Technologies

AI and machine learning technologies are becoming an increasingly prevalent trend within hospital logistics robot markets, enabling robots to adapt more readily to rapidly evolving hospital environments while learning from experience and making data-driven decisions. AI/ML technologies enable logistics robots to optimize routes, increase navigation efficiency and enhance overall efficiency; additionally they allow them to interact intelligently with their environment which further boosts efficiency while making them better at dealing with logistical hurdles encountered within hospitals.

Adopt Collaborative Robots (Cobots)

Collaborative robotics, or cobots, have gained momentum within hospital logistics robot markets over recent years. Designed to work alongside human operators while creating an open and synergistic work environment – cobots help healthcare staff in tasks such as loading/unloading cargo containers while inventory tracking or delivery for easier adherence with safety in mind.

Restraint

Initial Costs and Implementation Challenges

One major impediment to hospital logistics robot market growth is high initial costs associated with implementation robotic systems. From acquisition, integration and customization of logistics robots requiring substantial investments up front; to implementation challenges related to adapting existing infrastructure seamlessly in accommodating robotic technology seamlessly over time – initial costs remain an obstacle in hospital logistics robot market adoption.

Job Displacement and Ethical Considerations

The introduction of logistics robots in hospitals raises ethical considerations as well as fears over job displacement. As robots take over daily logistical tasks that healthcare staff used to doing manually, such as material handling or logistics work. This may cause resistance among staff that are directly affected, which ultimately may hinder smooth integration into hospital operations of logistic robots.

Opportunities

Robotic Technology and Customization

Hospital logistics robot manufacturers have an immense opportunity presented by advances in robotic technologies. New innovations, including improved sensors, enhanced navigation systems and increased payload capacities contribute to more capable logistics robots being designed by manufacturers that can perform various tasks with increased precision and efficiency.

Integration of Robots for Last-Mile Delivery and Telemedicine

Integrating robots in last-mile delivery and telemedicine represents an exciting prospect. Last mile delivery is an integral component of healthcare logistics that ensures medical supplies reach their final destinations efficiently within hospitals; robotic logistics robots play an essential part in optimizing last mile processes by cutting delays while improving overall supply chain speed.

Regional Analysis

North America held the 41.3% market share and holding USD 1.4 Bn revenue in 2023. Stakeholders and players operating within this field will find ample opportunities for expansion and growth here, in particular with regards to widespread adoption by healthcare facilities and institutions as well as North America’s robust medical and healthcare infrastructure which contributes greatly to market expansion here.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

This exhaustive report analyzes the current state of global hospital logistics robots market to provide insight into its performance and position among leading manufacturers and players in this sector. Notable participants of global hospital logistics robots market include prominent manufacturers, developers, and key players such as:

Key Market Players

- Toyota Motor Corp.

- ABB Ltd

- Aethon

- Omron Corporation

- Amazon

- Mobile Industrial Robots

- Nordson Corp.

- Teradyne

- Ateago Technology

- VGo Communications, Inc.

- Awabot

- Techcon

- Xenex Disinfection Services, LLC

- Intuition Robotics

Recent Development

- April 2023: ABB Robotics announced the successful deployment of their IRB 1200 robot at a hospital in Sweden to automate medication mixing and dispensing processes.

- May 2023: – Omron Healthcare announced on the introduction of their FORPHEUS robot into a hospital in Japan for use with rehabilitation of stroke or neurological conditions patients.

- June 2023: – Amazon Robotics and Providence Health & Services announced they would collaborate in developing an advanced robotic pharmacy system using robots for dispensing medications to patients.

- July 2023: – ChargeUp, Inc. develops charging stations for robots; Aethon plans on acquiring it to expand its product offering and make deploying and operating robots easier for hospitals.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 18.4 Billion CAGR (2024-2033) 16.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Hospital Robots, Care Robots, Imaging Assistance, Rehabilitation and Mobility, Surgical Robots, Walking Assisting Robots, Others);By End-use(Hospitals, Ambulatory Surgical Centers, Rehabilitation Centers, Research Institutes, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Toyota Motor Corp., ABB Ltd, Aethon, Omron Corporation, Amazon, Mobile Industrial Robots, Nordson Corp., Teradyne, Ateago Technology, VGo Communications, Inc., Awabot, Techcon, Xenex Disinfection Services, LLC, Intuition Robotics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Hospital Logistics Robots Market?The Hospital Logistics Robots Market pertains to the industry involved in the manufacturing, development, and deployment of robotic solutions for logistics and supply chain operations within healthcare settings.

How big is the Hospital Logistics Robots Market?The global Hospital Logistics Robots Market size was estimated at USD 3.9 Billion in 2023 and is expected to reach USD 18.4 Billion in 2033.

What is the Hospital Logistics Robots Market growth?The global Hospital Logistics Robots Market is expected to grow at a compound annual growth rate of 16.8%. From 2024 To 2033

Who are the key companies/players in the Hospital Logistics Robots Market?Some of the key players in the Hospital Logistics Robots Markets are Toyota Motor Corp., ABB Ltd, Aethon, Omron Corporation, Amazon, Mobile Industrial Robots, Nordson Corp., Teradyne, Ateago Technology, VGo Communications, Inc., Awabot, Techcon, Xenex Disinfection Services, LLC, Intuition Robotics

What Drives the Adoption of Logistics Robots in Hospitals?The adoption of logistics robots in hospitals is primarily driven by the need for automation to enhance efficiency, reduce errors, and optimize resource utilization in healthcare operations.

Which End-use Segment Dominates the Market, and Why?The hospitals segment holds the largest revenue share, accounting for 35.11% in 2022. This is due to the intricate and dynamic nature of hospital settings, demanding efficient execution of tasks that logistics robots excel at.

What Trends Are Shaping the Hospital Logistics Robots Market?Key trends include the integration of artificial intelligence (AI) and machine learning (ML), and the adoption of collaborative robotics (cobots) for a more inclusive and collaborative work environment.

Hospital Logistics Robots MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Hospital Logistics Robots MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Toyota Motor Corp.

- ABB Ltd

- Aethon

- Omron Corporation

- Amazon

- Mobile Industrial Robots

- Nordson Corp.

- Teradyne

- Ateago Technology

- VGo Communications, Inc.

- Awabot

- Techcon

- Xenex Disinfection Services, LLC

- Intuition Robotics