Global Herbal Beauty Products Market By Products (Skin care, Fragrance, Hair care, Others), By End-use (Women, Men), By Distribution Channel (Hypermarkets, Pharmacy and Drug stores, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132795

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

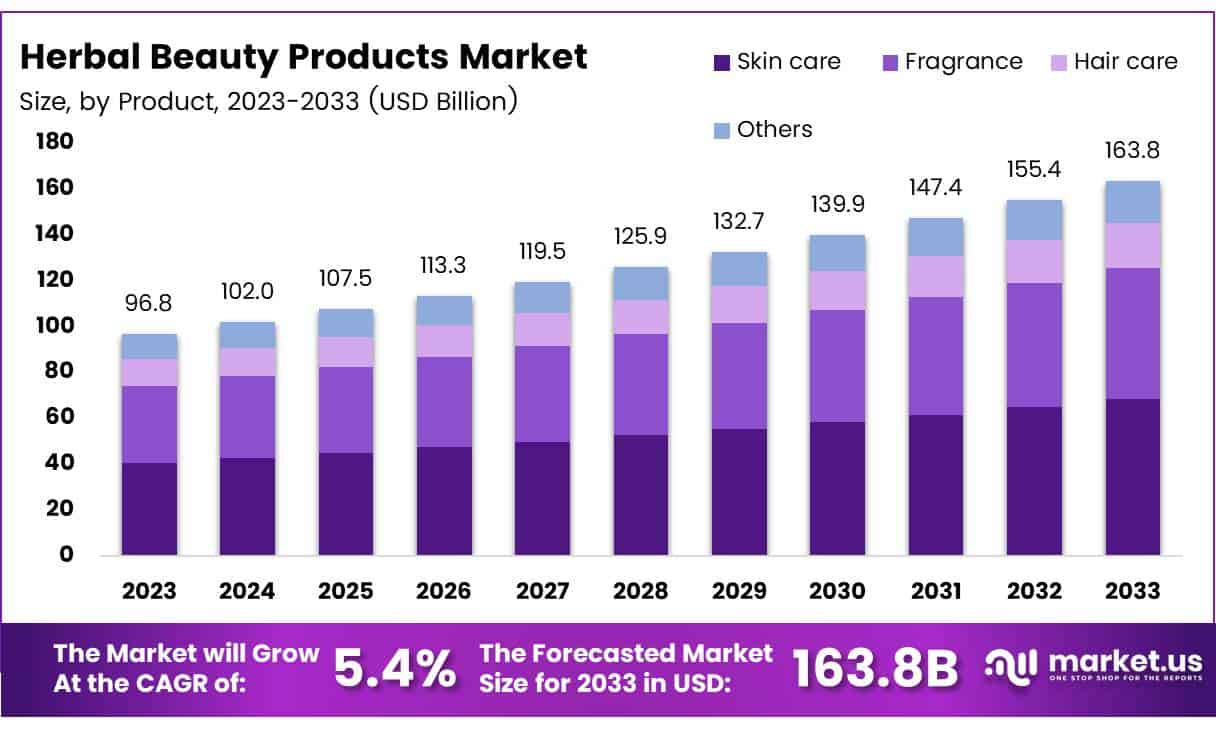

The Global Herbal Beauty Products Market size is expected to be worth around USD 163.8 Billion by 2033, from USD 96.8 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Herbal beauty products are cosmetics derived from plant-based ingredients, often marketed as natural or organic. These products utilize botanicals, essential oils, and herbal extracts, such as aloe vera, turmeric, and neem, to address various skin, hair, and personal care needs. With consumers increasingly seeking organic, chemical-free solutions, herbal beauty products have seen significant growth within the beauty and personal care sector.

The herbal beauty products market encompasses a wide range of categories, including skincare, haircare, cosmetics, and personal hygiene items, all formulated with natural ingredients.

A key driver of this market growth is the growing consumer demand for safe, sustainable, and natural beauty solutions. This trend is further supported by a shift toward eco-friendly and health-conscious products, as well as an increasing preference for traditional wellness practices like Ayurveda.

The market’s expansion is also fueled by the growing use of e-commerce. Online shopping provides consumers with greater access to herbal beauty products, allowing for easier comparison of brands and ingredients. The rise of digital platforms has broadened market reach and enabled brands to connect directly with global consumers.

Several factors are driving the growth of the herbal beauty market. First, there is increasing awareness about the harmful effects of synthetic chemicals in personal care products. Consumers are increasingly looking for products that are both effective and safer to use, making herbal beauty products an appealing option.

Additionally, growing interest in Ayurveda and traditional wellness is contributing to the long-term demand for herbal beauty products, particularly in North America and Europe. For example, a study found that 46% of consumers who had used Ayurvedic facial products expressed interest in continuing to use them in the future, reflecting strong consumer loyalty to herbal products.

Government regulations also play a role in shaping the market. Many countries, including the U.S. and those in the European Union, are introducing stricter regulations to ensure the safety and authenticity of herbal products. These regulations help protect consumers and promote greater transparency in ingredient sourcing, which builds trust in herbal beauty products.

Furthermore, increasing government support for research and development in the herbal beauty sector is driving innovation. This includes funding studies on the effectiveness of herbal ingredients and supporting eco-friendly manufacturing processes, both of which are likely to spur market growth.

E-commerce continues to be a vital channel for the herbal beauty products market. A report found that 45% of U.S. consumers are likely to purchase makeup products online, highlighting the shift toward digital shopping in the beauty sector.

Key Takeaways

- The global Herbal Beauty Products Market is projected to reach USD 163.8 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

- Skin care products dominate the market, accounting for 42% of the total share in 2023, driven by the demand for natural and organic ingredients.

- Women represent the largest consumer segment, holding a 73% share in the Herbal Beauty Products Market in 2023.

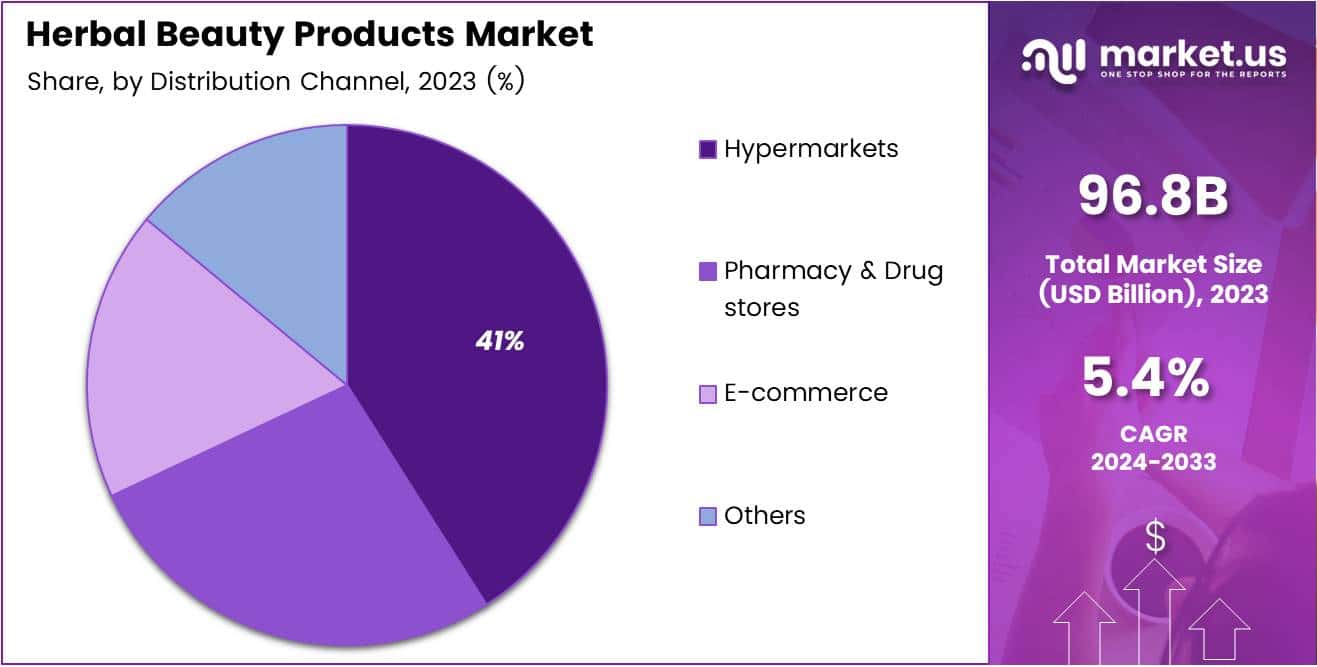

- Hypermarkets lead the distribution channel segment with a 41% share in 2023.

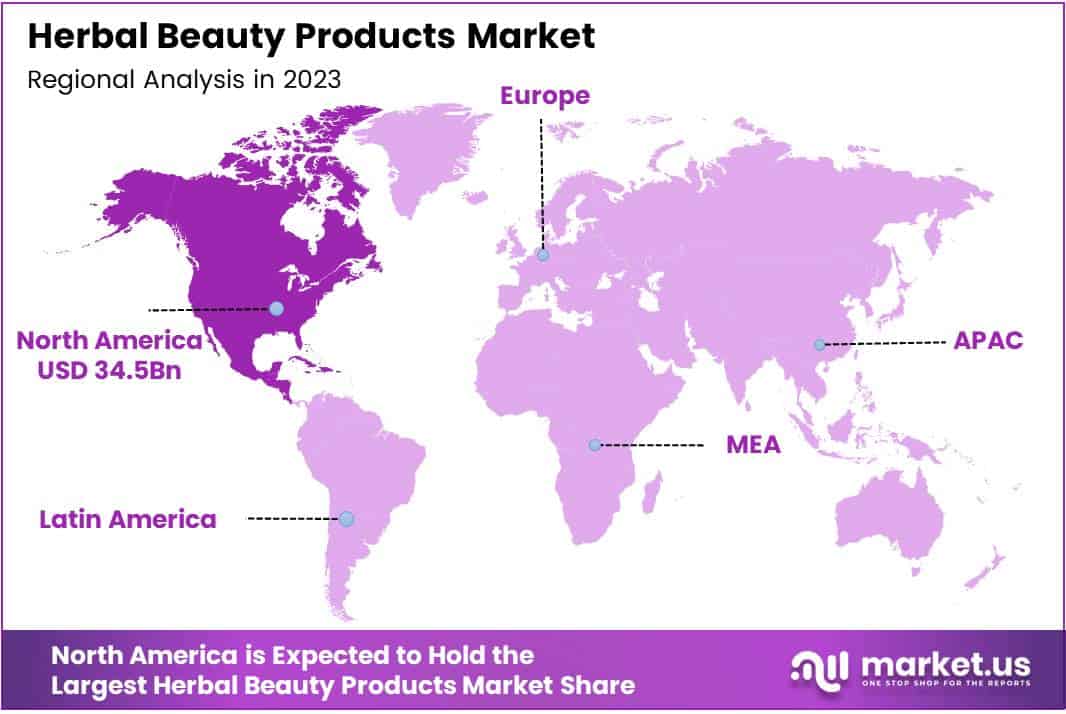

- North America holds the largest market share at 36%, valued at USD 34.56 billion, fueled by growing awareness of the harmful effects of synthetic ingredients in beauty products.

Products Analysis

Skin Care Dominated the Herbal Beauty Products Market in 2023 with a 42% Share

In 2023, Skin Care held a dominant market position in the By Products Analysis segment of the Herbal Beauty Products Market, accounting for 42% of the market share. This substantial share can be attributed to the growing consumer preference for natural and organic ingredients in skincare formulations, driven by increasing awareness of the potential harmful effects of synthetic chemicals in beauty products.

Skin care products such as cleansers, moisturizers, and anti-aging treatments, which leverage the benefits of herbal extracts like aloe vera, green tea, and chamomile, are gaining significant traction among health-conscious consumers.

Fragrance products followed as the second-largest segment, capturing a notable market share in 2023. The demand for herbal-based perfumes and body sprays has surged due to rising consumer inclination toward products that are free from synthetic fragrances and potentially harmful chemicals.

Hair care products, including shampoos, conditioners, and treatments, also contributed to the growth of the market, with an increasing number of consumers seeking natural solutions for scalp care and hair nourishment. The growing awareness about the scalp-hair connection has further boosted demand for herbal-based formulations.

End-Use Analysis

Women Dominate Herbal Beauty Products Market with 73% Share in 2023

In 2023, women held a dominant market position in the By End-Use Analysis segment of the Herbal Beauty Products Market, accounting for a substantial 73% share.

This significant market share can be attributed to the growing consumer preference for natural, chemical-free beauty solutions, which aligns with the increasing awareness of skin and hair care. The rising trend of self-care, along with women’s inclination towards holistic wellness, has propelled the demand for herbal and organic beauty products, further cementing their market leadership.

On the other hand, the men’s segment has also seen notable growth, albeit at a smaller pace compared to women. The increasing focus on personal grooming and wellness among men, coupled with the surge in awareness around the benefits of herbal ingredients, has driven the uptake of herbal beauty products in this demographic.

However, despite the growth in male consumers, women remain the predominant end-user group, driven by broader product offerings, enhanced marketing targeting, and a stronger preference for natural beauty alternatives.

Overall, the Herbal Beauty Products Market continues to be predominantly driven by female consumers, with both segments experiencing steady growth as demand for organic and sustainable beauty solutions rises globally.

Distribution Channel Analysis

Hypermarkets Led Herbal Beauty Products Distribution with 41% Market Share in 2023

In 2023, Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Herbal Beauty Products Market, with a 41% share.

The substantial share can be attributed to the widespread availability and convenience offered by hypermarkets, which typically stock a wide range of herbal beauty products, catering to diverse consumer preferences. The large footfall in hypermarkets, coupled with strategic product placements and promotions, has made them a key point of sale for mass-market herbal beauty products.

Pharmacies and drug stores followed as the second-largest distribution channel, capturing a significant portion of the market. These outlets are particularly favored by consumers seeking trusted and specialized health and beauty products. The trust placed in pharmacies for authentic and effective products has driven steady growth in this segment.

E-commerce, with its growing accessibility and convenience, has also become an increasingly important distribution channel. The expansion of online retail platforms has facilitated broader consumer reach, especially among younger, tech-savvy consumers.

The flexibility of online shopping, combined with the increasing trend of home delivery services, has positioned e-commerce as a key player in the herbal beauty sector. The Others category includes specialty stores and direct sales, contributing a smaller yet still notable share of the market.

Key Market Segments

By Products

- Skin care

- Fragrance

- Hair care

- Others

By End-use

- Women

- Men

By Distribution Channel

- Hypermarkets

- Pharmacy & Drug stores

- E-commerce

- Others

Drivers

Rising Consumer Demand for Natural and Sustainable Beauty Products

The growing consumer awareness surrounding the potential harms of synthetic chemicals and the benefits of natural ingredients is a key driver in the herbal beauty products market. As consumers become more health-conscious and environmentally aware, there is a noticeable shift towards products that use organic, chemical-free formulations.

Many consumers are now prioritizing products that align with their values of wellness, sustainability, and environmental responsibility. This is further supported by the increasing interest in eco-friendly packaging and cruelty-free production methods. Moreover, the popularity of veganism and ethical consumption is contributing to a shift in consumer preferences towards beauty products that are free from animal-derived ingredients and not tested on animals.

Brands that can offer transparency in their ingredient sourcing, promote environmental sustainability, and adopt ethical practices are increasingly gaining consumer trust and loyalty. The alignment of these trends with consumer values is expected to fuel the demand for herbal and natural beauty products, creating a robust market for sustainable, cruelty-free, and vegan offerings.

As such, businesses in this sector are positioning themselves to meet these evolving demands, with a focus on offering products that are not only good for the skin but also in harmony with the environment.

Restraints

Challenges Facing the Herbal Beauty Products Market

The herbal beauty products market faces several constraints, one of the primary challenges being intense competition from chemical-based products. Chemical-based alternatives like chemical cosmetic often provide faster and more noticeable results, which can attract consumers who prioritize immediate visible effects over the long-term benefits typically associated with herbal products.

This can hinder the growth of herbal beauty products, especially among consumers who are not fully aware of the benefits of natural ingredients. Additionally, the limited availability of certain herbs poses another significant constraint. Sourcing some of these ingredients in a sustainable manner can be challenging due to seasonal variations, climate change, or geographical limitations, which may lead to disruptions in the supply chain.

As a result, this can affect the production and pricing of herbal beauty products, making it harder for manufacturers to maintain consistent availability and quality. These factors create hurdles for companies within the herbal beauty industry, as they must navigate both the competition from chemical products and the complexities of sourcing high-quality, sustainable ingredients to meet consumer demand.

Growth Factors

Growth Opportunities in the Herbal Beauty Products Market

The herbal beauty products market is poised for substantial growth, driven by increasing consumer interest in natural, sustainable, and wellness-focused products such as anti-aging products, beauty products. One key opportunity lies in product innovation using rare and potent herbal ingredients.

By introducing unique botanicals such as ginseng, moringa, or spirulina into skincare and cosmetic formulations, brands can differentiate themselves and appeal to consumers seeking distinctive, high-performance solutions. These rare ingredients are associated with a range of skin and health benefits, including anti-aging, revitalization, and detoxification, which can attract niche customer segments.

Additionally, collaboration with wellness and lifestyle brands presents another growth avenue. As consumers become more health-conscious, partnering with established wellness labels can enhance brand credibility and expand market reach, especially among individuals who prioritize holistic well-being. Such partnerships can open up cross-promotional opportunities, where herbal beauty products are marketed as part of a broader wellness lifestyle.

Furthermore, the increasing popularity of men’s grooming and skincare presents an untapped market. Developing herbal beauty products specifically designed for men can help companies target this growing segment, which is showing rising demand for natural and sustainable personal care options.

By addressing the specific needs of male consumers, such as anti-aging and skin irritation relief, herbal beauty brands can successfully cater to this underserved market and expand their customer base. Together, these strategies offer promising opportunities for growth in the competitive herbal beauty sector.

Emerging Trends

Clean Beauty Movement Driving Market Growth

The herbal beauty products market is experiencing significant growth, largely driven by the rising demand for clean beauty products. This movement emphasizes transparency, with consumers increasingly seeking beauty products that contain natural ingredients and avoid synthetic chemicals.

As awareness of the harmful effects of certain chemicals in cosmetics grows, consumers are gravitating toward brands that offer clear labeling and demonstrate a commitment to eco-friendly and sustainable practices. This trend is not only shaping consumer preferences but is also influencing product development, pushing companies to innovate and align their offerings with the growing desire for safer, toxin-free options.

Additionally, celebrity and influencer endorsements have played a pivotal role in boosting the popularity of herbal beauty brands, often making them more relatable and aspirational to wider audiences. Through social media platforms, influencers and celebrities introduce their followers to herbal-based beauty products, increasing market visibility and driving sales.

Furthermore, the integration of beauty with overall wellness is becoming more common, as many consumers now seek products that support both skin health and general well-being.

Herbal beauty products, such as skincare products infused with herbal teas or supplements promoting radiant skin, are gaining traction. This holistic approach to health and beauty reflects a broader consumer interest in self-care routines that address both internal and external wellness, further propelling the demand for herbal beauty solutions.

These interrelated trends are shaping the future trajectory of the market and creating new opportunities for brands to tap into the growing consumer base.

Regional Analysis

North America Dominating Region with 36% Market Share, Valued at USD 34.56 Billion

The global herbal beauty products market is witnessing substantial growth across various regions, driven by increasing consumer demand for natural, organic, and chemical-free beauty solutions.

North America dominates the market, holding a significant share of approximately 36%, valued at USD 34.56 billion. This region’s growth can be attributed to the rising consumer awareness regarding the adverse effects of synthetic ingredients in skincare and personal care products.

The U.S. accounts for the largest share of the North American market, driven by the high adoption rate of clean beauty products, the growing influence of wellness trends, and the increasing prevalence of vegan and cruelty-free product demands. Furthermore, the market is bolstered by a well-established retail network, including both physical stores and online platforms, which facilitates widespread distribution of herbal beauty products.

Regional Mentions:

Europe is another key region in the global market, accounting for a significant portion of the market share. The region’s preference for organic and eco-friendly beauty products has been a primary driver of market expansion.

In countries such as Germany, France, and the UK, there is an increasing shift towards natural beauty solutions, with consumer purchasing decisions heavily influenced by sustainability and ingredient transparency. The European market is projected to grow steadily, fueled by regulatory support for natural cosmetic formulations and the presence of numerous regional players focused on clean beauty innovations.

Asia Pacific is anticipated to experience the highest growth rate over the forecast period. This can be attributed to the expanding middle-class population, particularly in countries like China, India, and Japan, where the demand for herbal beauty products is escalating rapidly.

The rising disposable income and increasing preference for natural beauty products are also key factors driving market growth in the region. Additionally, the growing influence of traditional herbal remedies and beauty rituals in countries like India and China further supports the market’s expansion.

Latin America and the Middle East & Africa also contribute to the overall market growth, albeit at a slower pace compared to the dominant regions. In Latin America, countries like Brazil are witnessing a surge in demand for organic beauty products, driven by increasing consumer awareness of skincare benefits. In the Middle East & Africa, rising interest in herbal and natural beauty products, combined with the region’s expanding retail infrastructure, offers significant growth potential.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global herbal beauty products market has witnessed significant growth in recent years, driven by increasing consumer demand for natural and sustainable alternatives to traditional beauty products. The key players within this market are poised to capitalize on these trends by leveraging their expertise in plant-based ingredients and natural formulations.

Weleda AG continues to be a dominant force, with a strong global presence and a reputation for producing high-quality, biodynamic skincare products. The company’s commitment to sustainability and eco-friendly practices aligns well with the growing consumer preference for ethically sourced, natural beauty solutions.

Bio Veda Action Research Co. and Shahnaz Ayurveda Pvt. Ltd are notable for their deep-rooted focus on traditional Ayurvedic formulations, offering consumers a blend of ancient wisdom and modern beauty science. This positions them as key contributors to the rising interest in holistic and therapeutic beauty solutions.

The Himalaya Drug Company and Lotus Herbals Limited benefit from their strong brand recognition and extensive product portfolios, which span skincare, haircare, and wellness. Their continuous innovation and product diversification enable them to remain competitive in a rapidly evolving market.

INIKA stands out with its premium organic offerings, appealing to the high-end segment of the market where consumers are willing to pay a premium for certified organic and cruelty-free products. This aligns with the broader consumer shift towards conscious consumption.

Other players such as Marc Anthony Cosmetics, Inc., Dr. Hauschka, and Surya Brasil Organic Beauty Products also contribute significantly through their emphasis on clean beauty, plant-based ingredients, and ethical manufacturing practices. These companies have effectively tapped into the eco-conscious consumer segment, further accelerating market growth.

Top Key Players in the Market

- Weleda AG

- Bio Veda Action Research Co.

- Herb Labo Co. Ltd

- GROWN ALCHEMIST

- Shenzhen Panni E-Business Co. Ltd.

- Marc Anthony Cosmetics, Inc.

- The Himalaya Drug Company

- Shahnaz Ayurveda Pvt. Ltd

- Lotus Herbals Limited

- Hemas Holdings PLC.

- Surya Brasil Organic Beauty Products

- INIKA

- Guangzhou Liwei Cosmetics Co Ltd.

- Dr. Hauschka

- VLCC Healthcare Ltd.

Recent Developments

- In September 2024, Seen Hair Care successfully secured $9 million in funding to support its growth and innovation efforts in the beauty industry, while Oak Essentials also garnered significant dual funding, further fueling the expansion of its natural skincare line.

- In May 2024, Three Ships Beauty, an AAPI-owned clean beauty brand, raised $3.5 million in funding to accelerate its expansion and enhance product development, reflecting growing support for diverse, mission-driven beauty companies.

- In October 2023, China committed $2.6 billion to develop its traditional Chinese medicine (TCM) infrastructure, signaling a major push to revitalize and globalize its indigenous healthcare practices in response to growing demand for natural wellness products.

- In February 2024, HAL Investments injected €140 million in preferred share capital into Koppert, with the funds directed towards expanding the company’s production facilities and enhancing its working capital to support global growth, particularly in the natural health and wellness sector.

Report Scope

Report Features Description Market Value (2023) USD 96.8 Billion Forecast Revenue (2033) USD 163.8 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Products (Skin care, Fragrance, Hair care, Others), By End-use (Women, Men), By Distribution Channel (Hypermarkets, Pharmacy and Drug stores, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Weleda AG, Bio Veda Action Research Co., Herb Labo Co. Ltd, GROWN ALCHEMIST, Shenzhen Panni E-Business Co. Ltd., Marc Anthony Cosmetics, Inc., The Himalaya Drug Company, Shahnaz Ayurveda Pvt. Ltd, Lotus Herbals Limited, Hemas Holdings PLC., Surya Brasil Organic Beauty Products, INIKA, Guangzhou Liwei Cosmetics Co Ltd., Dr. Hauschka, VLCC Healthcare Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Herbal Beauty Products MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Herbal Beauty Products MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Weleda AG

- Bio Veda Action Research Co.

- Herb Labo Co. Ltd

- GROWN ALCHEMIST

- Shenzhen Panni E-Business Co. Ltd.

- Marc Anthony Cosmetics, Inc.

- The Himalaya Drug Company

- Shahnaz Ayurveda Pvt. Ltd

- Lotus Herbals Limited

- Hemas Holdings PLC.

- Surya Brasil Organic Beauty Products

- INIKA

- Guangzhou Liwei Cosmetics Co Ltd.

- Dr. Hauschka

- VLCC Healthcare Ltd.