Global Herbal Toothpaste Market Size, Share, Growth Analysis By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online/E-commerce, Pharmacies and Drugstores, Others), By Application (Adults, Children, Babies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146088

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

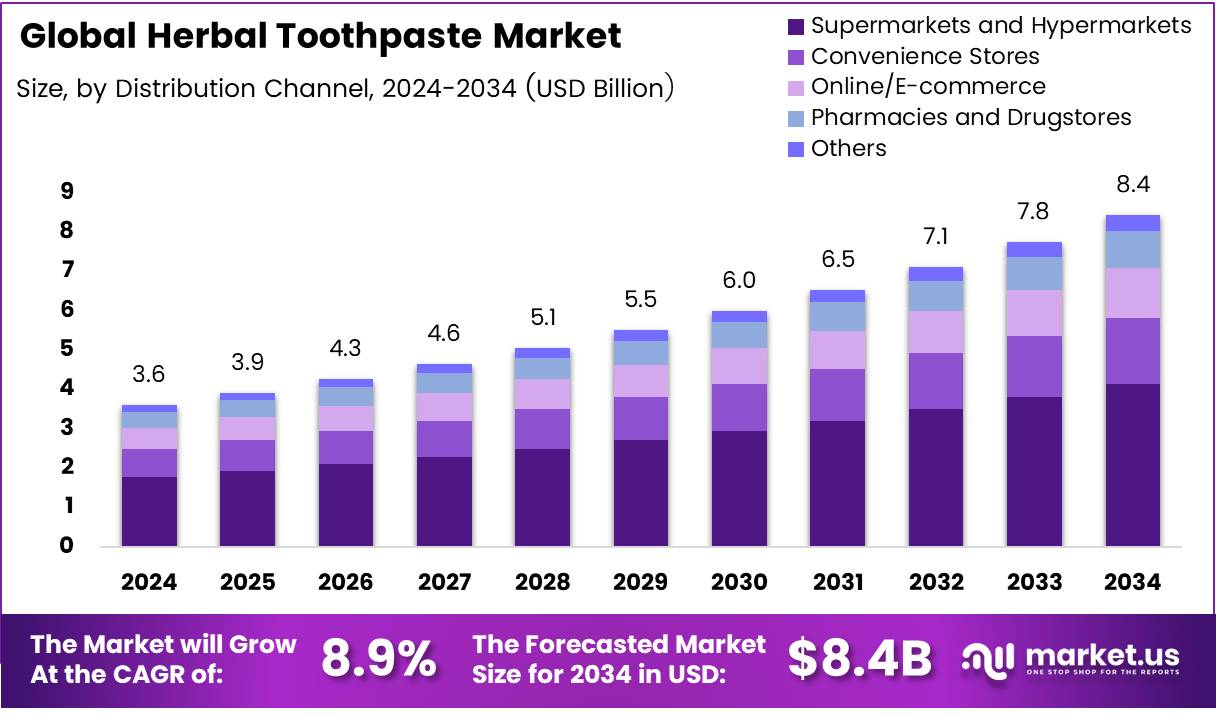

The Global Herbal Toothpaste Market size is expected to be worth around USD 8.4 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The herbal toothpaste market is growing fast as people all over the world become more careful about their health and the products they use every day. Herbal toothpaste is made using natural ingredients like neem, clove, mint, charcoal, and aloe vera. It doesn’t contain chemicals like fluoride or artificial flavors, making it a safer choice for people who want to avoid harsh ingredients. As consumers move toward cleaner and more sustainable products, herbal toothpaste is becoming a popular option in both developed and emerging markets.

Herbal toothpaste is not just a product trend—it’s a shift in consumer behavior. More people are looking for natural options that are safe, effective, and environmentally friendly. With around 3.5 billion people suffering from oral disorders globally, according to bmcoralhealth, consumers are now paying more attention to what they put in their mouths.

Herbal toothpaste offers benefits beyond basic cleaning—it often includes antibacterial, anti-inflammatory, and breath-freshening properties using time-tested natural ingredients. This creates an opportunity for companies to build trust and long-term customer loyalty by offering solutions that feel both modern and rooted in traditional health knowledge.

The overall herbal toothpaste market is expanding as brands continue to respond to demand for natural products. According to Times of India, over 70% of new toothpaste launches are now in the natural category, showing how fast the shift is happening. Consumers want safe, chemical-free products, and businesses are adjusting their product lines to match this demand.

Natural positioning, sustainability, and clean-label claims are helping companies attract attention in a crowded market. The demand is especially strong in countries like India, where herbal remedies already have cultural acceptance. But now, global consumers are also showing interest due to growing awareness around wellness and preventive healthcare.

The market size is also being supported by rising oral health concerns. According to WHO, more than 1 billion people suffer from severe gum diseases worldwide. This health concern, combined with a rising focus on personal wellness, creates space for herbal brands to grow. Governments in several countries are also investing in traditional medicine and encouraging natural health products.

These include funding support, simplified regulations, and promotion of Ayurveda and herbal care. However, to grow globally, companies still need to follow rules related to safety, labeling, and clinical testing. This makes it important to balance natural appeal with proven effectiveness.

Key Takeaways

- Global Herbal Toothpaste Market is projected to reach USD 8.4 Billion by 2034, growing from USD 3.6 Billion in 2024 at a CAGR of 8.9% (2025–2034).

- Supermarkets and Hypermarkets held a dominant 34.1% share in 2024 under the Distribution Channel segment, driven by strong brand trust and promotional offers.

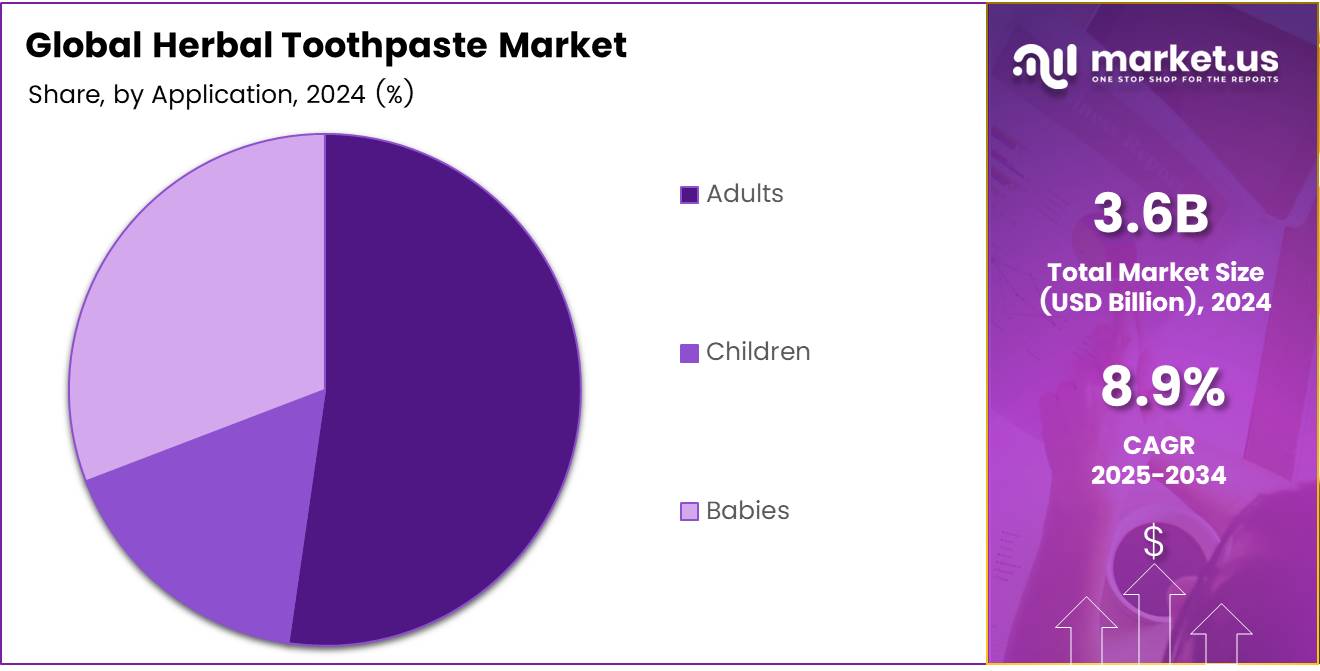

- Adults were the leading consumer group in 2024, driven by a rising preference for fluoride-free, chemical-free oral care products.

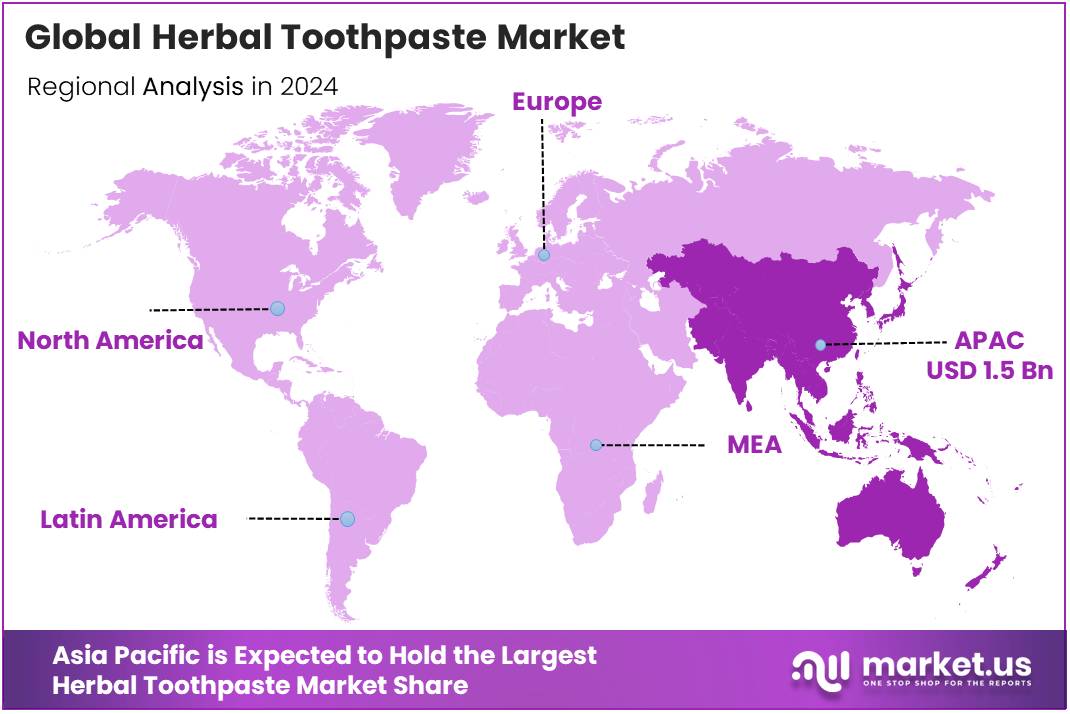

- Asia Pacific led the global market in 2024 with a 44.3% share, valued at USD 1.5 Billion, fueled by the popularity of Ayurvedic and herbal oral care in countries like India, China, and Thailand.

Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 34.1% share owing to strong shelf presence and consumer trust

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Herbal Toothpaste Market, with a 34.1% share. Their expansive product displays, bundled deals, and trusted brand image played a crucial role in influencing consumer purchasing decisions. These outlets offer direct physical access to multiple herbal toothpaste brands, boosting impulse buying and reinforcing consumer loyalty.

Convenience Stores also contributed significantly, particularly in urban and semi-urban regions. Their strategic locations and longer operational hours make them favorable for quick, on-the-go purchases, especially among working professionals and daily commuters seeking accessible oral care products.

The Online/E-commerce channel has been gaining strong traction, driven by the increasing digital penetration and consumer preference for doorstep delivery. Although lacking the sensory experience of physical stores, e-commerce platforms offer the benefit of comparison shopping, targeted deals, and a wider variety of herbal options, appealing particularly to health-conscious millennials and Gen Z.

Pharmacies and Drugstores remain a trusted outlet, particularly for consumers looking for medically-backed or dentist-recommended herbal formulations. Their endorsement-oriented positioning enhances brand credibility, especially among older demographics.

The Others segment, including specialty organic stores and direct selling models, has seen niche growth, propelled by the rising demand for personalized and premium herbal oral care solutions.

Application Analysis

Adults dominate herbal toothpaste usage in 2024 due to heightened oral health awareness

In 2024, Adults held a dominant market position in the By Application Analysis segment of the Herbal Toothpaste Market. The surge in demand is primarily attributed to increased awareness regarding natural oral hygiene, gum health, and long-term dental care benefits. Adults are more inclined to seek fluoride-free, chemical-free alternatives, aligning with the broader shift toward clean-label personal care products.

Children represent a growing segment as parents increasingly seek gentle, safe, and non-toxic options for their young ones. Herbal toothpaste brands are catering to this demand by introducing fruit-flavored variants and cartoon-themed packaging, making brushing more appealing for kids.

The Babies segment, while still niche, is emerging steadily. The rise in natural parenting trends and concerns over synthetic ingredients in infant oral care products are pushing demand for herbal toothpastes designed specifically for infants. These products are often free from SLS, parabens, and artificial sweeteners, and are formulated with natural extracts such as chamomile and xylitol, enhancing their safety and appeal among new parents.

Key Market Segments

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online/E-commerce

- Pharmacies and Drugstores

- Others

By Application

- Adults

- Children

- Babies

Drivers

Rising Consumer Awareness of Natural Ingredients Fuels Market Expansion

One of the main drivers of the herbal toothpaste market is the growing consumer interest in natural and chemical-free products. More people are becoming health-conscious and prefer personal care items that are safe, eco-friendly, and gentle on their bodies. Herbal toothpaste, made with natural ingredients like neem, clove, and mint, is seen as a safer and healthier choice compared to regular toothpaste filled with synthetic chemicals.

Another key factor is the rising number of dental problems such as cavities, gum infections, and bad breath. People are turning toward herbal options because they believe these products help prevent dental issues without harsh side effects.

Additionally, the growing trust in traditional medicine systems like Ayurveda is playing a big role. Ayurveda has long promoted the use of herbs for dental care, and this belief continues to influence purchasing decisions—especially in countries like India. Many consumers see herbal toothpaste as not just a product, but as part of a healthier lifestyle rooted in time-tested traditions.

With a global push towards sustainable and natural living, the herbal toothpaste market is gaining traction across both developed and developing nations. Companies that promote transparency, natural ingredients, and wellness-oriented branding are well-positioned to benefit from this ongoing trend.

Restraints

Lack of Standardization and Certification Slows Market Growth

Despite its popularity, the herbal toothpaste market faces several challenges. A major restraint is the lack of standardization and proper certifications. Many herbal products in the market vary in quality, which makes consumers unsure about their effectiveness and safety. Without regulatory bodies ensuring product quality and authenticity, trust becomes a big issue for new buyers.

Another challenge is the shorter shelf life of herbal toothpaste. Since these products use natural preservatives—or sometimes none at all—they tend to spoil faster than chemical-based alternatives. This creates issues in storage, transportation, and retail, especially in regions with hot climates or less reliable supply chains.

Also, limited awareness and misconceptions about herbal products in some regions restrict market reach. People may believe herbal options are less effective, or they may not be familiar with the ingredients and their benefits.

Overall, while demand is growing, the market needs better quality control, clearer labeling, and public education to ensure sustainable growth. Addressing these hurdles can significantly enhance consumer trust and market adoption.

Growth Factors

Product Innovation with Functional Ingredients Unlocks New Potential

The herbal toothpaste market has strong growth opportunities, especially through innovation. Brands that introduce new formulations with added functional benefits—like activated charcoal for whitening, or turmeric for its anti-inflammatory properties—can stand out in a crowded market. Consumers today are looking for more than just basic dental care; they want products that offer multiple benefits in one tube.

Expanding into rural and semi-urban areas, particularly in Asia and Africa, presents another major opportunity. These regions often have a traditional preference for herbal remedies and are seeing rising income levels. With better awareness and distribution networks, brands can tap into a large and loyal customer base.

Partnering with dental professionals and Ayurvedic practitioners can also build credibility. If dentists and traditional health experts recommend herbal toothpaste, it can encourage hesitant consumers to try it out. These collaborations can be useful in gaining trust and reaching new segments.

With the right marketing strategies and innovations, the herbal toothpaste market can grow significantly. Companies that adapt to customer needs and explore untapped regions will be best placed to capture future growth.

Emerging Trends

Rise of Vegan and Cruelty-Free Toothpaste Shapes Consumer Preferences

A major trend reshaping the herbal toothpaste market is the rising demand for vegan and cruelty-free products. Today’s consumers, especially younger ones, are more conscious about how their products are made. They prefer toothpaste that contains no animal-based ingredients and is not tested on animals. Brands offering these values are gaining a strong competitive edge.

Celebrity endorsements and influencer marketing are also fueling the trend. Many herbal toothpaste brands are collaborating with wellness influencers and lifestyle bloggers to reach health-conscious buyers. These campaigns create awareness and boost brand image, particularly among urban and millennial audiences.

Another interesting trend is the use of rare or exotic herbs. Ingredients like miswak, clove oil, tea tree oil, and myrrh are gaining popularity for their unique benefits and natural appeal. These ingredients not only offer therapeutic advantages but also help differentiate brands in the marketplace.

Overall, trends in lifestyle choices and marketing methods are heavily influencing buying behavior. Brands that align their offerings with these shifts—natural, ethical, and wellness-focused—will continue to thrive in the herbal toothpaste market.

Regional Analysis

Asia Pacific Dominates the Global Herbal Toothpaste Market with 44.3% Share Valued at USD 1.5 Billion

The global herbal toothpaste market demonstrates significant regional variation, with Asia Pacific emerging as the dominant region, accounting for 44.3% of the global market share, valued at approximately USD 1.5 billion in 2024. This strong performance is primarily driven by the region’s deep-rooted preference for herbal and Ayurvedic oral care products, especially in countries such as India, China, and Thailand.

Regional Mentions:

The increasing awareness regarding the side effects of chemical-based toothpaste, coupled with growing consumer inclination toward natural and plant-based ingredients, further supports market expansion in this region. India, in particular, has seen a surge in domestic brands leveraging Ayurvedic formulations, contributing notably to the overall regional growth.

In North America, the herbal toothpaste market is growing steadily, fueled by increasing health consciousness and the rising demand for organic and chemical-free personal care products. The U.S. and Canada are the primary contributors, with a notable rise in shelf space dedicated to herbal oral care in retail chains and pharmacies. The market here benefits from a strong base of consumers opting for natural alternatives due to concerns about fluoride and synthetic additives.

Europe follows closely, driven by a similar health and sustainability-oriented consumer mindset. Countries such as Germany, the UK, and France have seen a consistent uptick in demand, supported by the clean-label movement and strong regulatory frameworks promoting natural products.

The Middle East & Africa region reflects a moderate yet promising growth trajectory, where cultural acceptance of herbal and traditional remedies aligns with rising disposable incomes and improved access to premium oral care products.

In Latin America, markets such as Brazil and Mexico are witnessing growing consumer interest in natural personal care, further accelerated by expanding retail channels and marketing by both local and international brands focusing on herbal product lines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global herbal toothpaste market is experiencing robust growth, propelled by increasing consumer demand for natural and eco-friendly oral care solutions. Key players are strategically leveraging this trend to expand their market presence and cater to evolving consumer preferences.

Patanjali Ayurved Limited continues to dominate the Indian market with its Dant Kanti range, emphasizing Ayurvedic formulations that resonate with health-conscious consumers seeking traditional remedies. Similarly, Dabur India Limited maintains a strong foothold with its Meswak and Red toothpaste variants, capitalizing on its legacy in herbal healthcare. Vicco Laboratories, with its Vajradanti line, remains a trusted brand, reinforcing its commitment to natural ingredients and time-tested formulations.

Himalaya Wellness Company is expanding its global footprint, notably with increased production capacity to meet growing international demand. Amway Corp. offers its Glister Herbal toothpaste, integrating herbal extracts to appeal to consumers seeking multi-action oral care solutions.

Multinational corporations are also intensifying their focus on the herbal segment. Colgate-Palmolive Company has introduced products like Vedshakti, blending natural ingredients to cater to the herbal market segment. Sensodyne (GSK plc) has expanded its portfolio with herbal variants, addressing the niche of consumers with sensitive teeth seeking natural alternatives. Procter & Gamble and Unilever are leveraging their extensive distribution networks to introduce herbal toothpaste options under their respective brands, aligning with the global shift towards natural personal care products.

The Clorox Company, through its Burt’s Bees brand, offers fluoride-free, plant-based toothpaste options, appealing to environmentally conscious consumers. Overall, these key players are actively innovating and diversifying their product lines to meet the surging demand for herbal toothpaste.

Top Key Players in the Market

- Unilever

- Patanjali Ayurved Limited

- Sensodyne (GSK plc)

- Himalaya Wellness Company

- Amway Corp.

- Dabur India Limited

- The Clorox Company (Burt’s Bees)

- Colgate-Palmolive Company

- Vicco Laboratories

- Procter & Gamble

Recent Developments

- In November 2024, Theranautilus raised $1.2 million in a seed funding round, led by pi Ventures, to advance its nanorobotics-based oral healthcare technology and accelerate R&D initiatives.

- In August 2024, Boots partnered with The Hygiene Bank to launch a donation appeal for toothbrushes and toothpaste, aiming to support children’s oral hygiene as they return to school.

- In March 2025, Colgate-Palmolive entered the fresh pet food market by acquiring Prime100, marking a strategic expansion into the growing premium pet nutrition sector.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 8.4 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online/E-commerce, Pharmacies and Drugstores, Others), By Application (Adults, Children, Babies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unilever, Patanjali Ayurved Limited, Sensodyne (GSK plc), Himalaya Wellness Company, Amway Corp., Dabur India Limited, The Clorox Company (Burt’s Bees), Colgate-Palmolive Company, Vicco Laboratories, Procter & Gamble Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unilever

- Patanjali Ayurved Limited

- Sensodyne (GSK plc)

- Himalaya Wellness Company

- Amway Corp.

- Dabur India Limited

- The Clorox Company (Burt’s Bees)

- Colgate-Palmolive Company

- Vicco Laboratories

- Procter & Gamble