Global Healthcare Fraud Analytics Market By Type-(Descriptive Analytics, Prescriptive Analytics, Predictive Analytics), By Delivery Model-(On-Premises, Cloud-Based), By Application-(Insurance Claims Review, Pharmacy billing Issue, Payment Integrity, Others), By End-Use-(Public & Government Agencies, Private Insurance Payers, Third-Party Service Providers, Employers) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 84362

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

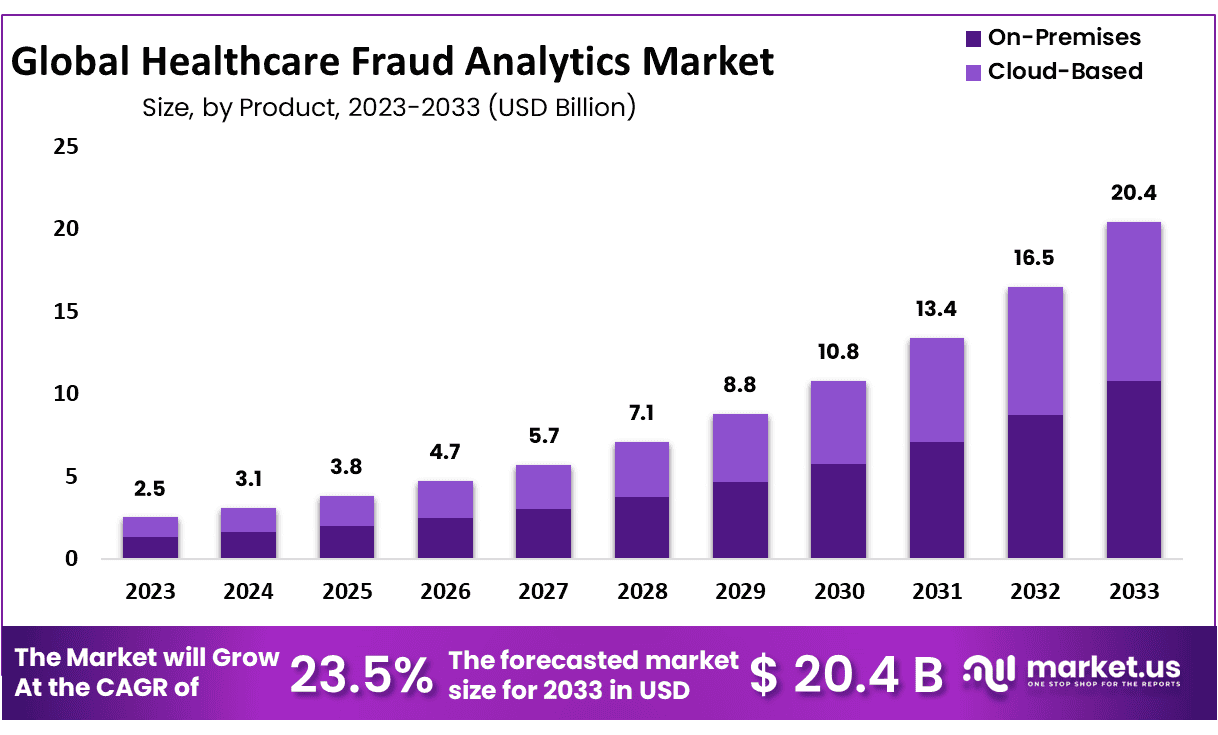

The Global Healthcare Fraud Analytics Market size is expected to be worth around USD 20.4 Billion by 2033 from USD 2.5 Billion in 2023, growing at a CAGR of 23.5% during the forecast period from 2024 to 2033.

Healthcare fraud is a form of white-collar crime characterized by the fraudulent submission of healthcare claims for illicit financial gain, usually by organized crime groups and dishonest healthcare practitioners. Common tactics may include billing for costly services or procedures that were never covered by insurance plans; misrepresenting non-covered treatments; engaging in insurance scams and engaging in other illegal practices. Healthcare fraud analytics utilize fraud detection solutions and software designed to detect instances of healthcare fraud such as false claim submissions duplicated claims submissions; pharmacist prescription fraud and health insurance fraud etc.

In today’s digital age, data has become an essential component of healthcare. Hospitals and healthcare institutions have begun gathering vast amounts of patient healthcare data as a result of rapid improvements in data sensing and acquisition technologies. Understanding and gaining knowledge from healthcare data needs the development of innovative analytical tools capable of transforming data into meaningful and actionable information.

General computer technologies have begun to transform the way medical care is delivered to patients. Analytics, in particular, is an important component of contemporary computing systems. When applied to healthcare data, analytical technologies have the potential to completely alter healthcare delivery.

The significance of analytics in the healthcare sector is expected to only increase in the coming years. Typically, studying health data will allow us to uncover hidden patterns in the data. It will also assist clinicians in developing an individualized patient profile, and in properly calculating the likelihood of an individual patient suffering from a medical issue in the near future.

Key Takeaways

- Market Size & Growth: Healthcare Fraud Analytics Market size is expected to be worth around USD 20.4 Billion by 2033 from USD 2.5 Billion in 2023, growing at a CAGR of 23.5%.

- Type Analysis: Base on type analysis, Descriptive analytics held approximately 41.2% market share in 2023

- Delivery Model Analysis: In 2023, on-premise segment held the 52.9% of revenue share.

- Application Analysis: Base on application analysis, the insurance claims review segment dominate over 36.5% market share in 2023.

- End-Use Analysis: Public and government agencies dominated the healthcare fraud analytics market in 2023 with over 40.8%

- Regional Analysis: North America held approximately 37.8% of the market and holding USD 0.945 Billion revenue in 2023.

- Healthcare Fraud Analytics Are Rising: Healthcare fraud analytics have become ever more essential in combatting the ever-increasing threats associated with fraud within healthcare services.

- Technological Advancement: State-of-the-art AI and machine learning (ML) technologies are driving continuous technological progress and innovation, improving accuracy and adaptability in fraud detection systems.

- Regulation Pressures: Health care organizations under mounting regulatory and compliance pressure have increasingly invested in analytics solutions as an insurance policy against fraud while meeting all regulations and remaining compliant. This can provide them with both fraud detection capabilities as well as ensure regulatory adherence.

Type Analysis

Base on type analysis, Descriptive analytics held approximately 41.2% market share in 2023. It can be attributed to its widespread adoption facilitated by user friendliness; descriptive analytics uses both current and historical data to recognize trends, relationships and detect any possible fraud, additionally it serves as the cornerstone for successful implementations of prescriptive and predictive analytics-making a substantial contribution toward its growth in 2023.

Predictive analytics is projected to experience rapid expansion during its projected time period. Recognizing fraud before claims are paid is crucial in effective prevention; consequently healthcare payers are rapidly adopting predictive analytics solutions as part of their fraud detection processes; such solutions identify potentially fraudulent patterns and create rules to flag specific claims, improving overall fraud detection processes.

Delivery Model Analysis

In 2023, on-premise segment held the 52.9% of revenue share, This can be attributed to its convenience for hospitals storing records directly at site, leading to enhanced record management and data monitoring capabilities. While current systems are ideal for small organizations such as hospitals, managing large datasets may present several scalability issues which necessitate substantial capital investments for storage and security solutions.

However, cloud-based segment is expected to experience the fastest compound annual growth at 29.4% during the forecast period. This surge can be attributed to cloud delivery becoming an increasingly preferred mode for patient data storage – offering both cost savings and commercial viability to industries alike; but with its advantages also come potential drawbacks such as security risks associated with data loss or decreased privacy concerns.

Application Analysis

In 2023, the insurance claims review segment dominate over 36.5% market share due to rising health insurance adoption and fraudulent claim activity. This segment can be broken down into post-payment review and prepayment review segments with prepayment review expected to experience faster compound annual growth rate due to rising healthcare provider demands.

Anticipated growth for pharmacy billing issues stems from rising incidences of medical billing fraud within pharmacies. Furthermore, payment integrity will experience tremendous expansion as payers use this tool to enhance administrative efficiency and thus lower costs.

End-Use Analysis

Public and government agencies dominated the healthcare fraud analytics market in 2023 with over 40.8%. This result can be attributed to factors like their higher patient volumes as well as being vulnerable to fraudulent activity in developing nations with less advanced infrastructure.

Employers’ segment is expected to experience the highest compound annual growth rate over the projected period, driven by increasing employer interest in healthcare fraud analytics as an aid for cost management. Furthermore, private insurers’ segment should experience considerable gains as more consumers adopt fraud analytics solutions to combat mounting financial losses.

Key Market Segments

Type

- Descriptive Analytics

- Prescriptive Analytics

- Predictive Analytics

Delivery Model

- On-Premises

- Cloud-Based

Application

- Insurance Claims Review

- Pharmacy billing Issue

- Payment Integrity

- Others

End-Use

- Public & Government Agencies

- Private Insurance Payers

- Third-Party Service Providers

- Employers

Driver

Rising Incidents of Healthcare Fraud

Healthcare fraud is an increasing global concern that costs billions every year in fraudulent activity. A major driver for the healthcare fraud analytics market is rising cases of false billing, identity theft and prescription fraud – practices such as false billing or overcharging patients for services they were never meant to receive in healthcare systems around the globe. With digital technologies integrating more into healthcare care delivery networks than ever before, fraudsters are becoming ever more adept in their fraudulent schemes requiring advanced analytics solutions in order to detect and prevent fraudulent activities before they have time become widespread within healthcare industries worldwide.

Stringent Regulatory Environment

Healthcare’s complex regulatory environment has long been one of the main drivers behind fraud analytics solutions adoption. Governments and regulatory bodies worldwide are taking stringent compliance measures against healthcare fraud to safeguard patient data; as a result, healthcare organizations invest in sophisticated analytics tools in order to stay compliant while safeguarding financial interests while staying ahead of evolving regulations requirements. Demand for fraud analytics solutions stems from this increasing regulatory environment for healthcare organizations worldwide.

Trend

Artificial Intelligence and Machine Learning Advances

Advances in artificial intelligence and machine learning technologies have emerged as one of the key trends in healthcare fraud analytics markets worldwide. AI/ML technologies offer advanced pattern recognition, anomaly detection, predictive modeling capabilities that greatly expand fraud detection systems’ capacities; as fraudsters continue to evolve their tactics AI and ML analytics provide dynamic adaptive approaches that quickly detect suspicious activities to drive market expansion.

Collaboration and Partnerships

Healthcare fraud analytics markets have witnessed an increased emphasis on collaboration and partnerships among healthcare organizations, technology vendors and regulatory bodies to jointly create comprehensive antifraud strategies that better position stakeholders to prevent fraud in healthcare institutions and practices. Collective efforts foster knowledge-sharing while strengthening analytical solutions designed for healthcare fraud detection mechanisms overall.

Restraint

High Implementation Costs

A major hindrance of healthcare fraud analytics market growth is high implementation costs associated with advanced analytics solutions. Initial investments may require considerable amounts for technology infrastructure, data integration and staff training as well as staff training costs – these might prove prohibitively expensive for smaller healthcare organizations that struggle allocating enough resources for comprehensive fraud analytics systems, hindering their ability to take full advantage of them effectively.

Data Security Concerns

Privacy issues pose a formidable barrier for healthcare fraud analytics systems in this market, given their handling of sensitive patient information that makes healthcare organizations tempting targets of cyberattack. Incorporating effective analytics solutions requires prioritizing security – any breaches or unwarranted access could stall adoption rates within healthcare.

Opportunity

Increased Adoption of Telehealth Services

Telehealth’s fast growth presents healthcare fraud analytics companies with an invaluable market opportunity. Virtual healthcare delivery opens the door for any number of fraudulent activities; hence analytics solutions designed to monitor and analyze telehealth transactions may prove particularly lucrative, providing healthcare providers with protection from potential risks in remote interactions or transactions that involve them.

Adoption of Electronic Health Records (EHRs)

Electronic health records (EHRs) represent an incredible opportunity for healthcare fraud analytics. As healthcare organizations transition away from paper records towards digital platforms, demand is on the rise for analytics solutions that monitor, analyze and secure electronic healthcare data – creating an opportunity for vendors who offer comprehensive EHR-integrated fraud analytics solutions to provide tailored solutions to meet this evolving environment for data management and security in healthcare organizations worldwide.

Regional Analysis

North America held approximately 37.8% of the market and holding USD 0.945 Billion revenue in 2023. This can be attributed to factors like high per capita income and healthcare spending levels, an aging and patient population with widespread health insurance coverage, notable incidences of healthcare fraud as well as favorable government initiatives against it and pressure to minimize healthcare costs; as well as proliferation of service providers and advances in fraud detection software which contributes to market expansion in this region.

North America is home to major players in healthcare fraud detection market. International Business Machines Corporation’s headquarters can be found in Armonk, New York – this has only added fuel to demand for software relating to fraud detection services.

According to the conclusions of the US Department of Health and Human Services in 2018, national Medicaid data includes flaws that could impede the detection of fraud in the public sector. According to the Office of Inspector General (OIG, the U.S. Department of Health and Human Services), Medicaid data is frequently insufficient and erroneous, affecting the process of detecting fraudulent claims and resulting in the waste of billions of dollars due to fraud and abuse. This factor is expected to hamper the economic growth of this market.

Key Regions

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Players Analysis

The competitive landscape of the healthcare fraud detection market offers insights into each competitor, encompassing aspects such as company overview, financials, revenue generation, market potential, investment in research and development, new market initiatives, global reach, production sites and facilities, production capacities, strengths and weaknesses, product launches, product range, and application dominance. It’s important to note that the mentioned data points specifically pertain to the companies’ endeavors in the healthcare fraud detection market.

Market Key Players

- IBM

- Optum, Inc.

- Cotiviti, Inc

- DXC Technology

- SAS Institute, Inc.

- EXL Service Holdings, Inc.

- Wipro Limited

- Conduent, Inc

- HCL Technologies Limited

- OSP Labs

Recent Developments

- AI and Machine Learning (ML) Combinations: AI and ML have revolutionized fraud detection by providing real-time analysis of vast quantities of healthcare data such as patient records, claims data and provider details. Advanced algorithms using this analysis can spot complex patterns or anomalies which indicate potential fraudulent activity.

- Predictive Analytics to Prevent Fraud: Predictive analytics has gained popularity for its ability to proactively detect high-risk patients and providers that might fall prey to fraud, by analyzing historical data and current trends; predictive models can anticipate any fraudulent behaviors while offering preventative solutions.

- Cloud Solutions for Scalability and Accessibility: Cloud-based healthcare fraud analytics solutions have gained popularity due to their scalability, flexibility, and cost effectiveness. Cloud platforms give healthcare organizations access to powerful analytics tools without extensive IT investments being necessary.

- Integration With Electronic Health Records (EHRs): Healthcare fraud analytics solutions are increasingly integrated with EHRs to facilitate detection and prevention efforts more easily. This enables seamless data exchange between analytics platforms and EHR systems for real-time risk evaluation and intervention purposes.

Report Scope

Report Features Description Market Value (2023) USD 2.5 Billion Forecast Revenue (2033) USD 20.4 Billion CAGR (2024-2033) 23.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Descriptive Analytics, Prescriptive Analytics, Predictive Analytics);By Delivery Model-(On-Premises, Cloud-Based); By Application-(Insurance Claims Review, Pharmacy billing Issue, Payment Integrity, Others); By End-Use-(Public & Government Agencies, Private Insurance Payers, Third-Party Service Providers, Employers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape IBM, Optum, Inc., Cotiviti, Inc, DXC Technology, SAS Institute, Inc., EXL Service Holdings, Inc., Wipro Limited, Conduent, Inc, HCL Technologies Limited, OSP Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Fraud Analytics MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Healthcare Fraud Analytics MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Optum, Inc.

- Cotiviti, Inc

- DXC Technology

- SAS Institute, Inc.

- EXL Service Holdings, Inc.

- Wipro Limited

- Conduent, Inc

- HCL Technologies Limited

- OSP Labs