Global Healthcare IT Integration Market By Component (Products(Integration Engines, Medical Device Integration Software, Media Integration, Others) Services(Implementation & Integration, Support & Maintenance, Consulting, Training & Education)) By Deployment Mode(On-premise, Cloud-based, Hybrid) By Application(Electronic Health Records (EHR), Computerized Physician Order Entry (CPOE), Electronic Prescribing Systems, Medical Imaging Information Systems, Revenue Cycle & Claims Integration, Population Health & Analytics Integration, Others) By Organization Size (Large Enterprises, Small & Medium Enterprises) By End User (Hospitals & Clinics, Diagnostic & Imaging Centers, Payers & TPAs, Pharmacies, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 149165

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- Organization Size Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

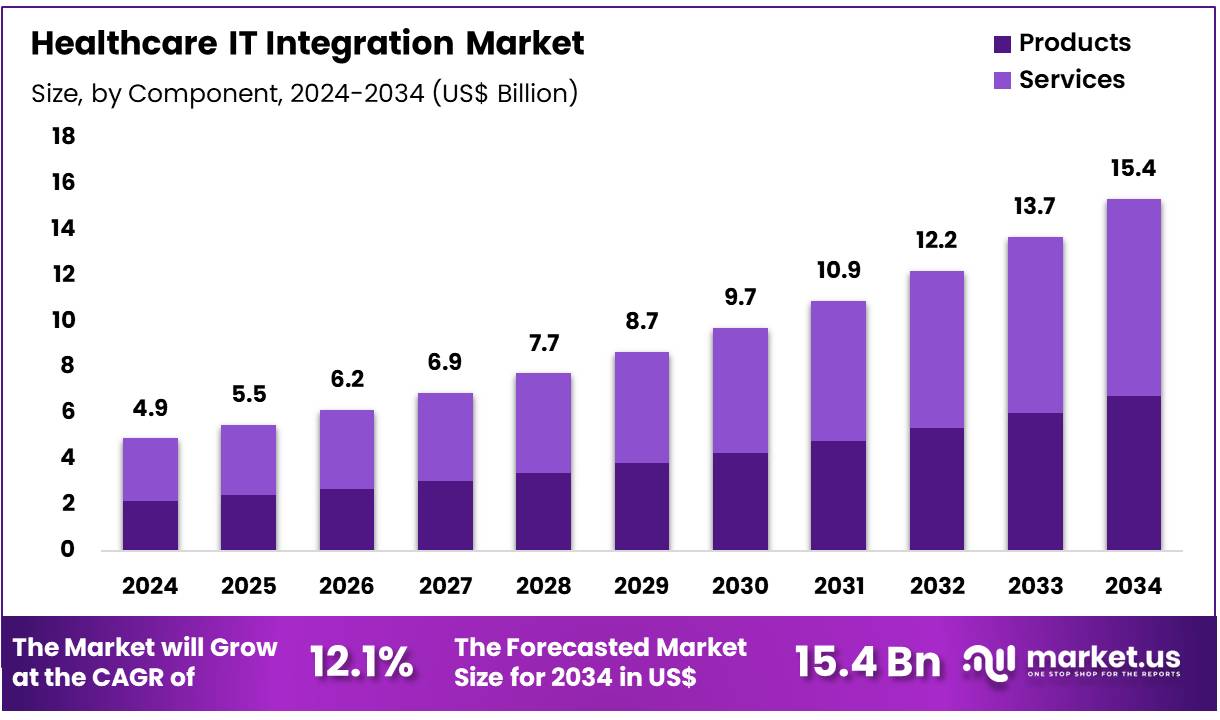

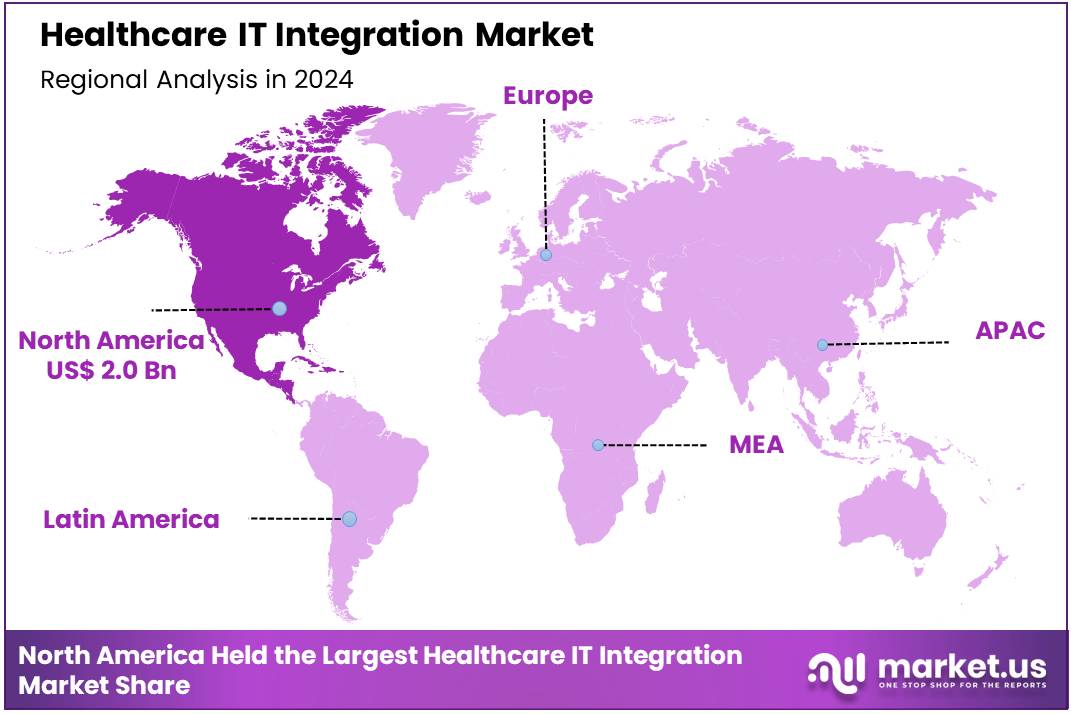

Global Healthcare IT Integration Market size is expected to be worth around US$ 15.4 Billion by 2034 from US$ 4.9 Billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.6% share with a revenue of US$ 2.0 Billion.

Increasing complexity in healthcare delivery drives the urgent need for seamless healthcare IT integration solutions that unify disparate systems, improve data interoperability, and enhance patient outcomes. Healthcare integration facilitates the exchange of clinical, administrative, and financial data across electronic health records (EHRs), laboratory information systems, imaging devices, and other health IT platforms.

This connectivity supports applications such as coordinated care management, population health analytics, telehealth services, and real-time clinical decision support. The Indonesian government’s launch of SATUSEHAT in August 2022 exemplifies the global shift toward unified healthcare data platforms, enabling a comprehensive view of patient health records and promoting continuity of care.

Healthcare providers increasingly adopt integration platforms to streamline workflows, reduce redundancies, and ensure compliance with evolving regulatory standards. Recent trends include the rise of cloud-based integration services, API-driven architectures, and the use of artificial intelligence to enhance data harmonization and predictive analytics. These technologies present significant opportunities for improving healthcare delivery efficiency and patient engagement.

As healthcare systems continue to evolve, integration solutions remain critical for enabling personalized medicine, improving care coordination, and supporting value-based care initiatives. The growing emphasis on interoperability underscores the transformative potential of healthcare IT integration in shaping future healthcare ecosystems.

Key Takeaways

- Market Size: Global Healthcare IT Integration Market size is expected to be worth around US$ 15.4 Billion by 2034 from US$ 4.9 Billion in 2024.

- Market Growth: The market growing at a CAGR of 12.1% during the forecast period 2025 to 2034.

- Component Analysis: Services account for 56.1% of the total market share, highlighting their critical role in enabling seamless connectivity, interoperability, and data exchange across healthcare systems.

- Deployment Mode Analysis: The on-premise segment dominates with a 63.5% market share, reflecting the strong reliance of healthcare organizations on in-house infrastructure.

- Application Analysis: EHR segment dominates with a 39.7% market share, reflecting its central role in improving patient care coordination, data accessibility, and regulatory compliance.

- Organization Size Analysis: The large enterprises segment accounts for a dominant 68.8% share of the healthcare IT integration market.

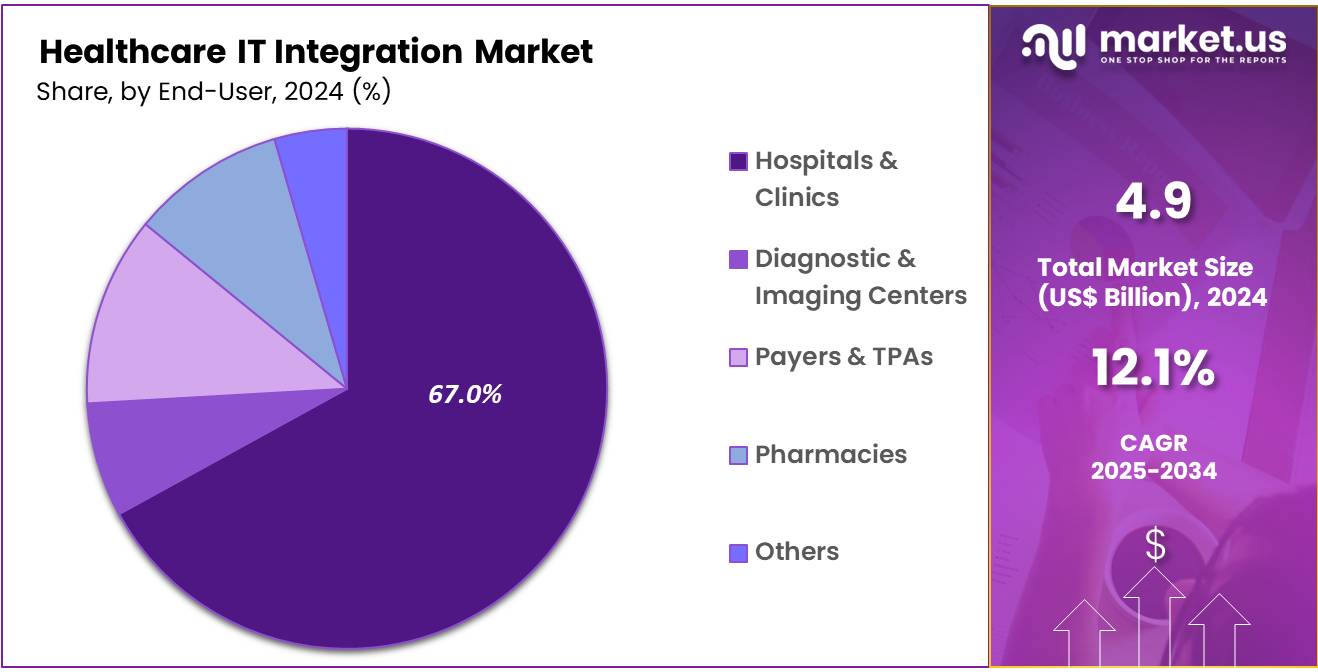

- End-Use Analysis: Hospitals and clinics emerged as the leading end-user segment, commanding a 67.0% share of the healthcare IT integration market.

- Regional Analysis: In 2024, North America led the market, achieving over 41.6% share with a revenue of US$ 2.0 Billion.

Component Analysis

In 2024, the healthcare IT integration market is segmented into services and products, with services emerging as the dominant category. Services account for 56.1% of the total market share, highlighting their critical role in enabling seamless connectivity, interoperability, and data exchange across healthcare systems. The demand for services such as consulting, implementation, support, and maintenance has grown significantly as healthcare providers focus on improving efficiency, reducing operational costs, and meeting regulatory compliance requirements. Additionally, the increasing adoption of cloud-based integration solutions and managed services has reinforced the dominance of this segment.

On the other hand, the products segment, comprising software platforms, middleware, and medical device integration tools, represents the complementary component of the market. Although it holds a smaller share compared to services, this segment remains vital as it forms the technological backbone for integration processes. The rising need for advanced data exchange platforms, interoperability standards, and patient monitoring device integration supports steady growth in this category. Together, both components create a synergistic ecosystem, but the services segment continues to lead, driven by the increasing complexity of healthcare IT environments.

Deployment Mode Analysis

In 2024, the healthcare IT integration market is segmented into on-premise, cloud-based, and hybrid deployment models. Among these, the on-premise segment dominates with a 63.5% market share, reflecting the strong reliance of healthcare organizations on in-house infrastructure. The preference for on-premise deployment is driven by stringent regulatory requirements, the need for enhanced data security, and direct control over sensitive patient information. Large hospitals and healthcare networks often favor on-premise models due to their ability to customize systems, maintain legacy integrations, and ensure uninterrupted access to critical applications.

The cloud-based segment is gaining momentum, supported by its scalability, cost-effectiveness, and ease of remote access. It is increasingly adopted by small and medium-sized healthcare providers seeking to reduce capital expenditure and enhance interoperability without investing heavily in hardware infrastructure. Meanwhile, the hybrid deployment model combines the strengths of both approaches, offering flexibility, scalability, and security.

It is particularly attractive to organizations transitioning from legacy systems to modern platforms. Although on-premise solutions continue to dominate in 2024, cloud-based and hybrid models are expected to record faster growth rates in the coming years, driven by digital transformation initiatives.

Application Analysis

Healthcare IT integration market is segmented by application into Electronic Health Records (EHRs), Computerized Physician Order Entry (CPOE), Electronic Prescribing Systems, Medical Imaging Information Systems, Revenue Cycle & Claims Integration, Population Health & Analytics Integration, and others.

Among these, the EHR segment dominates with a 39.7% market share, reflecting its central role in improving patient care coordination, data accessibility, and regulatory compliance. The widespread adoption of EHRs is driven by government initiatives, the need for standardized patient records, and the push for interoperability across healthcare systems.

The CPOE and electronic prescribing systems segments are also expanding, supported by the growing emphasis on reducing medical errors and ensuring accurate medication management. Medical imaging information systems contribute significantly, enabling seamless integration of imaging data into clinical workflows.

Meanwhile, revenue cycle and claims integration solutions are increasingly utilized to streamline administrative processes, enhance billing accuracy, and reduce reimbursement delays. Population health and analytics integration is gaining traction as healthcare providers focus on data-driven insights to manage chronic diseases and improve outcomes. Collectively, while EHRs remain the dominant application in 2024, other segments continue to grow steadily, enhancing efficiency and patient-centric care.

Organization Size Analysis

The large enterprises segment accounts for a dominant 68.8% share of the healthcare IT integration market. The leading position of this segment can be attributed to the high adoption of advanced IT solutions, robust financial capacity, and strong infrastructure support in large healthcare organizations.

These enterprises prioritize integrated platforms to streamline clinical workflows, reduce operational inefficiencies, and enable seamless data exchange across departments and facilities. Furthermore, compliance with stringent regulatory standards and increasing demand for advanced interoperability solutions further drive the reliance of large enterprises on sophisticated integration technologies.

On the other hand, the small and medium-sized enterprises (SMEs) segment is projected to witness notable growth during the forecast period. While SMEs currently hold a smaller share, increasing awareness of digital health benefits, coupled with government support programs and cost-effective cloud-based integration tools, is encouraging adoption. SMEs are focusing on scalable, interoperable solutions to enhance patient care while optimizing limited resources. The affordability of subscription-based models and the growing need to integrate electronic health records (EHRs), telehealth platforms, and billing systems are expected to accelerate uptake among smaller providers.

Overall, large enterprises will maintain dominance in 2024, while SMEs represent a significant growth opportunity for future market expansion.

End-User Analysis

In 2024, hospitals and clinics emerged as the leading end-user segment, commanding a 67.0% share of the healthcare IT integration market. This dominance is primarily driven by the growing need for integrated systems to manage large volumes of patient data, ensure interoperability across departments, and improve the efficiency of care delivery.

Hospitals and clinics are increasingly adopting advanced electronic health record (EHR) systems, clinical decision support solutions, and interoperability platforms to streamline workflows and meet regulatory requirements. The rising focus on patient-centric care, coupled with investments in digital infrastructure, further strengthens the demand for integration solutions in this segment.

Diagnostic and imaging centers are expected to exhibit steady adoption of IT integration solutions, driven by the need to share imaging results seamlessly with hospitals, specialists, and referring physicians. Payers and third-party administrators (TPAs) are also expanding their use of integration platforms to enhance claims processing, fraud detection, and data management, supporting more efficient operations.

Meanwhile, pharmacies are increasingly implementing integration tools to align prescription data with healthcare providers and insurance systems, ensuring accuracy and reducing errors. The others segment, which includes research institutions and home healthcare providers, is gaining momentum with the growing trend of personalized and remote care solutions.

Overall, while hospitals and clinics dominate the market, other end-user groups represent promising avenues for sustained growth.

Key Market Segments

By Component

- Products

- Integration Engines

- Medical Device Integration Software

- Media Integration

- Others

- Services

- Implementation & Integration

- Support & Maintenance

- Consulting

- Training & Education

By Deployment Mode

- On-premise

- Cloud-based

- Hybrid

By Application

- Electronic Health Records (EHR)

- Computerized Physician Order Entry (CPOE)

- Electronic Prescribing Systems

- Medical Imaging Information Systems

- Revenue Cycle & Claims Integration

- Population Health & Analytics Integration

- Others

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By End User

- Hospitals & Clinics

- Diagnostic & Imaging Centers

- Payers & TPAs

- Pharmacies

- Others

Drivers

The increasing adoption of electronic health records (EHRs) and digital health solutions is driving the market

The increasing adoption of electronic health records (EHRs) and a wide array of other digital health solutions is a primary driver for the healthcare IT integration market. As healthcare providers and payers increasingly rely on diverse digital tools for patient care, administrative tasks, and data analytics, the need for these disparate systems to communicate seamlessly becomes paramount.

Effective integration ensures that critical patient information flows accurately and efficiently across different platforms, improving care coordination, reducing errors, and enhancing overall operational efficiency. Without robust integration, the full benefits of digital health investments cannot be realized, making it a foundational requirement for modern healthcare IT ecosystems.

For instance, in 2023, 70% of US non-federal acute care hospitals were engaged in all four domains of interoperable electronic health information exchange (send, receive, find, and integrate), illustrating the pervasive adoption of systems requiring integration.

Restraints

Complex interoperability challenges and data silos are restraining the market

Complex interoperability challenges and the prevalence of data silos are significantly restraining the market. Healthcare organizations often utilize a multitude of legacy systems, specialized departmental applications, and vendor-specific platforms, many of which were not designed to communicate with each other. This creates fragmented data landscapes where critical patient information remains trapped in isolated systems, hindering a comprehensive view of patient health.

Overcoming these technical complexities requires significant investment in specialized integration platforms, skilled IT personnel, and adherence to evolving interoperability standards. The ongoing difficulty in achieving seamless data exchange across diverse systems and the persistence of these silos continue to pose a substantial barrier to the market’s growth.

Opportunities

The expansion of telehealth and remote patient monitoring is creating growth opportunities

The expansion of telehealth and remote patient monitoring (RPM) services is creating significant growth opportunities in the market. The widespread adoption of virtual care models, accelerated by recent global health events, has necessitated the integration of new data streams from remote devices and virtual consultation platforms into existing EHRs and clinical systems.

This ensures that care teams have a complete and up-to-date view of patient health, regardless of where care is delivered. Integration solutions are essential for enabling secure and efficient data flow between patients’ homes, virtual care providers, and traditional healthcare settings, making these innovative care models viable and scalable.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the healthcare IT integration market. Economic conditions affect healthcare organizations’ budgets for IT investments, directly impacting their capacity to fund complex integration projects; during economic growth, there is greater willingness to invest in digital transformation, while recessions can lead to delays or reduced spending on integration solutions.

Geopolitical tensions and international relations can influence data governance frameworks and cross-border data exchange regulations, adding complexity for global healthcare providers and technology vendors operating across different jurisdictions, potentially restricting data flow and collaboration. In 2023, the US imported approximately US$104 billion in automatic data processing machines (under HTS 8471), which include servers and components vital for integration platforms, highlighting the global nature of the IT supply chain.

Despite potential negative impacts from economic uncertainties and regulatory fragmentation driven by geopolitical shifts, the critical need for seamless data flow to enhance patient safety, improve care coordination, and drive operational efficiency ensures a persistent demand for integration solutions, encouraging continuous innovation and strategic investments to overcome these challenges.

Current US tariff policies can indirectly impact the healthcare IT integration market by affecting the cost of underlying IT infrastructure. While healthcare IT integration primarily involves software and services, these solutions rely on physical hardware such as servers, networking equipment, and data storage devices, many of which are imported.

Tariffs on these imported IT components can increase the operational costs for cloud service providers and healthcare organizations that host integration platforms, potentially leading to higher pricing for integration solutions or delayed infrastructure upgrades. For example, tariffs on specific Harmonized Tariff Schedule (HTS) codes for automatic data processing machines (like HTS 8471) can directly elevate the cost of essential equipment. These increased hardware costs present an indirect financial challenge for the market by raising deployment and maintenance expenses.

Nevertheless, the indispensable role of robust integration in achieving interoperability, supporting telehealth, and optimizing healthcare operations provides a compelling incentive for continued investment in these technologies, prompting market participants to adapt sourcing strategies and leverage efficiencies to ensure the seamless exchange of vital healthcare information.

Latest Trends

The push towards standardized data exchange via FHIR is a recent trend

The push towards standardized data exchange via Fast Healthcare Interoperability Resources (FHIR) is a significant recent trend in the market. FHIR is an emerging standard for exchanging healthcare information electronically, designed to be more flexible, easier to implement, and compatible with modern web technologies than older standards.

Regulatory bodies and industry leaders are increasingly advocating for and mandating FHIR adoption to improve interoperability and facilitate secure data sharing across the healthcare ecosystem. This trend is driving demand for integration platforms and services that support FHIR-based APIs, enabling healthcare organizations to build more agile and future-proof data exchange capabilities.

The Centers for Medicare & Medicaid Services (CMS) actively supports the adoption of FHIR, with key federal interoperability milestones in 2023 and 2024 centered around new rules and frameworks that promote its implementation.

Regional Analysis

North America is leading the healthcare IT integration Market

North America dominated the market with the highest revenue share of 41.6% owing to the ongoing push for interoperability and the need for seamless data exchange across disparate healthcare systems. The US Department of Health & Human Services (HHS) continues to emphasize the importance of data sharing to improve patient care and outcomes. The Office of the National Coordinator for Health Information Technology (ONC) actively promotes initiatives to advance interoperability.

For instance, the 21st Century Cures Act, with its focus on open APIs, is facilitating greater data exchange. The increasing adoption of Electronic Health Records (EHRs) across the US, with a reported high rate of adoption by office-based physicians, creates a foundation for more sophisticated integration solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing government initiatives aimed at digitizing healthcare infrastructure and improving the efficiency of healthcare delivery. Several countries in the region are investing in national digital health strategies that necessitate robust integration capabilities.

For example, the development of national health information exchanges is gaining momentum. The increasing adoption of EHRs and the growing focus on universal health coverage are also expected to drive the demand for solutions that can connect various healthcare IT systems. Furthermore, the rising number of healthcare partnerships and collaborations across the Asia Pacific region necessitates effective data integration to enhance care coordination.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the healthcare IT integration market drive growth through investments in advanced interoperability solutions, strategic partnerships, and expansion into new geographic markets. They prioritize developing scalable platforms that enable seamless data exchange across diverse healthcare systems.

Additionally, companies focus on enhancing security features and ensuring compliance with evolving regulations to build customer trust. Investment in research and development allows incorporation of AI and cloud technologies, which improves service delivery and operational efficiency.

Cerner Corporation, a leading player, specializes in healthcare technology solutions, including electronic health records (EHR) and interoperability services that connect healthcare providers, payers, and patients. Founded in 1979, Cerner has grown into a global company operating in over 35 countries, with a strong emphasis on innovation and data-driven insights. Its platforms facilitate clinical workflow optimization, population health management, and patient engagement, supporting healthcare organizations in delivering more coordinated and effective care.

Top Key Players

- Oracle

- Philips Healthcare

- Infor

- Epic Systems Corporation

- GE Healthcare

- InterSystems Corporation

- Lyniate

- IBM Corporation

- Siemens Healthineers

- Optum

- Altera Digital Health Inc.

- Orion Health

- Redox

- MEDITECH

- NextGen Healthcare

- Connexall

- Change Healthcare

- Qvera

- Rhapsody Health Solutions

- iNTERFACEWARE

Recent Developments

- In June 2024, Oracle Corporation unveiled the Oracle Health Insurance Data Exchange Cloud Service, a cloud-native solution aimed at streamlining the integration of diverse and evolving data formats within the health insurance industry. This innovation reflects Oracle’s commitment to advancing efficient data exchange and management across the healthcare sector.

- In January 2023, CipherHealth Inc. formed a partnership with SADA, Inc. to improve patient outcomes by incorporating social determinants of health (SDOH) into data integration efforts, enhancing the ability to deliver personalized and holistic care through technology-driven patient engagement.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 Billion Forecast Revenue (2034) US$ 15.4 Billion CAGR (2025-2034) 9.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Products(Integration Engines, Medical Device Integration Software, Media Integration, Others) Services(Implementation & Integration, Support & Maintenance, Consulting, Training & Education)) By Deployment Mode(On-premise, Cloud-based, Hybrid) By Application(Electronic Health Records (EHR), Computerized Physician Order Entry (CPOE), Electronic Prescribing Systems, Medical Imaging Information Systems, Revenue Cycle & Claims Integration, Population Health & Analytics Integration, Others) By Organization Size (Large Enterprises, Small & Medium Enterprises) By End User (Hospitals & Clinics, Diagnostic & Imaging Centers, Payers & TPAs, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle, Philips Healthcare, Infor, Epic Systems Corporation, GE Healthcare, InterSystems Corporation, Lyniate, IBM Corporation, Siemens Healthineers, Optum, Altera Digital Health Inc., Orion Health, Redox, MEDITECH, NextGen Healthcare, Connexall, Change Healthcare, Qvera, Rhapsody Health Solutions, iNTERFACEWARE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Integration MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Integration MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle

- Philips Healthcare

- Infor

- Epic Systems Corporation

- GE Healthcare

- InterSystems Corporation

- Lyniate

- IBM Corporation

- Siemens Healthineers

- Optum

- Altera Digital Health Inc.

- Orion Health

- Redox

- MEDITECH

- NextGen Healthcare

- Connexall

- Change Healthcare

- Qvera

- Rhapsody Health Solutions

- iNTERFACEWARE