Global Window Film Market Size, Share, And Business Benefits By Product (Sun Control Film, Decorative Film, Safety and Security Film, Insulating Film, Privacy Film, Others), By Material (Vinyl, Polyester, Plastic, Ceramic, Others), By Application (Automotive, Residential, Commercial, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161276

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

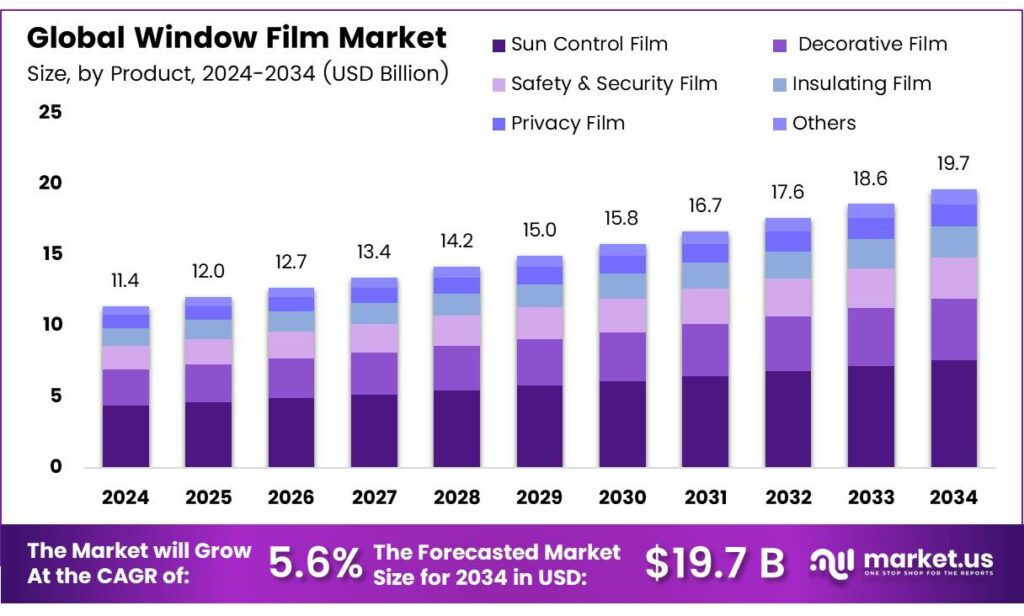

The Global Window Film Market size is expected to be worth around USD 19.7 billion by 2034, from USD 11.4 billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The window film industry comprises thin polymer, metalized, or ceramic films that are laminated or adhered to glass surfaces (in buildings, vehicles, marine craft) to provide solar control, UV protection, glare reduction, privacy, insulation, safety/security, and aesthetic functions. These films augment existing glazing systems and permit retrofit upgrades without full window replacement.

3M Window Films let you enjoy natural light while reducing up to 78% of the sun’s heat, lowering energy costs, and eliminating hot spots for a comfortable space. They evenly disperse light, reduce glare, and block up to 99% of UV rays, protecting furnishings without obstructing your view. Urbanization and rising construction volume, especially in the Asia Pacific, drive demand in residential and commercial segments. Advances in film technologies further stimulate uptake.

Moreover, many green building certification regimes recognize window films as cost-effective upgrades. Nevertheless, constraints include high upfront installation costs, limited awareness or perceived value in some regions, performance trade-offs (optical clarity vs. efficiency), competition from alternative glazing technologies, and regulatory barriers on allowed film darkness in certain jurisdictions.

Significant opportunities lie in smart and switchable films, integration with IoT and building automation, retrofit demand in existing building stock, modular film solutions for emerging markets, and expanded adoption in niche end-uses (marine, aerospace, or high-security installations). In sum, the global window film industry is poised for steady mid-single-digit growth, with differentiation increasingly coming via materials innovation, ease of installation, and regulatory alignment.

Key Takeaways

- The Global Window Film Market is projected to grow from USD 11.4 billion in 2024 to USD 19.7 billion by 2034, at a CAGR of 5.6%.

- Sun control film dominated in 2024, holding a 38.6% market share due to demand for energy-efficient glazing solutions.

- Polyester-based films led in 2024 with a 43.9% share, valued for clarity, durability, and versatility in various applications.

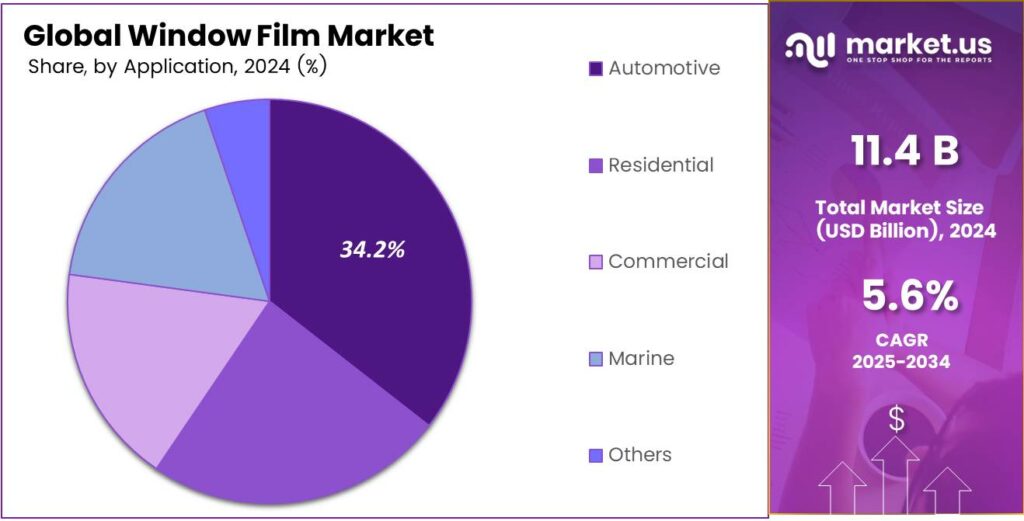

- The automotive sector captured a 34.2% market share in 2024, driven by demand for UV protection and cabin comfort.

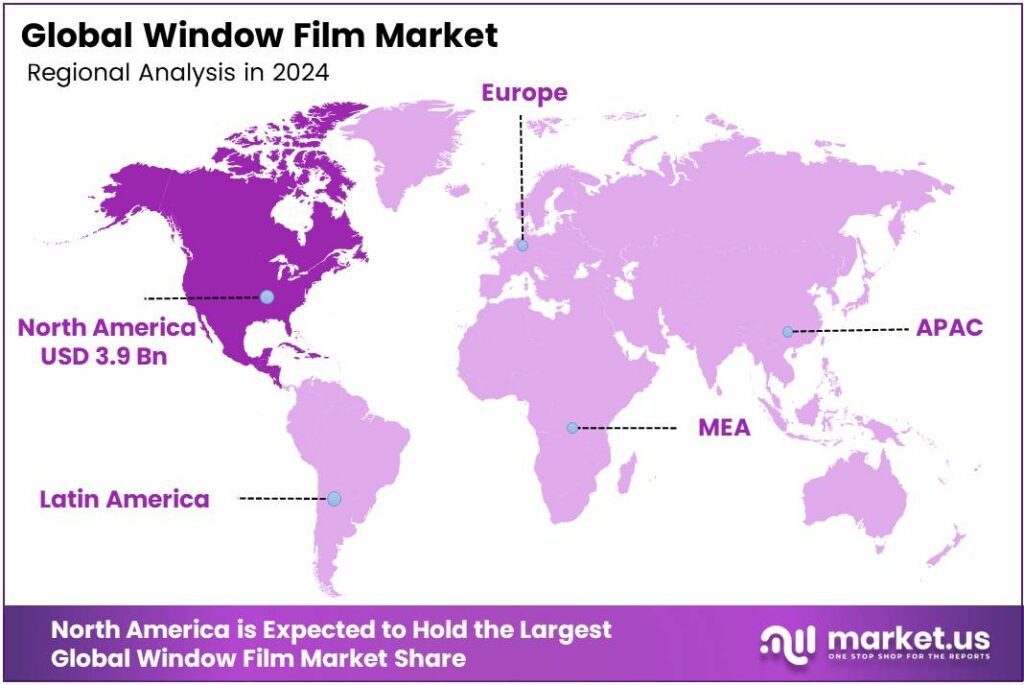

- North America held a 34.8% market share in 2024, valued at USD 3.9 billion, due to strong adoption of energy-efficient technologies.

Analyst Viewpoint

The window film industry, through an investment lens, always appreciated how it sits at the crossroads of everyday practicality and bigger-picture sustainability things like keeping homes cooler without cranking up the AC, or protecting car interiors from fading under the sun. Right now, the market feels ripe for growth, with projections showing it climbing.

That’s not flashy like tech stocks, but it’s reliable, especially as more folks chase energy-efficient upgrades in homes and offices. Opportunities jump out in the green building boom; think retrofitting older structures with films that slash heat gain, qualifying for rebates, and appealing to eco-conscious buyers.

North America is leading the charge with massive construction pushes, while the Asia Pacific rebound in residential projects offers steady entry points for investors eyeing established players like 3M or Eastman. On the flip side, risks lurk in supply chain hiccups, raw material shortages from past disruptions could squeeze margins, and the upfront costs for smarter, high-performance films might deter budget-strapped consumers, though the long-term savings usually win out.

By Product

Sun Control Film Leads Global Window Film Market – 38.6% Share

In 2024, Sun Control Film held a dominant market position, capturing more than a 38.6% share of the global window film market. This strong share reflects growing consumer demand for energy-efficient glazing solutions that reduce heat gain and improve indoor comfort.

Sun control films help block harmful UV radiation, lower air-conditioning loads, and protect interiors from fading, making them a preferred choice for both automotive and architectural applications. The demand for sun control films is expected to rise further as commercial buildings, residential complexes, and transport fleets increasingly adopt thermal management solutions to meet sustainability targets.

Regulatory pushes for energy conservation, particularly in Asia-Pacific and North America, are boosting installation rates. These films also contribute to carbon reduction goals by minimizing energy use in cooling systems. The sun control film segment continues to dominate the product landscape, driven by its practical benefits, heat rejection, glare reduction, and cost efficiency, coupled with rising awareness about eco-friendly building materials.

By Material

Polyester Dominates Window Film Market – 43.9% Share

In 2024, Polyester held a dominant market position, capturing more than a 43.9% share of the global window film market. Polyester-based films remain the most widely used material due to their excellent clarity, durability, and resistance to heat and chemicals. Their strong optical properties and ease of coating make them ideal for solar control, safety, decorative, and privacy applications across commercial, residential, and automotive sectors.

The material’s ability to maintain tensile strength and dimensional stability under varying temperatures further supports its wide acceptance. Demand for polyester films is projected to stay high as construction and automotive industries increasingly emphasize energy efficiency and UV protection.

The material’s compatibility with metallization, dyeing, and lamination techniques allows manufacturers to develop advanced film grades with enhanced infrared rejection and glare control. Moreover, the growing push for sustainable buildings and reduced cooling energy use continues to strengthen polyester’s market dominance.

By Application

Automotive Segment Leads Window Film Market – 34.2% Share

In 2024, Automotive held a dominant market position, capturing more than a 34.2% share of the global window film market. The automotive industry continues to be a major consumer of window films, driven by rising demand for vehicle comfort, energy efficiency, and enhanced aesthetics. Sun control and safety films are increasingly used in passenger and commercial vehicles to block harmful UV rays, reduce cabin heat, and improve driving visibility.

The adoption of advanced films with infrared rejection and glare control has also expanded as automakers focus on passenger comfort and energy-saving technologies. The use of window films in the automotive segment is expected to grow further, supported by global vehicle production recovery and stricter regulations on thermal management and safety glazing.

Electric vehicle manufacturers are also embracing tinted and reflective films to maintain battery efficiency by reducing interior cooling loads. Moreover, the customization trend in car design—ranging from privacy tints to decorative films is strengthening market appeal across both OEM and aftermarket channels.

Key Market Segments

By Product

- Sun Control Film

- Decorative Film

- Safety and Security Film

- Insulating Film

- Privacy Film

- Others

By Material

- Vinyl

- Polyester

- Plastic

- Ceramic

- Others

By Application

- Automotive

- Residential

- Commercial

- Marine

- Others

Drivers

Energy-Efficiency Mandates in Buildings Are Pushing Window Film Adoption

A simple, measurable force is at work: buildings must cut energy waste, and windows are a big part of that waste. The International Energy Agency estimates building operations account for 30% of global final energy use and 26% of energy-related CO₂ emissions, a scale that keeps efficiency on top of policy agendas worldwide (IEA).

Governments translate this into codes, incentives, and retrofit programs that target the envelope, especially glazing, because windows drive cooling and heating loads. The U.S. Department of Energy notes that heat gain and loss through windows cause 25–30% of residential heating and cooling energy use, making them a prime retrofit priority (DOE).

Restraints

Durability & Installation Risks Undermine Trust in Window Film

One of the biggest restraints that slows the broader adoption of window film is long-term durability and installation reliability. Even if a film looks good when first applied, over the years, it may begin to peel, bubble, delaminate, fade, or suffer adhesive failures. Such defects not only reduce performance but also erode confidence among building owners.

Films are exposed to cycles of sun, heat, moisture, and cleaning chemicals. If the adhesive or polymer layers degrade faster than expected, they lose their bond to the glass or delaminate under stress. Typical film failures include peeling, cracking, delamination, fading, and color shifts.

Moreover, improper installation is a leading cause of failure. If the glass surface isn’t cleaned thoroughly, or if there’s dust, residual oils, or humidity under the film, adhesion is compromised. Bubbles, creases, or edge lifting can appear within months.

Opportunity

Rising Building-Decarbonization Rules Fuel Window Film Adoption

One major growth engine pushing the window film industry ahead is the increasing number of building performance standards and decarbonization mandates globally. Governments and cities are now demanding stricter energy use and CO₂ limits for existing and new buildings, and window upgrades, including films, are one of the few retrofits with relatively low disruption and fast payoff.

Consider the scale: the International Energy Agency states buildings account for 36% of global final energy use and 37% of energy-related CO₂ emissions in its recent estimates. When you break that down, windows become a big lever: the U.S. Department of Energy notes that heat gain and loss through windows result in 25–30% of residential heating and cooling energy use.

Several cities and states have adopted Building Performance Standards (BPS) that force property owners to meet strict energy or emissions targets by certain deadlines. In the U.S., jurisdictions under the Institute for Market Transformation’s BPS Network of real estate with performance rules. Under those rules, upgrades to façades, glazing, and HVAC systems must reduce energy use — making window films a favorable add-on.

Trends

Heat-Resilience & Peak-Demand Pressures Are Making Solar-Control Films a Must-Have

A powerful, newer driver for window films is the push for heat resilience as grids strain under record peaks. India is a clear example. National peak demand hit 250 GW in May 2024, the highest on record, with officials linking the surge to hotter weather and rising space-cooling loads.

When heatwaves arrive earlier and last longer, utilities and building owners look for passive measures that tame indoor heat without adding load. Films do exactly that by lowering solar heat gain through existing glass. The U.S. Department of Energy puts the physics plainly: in cooling seasons, about 76% of sunlight on standard double-pane windows becomes indoor heat, a loss that channel films can meaningfully reduce.

Regional Analysis

North America leads with a 34.8% share and a USD 3.9 Billion market value.

In 2024, North America held a commanding 34.8% share of the global window film market, valued at approximately USD 3.9 billion. The region’s leadership reflects its early adoption of energy-efficient retrofit technologies, strong building-code enforcement, and a large base of aging commercial and residential structures that demand cost-effective energy solutions.

Across the United States and Canada, growth is further supported by public-sector programs such as the DOE’s Building Technologies Office (BTO) initiatives, which promote high-performance building envelopes and window attachments. State-level energy offices and utilities, especially in California, Texas, and New York, offer rebates or tax incentives for installing energy-saving window films in both commercial and residential properties.

Beyond energy savings, window films in North America are increasingly used for UV protection, glare control, privacy, and security enhancement in offices, vehicles, and public infrastructure. The ongoing shift toward sustainable construction and the rapid pace of green-building certifications such as LEED and Energy Star continue to elevate product demand.

Post-pandemic building upgrades emphasizing comfort, daylight optimization, and energy balance have positioned films as a fast, low-capital retrofit option. North America is projected to maintain its dominance, driven by robust construction activity, government-backed energy efficiency programs, and widespread consumer awareness of the comfort and sustainability benefits associated with advanced window films.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M is a dominant force in the window film market, renowned for its strong brand reputation and extensive R&D. Its diverse product portfolio includes high-performance automotive, residential, and commercial films. Leveraging its advanced adhesive technology and global distribution network, 3M sets industry standards for quality and innovation.

Eastman is a key player distinguished by its strong material science heritage, notably as the manufacturer of LLumar, Vista, and SunTek films. It focuses on high-quality, durable products for automotive and architectural applications. Eastman’s strength lies in its proprietary polyester and ceramic coating technologies, which deliver superior heat rejection and clarity.

American Standard Window Film offers a cost-effective range of products for automotive and residential use. Its strategy focuses on providing reliable performance and essential protection from UV rays and heat at a competitive price point. This positions the company as a strong contender in the value segment, appealing to budget-conscious consumers and contractors seeking a balance between affordability and fundamental functionality without premium brand costs.

Top Key Players in the Market

- 3M

- Eastman Chemical Company

- American Standard Window Film

- Saint-Gobain Performance Plastics Corporation

- Madico, Inc.

- Toray Plastics

- Hanita Coatings RCA Ltd.

- Johnson Window Films, Inc.

- Armolan Window Films

- Garware Suncontrol

- Reflectiv

Recent Developments

- In February 2025, Eastman partnered with Ceres Holographics and Covestro to advance holographic transparent display HUD technology for automotive windshields, integrating interlayer materials to meet OEM demands for innovative glass solutions. Eastman invested in its Ghent, Belgium, facility to enhance extrusion capabilities for PVB interlayers used in laminated glass, supporting growth in automotive and architectural window applications.

- In March 2025, Madico attended the European Window Film Association General Assembly in Munich, Germany, to discuss industry trends and expand its architectural film offerings across Europe. Madico sponsored educational content on window film longevity and maintenance, addressing common issues such as bubbling, to promote consumer education and product durability.

Report Scope

Report Features Description Market Value (2024) USD 11.4 Billion Forecast Revenue (2034) USD 19.7 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sun Control Film, Decorative Film, Safety and Security Film, Insulating Film, Privacy Film, Others), By Material (Vinyl, Polyester, Plastic, Ceramic, Others), By Application (Automotive, Residential, Commercial, Marine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Eastman Chemical Company, American Standard Window Film, Saint-Gobain Performance Plastics Corporation (Solar Gard), Madico, Inc., Toray Plastics, Hanita Coatings RCA Ltd., Johnson Window Films, Inc., Armolan Window Films, Garware Suncontrol, Reflectiv Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- 3M

- Eastman Chemical Company

- American Standard Window Film

- Saint-Gobain Performance Plastics Corporation

- Madico, Inc.

- Toray Plastics

- Hanita Coatings RCA Ltd.

- Johnson Window Films, Inc.

- Armolan Window Films

- Garware Suncontrol

- Reflectiv