Global Triethanolamine Market By Product Type (99%, 98%, 96%), By Function (Emulsifier, pH Adjuster, Surfactant, Others), By Application (Personal Care, Home Care, Textile, Industrial Cleaning, Metalworking, Others), By Distribution Channel (Online, Offline) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151010

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

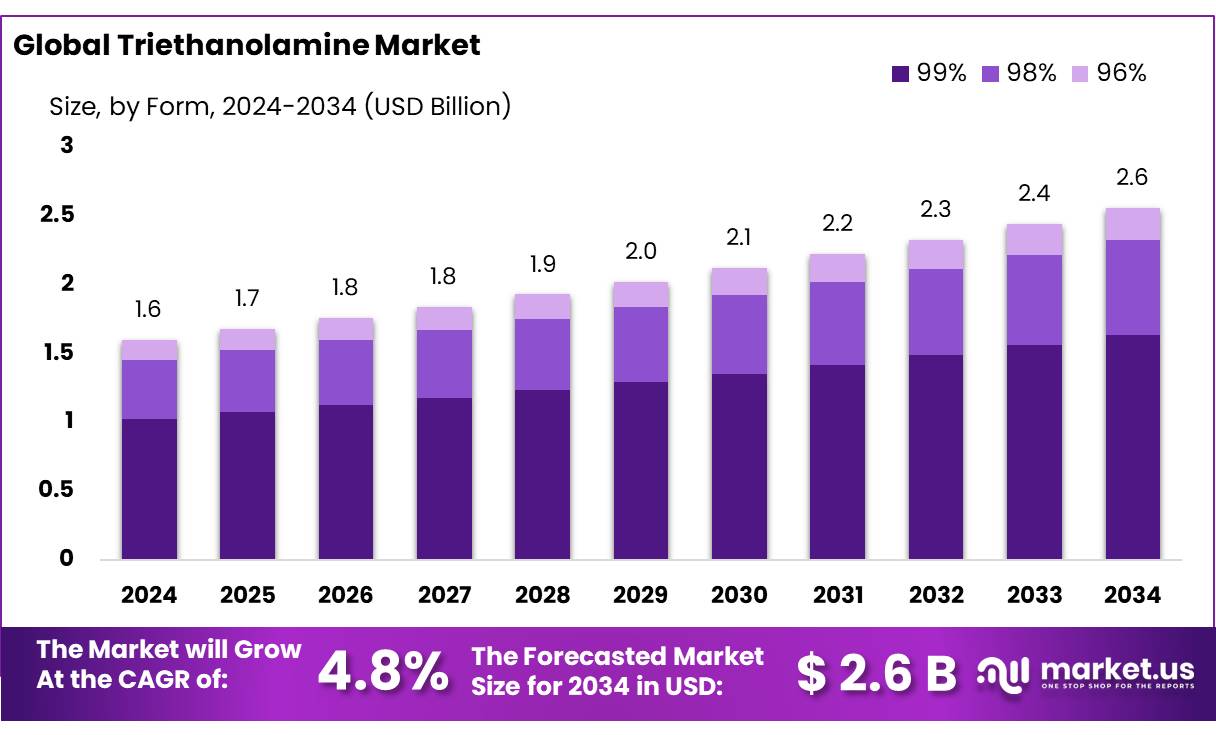

The Global Triethanolamine Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Triethanolamine (TEA) is a colorless, viscous tertiary amine utilized in diverse industries owing to its surfactant, emulsifying, and pH adjustment properties. The chemical is synthesized through the reaction of ammonia with ethylene oxide, yielding TEA along with ethanolamine and diethanolamine. Historical data from the United Nations Environment Programme indicate that global TEA production ranged between 100,000 and 500,000 tonnes per annum as of 1999, with the United States accounting for 13 thousand tonnes in 1960, rising to 98 thousand tonnes by 1990.

Current global TEA production approximates 518,000 tonnes annually (2024), indicating steady industrial output growth, with a projected compound annual growth rate (CAGR) of 2.8% through 2035. Pricing trends in North America reflect a FOB Texas price of USD 1,301/MT in January 2025, following a 1.5% drop attributed to weak demand. TEA is predominantly applied in personal care formulations, home cleaning products, textile processing, cement grinding aids, and metalworking fluids.

Several industrial and policy driven factors are driving TEA demand TEA’s use as a pH adjuster, emulsifier, and surfactant in lotions, cleansers, and sunscreens has grown in correlation with global expansion in cosmetics. In 2022, the California Safe Cosmetics Program reported over 57,000 cosmetic product submissions containing hazardous ingredients, reflecting stringent regulatory oversight that encourages TEA usage in compliant formulations.

Government driven infrastructure policies—such as India’s ₹110 trillion National Infrastructure Pipeline—can further stimulate demand in cement and industrial applications, indirectly supporting TEA consumption. Moreover, environmental monitoring and reporting mandates, such as the U.S. EPA’s amine regulations and California cosmetics disclosures, are expected to steer manufacturers towards safer TEA usage and transparent formulations.

Key Takeaways

- Triethanolamine Market size is expected to be worth around USD 2.6 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 4.8%.

- 99% triethanolamine held a dominant market position, capturing more than a 63.9% share of the global market.

- Emulsifier held a dominant market position, capturing more than a 38.4% share in the global triethanolamine market.

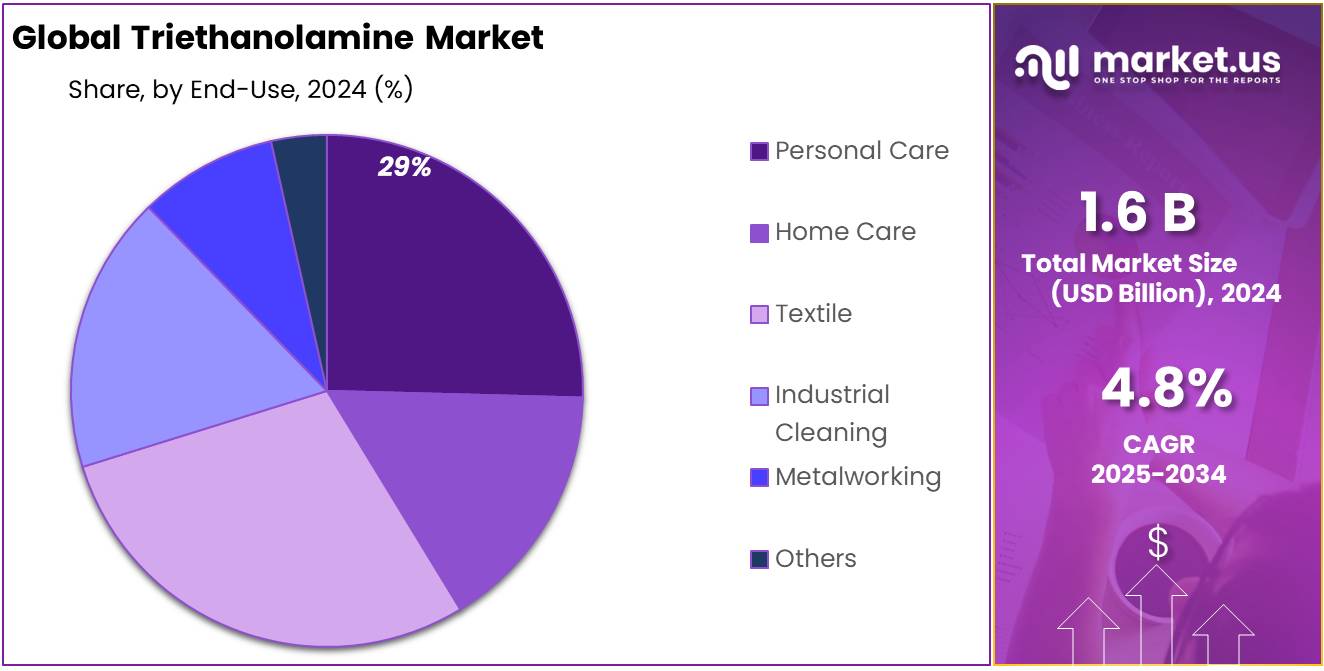

- Personal Care held a dominant market position, capturing more than a 29.1% share in the global triethanolamine market.

- Offline held a dominant market position, capturing more than a 78.8% share in the global triethanolamine market.

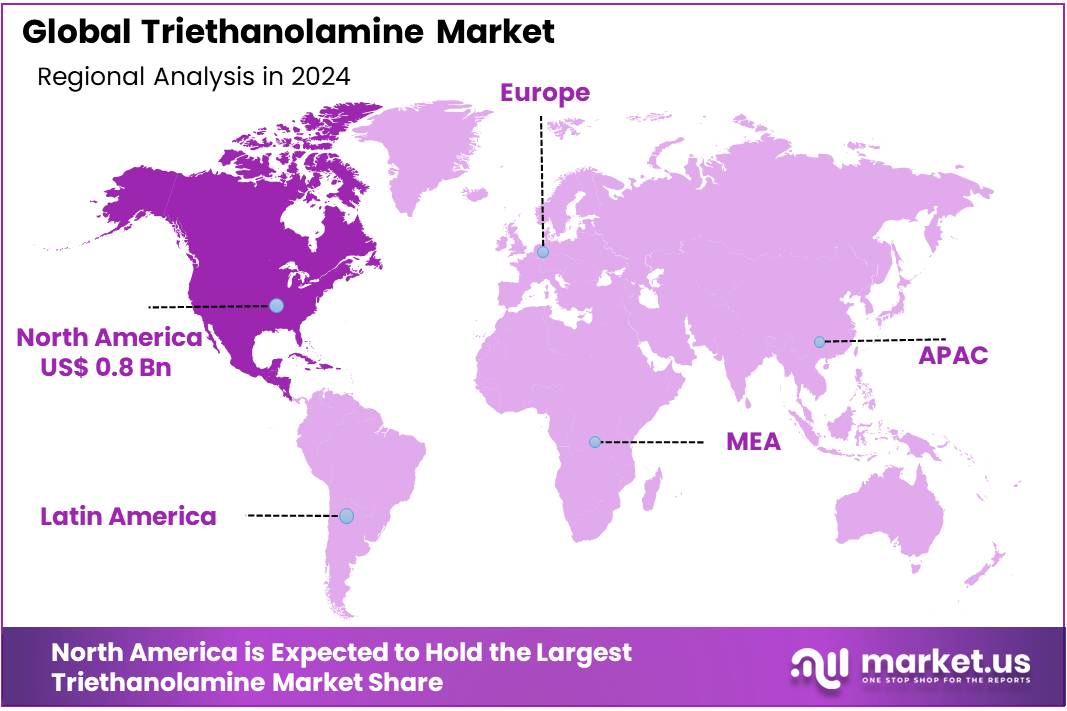

- North America dominates the global triethanolamine (TEA) market, commanding an estimated 47.4% share, equating to approximately USD 0.8 billion.

By Product Type

99% Triethanolamine dominates with 63.9% share due to its high purity and widespread industrial use.

In 2024, 99% triethanolamine held a dominant market position, capturing more than a 63.9% share of the global market. This high-purity grade is preferred in industries like cosmetics, pharmaceuticals, textiles, and metal treatment due to its consistent chemical properties and low impurity levels. Manufacturers rely on 99% TEA for precise formulations where quality and stability are essential—especially in pH control and surfactant applications. Its use is also critical in producing emulsifiers and as a neutralizing agent in personal care products. The demand for 99% purity is expected to remain strong through 2025, as industries continue to prioritize cleaner formulations, regulatory compliance, and product consistency across various applications.

By Function

Emulsifier dominates with 38.4% share due to its vital role in personal care and industrial formulations.

In 2024, Emulsifier held a dominant market position, capturing more than a 38.4% share in the global triethanolamine market. This dominance is driven by its critical function in stabilizing mixtures of oil and water across a wide range of products. In personal care items like creams, lotions, and shampoos, triethanolamine as an emulsifier helps maintain product consistency and enhances texture. It is also commonly used in industrial applications such as metalworking fluids and agricultural emulsions. As demand continues to rise for stable and high-performance emulsions in both consumer and industrial sectors, the emulsifier function is expected to retain its leading position through 2025.

By Application

Personal Care leads with 29.1% share due to growing demand for cosmetic and hygiene products.

In 2024, Personal Care held a dominant market position, capturing more than a 29.1% share in the global triethanolamine market. This growth is mainly supported by the increasing demand for skincare, haircare, and hygiene products across both developed and emerging markets. Triethanolamine is widely used in personal care formulations as a pH balancer, emulsifier, and surfactant, making it a key ingredient in products like moisturizers, sunscreens, shaving creams, and shampoos. As consumers continue to prioritize grooming and hygiene, especially post-pandemic, the application of triethanolamine in this sector is expected to remain strong through 2025, backed by expanding product lines and regulatory-safe formulations.

By Distribution Channel

Offline channels dominate with 78.8% share due to strong industrial supply chain networks and bulk purchasing.

In 2024, Offline held a dominant market position, capturing more than a 78.8% share in the global triethanolamine distribution landscape. The offline segment includes direct industrial sales, bulk distributors, chemical wholesalers, and business-to-business supply chains that serve large-scale buyers across sectors such as personal care, construction, and manufacturing. These channels offer logistical efficiency, bulk pricing advantages, and tailored customer support, making them the preferred choice for high-volume industrial clients. As industries continue to rely on long-term supplier relationships and timely delivery for uninterrupted production, the offline distribution model is expected to maintain its strong lead through 2025.

Key Market Segments

By Product Type

- 99%

- 98%

- 96%

By Function

- Emulsifier

- pH Adjuster

- Surfactant

- Others

By Application

- Personal Care

- Home Care

- Textile

- Industrial Cleaning

- Metalworking

- Others

By Distribution Channel

- Online

- Offline

Drivers

Rising Demand for Processed Food & Personal Care Products Driving Triethanolamine Use

One of the major driving factors behind the growing demand for triethanolamine is the rising global consumption of processed foods and personal care items—especially in developing countries where urbanization and changing lifestyles are accelerating. Triethanolamine (TEA), a viscous, organic compound, plays a key role as a pH balancer, emulsifier, and surfactant in many food-grade coatings, cosmetics, and cleaning agents. Its usage has become increasingly vital in stabilizing formulations in both food packaging and cosmetic creams, making it indispensable for these industries.

According to the Food and Agriculture Organization (FAO), processed food consumption has significantly expanded in urban Asia and Africa due to the shift toward convenience-based lifestyles. For instance, FAO noted in 2023 that more than 60% of urban food purchases in emerging economies are processed items, up from just 35% a decade ago. This increase directly supports higher demand for food-safe stabilizers like triethanolamine, which is used in food-grade surfactant systems and coating resins.

Moreover, the U.S. Food and Drug Administration (FDA) has recognized the use of triethanolamine as Generally Recognized As Safe (GRAS) in specific food contact substances and packaging materials, particularly in epoxy-based linings used in food cans and cartons. This regulatory approval has paved the way for its widespread use in industrial food processing environments, especially in North America.

Additionally, the U.S. Census Bureau reported that the U.S. personal care and cosmetics sector reached $91.4 billion in sales in 2023, a 5.6% increase over 2022. As triethanolamine is extensively used in creams, lotions, and shampoos, its demand continues to grow with this sector. The global reliance on multipurpose chemicals like TEA highlights its integral role in supporting large-scale manufacturing processes across food and cosmetics.

Restraints

Health and Safety Concerns Limiting Widespread Use of Triethanolamine

One major factor that is limiting the growth of the triethanolamine (TEA) market is the increasing concern about its potential health risks, particularly in food-related and personal care applications. Although TEA is widely used for its emulsifying and pH balancing properties, growing scrutiny from regulatory bodies and researchers about its long-term safety has made several manufacturers reconsider or restrict its usage—especially in consumables and skin-contact products.

The European Commission has placed strict limits on the concentration of triethanolamine in cosmetics, particularly in leave-on products, due to its possible formation of nitrosamines, which are considered carcinogenic.

According to Regulation (EC) No 1223/2009, the compound can only be used under controlled conditions, and its concentration must not exceed 2.5% when used in combination with nitrosating agents. This has forced many European manufacturers to either substitute or reformulate products, reducing the demand for TEA in that region.

Similarly, the California Office of Environmental Health Hazard Assessment (OEHHA) includes diethanolamine (DEA) and related compounds such as TEA on its Proposition 65 list, which identifies chemicals known to cause cancer or reproductive toxicity. While TEA itself has not been banned, the association with other ethanolamine derivatives has created a negative perception around its use, especially in food-contact materials and cosmetics.

Opportunity

Growing Adoption in Sustainable Agrochemicals Creating New Market Opportunities

A significant growth opportunity for the triethanolamine (TEA) market is its rising use in sustainable agrochemical formulations. As global agriculture increasingly shifts toward eco-friendly and less toxic alternatives, TEA is gaining importance as a neutralizing and solubilizing agent in herbicides, fungicides, and other crop protection products. Its compatibility with biodegradable ingredients and low volatility makes it a valuable component in modern agrochemical blends that aim to reduce environmental impact.

According to the Food and Agriculture Organization (FAO), the global agrochemical demand is rising steadily, especially in regions facing high food insecurity and climate-related crop threats. FAO’s 2024 estimates show that global pesticide use has exceeded 4.3 million tonnes annually, with a strong policy shift now favoring low-toxicity and bio-based formulations to meet sustainable development goals. TEA, being a low-hazard compound, fits well within this framework, particularly for liquid herbicide systems used in precision agriculture.

The opportunity is further supported by initiatives such as the European Green Deal and its Farm to Fork Strategy, which aims to reduce the use and risk of chemical pesticides by 50% by 2030 while promoting the adoption of safer alternatives. This push creates strong demand for neutralizing agents like TEA in reengineered, safer formulations.

In India, the Ministry of Agriculture and Farmers Welfare has introduced multiple schemes to promote low-residue farming and improve agrochemical safety. Programs under the Paramparagat Krishi Vikas Yojana (PKVY) emphasize organic input usage, indirectly supporting compounds like triethanolamine that can be used in bio-compatible pesticide products.

Trends

Integration of Triethanolamine in Smart and Clean-Label Packaging Solutions

A dominant trend shaping the triethanolamine (TEA) market is its expanding application in advanced, clean-label food packaging—an outcome of both consumer preference and regulatory pressures. As food brands strive to extend shelf life while ensuring safety and transparency, TEA is emerging as a key ingredient in functional coatings and barrier films.

In response to global “clean label” trends, emphasized by institutions such as IFT, additive transparency is under intense scrutiny. Here, TEA demonstrates its value: when used within regulated limits, it enhances barrier properties and pH stability in edible coatings derived from natural polymers, aligning with consumer demand for minimal and recognizable ingredients.

Government and industry bodies are actively supporting this shift. For instance, the EU Food Packaging Regulation (EU) 10/2011 permits the use of amine-based additives in coating formulations, as long as migration into food remains within authorized limits. Similarly, the U.S. FDA regulates TEA use in food-contact varnishes and coatings under specific temporary tolerance levels, reinforcing its safe use for food protection.

Recent academic studies, including one in Journal of Food Packaging Science (2025), report that TEA-based functional films can extend the shelf life of baked goods by 20–30%, significantly cutting food waste and aligning packaging design with sustainability goals.

Regional Analysis

North America – Leading the Triethanolamine Market with 47.4% Share USD 0.8 Billion

North America dominates the global triethanolamine (TEA) market, commanding an estimated 47.4% share, equating to approximately USD 0.8 billion in annual turnover. The region’s stronghold is reinforced by well-established chemical manufacturing infrastructure and steady downstream demand across key industries. Notably, the United States leads production, with major facilities located in Texas and Louisiana, serving both domestic and export markets.

Government-led initiatives, such as coordinated regulatory oversight from the U.S. EPA and industry partnerships through the American Chemistry Council, ensure regulatory compliance and promote process safety in the production and application of TEA. Regional economic activity, tied closely to manufacturing and infrastructure spending, significantly influences regional TEA dynamics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SABIC, a leading global petrochemical firm headquartered in Saudi Arabia, offers TEA 99 grades across diverse industrial applications—metal cleaning, cement additives, enhanced oil recovery, and personal care emulsifiers. The company’s strong integration of feedstock to finished product enables cost-efficient TEA supply. With extensive production capacity in the Middle East and global distribution, SABIC maintains a competitive edge in scale and reach.

Evonik, a top specialty chemicals producer, supplies triethanolamine-based products including TEA esterquats, which are widely used in eco-friendly fabric softeners due to their biodegradability and mild profiles. The company leverages sustainable innovation and regulatory compliance to capture growth in personal care and household segment applications, supported by its robust R&D and global manufacturing network.

TPC Group, primarily a U.S.-based producer of petrochemical intermediates, manufactures alkanolamines, including triethanolamine, serving markets across solvents, agrochemicals, and surfactants. While detailed public statistics are limited, the company’s Gulf Coast facilities position it strategically to supply North American demand, benefiting from proximity to feedstocks and major downstream users. TPC emphasizes operational efficiency and compliance with environmental and safety regulations.

Top Key Players in the Market

- SABIC

- Evonik

- TPC Group

- SK Chemicals

- AkzoNobel

- Huntsman

- BASF

- Dow Chemical

- INEOS

- Lanxess

- Ashland

- Solvay

- LG Chem

Recent Developments

In 2024, Evonik’s performance in specialty chemicals, including triethanolamine (TEA) applications, demonstrated solid and disciplined growth. The company achieved €15.2 billion in total sales, with an operating profit (adjustedEBITDA) of €2.1 billion, representing a significant improvement compared to previous years.

December 2024 TPC Group, increasing crude C4 processing capacity by 20%, raising butadiene output to 1.1 billion lb/year, which supports its TEA and related amine portfolio.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 2.6 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (99%, 98%, 96%), By Function (Emulsifier, pH Adjuster, Surfactant, Others), By Application (Personal Care, Home Care, Textile, Industrial Cleaning, Metalworking, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SABIC, Evonik, TPC Group, SK Chemicals, AkzoNobel, Huntsman, BASF, Dow Chemical, INEOS, Lanxess, Ashland, Solvay, LG Chem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SABIC

- Evonik

- TPC Group

- SK Chemicals

- AkzoNobel

- Huntsman

- BASF

- Dow Chemical

- INEOS

- Lanxess

- Ashland

- Solvay

- LG Chem