Global Honeycomb Packaging Market Size, Share, Growth Analysis By Packaging Type (Exterior Packaging, Interior Packaging, Pallets, Others), By End-use Industry (Furniture, Automotive, Consumer goods, Food and beverages, Industrial goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 152850

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

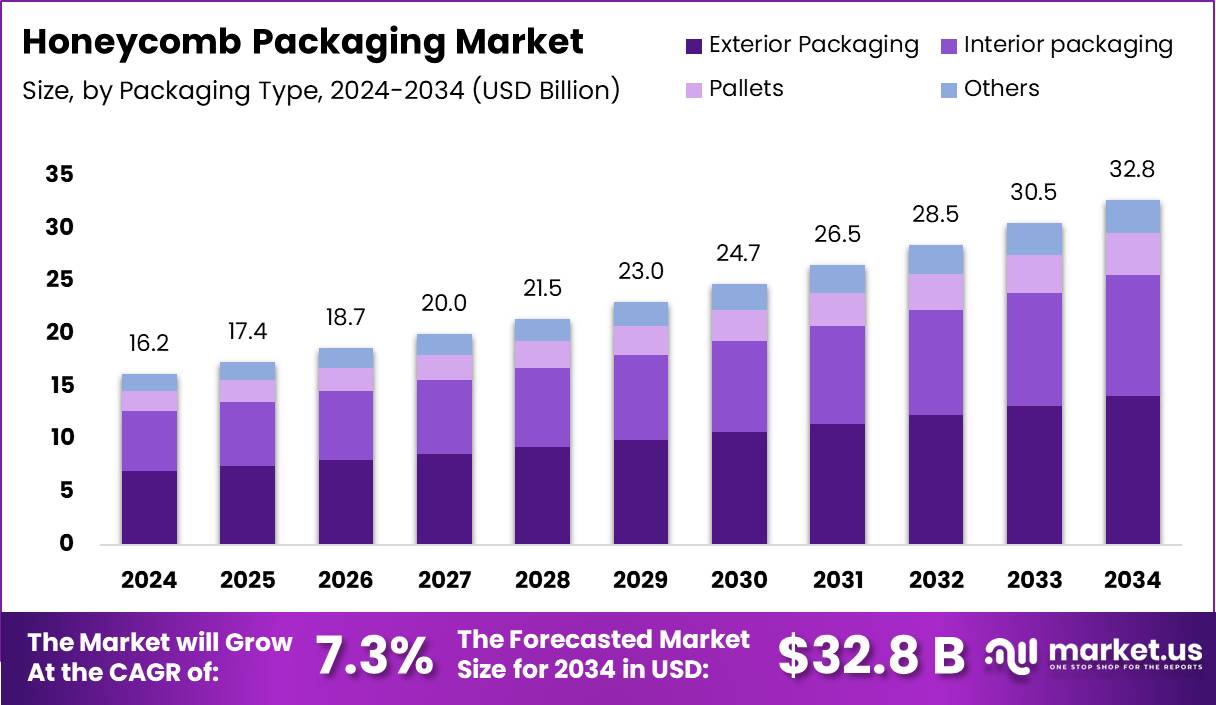

The Global Honeycomb Packaging Market size is expected to be worth around USD 32.8 Billion by 2034, from USD 16.2 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The Honeycomb Packaging Market is gaining strong traction due to its eco-friendliness, lightweight properties, and increasing demand across industrial and commercial sectors. Honeycomb packaging is a paper-based structure with a hexagonal design, offering excellent cushioning, rigidity, and shock absorption. It’s widely used in furniture, automotive, electronics, and logistics industries for protective packaging.

From a market standpoint, this segment is witnessing rapid growth, driven by sustainability goals and rising e commerce. Companies are shifting from plastic to biodegradable packaging. Honeycomb packaging aligns with circular economy practices, and its recyclability is pushing adoption in Europe, North America, and parts of Asia-Pacific.

Notably, with the same load, honeycomb paperboard can reduce weight by 30% compared to corrugated paperboard, according to Engmeixun. This weight reduction directly translates to fuel savings and lower carbon emissions during transportation. Hence, businesses see dual benefits in cost and compliance.

Moreover, production scalability remains favorable. According to Linkairpak, 150/160 rolls of honeycomb paper can be produced under an average working time of 8 hrs a day, meeting industrial and commercial packaging requirements efficiently. This improves operational feasibility, especially for bulk manufacturers.

Technologically, the material is adaptable. As per Tantan, the height of the honeycomb structure, which defines core thickness, ranges between 10 mm to 100 mm or more. This allows manufacturers to customize strength and cushioning for specific goods—ranging from fragile electronics to heavy industrial items.

As governments worldwide tighten single-use plastic regulations, paper-based solutions like honeycomb packaging are drawing significant interest. Investment in green packaging and subsidy schemes is supporting market players in scaling up capacity and improving material efficiency.

In Asia, especially China and India, strong infrastructure growth and manufacturing exports are fueling demand. Packaging needs for automotive components and consumer appliances are expected to drive local production of honeycomb structures.

In the U.S. and EU, strict environmental regulations such as the ban on EPS (expanded polystyrene) in certain states and countries are pushing companies to shift to sustainable alternatives, enhancing demand for honeycomb packaging solutions.

Rising global freight volumes and the need for lightweight yet durable packaging are expanding honeycomb usage in logistics and warehousing. Its shock resistance ensures safe transit of delicate goods over long distances. With rising market awareness and performance advantages, honeycomb packaging continues to carve space in industrial packaging. Its compatibility with digital printing and die-cutting also unlocks branding potential for retail-ready packaging.

The honeycomb packaging market shows promise for double-digit growth over the next few years, supported by sustainable trends, cost savings, and regulatory pressures. Manufacturers investing early in technology and process scalability are poised to lead in this transforming segment.

Key Takeaways

- The Global Honeycomb Packaging Market is projected to grow from USD 16.2 Billion in 2024 to a significantly higher value by 2034, at a CAGR of 7.3%.

- Exterior Packaging dominated by packaging type in 2024 with a 43.2% share due to its protective qualities for bulky and fragile items.

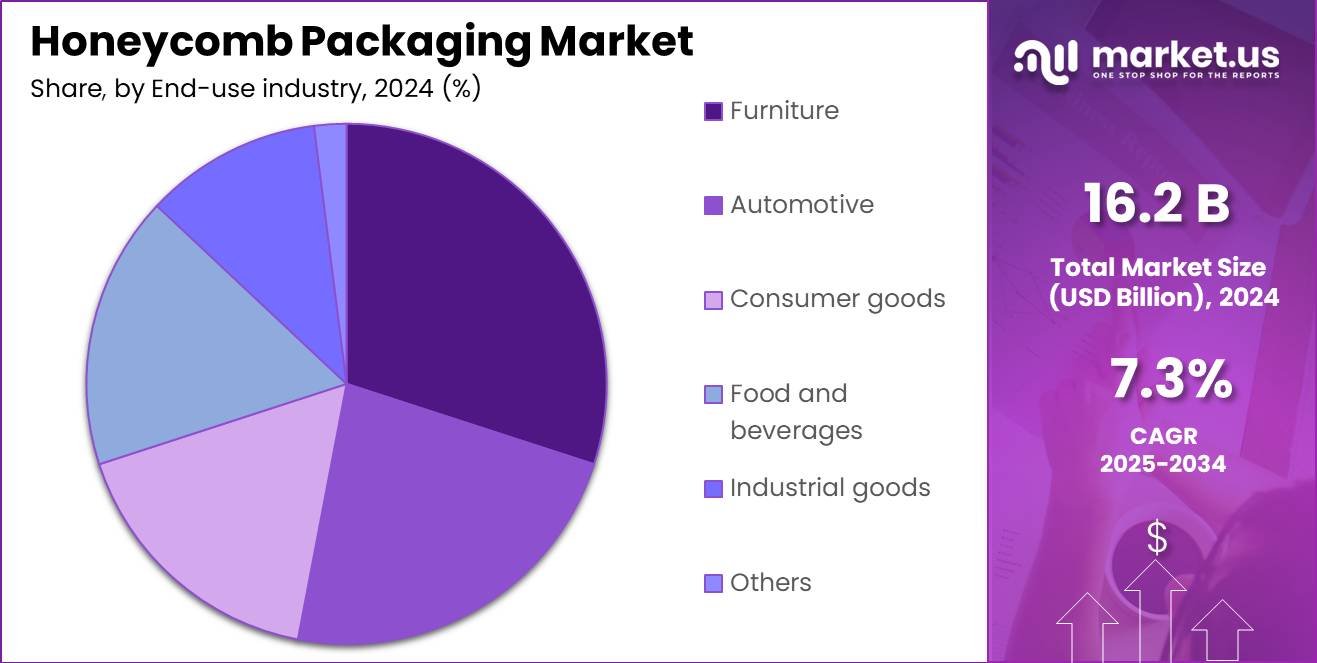

- The Furniture industry led end-use applications in 2024, driven by the need for rigid, shock-absorbing transport solutions.

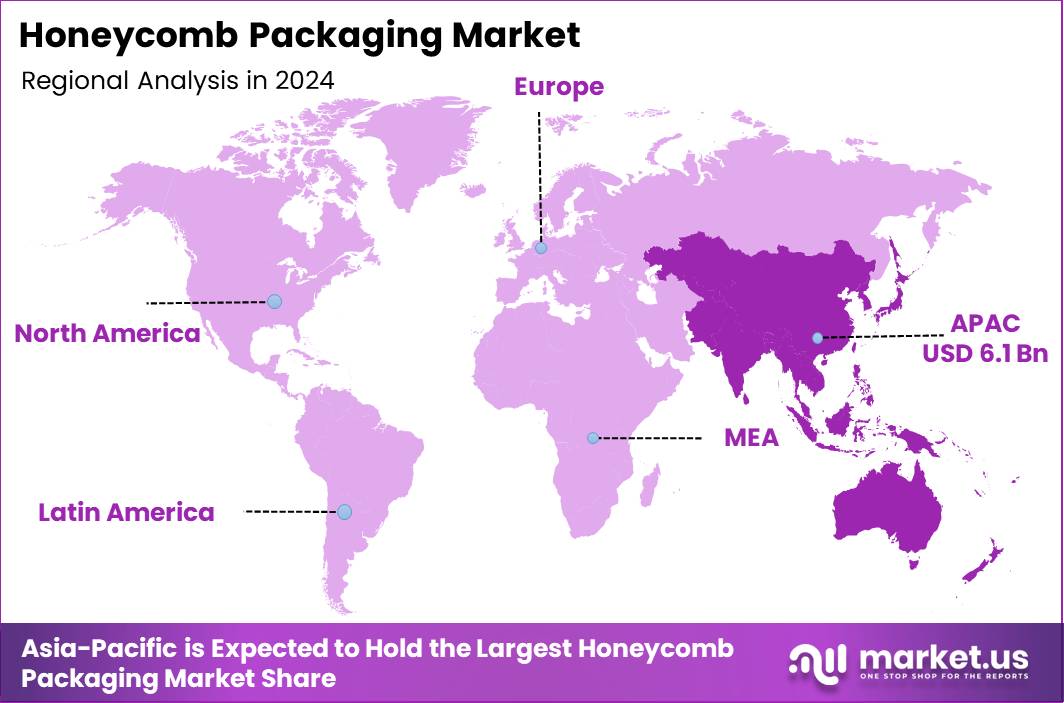

- Asia Pacific led the market with a 34.2% share and USD 6.1 Billion valuation, powered by growth in e-commerce and industrial sectors.

Packaging Type Analysis

Exterior Packaging leads with 43.2% as the top choice in protective honeycomb packaging.

In 2024, Exterior Packaging held a dominant market position in By Packaging Type Analysis segment of the Honeycomb Packaging Market, with a 43.2% share. This segments leadership stems from its widespread use in securing products during transit, especially for bulky or fragile items. The robust cushioning and impact resistance properties of honeycomb packaging make it a preferred solution for outer layer protection in logistics and supply chains.

Interior Packaging followed as a significant segment, offering added protection to individual products inside the main packaging. Its commonly used to prevent movement and minimize product damage. The adoption of sustainable and lightweight materials is also boosting demand for interior honeycomb designs.

Pallets represented a steady portion of the market, gaining popularity due to their structural strength and eco-friendliness. Honeycomb pallets are increasingly used as an alternative to wooden or plastic ones, especially where weight reduction is a priority.

The Others segment, which includes specialized and niche applications, also maintained relevance. Custom solutions for electronics or medical equipment fall within this category, where precision packaging is required for sensitive items.

End-use Industry Analysis

Furniture leads the market due to protective and cost-effective packaging needs.

In 2024, Furniture held a dominant market position in By End-use industry Analysis segment of the Honeycomb Packaging Market. The demand is driven by the need to protect large, heavy, and often delicate furniture items during transportation. Honeycomb packaging offers excellent shock absorption and rigidity, making it a top solution for manufacturers and retailers alike.

The Automotive segment ranked next in market share, as manufacturers increasingly turn to sustainable packaging options for spare parts and components. Honeycomb structures are ideal for irregular-shaped automotive parts, offering both strength and weight efficiency.

Consumer Goods also held a notable position, particularly in electronics and appliances. The push toward eco-conscious packaging in consumer-facing brands is boosting honeycomb adoption in this space.

Food and Beverages remained a niche but growing area, particularly in reusable and biodegradable solutions for bulk shipments. Lightweight yet protective features make honeycomb packaging an emerging alternative in this sector.

Industrial Goods saw stable demand as companies seek reliable protection for machinery and tools during shipment. Lastly, the Others category, including custom or small-scale industrial applications, showed promising adoption trends in specialized sectors.

Key Market Segments

By Packaging Type

- Exterior Packaging

- Interior Packaging

- Pallets

- Others

By End-use Industry

- Furniture

- Automotive

- Consumer goods

- Food and beverages

- Industrial goods

- Others

Drivers

Surge in E-commerce and Home Delivery Services Fuels Honeycomb Packaging Demand

The rapid growth of e-commerce and home delivery services has significantly increased the need for protective and lightweight packaging solutions. Honeycomb packaging offers excellent cushioning and strength, making it ideal for shipping a wide range of products. As more consumers shop online, businesses are adopting honeycomb packaging to ensure safe product deliveries and reduce damage during transit.

Compared to plastic and foam alternatives, honeycomb packaging stands out as a cost-effective option. It is made primarily from paper, which is more affordable and easily recyclable. This makes it a preferred choice for companies looking to cut packaging costs while staying environmentally responsible, especially in large-scale shipping operations.

Industrial sectors value honeycomb packaging for its strong load-bearing capacity. It provides a high strength-to-weight ratio, which is essential when transporting heavy or fragile goods. This has led to growing adoption in industries like electronics, automotive, and machinery, where product safety during shipping is critical.

Restraints

Limited Moisture Resistance Restrains Honeycomb Packaging Growth

One major limitation of honeycomb packaging is its low resistance to moisture. Since it’s made primarily of paper materials, exposure to water or damp conditions can weaken its structure. This makes it less suitable for products that need extra protection from humidity or wet environments.

In high-humidity regions or industries like seafood or produce, where moisture control is crucial, honeycomb packaging may not perform well. This restricts its usage and opens the door for other packaging options that offer better water resistance.

Emerging markets often seek cheaper alternatives, and synthetic packaging materials tend to be more affordable and water-resistant. The presence of such low-cost substitutes can limit the market share of honeycomb packaging, especially in price-sensitive regions.

Growth Factors

Expansion into Cold Chain and Perishable Goods Packaging Offers Growth Potential

The growing demand for packaging in cold chain logistics presents a new opportunity for honeycomb packaging. With the right coatings or barrier layers, honeycomb panels can be adapted to protect perishable goods like fruits, vegetables, and dairy during transit, offering both protection and sustainability.

Retail brands are increasingly using packaging as a tool for marketing and branding. Honeycomb packaging can be easily customized in size, print, and shape. This flexibility makes it suitable for attractive, branded retail packaging that aligns with eco-conscious consumer preferences.

In sectors like automotive and aerospace, where parts need to be transported safely and securely, honeycomb packaging is gaining popularity. Its lightweight nature and strength make it ideal for protecting delicate or irregular-shaped components, opening new avenues for market growth.

Emerging Trends

Use of Recycled Paper and Circular Economy Practices Drives Honeycomb Packaging Trends

The shift toward using recycled materials is transforming the honeycomb packaging market. Many manufacturers are adopting recycled paper in their production processes, aligning with circular economy principles. This trend is helping companies meet sustainability goals while reducing environmental impact.

Lightweight and foldable designs are another innovation shaping the market. Modern honeycomb packaging is being engineered to be even lighter while retaining strength. Foldable versions save space in storage and reduce transportation costs, which is a key advantage for logistics and supply chain players.

Automation in manufacturing is improving the efficiency and scalability of honeycomb packaging production. Advanced machinery is enabling faster production times, higher consistency, and lower labor costs. This trend is expected to support wider market adoption across various industries.

Regional Analysis

Asia Pacific Dominates the Honeycomb Packaging Market with a Market Share of 34.2%, Valued at USD 6.1 Billion

Asia Pacific leads the global honeycomb packaging market, accounting for 34.2% of the total market share and valued at USD 6.1 Billion. This dominance is primarily driven by the region’s expanding industrial and e-commerce sectors, especially in countries like China and India. Increasing demand for sustainable and cost-effective packaging solutions in the automotive, electronics, and consumer goods industries further supports growth in this region.

North America Honeycomb Packaging Market Trends

North America holds a significant share of the honeycomb packaging market, fueled by the region’s mature manufacturing base and high adoption of environmentally friendly packaging materials. The growing demand from the logistics and warehousing sectors, along with stringent regulations regarding sustainable packaging, has contributed to market expansion. Technological advancements in packaging processes also bolster the region’s market presence.

Europe Honeycomb Packaging Market Trends

The European honeycomb packaging market is witnessing steady growth, supported by increasing environmental awareness and strict regulations surrounding packaging waste. The automotive and industrial sectors are key end-users, driving demand for durable and recyclable materials. Innovations in lightweight and shock-absorbent packaging designs are further enhancing market adoption across the region.

Middle East and Africa Honeycomb Packaging Market Trends

In the Middle East and Africa, the honeycomb packaging market is gradually expanding, with infrastructure development and increased industrial activities playing a major role. The growing emphasis on sustainable construction and protective packaging in logistics is contributing to the market’s growth. However, the market remains in a nascent stage compared to other regions.

Latin America Honeycomb Packaging Market Trends

Latin America shows emerging potential in the honeycomb packaging market, driven by the increasing need for cost-effective and sustainable packaging solutions in sectors like agriculture and automotive. Rising urbanization and improvements in the supply chain infrastructure are likely to fuel demand. However, economic fluctuations and lack of awareness may hinder rapid growth in certain areas.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Honeycomb Packaging Company Insights

In 2024, The Global Honeycomb Packaging Market is being shaped significantly by a few major players, each contributing through innovation, sustainability efforts, and strategic positioning. BASF S.E. continues to drive advancements by integrating chemical expertise into lightweight and recyclable materials, addressing environmental concerns while enhancing protective packaging solutions. The company’s focus on sustainable chemistry aligns well with evolving industry demands.

ACH Foam Technologies is making its mark with specialized foam-based honeycomb structures, particularly in insulation and cushioning applications. Their ability to tailor packaging to specific industrial requirements has maintained their relevance in niche market segments.

DS Smith Plc remains a dominant force in the European market, with its focus on circular economy principles. Through the expansion of paper-based honeycomb packaging solutions, the company addresses both cost-effectiveness and eco-conscious consumer expectations.

Huhtamaki Group leverages its global footprint and expertise in molded fiber to offer eco-friendly honeycomb packaging options. The company continues to prioritize renewable materials and innovation in protective design, aligning with regulatory and sustainability pressures globally.

These companies play a critical role in shaping the competitive landscape of honeycomb packaging, pushing the market toward more sustainable, cost-efficient, and adaptable solutions. As environmental standards tighten and e-commerce logistics expand, players who combine technological innovation with sustainable practices are well-positioned for long-term growth.

Top Key Players in the Market

- BASF S.E.

- ACH Foam Technologies

- DS Smith Plc

- Huhtamaki Group

- Lsquare Eco-Products Pvt. Ltd.

- Packaging Corporation of America

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group

- WestRock Company

Recent Developments

- In Jan 2024, the European Manufacturers Paper Honeycomb Association (EMPHA) officially joined Two Sides, an initiative promoting the sustainability of print and paper. This move strengthens industry collaboration to counter greenwashing and promote environmental transparency.

- In Feb 2024, The Spicers Group signed an agreement with Winson Group to acquire the Australian packaging company Signet. The acquisition aims to expand Spicer’s footprint in the packaging sector and enhance its product offerings across Australia.

- In June 2024, Smurfit Kappa completed the acquisition of WestRock, resulting in the formation of the new global packaging giant Smurfit WestRock. This merger creates one of the world’s largest paper-based packaging companies with a broader international reach and combined expertise.

Report Scope

Report Features Description Market Value (2024) USD 16.2 Billion Forecast Revenue (2034) USD 32.8 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Exterior Packaging, Interior Packaging, Pallets, Others), By End-use Industry (Furniture, Automotive, Consumer goods, Food and beverages, Industrial goods, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF S.E., ACH Foam Technologies, DS Smith Plc, Huhtamaki Group, Lsquare Eco-Products Pvt. Ltd., Packaging Corporation of America, Sealed Air Corporation, Sonoco Products Company, Smurfit Kappa Group, WestRock Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF S.E.

- ACH Foam Technologies

- DS Smith Plc

- Huhtamaki Group

- Lsquare Eco-Products Pvt. Ltd.

- Packaging Corporation of America

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group

- WestRock Company