Global High-Flow Oxygen Therapy Devices Market By Product Type-(High-flow Nasal Cannulas, High-flow Oxygen Masks, Breathing Circuits, and other) By Application-(Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Failure, Pneumonia, Other Applications) By End User-(Less than 100 Beds in Hospitals, 100 to 250 Beds Hospitals, 250 to 500 Beds Hospitals, 500 Beds and Above Hospitals) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 84569

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

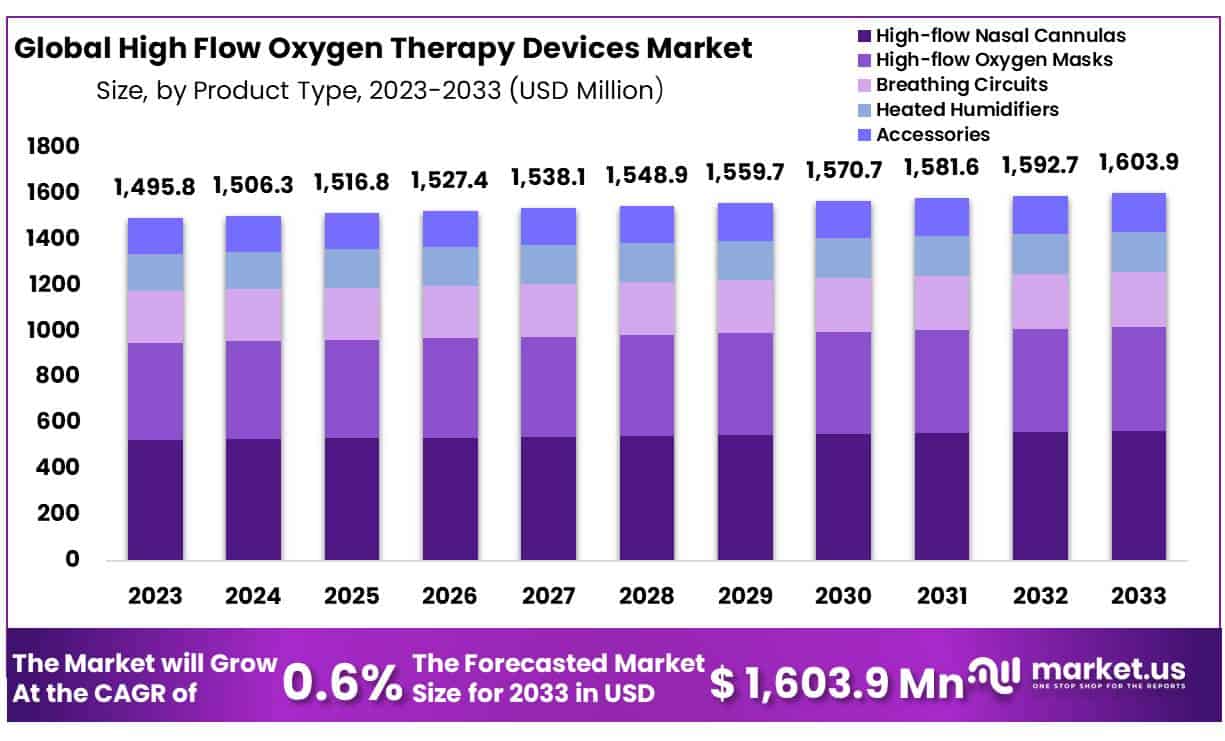

The Global High Flow Oxygen Therapy Devices Market size is expected to be worth around USD 1,603.9 Million by 2033 from USD 1,495.8 Million in 2023, growing at a CAGR of 0.6% during the forecast period from 2024 to 2033.

High-Flow Oxygen Therapy (HFOT) devices are designed to provide higher levels of oxygen for patients who need it to enhance their respiratory function. These devices are often used in hospital settings, to help people breathe easier during medical emergencies. The use of HFOT can be life-saving, potentially reducing mortality rates by up to 50%.

High-flow oxygen therapy is a type of mechanical ventilation that is most often used in neonatal intensive care units and comes with a variety of features. Some devices can also measure the concentration of oxygen in a patient’s blood whereas others only measure the concentration of CO2 in a patient’s exhaled breath. High-flow oxygen therapy devices are used to increase the rate of oxygen consumption by the lungs, and thereby provide more oxygen to the blood.

It consists of a tube that diverts air from the outside into an air compressor. The air is then heated by either steam or electric heating elements to about 150° Fahrenheit, which causes it to expand. This expansion causes the pressure in the device to be greater than the atmospheric pressure which forces it through a narrow passage.

The high-flow system can deliver up to 4 Liters Per Minute (LPM) at pressures as low as 2 psi. A typical adult requires approximately 15 LPM for adequate ventilation. However, this amount may vary depending on age, weight, activity level, etc.

Key Takeaways

- Market Size: High Flow Oxygen Therapy Devices Market size is expected to be worth around USD 1,603.9 Million by 2033 from USD 1,495.8 Million in 2023.

- Market Growth: The global growing at a CAGR of 0.6% during the forecast period from 2024 to 2033.

- Product Type: High-flow Nasal Cannulas stand out as the dominant player, holding an impressive 35% share of the market.

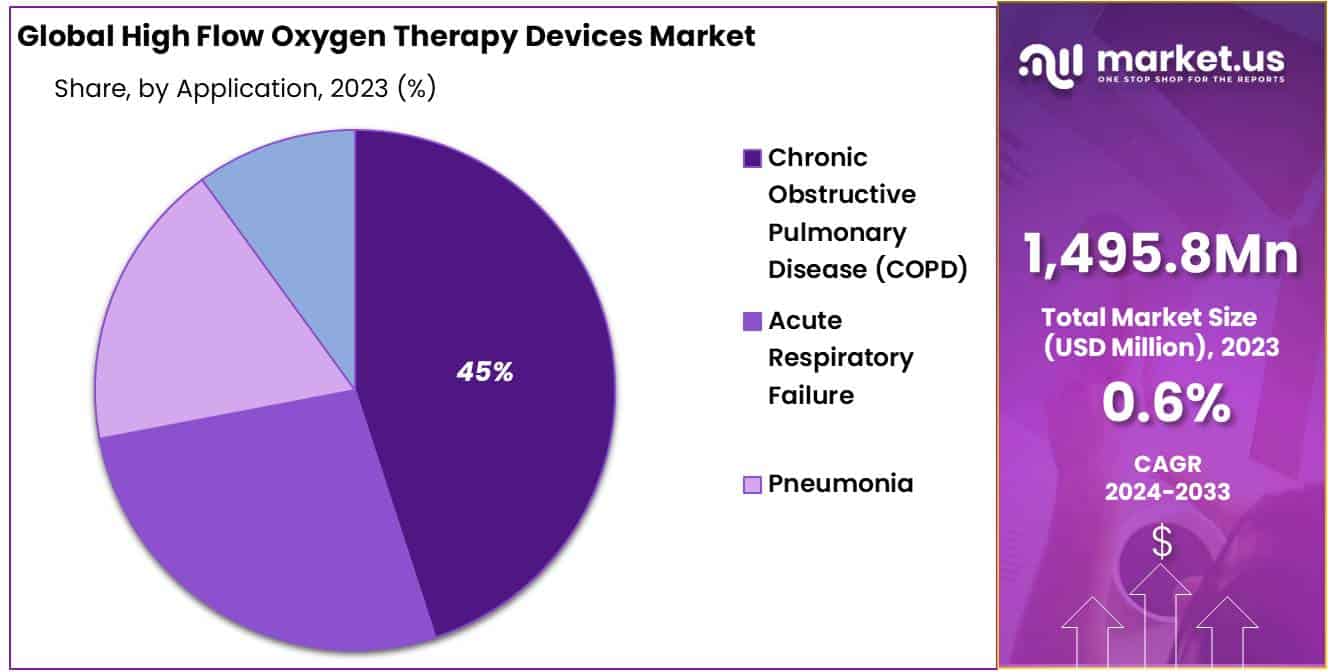

- Application: Chronic Obstructive Pulmonary Disease (COPD) stands out as the most prominent, commanding a substantial 45% share of the market.

- End-Use: Hospitals with fewer than 100 beds dominate the market, accounting for a substantial 43% share.

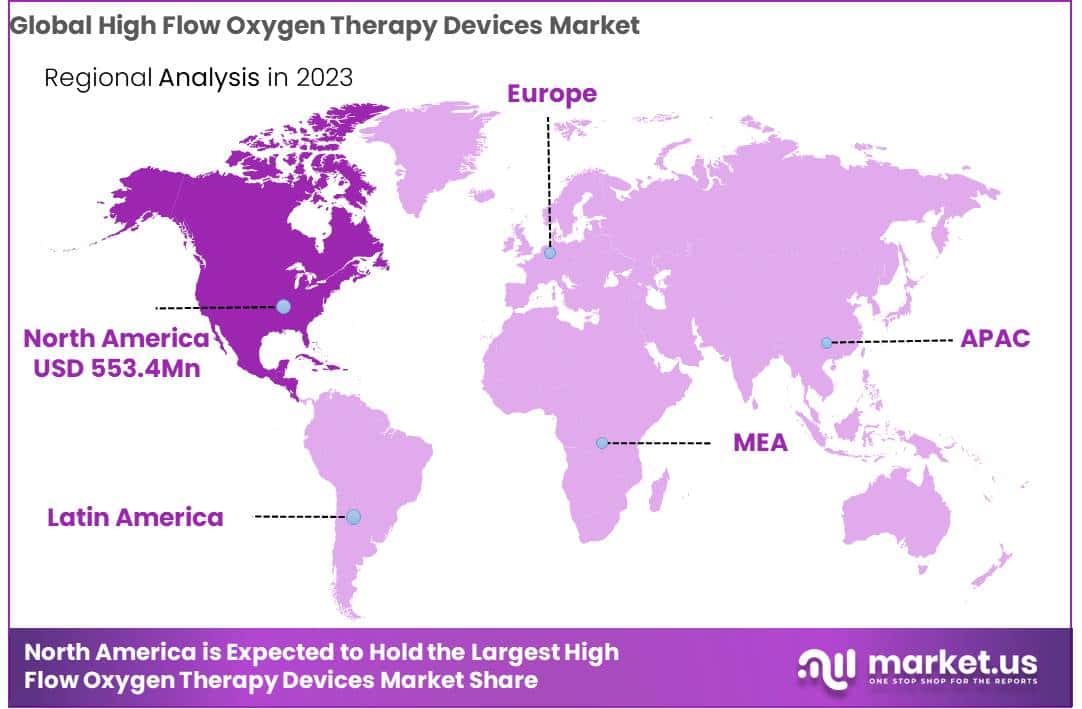

- Regional Analysis: North America held approximately 37% market share and held USD 553.4 million market revenue in 2023

Product Type Analysis

The High Flow Oxygen Therapy Devices Market encompasses a range of products designed to provide high-flow oxygen therapy to patients with respiratory conditions. Among these products, High-flow Nasal Cannulas stand out as the dominant player, holding an impressive 35% share of the market. These cannulas deliver a precise mixture of oxygen and air at high flow rates, making them highly effective in various clinical settings.

In addition to High-flow Nasal Cannulas, other essential products in this market include High-flow Oxygen Masks, Breathing Circuits, and Heated Humidifiers. High-flow Oxygen Masks offer an alternative delivery method, particularly for patients who may not tolerate nasal cannulas. Breathing Circuits are vital components that facilitate the flow of oxygen to patients during mechanical ventilation, while Heated Humidifiers play a crucial role in ensuring that the oxygen delivered is adequately humidified, preventing dryness and discomfort for patients.

Application Analysis

The High Flow Oxygen Therapy Devices Market plays a crucial role in addressing various respiratory conditions, with a primary focus on improving patient outcomes. Among its diverse applications, Chronic Obstructive Pulmonary Disease (COPD) stands out as the most prominent, commanding a substantial 45% share of the market. COPD patients benefit greatly from high-flow oxygen therapy devices, which help alleviate their breathing difficulties and enhance their quality of life.

In addition to COPD, these devices also find extensive use in managing Acute Respiratory Failure and Pneumonia cases. Acute Respiratory Failure often requires immediate and intensive oxygen therapy, making high-flow oxygen therapy devices a critical resource in emergency care settings. Pneumonia, a common respiratory infection, can lead to severe respiratory distress, and high-flow oxygen therapy plays a vital role in supporting patients during their recovery.

End User Analysis

The High Flow Oxygen Therapy Devices Market caters to a diverse range of healthcare settings, with its adoption varying across different types of hospitals. Notably, hospitals with fewer than 100 beds dominate the market, accounting for a substantial 43% share. These smaller healthcare facilities rely on high-flow oxygen therapy devices to provide essential respiratory support to their patients efficiently and cost-effectively.

However, the market extends its reach to larger healthcare institutions as well. Hospitals with 100 to 250 beds, 250 to 500 beds, and those with 500 beds and above all utilize high-flow oxygen therapy devices to varying degrees. These devices play a critical role in ensuring that patients receive optimal oxygen therapy, regardless of the hospital’s size.

Market Segments

Product Type

- High-flow Nasal Cannulas

- High-flow Oxygen Masks

- Breathing Circuits

- Heated Humidifiers

- Accessories

Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Acute Respiratory Failure

- Pneumonia

- Other Applications

End User

- Less than 100 Beds in Hospitals

- 100 to 250 Beds Hospitals

- 250 to 500 Beds Hospitals

- 500 Beds and Above Hospitals

Driver

Rising Respiratory Conditions and Aging Population

High-flow oxygen therapy devices have been an excellent way to help patients with asthma, chronic obstructive pulmonary disease, cystic fibrosis, and other respiratory illnesses. HFOTs are a type of medical device that provides a high concentration of oxygen to a patient through a face mask or nasal cannula.

Oxygen is not only beneficial in treating infections but can also help with inflammation and pain. Hence, this is expected a significant factor that is expected to boost the economic trajectory of high-flow oxygen therapy devices over the forecast period.

Technological Advancements

Advancements in technology have greatly improved the design and functionality of high-flow oxygen therapy devices. Smaller, more portable devices with improved user interfaces are becoming available, making these therapies more accessible and user-friendly. These technological innovations attract both healthcare providers and patients, driving market growth.

The components of a high-flow oxygen therapy device typically consist of an oxygen cylinder and a regulator. Oxygen cylinder manufacturers list how much flow and what pressure is needed for a device. Hospitals use these devices in order to provide better care to their patients. They are used by doctors as well as nurses when caring for critically ill patients.

These devices allow them to monitor vital signs such as blood pressure, heart rate, breathing rates, etc., while providing comfort to a patient. High-flow oxygen therapy devices are mainly utilized in the Asia Pacific and Europe.

Trend

Home-Based High Flow Oxygen Therapy

One prominent trend in the market is the increasing adoption of home-based high-flow oxygen therapy. Patients with chronic respiratory conditions are now opting for homecare settings, where they can receive high-flow oxygen therapy comfortably without the need for extended hospital stays. This trend aligns with the preference for more cost-effective and patient-centric healthcare solutions.

The use of high-flow oxygen therapy devices can lead to longer hospital stays, increase the risk of hospital-acquired infections, and decrease patient safety. The field of high-flow oxygen therapy devices, which is now widely used in the medical profession, has its share of negative aspects. There are now more than one hundred million anesthetics and numerous other types of medical professionals who use such devices, and there is a great demand for them.

A typical High-Flow Nasal Cannula (HFNC) delivers up to 60 L/min, with pressures ranging from 5cm H2O to 15cm H20. It consists of two parts: one section that fits over the nose or mouth, and another that connects to tubing which leads into a patient’s airway. This type of mask can be used in place of Continuous Positive Airway Pressure (CPAP) therapy.

HFNCs are most commonly used as rescue therapies when patients fail conventional treatment such as NIV or BiPAP. They may also be used during the weaning-off mechanical ventilation. The main advantage of this method is its ability to deliver large amounts of oxygen at low positive end-expiratory pressure levels without causing significant discomfort. However, it has been found that there is no difference between HFNC and standard noninvasive ventilator support, in terms of mortality rates.

Integration of Telehealth

The integration of telehealth services into high-flow oxygen therapy is on the rise. Remote monitoring and consultations allow healthcare providers to assess patients’ progress and adjust therapy settings remotely. This not only enhances patient convenience but also improves healthcare efficiency, a trend expected to continue in the market.

Restraint

Cost Constraints

The high cost associated with some advanced high-flow oxygen therapy devices can act as a restraint, limiting their adoption in resource-constrained healthcare systems and regions. Cost-sensitive markets may struggle to afford these devices, hindering their widespread use.

Regulatory Challenges

Compliance with strict regulatory standards and requirements is a significant challenge for manufacturers and healthcare providers in the high-flow oxygen therapy market. Meeting regulatory standards for safety and efficacy can be a time-consuming and costly process, potentially slowing down product development and market entry.

Opportunity

Emerging Markets and Healthcare Expansion

An exciting opportunity lies in expanding into emerging markets where healthcare infrastructure is growing rapidly. As these regions invest in healthcare facilities and services, the demand for high-flow oxygen therapy devices is expected to surge. Companies that establish a presence in these markets early stand to benefit significantly.

Research and Development

Continued investment in research and development to create more advanced, cost-effective, and user-friendly high-flow oxygen therapy devices presents an opportunity for market growth. Innovations that improve patient outcomes and reduce the overall cost of therapy are likely to be well-received and gain market traction.

Regional Analysis

North America held approximately 37% market share and held USD 553.4 million market revenue in 2023 and this region is projected to remain extremely profitable throughout its forecast period. North America’s dominance can be attributed to increasing chronic disease incidence rates that serve as the driving force of market expansion; within North America itself, United States held first position due to factors including industry leaders as well as an upsurge in research and development activities related to high-flow oxygen therapy devices.

Asia Pacific region is forecasted to become the fastest-growing market for high-flow oxygen therapy devices over its forecast period (2024-2033), projected with an impressive compound annual growth rate. Driven by significant incidence rate for respiratory conditions as well as population expansion, Asia Pacific offers tremendous promise when it comes to development and adoption of high-flow oxygen therapy devices in this market.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Players Analysis

Prominent industry leaders place a strong emphasis on innovation, continually introducing cutting-edge devices to enhance production efficiency. These companies are progressively channeling their investments into research and development to uphold their competitive advantage and market prominence. The primary strategy adopted by most of these firms revolves around the development of novel technologies and their implementation to improve patient health.

Market Key Players

- GE Healthcare

- CareFusion Corporation

- Invacare Corporation

- Smiths Medical

- Philips Respironics

- Teleflex Medical GmBH

- Fisher & Paykel Corporation Ltd.

- Flexicare Medical

- Hamilton Medical Inc.

Recent Developments

- Philips Respironics: In October 2023, Philips Respironics launched Trilogy Evo ventilators equipped with HFO therapy capabilities as part of their expanded product lineup to address increasing demands for versatile respiratory support solutions. This marked an expansion in product offerings while satisfying this growing market need.

- Fisher & Paykel Healthcare: Fisher & Paykel Healthcare collaborated with ResMed in September 2023 to design and market high-flow nasal cannulas (HFNCs) featuring advanced comfort and performance features, in an effort to enhance patient experience and treatment outcomes. This partnership seeks to deliver better experiences and better treatment results.

- GE Healthcare: Development: In August 2023, GE Healthcare unveiled the creation of a portable HFO therapy device specifically tailored for home care settings that could significantly improve patient mobility and quality of life.

- Teleflex Medical GmbH: Development: Teleflex Medical expanded their product offering and strengthened their position within HFO therapy by acquiring IMT Medical AG, a top manufacturer of HFO cannulas and accessories. This acquisition helped expand Teleflex’s presence within this market segment as well as increase product offerings across their portfolio.

Report Scope

Report Features Description Market Value (2023) USD 1,495.8 Million Forecast Revenue (2033) USD 1,603.9 Million CAGR (2024-2033) 0.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type-(High-flow Nasal Cannulas, High-flow Oxygen Masks, Breathing Circuits, Heated Humidifiers, Accessories);By Application-(Chronic Obstructive Pulmonary Disease (COPD), Acute Respiratory Failure, Pneumonia, Other Applications);By End User-(Less than 100 Beds in Hospitals, 100 to 250 Beds Hospitals, 250 to 500 Beds Hospitals, 500 Beds and Above Hospitals) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape GE Healthcare, CareFusion Corporation, Invacare Corporation, Smiths Medical, Philips Respironics, Teleflex Medical GmBH, Fisher & Paykel Corporation Ltd., Flexicare Medical, Hamilton Medical Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are High Flow Oxygen Therapy Devices?High Flow Oxygen Therapy Devices are medical equipment designed to deliver a high flow of oxygen to patients with respiratory conditions, ensuring optimal oxygen levels for improved breathing.

How big is the High Flow Oxygen Therapy Devices Market?The global High Flow Oxygen Therapy Devices Market size was estimated at USD 1,495.8 Million in 2023 and is expected to reach USD 1,603.9 Million in 2033.

What is the High Flow Oxygen Therapy Devices Market growth?The global High Flow Oxygen Therapy Devices Market is expected to grow at a compound annual growth rate of 0.6%. From 2023 To 2033

Who are the key companies/players in the High Flow Oxygen Therapy Devices Market?Some of the key players in the High Flow Oxygen Therapy Devices Markets are GE Healthcare, CareFusion Corporation, Invacare Corporation, Smiths Medical, Philips Respironics, Teleflex Medical GmBH, Fisher & Paykel Corporation Ltd., Flexicare Medical, Hamilton Medical Inc.

Which region dominates the global market?North America holds the largest share of the global market, with around 37% in 2023, primarily driven by the prevalence of chronic diseases.

Who benefits from high-flow oxygen therapy?High-flow oxygen therapy is beneficial for patients with respiratory conditions, including Chronic Obstructive Pulmonary Disease (COPD), asthma, pneumonia, and those requiring acute respiratory support.

High Flow Oxygen Therapy Devices MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

High Flow Oxygen Therapy Devices MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- CareFusion Corporation

- Invacare Corporation

- Smiths Medical

- Philips Respironics

- Teleflex Medical GmBH

- Fisher & Paykel Corporation Ltd.

- Flexicare Medical

- Hamilton Medical Inc.