Global Heavy Commercial Vehicle Market Size, Share, Growth Analysis By Propulsion(ICE, BEV, HEV/PHEV, LPG, Fuel Cell, Others), By Class(Class 8, Class 7, Cab Type), By Type(Tractor Units, Rigid Trucks), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159209

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

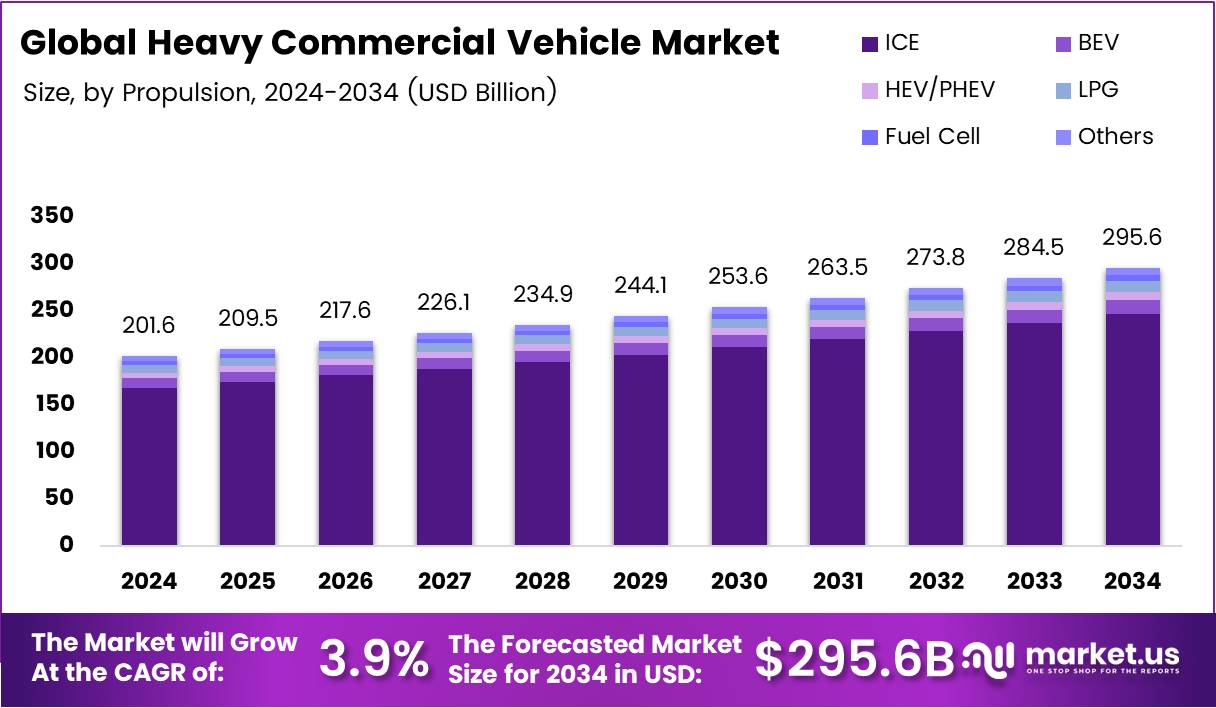

The Global Heavy Commercial Vehicle Market size is expected to be worth around USD 295.6 Billion by 2034, from USD 201.6 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

The Heavy Commercial Vehicle (HCV) market represents a vital component of the global transportation infrastructure, primarily covering large vehicles used for freight, construction, and logistics. These vehicles, including trucks, trailers, and heavy-duty equipment, are essential for the movement of goods across regions. The sector is witnessing significant shifts, driven by innovation, regulatory frameworks, and evolving consumer demands.

Growth in the HCV market is driven by increasing demand for logistics and construction vehicles, expanding urbanization, and evolving consumer preferences. Additionally, the rising need for last-mile delivery solutions is contributing to the increasing penetration of HCVs in urban areas. Manufacturers are innovating to meet these demands with improved fuel efficiency, safety features, and enhanced payload capacity.

Opportunities in the HCV sector are bolstered by government investments aimed at supporting infrastructure development and sustainability initiatives. For instance, public-private partnerships and financial incentives are encouraging the adoption of more environmentally friendly solutions, including electric and hybrid vehicles. These trends are expected to drive the future of the market, particularly in the context of energy-efficient heavy-duty trucks.

Government regulations on emissions are pushing the HCV sector to adopt stricter standards. This is particularly evident in the growing push for zero-emission vehicles, which is expected to define the industry’s future. Regulations such as the Euro VI standards are compelling manufacturers to invest in cleaner, greener technologies, contributing to the market’s evolution.

According to a survey, in the first quarter of 2025, sales of zero-emission heavy-duty vehicles rose to 4,100 units, a 45% increase from the 2,800 vehicles sold in Q1 2024. This growth highlights the rising demand for electric heavy-duty trucks and the impact of regulatory incentives on market trends.

Furthermore, there are 13.5 million trucks currently registered in the US, which showcases the size of the existing fleet and potential replacement market. With increased demand for fleet upgrades and the shift toward electrification, the HCV market is poised for significant transformation in the coming years, presenting substantial growth opportunities for stakeholders in the industry.

Key Takeaways

- Global Heavy Commercial Vehicle Market size is expected to reach USD 295.6 Billion by 2034, growing at a CAGR of 3.9% from 2025 to 2034.

- Internal Combustion Engine (ICE) holds a dominant market position in the By Propulsion segment with a 83.3% share.

- Class 8 trucks dominate the By Class segment with a 58.5% share in 2024.

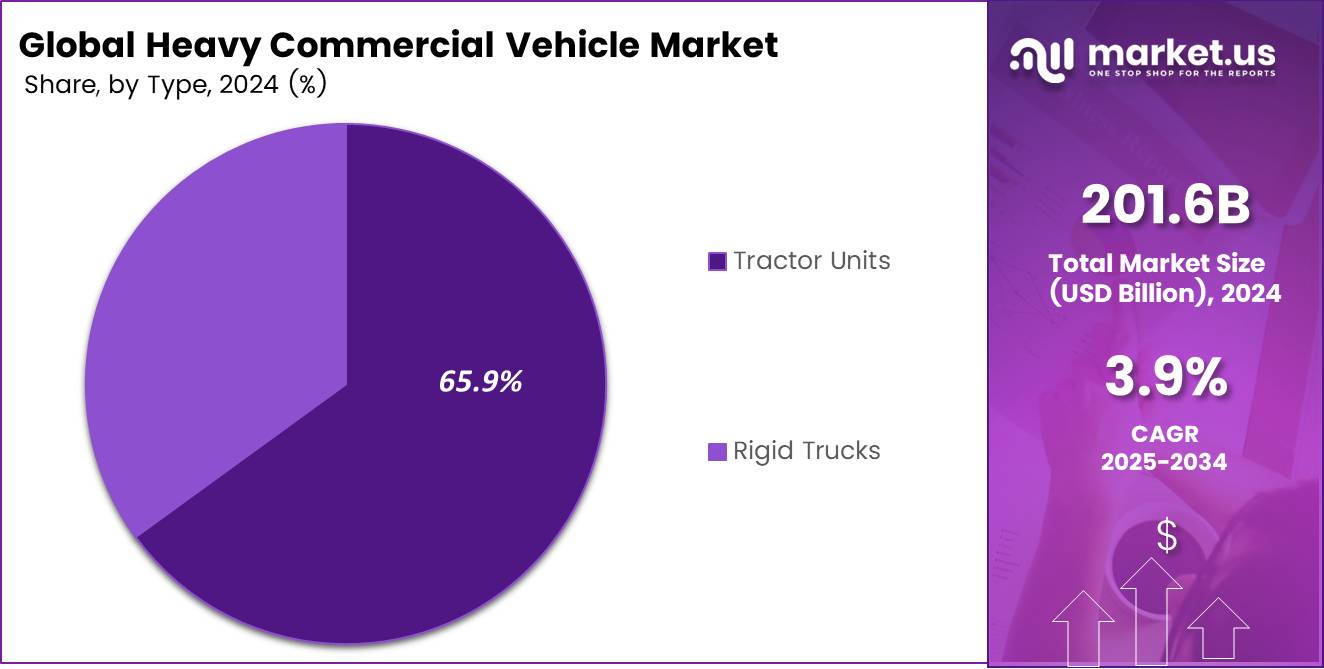

- Tractor Units lead the By Type segment with a 65.9% share in 2024.

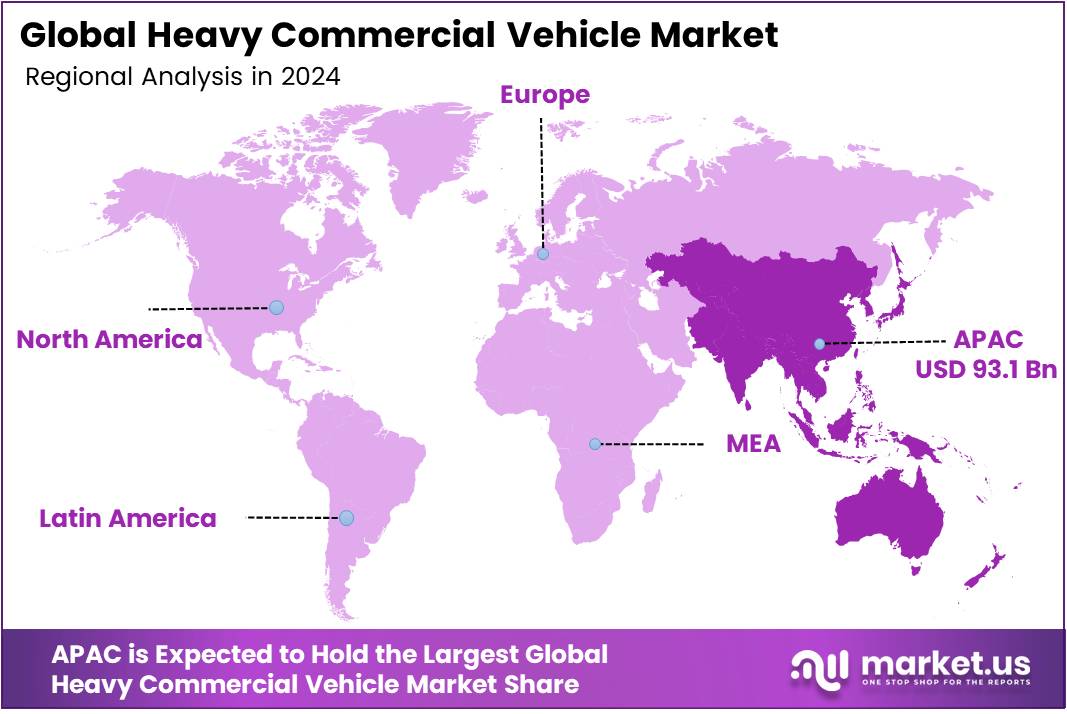

- The Asia Pacific (APAC) region dominates the market with a 46.2% share, valued at USD 93.1 Billion.

By Propulsion Analysis

Internal Combustion Engine (ICE) dominates with 83.3% due to its established infrastructure and proven reliability in heavy-duty applications.

In 2024, Internal Combustion Engine (ICE) held a dominant market position in the By Propulsion Analysis segment of Heavy Commercial Vehicle Market, with a 83.3% share. ICE vehicles continue leading the market primarily because of their extensive refueling infrastructure, longer operational range, and lower upfront costs. Fleet operators prefer ICE trucks for long-haul transportation where consistent performance and quick refueling are critical factors.

Battery Electric Vehicles (BEV) represent the fastest-growing segment, driven by stringent emission regulations and government incentives. Major manufacturers are investing heavily in electric commercial vehicle development, focusing on improved battery technology and charging infrastructure expansion. Urban delivery operations increasingly adopt BEV solutions for their zero-emission benefits and lower operating costs.

Hybrid Electric Vehicles (HEV/PHEV) serve as a transitional technology, combining traditional engines with electric powertrains. These vehicles offer improved fuel efficiency compared to conventional ICE trucks while addressing range anxiety concerns. They particularly appeal to operators seeking gradual transition toward electrification.

LPG-powered vehicles maintain niche market presence, especially in regions with established LPG infrastructure. Fuel Cell technology remains in early adoption phase, with limited commercial availability. Other alternative fuel options continue exploring market viability through pilot programs and specialized applications.

By Class Analysis

Class 8 vehicles dominate with 58.5% due to their versatility in long-haul transportation and freight operations.

In 2024, Class 8 held a dominant market position in the By Class Analysis segment of Heavy Commercial Vehicle Market, with a 58.5% share. Class 8 trucks, typically weighing over 33,000 pounds, represent the backbone of commercial transportation industry. Their popularity stems from superior payload capacity, advanced engine technology, and comprehensive dealer networks. These vehicles excel in interstate commerce, container shipping, and bulk material transportation where maximum hauling capacity is essential.

Class 7 vehicles occupy the secondary position, serving specific market needs in urban delivery and regional distribution. These medium-heavy trucks bridge the gap between smaller commercial vehicles and full-size Class 8 trucks. They offer maneuverability advantages in congested urban areas while maintaining substantial payload capacity for construction equipment, waste management, and utility services.

The dominance of heavier vehicle classes reflects the industry’s focus on maximizing operational efficiency through larger payload capacities. Fleet operators increasingly prefer Class 8 vehicles for their ability to handle diverse cargo types, advanced safety features, and proven durability in demanding operational environments across various industry sectors.

By Type Analysis

Tractor Units dominate with 65.9% due to their operational flexibility and widespread use in logistics operations.

In 2024, Tractor Units held a dominant market position in the By Type Analysis segment of Heavy Commercial Vehicle Market, with a 65.9% share. Tractor units, designed to pull semi-trailers, offer unmatched versatility in freight transportation. Their modular design allows operators to interchange different trailer types based on cargo requirements, maximizing asset utilization. Fleet operators prefer tractor-trailers for long-distance hauling, intermodal transportation, and specialized cargo movement where flexibility is paramount.

Rigid Trucks constitute the remaining market segment, serving specialized applications where integrated cab-chassis design is preferred. These vehicles excel in construction, waste management, and local delivery operations where maneuverability and specialized body configurations are essential. Rigid trucks offer advantages in urban environments with tight turning radii and specific loading requirements.

The preference for tractor units reflects the logistics industry’s emphasis on operational efficiency and asset optimization. Their ability to detach from trailers enables continuous vehicle utilization while trailers are being loaded or unloaded. This configuration supports just-in-time delivery models and reduces overall transportation costs through improved fleet productivity and enhanced operational flexibility.

Key Market Segments

By Propulsion

- ICE

- BEV

- HEV/PHEV

- LPG

- Fuel Cell

- Others

By Class

- Class 8

- Class 7

- Cab Type

- Day Cab

- Sleeper Cab

By Type

- Tractor Units

- Rigid Trucks

- Curtain-side Truck

- Box Truck

- Refrigerated Truck

- Tipper Truck

- Tanker Truck

- Flatbed Truck

- Others

Drivers

Increasing Demand for Efficient Transportation Solutions Drives Heavy Commercial Vehicle Market Growth

The increasing demand for efficient transportation solutions is a major driver of the heavy commercial vehicle market. Companies and industries are seeking more reliable and cost-effective ways to transport goods over long distances. This shift is pushing the market toward vehicles that provide better fuel efficiency, durability, and cost-effectiveness. Companies are increasingly looking for vehicles that can reduce operational costs while improving delivery speed, thus promoting growth in this sector.

In parallel, the growth in infrastructure development projects contributes significantly to the demand for heavy commercial vehicles. As governments and private sectors invest in upgrading roads, bridges, and ports, the need for transporting materials and equipment grows, directly benefiting the heavy commercial vehicle market. Such infrastructure projects often require specialized vehicles to handle the large-scale transportation of construction materials, machinery, and other essential goods.

Additionally, the rising demand from the e-commerce and logistics industries fuels market expansion. As e-commerce continues to grow globally, the demand for transportation to move products efficiently has surged. This growth is driving demand for larger and more specialized vehicles designed to handle the logistics of moving goods faster and more efficiently.

Lastly, advancements in fuel efficiency and sustainability technologies are also pushing the market forward. New innovations in electric and hybrid vehicle technology, along with more fuel-efficient engines, are allowing heavy commercial vehicles to operate more sustainably, aligning with global environmental goals and reducing long-term operational costs.

Restraints

Stringent Government Regulations and Emission Standards Restrain Heavy Commercial Vehicle Market Growth

One of the key restraints on the heavy commercial vehicle market is the increasing stringency of government regulations and emission standards. Governments worldwide are tightening emissions regulations, which require heavy commercial vehicles to meet strict environmental standards. This shift increases the operational cost for manufacturers, who must invest in more advanced technology to comply with these standards, potentially raising vehicle prices and limiting market growth.

Fluctuating fuel prices also act as a restraint in the industry. The heavy commercial vehicle market is highly dependent on fuel, and any significant price hikes can negatively impact the cost of operations. This makes it difficult for fleet owners and operators to maintain predictable costs, leading to financial uncertainty and affecting purchasing decisions.

Another challenge is the limited availability of skilled drivers. The shortage of experienced drivers is a significant constraint on the industry, as it directly impacts fleet operations. A lack of skilled drivers reduces the efficiency of transportation services and increases labor costs, which, in turn, hampers market growth.

Growth Factors

Expansion of Electric and Hybrid Vehicles and Telematics Solutions Drive Heavy Commercial Vehicle Market Growth

The heavy commercial vehicle market is expected to experience significant growth opportunities, especially with the expansion of electric and hybrid heavy commercial vehicles. As more industries seek to reduce their carbon footprint, the demand for electric and hybrid vehicles is growing, presenting a new avenue for innovation and growth. Manufacturers are developing more efficient electric commercial vehicles that can compete with traditional diesel-powered trucks.

Another growth opportunity lies in the adoption of telematics and fleet management solutions. These technologies enable companies to track vehicle performance, reduce downtime, and optimize routes. As these solutions become more advanced, they will provide further opportunities for market growth by improving the efficiency and profitability of fleet operations.

Emerging markets are also contributing to the growth potential in the heavy commercial vehicle market. Countries in regions like Asia-Pacific, Latin America, and Africa are rapidly developing their infrastructure, leading to higher demand for heavy commercial vehicles. This growth in emerging markets offers significant expansion opportunities for manufacturers looking to tap into these new regions.

Finally, the development of autonomous heavy vehicles is another key growth opportunity. Self-driving technology in heavy vehicles promises to revolutionize the logistics and transportation sectors, reducing the need for human drivers and increasing the efficiency of operations. As the technology matures, it could reshape the industry in the coming years.

Emerging Trends

Integration of Advanced Safety Features and Green Technologies Drives Heavy Commercial Vehicle Market Trends

Several key trends are shaping the future of the heavy commercial vehicle market. The adoption of green technologies and alternative fuels is one of the most prominent trends. As environmental concerns grow, there is a significant push for vehicles that use alternative fuels such as natural gas, hydrogen, and electricity. This trend is likely to continue as more regulations are put in place to reduce carbon emissions.

Increased use of AI for route optimization is also becoming a major trend in the market. AI-powered solutions help drivers select the most efficient routes, reducing fuel consumption, travel time, and operational costs. These technologies are becoming increasingly important as logistics companies look to improve efficiency.

Another significant trend is the shift towards low-emission and zero-emission vehicles. With governments implementing stricter environmental regulations, the demand for low-emission and zero-emission vehicles is rising. This trend aligns with broader sustainability goals and is driving manufacturers to invest in cleaner technologies.

Finally, the integration of advanced safety features in commercial vehicles is becoming more prevalent. Features such as automatic emergency braking, lane-keeping assist, and collision avoidance systems are being increasingly incorporated into heavy commercial vehicles. These technologies not only enhance driver safety but also improve overall operational efficiency, contributing to market growth.

Regional Analysis

Asia Pacific Dominates the Heavy Commercial Vehicle Market with a Market Share of 46.2%, Valued at USD 93.1 Billion

In 2024, the Asia Pacific (APAC) region dominates the Heavy Commercial Vehicle market with a substantial share of 46.2%, valued at USD 93.1 Billion. This dominance is attributed to the region’s strong manufacturing base, increasing infrastructure development, and rising demand for heavy commercial vehicles in countries such as China, India, and Japan.

North America Heavy Commercial Vehicle Market Trends

North America holds a significant share in the Heavy Commercial Vehicle market, driven by growing demand for efficient transportation solutions and an expanding logistics sector. The region is expected to see steady growth, with the U.S. contributing the largest portion due to its well-established transportation networks and technological advancements in fuel efficiency.

Europe Heavy Commercial Vehicle Market Insights

Europe remains a key player in the Heavy Commercial Vehicle market, supported by the region’s stringent emission regulations and advancements in sustainable vehicle technologies. Growth is expected to be fueled by the increasing adoption of electric and hybrid heavy commercial vehicles as governments push for cleaner transportation alternatives.

Middle East and Africa Heavy Commercial Vehicle Market Trends

The Middle East and Africa (MEA) region is experiencing growth in the Heavy Commercial Vehicle market, primarily due to increasing construction and infrastructure projects in countries like Saudi Arabia, UAE, and South Africa. The demand for heavy commercial vehicles is expected to rise in alignment with the growth of these sectors, along with a gradual increase in adoption of advanced vehicle technologies.

Latin America Heavy Commercial Vehicle Market Outlook

The Latin American market for Heavy Commercial Vehicles is projected to grow steadily, driven by the need for better road infrastructure and logistics solutions across countries like Brazil and Argentina. Economic recovery and increasing investments in the transportation sector are expected to support market expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Heavy Commercial Vehicle Company Insights

In 2024, Volvo Group continues to lead the global heavy commercial vehicle market with its strong presence in Europe and North America. The company is known for its innovative solutions in fuel efficiency and sustainability, catering to a wide range of heavy-duty trucks and transport solutions.

Daimler AG remains a significant player, offering a diverse range of products under the Mercedes-Benz and Freightliner brands. Its emphasis on electric and hydrogen-powered trucks has positioned the company at the forefront of the industry’s transition towards greener technologies.

PACCAR Inc. has maintained a prominent market position, primarily in the North American market, with its well-established brands, including Kenworth, Peterbilt, and DAF. PACCAR focuses on high-performance trucks and has expanded its portfolio with electric vehicle options to meet future transportation demands.

MAN SE has strengthened its position in Europe with a strong portfolio of heavy trucks, emphasizing high efficiency and advanced safety systems. The company continues to invest in electric vehicles and autonomous driving technologies, keeping pace with industry trends.

Top Key Players in the Market

- Volvo Group

- Daimler AG

- PACCAR Inc.

- MAN SE

- Tata Motors

- Ashok Leyland

- BharatBenz

- Eicher Motors Limited

- Ford Motor Company

- General Motors

- Scania AB

- Hyundai Motor

- Dongfeng Motor Corporation

Recent Developments

- In May 2025, Mahindra & Mahindra successfully completed the acquisition of a 58.96% controlling stake in SML Isuzu, strengthening its position in the commercial vehicle segment. This strategic move is expected to expand Mahindra’s portfolio in the growing light and medium commercial vehicle market.

- In July 2025, shares of Tata Motors fell by more than 4% amid reports of ongoing discussions for a $4.5 billion acquisition of Iveco. This move could mark a significant shift in Tata Motors’ global expansion strategy, particularly in the European commercial vehicle market.

- In April 2025, Mahindra and SML Isuzu joined forces in a ₹555 crore acquisition deal, enhancing their capabilities in the commercial vehicle sector. This partnership is poised to leverage SML Isuzu’s established manufacturing expertise in light commercial vehicles.

Report Scope

Report Features Description Market Value (2024) USD 201.6 Billion Forecast Revenue (2034) USD 295.6 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion(ICE, BEV, HEV/PHEV, LPG, Fuel Cell, Others), By Class(Class 8, Class 7, Cab Type), By Type(Tractor Units, Rigid Trucks) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Volvo Group, Daimler AG, PACCAR Inc., MAN SE, Tata Motors, Ashok Leyland, BharatBenz, Eicher Motors Limited, Ford Motor Company, General Motors, Scania AB, Hyundai Motor, Dongfeng Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heavy Commercial Vehicle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Heavy Commercial Vehicle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Volvo Group

- Daimler AG

- PACCAR Inc.

- MAN SE

- Tata Motors

- Ashok Leyland

- BharatBenz

- Eicher Motors Limited

- Ford Motor Company

- General Motors

- Scania AB

- Hyundai Motor

- Dongfeng Motor Corporation