Global Yogurt Market Size, Share, And Business Benefits By Type (Flavoured, Non-flavoured), By Product Type (Set Yogurt, Greek Yogurt, Yogurt Drinks, Frozen Yogurt, Others), By Flavor (Strawberry Blend, Vanilla, Plain, Strawberry, Peach, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150734

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

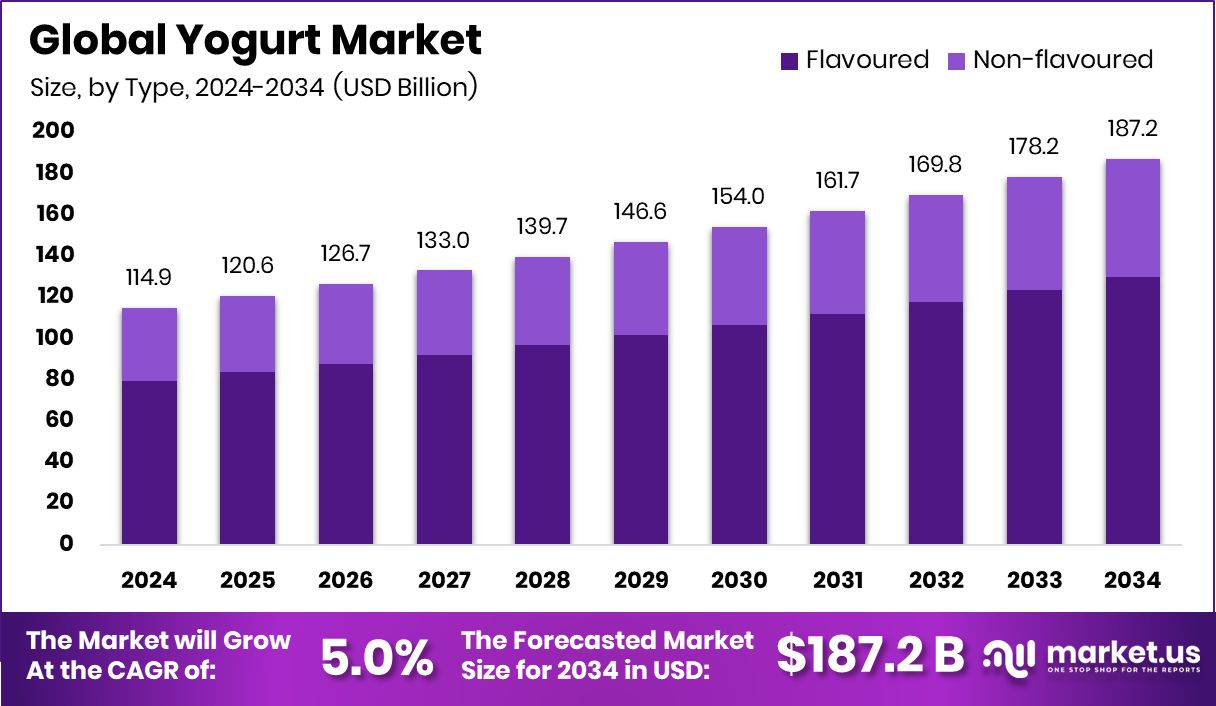

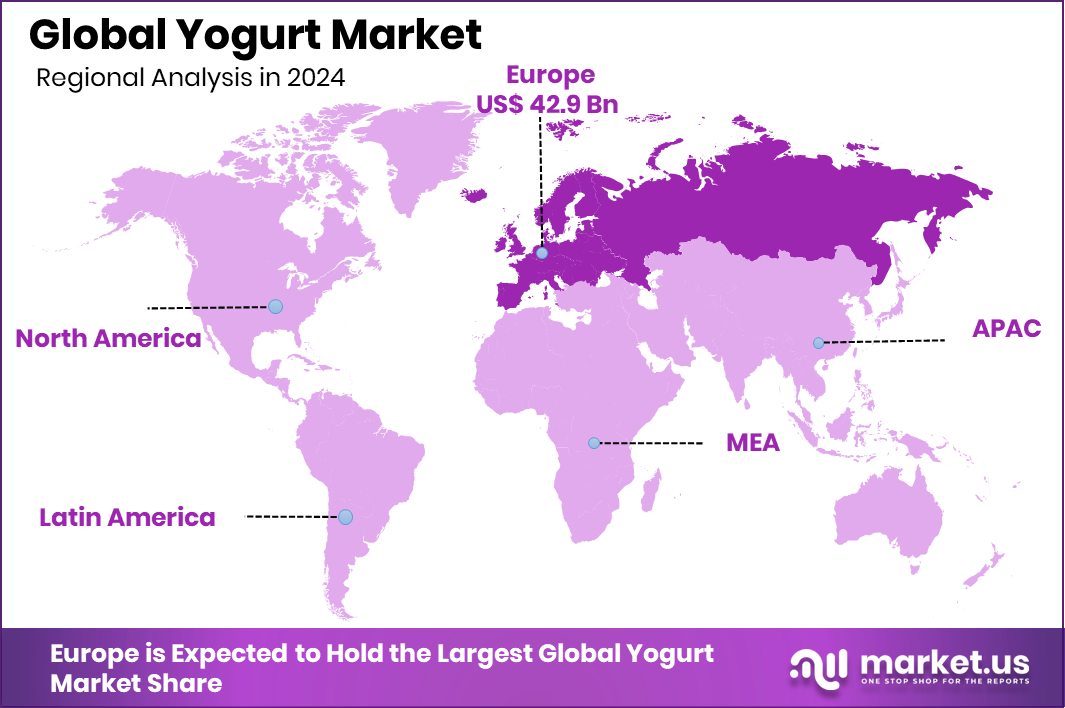

Global Yogurt Market is expected to be worth around USD 187.2 billion by 2034, up from USD 114.9 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034. Rising health awareness and dairy traditions supported Europe’s USD 42.9 billion yogurt demand.

Yogurt is a dairy product made by fermenting milk with specific bacterial cultures. This fermentation process thickens the milk and gives yogurt its tangy flavor. It’s rich in protein, calcium, and probiotics, making it a popular choice for people seeking digestive health and balanced nutrition. Yogurt can be consumed plain or flavored, and it’s available in various forms like Greek yogurt, drinkable yogurt, and plant-based alternatives.

The yogurt market includes all forms of yogurt sold across retail and foodservice channels, catering to a wide demographic looking for health-focused food options. It covers flavored, unflavored, organic, non-dairy, low-fat, and functional yogurts. The market’s expansion is tied closely to rising consumer awareness about gut health, protein intake, and overall wellness.

Growth is driven by changing lifestyles and increasing demand for convenient, nutritious snacks. Urban consumers, in particular, are shifting toward on-the-go food options that offer both taste and health. Yogurt fits this space perfectly due to its ready-to-eat format and high nutritional value.

Demand continues to rise among health-conscious individuals, especially those reducing sugar or avoiding traditional desserts. Yogurt’s perceived health halo also boosts its presence in breakfast routines and post-workout consumption.

Key Takeaways

- Global Yogurt Market is expected to be worth around USD 187.2 billion by 2034, up from USD 114.9 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

- Flavoured yogurt dominates the Yogurt Market, capturing 69.3% due to wide taste preferences globally.

- Greek yogurt leads by product type in the Yogurt Market, holding a strong 32.8% share.

- Strawberry blend flavor is most preferred in the Yogurt Market, accounting for 23.5% of sales.

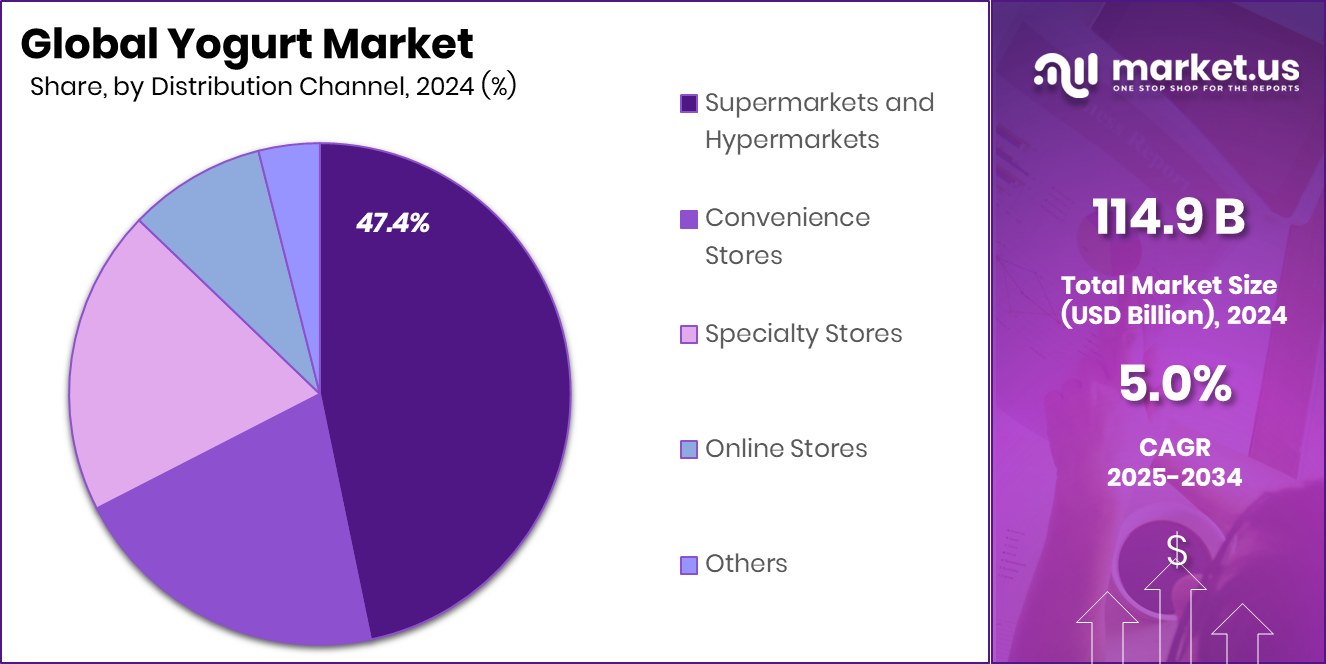

- Supermarkets and hypermarkets drive 47.4% of Yogurt Market sales through widespread availability and promotions.

- The yogurt market in Europe reached a value of USD 42.9 billion.

By Type Analysis

Flavoured yogurt dominates the yogurt market with a 69.3% share globally.

In 2024, Flavoured held a dominant market position in the By Type segment of the Yogurt Market, with a 69.3% share. This leadership reflects strong consumer preference for taste-enhanced dairy options that align with both indulgence and health goals.

Flavoured yogurt has become a popular alternative to sugary desserts, offering the appeal of fruits, vanilla, and other natural infusions without compromising on nutritional value. The segment’s dominance is also supported by its versatility across age groups and meal occasions, from children’s lunchboxes to adult breakfast routines.

The rising demand for convenient and tasty snacks has further accelerated the consumption of flavoured yogurt, especially in urban regions where time-pressed consumers look for ready-to-eat options. Additionally, the inclusion of probiotics and functional ingredients in flavoured variants has broadened their appeal among health-conscious buyers. Retail shelves continue to prioritize flavoured SKUs due to their faster turnover and wider acceptance.

The high market share also indicates how product innovation, such as low-sugar or high-protein flavoured options, is playing a key role in maintaining consumer interest. Given this strong market hold, flavoured yogurt is expected to remain the anchor of growth within the yogurt category, backed by evolving dietary trends and shifting taste preferences.

By Product Type Analysis

Greek yogurt leads by product type, capturing 32.8% of the market.

In 2024, Greek Yogurt held a dominant market position in the By Product Type segment of the Yogurt Market, with a 32.8% share. This strong foothold is largely attributed to the product’s rich texture, high protein content, and health-oriented appeal.

Consumers increasingly recognize Greek yogurt as a balanced choice that supports muscle health, satiety, and digestive wellness. Its thicker consistency and tangier taste profile have also distinguished it from other types of yogurt, making it a preferred option for both standalone consumption and recipe inclusion.

The rise in fitness awareness and protein-focused diets has played a significant role in pushing Greek yogurt to the forefront of consumer choices. Its growing popularity across supermarkets, health stores, and online channels has further reinforced its market presence. Additionally, the product’s suitability for breakfast, snacks, and even savory dishes has expanded its use across varied eating habits.

Greek yogurt’s ability to meet nutritional needs while delivering indulgent taste has kept it relevant among millennials and working professionals. With sustained consumer interest and clear product positioning, the segment’s dominance in 2024 highlights its continuing relevance in the evolving dairy landscape and its contribution to the yogurt market’s overall growth trajectory.

By Flavor Analysis

Strawberry blend flavor holds 23.5%, making it the top consumer choice.

In 2024, Strawberry Blend held a dominant market position in the By Flavor segment of the Yogurt Market, with a 23.5% share. This leadership stems from the flavor’s broad consumer appeal across all age groups, particularly among children and young adults who prefer familiar and fruity profiles.

Strawberry Blend offers a balanced taste that combines natural sweetness with a refreshing note, making it a go-to option for breakfast, snacks, and light desserts. Its versatility in both spoonable and drinkable yogurt formats has further contributed to its market strength.

The visual appeal of the flavor, often featuring real fruit bits or puree, enhances its attractiveness on store shelves and encourages repeat purchases. Moreover, Strawberry Blend aligns well with consumer demand for fruit-based, naturally flavored products that feel healthier and more indulgent than artificial alternatives.

The 23.5% share in 2024 underscores how effectively this flavor continues to connect with evolving taste preferences while maintaining a trusted position in both traditional and modern yogurt portfolios. With strong market resonance and brand familiarity, Strawberry Blend remains a cornerstone flavor driving segment growth within the yogurt industry.

By Distribution Channel Analysis

Supermarkets and hypermarkets contribute 47.4% to the yogurt market distribution channels.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Yogurt Market, with a 47.4% share. This dominance is driven by the wide reach, extensive shelf space, and organized retail infrastructure that these outlets offer.

Consumers prefer supermarkets and hypermarkets for their convenience, product variety, and consistent availability of fresh dairy items, including yogurt. These retail formats also enable shoppers to compare brands, flavors, and pack sizes in a single location, supporting higher volume sales.

The 47.4% share reflects how effectively these outlets cater to both daily needs and bulk purchases, especially in urban and semi-urban regions. In-store promotions, discounts, and cold chain reliability further enhance consumer preference for buying yogurt through this channel. Additionally, strategic shelf placement and brand tie-ups in supermarkets contribute to product visibility and impulse purchases.

For families and regular buyers, these stores remain the most trusted point of sale for fresh and flavored yogurt products. Their continued expansion and modernization in both developed and developing regions have made supermarkets and hypermarkets the cornerstone of yogurt retail distribution, firmly securing their leading market position in 2024.

Key Market Segments

By Type

- Flavoured

- Non-flavoured

By Product Type

- Set Yogurt

- Greek Yogurt

- Yogurt Drinks

- Frozen Yogurt

- Others

By Flavor

- Strawberry Blend

- Vanilla

- Plain

- Strawberry

- Peach

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Driving Factors

Health-Conscious Lifestyles Drive Yogurt Market Demand

More people today are choosing foods that support a healthy lifestyle, and yogurt fits this trend perfectly. It is seen as a nutritious snack that helps with digestion, builds immunity, and keeps the stomach full. Yogurt is packed with protein, calcium, and probiotics, which are good for gut health. Because of this, people of all ages, especially adults and fitness-focused individuals, are eating yogurt more often.

It’s also being added to daily meals like breakfast or snacks instead of sugary or fried foods. As consumers become more aware of what they eat, they look for products that are both tasty and healthy, and yogurt offers that balance. This shift is pushing steady growth in the yogurt market globally.

Restraining Factors

Cold Storage Needs Increase Cost And Limit Reach

One of the biggest challenges in the yogurt market is its need for cold storage. Yogurt is a perishable dairy product and must be stored and transported at low temperatures to stay fresh. This makes distribution difficult in rural or remote areas where cold chain systems are weak or expensive. Small shops and local vendors may not have the right equipment to keep yogurt fresh, leading to limited product availability.

Also, maintaining refrigeration throughout the supply chain adds to overall costs, especially in regions with unreliable electricity. This restrains market growth, particularly in developing countries, where infrastructure gaps and high refrigeration costs reduce access to a wider consumer base.

Growth Opportunity

Plant-Based Yogurt Offers Huge Growth Opportunity Worldwide

There is a big chance for yogurt brands to grow by making and selling plant-based yogurt. Many people today are trying vegan or dairy-free diets because of allergies, health reasons, or caring for animals and the environment. Plant-based yogurt, made from ingredients like soy, almond, coconut, and oat, meets these needs. It gives similar creamy textures and tastes, but without milk.

This means companies can reach new customers who don’t eat dairy or prefer plant-based options. By offering tasty, probiotic-rich products in different flavors, brands can stand out. Also, plant-based yogurt can be sold in both regular stores and health-food shops, attracting a wider audience. This trend is strengthening and will likely help yogurt producers grow in the future.

Latest Trends

Mini Snack Pots and On-the-Go Yogurt Cups

A big new trend in the yogurt market is the rise of mini snack pots and on-the-go yogurt cups. These smaller, single-serve portions are perfect for busy people who need quick, healthy snacks between meals. They are easy to carry in bags, perfect for lunchboxes, and great for those who want portion control.

Brands are making them tasty by adding fruit swirls, crunchy toppings, and flavored layers. They are also more convenient because you don’t need a big spoon or bowl—just open and enjoy. Because people are eating more outside the home and want healthy snacks, these small yogurt cups fit daily routines well. This trend is growing fast and helping yogurt sales in the quick snack segments.

Regional Analysis

In 2024, Europe led the yogurt market with a 37.4% share.

In 2024, Europe dominated the global yogurt market, accounting for 37.4% of the total share, valued at USD 42.9 billion. This dominance is attributed to the region’s long-standing dairy consumption culture, high awareness of probiotic health benefits, and strong retail infrastructure. Countries like Germany, France, and the UK have seen consistent yogurt consumption across all age groups, especially in functional and flavored variants.

North America followed closely, driven by the rising demand for high-protein and Greek-style yogurts, supported by a growing population of health-conscious consumers. In Asia Pacific, the market is expanding steadily due to urbanization, increasing disposable incomes, and a shift toward Western dietary patterns. However, market size figures for Asia Pacific, the Middle East & Africa, and Latin America were not provided.

In the Middle East & Africa, yogurt is a traditional staple, and its consumption remains stable, though the market is comparatively smaller in value. Latin America is gradually growing with the expansion of retail distribution and increased product availability.

While all regions are witnessing growth based on unique local preferences and consumption patterns, Europe remains the most mature and revenue-generating region, maintaining its leadership with strong consumer loyalty and a well-developed yogurt product portfolio.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Chobani, LLC has continued to expand its reach by focusing on protein-rich innovations and brand authenticity. Its unwavering commitment to high-quality ingredients and functional benefits has resonated strongly with health-conscious consumers. Chobani’s consistent efforts in launching Greek-style, low-sugar, and limited-ingredient lines have helped maintain its relevance in North America and increasingly in Europe.

Danone SA remains a global powerhouse with comprehensive dairy portfolios across regions. Its century-long experience in probiotics has given it a strong advantage in the functional yogurt segment. Danone’s ability to tailor offerings to local tastes, such as regional flavors and texture adaptations, has reinforced its presence across Europe, Latin America, and Asia Pacific. Its distribution expertise ensures consistent availability through supermarkets and convenience channels.

Fage continues to act as the purist Greek yogurt specialist, recognized for its thick texture and authentic taste. Its disciplined focus on classic Greek yogurt—rather than sprawling into multiple subsegments—has enabled it to maintain unmistakable brand positioning. Consumer perceptions of Fage as a premium yet traditional offering allow it to command price premium, especially in Europe and North America.

Top Key Players in the Market

- Amul (Gujarat Cooperative Milk Marketing Federation Ltd)

- China Mengniu Dairy Company Ltd

- Chobani, LLC

- Danone SA

- Fage

- General Mills Inc.

- Greek Gods

- La Yogurt Lifeway Foods

- Lactalis Group

- Nestlé SA

- Saputo Inc.

- Stonyfield Farms

- The Hain Celestial Group Inc.

- Valio

- Yili Group

- Yoplait

Recent Developments

- In October 2024, Amul partnered with Costco in the U.S. to introduce its curd (yogurt) alongside fresh milk, buttermilk, and fresh cream. This launch marks Amul’s first move into mainstream U.S. retail outlets, targeting both the Indian diaspora and American consumers.

- In July 2024, Mengniu began human clinical studies on its proprietary probiotic strain PC‑01 used in the Yoyi C yogurt range. Early results from a 28‑day trial showed improvements in digestive symptoms, such as bloating and heartburn, after daily consumption of two bottles containing 100 billion CFU PC‑01.

Report Scope

Report Features Description Market Value (2024) USD 114.9 Billion Forecast Revenue (2034) USD 187.2 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavoured, Non-flavoured), By Product Type (Set Yogurt, Greek Yogurt, Yogurt Drinks, Frozen Yogurt, Others), By Flavor (Strawberry Blend, Vanilla, Plain, Strawberry, Peach, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amul (Gujarat Cooperative Milk Marketing Federation Ltd), China Mengniu Dairy Company Ltd, Chobani, LLC, Danone SA, Fage, General Mills Inc., Greek Gods, La Yogurt Lifeway Foods, Lactalis Group, Nestlé SA, Saputo Inc., Stonyfield Farms, The Hain Celestial Group Inc., Valio, Yili Group, Yoplait Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amul (Gujarat Cooperative Milk Marketing Federation Ltd)

- China Mengniu Dairy Company Ltd

- Chobani, LLC

- Danone SA

- Fage

- General Mills Inc.

- Greek Gods

- La Yogurt Lifeway Foods

- Lactalis Group

- Nestlé SA

- Saputo Inc.

- Stonyfield Farms

- The Hain Celestial Group Inc.

- Valio

- Yili Group

- Yoplait