Global Vascular Closure Devices Market By Product Type (Active Approximators (Suture-Mediated Closure Devices, Clip-Based Closure Devices and Collagen Plug-Based Devices) and Passive Approximators (Compression-Based Devices and Extravascular Sealants)), By Access Site (Femoral and Radial), By Procedure Type (Interventional Cardiology, Interventional Radiology and Interventional Vascular Surgery), By End-User (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs) and Cardiac Cath Lab), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173136

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

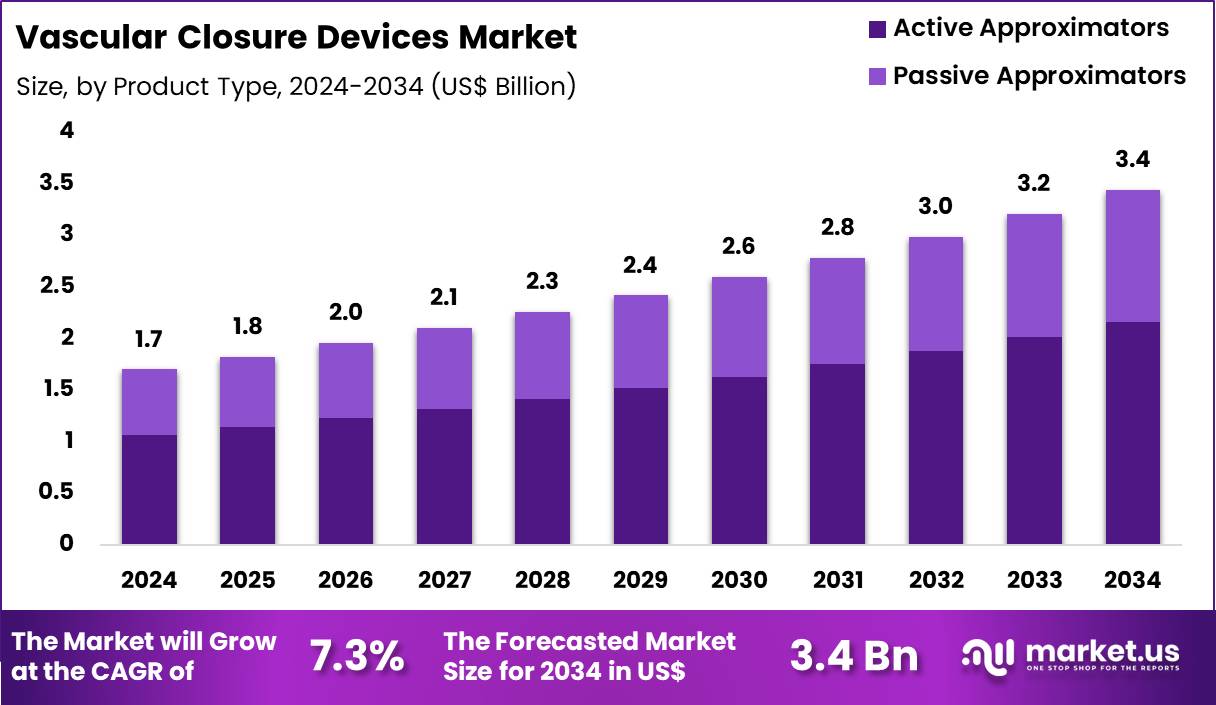

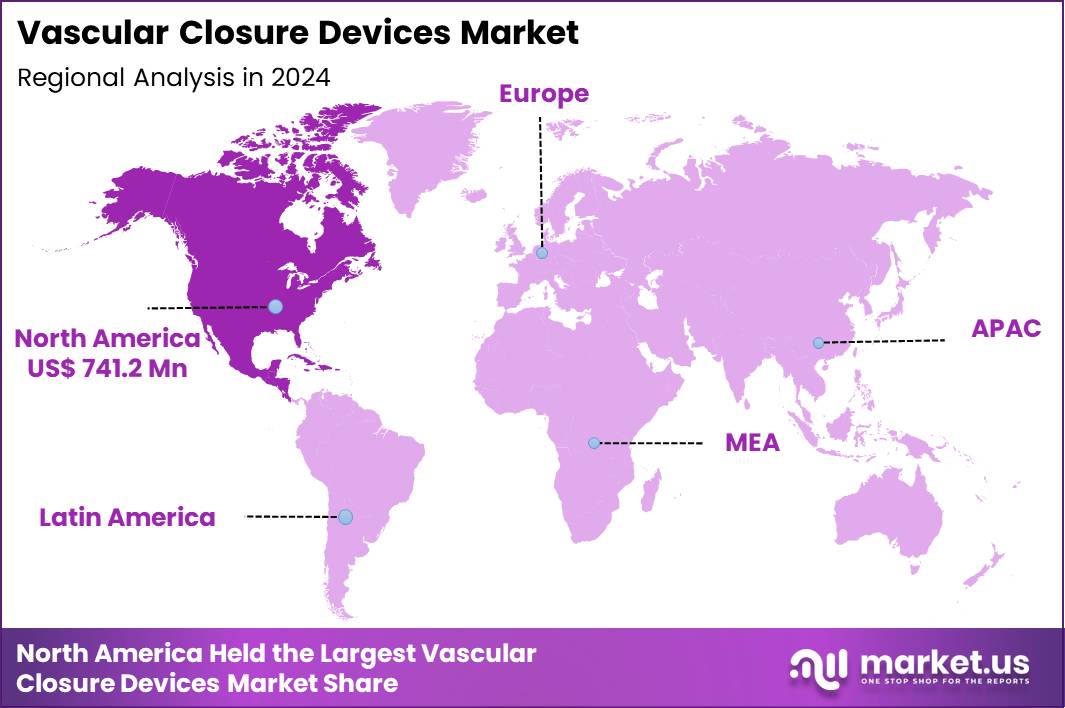

The Global Vascular Closure Devices Market size is expected to be worth around US$ 3.4 Billion by 2034 from US$ 1.7 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.6% share with a revenue of US$ 741.2 Million.

Rising adoption of minimally invasive cardiovascular procedures drives demand for vascular closure devices that achieve rapid and reliable hemostasis at femoral access sites following catheter-based interventions. Interventional cardiologists increasingly deploy these devices after diagnostic angiography and percutaneous coronary interventions to seal arteriotomies efficiently, reducing time to ambulation and enhancing patient comfort.

These tools support peripheral vascular procedures by providing secure closure in lower extremity interventions, minimizing hematoma formation and bleeding complications. Clinicians utilize vascular closure systems in structural heart interventions, including transcatheter aortic valve replacement, where large-bore access requires robust hemostatic control. These devices facilitate neurovascular embolization treatments by ensuring precise arterial puncture site management during cerebral angiography.

In December 2025, Abbott received FDA clearance for the Amplatzer Piccolo Delivery System, a device developed for closing patent ductus arteriosus in very small premature infants. The system features a more flexible catheter design to allow accurate placement while minimizing the risk of vessel injury, improving procedural safety in neonatal cardiac care.

Manufacturers pursue opportunities to develop bioabsorbable vascular closure technologies that eliminate permanent implants, broadening applications in patients requiring repeated access for ongoing therapies. Developers engineer suture-mediated systems for large-bore closures, enabling safer hemostasis in complex structural heart procedures with enhanced vessel integrity preservation. These innovations expand utility in ambulatory settings, where rapid recovery protocols benefit outpatient percutaneous interventions.

Opportunities emerge in radial artery closure devices that address growing preference for transradial approaches in diagnostic and therapeutic cardiology. Companies advance clip-based mechanisms for small-vessel applications, facilitating precise deployment in peripheral arterial disease treatments. Firms invest in integrated platforms that combine closure with hemostatic patches, optimizing outcomes in high-risk patients undergoing endovascular aneurysm repair.

Industry leaders introduce active approximators with automated deployment features that streamline procedural workflows and reduce operator variability in high-volume catheterization laboratories. Developers refine collagen plug designs with enhanced absorbable properties, minimizing long-term foreign body presence in femoral access site management.

Market participants prioritize extravascular sealing solutions that avoid intraluminal components, lowering risks of distal embolization in neurointerventional applications. Innovators incorporate real-time feedback mechanisms into closure systems, supporting consistent performance across diverse vessel sizes in peripheral interventions.

Companies emphasize patient-specific sizing algorithms for optimal fit in structural heart access closures. Ongoing advancements focus on hybrid active-passive technologies that combine mechanical and biological elements, elevating safety standards in evolving minimally invasive cardiovascular practices

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.7 Billion, with a CAGR of 7.3%, and is expected to reach US$ 3.4 Billion by the year 2034.

- The product type segment is divided into active approximators and passive approximators, with active approximators taking the lead in 2024 with a market share of 62.8%.

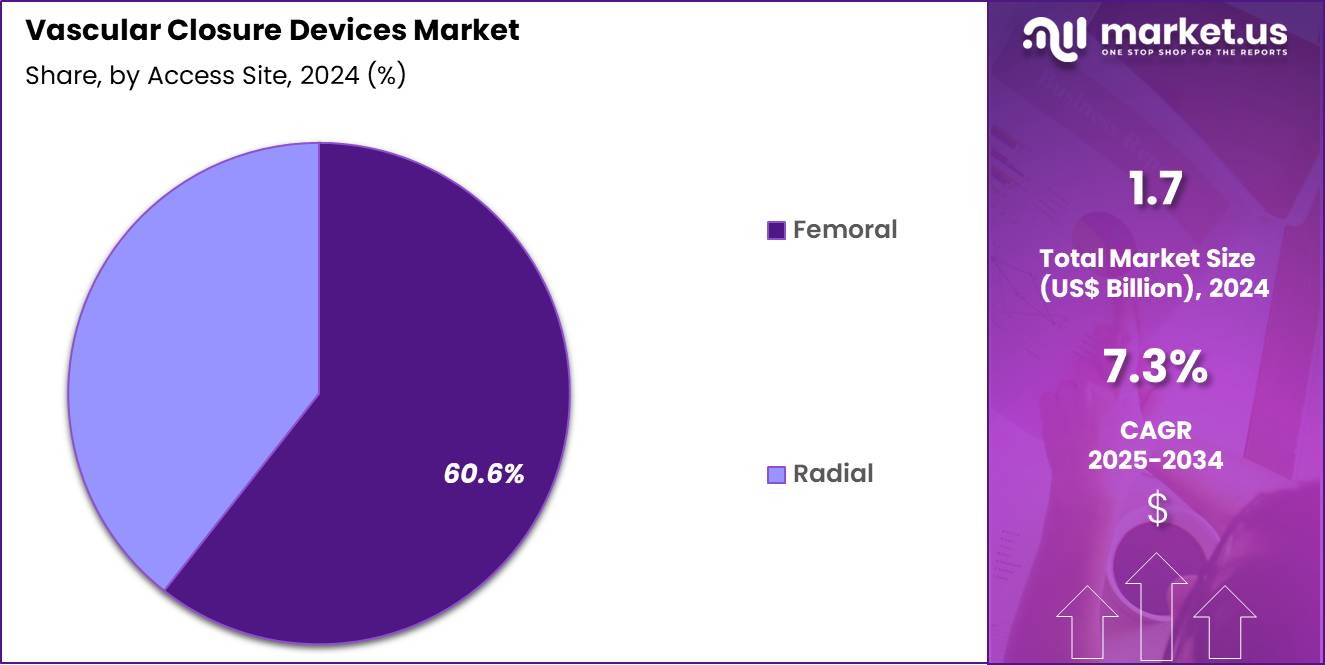

- Considering access site, the market is divided into femoral and radial. Among these, femoral held a significant share of 60.6%.

- Furthermore, concerning the procedure type segment, the market is segregated into interventional cardiology, interventional radiology and interventional vascular surgery. The interventional cardiology sector stands out as the dominant player, holding the largest revenue share of 41.1% in the market.

- The end-user segment is segregated into hospitals and clinics, ambulatory surgical centers (ASCs) and cardiac cath lab, with the hospitals and clinics segment leading the market, holding a revenue share of 63.5%.

- North America led the market by securing a market share of 43.6% in 2024.

Product Type Analysis

Active approximators accounted for 62.8% of the vascular closure devices market, reflecting their ability to deliver immediate and reliable hemostasis after catheterization. Clinicians prefer these devices due to precise tissue apposition that reduces time to ambulation. Faster closure supports shorter recovery periods and improves patient throughput. Reduced bleeding complications strengthen confidence among interventional teams.

Technological advances improve deployment accuracy and consistency across operators. Training familiarity accelerates adoption in high volume centers. Compatibility with large bore access procedures expands clinical use. Evidence from real world outcomes reinforces safety perceptions. Reimbursement alignment in several regions supports procurement decisions. This segment is projected to grow due to efficiency gains and superior hemostatic performance.

Access Site Analysis

Femoral access represented 60.6% of the vascular closure devices market, driven by its continued use in complex interventional procedures. Many structural heart and peripheral interventions require femoral access due to vessel size considerations. High sheath sizes increase the need for effective closure solutions. Established procedural protocols favor femoral approaches in advanced cardiology cases.

Operator experience with femoral techniques improves procedural confidence. Growing volumes of transcatheter interventions sustain femoral access demand. Closure devices reduce post procedure bed rest associated with femoral punctures. Hospitals prioritize solutions that minimize access site complications. Device innovation enhances performance in calcified vessels. This segment is anticipated to maintain leadership due to procedural necessity and clinical familiarity.

Procedure Type Analysis

Interventional cardiology accounted for 41.1% of the vascular closure devices market, reflecting sustained growth in minimally invasive cardiac procedures. Rising prevalence of coronary artery disease increases catheter based interventions. Percutaneous coronary interventions generate consistent demand for reliable closure methods. Early ambulation protocols in cardiology favor advanced closure devices.

Procedural efficiency directly impacts cath lab productivity. Device assisted closure improves patient comfort and satisfaction. Expanding indications for structural heart therapies support continued growth. Training programs emphasize best practices in access management. Clinical guidelines reinforce closure device use in high risk patients. This segment is expected to expand due to increasing cardiac intervention volumes.

End-User Analysis

Hospitals and clinics held a 63.5% share of the vascular closure devices market, reflecting their role as primary centers for interventional care. These settings manage high patient volumes requiring catheter based diagnostics and therapies. Integrated care pathways support routine use of closure devices. Availability of skilled staff improves procedural outcomes.

Capital budgets favor technologies that reduce complications and length of stay. Hospitals emphasize patient safety and workflow efficiency. Centralized purchasing enables standardized device adoption. Emergency and elective procedures sustain steady utilization rates. Quality metrics encourage rapid recovery and discharge. Consequently, this end user segment is likely to remain dominant due to scale, expertise, and procedural concentration.

Key Market Segments

By Product Type

- Active Approximators

- Suture-mediated Closure Devices

- Clip-based Closure Devices

- Collagen Plug-based Devices

- Passive Approximators

- Compression-based Devices

- Extravascular Sealants

By Access Site

- Femoral

- Radial

By Procedure Type

- Interventional Cardiology

- Interventional Radiology

- Interventional Vascular Surgery

By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Cardiac Cath Lab

Drivers

Increasing number of percutaneous coronary interventions is driving the market

The vascular closure devices market is driven by the increasing number of percutaneous coronary interventions, which necessitate reliable and efficient closure of arterial access sites following catheterization procedures. These devices provide rapid hemostasis, reducing time to ambulation and improving patient comfort compared to manual compression. Cardiologists prefer vascular closure devices to minimize complications such as bleeding and hematoma formation in high-volume procedural settings.

Hospitals expand their interventional cardiology programs to accommodate growing demand for minimally invasive cardiovascular treatments. Regulatory support for device safety and efficacy encourages broader adoption in clinical practice. Technological refinements in closure mechanisms enhance reliability for diverse sheath sizes and patient profiles. Global cardiovascular disease burdens sustain procedural volumes, supporting consistent market demand.

Professional guidelines recommend vascular closure devices for appropriate cases to optimize outcomes. Economic benefits include shorter hospital stays and reduced resource utilization post-procedure. According to the American Heart Association’s 2025 Heart Disease and Stroke Statistics Update, the number of percutaneous coronary interventions performed in the United States remained substantial, with procedural trends reflecting ongoing reliance on femoral access where closure devices are critical.

Restraints

Complications associated with device deployment are restraining the market

The vascular closure devices market is restrained by complications associated with device deployment, including device failure, infection, and vessel occlusion, which raise concerns among clinicians. These adverse events can lead to prolonged recovery, additional interventions, or increased morbidity in affected patients. Regulatory scrutiny intensifies following reports of complications, requiring manufacturers to conduct extensive post-market surveillance.

Healthcare facilities implement rigorous training protocols to mitigate risks, adding operational complexity. Patient selection criteria become more stringent, limiting device use in high-risk populations. Manufacturers invest in redesigns to address failure modes, elevating development costs. Clinical studies reveal variability in complication rates across device types and operator experience.

Reimbursement challenges arise when complications necessitate extended care or readmissions. Legal considerations deter some providers from routine adoption amid liability risks. These factors collectively temper market growth by necessitating cautious utilization and ongoing improvements in device safety.

Opportunities

Advancements in large-bore closure technologies are creating growth opportunities

The vascular closure devices market offers growth opportunities through advancements in large-bore closure technologies, which address the demands of emerging structural heart and endovascular procedures. These innovations enable safe hemostasis for sheaths exceeding 12 French, expanding applications in transcatheter valve replacements and mechanical circulatory support. Developers focus on bioresorbable materials to reduce long-term vessel impact and improve patient recovery.

Regulatory clearances validate expanded indications, facilitating broader clinical integration. Hospitals invest in hybrid operating suites equipped for large-bore access, driving demand for compatible closure systems. Clinical evidence supports reduced complication rates with next-generation devices in complex interventions. Partnerships between manufacturers and interventional specialists accelerate device refinement and training.

Patient populations with valvular disease and peripheral vascular conditions benefit from less invasive approaches. Global adoption in emerging markets aligns with infrastructure growth for advanced cardiology. In June 2024, the U.S. Food and Drug Administration cleared the MYNX CONTROL Venous Vascular Closure Device for 6F-12F access sites, highlighting progress in large-bore venous closure capabilities.

Impact of Macroeconomic / Geopolitical Factors

Rising healthcare expenditures and the growing volume of interventional cardiology procedures worldwide invigorate the vascular closure devices market, as hospitals and catheterization labs increasingly adopt advanced suture-mediated and collagen-plug systems to achieve faster hemostasis and improved patient recovery. Industry leaders actively innovate with bioabsorbable and clip-based technologies, capitalizing on aging populations and expanded outpatient care to strengthen their positions in competitive segments.

Persistent inflation and economic volatility, however, drive up costs for raw materials such as stainless steel and polymers, compelling manufacturers to adjust pricing strategies and prompting facilities to delay capital investments during periods of constrained budgets. Geopolitical frictions, including U.S.-China trade disputes and supply disruptions from regional conflicts, frequently interrupt shipments of precision components, leading to production bottlenecks and heightened uncertainty for producers reliant on international sourcing.

Current U.S. tariffs under Section 301 impose duties up to 25 percent on Chinese-origin medical devices and related equipment as of December 2025, elevating procurement expenses for American distributors and compressing margins in the supply chain. These tariffs also provoke retaliatory measures from trading partners, restricting U.S. exports of innovative closure technologies and complicating multinational development efforts.

Despite these challenges, the tariff framework accelerates investments in domestic manufacturing facilities and diversified sourcing from allies, forging more secure supply networks. This strategic evolution enhances operational resilience, promotes technological advancements, and lays the foundation for sustained, profitable growth in the sector ahead.

Latest Trends

Introduction of bioresorbable and venous closure devices is a recent trend

In 2024, the vascular closure devices market has exhibited a prominent trend toward the introduction of bioresorbable and venous closure devices, enhancing safety and reducing long-term vessel complications. These bioresorbable options eliminate permanent implants, promoting natural healing and minimizing inflammation risks. Manufacturers emphasize venous applications to address growing needs in structural heart procedures and electrophysiology.

Regulatory approvals validate performance for larger access sites, supporting expanded clinical indications. Interventional cardiologists adopt these devices to improve outcomes in patients requiring prolonged anticoagulation. Clinical studies demonstrate reduced time to hemostasis and ambulation with advanced bioresorbable designs. Healthcare facilities integrate these technologies into protocols for complex interventions.

Academic research focuses on long-term vessel patency following bioresorbable closure. Patient satisfaction increases with devices that avoid foreign body retention. In June 2024, the U.S. Food and Drug Administration cleared the MYNX CONTROL Venous Vascular Closure Device for 6F-12F venous access sites, marking a significant advancement in venous-specific closure solutions.

Regional Analysis

North America is leading the Vascular Closure Devices Market

In 2024, North America commanded a 43.6% share of the global vascular closure devices market, sustained by the persistent rise in percutaneous coronary interventions and peripheral vascular procedures that require reliable arterial access site management. Interventional cardiologists increasingly favor active approximators and collagen-based sealants to achieve rapid hemostasis, particularly in patients on dual antiplatelet therapy, thereby reducing time to ambulation and hospital stay lengths in ambulatory settings.

Regulatory advancements from the Food and Drug Administration have streamlined clearances for next-generation bioresorbable plugs and suture-mediated systems, promoting their integration into high-volume catheterization laboratories. Aging demographics and the prevalence of comorbidities like obesity and diabetes amplify procedural volumes for diagnostic angiography and therapeutic stenting, necessitating devices that minimize complications such as hematoma formation.

Hospital networks prioritize cost-effective solutions with high technical success rates to optimize resource utilization amid staffing pressures. Collaborative quality improvement programs track deployment outcomes, encouraging adoption of devices with proven low vascular complication profiles. Supply chain stabilization post-pandemic ensures consistent availability of sterile, single-use options compliant with infection control standards. The American Heart Association reported that coronary heart disease remained the leading cause of cardiovascular mortality in the United States in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate accelerated adoption of vascular closure technologies in Asia Pacific over the forecast period, as governments intensify efforts to expand interventional cardiology capabilities in response to rising cardiovascular burdens. Cardiologists integrate suture-mediated and plug-based systems into routine femoral access protocols, enhancing procedural safety in high-throughput centers managing acute coronary syndromes.

Health ministries allocate resources to equip tertiary hospitals with advanced hemostasis tools, addressing the growing volume of endovascular repairs for peripheral artery disease. Local manufacturers develop cost-optimized bioabsorbable alternatives, tailoring them to regional anatomical variations and supporting broader utilization in emerging economies. Regional professional societies disseminate evidence-based guidelines, training interventionalists on optimal deployment techniques to curtail access-site bleeding risks.

Pharmaceutical partnerships promote combination use with antithrombotic regimens, optimizing outcomes in diabetic cohorts susceptible to vascular complications. Economic corridors facilitate technology transfers, enabling secondary facilities to incorporate these devices into diagnostic workflows. The World Health Organization estimates that cardiovascular diseases caused over 10 million deaths in the South-East Asia and Western Pacific regions combined in recent assessments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Vascular Closure Devices market drive growth by developing minimally invasive solutions that reduce time to hemostasis, shorten patient recovery, and enable faster ambulation after catheter-based procedures. Companies expand adoption by aligning products with the rising volume of interventional cardiology and peripheral vascular interventions performed in hospitals and ambulatory centers.

Commercial strategies emphasize physician training, evidence-backed performance data, and protocol integration to strengthen clinician confidence and repeat usage. Innovation efforts focus on improving ease of deployment, compatibility with larger bore access sites, and consistent closure outcomes across diverse patient profiles.

Geographic expansion targets regions increasing investments in catheterization labs and advanced cardiovascular care infrastructure. Abbott Laboratories represents a major participant through its broad vascular device portfolio, strong clinical relationships, and global scale that supports sustained adoption of vascular closure technologies.

Top Key Players

- Abbott Laboratories

- Terumo Corporation

- Teleflex Incorporated

- Cardinal Health

- Haemonetics Corporation

- Merit Medical Systems Inc.

- Medtronic

- Meril Life

- Rex Medical

- Transluminal Technologies LLC

- TZ Medical, Inc.

- Forge Medical

- Vasorum Ltd.

- Vivasure Medical

Recent Developments

- In July 2024, Cordis obtained FDA clearance for its MYNX Control venous vascular closure device. The approval expands Cordis’ portfolio of extravascular closure technologies and supports wider use of minimally invasive solutions to achieve effective venous site closure following catheter-based procedures.

- In June 2024, Haemonetics Corporation introduced a limited market release of the VASCADE MVP XL venous closure device. The product builds on the company’s existing VASCADE platform by incorporating collapsible disc technology and a resorbable collagen component, enabling faster hemostasis at mid-bore venous access sites and supporting quicker patient recovery.

Report Scope

Report Features Description Market Value (2024) US$ 1.7 Billion Forecast Revenue (2034) US$ 3.4 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Active Approximators (Suture-Mediated Closure Devices, Clip-Based Closure Devices and Collagen Plug-Based Devices) and Passive Approximators (Compression-Based Devices and Extravascular Sealants)), By Access Site (Femoral and Radial), By Procedure Type (Interventional Cardiology, Interventional Radiology and Interventional Vascular Surgery), By End-User (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs) and Cardiac Cath Lab) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Terumo Corporation, Teleflex Incorporated, Cardinal Health, Haemonetics Corporation, Merit Medical Systems Inc., Medtronic, Meril Life, Rex Medical, Transluminal Technologies LLC, TZ Medical, Inc., Forge Medical, Vasorum Ltd., Vivasure Medical. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vascular Closure Devices MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Vascular Closure Devices MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Terumo Corporation

- Teleflex Incorporated

- Cardinal Health

- Haemonetics Corporation

- Merit Medical Systems Inc.

- Medtronic

- Meril Life

- Rex Medical

- Transluminal Technologies LLC

- TZ Medical, Inc.

- Forge Medical

- Vasorum Ltd.

- Vivasure Medical