Global Green Building Material Market By Material Type (Green Cement, Earthen Materials, Wood and Bamboo, Recycled Plastics, Non-VOC paints, Recycled Metals, Fibers, Slate/ Stone, Composites, Others), By Category (Healthy, High-performance, Recycled, Ecological), By Construction Phase (New Construction, Renovation /Remodeling), By Application (Insulation, Framing, Roofing, Exterior Siding, Interior Finishing, Others), By End-use ( Residential, Commercial, Industrial and Institutional, Infrastructure) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145823

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

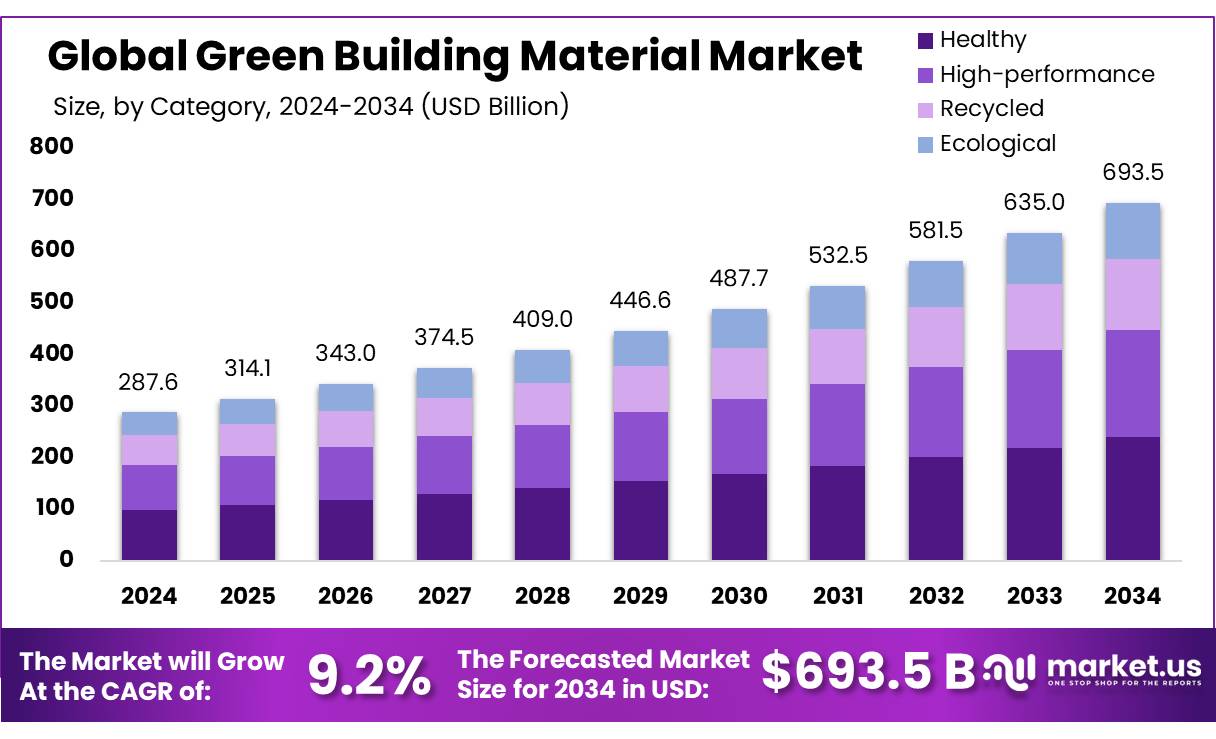

The Global Green Building Material Market size is expected to be worth around USD 693.5 Bn by 2034, from USD 287.6 Bn in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034.

The concept of green building materials encompasses a range of products and technologies designed to minimize environmental impact. These materials are sourced, manufactured, and implemented with the objective of reducing carbon footprints, enhancing energy efficiency, and conserving natural resources. In recent years, this market has expanded significantly, influenced by changing consumer preferences and stringent environmental regulations.

Governmental initiatives have also played a crucial role. For instance, the European Union’s directive on the energy performance of buildings requires all new constructions to be nearly zero-energy buildings by 2021. Similarly, in the United States, federal tax incentives and local grants support the adoption of green construction practices.

The driving factors behind the rise of green building materials include the growing recognition of the need for sustainable infrastructure, the rising costs of energy, and the increasing stringency of national and international regulations regarding building emissions and energy use. For example, the International Energy Agency (IEA) reported that buildings account for over 36% of global energy usage and nearly 40% of direct and indirect CO2 emissions. To combat this, there is a compelling shift towards materials that offer better energy efficiency and lower emissions.

The future growth of the green building material market looks promising with several opportunities on the horizon. Innovations in material science, such as the development of high-performance insulation materials and eco-friendly cement substitutes like green concrete, are expected to drive the market forward. According to the United Nations, 68% of the world population is projected to live in urban areas by 2050, necessitating the construction of millions of homes and commercial buildings that could benefit from green materials.

Key Takeaways

- Green Building Material Market size is expected to be worth around USD 693.5 Bn by 2034, from USD 287.6 Bn in 2024, growing at a CAGR of 9.2%.

- Green Cement held a dominant market position, capturing more than a 24.40% share of the green building material market.

- Healthy building materials held a dominant market position, capturing more than a 34.50% share of the green building material market.

- New Construction held a dominant market position in the green building material sector, capturing more than a 72.20% share.

- Insulation held a dominant market position in the green building material sector, capturing more than a 21.50% share.

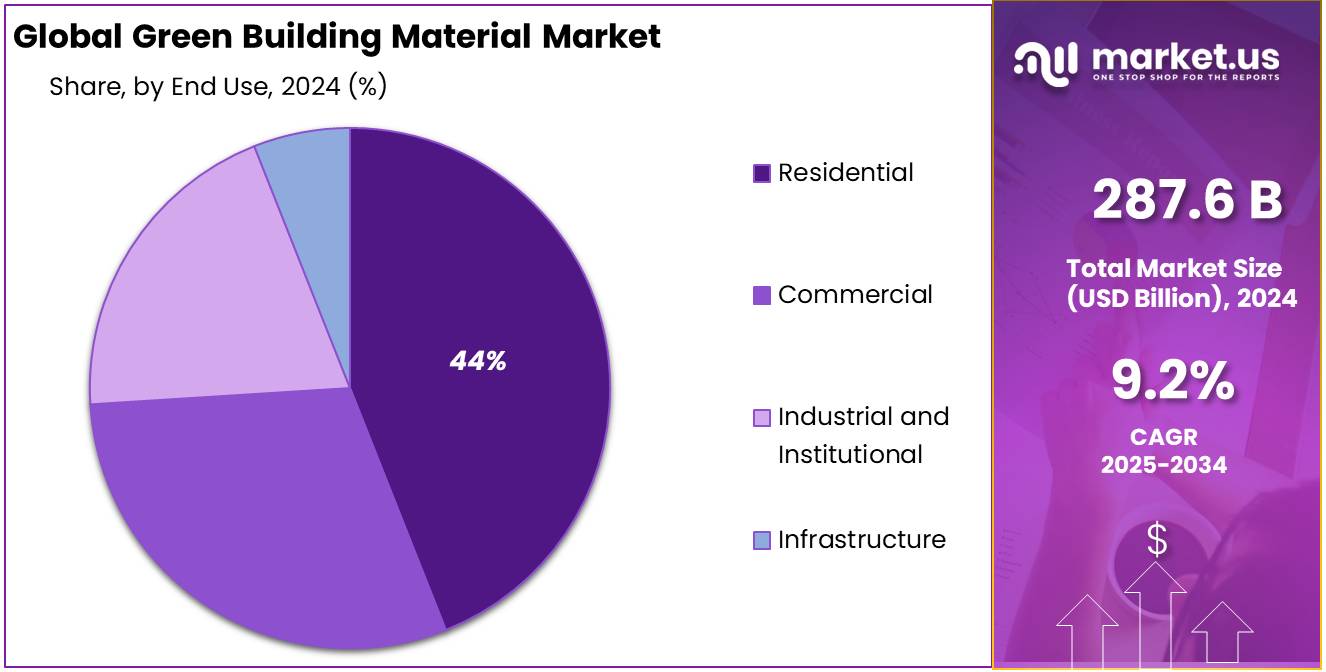

- Residential sector held a dominant market position in the green building material market, capturing more than a 44.50% share.

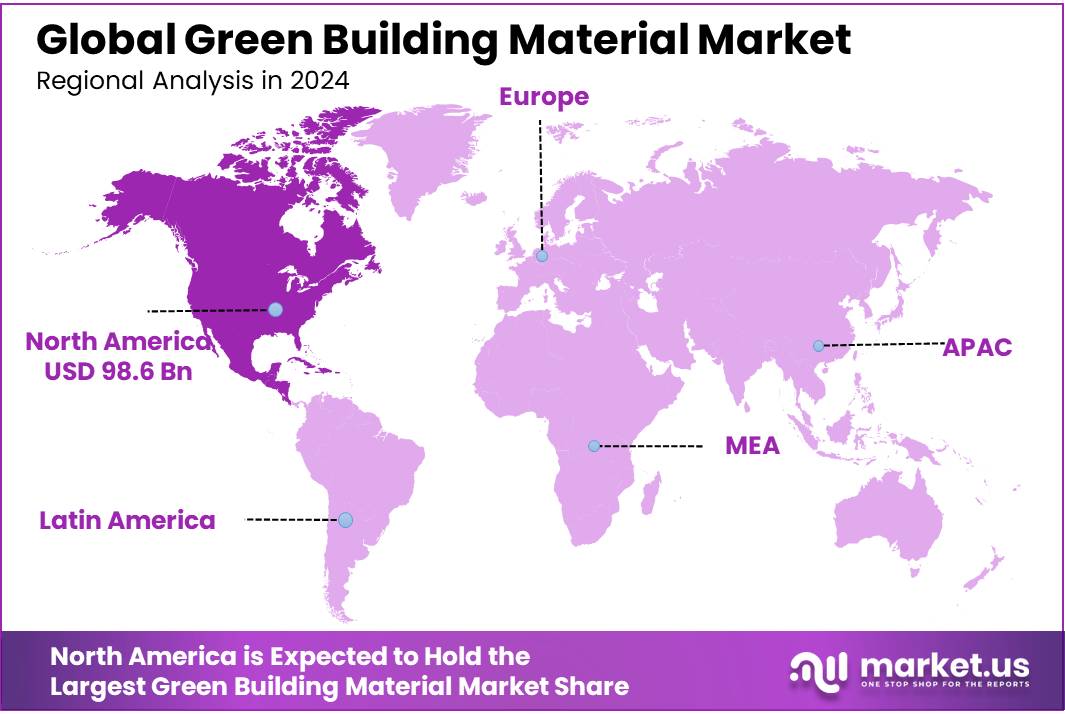

- North America stands as a dominant force in the green building materials market, capturing approximately 34.30% of the global market share, equating to a valuation of approximately USD 98.6 billion.

By Material Type

Green Cement Dominates with 24.40% Market Share Due to Its Sustainable Qualities

In 2024, Green Cement held a dominant market position, capturing more than a 24.40% share of the green building material market. This significant market share highlights the growing preference for environmentally friendly construction practices. Green Cement, known for its reduced carbon footprint compared to traditional cement, has gained traction among builders and architects striving for sustainable development goals.

This shift is primarily driven by increasing regulatory support and incentives for green building projects, coupled with a rising awareness of environmental sustainability. As the construction industry continues to evolve, Green Cement’s role in promoting eco-friendly building practices is expected to further strengthen, reflecting a broader commitment to reducing the environmental impact of the built environment.

By Category

Healthy Building Materials Lead with a 34.50% Share, Emphasizing Well-being

In 2024, Healthy building materials held a dominant market position, capturing more than a 34.50% share of the green building material market. This category’s strong performance underscores the increasing consumer and industry emphasis on health and well-being within living and working spaces. Materials classified under this category are known for their low-emission and non-toxic properties, contributing significantly to indoor air quality and occupant health.

As awareness of the health implications of building materials grows, demand for these healthier alternatives continues to rise, reflecting a broader trend towards wellness-oriented construction practices. This shift is not just a fad but a lasting movement towards creating environments that promote physical and mental health.

By Construction Phase

New Construction Commands a 72.20% Market Share, Reflecting Strong Development Momentum

In 2024, New Construction held a dominant market position in the green building material sector, capturing more than a 72.20% share. This substantial share underscores the robust growth and expansion in the construction industry, particularly in the development of new infrastructure that incorporates sustainable building practices.

The drive towards new construction projects that utilize green materials reflects a growing commitment from developers and government entities to reduce environmental impact and promote sustainability. This trend is fueled by regulatory frameworks and incentives that encourage the use of environmentally friendly materials in new building projects, showing a clear shift towards more sustainable development practices in the construction industry.

By Application

Insulation Leads with a 21.50% Share, Enhancing Energy Efficiency in Buildings

In 2024, Insulation held a dominant market position in the green building material sector, capturing more than a 21.50% share. This segment’s strong performance is largely due to its critical role in enhancing energy efficiency within buildings. Green insulation materials, which are known for their superior thermal properties and reduced environmental impact, are increasingly favored in both residential and commercial construction.

The focus on insulation reflects a wider industry trend towards sustainability, aiming to reduce energy consumption and decrease utility costs. As more builders and developers recognize the long-term benefits and cost savings associated with energy-efficient buildings, the demand for green insulation materials continues to grow, solidifying its significant share in the market.

By End-use

Residential Sector Leads with 44.50% Share, Driven by Demand for Sustainable Living

In 2024, the Residential sector held a dominant market position in the green building material market, capturing more than a 44.50% share. This notable market share is indicative of a growing consumer preference for sustainable and environmentally friendly living spaces.

As more individuals become aware of the environmental impacts of their choices, there is a significant shift towards green building materials in residential construction. These materials not only improve the ecological footprint of homes but also offer enhanced energy efficiency, reduced utility costs, and potentially higher property values. The rising demand in the residential sector is supported by various government incentives and an increasing number of green certifications that encourage the adoption of sustainable practices in home building.

Key Market Segments

By Material Type

- Green Cement

- Earthen Materials

- Wood & Bamboo

- Recycled Plastics

- Non-VOC paints

- Recycled Metals

- Fibers

- Slate/ Stone

- Composites

- Others

By Category

- Healthy

- High-performance

- Recycled

- Ecological

By Construction Phase

- New Construction

- Renovation/Remodeling

By Application

- Insulation

- Framing

- Roofing

- Exterior Siding

- Interior Finishing

- Others

By End-use

- Residential

- Commercial

- Industrial and Institutional

- Infrastructure

Drivers

Government Regulations and Initiatives Promoting Green Building Materials

One major driving factor for the growth of the green building material market is the increasing number of government initiatives and regulations promoting sustainability in the construction sector. Over the last decade, governments worldwide have recognized the need for green buildings to reduce energy consumption, lower carbon emissions, and promote overall environmental sustainability.

In 2021, the European Union adopted a new “Green Deal” that aims to cut down carbon emissions by 55% by 2030 compared to 1990 levels. This ambitious target includes encouraging the construction of energy-efficient buildings, with a particular focus on green building materials. In fact, countries like the UK, Germany, and France have set up tax incentives and subsidies for buildings that use sustainable materials. In the United States, the federal government has set up the Energy Star program to support energy-efficient building products, rewarding manufacturers who align with sustainability goals.

Governments are also driving the demand for green building materials by adopting strict building codes. For example, California’s Title 24 Building Standards Code mandates the use of energy-efficient materials, particularly in residential and commercial buildings, as part of the state’s climate strategy. As per the California Department of General Services, buildings complying with these codes contribute to reducing state-wide energy consumption by about 12%. In 2022, approximately 16,000 new homes in California were built following these energy-efficient guidelines, reflecting the effectiveness of such government-led programs.

Another significant example is the U.S. Green Building Council’s (USGBC) LEED certification program, which sets standards for environmentally sustainable construction practices. According to the USGBC, over 100,000 commercial projects globally have earned LEED certification, demonstrating the growing adoption of sustainable materials in building designs. In fact, LEED-certified buildings use 25% less energy and produce 34% fewer greenhouse gas emissions than traditional buildings.

Restraints

High Initial Costs and Financial Barriers

One of the major restraining factors for the growth of the green building material market is the high initial cost associated with these materials. While green buildings provide long-term benefits such as energy savings, reduced operational costs, and environmental advantages, the upfront investment required to implement green building technologies is still a significant challenge for many developers and homeowners.

For instance, a report from the National Renewable Energy Laboratory (NREL) states that the construction of energy-efficient homes, which use green building materials, can cost up to 10-15% more than traditional buildings. This initial cost can be a substantial barrier for builders, especially in developing regions where affordability is a primary concern. Many developers find it difficult to balance the cost of sustainable materials with their limited budgets. While government incentives can help, these costs often remain a significant roadblock for widespread adoption.

The cost of raw materials like recycled steel, high-performance windows, and solar panel systems can be much higher than traditional options. For example, the cost of installing solar panels in buildings is around $18,000 to $20,000 for a 5kW system, which may not seem justifiable for all property owners. The high initial expense creates a hesitation among individuals and businesses to fully transition to these materials, despite the long-term savings on energy and maintenance.

Despite government programs offering tax credits and incentives to promote green construction, such as the Energy Tax Credit in the United States, the upfront investment still poses a challenge. In fact, the U.S. Department of Energy estimates that more than 60% of homebuyers still express concerns over the affordability of green building materials.

Opportunity

Rising Demand for Sustainable Building Certifications

One significant growth opportunity for the green building material market is the increasing demand for sustainable building certifications, such as LEED and BREEAM. These certifications are becoming crucial in the construction industry, with more developers and builders striving to meet green building standards due to growing awareness about sustainability and energy efficiency.

Governments worldwide are supporting these certifications through incentives and regulations. In the United States, for example, over 100,000 commercial projects have earned LEED certification, indicating a strong trend toward adopting energy-efficient materials in construction. The U.S. Green Building Council (USGBC) reports that buildings with LEED certification use 25% less energy and produce 34% fewer greenhouse gas emissions compared to traditional buildings. This growing adoption of certification programs is providing a significant boost to the green building material market, as more projects need sustainable materials to meet these standards.

In the UK, the demand for BREEAM certified buildings has also surged. A report from BREEAM indicates that certified buildings are associated with 30% lower energy consumption and 27% lower operating costs. As companies and developers realize the benefits of these certifications, more are investing in sustainable materials to meet these benchmarks. In fact, the UK government has set a target to make all new buildings carbon-neutral by 2050, pushing for a widespread adoption of green materials.

Moreover, corporate sustainability targets are adding fuel to this demand. According to CDP (Carbon Disclosure Project), 90% of companies globally are now setting targets for reducing their carbon footprint, which often includes using more sustainable building materials. This shift in corporate responsibility is further driving the growth of the green building material market, as businesses look to meet environmental goals through their construction and renovation projects.

Trends

Innovative Use of Waste Materials in Green Building

A notable trend in green building is the innovative repurposing of waste materials to create sustainable construction products. This approach not only reduces waste but also lowers the carbon footprint of buildings.

For example, Taiwanese companies like Miniwiz are transforming waste such as insect shells, rice husks, and plastic bottles into durable building materials. They have developed over 1,200 waste conversion processes, leading to structures like the Taipei EcoARK, constructed from 1.5 million PET bottles.

Similarly, Material Cultures, an ecological design studio, utilizes natural materials like bark, pine needles, and sap to create building components. Their projects, such as the straw bale and clay-rendered community hub in London, demonstrate the feasibility of low-carbon, community-built infrastructure.

These initiatives are supported by government policies promoting sustainable construction. In the United States, programs like the Inflation Reduction Act have expanded green building tax incentives, encouraging developers to adopt energy-efficient and environmentally friendly practices.

Regional Analysis

North America stands as a dominant force in the green building materials market, capturing approximately 34.30% of the global market share, equating to a valuation of approximately USD 98.6 billion. This prominence is largely attributed to the United States, where the market is further bolstered by robust government initiatives and a growing emphasis on sustainable construction practices.

In 2024, the U.S. green building materials market accounted for a substantial portion of North America’s market share, driven by heightened consumer awareness and a shift towards energy-efficient building solutions. This trend is supported by favorable government policies, including tax incentives and stringent building codes aimed at promoting energy efficiency.

For instance, the U.S. government’s implementation of tariffs under the “Liberation Day” policy has led to an average increase of $9,200 in the cost of building new homes. While these tariffs aim to bolster domestic manufacturing, they also underscore the complexities and costs associated with construction in the current economic climate.

Regionally, the demand for green building materials is expected to continue its upward trajectory, propelled by ongoing urbanization, supportive policies, and a collective commitment to environmental stewardship. This growth not only signifies a shift towards more sustainable construction practices but also highlights North America’s pivotal role in shaping the future of green building.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sika AG, headquartered in Switzerland, is a leading specialty chemicals company renowned for its innovative green building materials. Their product portfolio includes sustainable solutions such as concrete admixtures, sealants, and adhesives, all designed to enhance energy efficiency and environmental performance in construction. Sika’s commitment to sustainability is evident in their continuous investment in research and development, aiming to provide eco-friendly alternatives that meet the evolving demands of the green building sector.

Alumasc Group Plc, based in the UK, specializes in sustainable building products and solutions. Their offerings encompass green roofing systems, external wall insulation, and rainwater harvesting products, all contributing to improved energy efficiency and reduced carbon footprints in buildings. Alumasc’s dedication to environmental stewardship is reflected in their comprehensive approach to developing products that not only meet performance standards but also support sustainable construction practices.

Amvic Inc., a North American company, is recognized for its Insulating Concrete Forms (ICFs), which are widely used in green building projects. ICFs provide superior insulation, leading to reduced energy consumption and enhanced indoor comfort. Amvic’s products are designed to support sustainable construction by offering durable, energy-efficient solutions that align with the principles of green building and environmental responsibility.

Top Key Players in the Market

- Sika AG

- Alumasc Group Plc

- Amvic Inc.

- BASF SE

- PPG Industries, Inc.

- Bauder Ltd

- Binderholz GmbH

- CertainTeed

- DuPont

- RedBuilt

- Forbo International SA

- Kingspan Group

- Lafarge

- Owens Corning

- Other Key Players

Recent Developments

In 2024, BASF reported total sales of €111.8 billion, with €2.1 billion allocated to research and development, underscoring its commitment to innovation in sustainable solutions.

Amvic Inc., a key player in the green building materials sector, specializes in manufacturing environmentally friendly products like Insulating Concrete Forms (ICFs) and radiant heat flooring systems.

Report Scope

Report Features Description Market Value (2024) USD 287.6 Bn Forecast Revenue (2034) USD 693.5 Bn CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Green Cement, Earthen Materials, Wood and Bamboo, Recycled Plastics, Non-VOC paints, Recycled Metals, Fibers, Slate/ Stone, Composites, Others), By Category (Healthy, High-performance, Recycled, Ecological), By Construction Phase (New Construction, Renovation /Remodeling), By Application (Insulation, Framing, Roofing, Exterior Siding, Interior Finishing, Others), By End-use ( Residential, Commercial, Industrial and Institutional, Infrastructure) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sika AG, Alumasc Group Plc, Amvic Inc., BASF SE, PPG Industries, Inc., Bauder Ltd, Binderholz GmbH, CertainTeed, DuPont, RedBuilt, Forbo International SA, Kingspan Group, Lafarge, Owens Corning, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Green Building Material MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Green Building Material MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sika AG

- Alumasc Group Plc

- Amvic Inc.

- BASF SE

- PPG Industries, Inc.

- Bauder Ltd

- Binderholz GmbH

- CertainTeed

- DuPont

- RedBuilt

- Forbo International SA

- Kingspan Group

- Lafarge

- Owens Corning

- Other Key Players