Global Heavy Lift Delivery Drones Market Size, Share, Industry Analysis Report By Payload Capacity (Up to 10 kg, 10-50 kg, 50-100 kg, 100+ kg), By Range (Short Range (200 km)), By Application (E-commerce & Retail, Healthcare & Medical Supply, Industrial Supply, Food Delivery, Others), By End-User (Logistics Companies, Healthcare, Retail, Defense, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165078

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

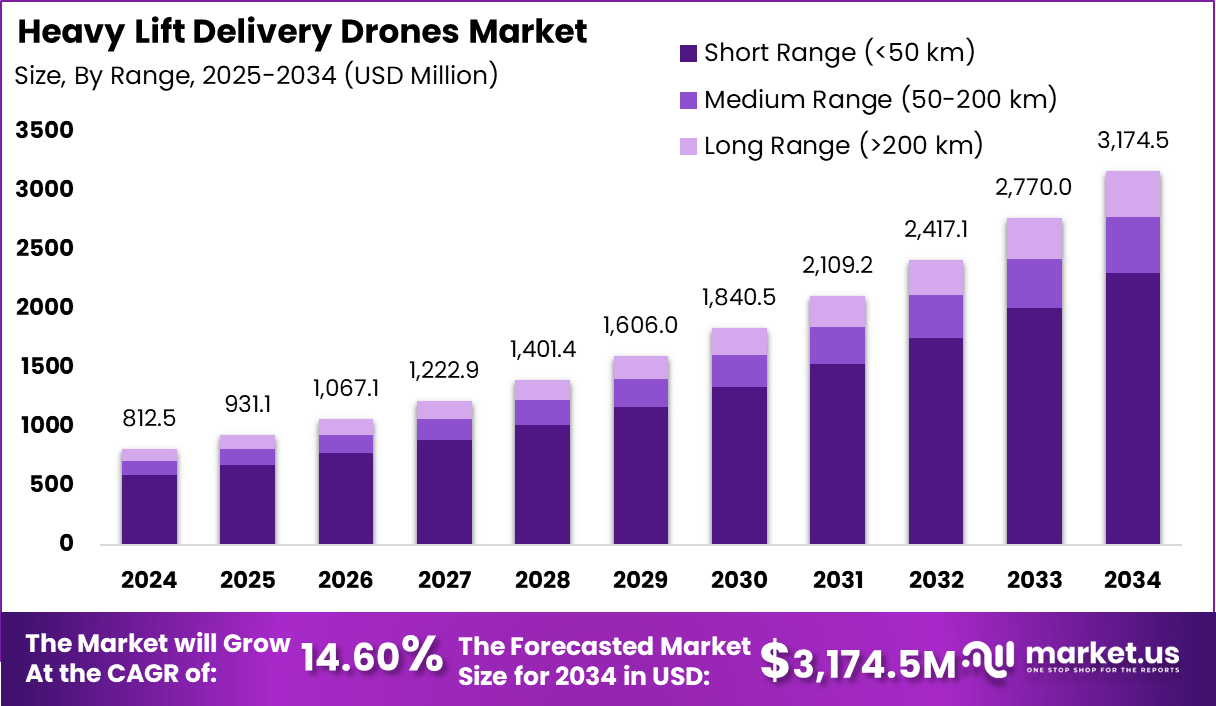

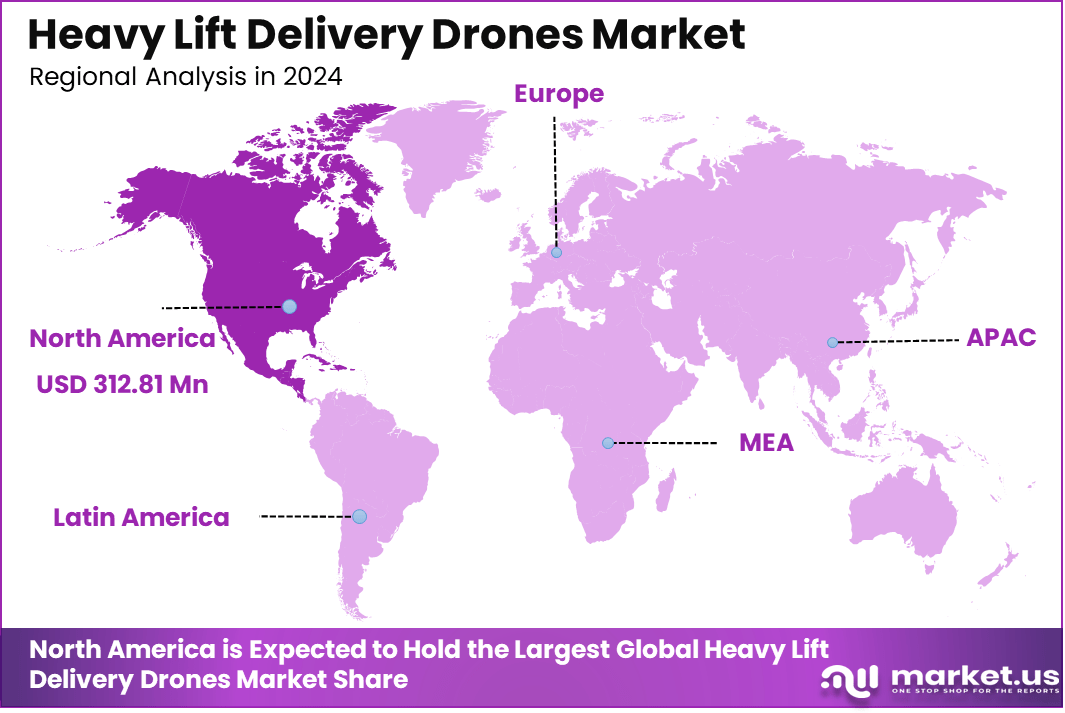

The Global Heavy Lift Delivery Drones Market generated USD 812.5 million in 2024 and is predicted to register growth from USD 931.1 million in 2025 to about USD 3,174.5 million by 2034, recording a CAGR of 14.60% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 312.81 Million revenue.

Heavy lift delivery drones are advanced unmanned aerial vehicles (UAVs) designed to transport large and heavy payloads over medium to long distances. These drones are built with reinforced airframes, powerful motors, and enhanced stability systems to carry materials such as medical supplies, construction tools, or industrial goods. They are particularly valuable in industries where ground transportation is slow, expensive, or impractical.

The heavy lift delivery drone market represents a growing segment of the broader drone logistics industry. It focuses on aerial cargo solutions that can support high-payload missions across commercial, industrial, and government applications. The market is benefiting from the increasing need for autonomous material handling, infrastructure development, and real-time supply delivery. Businesses are investing in drone systems that offer endurance, precision, and payload versatility.

Key driving factors include the need for rapid deployment in emergency situations and disaster relief, the push toward sustainable low-emission logistics, and the challenge of last-mile and middle-mile deliveries in urban and off-grid areas. Hybrid-electric powertrains and tilt-wing VTOL designs enable these drones to take off vertically and cruise efficiently, overcoming payload and range limitations.

About 60% of heavy lift drones now leverage such advanced propulsion and flight control technologies, while AI-powered navigation and onboard predictive maintenance further drive operational reliability and safety. Demand analysis reveals that sectors like construction and logistics form the largest user base, where drones transport materials, equipment, and supplies directly to challenging sites.

Top Market Takeaways

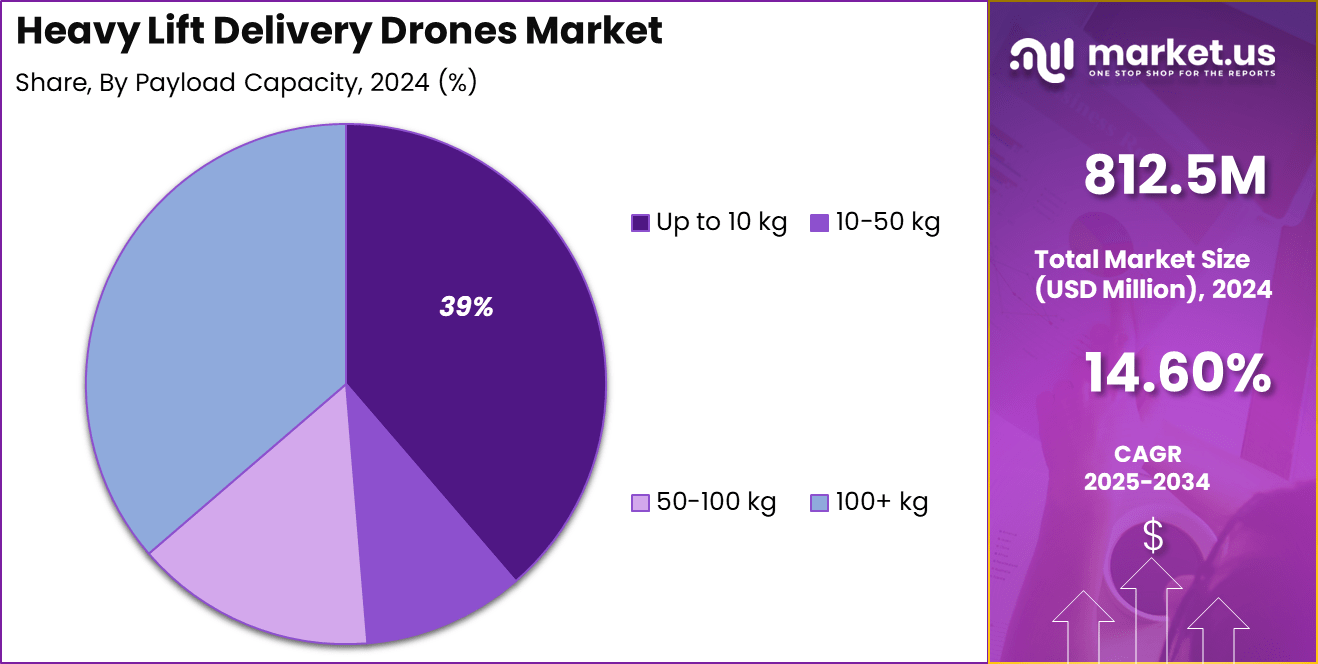

- By payload capacity, drones with up to 10 kg capacity hold a 39% market share. This segment balances load capacity with operational efficiency, suitable for small- to mid-sized deliveries like e-commerce parcels and medical supplies.

- By range, short-range drones (<50 km) dominate with 52.6% share, driven by last-mile delivery demand and regulatory ease for shorter flights.

- By application, e-commerce and retail lead with 51.7% share, reflecting the booming online retail sector’s reliance on drones for efficient, speedy delivery solutions.

- By end-user, logistics companies constitute the largest segment at 72.6%, as they increasingly integrate drone delivery into supply chain and last-mile logistics operations.

- Regionally, North America accounts for about 38.5% of the market.

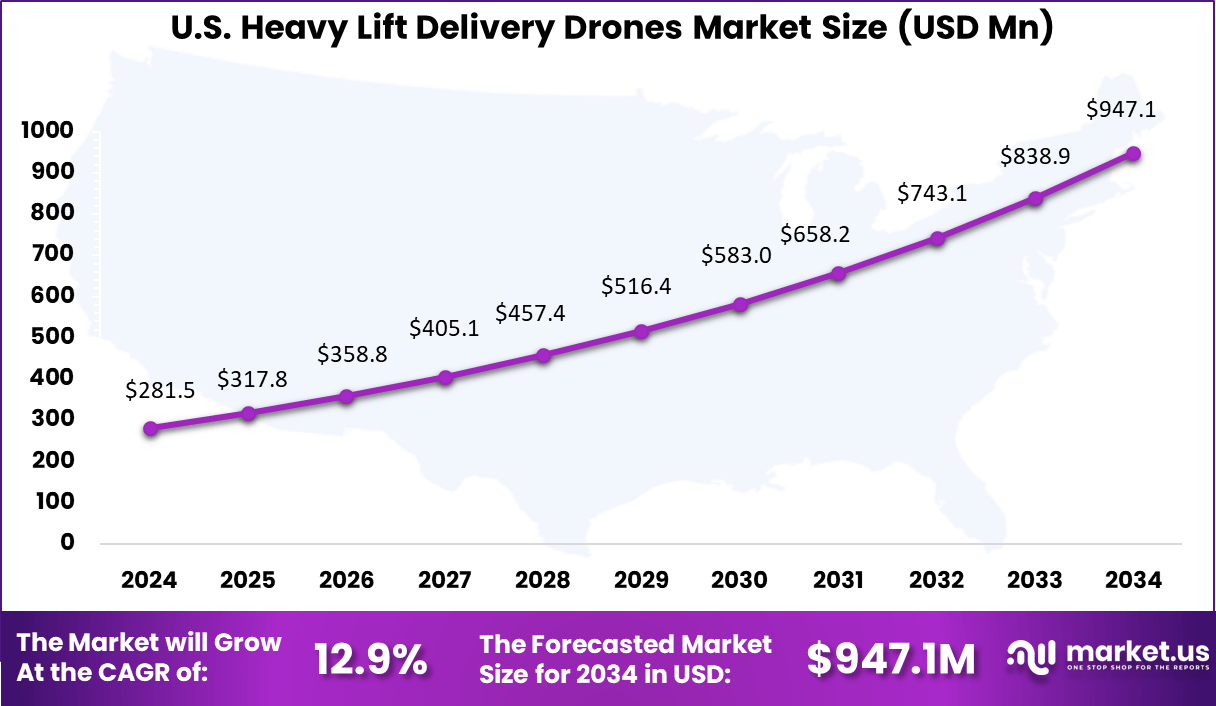

- The U.S. market size is approximately USD 281.5 million in 2025.

- The market is growing at a CAGR of 12.9%, fueled by advancements in drone technology, supportive regulations, and rising demand for contactless delivery accelerated by e-commerce growth.

- Key trends include increased adoption of electric and hybrid drones, improved autonomy and navigation, and expanding use cases beyond e-commerce into healthcare and industrial segments.

By Payload Capacity

Drones with payload capacity up to 10 kg represent a significant 39% of the heavy lift delivery drones market. These drones are well-suited for transporting lightweight packages, such as small electronics, pharmaceuticals, and everyday retail items. Their moderate weight capacity allows them to be agile and efficient, particularly for quick last-mile deliveries within urban environments where speed and maneuverability are critical.

The popularity of this payload range is also driven by the expanding e-commerce sector, where demand for fast, reliable delivery of smaller products continues to grow. Additionally, drones with payloads under 10 kg benefit from fewer regulatory hurdles in many regions, making deployment easier for logistics companies. This segment reflects a balance between operational efficiency and the growing need for accessible delivery solutions.

By Range

Short-range drones with delivery ranges under 50 km dominate the market with a 52.6% share. They are highly favored for urban and suburban delivery tasks, including e-commerce parcel drops and local retail fulfillment. The limited range keeps operations within tighter control zones, often complying with visual line-of-sight regulations, which simplifies regulatory compliance and reduces operational risk.

Short-range drones are particularly useful for last-mile delivery solutions that require fast response times and high delivery frequencies. Their relatively lower energy consumption helps extend flight times during short trips while maintaining affordability and ease of maintenance. The strong growth in urban centers globally is expected to sustain demand for these drones as retailers and logistics providers prioritize rapid delivery services.

By Application

E-commerce and retail applications make up the largest share at 51.7% in the heavy lift delivery drones market. The explosive growth in online shopping has created a critical need for faster and more flexible delivery systems. Drones help meet consumer expectations for same-day or even one-hour delivery, especially in congested urban areas or locations with limited road access.

Retailers are increasingly integrating drones into their logistics strategies to reduce shipping times and enhance customer satisfaction. This trend is accelerated by technological improvements in drone navigation and payload management, allowing reliable service over densely populated areas. The convenience and speed offered by drones make them a preferred choice in the competitive e-commerce landscape.

By End-User

Logistics companies constitute the majority market share with 72.6% usage of heavy lift delivery drones. These firms leverage drone technology to optimize supply chain operations, particularly for last-mile delivery services where traditional transport faces challenges such as traffic congestion and limited access. Drones help improve delivery times, reduce costs, and increase operational flexibility in fast-paced logistic networks.

The increasing adoption by logistics companies is supported by investments in drone fleet management systems and partnerships with technology providers. This focus on drones reflects the industry’s shift towards automation and digital transformation to meet growing consumer demand. The prominence of logistics companies in this segment underscores the sector’s role as a key driver in the market’s overall expansion.

Emerging Trends

The heavy lift delivery drones market is developing with some powerful trends and growth drivers making a real difference. One key trend is the rise of hybrid drones that combine vertical takeoff and landing with the endurance of fixed-wing flight.

This technology lets drones carry heavier loads over longer distances, perfect for industries like construction, logistics, and emergency response. Advances in battery technology and lightweight materials push the limits on flight time and payload capacity, making drones more practical for serious cargo transport.

Growth Factors

A big growth driver is the growing need for faster, safer, and more flexible cargo delivery, especially in remote or difficult-to-access areas. Companies and governments are turning to heavy lift drones to reduce reliance on traditional vehicles, cut delivery times, and lower carbon footprints.

The expansion of e-commerce and demand for rapid supplies also fuel this market, as drones can fill gaps in last-mile and middle-mile deliveries. Regulatory progress, especially around beyond-visual-line-of-sight flight permissions, unlocks broader operational capabilities.

Key Market Segments

By Payload Capacity

- Up to 10 kg

- 10–50 kg

- 50–100 kg

- 100+ kg

By Range

- Short Range (<50 km)

- Medium Range (50–200 km)

- Long Range (>200 km)

By Application

- E-commerce & Retail

- Healthcare & Medical Supply

- Industrial Supply

- Food Delivery

- Others

By End-User

- Logistics Companies

- Healthcare

- Retail

- Defense

- Others

Regional Analysis

In 2024, North America stood out as a major hub for heavy lift delivery drones, commanding a substantial 38.5% share of the global market. This growth is fueled by a combination of technological advancements, strategic investments, and favorable regulatory environments. Drones capable of lifting payloads up to 10 kg hold a significant segment, appealing to various industries for efficient last-mile delivery.

Focusing specifically on the U.S., the heavy lift delivery drone market was valued at USD 281.5 million in 2024 and is projected to continue its steady growth at a CAGR of 12.9%. This momentum is driven by the expanding e-commerce landscape and retailers’ growing reliance on autonomous delivery technologies to meet consumer expectations for faster and more reliable service.

The U.S. benefits from an advanced drone manufacturing sector, progressive regulatory frameworks including evolving FAA rules enabling beyond visual line of sight (BVLOS) operations, and widespread pilot programs led by industry giants such as Amazon and Walmart.

Additionally, investments in hybrid drone technologies and battery innovations underscore the U.S. focus on enhancing flight endurance and payload capacity while addressing sustainability goals. With these factors in play, the U.S. remains a key influencer shaping the heavy lift drone market trends within North America and globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Need for Efficient and Rapid Cargo Transport

The heavy lift delivery drones market is driven by the rising demand for efficient logistics solutions, especially in areas where traditional transportation faces challenges. Industries such as construction, agriculture, and emergency response require rapid, reliable, and cost-effective delivery of heavy payloads, including equipment and supplies.

Drones capable of carrying large loads reduce dependency on ground transportation, cut delivery times, and access hard-to-reach locations, making them indispensable in modern logistics frameworks. Advancements in drone technology, including hybrid-electric propulsion and AI-powered navigation, have improved flight duration and payload capacity, further boosting market growth.

Restraint

High Initial Investment and Regulatory Hurdles

Despite strong growth prospects, the heavy lift delivery drones market faces restraints from the high initial investment and evolving regulatory environments. Developing, purchasing, and maintaining advanced drone systems with sophisticated payload and navigation capabilities demand significant capital, which can deter smaller businesses and startups from entering the market.

Additionally, stringent aviation regulations related to heavy payload drone operation, including safety certifications and beyond-visual-line-of-sight (BVLOS) permissions, create operational challenges. Navigating these compliance requirements adds complexity and delays commercial deployments, limiting scalability in certain regions.

Opportunity

Emerging Use Cases in Disaster Relief and Remote Logistics

Heavy lift delivery drones offer substantial opportunities in disaster relief and remote logistics operations. Their ability to quickly transport vital supplies like medical equipment, food, and water to disaster-affected or inaccessible areas can revolutionize emergency response effectiveness. Governments and NGOs are increasingly adopting drones to enhance supply chain resilience in crisis situations.

Further opportunities exist in expanding applications within industrial sectors such as mining, oil and gas, and infrastructure inspection. The potential for autonomous UAV networks to coordinate deliveries over vast geographic areas could significantly reduce operational costs and downtime, opening new markets and revenue streams for drone manufacturers and service providers.

Challenge

Battery Life Limitation and Payload Optimization

A major challenge in the market is balancing battery life with payload capacity to optimize flight endurance and operational efficiency. Carrying heavier loads requires more energy, which often reduces drone flight times and limits mission scope, especially over long distances. This tradeoff necessitates continuous innovation in power systems and lightweight materials.

Moreover, optimizing payload configurations for diverse cargo types while ensuring safe and secure transport is technically complex. Companies must invest in R&D to develop flexible payload compartments and smart load management technologies to meet varied industry demands. Addressing these technical challenges is crucial for expanding the operational viability and adoption of heavy lift delivery drones.

Competitive Analysis

Zipline and Wing (Alphabet) are leading innovators in the heavy lift delivery drones market, focusing on autonomous aerial logistics and healthcare delivery. DJI and EHang are advancing drone manufacturing with robust payload capacity and reliable flight control systems, supporting both commercial and emergency operations. Volocopter and Matternet are developing urban air mobility and mid-range cargo transport models, emphasizing efficiency and sustainability.

Airbus and Boeing are expanding their presence in drone logistics through heavy-duty unmanned aerial systems (UAS) capable of transporting large payloads across longer distances. Amazon Prime Air and UPS Flight Forward are driving large-scale adoption with autonomous delivery networks designed for fast and efficient last-mile transport.

Swoop Aero, Elroy Air, and Dronamics are focusing on scalable mid-range cargo drones that serve underserved or remote areas with fast delivery capabilities. Their systems combine affordability with strong payload performance, expanding drone logistics in healthcare, defense, and e-commerce. Collaboration among private drone manufacturers, logistics firms, and aviation authorities is increasing.

Top Key Players in the Market

- Zipline

- Wing (Alphabet)

- DJI

- EHang

- Volocopter

- Matternet

- Airbus

- Boeing

- Amazon Prime Air

- UPS Flight Forward

- Kaman

- Lockheed Martin

- Swoop Aero

- Elroy Air

- Dronamics

- Others

Recent Developments

- May, 2023, Zipline reported completing over 600,000 deliveries, demonstrating the scalability and efficiency of its drone-as-a-service (DaaS) model, particularly in healthcare logistics like delivering blood and vaccines to remote regions.

- January, 2024, Alphabet’s Wing unveiled a larger delivery drone capable of carrying up to 5 pounds (about 2.3 kg), doubling payload capacity over its previous models. The drone can complete 12-mile round trips at speeds up to 65 mph, with deployments planned within a year in existing service areas.

Report Scope

Report Features Description Market Value (2024) USD 812.5 Mn Forecast Revenue (2034) USD 3,174.5 Mn CAGR(2025-2034) 14.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Payload Capacity (Up to 10 kg, 10-50 kg, 50-100 kg, 100+ kg), By Range (Short Range (<50 km), Medium Range (50-200 km), Long Range (>200 km)), By Application (E-commerce & Retail, Healthcare & Medical Supply, Industrial Supply, Food Delivery, Others), By End-User (Logistics Companies, Healthcare, Retail, Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zipline, Wing (Alphabet), DJI, EHang, Volocopter, Matternet, Airbus, Boeing, Amazon Prime Air, UPS Flight Forward, Kaman, Lockheed Martin, Swoop Aero, Elroy Air, Dronamics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heavy Lift Delivery Drones MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Heavy Lift Delivery Drones MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zipline

- Wing (Alphabet)

- DJI

- EHang

- Volocopter

- Matternet

- Airbus

- Boeing

- Amazon Prime Air

- UPS Flight Forward

- Kaman

- Lockheed Martin

- Swoop Aero

- Elroy Air

- Dronamics

- Others