Global Gluten-Free Products Market By Product (Bakery Products, Desserts & Ice Creams, and Other Products), By Distribution Channel (Convenience Stores, Specialty Stores, Online, and Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 16550

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

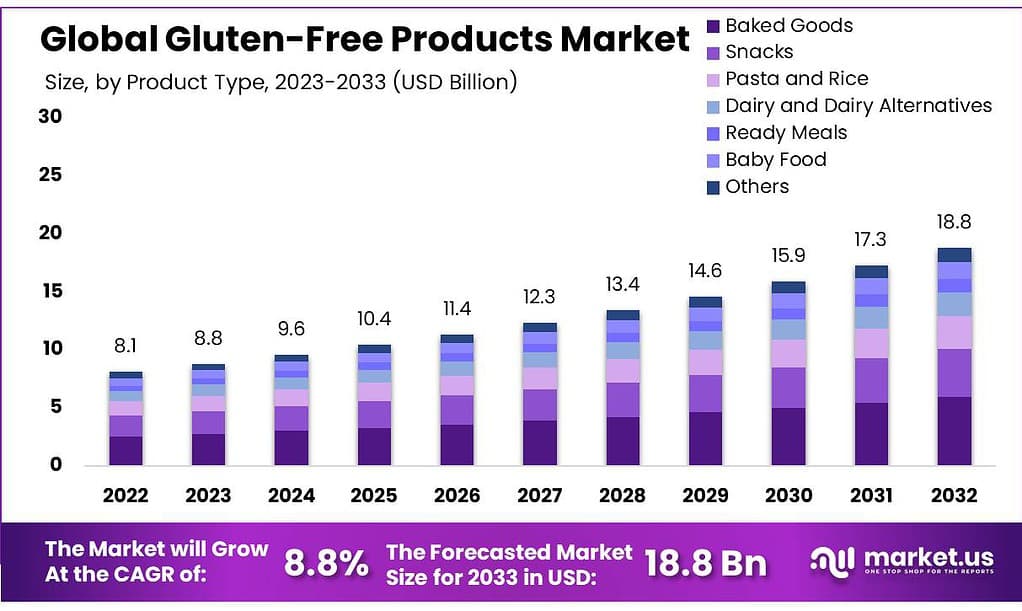

The global Gluten-Free Products market size is expected to be worth around USD 18.8 billion by 2033, from USD 8.1 billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2023 to 2033.

Gluten-free products will be in demand due to the rising incidence of celiac and other conditions resulting from unhealthy lifestyles. This market is expected to grow because of the increased consumption of healthy food products to prevent diseases such as diabetes, heart disease, obesity, chronic lung disease, metabolic syndrome, and other health conditions.

Due to the rising health and wellness concerns of consumers, the use of gluten-free products has been impacted by the COVID-19 pandemic.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The gluten-free products market is projected to reach a substantial worth of around USD 18.8 billion by 2033, exhibiting a CAGR of 8.8% from USD 8.1 billion in 2023. This growth is primarily driven by increased health consciousness and rising instances of conditions like celiac disease.

- Product Analysis: Baked Goods Dominance Baked goods accounted for over 31.5% of the gluten-free products market in 2023. Items like bread, cookies, and cakes without gluten witnessed high demand due to health-conscious consumers seeking alternatives. Bakery Segment Growth The bakery segment is expected to have the fastest CAGR of 11.7% from 2032 to 2033. Factors include a wide product portfolio, innovation, and increasing awareness of healthy eating habits.

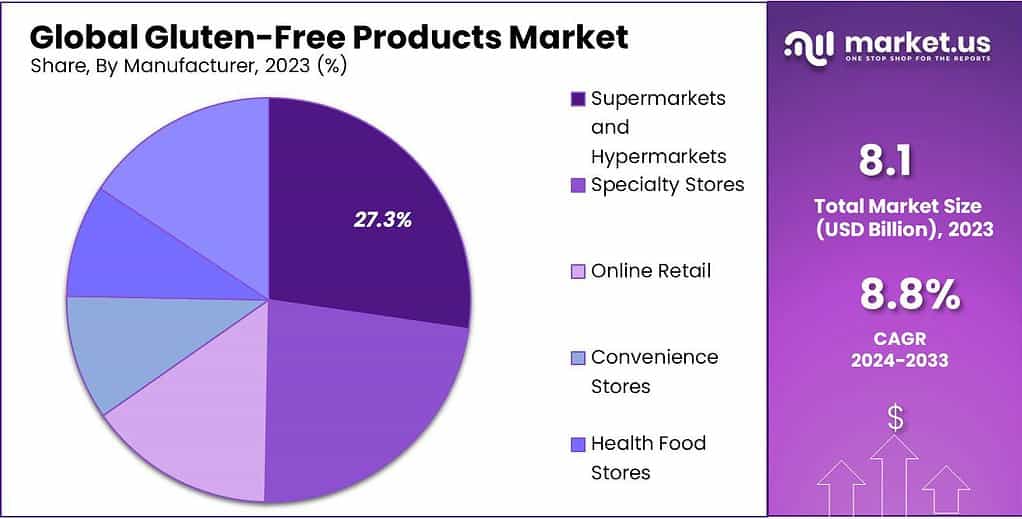

- Distribution Channel Insights: Supermarkets and hypermarkets Secured a significant share of over 27.3% in 2023. These retail giants catered to the demand for gluten-free alternatives by offering diverse product ranges and convenience. Online Channels Projected to experience a 12.8% CAGR from 2023 to 2032. Their appeal lies in home shopping, doorstep delivery, discounts, and attracting younger generations, significantly bolstered during the COVID-19 pandemic.

- Drivers and Restraints: Increased Diagnoses and Awareness: Higher diagnoses of celiac disease and food allergies drive demand. Government campaigns and labeling initiatives have raised consumer awareness about the necessity of gluten-free products. Dietary Fiber and Health Concerns: Gluten-free products may lack sufficient dietary fiber, potentially leading to digestive issues. Refined grains and low-fiber content in these products pose health concerns despite their perceived advantages.

- Opportunities and Challenges: Innovative Technologies: The use of micro-encapsulation technology offers a chance to enhance the shelf life of gluten-free foods, maintaining taste and texture. However, companies face challenges in replicating the taste and texture of gluten-containing products, hindering consumer acceptance.

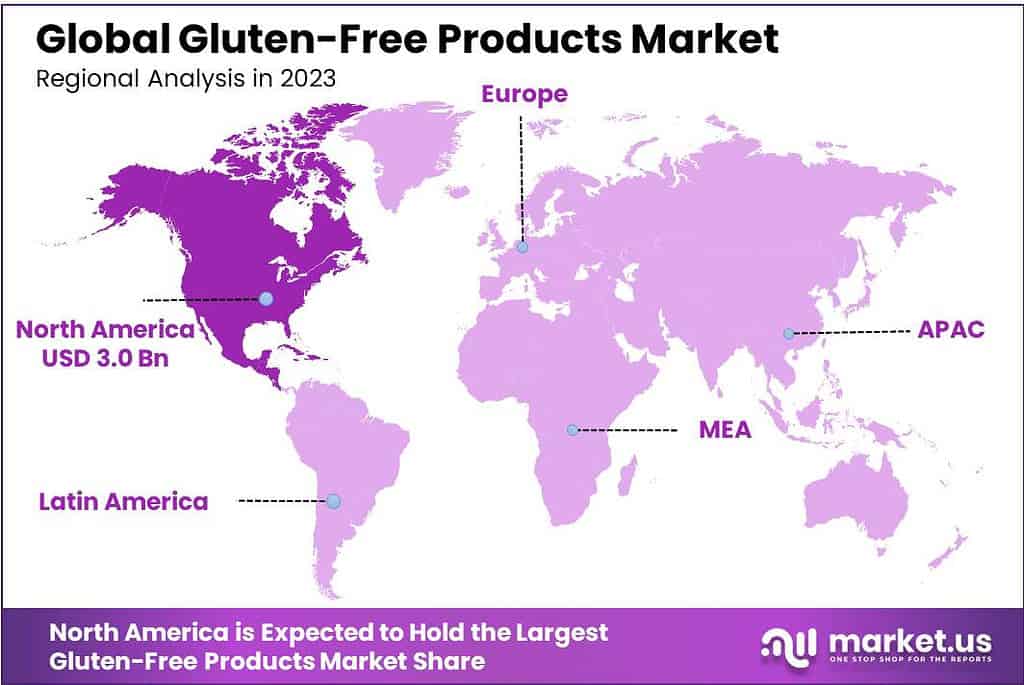

- Regional Analysis: North America Dominance: Accounting for 37.2% of the total revenue in 2023, the region’s demand is fueled by health considerations and increased availability of gluten-free products in grocery stores. Asia Pacific Growth Potential: Predicted to record the highest CAGR of 13% between 2023 and 2032. Factors include growing internet penetration, health-conscious consumers, and unique marketing strategies.

- Key Market Players: Major companies in the market include Conagra Brands, Nestlé, The Hershey Company, General Mills, and others, actively contributing to market growth through vertical integration, new product launches, and expansions.

Product Analysis

In 2023, Baked Goods stood out in the gluten-free products market, securing a dominant share of more than 31.5%. These gluten-free baked items, including bread, cookies, and cakes without gluten, were in high demand among consumers seeking alternatives due to gluten intolerance or dietary preferences.

The segment growth is expected to be driven by rising awareness about healthy eating, including organic, natural, and gluten-free. The future growth of the segment will be influenced by factors such as the existence of a broad product portfolio and continuous innovation.

The primary driver of the bakery product segment is the growing demand for gluten-free bread. Packaged bread manufacturers, including the U.K.’s major player Warburton’s, have developed free-from sub-brands for their flagship brands. These are becoming increasingly popular among consumers from all income levels.

A number of bakery startups are now offering gluten-free bread, like Coconut Wraps by NUCO in America. This is a product that is not only gluten-free but also meets all other health criteria such as raw, organic, vegan, and paleo. From 2032 to 2032, the bakery segment will experience the fastest CAGR at 11.7%.

It is expected that the availability of many products at reasonable prices, along with the convenience of ready-to-eat foods, will have a positive effect on the segment’s growth. Additionally, growing awareness about the health benefits of baking products and rapid urbanization will likely drive growth.

Distribution Channel Analysis

In 2023, Supermarkets and Hypermarkets asserted their dominance in the gluten-free products market, securing a significant share of more than 27.3%. These expansive retail giants played a pivotal role in catering to the demands of consumers seeking gluten-free alternatives.

They offered a diverse array of gluten-free products market across various categories, providing convenience and a one-stop shopping experience for individuals looking for these specialized items.

Seasonally driven displays include gluten-free products. This promotes new products and expands the market. It is easier to deal with one large customer base than with many smaller customers. Because supermarkets and hypermarkets can access a large customer base, they have huge sales volumes. A national distribution network allows for greater brand recognition, which in turn leads to higher sales volumes.

The supplier also benefits from a contract with large supermarkets while they seek financial support for product development. These food manufacturers prefer to sell their products through hypermarkets and supermarkets. This leads to greater penetration.

From 2023 to 2032, the online segment will experience a 12.8% CAGR. The benefits of the online channel include shopping at home, delivery to your doorstep, free shipping, and discounts. This channel is attracting the millennial generation and younger generations. Online channels were also crucial for retailers during the COVID-19 pandemic.

Newer delivery methods are also making a difference in the retail sector. Customers and retailers alike prefer click-and-collect (also known as BOPIS or buying online and picking it up in-store) over curbside pickup. Pickup may be more convenient than home delivery because it allows customers to pick up their items at any time they want, instead of waiting for delivery. These innovations in services will make online shopping more attractive over the forecast period.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Bakery Products

- Desserts & Ice Creams

- Prepared Foods

- Pasta and Rice

- Other Products

By Distribution Channel

- Convenience Stores

- Specialty Stores

- Online

- Supermarkets & Hypermarkets

- Other Distribution Channels

Drivers

Increased diagnosis of celiac disease and other food allergies

Gluten intolerance or celiac disease is an autoimmune condition that damages the small intestine lining, inhibiting nutrients from being absorbed when eaten. Left untreated, this may result in other immunity disorders like osteoporosis, thyroid disease, and cancer forming over time – according to one study by Cornell University Medical Centre in 2023.

Early Celiac diseases were unknown to most of the general public prior to 2000 as they could easily have been misdiagnosed for another digestive-related ailment.

Due to new diagnostic tools being made easily accessible and reliable, things have undergone profound change. Now we are able to accurately gauge celiac disease frequency across various cultures and regions – providing much-needed support for epidemiological studies in this field.

Consuming and avoiding gluten-containing products are currently the only effective means of treating celiac disease, driving demand for the gluten-free products market.

Gluten-free product market growth can also be observed through an increase in diagnoses of celiac disease and associated ailments such as non-celiac gluten sensitivity, inflammation, and autoimmunity disorders.

Under government awareness campaigns and initiatives regarding celiac diseases and labeling for gluten-free products, awareness has been spread about their necessity across most regions – even developing ones.

These promotions have increased consumer awareness about celiac disease diagnosis as well as the demand for gluten-free products in the market.

Restraints

Gluten-free products generally do not provide enough dietary fiber, leading to constipation and other digestive ailments. A gluten-free diet does not automatically mean healthier living despite some perceived advantages associated with its consumption.

Gluten-free flours used in gluten-free products such as bread, pasta and pizza may contain highly refined grains that have low amounts of fiber with a high glycemic index (GI) score. Sometimes fats or sugar may also be added for optimal taste/texture/feel; which could potentially pose health concerns in humans.

Many individuals on gluten-free diets have adopted low-fiber diets due to the nature of gluten-free food products being made with refined flour and starches such as white rice flour, tapioca starch, corn starch and potato starch that lack essential dietary fiber for digestive system health. Fiber is vitally important to human beings.

People suffering from digestive issues that lead to diarrhea or constipation typically consume an abundance of fiber daily in their diet, thus most key players in the gluten-free products market are creating and formulating ingredients with plenty of dietary fiber, so as not to leave their consumers vulnerable to constipation or any other digestive ailments like irregular bowel movements, loose stools or stomach ache due to any deficit of this nutrient in their daily meals.

However, conventional fiber-rich gluten foods will still offer higher intake levels when compared with gluten-free food products; thus limiting market growth.

Opportunity

There’s a cool chance to use micro-encapsulation tech to make gluten-free foods last longer on shelves. Normally, gluten helps foods stay fresh for a while, but without it, gluten-free stuff tends to go bad quicker and lose its texture. This new tech, microencapsulation, can change that. It’s been used to fix the texture of refrigerated pizza and extend the shelf life of frozen dough, muffins, and biscuits.

This tech works by coating gluten-free foods with special coatings that keep them fresh. Some natural acids can also be used to maintain the taste and texture without any reactions. So, this innovation helps gluten-free food makers create products that stay fresh longer and still taste great, making them available for a longer time and across different places. For example, Legacy Farms has gluten-free products like cheese and broccoli bake, soup mixes, and pinto bean stews that last a long time.

Challenges

Companies making gluten-free foods face an uphill battle when trying to transition people away from regular diets due to taste and texture differences; this presents companies with an immense challenge as they work on making these products as appetizing as their gluten counterparts.

Producing gluten-free items requires using alternative ingredients that hold everything together and create delicious tastes, but getting these replacements to work similarly to their original versions can be difficult. Companies must ensure their gluten-free food offerings look, taste, and feel just like conventional ones to convince people to give them a try.

Companies invest both time and money experimenting with ingredients until they create the ideal combination, while simultaneously making sure their gluten-free food products remain separate from anything containing gluten throughout production and storage. It may prove challenging; nevertheless, these companies strive to create delicious gluten-free fare at an accessible price point for everyone.

Regional Analysis

North America was the dominant market, accounting for 37.2% of the total revenue in 2023. Gluten-free foods are thought to be healthier for the digestive system, have less cholesterol, and are lower in fat. These factors will increase demand during the forecast period.

Consumption will also be aided by their availability in almost every grocery store, especially in the U.S. With the increasing awareness of celiac disease, the U.S. market will likely grow. To avoid symptoms, celiac disease patients are now following a gluten-free diet. People who have not been diagnosed with the disease are also following a gluten-free diet to reduce their cardiovascular risk.

Asia Pacific is predicted to record the highest CAGR at 13% between 2023 and 2032. Due to factors like the growing internet penetration, booming online market, and favorable demographics, the regional market conditions look promising. The country’s consumers include those with celiac disease, and gluten intolerance/sensitivity, as well as those who are healthy and need these products for weight control. The region has a huge potential growth opportunity due to its growing consumption of healthy foods and unique marketing strategies used by key manufacturers to gain a significant market share.

A second trend that is emerging in the Asia Pacific is health and wellness tourism. This promotes healthier food choices. To improve their well-being, people are increasingly traveling more. The Global Wellness Institute’s latest research shows that the Asia Pacific is the fastest-growing market for wellness tourism, as well as the largest number of spas.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

With the presence of many multinational companies from major economies, the market is highly competitive. Most of these companies are vertically integrated to produce gluten-free food. This allows them to have a better product portfolio and launch new brands. The following are some of the major initiatives that the companies have taken:

Маrkеt Кеу Рlауеrѕ

- Conagra Brands, Inc.

- Nestlé SA

- The Hershey Company

- DR. SCHÄR AG/SPA

- ENJOY LIFE NATURAL

- General Mills, Inc.

- Kellogg Company

- The Kraft Heinz Company

- Genius Foods

- Amys Kitchen Inc.

- Bobs Red Mill Natural Foods Inc.

- Campbell Soup Co.

- The Hain Celestial Group, Inc.

Recent Development

September 2022: Vegolution, a company from Bengaluru, said they’d start selling Hello Tempayy, a super bean-based, easy-to-cook, gluten-free food that works in different dishes and cooking styles. They plan to release it first in New Delhi and Gurgaon.

November 2021: Hy-Vee Inc. told everyone about Good Graces, their new brand with lots of gluten-free items. They’re starting with 30 products and planning 60 more soon.

Report Scope

Report Features Description Market Value (2023) USD 18.8 Billion Forecast Revenue (2033) USD 132.7 Billion CAGR (2023-2032) 8.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bakery Products, Desserts & Ice Creams, and Other Products), By Distribution Channel (Convenience Stores, Specialty Stores, Online, and Other Distribution Channels) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Conagra Brands, Inc., Nestlé SA, The Hershey Company, DR. SCHÄR AG/SPA, ENJOY LIFE NATURAL, General Mills, Inc., Kellogg Company, The Kraft Heinz Company, Genius Foods, Amys Kitchen Inc., Bobs Red Mill Natural Foods Inc., Campbell Soup Co., The Hain Celestial Group, Inc., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are gluten-free products?Gluten-free products are items that do not contain gluten, a protein found in wheat, barley, rye, and their derivatives. These products are designed for individuals with gluten intolerance, celiac disease, or those who choose to follow a gluten-free diet for health reasons.

How important is labeling in the gluten-free market?Accurate and clear labeling indicating "gluten-free" is crucial for consumers with gluten-related disorders to make informed choices. Strict regulations are in place in many countries to ensure proper labeling

How do gluten-free products impact the food industry?The rise in demand for gluten-free products has influenced food manufacturers to diversify their product lines, catering to a wider consumer base. It has also led to the development of dedicated production lines for gluten-free items.

Gluten-Free Products MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Gluten-Free Products MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Conagra Brands, Inc.

- Nestlé SA

- The Hershey Company

- DR. SCHÄR AG/SPA

- ENJOY LIFE NATURAL

- General Mills, Inc.

- Kellogg Company

- The Kraft Heinz Company

- Genius Foods

- Amys Kitchen Inc.

- Bobs Red Mill Natural Foods Inc.

- Campbell Soup Co.

- The Hain Celestial Group, Inc.