Global Hearing Protection Devices Market By Type-(Earplugs, Earmuffs, Canal Caps) By Application-(Manufacturing, Construction, Aviation, Defense Industry, Other application) By Distribution Channels-(Supermarkets, Retails, E-Commerce, Others) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023–2033

- Published date: July 2024

- Report ID: 14751

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

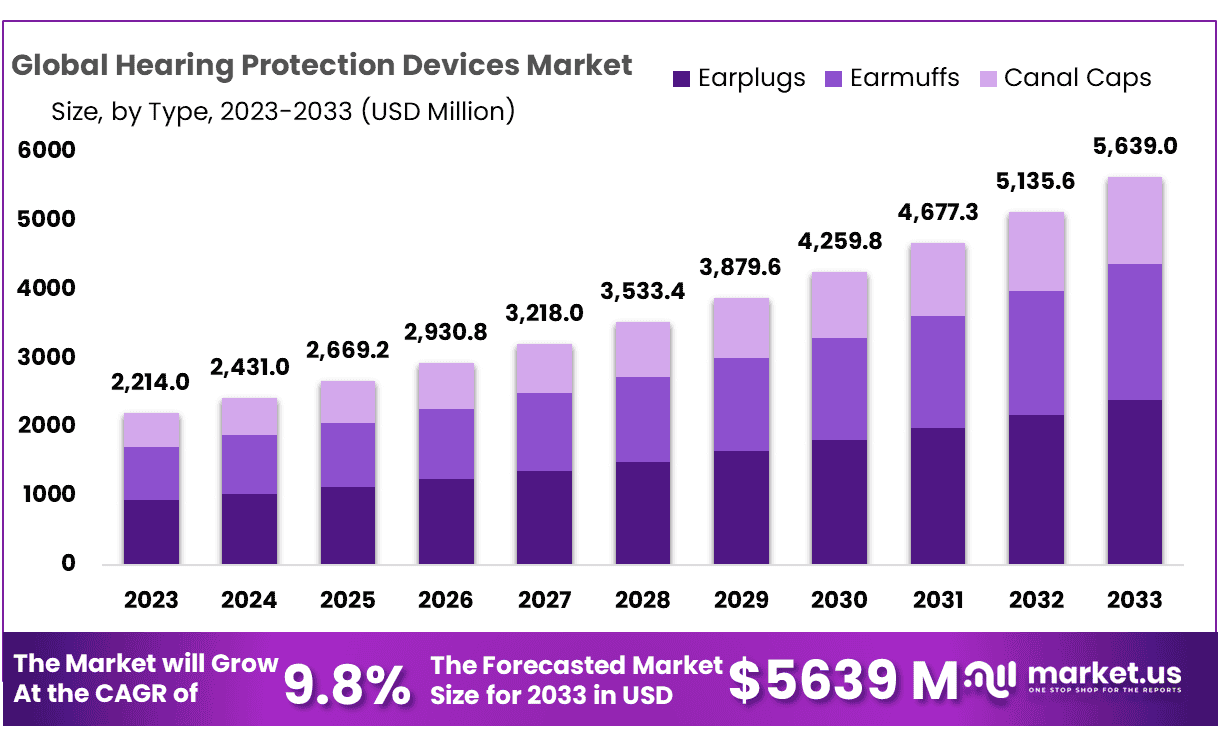

The Global Hearing Protection Devices Market size is expected to be worth around USD 5639.0 Million by 2033 from USD 2214.0 Million in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033.

The main driving force behind the global market for hearing protection equipment is the growing concern among individuals and workers regarding potential hearing loss due to elevated noise levels in manufacturing plants and other production sites. A notable challenge faced by the worldwide hearing protection equipment market is the inadequate attenuation of devices.

Consequently, manufacturers are placing emphasis on developing technologically advanced and customized intelligent hearing protection devices. Additionally, there is a need for manufacturers to concentrate on creating hearing protection equipment that integrates hearing protection with hearing loops, communication systems, and situational awareness. Key industry players are strategically introducing cost-effective earplugs to tap into lucrative growth opportunities.

Looking ahead, the growth of the hearing protection devices industry will be driven by an increase in government safety guidelines, a rise in hearing impairments resulting from industrial noise exposure, the development of advanced sound amplification earmuffs, and an upswing in employment within the construction industry. Potential obstacles to market growth in the future include the impact of the coronavirus pandemic, geopolitical tensions, and a lack of awareness about the product.

Earmuffs hearing devices are designed to fit over the outer ear, typically consisting of two ear cups and a headband. Ear cups are lined with sound-absorbing material and the headband applies pressure to seal ear cups over the ear. Earplugs HPDs are designed to fit in the ear canal, and earplugs come in a variety of subtypes. Canal caps are similar to earplugs since they consist of a soft tip that is inserted slightly into the ear canal or sits at the opening of the ear canal with a connected lightweight band that holds them in position.

Key Takeaways

- Market Size & Growth: Hearing Protection Devices Market size is expected to be worth around USD 5639.0 Million by 2033 from USD 2214.0 Million in 2023, growing at a CAGR of 9.8%.

- Type Analysis: Earplugs represent an integral segment in the Hearing Protection Devices (HPD) market dominating 44.9% market share in 2023.

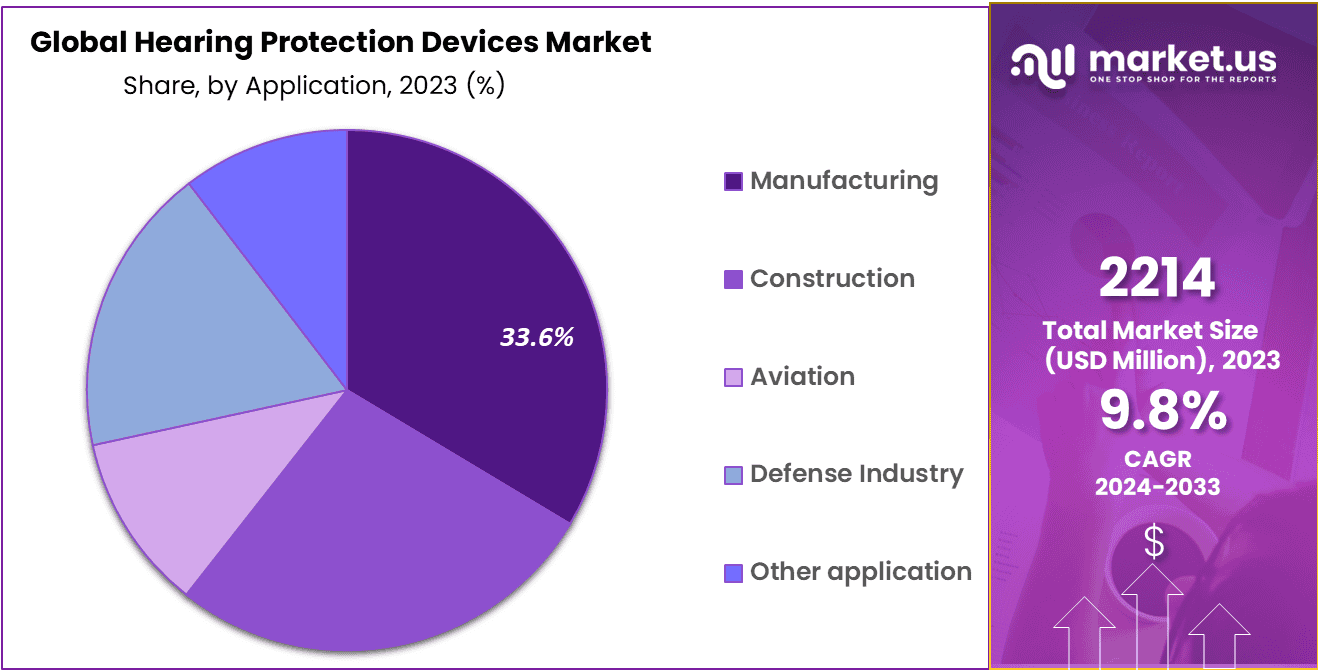

- Application Analysis: Application analysis in the Hearing Protection Devices (HPD) market indicates a clear dominance for manufacturing – accounting for an impressive 33.6% market share by 2023.

- By Distribution Channels: supermarkets come out on top, holding an impressive 32% market share by 2023.

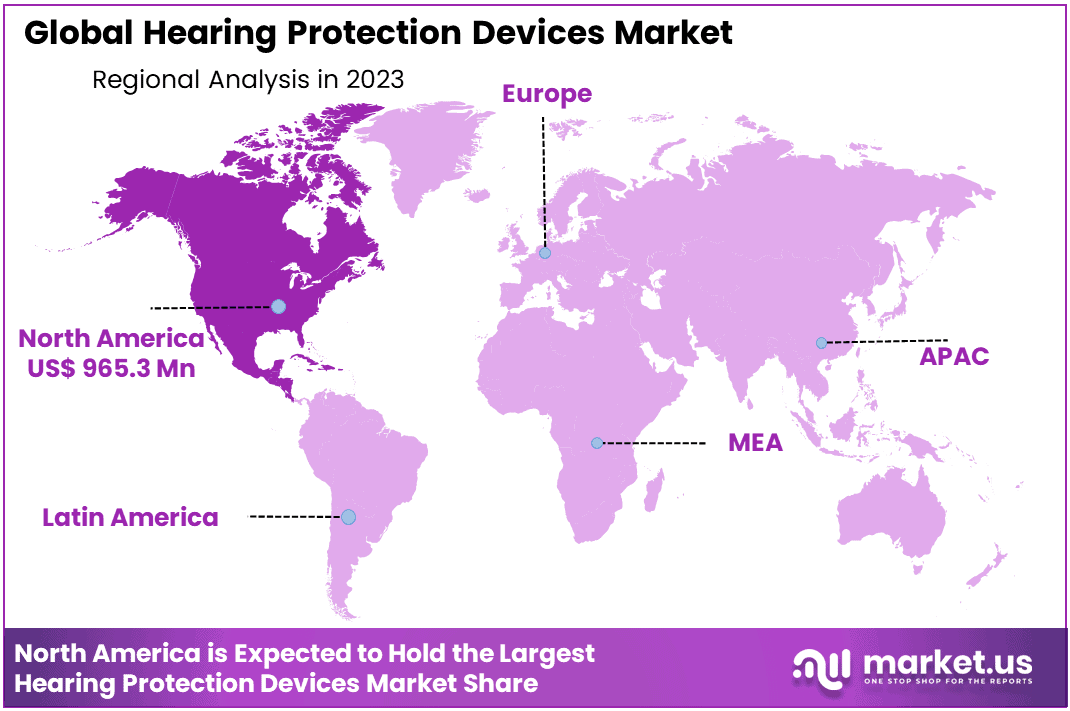

- Regional Analysis: North America led the hearing protection devices market with 43.6% share and holding revenue of USD 965.3 million in 2023.

- Market Dominance: Few major players command a significant share in the hearing protection devices market, leading to its consolidation.

- Innovation Focus: Substantial investments in research and development fuel the creation of technologically advanced hearing protection products.

- Strategic Expansion: Key players increasingly engage in portfolio expansion and merger/acquisition activity to bolster market positions and strengthen their market positions.

By Type Analysis

By type analysis, Earplugs represent an integral segment in the Hearing Protection Devices (HPD) market dominating 44.9% market share in 2023, serving to protect against noise-induced hearing loss. There is an array of earplug styles designed specifically to meet diverse requirements in various environments. Foam earplugs, known for their ease of use and comfort, are popular. Expandable foam models expand to conform effectively to ear canal shape while pre-molded silicone earplugs offer a reusable and customizable solution with tailored fit capabilities.

Custom molded earplugs offer a customized and snug fit, while banded ones feature an easily detachable band for easy wear and removal. Electronic earplugs utilize advanced technologies that increase situational awareness. Manufacturers are prioritizing innovation when it comes to the creation of intelligent earplugs that not only offer effective noise attenuation, but also seamlessly integrate into modern communication systems ensuring adaptability to modern work environments. As market conditions progress further developments in materials and technologies should lead to further improvements in earplug design and functionality.

By Application Analysis

Application analysis in the Hearing Protection Devices (HPD) market indicates a clear dominance for manufacturing – accounting for an impressive 33.6% market share by 2023. Hearing protection plays an essential role in mitigating the adverse impact of high noise levels in manufacturing environments. Workers and individuals in this sector recognize the risks associated with noise-induced hearing loss, increasing demand for effective hearing protection solutions.

Manufacturing industries include production plants and factories where noise levels may reach harmful thresholds. As regulatory awareness and safety standards evolve, manufacturing remains one of the primary drivers behind hearing protection device adoption – emphasizing its essentiality for protecting auditory health in industrial settings.

By Distribution Channels

By distribution channels, supermarkets come out on top, holding an impressive 32% market share by 2023. This widespread availability is evidence of hearing protection devices being easily accessible and widely available in retail settings, particularly supermarkets where both individuals and workers can easily find an array of protection solutions. Supermarkets’ widespread availability of hearing protection devices indicates an increasing awareness among the general public about its importance.

Supermarkets provide an easy and consumer-friendly option for consumers to research and purchase a variety of hearing protection solutions, reflecting an increase in emphasis on hearing health and safety across various environments. This trend also signifies a move toward making these essential safety products more widely accessible – which coincides with increased awareness around hearing protection products as essential safety products.

Market Segmentation

Type

- Earplugs

- Earmuffs

- Canal Caps

Application

- Manufacturing

- Construction

- Aviation

- Defense Industry

- Other application

Distribution Channels

- Supermarkets

- Retails

- E-Commerce

- Others

Driver

Increased Awareness about Occupational Hearing Loss

A key driver of Hearing Protection Devices (HPD) market growth is rising awareness regarding occupational hearing loss. With increased understanding of long-term consequences from exposure to high noise levels in workplace environments, both individuals and employers alike are seeking effective hearing protection solutions. Furthermore, an increasing correlation between noise-induced hearing damage and certain industries such as manufacturing and construction has resulted in an explosion of demand for HPD devices.

Stringent Regulatory Standards and Workplace Safety Norms

Globally, strict regulatory standards and workplace safety norms serve as a driving force behind the HPD market. Governments and regulatory bodies increasingly emphasize measures designed to safeguard workers’ health – hearing protection included – leading many industries to comply with these standards, prompting adoption of advanced hearing protection devices across various sectors.

Trend

Integration of Advanced Technologies in Hearing Protection Devices

One trend in the HPD market is the incorporation of advanced technologies into hearing protection devices, with manufacturers adding Bluetooth connectivity, noise cancelling capabilities and communication systems as enhancements to enhance their functionality. This trend towards smart hearing protection not only provides effective noise attenuation but also addresses communication and situational awareness needs in noisy environments.

Customization and Comfort in Design

A rising trend is to emphasize customization and user comfort when designing hearing protection devices. Manufacturers increasingly offer customized-molded earplugs and ergonomic designs to ensure secure yet comfortable usage over extended periods. This trend acknowledges the key role user comfort can play in maintaining consistent use.

Restrictions

Impact of COVID-19 Pandemic

One major barrier for HPD market growth has been caused by the COVID-19 pandemic. Disruptions caused by this pandemic such as lockdowns, supply chain disruptions and economic uncertainties have had a severe detrimental effect on production and distribution of hearing protection devices, with demand temporarily diminishing as industrial activity receded during this time.

Limited Awareness and Education

Unfortunately, limited awareness and education regarding noise-induced hearing loss act as a barrier to market growth. Although comprehensive awareness programs for individuals and workers concerning hearing protection devices exist in certain regions or industries, more needs to be done by way of public campaigns and workplace training programs to break this bottleneck.

Opportunity

Rising Demand in Emerging Economies

An opportunity in the HPD market lies in its increasing demand for hearing protection devices in emerging economies. As industrialization and manufacturing activities expand in developing nations, so too does their need for effective hearing protection solutions increase accordingly. Manufacturers can capitalise on this by expanding their presence into these regions to meet this growing need.

Innovation in Sustainable and Eco-Friendly Hearing Protection

There exists an opportunity for innovation in developing sustainable and eco-friendly hearing protection devices. As environmental concerns gain prominence, consumers and industries are showing interest in products which align with sustainability goals. Manufacturers that invest in eco-friendly materials and production processes for hearing protection devices could tap into an untapped niche market and meet this increasing demand for eco-conscious products.

Regional Analysis

North America led the hearing protection devices market with 32% share and holding revenue of USD 965.3 million in 2023, closely followed by Asia-Pacific and Western Europe regions. Future projections predict Eastern Europe and the Middle East are poised for rapid expansion of hearing protection devices market with projected compound annual growth rates between 2023-2033 of 14.3%.

As part of this projection, South America and Africa are expected to experience rapid expansion over the period from 2023-2033. Projected compound annual growth rates range between 10.6% during that same time frame. This evidence highlights how emerging regions will play a pivotal role in its expansion over the coming decade.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global market for hearing protection equipment is characterized by consolidation, where a small number of prominent manufacturers dominate the majority of the market share. Many companies are making substantial investments in extensive research and development endeavors, focusing on the creation of technologically advanced products. Key strategies employed by established players involve expanding their product portfolios and engaging in mergers and acquisitions to enhance their market position.

Market Key Players

- The 3M Company

- Amplifon

- Centurion Safety Products Ltd

- Dynamic Ear Company

- DELTA PLUS CORP.

- Etymotic Research, Inc.

- Hultafors Group

- Honeywell International Inc.

- Moldex-Metric

- Cotral Lab

Recent Developments

- The 3M Company: In June 2024, The 3M Company launched the E-A-R UltraFit, an advanced hearing protection device featuring adaptive noise-cancellation technology. This product targets professionals in noisy environments, offering enhanced communication clarity and safety.

- Amplifon: In May 2024, Amplifon acquired HearSafe, a startup specializing in smart hearing protection solutions. This acquisition aims to expand Amplifon’s digital offerings and improve accessibility to personalized hearing protection technologies.

- Centurion Safety Products Ltd: In April 2024, Centurion Safety Products Ltd introduced a new line of hearing protection earmuffs designed specifically for the construction industry, featuring enhanced durability and improved noise reduction capabilities.

- Dynamic Ear Company: In March 2024, Dynamic Ear Company merged with AcoustiTech, a manufacturer of high-fidelity earplugs. The merger aims to enhance their product line with superior sound management technologies tailored for musicians and concert attendees.

- DELTA PLUS CORP.: In February 2024, DELTA PLUS CORP. launched the Delta Defend EarGuard, a state-of-the-art hearing protection device with IoT connectivity. This device tracks exposure to hazardous noise levels in real-time and provides data-driven insights for occupational health safety.

- Etymotic Research, Inc.: In January 2024, Etymotic Research, Inc. introduced the HD15 High-Definition Earplugs, designed for precision sound filtering without distorting speech and music quality. This launch targets professionals and audiophiles seeking both protection and audio clarity.

Report Scope

Report Features Description Market Value (2023) USD 2214.0 Million Forecast Revenue (2033) USD 5639.0 Million CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Earplugs, Earmuffs, Canal Caps);By Application-(Manufacturing, Construction, Aviation, Defense Industry, Other application);By Distribution Channels-(Supermarkets, Retails, E-Commerce, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape The 3M Company, Amplifon, Centurion Safety Products Ltd, Dynamic Ear Company, DELTA PLUS CORP., Etymotic Research, Inc., Hultafors Group, Honeywell International Inc., Moldex-Metric, Cotral Lab Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current state of the Hearing Protection Devices (HPD) Market?The HPD market is consolidated, with a few major players dominating. Global trends include a focus on innovation, strategic expansion, and increasing awareness of occupational hearing loss.

How big is the Hearing Protection Devices Market?The Global Hearing Protection Devices Market size was estimated at USD 2214.0 Million in 2023 and is expected to reach USD 5639.0 Million in 2033.

What is the Hearing Protection Devices Market growth?The global Hearing Protection Devices Market is expected to grow at a compound annual growth rate of 9.8%. From 2023 To 2033.

Who are the key companies/players in the Hearing Protection Devices Market?Some of the key players in the Hearing Protection Devices Markets are The 3M Company, Amplifon, Centurion Safety Products Ltd, Dynamic Ear Company, DELTA PLUS CORP., Etymotic Research, Inc., Hultafors Group, Honeywell International Inc., Moldex-Metric, Cotral Lab

Who are the key players in the Hearing Protection Devices Market?Major manufacturers control a significant share, investing in research and development. Strategic expansion through mergers and acquisitions is a common approach among key players.

What drives the growth of the HPD Market?Market growth is driven by factors such as rising awareness of occupational hearing loss, adherence to stringent regulatory standards, and ongoing technological advancements in hearing protection products.

Are there regional variations in the HPD Market?Yes, regional dynamics vary, with North America leading in 2023. Future growth is anticipated in Eastern Europe and the Middle East, presenting global opportunities.

Hearing Protection Devices MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Hearing Protection Devices MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- The 3M Company

- Amplifon

- Centurion Safety Products Ltd

- Dynamic Ear Company

- DELTA PLUS CORP.

- Etymotic Research, Inc.

- Hultafors Group

- Honeywell International Inc.

- Moldex-Metric

- Cotral Lab