Global Hernia Repair Devices Market By Product Type [Hernia Mesh (Biologic Mesh and Synthetic Mesh) Hernia Fixation Devices (Sutures, Tack Applicators and Glue Applicators)] By Procedure ( Open Surgery and Laparoscopic Surgery) By Surgery Type (Inguinal Hernia, Umbilical Hernia, Incisional Hernia, Femoral Hernia and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 36287

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

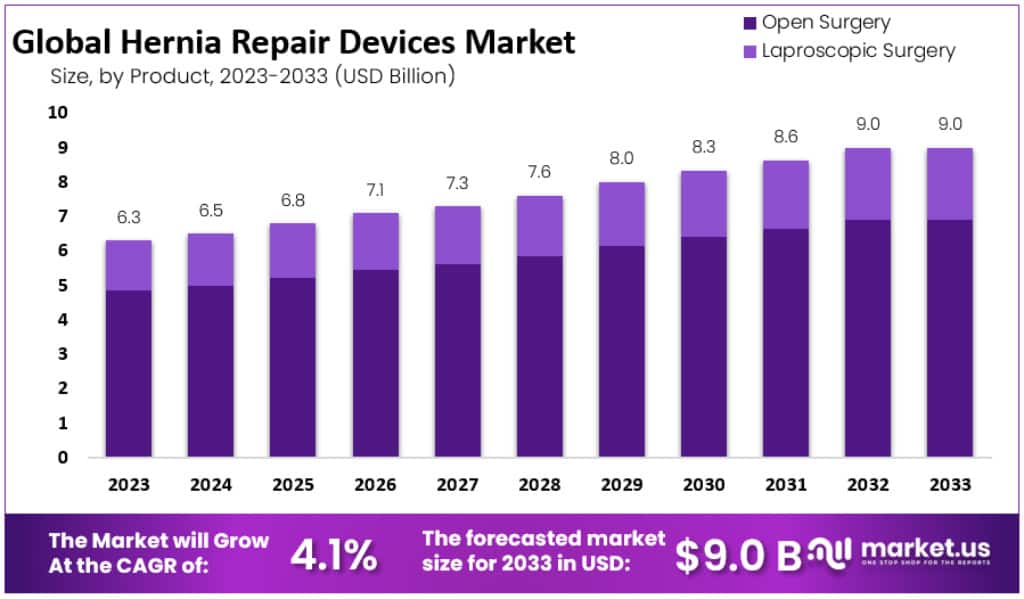

The Global Hernia Repair Devices Market size is expected to be worth around USD 9 Billion by 2033, from USD 3.3 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033.

Hernia repair devices, also known as hernia mesh, are medical devices used to support damaged tissue around a hernia as it heals. The majority of hernia repair surgeries in the U.S. use mesh, as it strengthens the repair of the abdominal wall and reduces the risk of recurrence. Surgical mesh is a flat, flexible weave that supports damaged tissue around a hernia as it heals, and it is made from biological or synthetic materials.

Surgeons use mesh in 90% of hernia surgeries annually in the U.S., and it is considered safe and effective for most patients. The use of mesh can decrease the chances of hernia recurrence by up to 50% and improve patient outcomes through decreased operative time and minimized recovery time.

The market’s growth is attributed to the rising incidence of hernia and favorable reimbursement policies. Market growth is expected to be aided by rising demand for effective repair devices due to the high incidence of hernia. The U.S. FDA estimates that more than a million hernia repairs are performed annually in the United States alone. Market growth is expected to be driven by the demand for a more efficient solution due to high hernia incidence.

In the 13 weeks that the COVID-19 pandemic caused the most disruption, it was estimated that 28 million elective surgeries and operations were canceled. Inguinal hernias were affected by 2.5% and umbilical and incisional hernias respectively.

Key Takeaways

- The Global Hernia Repair Devices Market is projected to reach approximately USD 9 billion by 2033, a significant increase from USD 3.3 billion in 2023.

- This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 4.1% during the forecast period from 2023 to 2033.

- The use of mesh in hernia repair surgeries can reduce the risk of hernia recurrence by up to 50%.

- In 2023, Hernia Mesh accounted for 76.1% of the hernia repair devices market, with Biologic Mesh and Synthetic Mesh as its two subtypes.

- Open Surgery was the dominant procedure type in 2023, with a market share of 76.9%, while

- Laparoscopic Surgery made up the remaining share.

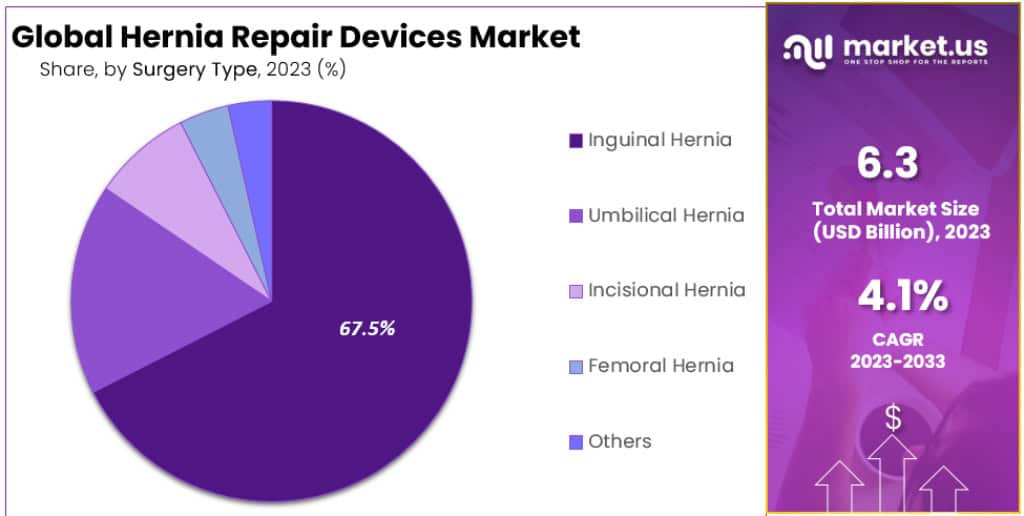

- Inguinal Hernia surgeries constituted 67.5% of the market, making it the most common hernia type requiring surgical intervention.

- The Asia Pacific region is expected to witness the fastest revenue growth, with a projected CAGR of 4.2% over the forecast period.

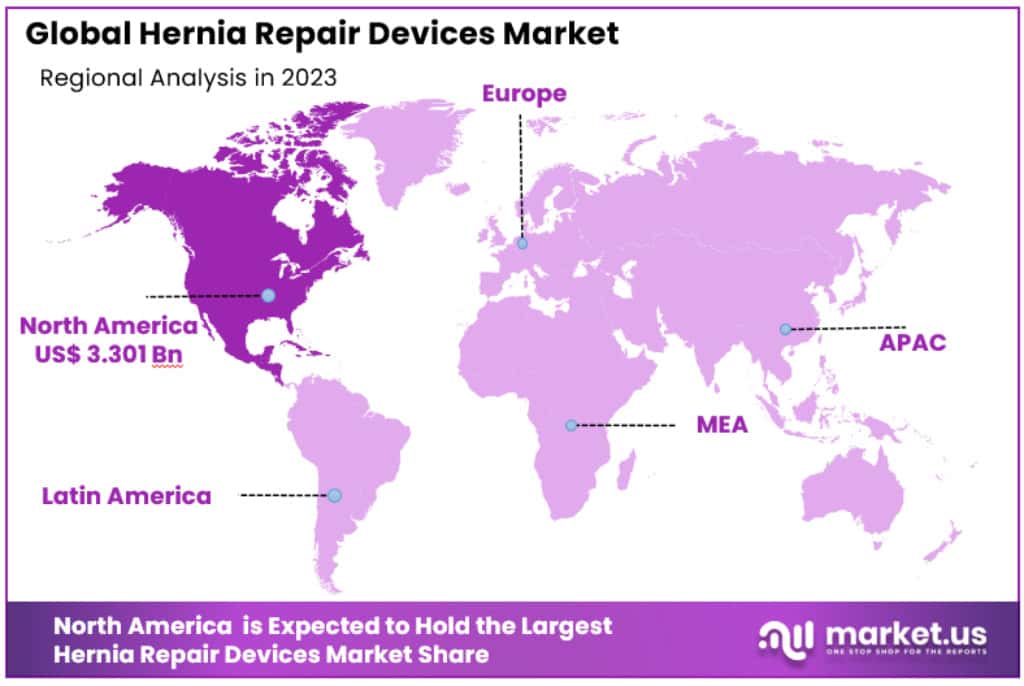

- North America dominated the market in 2023, with a revenue share of 52.4%, valued at USD 3.3 billion.

- Medtronic, a major player in the market, holds approximately 30% of the market share.

- High costs of hernia mesh repair, ranging from $100 to $3,000, can limit accessibility in lower-income countries.

Product Type Analysis

In 2023, Hernia Mesh was the biggest player in the hernia repair devices market, grabbing a huge 76.1% share. This segment is split into two types: Biologic Mesh and Synthetic Mesh. Biologic Mesh, made from natural materials, is popular for its compatibility with the human body. Synthetic Mesh, crafted from man-made materials, stands out for its durability and lower cost. Both types are in demand for their ability to reduce hernia recurrence and ensure a swift recovery.

Next, we have Hernia Fixation Devices, holding the rest of the market share. This segment includes Sutures, Tack Applicators, and Glue Applicators. Sutures, the traditional choice, are widely used for their simplicity and effectiveness. Tack Applicators offer a more modern approach, providing secure mesh placement with minimal invasion. Glue Applicators are gaining traction for their quick, pain-free application, making them a go-to for less complex hernias. Each of these fixation methods plays a key role in successful hernia repairs, catering to diverse surgical needs and preferences.

Procedure Type Analysis

Open Surgery led the hernia repair devices market, holding a commanding 76.9% share, in 2023. This traditional procedure involves a larger cut, giving surgeons direct access to the hernia. It’s widely chosen for its straightforward approach and suitability for a range of hernia types, especially larger or more complex ones. Open Surgery remains a reliable choice in many cases, favored for its familiarity among surgeons and proven effectiveness.

On the other hand, Laparoscopic Surgery, making up the remaining market share, is a less invasive option. This method uses small incisions and special cameras and tools to fix the hernia. It’s gaining popularity for its quicker recovery time, less pain post-surgery, and reduced scarring. While it requires more technical skill, Laparoscopic Surgery is becoming a preferred choice for smaller or less complicated hernias, reflecting advancements in surgical techniques and patient preferences for less invasive procedures.

Surgery Type Analysis

In 2023, Inguinal Hernia surgeries led the hernia repair devices market, taking a massive 67.5% share. This type of hernia, occurring near the groin area, is the most common and often requires surgical intervention. The high prevalence of Inguinal Hernias, especially among men, drives the demand for effective repair devices in this segment.

Umbilical Hernia surgeries follow, mainly affecting infants and sometimes adults. These hernias appear near the belly button, and while often less complex, they still contribute significantly to the market.

Incisional Hernias, arising from previous surgical incisions, represent another key segment. The increasing number of abdominal surgeries globally makes this type a notable player in the hernia repair market.

Femoral Hernias, though less common and primarily affecting older women, also hold a share. Their unique location near the upper thigh demands specialized repair approaches.

The ‘Others’ category encompasses less common types of hernias. These varied cases, while individually rare, collectively contribute to the market, necessitating a broad range of repair devices to cater to different surgical requirements.

According to Medscape, approximately 30.7% of all laparotomies performed in the U.S. each year are incisional hernia operations. Incisional hernias account for 52% of all surgeries within two years. However, 75% occur within four years. This boosts the demand for hernia repair devices.

Key Market Segments

Product Type

- Hernia Mesh

- Biologic Mesh

- Synthetic Mesh

- Hernia Fixation Devices

- Sutures

- Tack Applicators

- Glue Applicators

Procedure Type

- Open Surgery

- Laparoscopic Surgery

Surgery Type

- Inguinal Hernia

- Incisional Hernia

- Umbilical Hernia

- Femoral Hernia

- Other Surgery Types

Drivers

- Increasing Hernia Cases: The rise in hernia cases, especially inguinal hernias, is a major driver. For instance, groin hernias lead to 500,000 surgeries in the U.S. annually.

- Aging Population: The aging population has more hernia risks. In the UK, hernia prevalence increases from 5% in people aged 25-34 to 45% in men over 75.

- Obesity and Lifestyle Factors: Obesity, heavy lifting, and chronic coughing are increasing hernia risks, fueling the need for repair devices.

- Advances in Surgery: The growth of minimally invasive surgeries, like laparoscopic and robotic-assisted techniques, encourages more hernia repairs.

Restraints

- High Costs: Hernia mesh repair can be expensive, costing between $100 to $3,000, making it less accessible in lower-income countries.

- Hospital Budget Constraints: With hospitals focusing on cost-benefit analysis, expensive advanced surgical products face slower adoption.

Opportunities

- Technological Innovations: Advances like bioactive biodegradable polymers and bio-nanocellulose materials offer new opportunities for market growth.

- Emerging Markets: Developing countries, with growing healthcare spending and awareness, present significant market opportunities.

- Reimbursement Policies: Favorable reimbursement environments in certain regions encourage more surgeries using hernia repair devices.

Challenges

- COVID-19 Impact: The pandemic led to a decrease in elective surgeries, like hernia repairs, affecting market growth.

- Skill Requirement: The need for skilled professionals to operate advanced hernia repair devices is a challenge, especially in regions with less developed healthcare systems.

Trends

- Minimally Invasive Surgeries: Growing preference for laparoscopic and robotic-assisted surgeries due to their benefits like less pain and quicker recovery.

- Use of Biological Materials: A shift towards biologic mesh materials, derived from human or animal tissue, especially in complex hernia cases.

- Polymeric and Prosthetic Mesh: Polypropylene meshes, considered the gold standard, are widely used, with a broad range of prosthetics available for hernia repair.

Regional Analysis

North America was the dominant market, with a revenue share of 52.4% in 2023 due to the presence of major players. Market growth in North America is due to a growing population of elderly people, sedentary lifestyles, and high recurrence rates of hernia. The market is also growing due to rising healthcare spending and quicker FDA approvals.

The Asia Pacific experienced the fastest revenue growth over the forecast period. The market is driven by rising medical tourism, affordable treatment, and technological advances, as well as rising healthcare reimbursements. Due to the large patient population, Asian countries are seeing a rise in demand for hernia repair devices. Due to a large number of undiagnosed cases and untreated cases in the region, the market is expected to grow strongly.

North America

- Dominant Market: North America, especially the U.S., dominates the market with a 52.4% share in 2023, valued at USD 3.3 billion. This dominance is driven by advanced healthcare systems, high awareness, and favorable reimbursement policies.

- Key Factors: The presence of major companies like Johnson & Johnson, and the rising demand for minimally invasive surgeries contribute to this growth.

Asia Pacific

- Growth Rate: Asia Pacific is expected to witness the fastest growth with a CAGR of 4.2% over the forecast period.

- Drivers: Increasing medical tourism, affordable treatments, and technological advancements are key drivers in this region.

- Large Patient Pool: Countries like Japan and China are seeing a surge in demand due to a large number of undiagnosed and untreated cases.

China

- Rapid Expansion: China is seeing a rapid increase in hernia repair procedures, with 1 million stress hernia repairs in 2015, growing annually by 20-30%.

- Affordability: The cost-effectiveness of treatments in China, with an average cost of USD 922.6 per inguinal hernia case, is driving the market growth.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global market for hernia repair devices is mainly controlled by a few big companies. These include Medtronic, Ethicon Inc. (part of Johnson & Johnson), BD, Atrium, W. L. Gore & Associates, LifeCell International, B. Braun SE, Baxter, Cook, and Herniamesh. These companies are always creating new products to stay ahead in the market.

Medtronic is at the top in this market, with about 30% market share. Its strong reputation, wide reach, and a large range of products help it lead the market.

Ethicon Inc., under Johnson & Johnson, is another big name. Its Prolene mesh is one of the most used hernia repair devices globally.

BD, another major medical technology firm, also has a big part of the market. Its Bard hernia repair products are known for their quality and effectiveness.

Key Market Players

- Medtronic

- Ethicon Inc.

- BD

- Atrium

- W. L. Gore & Associates, Inc.

- LifeCell International Pvt. Ltd.

- B. Braun SE

- Baxter

- Cook

- Herniamesh S.r.l.

- Other Key Players

Recent Developments

- November 2023: Medtronic announced the launch of its new Agility FX hernia repair system, which is designed to provide surgeons with greater precision and control during minimally invasive hernia repair procedures.

- October 2023: Ethicon received FDA approval for its new Prolene Hernia Patch, which is a lightweight, biocompatible mesh that is designed to provide strong tissue reinforcement and minimize the risk of recurrence.

- September 2023: BD announced the launch of its new Bard PerFix hernia repair device, which is a self-fixating mesh that is designed to reduce the operating time and improve patient outcomes.

- August 2023: Atrium announced the launch of its new Physiomesh Xtra hernia repair device, which is designed to provide even greater tissue reinforcement and minimize the risk of recurrence.

- July 2023: W. L. Gore & Associates, Inc. announced the launch of its new Ventralight Go hernia repair device, which is a lightweight, flexible, and biocompatible mesh that is designed for use in minimally invasive hernia repair procedures.

- June 2023: LifeCell announced the launch of its new AlloMend Regen hernia repair device, which is a biologic mesh that is derived from human amniotic membrane.

Report Scope

Report Features Description Market Value (2023) USD 3.3 Billion Forecast Revenue (2033) USD 9 Billion CAGR (2023-2032) 4.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type [Hernia Mesh (Biologic Mesh and Synthetic Mesh) Hernia Fixation Devices (Sutures, Tack Applicators and Glue Applicators)] By Procedure (Open Surgery and Laparoscopic Surgery) By Surgery Type (Inguinal Hernia, Umbilical Hernia, Incisional Hernia, Femoral Hernia and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, Ethicon Inc, BD, Atrium, W. L. Gore & Associates, Inc, LifeCell International Pvt. Ltd, B. Braun SE, Baxter, Cook, Herniamesh S.r.l. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Hernia Repair Devices market in 2023?The Global Hernia Repair Devices Market size is expected to be worth around USD 9 Billion by 2033, from USD 3.3 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033.

What is the projected CAGR at which the Hernia Repair Devices market is expected to grow at?The Hernia Repair Devices market is expected to grow at a CAGR of 4.1% (2023-2033).

List the segments encompassed in this report on the Hernia Repair Devices market?Market.US has segmented the Hernia Repair Devices Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type [Hernia Mesh (Biologic Mesh and Synthetic Mesh) Hernia Fixation Devices (Sutures, Tack Applicators and Glue Applicators)] By Procedure (Open Surgery and Laparoscopic Surgery) By Surgery Type (Inguinal Hernia, Umbilical Hernia, Incisional Hernia, Femoral Hernia and Others)

Hernia Repair Devices MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Hernia Repair Devices MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Ethicon Inc.

- BD

- Atrium

- W. L. Gore & Associates, Inc.

- LifeCell International Pvt. Ltd.

- B. Braun SE

- Baxter

- Cook

- Herniamesh S.r.l.

- Other Key Players