Global Hematology Analyzer Market By Component(Instruments, Reagents, consumables),By Type(Fully Automated Hematology Analyzer, Semi Automated Hematology Analyzer), By End-Use-(Hospitals, Clinical Laboratories, Research Institites, Others) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 19506

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

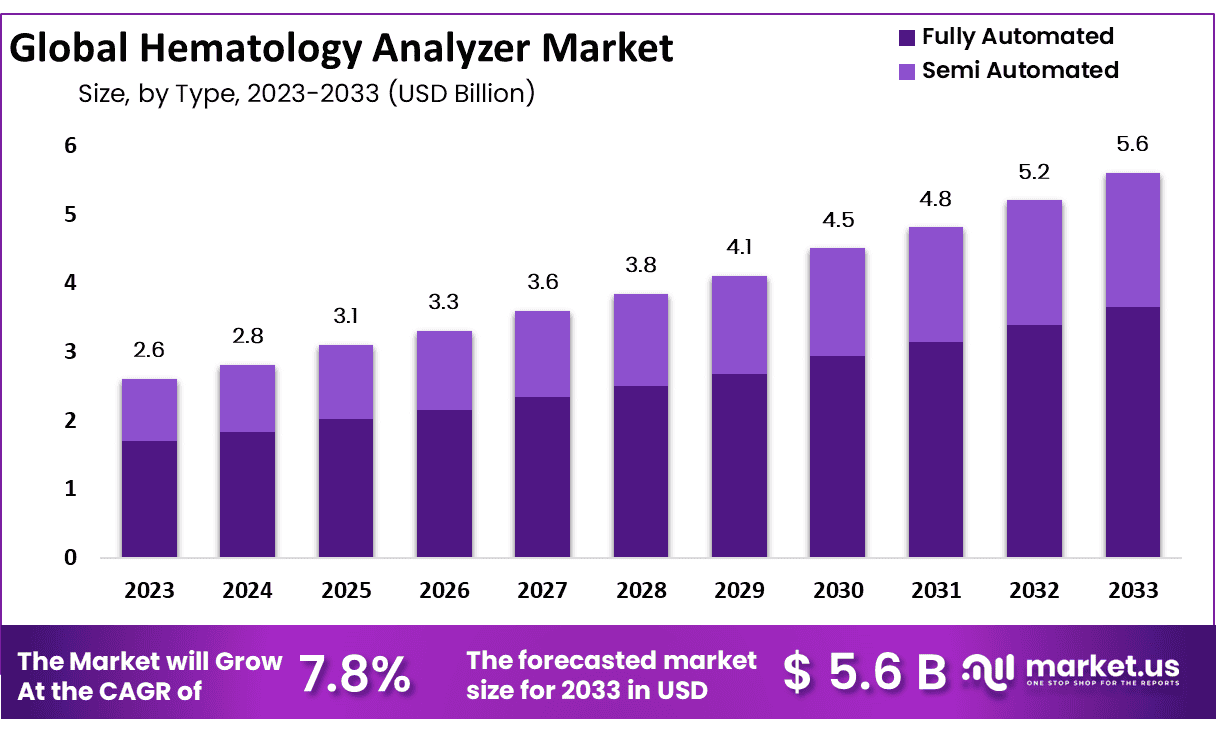

The Global Hematology Analyzer Market size is expected to be worth around USD 5.6 Billion by 2033 from USD 2.6 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2023 to 2032.

Hematology analyzers are used to count and identify blood cells at high speed and accuracy. White blood cell counts, complete blood counts, reticulocyte analysis, and coagulation tests are done within the medical sector. Hematology analyzers are available for both human and animal blood, making them helpful for veterinarians, zoos, and research facilities as well.

Closed vial testing and open sampling testing are two features that differ from one hematological analyzer to the other. The user can select the type of testing they want on some hematological analyzers. The sample size required, the type and amount of testing modes, the speed with which results are provided, the automatic flagging of findings that are outside of the normal range, and the capacity of test results it can store are all factors to consider in a hematology analyzer.

Advanced hematology analyzers can provide more quantitative and qualitative information, such as questionable flags (used to detect errors), etc. Real-time graphical data improves efficiency by providing information on abnormal cell populations and illness patterns.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size & Growth: Hematology Analyzer Market size is expected to be worth around USD 5.6 Billion by 2033 from USD 2.6 Billion in 2023, growing at a CAGR of 7.8%.

- Component Analysis: In 2023, reagent & consumables segment dominating 41.6% market share.

- Type Analysis: Fully-automated analyzers dominating 65.2% market share in 2023.

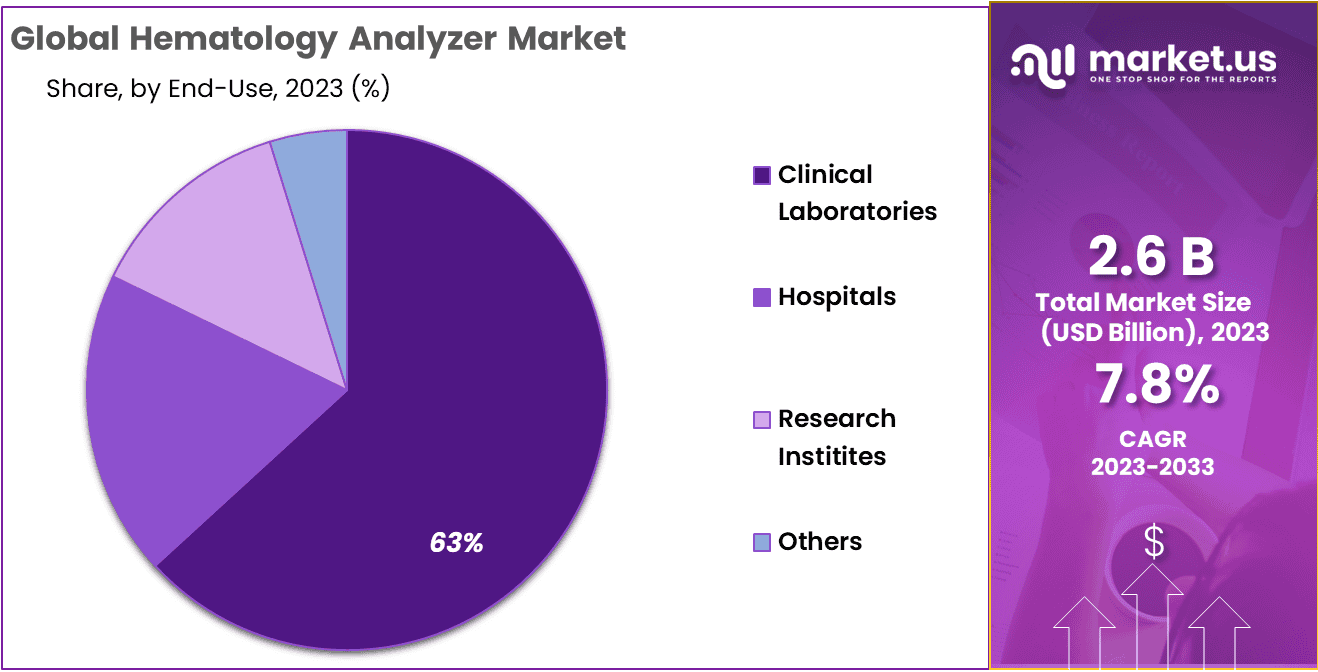

- End-Use Analysis: clinical laboratories dominating 63.2% market share in 2023.

- Regional Analysis: North America dominating 41.5% market share and holding the USD 1.07 Billion revenue share in 2023

Component Analysis

The Hematology Analyzer can be divided into instruments, consumables & reagents. Instruments remain an influential force within this global market segment while services remain more of an afterthought. In 2023, reagent & consumables segment dominating 41.6% market share. particularly for functions such as blood cell counts, coagulation testing, other forms of hematology tests as well as control & calibration purposes reagent & consumables have proven instrumental.

Consumables have experienced unprecedented demand due to their vital role in assuring accurate, precise, and reliable hematological analyses. Clinical laboratories that prioritize precise diagnostics rely heavily on consumables for various hematological exams involving blood cells as well as complex blood-coagulation testing services; hence this increased adoption is in response to increased needs in comprehensive blood diagnostic services from routine cell counts through to more specialized coagulation tests.

Type Analysis

Base on type can be divided into fully-automated hematology analyzers and semi-automated hematology analyzers – with fully-automated analyzers dominating 65.2% market share due to increased interest for automated instruments coupled with technological developments and integration of fundamental flow-cytometry techniques into fully-automated analyzers.

Notably in 2023 fully-automated analyzers established their prominence as market leaders due to rising adoption attributed to rise of automation instruments as a trend projected throughout forecast period by rising interest towards fully automating instruments combined with continuous technological development & incorporation of flow cytometry techniques into fully automated analyzers.

This trend can be credited due to rising interest towards automating instruments combined with increasing interest towards automated instruments combined with advancement of fundamental flow-cytometry techniques into fully-automated analyzers as attributed.

Fully-automated hematology analyzers have seen tremendous popularity due to their ability to streamline laboratory workflows. Automating processes from sample preparation through result analysis not only enhances efficiency but also guarantees greater accuracy and reproducibility in hematological analyses. Technological advances such as improved software algorithms and robotic handling systems contribute further to fully-automated analyzers’ precision and speed; furthering their widespread adoption.

End-Use Analysis

By end user, segment divided into hospitals, clinical laboratories, research institutes and others – including blood banks and biopharma companies – with clinical laboratories dominating 63.2% market share in 2023 and likely continuing this position throughout its forecast period. This dominance can be attributed to their abundance of high-quality equipment ensuring precise and reliable results with convenient yet accurate hematology analyzers providing further impetus.

Clinical laboratories stand out as key players in the market due to their commitment to using cutting-edge equipment and technologies, producing accurate results which facilitate timely, effective diagnosis. Hematology analyzers’ convenience and reliability meet these essential healthcare diagnostic needs perfectly, contributing greatly to sustained market expansion during this forecast period.

*Actual Numbers Might Vary In The Final Report

Kеу Маrkеt Ѕеgmеntѕ

Component

- Instruments

- Reagents

- consumables

Type

- Fully Automated Hematology Analyzer

- Semi Automated Hematology Analyzer

End-Use

- Hospitals

- Clinical Laboratories

- Research Institites

- Others

Drivers

Technological Advancements in Hematology Analyzers

Over the last several years, the market for hematology analyzers has seen rapid technological development. These advances have significantly enhanced accuracy, speed and efficiency of these analyzers; thanks to AI technologies like machine learning they now produce more precise and reliable results; leading to greater uptake among laboratories and healthcare facilities, propelling overall market expansion.

Rising Incidence of Blood Disorders

The rise in incidence and prevalence of hematological diseases such as anemia, leukemia and various clotting disorders are driving growth for the global hematology analyzer market. Such conditions require frequent blood tests for accurate diagnosis and monitoring – something hematology analyzers play an integral part in by analyzing samples, counting cells and detecting anomalies – increasing demand for these devices from healthcare practitioners globally to assist early diagnosis and effective management.

Trends

Integration of Point-of-Care Testing (POCT) Hematology Analyzers

One notable trend in the hematology analyzer market is the increasing incorporation of point-of-care testing (POCT). POCT provides on-the-spot blood analysis that eliminates sending samples away for testing at central labs; this trend can be especially useful in settings where immediate test results are essential, like emergency departments and clinics, such as immediate results being required to meet medical protocols or appointments on time. Decentralized testing also is expected to drive compact portable analyzer adoption rates resulting in market expansion.

Focus on Automation and High-Throughput Systems

Automation has emerged as a top trend in the hematology analyzer market due to an emphasis on streamlining laboratory workflows and improving testing efficiency. Manufacturers have focused on producing high-throughput systems capable of handling larger amounts of samples faster, catering specifically to labs whose processes demand such systems – this trend not only reduces staff workload but also boosts productivity in overall hematology testing processes.

Restraints

Low Cost of Hematology Analyzers

A major impediment to widespread adoption of hematology analyzers lies within their high initial and ongoing costs, such as installation fees. Initial investment, as well as maintenance expenses can represent a considerable financial strain for smaller healthcare facilities and laboratories with restricted healthcare budgets; further hindering market expansion.

Reimbursement Policies

Hematology tests and analyzers vary across healthcare systems and regions in their availability and extent of reimbursement policies, making some diagnostic services unaffordable to patients, deterring healthcare providers from investing in advanced hematology analyzers, which in turn impacts market growth in regions where reimbursement plays a crucial role.

Opportunities

Emerging Market Opportunities for Hematology Analyzer

Emerging markets offer great potential to the hematology analyzer market. As healthcare infrastructure improves in developing nations, demand increases for advanced diagnostic technology – like hematology analyzers – that help detect early disease management. With manufacturers exploring strategic partnerships to take advantage of emerging market growth potential.

Development of Compact and Affordable Analyzers

One approach manufacturers could take towards breaking through cost barriers is developing cost-effective hematology analyzers. Market participants would see great value from devices which deliver accurate yet reliable results at reduced costs; making healthcare accessible across more settings. Advancements in engineering materials as well as economies of scale may contribute to creating cost-efficient analyzers which open doors to new market segments while simultaneously increasing overall adoption rates.

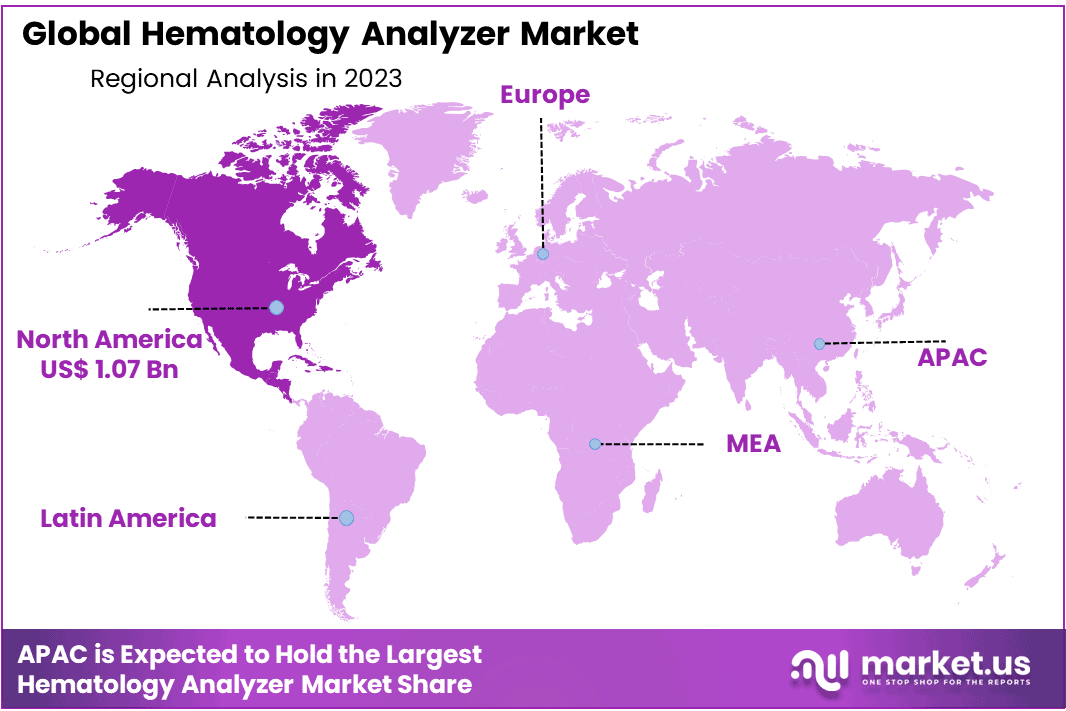

Regional Analysis

North America dominating 41.5% market share and holding the USD 1.07 Billion revenue share in 2023 due to high disposable income levels and widespread adoption of automated hematology instruments by diagnostic laboratories there; but Asia Pacific looks set for significant expansion during its forecast period due to untapped opportunities present in developing economies like China and India.

Asia Pacific’s expected growth is driven by multiple factors. Rising awareness about improved healthcare facilities combined with rising disease occurrence rates and an expanding population all combine to fuel an increasing need for hematology analyzers.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

A comprehensive overview is presented of the global hematology (CBC) analyzer market. Each competitor is carefully highlighted, providing key insight into various aspects of their operation. These details include an overview, financials, revenue generation, market potential and research and development investments for new market initiatives as well as global presence including production sites, facilities, production capacities, strengths and weaknesses assessment; product launches or portfolio breadth; dominating applications etc

Market Key Players

- HORIBA, LTD.

- F. HOFFMANN-LA ROCHE AG

- NIHON KOHDEN CORPORATION

- ABBOTT LABORATORIES

- DANAHER CORPORATION

- SIEMENS AG,

- BOULE DIAGNOSTICS AB,

- BIO-RAD LABORATORIES, INC.,

- SYSMEX CORPORATION,

- Other Key Players

Recent Developments

- Artificial Intelligence (AI) integration: Artificial intelligence is becoming more integrated into hematology analyzers to enhance their capabilities and offer more complete insights. AI algorithms are capable of scanning large volumes of hematology data for patterns or anomalies to aid pathologists with providing more informed diagnoses.

- Integration of Flow Cytometry: Hematology analyzers now use flow cytometry as part of their analyses to gain more detailed knowledge on blood cells’ size, shape, morphology and fluorescence characteristics; this allows clinicians to more precisely detect rare cell populations or any abnormalities not apparent from traditional analysis techniques.

- Automated Data Management: Hematology analyzers have become more common with automated data management systems for streamlining workflow and improving efficiency. These systems connect automatically with laboratory information systems (LIS) and electronic health records (EHR), sharing data more freely while decreasing manual entry errors.

- Advanced Reagent Technology: Reagent manufacturers have recently developed new and better reagents for use with hematology analyzers that enhance sensitivity, specificity and stability resulting in more precise blood count results. These innovations contribute to more accurate blood count results overall.

Report Scope

Report Features Description Market Value (2023) USD 2.6 Billion Forecast Revenue (2033) USD 5.6 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component-(Instruments, Reagents, consumables); By Type-(Fully Automated Hematology Analyzer, Semi Automated Hematology Analyzer); By End-Use-(Hospitals, Clinical Laboratories, Research Institites, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Horiba, ltd., F. hoffmann-la roche ag, Nihon kohden corporation, Abbott laboratories, Danaher corporation, siemens ag,, Boule diagnostics ab,, Bio-rad laboratories, inc.,, Sysmex corporation,, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Hematology Analyzer?A hematology analyzer is a medical device used to analyze blood samples for various parameters, including cell counts, hemoglobin levels, and cell morphology. It aids in the diagnosis and monitoring of blood-related disorders.

How big is the Hematology Analyze Market?The global Hematology Analyze Market size was estimated at USD 2.6 Billion in 2023 and is expected to reach USD 5.6 Billion in 2033.

What is the Hematology Analyze Market growth?The global Hematology Analyze Market is expected to grow at a compound annual growth rate of 7.8%. From 2024 To 2033

Who are the key companies/players in the Hematology Analyze Market?Some of the key players in the Hematology Analyze Markets are Horiba, ltd., F. hoffmann-la roche ag, Nihon kohden corporation, Abbott laboratories, Danaher corporation, siemens ag,, Boule diagnostics ab,, Bio-rad laboratories, inc.,, Sysmex corporation,, Other key players

Why is the Hematology Analyzer Market Growing?The market is growing due to factors such as technological advancements, increased prevalence of blood disorders, a shift towards point-of-care testing, and the emphasis on automation and high throughput in laboratory processes.

What Drives the Adoption of Hematology Analyzers in Clinical Laboratories?The adoption is driven by the presence of high-quality equipment in clinical laboratories, ensuring accurate results. The convenience and reliability of hematology analyzers contribute to their widespread use in clinical settings.

What Challenges Does the Market Face?Challenges include the high initial costs of hematology analyzers, limited reimbursement policies, and the need for more affordable solutions. Overcoming these challenges is crucial for market growth.

-

-

- HORIBA, LTD.

- F. HOFFMANN-LA ROCHE AG

- NIHON KOHDEN CORPORATION

- ABBOTT LABORATORIES

- DANAHER CORPORATION

- SIEMENS AG,

- BOULE DIAGNOSTICS AB,

- BIO-RAD LABORATORIES, INC.,

- SYSMEX CORPORATION,

- Other Key Players