Global Water Holding Market Size, Share, And Enhanced Productivity By Product Type (Tanks, Barrels, Ponds, Reservoirs, Others), By Material (Plastic, Metal, Concrete, Others), By Capacity (Small, Medium, Large), By Application (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171750

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

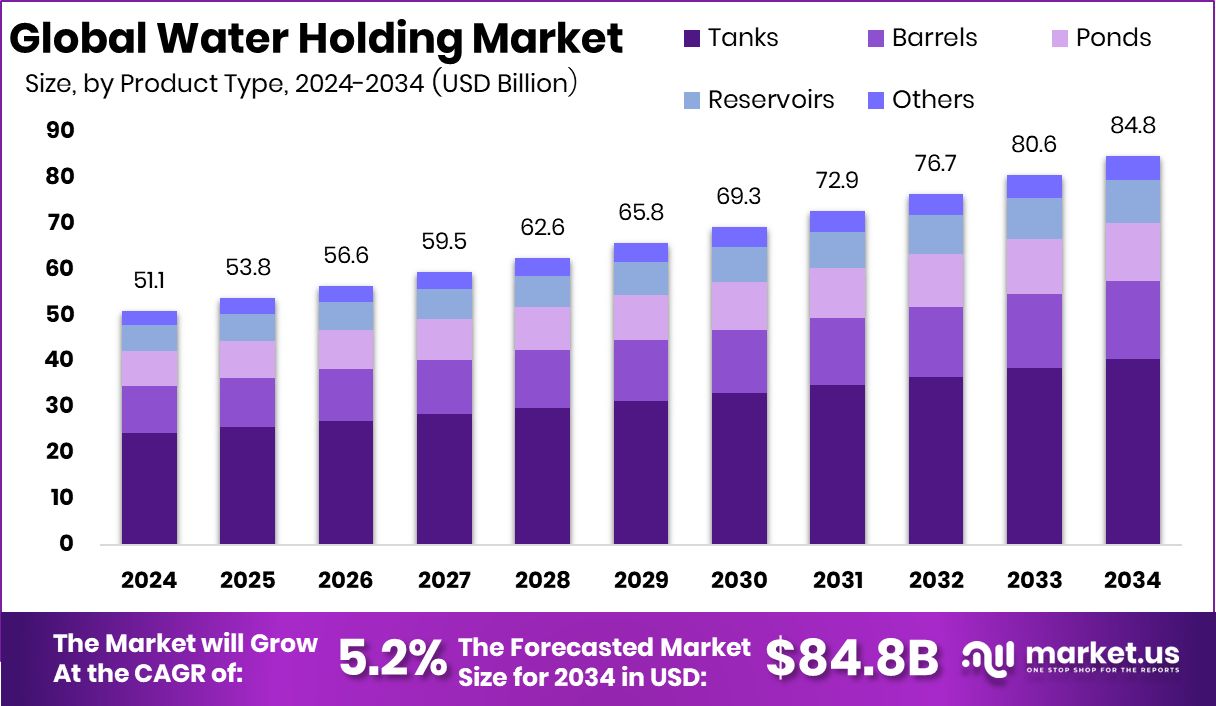

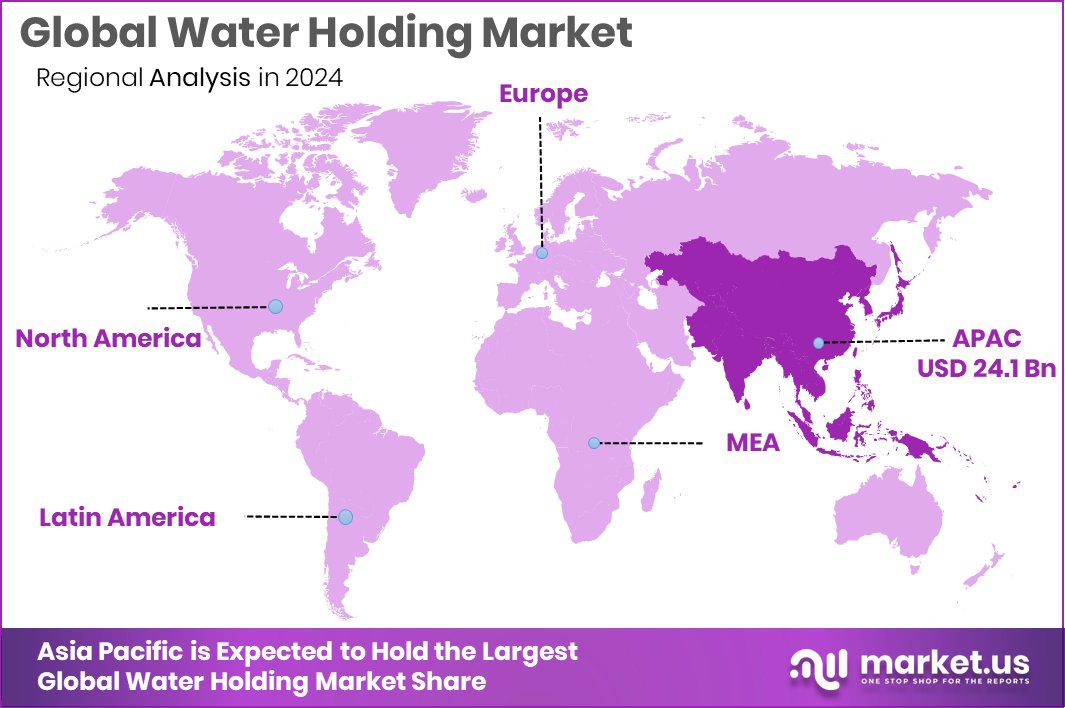

The Global Water Holding Market is expected to be worth around USD 84.8 billion by 2034, up from USD 51.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. The Asia Pacific region secures a 47.20% share, reaching a USD 24.1 Bn valuation.

Water holding refers to the ability to store and retain water for later use, whether in tanks, reservoirs, underground basins, or natural systems. It plays a vital role in ensuring stable water access during droughts, seasonal shortages, or high-demand periods. This function supports households, farms, industries, and entire regions that rely on dependable water availability.

The Water Holding Market includes all products, systems, and infrastructure that help capture, store, and distribute water safely. It covers storage tanks, groundwater recharge systems, reservoirs, and community-level water facilities. The market grows as regions strengthen their resilience against climate variability, demand fluctuations, and long-term water security challenges.

Growing water stress continues to push demand, especially as governments increase funding to improve supply stability. Supportive programs like the $514 million allocation by the Biden-Harris Administration to secure drinking water for Western communities reflect how national priorities accelerate development. These investments help upgrade local storage networks and reinforce long-term reliability.

Infrastructure expansion also creates notable opportunities. Large projects such as the Sites Reservoir and Harvest Water initiatives, which may receive $500 million in funding, highlight how regions are building new storage capacity. Additional support, like the $22 million Proposition 1 funding for the Kern Water Banking Project, further strengthens the sector.

Several regions are also improving groundwater and utility systems, opening space for new storage solutions. The $187 million awarded by California’s DWR for better groundwater use and the £31 million funding for NI Water support both modernization and long-term sustainability. Even innovation programs—such as the $10 million WPTO funding for marine-energy-linked water infrastructure—create new avenues for storage technology advancements.

Key Takeaways

- The Global Water Holding Market is expected to be worth around USD 84.8 billion by 2034, up from USD 51.1 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In the Water Holding Market, tanks dominate with a strong 47.8% share across global installations.

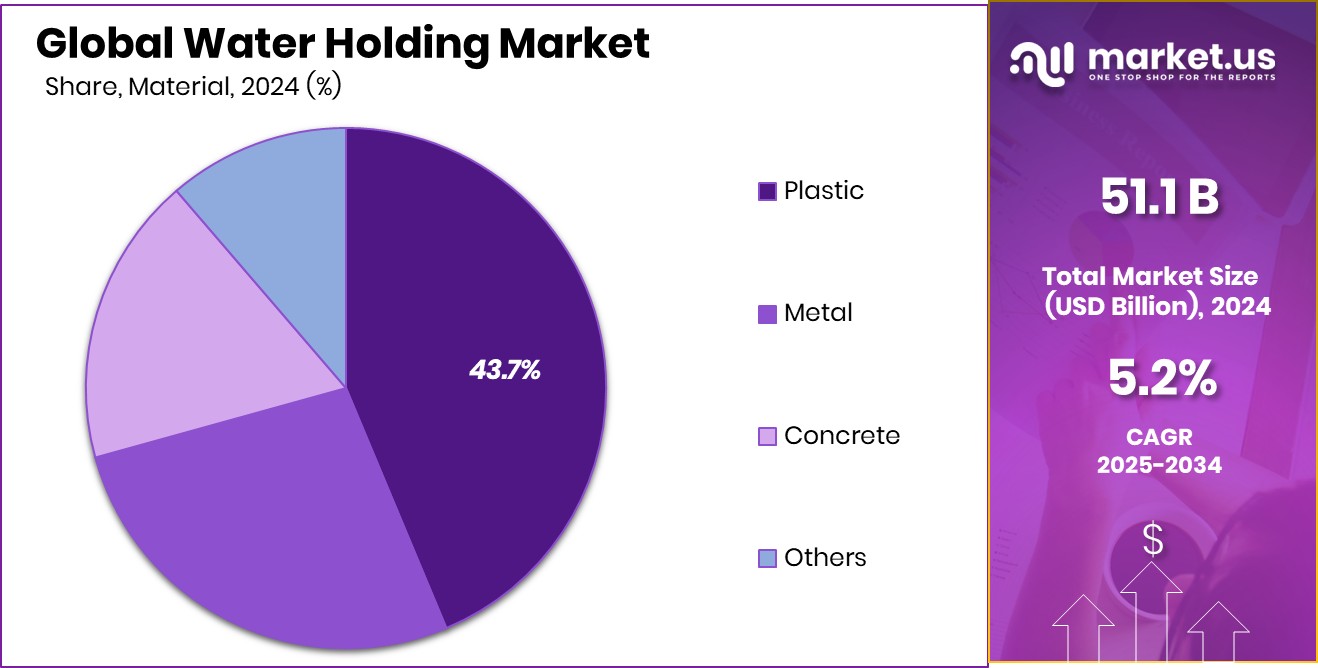

- Plastic materials lead the Water Holding Market, securing 43.7% due to durability and wide industrial use.

- Medium-capacity units hold 47.2% of the Water Holding Market, driven by balanced cost and efficiency.

- Industrial applications account for 41.6% of the water holding market, reflecting rising demand from manufacturing sectors.

- Asia Pacific dominates this market segment, holding 47.20% worth nearly USD 24.1 Bn.

By Product Type Analysis

Tanks lead the Water Holding Market with a strong 47.8% share.

In 2024, Tanks held a dominant market position in the By Product Type segment of the Water Holding Market, with a 47.8% share, reflecting their strong suitability for long-term water storage needs. Their dominance comes from widespread adoption across households, farms, and small industries that require reliable containment with minimal maintenance. Tanks also offer flexibility in installation and capacity, allowing users to adapt them to space limitations and specific water usage patterns.

This strong market presence shows how tanks remain the most trusted option for regions with fluctuating water supply conditions. Their durable structure and ease of handling continue to make them the preferred product type within the broader Water Holding Market in 2024.

By Material Analysis

Plastic materials dominate the Water Holding Market with a 43.7% share.

In 2024, Plastic held a dominant market position in the By Material segment of the Water Holding Market, with a 43.7% share, driven by its lightweight design and cost-effective nature. Plastic materials are easier to transport, install, and maintain compared to heavier alternatives, making them a practical choice for residential and commercial water storage.

The segment’s strong lead reflects increasing acceptance of plastic solutions due to their corrosion-resistant properties and ability to maintain water quality over extended periods. These advantages support wide-scale use in diverse climates, reinforcing plastic as the primary material choice within this segment throughout 2024.

By Capacity Analysis

Medium capacity units dominate the Water Holding Market with 47.2% share.

In 2024, Medium held a dominant market position in the By Capacity segment of the Water Holding Market, with a 47.2% share, highlighting its suitability for users who require a balanced storage solution without excessive space demands. Medium-capacity units serve farms, residential communities, and small commercial setups that need dependable water availability.

This segment’s leadership indicates increasing preference for storage systems that offer both adequate volume and manageable installation requirements. As water management practices evolve, medium-capacity solutions remain the most practical fit for a wide range of usage patterns, strengthening their position in 2024.

By Application Analysis

Industrial applications lead the Water Holding Market with 41.6% share.

In 2024, Industrial held a dominant market position in the By Application segment of the Water Holding Market, with a 41.6% share, reflecting the high water dependence of large-scale operations. Industrial facilities rely on stable water storage to support manufacturing, cooling, cleaning, and continuous processing needs.

The segment’s strong control shows how industries prioritize reliable storage capacity to prevent operational interruptions. With rising focus on internal water efficiency and contingency reserves, the industrial segment remained the leading application area in 2024, reinforcing its central role in the Water Holding Market.

Key Market Segments

By Product Type

- Tanks

- Barrels

- Ponds

- Reservoirs

- Others

By Material

- Plastic

- Metal

- Concrete

- Others

By Capacity

- Small

- Medium

- Large

By Application

- Industrial

- Residential

- Commercial

Driving Factors

Growing Investment in Community Water Infrastructure Strengthens Supply

The municipal water market is expanding as cities and towns urgently upgrade storage, treatment, and distribution systems to ensure reliable water access. Many regions face old pipelines, rising demand, and limited storage capacity, making infrastructure improvement a top priority. This trend becomes stronger when essential community projects struggle due to limited financial support, such as the funding shortage that stalled Natipora’s 1 lakh-gallon overhead tank. Situations like this highlight how many areas depend on sustained investment to maintain a safe and consistent municipal water supply.

At the same time, new funding in other areas shows the momentum behind improved water storage. One strong example is the $8.3 million McCall drinking water project, which focuses on building a new storage tank to increase supply security and support future population growth. This type of investment shows how municipalities are actively strengthening their water systems to prevent shortages, improve pressure management, and ensure quality.

Restraining Factors

Limited Capital Slows Expansion of Municipal Water Systems

One major restraining factor in the municipal water market is the shortage of timely and adequate funding needed to upgrade or expand essential water infrastructure. Many regions face rising population needs, but large projects often move slowly because financing does not arrive when required. Even though some sectors receive support—such as Barclays investing £12M in Mixergy for grid-connected water tanks—this funding targets home-heating and storage innovation rather than municipal-scale systems. This mismatch leaves many public projects struggling to secure the resources needed for large community water improvements.

Another challenge appears when agencies initiate long-term planning without guaranteed capital. A clear example is the Desert Groundwater Agency beginning the funding process for a 50-mile pipeline to import water, a project that requires significant financial commitment before construction can move forward. Long timelines, complex budgeting, and approval delays limit the execution of large-scale municipal solutions. These barriers slow system expansion, restrict maintenance schedules, and delay the replacement of aging infrastructure.

Growth Opportunity

Large-Scale Public Funding Unlocks New Water Infrastructure

A major growth opportunity in the municipal water market comes from rising public investment aimed at strengthening long-term water security. Many regions are increasing budgets for new wells, pipelines, and treatment systems, creating space for modern solutions and upgraded capacity. This momentum is visible even when smaller projects experience setbacks, such as Orland diverting its $800K grant due to supply-chain delays that stalled the new city well. Situations like this highlight how municipal systems require dependable funding channels, and when grants are available, they open doors for future improvements once material and equipment issues are resolved.

Stronger opportunities emerge from large voter-backed initiatives that reshape regional water planning. A notable example is Texas voters approving a $20 billion package to secure the state’s water supply, signaling major long-term commitments toward reservoirs, groundwater storage, and new infrastructure that can benefit local communities. This substantial financial support encourages municipalities to modernize networks, expand treatment capacities, and invest in drought-resilient systems.

Latest Trends

Rising Public Grants Accelerate Modern Water Upgrades

A key trend in the municipal water market is the sharp increase in public grants aimed at strengthening local water supply systems. Communities are prioritizing modern infrastructure to handle growth, drought risk, and aging networks, which pushes agencies to adopt smarter storage, distribution, and treatment solutions. This shift is clearly reflected in the $25 million provided by FDEP to local agencies to boost their water supply infrastructure, helping regions upgrade pipelines, improve pressure management, and secure long-term water reliability. Such funding encourages municipalities to adopt more advanced designs and faster project execution.

Another strong trend is growing support for combined water and sewer system improvements, which helps municipalities create more integrated service structures. A good example is the $10 million grant awarded for Hampton County’s water and sewer improvements, showing how funding now focuses on complete system upgrades rather than isolated fixes. These investments highlight a broader move toward resilient, well-connected municipal networks capable of serving expanding populations.

Regional Analysis

Asia Pacific leads the Water Holding Market with 47.20%, valued at USD 24.1 Bn.

Asia Pacific dominated the Water Holding Market in 2024, securing 47.20% and reaching USD 24.1 Bn, reflecting the region’s large population base, expanding industrial activity, and strong demand for reliable water storage systems. This dominance also highlights the region’s rapid urban development and increasing need for structured water management across residential and commercial spaces.

North America followed with steady adoption driven by consistent infrastructure upgrades and growing emphasis on water efficiency across agriculture and municipal services. Europe showed stable growth as countries continued strengthening storage solutions to support sustainability and seasonal water shortages.

The Middle East & Africa region relied heavily on water holding systems due to arid climate conditions and rising construction activities requiring dependable storage capacity. Latin America also demonstrated gradual expansion as communities and industries increased focus on improving water reliability in both rural and urban settings. Across all regions, market performance was shaped by the need for dependable storage, yet Asia Pacific remained the clear leader in scale and investment potential.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Veolia Environnement S.A. continued to strengthen its role in the global Water Holding Market by focusing on efficient water management and large-scale storage integration across municipal and industrial systems. The company’s long-standing expertise in water treatment and infrastructure allowed it to support regions facing increasing demand for secure and stable water reserves. Veolia’s approach of combining operational reliability with sustainable practices positioned it as a key influence in shaping modern water-holding solutions.

Suez S.A. maintained a competitive edge through its emphasis on advanced water system design and strong service capabilities. Its focus on improving storage resilience, optimizing distribution networks, and supporting smart-water operations enabled the company to remain relevant in markets undergoing rapid environmental pressure and urban growth. Suez’s continued commitment to system efficiency and technological upgrades reinforced its presence as a strategic player.

Xylem Inc. contributed significantly by delivering integrated pumping, monitoring, and storage-support technologies that helped enhance water mobility and reserve management. The company’s strength in equipment innovation and digital tools made it a valuable partner for industrial and municipal users requiring dependable water-holding performance. Xylem’s capability to align engineering solutions with real-world storage needs allowed it to maintain meaningful influence throughout 2024.

Top Key Players in the Market

- Veolia Environnement S.A.

- Suez S.A.

- Xylem Inc.

- Pentair plc

- American Water Works Company, Inc.

- Kurita Water Industries Ltd.

- Aqua America, Inc.

- Ecolab Company

- United Utilities Group PLC

- Thames Water Utilities Limited

Recent Developments

- In May 2025, Veolia signed an agreement to acquire the remaining 30% stake in its subsidiary Veolia Water Technologies and Solutions (WTS) from CDPQ, giving Veolia full ownership of this important water tech business. This move will help the company simplify its structure and focus more on delivering advanced water treatment and storage-related services worldwide.

- In December 2024, Suez S.A. teamed up with UK investor Covalis Capital to submit a joint bid to support the management of Britain’s Thames Water utility, focusing on improving its operations and addressing challenges in water service delivery. This move showed Suez’s interest in strengthening its role in large utility operations.

Report Scope

Report Features Description Market Value (2024) USD 51.1 Billion Forecast Revenue (2034) USD 84.8 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tanks, Barrels, Ponds, Reservoirs, Others), By Material (Plastic, Metal, Concrete, Others), By Capacity (Small, Medium, Large), By Application (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Veolia Environnement S.A., Suez S.A., Xylem Inc., Pentair plc, American Water Works Company, Inc., Kurita Water Industries Ltd., Aqua America, Inc., Ecolab Company, United Utilities Group PLC, Thames Water Utilities Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Veolia Environnement S.A.

- Suez S.A.

- Xylem Inc.

- Pentair plc

- American Water Works Company, Inc.

- Kurita Water Industries Ltd.

- Aqua America, Inc.

- Ecolab Company

- United Utilities Group PLC

- Thames Water Utilities Limited