Global Hemodialysis and Peritoneal Dialysis Market By Type (Hemodialysis, Conventional hemodialysis, Short daily hemodialysis, Nocturnal hemodialysis, Peritoneal dialysis, Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD)) By Product -Device(Machine, Dialyzer, Water treatment system, Others) Consumables (Bloodline, Concentrates, Catheters, Others, Services) By End-user (Home-based, Hospital-based) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 53915

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

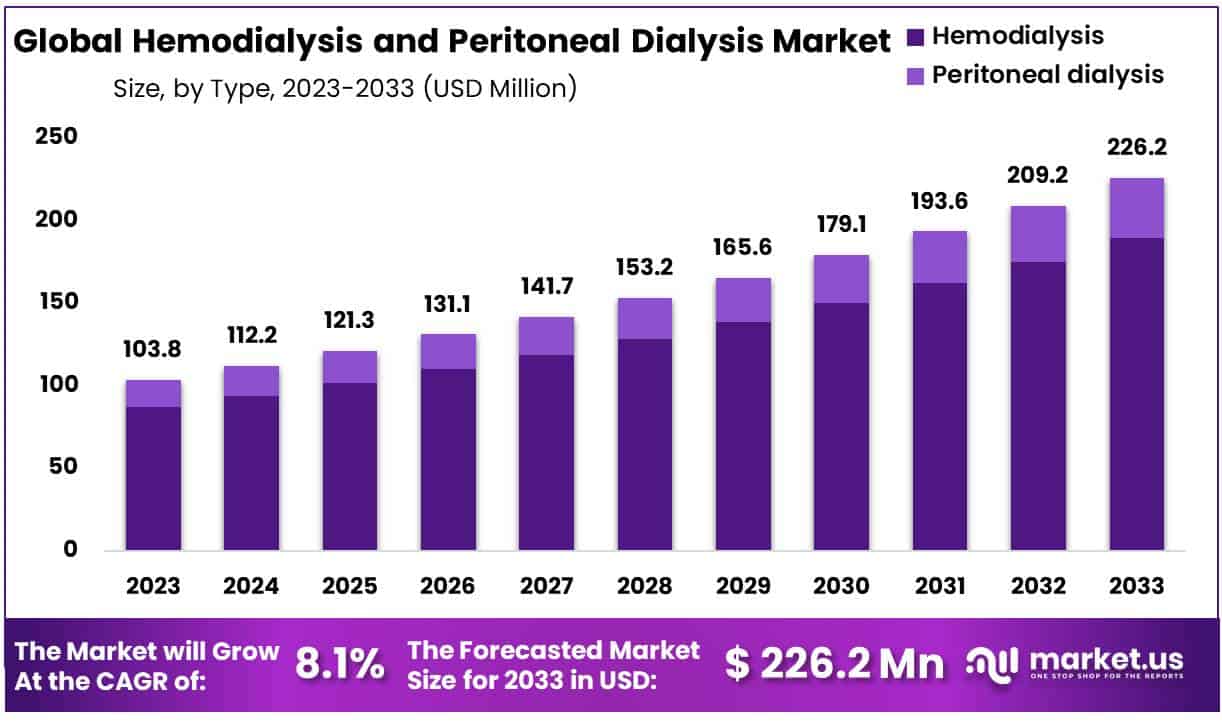

The Global Hemodialysis and Peritoneal Dialysis Market size is expected to be worth around USD 226.3 Million by 2033 from USD 103.8 Million in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

Hemodialysis and peritoneal dialysis are among the primary treatments for end-stage kidney disease. Hemodialysis uses a dialyzer machine to purify blood by extracting toxins and fluid surplus. Through the process of dialysis, blood is passed through a dialyzer for filtering before returning to the patient’s body.

Conversely, peritoneal dialysis uses the body’s peritoneal membrane as an effective natural filter. Here, a special solution called dialysate is introduced into the abdominal cavity where it absorbs waste and extra fluids through osmosis, and then drains off into an external drain system. Selecting between hemodialysis and peritoneal dialysis depends on various factors, including the patient’s medical status, lifestyle choices, and personal preferences. Both approaches offer unique advantages that may meet specific requirements associated with end-stage kidney disease.

The global hemodialysis and peritoneal dialysis market can be divided into several distinct segments, including type, dialysis site, modality, product, and region. By type, it is divided between hemodialysis and peritoneal dialysis with subcategories including short-term catheter, chronic catheter grafts, and fistula.

Dialysis site classification includes hospitals, clinics & dialysis centers as well as home dialysis which has sub-segments of home hemodialysis, home peritoneal dialysis hemodialysis dialysis, home dialysis with home dialysis, home dialysis further subdivisions of home hemodialysis, peritoneal dialysis, home peritoneal dialysis, home peritoneal dialysis, home peritoneal dialysis; conventional and daily (daytime, nighttime); finally product, regionally evaluated across North America Europe Asia Pacific, LAMEA regions respectively.

In addition, dialysis requirements have increased in recent years. According to the National Kidney Foundation, 785,883 Americans suffered from kidney failure in 2018. 554,038 of these people received dialysis. According to the FDA data, approximately 10,000 children in the U.S. are affected by acute AKI. The survival rate for these children is between 38% and 43%. AKI causes a 60% death rate in neonates.

Key Takeaways

- Market Size: Hemodialysis and Peritoneal Dialysis Market size is expected to be worth around USD 226.3 Million by 2033 from USD 103.8 Million in 2023.

- Market Growth: The market growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

- Type analysis: The market leader in hemodialysis was the segment with the highest revenue share at over 83.8% in 2023.

- Product analysis: The service segment was the dominant market share in 2023 with more than 57.1%.

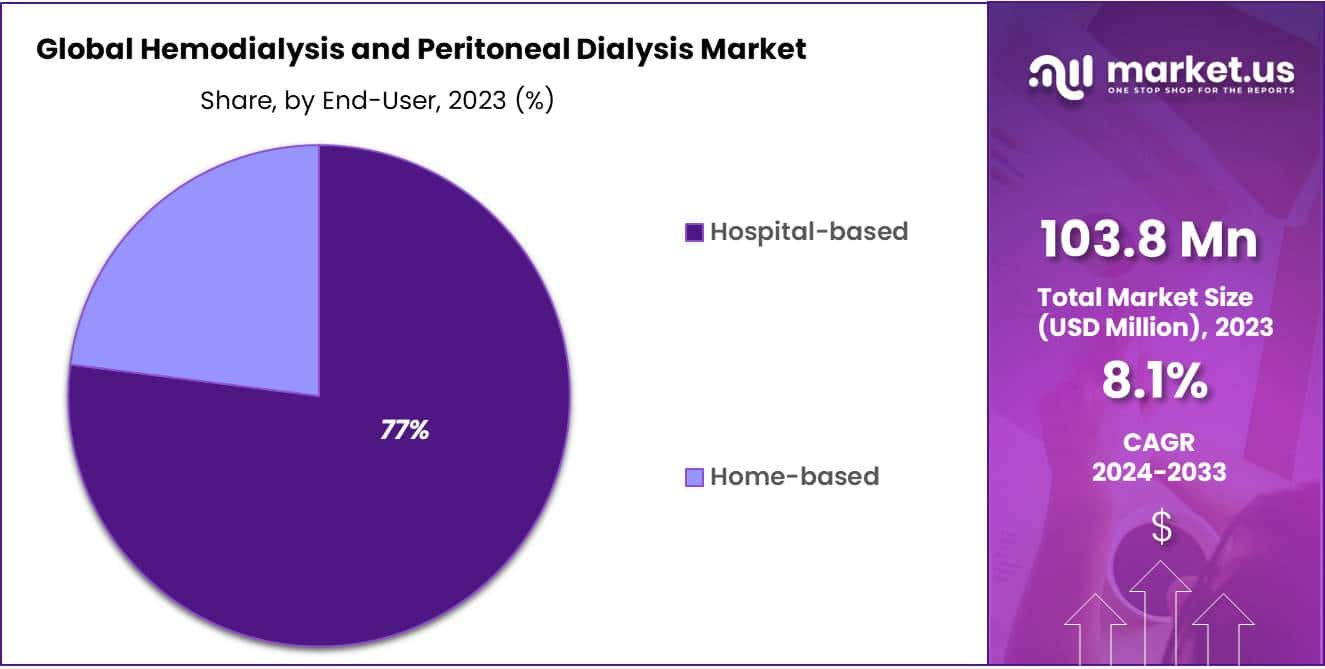

- End-Use Analysis: The Hospital-based segment was the dominant By 77% in 2023.

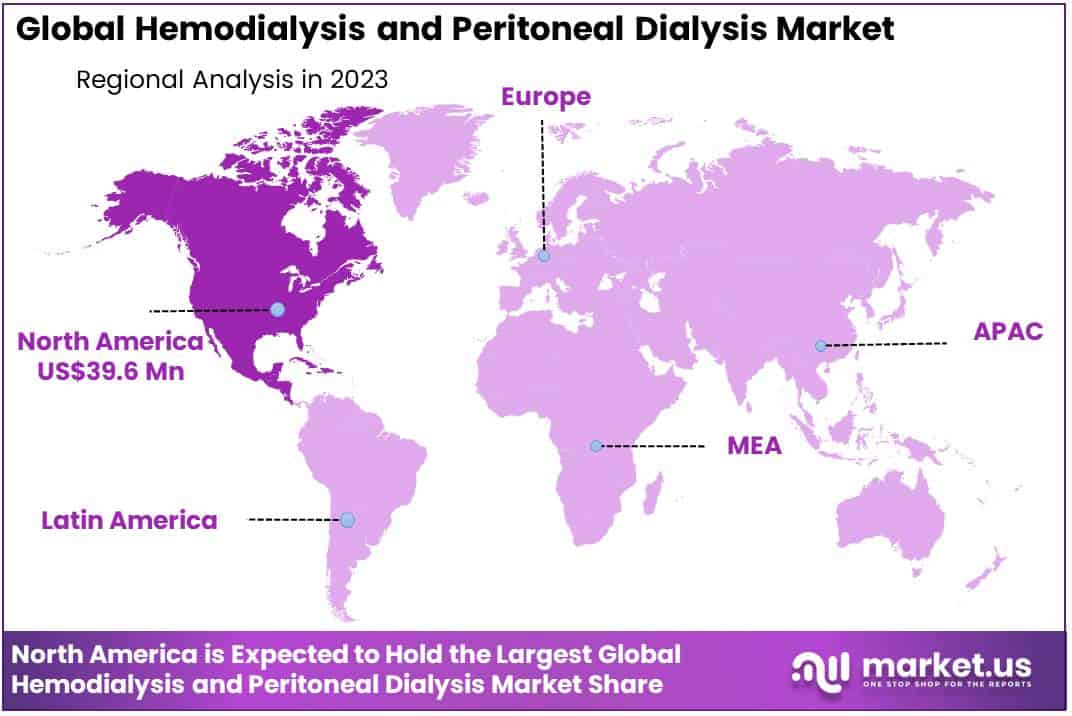

- Regional Analysis: North America was the dominant market, with a revenue share of more than 38% in 2023.

Type analysis

The market leader in hemodialysis was the segment with the highest revenue share at over 83.8% in 2023. It is expected that the segment will continue to grow at the CAGR for the forecast period. The hemodialysis market is further divided into short-term hemodialysis (conventional), and nocturnal.

Peritoneal dialysis can be sub-segmented into Ambulatory Peritoneal Dialysis (APD) and Continuous Ambulatory Peritoneal Dialysis (CAPD). This segment is driven by an increasing number of ESRD sufferers, a rise in the geriatric population with kidney disease, and the increasing prevalence of diabetes and high blood pressure.

The World Population Ageing 2020 report estimates that there are 726 million people over 65 in the world. By 2050, the population is expected to increase by more than two-thirds to 1.4 billion people. The segment’s growth is expected to be significantly boosted by an aging population and a rising incidence of CKD.

A hemodialyzer is used to eliminate extra chemicals and fluids from your body. Dialysate is a fluid that comes in contact with blood as it passes through the filter. It is similar to a bodily fluid but without the presence of impurities. This type of dialysis is very complex and requires a strict treatment plan and limited mobility and transport options for patients.

It also involves the establishment and maintenance of vascular access such as a dialysis catheter, or the formation or grafting of an AV fistula in the arm or groin to allow dialysis patients access to the high blood flow required.

Product analysis

The service segment was the dominant market share in 2023 with more than 57.1%. This is due to an increase in dialysis service providers as well as an increase in ESRD prevalence. Several dialysis service providers have opened new centers around the globe to expand their services, which will help boost segment growth.

Market growth will be further boosted by technological advancements and other initiatives taken by different manufacturers. DaVita Care Connect is a secure telehealth system that DaVita integrated into its home dialysis segment in February 2021. It was just one of many connected technologies that DaVita offered to patients who prefer to be treated at home.

Consumables will grow at a 5.8% annual compound rate during the forecast period. The government is expected to make significant investments to improve patient safety, patient-centered healthcare, and efficacy over the forecast period. Advanced materials such as peroxides and iodine are being developed by companies to create catheters. This can increase the catheter’s life expectancy and decrease the likelihood of it malfunctioning.

Antimicrobial-coated catheters are in high demand, which helps to reduce the incidence of bloodstream infections. The growth of the consumable market is also being influenced by new dialyzer manufacturing technologies like improved surface contact and cutoff membrane dialyzers. The consumables market can be further divided into bloodlines, concentrates, and catheters.

End-use analysis

With a market share of more than 77%, the hospital-based segment was the dominant segment in 2023. Because of the high quality and experience of hospital staff, the segment will likely continue to lead the market in the future. A professional and experienced team of renal care professionals ensures that patients receive optimal treatment in hospitals and dialysis centers.

The segment will be driven by the increasing focus on independent dialysis centers as well as the adoption of in-center dialysis patients. Companies are also focusing their efforts on developing customized hemodialysis machines that can be used for a wide range of interventions. This will likely have an impact on the user experience.

Home-based segments are expected to grow at a 6.6% CAGR over the forecast period. There are many benefits to home dialysis, such as improved quality of life and lower travel costs. It is also more flexible and can be done at home, making it easier for patients to move around. This will increase its adoption rate over the next few years.

The segment will also benefit from an increase in home dialysis among older people with various renal problems. Patients are increasingly choosing this method of dialysis because it is convenient and easy to use.

Кеу Маrkеt Ѕеgmеntѕ

Type

- Hemodialysis

- Conventional hemodialysis

- Short daily hemodialysis

- Nocturnal hemodialysis

- Peritoneal dialysis

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

Product

Device

- Machine

- Dialyzer

- Water treatment system

- Others

Consumables

- Bloodline

- Concentrates

- Catheters

- Others

Services

End-user

- Home-based

- Hospital-based

Driver

Rising Prevalence of End-Stage Renal Disease (ESRD)

The growing incidence of chronic kidney diseases (CKD), caused by factors such as hypertension, diabetes and ageing populations is one key driver behind hemodialysis market growth. When chronic CKD progresses to end-stage renal disease (ESRD) patients require life-sustaining treatments like dialysis treatments; this trend is especially evident in emerging economies with limited access to preventive healthcare and disease management; thus fuelling increased need for kidney replacement therapies like dialysis therapy.

Technological Advancements in Hemodialysis Equipment

Recent technological innovations in hemodialysis have resulted in more efficient and patient-centric devices for treatment, including portable machines, wearable artificial kidneys and improved dialyzers that enhance treatment effectiveness, reduce treatment times and provide greater mobility and convenience for patients. Not only have these technological enhancements led to positive patient outcomes but have also expanded the hemodialysis market globally by reaching more patients worldwide.

Trend

Shift to Home Hemodialysis

At home hemodialysis is becoming an increasing trend as its flexibility, convenience and potential clinical outcomes outstrip those offered at in-center dialysis centers. Patients choosing home dialysis typically enjoy reduced travel-related burdens, more control over treatment schedules and may benefit from increasing frequency resulting in improved quality of life resulting from more treatments overall. Telehealth technologies enable management of home hemodialysis further propelling this trend.

Increased Adoption of High-Volume Hemodiafiltration (HVHDF)

High-volume hemodiafiltration (HVHDF) has become an attractive alternative to standard dialysis due to its superior removal of uremic toxins and inflammatory mediators, improved solute clearance and cardiovascular stability as well as potentially lower risks associated with long-term complications in ESRD patients. With growing clinical support behind its benefits expected by industry analysts and rising adoption expected, HVHDF adoption should increase along with market expansion for related equipment and consumables.

Restraint

High Cost of Hemodialysis Treatment

Hemodialysis treatment costs, such as equipment, consumables and facility fees are a significant hindrance to market expansion. Accessing treatment may become financially prohibitive for some patients in low and middle income countries due to equipment costs alone – not including reimbursement challenges and inadequate insurance coverage that further limit its accessibility and limit market expansion.

Hemodialysis Complications and Limits

Even though hemodialysis has proven its worth in treating ESRD, its use has its share of complications and limitations that impact patient safety, quality of life and healthcare costs associated with adverse events management. Addressing these challenges through innovation and clinical advancement is vital in order to overcome barriers and drive market expansion.

Opportunity

Opportunity in Emerging Markets and Untapped Patient Population

Emerging markets present significant opportunities for growth within the hemodialysis market due to increasing prevalence of chronic kidney disease (CKD), improving healthcare infrastructure, and expanding access to renal replacement therapies. Companies can capitalize on these growth prospects by expanding into emerging economies with cost-effective solutions tailored to local needs; working closely with healthcare providers and policymakers on increasing access to their hemodialysis services; or by opening additional branches and offices overseas.

Customized and Precision Medicine in Hemodialysis

Personalized and precision medicine approaches hold promise to enhance hemodialysis treatment outcomes by tailoring therapy specifically to individual patient characteristics and disease profiles. Biomarker research, genetic testing, artificial intelligence, and automation make personalized hemodialysis prescriptions, prediciting treatment responses accurately, mitigating complications more successfully – creating lucrative opportunities for market players looking to differentiate their offerings and advance patient care through personalized medicine initiatives.

Regional Analysis

North America was the dominant market, with a revenue share of more than 38% in 2023. The region’s growth is supported by the presence of key players, large investments made by governments to develop innovative medical devices, as well as a favorable reimbursement situation. There is a growing demand for dialysis due to rising kidney disease rates and chronic kidney diseases (CKD).

Other factors that contribute to market growth include increased healthcare spending, government initiatives, and high disposable income.

Asia Pacific is expected to experience the highest CAGR at 5.6% during the forecast period. Market growth will be supported by rising kidney disease incidences, a growing elderly population, and enhanced product development. According to the IDF, South East Asia has approximately 88 million people living with diabetes. This number is expected to increase to 153 million by 2045.

Other factors that contribute to market growth include rising healthcare spending, increased government initiatives, awareness campaigns about CKD, the availability of technologically enhanced products, and newly-established, state-of-the-art healthcare facilities.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Hemodialysis and Peritoneal Dialysis market are fragmented. Major players are involved in product development, strategic partnerships, mergers and acquisitions, and joint ventures to vertically incorporate across the value chain. This reduces operational costs and allows for higher profit margins.

In March 2019, BASF SE joined forces with Landa Labs in order to launch its second stir-in pigment, eXpand. Blue (EH 6001) is sold under the Colors & Effects label. eXpand Blue (EH 6001) can be used for automotive coatings as well as outdoor coating applications.

Organic Dyes and Pigments also acquired Premier Colors, Inc. in December 2020 to expand its business in Providence and serve the customers of the former. Premier Colors, Inc. is a South Carolina-based company that supplies specialty chemicals and Hemodialysis and Peritoneal Dialysis s to the paper, textile, paints and coatings, and leather industries. These are the major players in the global Hemodialysis and Peritoneal Dialysis industry.

Маrkеt Кеу Рlауеrѕ

- Baxter

- B. Braun Melsungen AG

- Fresenius Medical Care AG

- Medtronic

- Asahi Kasei Medical Co., Ltd.

- Nipro Corp.

- DaVita

- BD

- Nikkiso Co., Ltd.

- Cantel Medical

Recent Developments

- Baxter: Received FDA approval of their NxStage System One portable hemodialysis machine in October 2023. This approval is expected to increase home hemodialysis adoption for patients, providing greater flexibility and convenience than institutional care.

- B. Braun Melsungen AG: B. Braun Melsungen AG has introduced their Avitum hemodialysis system in Europe since September 2023, featuring cutting-edge technologies designed to ensure patient comfort and safety.

- Medtronic: received FDA approval for their Enlite glucose sensor used with peritoneal dialysis treatments in April 2023. This real-time monitoring enables patients to better manage diabetes.

- Nipro Corp.: Introduced their Lifecore CUBE hemodialysis system in Japan in June 2023, featuring more compact and energy efficient design than previous models.

- DaVita: DaVita announced their partnership with Verve Therapeutics to develop and commercialize gene therapies to treat chronic kidney disease.

Report Scope

Report Features Description Market Value (2023) USD 103.8 Million Forecast Revenue (2033) USD 226.3 Million CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hemodialysis, Conventional hemodialysis, Short daily hemodialysis, Nocturnal hemodialysis, Peritoneal dialysis, Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD)) By Product -Device(Machine, Dialyzer, Water treatment system, Others) Consumables (Bloodline, Concentrates, Catheters, Others, Services) By End-user (Home-based, Hospital-based) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Baxter, B. Braun Melsungen AG , Fresenius Medical Care AG, Medtronic, Asahi Kasei Medical Co., Ltd., Nipro Corp., DaVita, BD, Nikkiso Co., Ltd., Cantel Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is hemodialysis?Hemodialysis is a medical procedure used to treat end-stage kidney disease by filtering waste products and excess fluids from the blood using a dialyzer machine.

What is peritoneal dialysis?Peritoneal dialysis is a renal replacement therapy that utilizes the peritoneal membrane in the abdomen to filter waste and fluids from the blood by introducing dialysate fluid into the peritoneal cavity.

How big is the Hemodialysis and Peritoneal Dialysis Market?The global Hemodialysis and Peritoneal Dialysis Market size was estimated at USD 103.8 Million in 2023 and is expected to reach USD 226.3 Million in 2033.

What is the Hemodialysis and Peritoneal Dialysis Market growth?The global Hemodialysis and Peritoneal Dialysis Market is expected to grow at a compound annual growth rate of 8.1%. From 2024 To 2033

Who are the key companies/players in the Hemodialysis and Peritoneal Dialysis Market?Some of the key players in the Hemodialysis and Peritoneal Dialysis Markets are Baxter, B. Braun Melsungen AG , Fresenius Medical Care AG, Medtronic, Asahi Kasei Medical Co., Ltd., Nipro Corp., DaVita, BD, Nikkiso Co., Ltd., Cantel Medical.

How is the hemodialysis and peritoneal dialysis market segmented?The market is segmented based on type (hemodialysis and peritoneal dialysis), dialysis site (hospitals, clinics & dialysis centers, home dialysis), modality (conventional, daily), product (devices, consumables), and region (North America, Europe, Asia-Pacific, LAMEA).

What are the advantages of home dialysis?Home dialysis, including home hemodialysis and home peritoneal dialysis, offers greater flexibility, convenience, and potentially improved outcomes for patients compared to in-center dialysis. It allows patients to undergo treatment in the comfort of their own homes, potentially leading to better adherence and quality of life.

What factors influence the choice between hemodialysis and peritoneal dialysis?Factors such as the patient's medical condition, lifestyle, personal preference, vascular access, residual kidney function, and availability of resources play a significant role in determining whether hemodialysis or peritoneal dialysis is more suitable for a particular patient.

Hemodialysis and Peritoneal Dialysis MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Hemodialysis and Peritoneal Dialysis MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Baxter

- B. Braun Melsungen AG

- Fresenius Medical Care AG

- Medtronic

- Asahi Kasei Medical Co., Ltd.

- Nipro Corp.

- DaVita

- BD

- Nikkiso Co., Ltd.

- Cantel Medical