Global Unmanned Ground Vehicle (UGV) Market Size, Share Analysis Report By Operation (Teleoperated, Autonomous, and Tethered), By Mobility (Wheels, Tracks, Legs, and Hybrid), By Size (Small, Medium, Large, and Very Large), By System (Payloads, Navigation And Control System, Power System, Others), By Application (Government & Law Enforcement, Military and Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2025

- Report ID: 152395

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. Market Size

- By Operation Analysis

- By Mobility Analysis

- By Size Analysis

- By System Analysis

- By Application Analysis

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Latest Trends

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

Report Overview

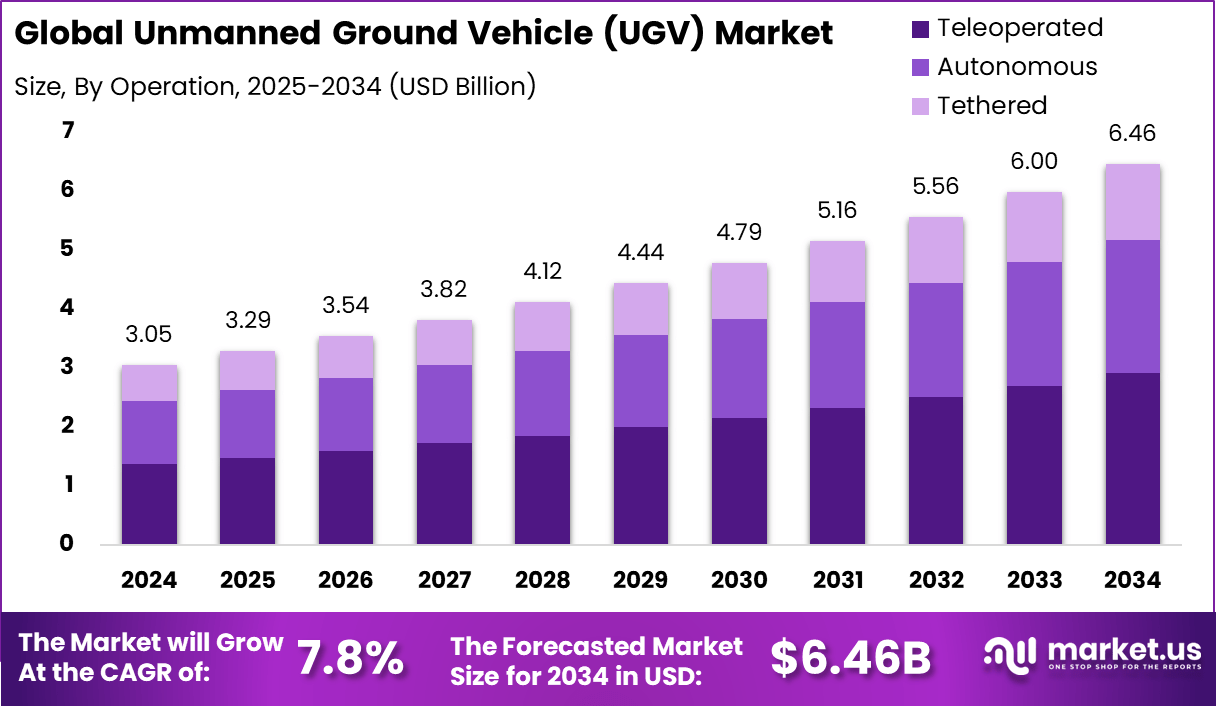

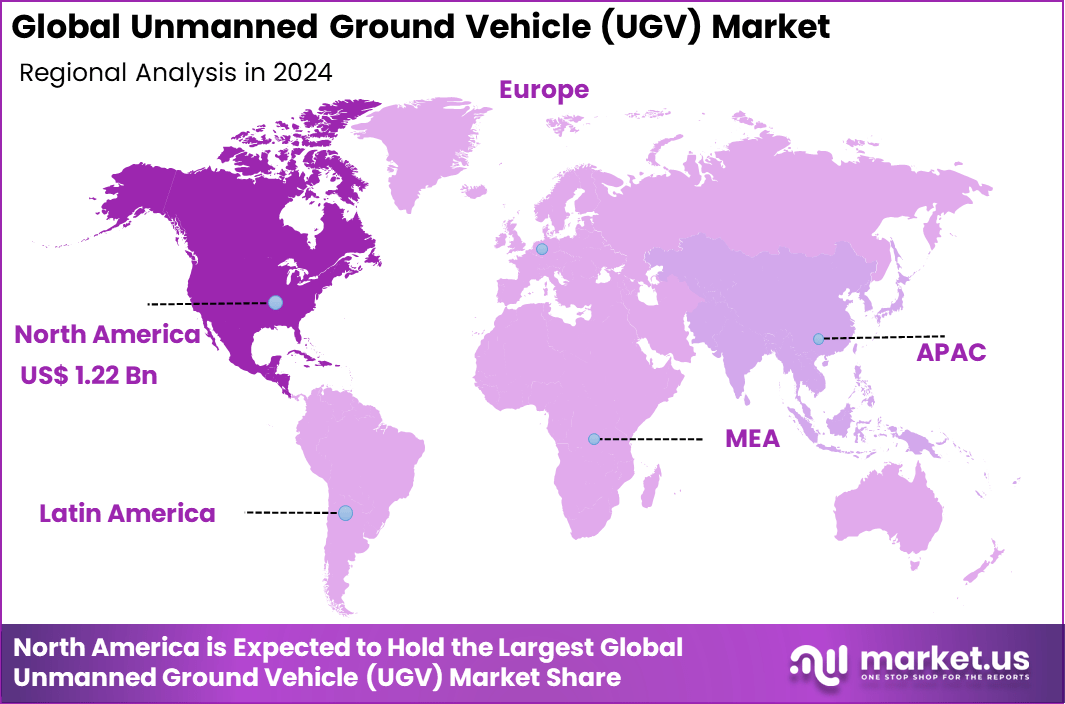

The Global Unmanned Ground Vehicle (UGV) Market size is expected to be worth around USD 6.46 Billion By 2034, from USD 3.05 billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 1.22 Billion revenue.

The Unmanned Ground Vehicle (UGV) market comprises robotic platforms that operate on land without onboard human operators. These vehicles perform a variety of roles across sectors such as defense, industry, agriculture, and public safety. UGVs range from small, wheeled robots tasked with surveillance or bomb disposal to large, tracked, or legged machines designed for logistics, firefighting, or military combat support.

Their capabilities derive from advanced sensors, navigation systems, and autonomy levels, making them crucial for missions in hazardous or inaccessible environments. Top Driving Factors in the UGV market include increased defense modernization aimed at reducing human casualties and automating front-line tasks, expansion in industrial automation, and stringent environmental regulations in mining and agriculture.

Market Scope and Forecast

Report Features Description Market Value (2024) USD 3.05 Bn Forecast Revenue (2034) USD 6.46 Bn CAGR (2025-2034) 7.8% Largest market in 2024 North America [40% market share] Defense agencies worldwide continue to escalate investments in AI-enabled platforms for reconnaissance and explosive ordnance disposal. Concurrently, industries seek UGVs to monitor and operate in dangerous or remote areas with greater safety and efficiency. Increasing Adoption Technologies include AI-powered autonomy, multi-sensor fusion, remote teleoperation, and swarm coordination. Autonomous navigation systems integrate lidar, GPS, cameras, and inertial sensors to navigate complex, unpredictable terrain.

For instance, In September 2024, BAE Systems Australia launched a new unmanned ground vehicle aimed at improving military tactical operations. The innovation enables commanders to conduct missions more effectively while reducing risks to soldiers by operating in hazardous environments remotely. This highlights the rising focus on autonomous defense solutions that combine operational efficiency with enhanced troop safety.

Key Takeaways

- The global unmanned ground vehicle (UGV) market is forecasted to reach USD 6.46 billion by 2034, rising from USD 3.05 billion in 2024, at a CAGR of 7.8% through the forecast period.

- In 2024, North America led the market with over 40% share, generating around USD 1.22 billion in revenue, reflecting strong defense modernization programs.

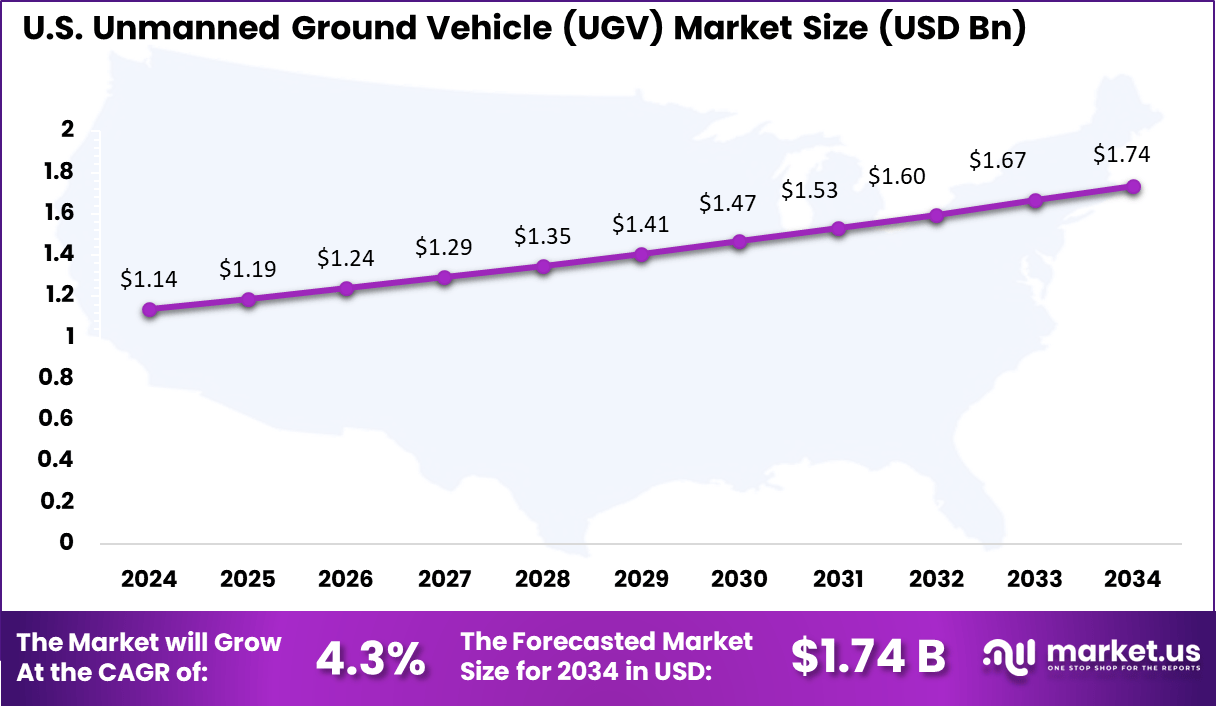

- The United States alone contributed USD 1.14 billion, growing at a CAGR of 4.3%, supported by increasing adoption of UGVs in military and homeland security.

- By operation mode, teleoperated UGVs held 45% share, as remote-controlled vehicles remain preferred for tactical missions.

- Wheeled mobility dominated with 56% share, favored for its efficiency and ease of deployment in diverse terrains.

- Among sizes, small UGVs accounted for 30% share, driven by demand for compact surveillance and reconnaissance solutions.

- In system components, payloads contributed 37% share, reflecting the importance of modular and mission-specific equipment.

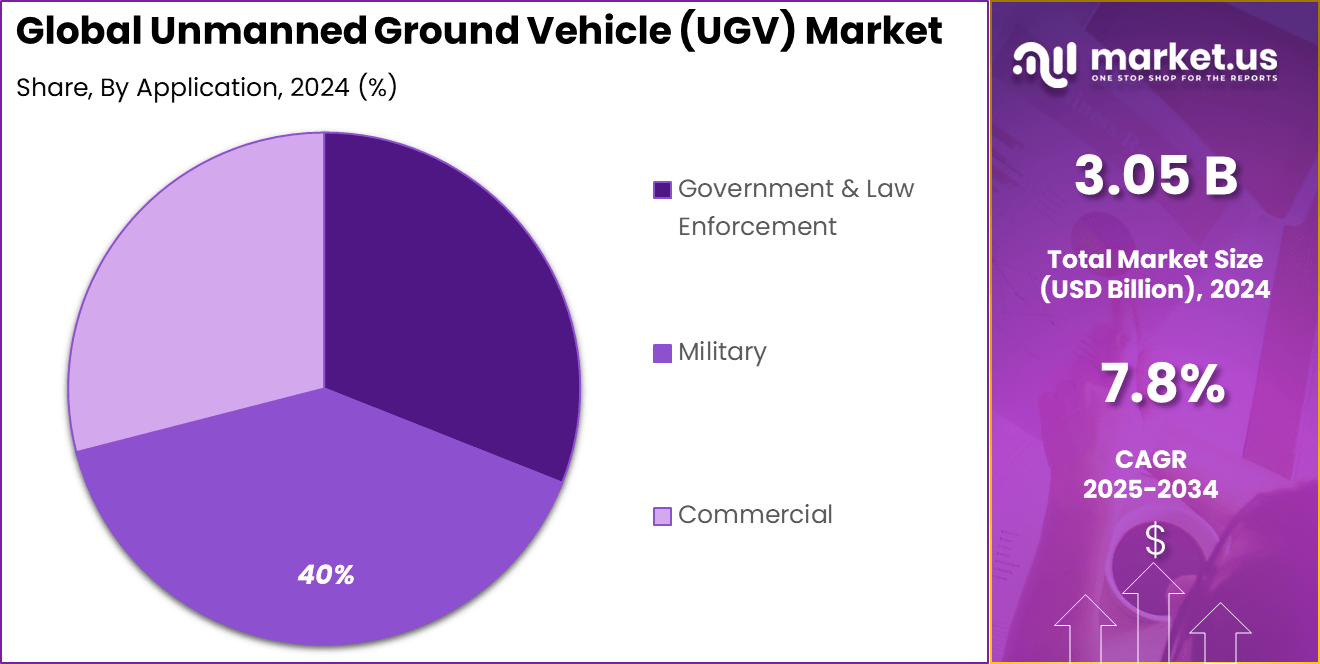

- The military segment led with 40% share, owing to rising demand for unmanned solutions in combat and support operations.

Analysts’ Viewpoint

The UGV market is poised for robust growth, driven by military modernization, AI advancements, and expanding commercial applications. Though high costs and regulatory challenges are still major constraints, game-changing trends such as autonomous swarming and modular designs are opening up powerful new pathways.

North America is the most market dominating region. Asia-Pacific is expected to have the highest growth potential with increasing defense budgets across various economies. Players having the most success investing in and developing AI and swarm capabilities will establish themselves as market leaders.

Crowding down the cost curve, along with public-private partnerships, has the potential to speed adoption. Analysts now forecast an unwavering 7.8% CAGR through 2034, with military demand continuing to fuel dominance but commercial sectors increasingly taking hold in logistics, agriculture, and other hazardous industries.

U.S. Market Size

The United States dominates the global UGV market, accounting for USD 1.14 billion in revenue, driven by early adoption of strong defense investment, technological innovation and autonomous systems worldwide.

The US Department of Defense (DOD) remains a primary catalyst, which plays an important role in the UGVs modern battle strategies, including intelligence, monitoring and reconnaissance (ISR), explosive Ordnance Settlement (EOD), and logistics support.

Programs such as the Robotic Combat Vehicle (RCV) and the next generation Combat Vehicle (NGCV) underlined military changes towards unmanned and alternatively manned systems with unmanned and alternatively manic systems with an army plan to integrate the UGVs in brigade combat teams by 2030.

Beyond defense, commercial and industrial applications are gaining momentum, especially in oil and gas inspection, disaster response and accurate agriculture. Companies such as Boston Dynamics (Hyundai) and Caterpillar are deploying autonomous UGVs for infrastructure monitoring and dangerous environmental operations, reducing human risk and improving efficiency. However, high growth costs and regulatory barriers around autonomous operations in public places remain important challenges.

Technologically, the U.S. leads in AI-driven autonomy, swarm robotics, and hybrid-electric propulsion systems, with firms like General Dynamics, FLIR Systems, and Endeavor Robotics at the forefront. The Pentagon’s Replicator Initiative, aimed at mass-producing affordable autonomous systems, could further accelerate UGV deployment.

Analysts project steady growth at a 4.3% CAGR, supported by defense budgets and private-sector innovation, though competition from China and Europe is intensifying. As AI and machine learning evolve, UGVs will become smarter, more affordable, and integral to both military and civilian operations in the coming decade.

In 2024, North America held a dominant market position, capturing more than a 40% share and generating approximately USD 1.22 billion in revenue. This leadership can be attributed to the strong presence of advanced defense infrastructure, consistent military modernization initiatives, and significant investments in autonomous systems.

The region benefits from robust funding by defense agencies for unmanned ground vehicles to enhance surveillance, logistics, and combat operations. Additionally, the integration of UGVs in border security and disaster management has been prioritized due to rising security concerns, further strengthening market adoption across the United States and Canada.

By Operation Analysis

The global UGV market’s operation segment is divided into teleoperated, autonomous, and tethered systems. Teleoperated UGVs currently lead with 45% market share, favored for missions requiring direct human control like bomb disposal and search-and-rescue. Systems like QinetiQ’s TALON demonstrate their critical role in high-risk military and emergency scenarios where real-time decision-making is essential.

The segment is evolving toward greater autonomy, with hybrid systems blending human oversight with AI capabilities gaining traction. While teleoperation will remain important for critical missions, autonomous UGVs are expected to dominate long-term as technology matures and costs decrease. This shift reflects broader trends toward smarter, more independent robotic systems across defense and commercial sectors.

By Mobility Analysis

The mobility segment of the global UGV market is categorized into wheeled, tracked, legged, and hybrid systems, each offering unique advantages for different terrains and missions. Wheeled UGVs dominate with 56% market share, prized for their speed, energy efficiency, and cost-effectiveness on flat surfaces.

These platforms excel in urban operations, logistics, and perimeter security, with models like General Dynamics’ MUTT widely used by military forces for troop support and cargo transport. The mobility landscape reflects a trade-off between specialization and versatility.

While wheeled systems maintain dominance for most applications, defense and industrial sectors are driving demand for more adaptable platforms. Future developments in articulated joints and terrain-sensing AI are expected to blur traditional mobility categories, enabling next-generation UGVs to dynamically adjust their movement strategies.

By Size Analysis

The Small size segment of the global UGV market is classified into small, medium, large, and very large categories, each serving distinct operational needs. Small UGVs (under 100kg) lead the market with 30% share, valued for their portability and tactical versatility in urban warfare and reconnaissance.

Platforms like the QinetiQ Dragon Runner exemplify their use in explosive detection and indoor surveillance where compact size is critical. Market trends show growing demand for modular designs that maintain compact footprints while expanding capability through swappable payloads.

The small UGV segment continues to dominate due to cost-effectiveness and deployment flexibility, though medium platforms are gaining share as autonomy improves. Future developments may see size categories blur as folding and transformable designs emerge.

By System Analysis

The system segment of the global UGV market comprises four key components: payloads, navigation & control systems, power systems, and other auxiliary systems. Payloads dominate with 37% market share, as mission-specific configurations drive UGV adoption across sectors.

Military applications favor sensor suites and weapon systems, while commercial UGVs typically integrate inspection tools or material handling equipment. The growing demand for modular, swappable payloads reflects the market’s shift toward multi-role platforms.

By Application Analysis

The application segment of the global UGV market spans military, government/law enforcement, and commercial sectors, each with distinct operational requirements. Military applications dominate with 40% market share, driven by rising defense budgets and the need for force protection.

Key use cases include explosive ordnance disposal (EOD), intelligence surveillance and reconnaissance (ISR), and logistics support. The U.S. Army’s adoption of robotic mules like the SMET (Squad Multipurpose Equipment Transport) exemplifies this trend, reducing soldier workload in combat zones.

The application landscape shows increasing convergence between sectors, with military-grade technologies adapting to civilian uses. Firefighting UGVs, originally developed for combat zones, now protect industrial facilities, while agricultural autonomy tech is being repurposed for perimeter security.

This cross-pollination is accelerating innovation and reducing development costs across the UGV ecosystem. Future growth will likely concentrate on multi-role platforms capable of serving diverse applications through modular payload systems.

Key Market Segments

By Operation

- Teleoperated

- Autonomous

- Tethered

By Mobility

- Wheels

- Tracks

- Legs

- Hybrid

By Size

- Small

- Medium

- Large

- Very Large

By System

- Payloads

- Navigation And Control System

- Power System

- Others

By Application

- Government & Law Enforcement

- Urban Search And Rescue

- Fire Fighting

- Nuclear Response

- Crowd Control

- Others

- Military

- Intelligence, Surveillance, and Reconnaissance

- Serach & Rescue

- Combat Support

- Transportation

- Explosive Ordnance Disposal (EOD)

- Mine Clearance

- Firefighting

- Other Applications

- Commercial

- Firefighting

- Oil & Gas

- Agriculture

- CBRN

- Autonomous Delivery

- Physical Security

Driving Factor

Rapid advancement in autonomous technologies

Modern UGVs are no longer limited to basic remote-controlled operations; Instead, they include sophisticated AI algorithms, machine learning and advanced perception systems that enable them to navigate complex areas, identify dangers and execute missions with minimal human intervention.

A prominent example of this trend is the Robotic Combat Vehicle (RCV) program of the US Army, which aims to integrate autonomous and semi-luxurious yogies in future war operations. Companies such as General Dynamics and Textron are equipping the next generation users with AI-operated target recognition, real-time data processing, and flock coordination, which increases the battlefield decision making by reducing military risk for danger.

Beyond defense, AI-enchanced UGVs are transforming commercial areas. In agriculture, companies such as John Dere and Agrointelli employ autonomous robot tractors and weed-control UGV that optimize computer vision and machine learning to customize crop management. The oil and gas industry uses UGVs like ANYmal by ANYbotics- a quadruple robot equipped with Lidar and thermal cameras – to inspect dangerous offshore rigs and refineries, improves safety and operational efficiency.

Restraining Factor

High Development and Operational Costs

One of the most significant restrictions that obstruct unmanned ground vehicles (UGVs) widely adopt is their adequate growth and operational cost. Advanced technologies required for autonomous navigation, artificial intelligence and special payloads are much more expensive than traditional manned systems or simple robotic solutions in the usage.

For military-grade UGV, costs per unit can run in millions of dollars, while commercial variants designed for industrial applications often carry price tags that limit their access to the best-funded outfits only. This financial barrier slows the entry into the market, especially for commercial enterprises with small defense forces and tight budget.

A clear example of cost-related challenges can be seen in the Robotic Combat Vehicle (RCV) program of the US Army, where each prototype is developed by companies such as Qinetiq and Textron, the cost between $ 2-5 million per unit. While these systems offer state -of -the -art capabilities, their high prices have delayed the purchase on a large scale.

Similarly, the British Army project, which is aimed at deploying the UGVs for logistics support, faced budgetary obstacles that limit their initial rollouts. Even in commercial areas, the high cost of autonomous UGV has been a barrier. For example, the spot robot of Boston Dynamics, which is approximately $ 75,000, is out of access to many small and medium -sized enterprises (SMEs) that may otherwise benefit from its inspection and monitoring capabilities.

Growth Opportunity

Expanding Commercial Applications

Unmanned ground vehicles (UGV) are experiencing significant growth through its expansion applications in market commercial areas. While military applications have traditionally dominated UGV usage, in industries, like logistics, oils and gas. Infrastructure inspections are increasingly adopting these robotic systems rapidly to improve efficiency, reduce operating costs and increase security.

A prominent example of this occasion can be seen in precision agriculture, where autonomous UGVs are revolutionized in farming practices. Companies such as John Dere have developed a completely autonomous tractor that leverage GPS and AI-operated vision system for planting, spraying and cropping crops with centimeter level accuracy.

Companies like Amazon and Fedex are testing autonomous distribution robots in urban environment, with Amazon’s scout vehicles completing more than 100,000 delivery in testing markets by 2023. In the operation of the warehouse, UGVs of companies such as locos robotics, according to the industry case, are performing 300-500% productivity improvement in inventory management compared to inventory management.

Latest Trends

Rise of AI-Powered Autonomous Swarming

One of the most significant trends revolutionizing the unmanned ground vehicle (UGV) market is the development of AI-powered swarming capabilities, where multiple autonomous UGVs coordinate to complete complex missions with minimal human oversight.

This emerging technology represents a paradigm shift from single-vehicle operations to collaborative robotic systems that demonstrate collective intelligence, dramatically expanding potential applications across military, industrial, and public safety domains. The UGV swarming concept draws inspiration from natural systems like ant colonies or bird flocks, where decentralized control and local interactions produce sophisticated group behaviors.

In military applications, swarming UGVs are proving to be a force multiplier for modern armed forces. The U.S. Army’s Autonomous Multi-Domain Adaptive Swarm-of-Swarms (AMASS) project, developed in collaboration with Raytheon, successfully demonstrated in 2023 how a mix of 30 different UGVs could autonomously coordinate reconnaissance, target identification, and suppression missions across a 20-square-kilometer urban training area.

Similarly, China’s People’s Liberation Army showcased its Sharp Claw swarm UGV system during military exercises, where dozens of armed UGVs autonomously coordinated flanking maneuvers and suppressive fire patterns. According to a 2024 RAND Corporation analysis, swarm-capable UGVs could reduce casualty rates in urban warfare by 35-40% while increasing mission success probability by 50% compared to traditional approaches.

In mining operations, Rio Tinto has deployed AutoHaul 2.0, a swarm system of 50 autonomous haul trucks that collectively optimize ore transport routes in real-time, achieving a 15% reduction in fuel consumption and 20% faster cycle times compared to human-operated fleets. Australian cotton farmers have reported the technology has reduced their chemical usage by 30% and their labor costs by 60% after agricultural technology company SwarmFarm Robotics proved how teams of small UGVs can collectively weed, spray and harvest crops over large fields.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Key Player Analysis

Leading companies in the unmanned ground vehicle market, such as Teledyne FLIR LLC, General Dynamics Corporation, and Rheinmetall AG, are advancing the field through innovation in surveillance, reconnaissance, and combat-ready platforms. Their focus on robust designs and autonomous capabilities has strengthened their adoption across defense and security operations.

Oshkosh Corporation and ECA GROUP contribute with versatile, mission-specific UGV solutions for tactical and hazardous environments. Players like Aunav, HORIBA MIRA Ltd, and ASELSAN AS have emphasized modular and scalable systems, making their UGVs adaptable to diverse military and civilian needs.

QinetiQ Group PLC and Telerob GmbH also stand out for integrating cutting-edge sensors and remote-control technologies, enabling precision and safety in complex scenarios. These companies continue to expand their global presence through strategic collaborations.

Milrem AS, Roboteam, and Israel Aerospace Industries Ltd drive competitiveness by offering lightweight and highly mobile UGVs suited for urban and border operations. Textron Inc., Leonardo SpA, and Peraton Corp. focus on enhancing autonomous navigation and interoperability with broader defense systems. Along with other key players, they are shaping a dynamic market, fostering advancements in unmanned ground mobility and mission efficiency.

Top Key Players

- Teledyne FLIR LLC

- General Dynamics Corporation

- Rheinmetall AG

- Oshkosh Corporation

- ECA GROUP

- Aunav (everis Aeroespacial y Defensa SLU)

- HORIBA MIRA Ltd

- ASELSAN AS

- QinetiQ Group PLC

- Telerob GmbH (AeroVironment Inc.)

- Milrem AS

- Roboteam

- Israel Aerospace Industries Ltd

- Textron Inc.

- Leonardo SpA

- Peraton Corp.

- Other Key Players

Recent Developments

- In June 2025, Sweden’s Defence Materiel Administration (FMV) awarded Rheinmetall a contract worth EUR 488,536 (~USD 563,000) to assess the Mission Master unmanned ground vehicle under the DAMM program. This initiative is seen as a significant step toward modernizing Sweden’s ground robotics capabilities by validating autonomous systems in operational scenarios and aligning with NATO-standard innovation frameworks for future force readiness.

- In May 2025, Huawei successfully deployed 100 5G-A autonomous electric mining trucks at the Yimin mine in China, demonstrating an impressive 120% operational efficiency compared to conventional manual fleets. This milestone reflects the growing reliance on autonomous mobility technologies in heavy industries, highlighting their potential to enhance productivity, reduce labor risks, and lower carbon emissions within resource-intensive sectors.

- In March 2025, Ukraine conducted the world’s first combat assault entirely utilizing unmanned ground vehicles and FPV drones, establishing a new benchmark for autonomous combined-arms warfare. This unprecedented deployment has demonstrated both the tactical viability and strategic promise of fully autonomous military operations, reinforcing confidence in unmanned systems as integral components of next-generation defense strategies.

- In January 2025, France’s Directorate General of Armaments (DGA) initiated the DROIDE program in collaboration with KNDS and Safran, aiming to field multi-mission ground robots by 2035. This long-term project underlines France’s commitment to autonomous ground combat platforms, ensuring the development of flexible and mission-adaptable robots to support a broad spectrum of military operations in the coming decade.

Unmanned Ground Vehicle MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Unmanned Ground Vehicle MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teledyne FLIR LLC

- General Dynamics Corporation

- Rheinmetall AG

- Oshkosh Corporation

- ECA GROUP

- Aunav (everis Aeroespacial y Defensa SLU)

- HORIBA MIRA Ltd

- ASELSAN AS

- QinetiQ Group PLC

- Telerob GmbH (AeroVironment Inc.)

- Milrem AS

- Roboteam

- Israel Aerospace Industries Ltd

- Textron Inc.

- Leonardo SpA

- Peraton Corp.

- Other Key Players