Global Tobacco Packaging Market Size, Share, Growth Analysis By Material (Plastic, Paperboard, Paper, Others), By Packaging Type (Primary, Secondary), By Tobacco Type (Smoking Tobacco, Cigars and Cigarillos, Smokeless Tobacco, Next-Generation Products (HTP and e-cig)), By Product Type (Boxes, Bags & Pouches, Films & Wraps, Folding Cartons, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154378

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

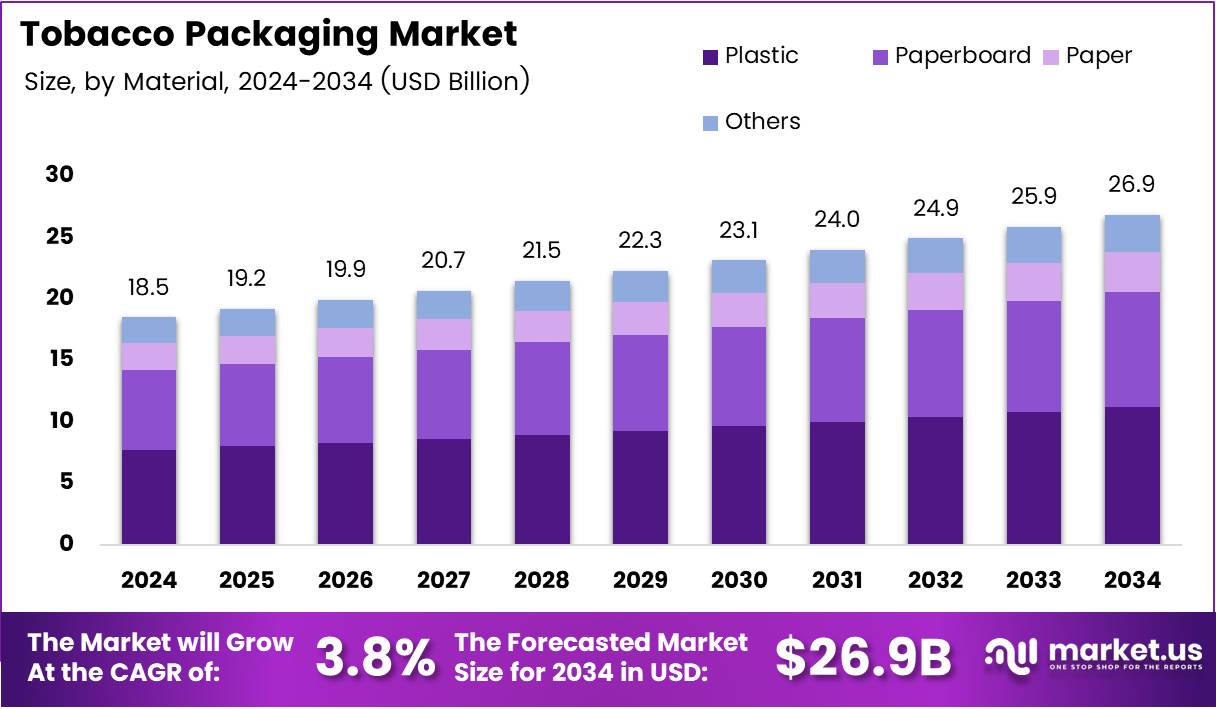

The Global Tobacco Packaging Market size is expected to be worth around USD 26.9 Billion by 2034, from USD 18.5 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The Tobacco Packaging market plays a critical role in shaping consumer perception and influencing buying behavior within the tobacco industry. Packaging is no longer just a protective layer—it now serves as a regulatory, informational, and branding tool. It combines marketing tactics with public health warnings, especially as governments intensify control over tobacco consumption.

Demand is steadily increasing due to rising global smoking rates, combined with an evolving regulatory environment. According to Vital Strategies, 3.29 billion people in 32 countries are now protected by graphic health warnings on tobacco packaging. This signifies growing public health efforts influencing packaging design and compliance needs.

The global tobacco packaging market is witnessing consistent growth, driven by demand for cigarettes, cigars, and smokeless tobacco products. Regulatory changes are creating new packaging challenges and opportunities for innovation. Manufacturers are investing in compliance-friendly, sustainable packaging while also seeking differentiation within legal limits.

Notably, government involvement continues to shape the market. According to HealthGovtNZ, new images and health warnings must now cover at least 75% of the front of tobacco packs. Additionally, all brand-related imagery has been banned—this boosts demand for standardized, regulation-compliant packaging materials.

In line with global trends, many nations are enforcing plain packaging laws. According to Valvira, the Finnish Tobacco Act mandates strict size regulations—each unit packet must contain a minimum of 10 cigarillos. These requirements prompt a shift towards cost-effective, modular packaging solutions that meet legal thresholds.

Emerging economies present expansion opportunities, especially where tobacco use remains prevalent and regulations are still evolving. Businesses entering these markets must stay agile and responsive to legal shifts. Investment in regional packaging hubs is increasing to meet local compliance needs and improve supply chain efficiency.

Meanwhile, health-driven policy pressure is rising. Regulatory authorities are now using packaging as a primary communication channel for tobacco control. This has opened up opportunities for packaging firms specializing in high-quality printing, tamper-proof seals, and recyclable materials tailored to tobacco laws.

In response to growing regulation, packaging companies are expanding their R&D spend. Customization, anti-counterfeit measures, and eco-friendly designs are key differentiators. As plain packaging becomes more widespread, brand value is increasingly transferred to innovation in material and structure.

Key Takeaways

- The Global Tobacco Packaging Market is projected to reach USD 26.9 Billion by 2034, up from USD 18.5 Billion in 2024, growing at a CAGR of 3.8% (2025–2034).

- Plastic held the leading material share in 2024 with 43.7%, favored for its strength, flexibility, and barrier properties.

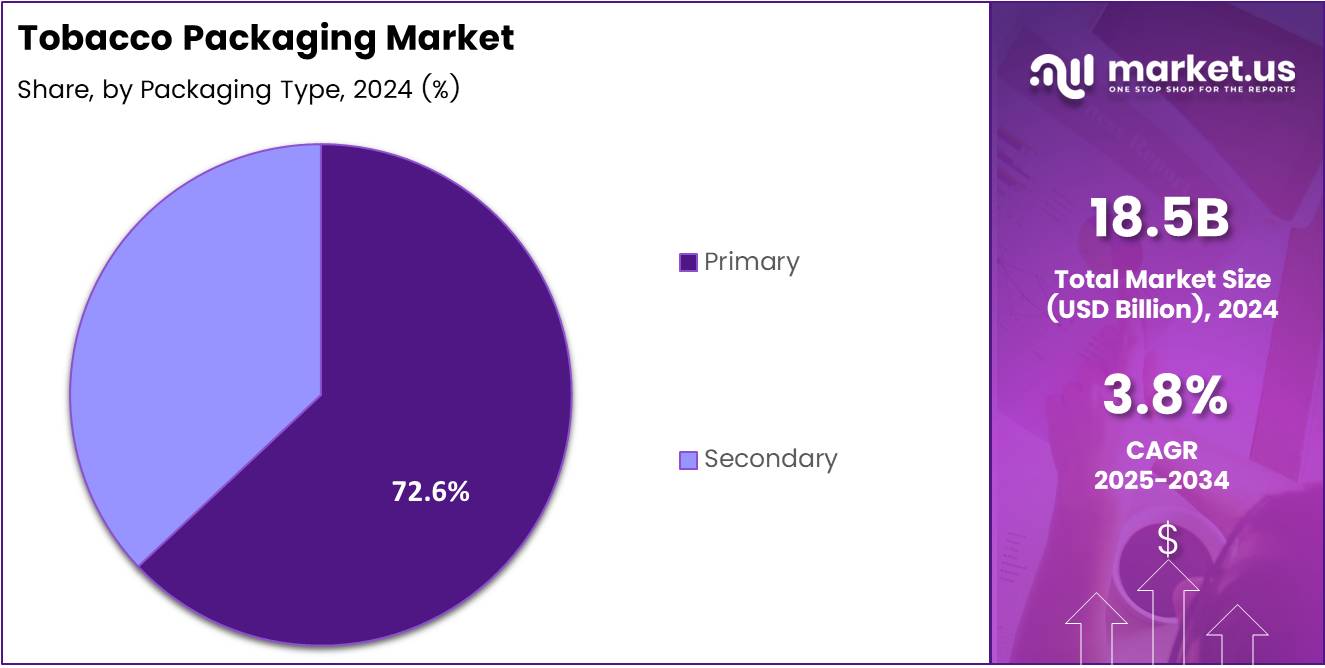

- Primary packaging dominated by packaging type in 2024 with a 72.6% share, driven by the need for freshness, safety, and brand protection.

- Smoking Tobacco led the market by tobacco type in 2024 with a 52.4% share, due to popularity of loose and roll-your-own products.

- Boxes were the top product type in 2024 with a 38.1% share, valued for their durability and branding potential.

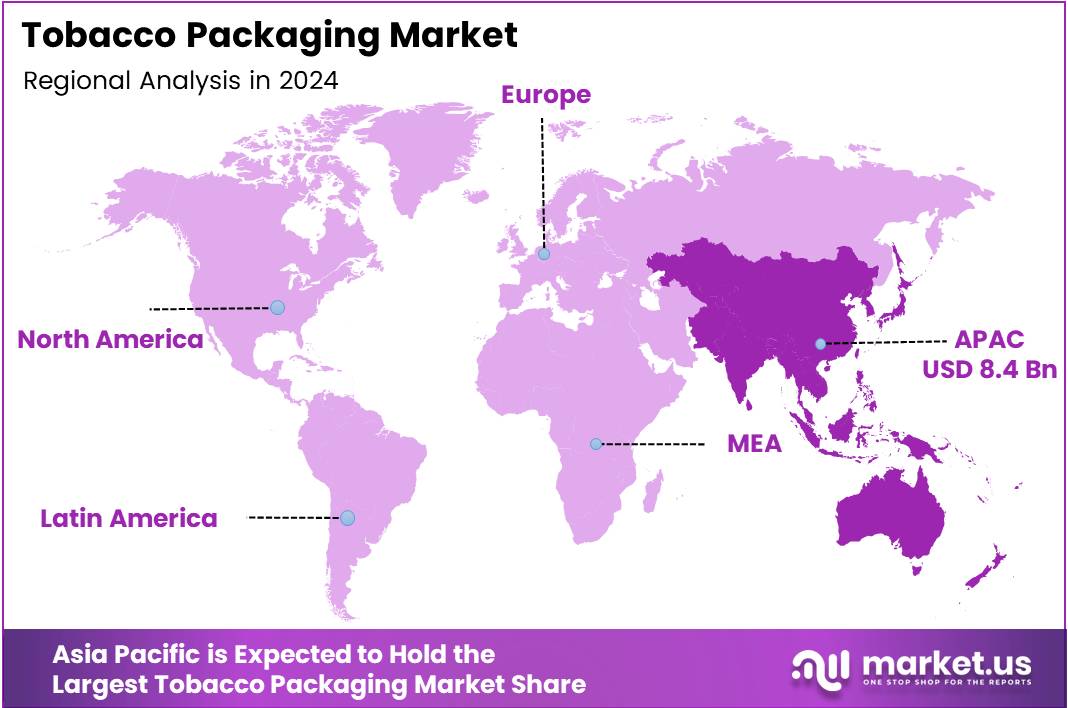

- Asia Pacific led regionally in 2024 with a 45.8% market share, valued at USD 8.4 Billion, driven by high consumption in China and India, low production costs, and rapid urbanization.

Material Analysis

Plastic leads with 43.7% due to its durability and moisture-resistant properties.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of the Tobacco Packaging Market, with a 43.7% share. The material’s strength, flexibility, and superior barrier qualities make it ideal for preserving tobacco freshness and flavor, especially in humid or transport-heavy regions.

Paperboard maintained a notable position due to its eco-friendliness and ease of customization. Many premium and sustainable brands preferred paperboard for its aesthetic appeal and recyclability, aligning with growing environmental concerns.

Paper packaging, while less dominant, continued to serve a niche in traditional and small-scale tobacco products. Its lightweight nature and cost-efficiency attracted regional manufacturers focused on affordability.

The Others category consisted of alternative materials that met specific regional or regulatory demands. These included biodegradable or hybrid composites aimed at reducing environmental impact.

Packaging Type Analysis

Primary packaging dominates with 72.6% as it directly preserves product integrity and freshness.

In 2024, Primary held a dominant market position in the By Packaging Type Analysis segment of the Tobacco Packaging Market, with a 72.6% share. This segment covers materials in direct contact with tobacco products, such as pouches, foil wraps, and blister packs. The growth is driven by consumer demand for freshness, brand protection, and compliance with safety regulations.

Primary packaging also supports health warnings and brand identity, both crucial in competitive markets. Innovations in tamper-proof sealing and barrier technologies further solidified its lead.

Secondary packaging, used for bundling multiple tobacco items, accounted for the remaining market share. While it plays a key role in logistics and point-of-sale marketing, its lower share reflects the market’s emphasis on direct product preservation.

Tobacco Type Analysis

Smoking Tobacco leads with 52.4% as traditional consumption continues to dominate global markets.

In 2024, Smoking Tobacco held a dominant market position in the By Tobacco Type Analysis segment of the Tobacco Packaging Market, with a 52.4% share. This segment includes products like loose tobacco and roll-your-own (RYO), popular for affordability and customization.

Consumers in emerging economies and among younger demographics have favored these products, driving demand for flexible packaging solutions. The format allows manufacturers to experiment with design, branding, and sustainability.

Cigars and Cigarillos held a smaller but steady share, appealing to premium and occasional users. Their packaging focuses heavily on luxury and presentation.

Smokeless Tobacco, though niche, sustained demand in specific regions like South Asia and the Nordic countries. Packaging here often focused on moisture control and portability.

Next-Generation Products (HTP and e-cig) continued to gain interest, especially among tech-savvy users. While not yet dominant, this segment’s packaging leaned into innovation and sleek design.

Product Type Analysis

Boxes lead with 38.1% as they offer structural integrity and brand visibility.

In 2024, Boxes held a dominant market position in the By Product Type Analysis segment of the Tobacco Packaging Market, with a 38.1% share. Their sturdy design and ability to display detailed branding make them a preferred choice across both premium and standard tobacco products.

Boxes also offer excellent protection during transport and storage, reducing the risk of product degradation. Their compatibility with automated filling and sealing systems enhances operational efficiency.

Bags & Pouches followed as a flexible and lightweight option, especially for loose tobacco products. These are widely used in smoking tobacco formats due to their resealability and cost-effectiveness.

Films & Wraps played a crucial role in preserving moisture and aroma, particularly in cigar packaging. Their transparency also added to product appeal at retail points.

Folding Cartons provided a balance between cost and presentation, often used in combination with inner wraps for added protection.

The Others category included niche packaging types tailored for regional preferences or innovative tobacco forms, contributing to a diverse product mix.

Key Market Segments

By Material

- Plastic

- Paperboard

- Paper

- Others

By Packaging Type

- Primary

- Secondary

By Tobacco Type

- Smoking Tobacco

- Cigars and Cigarillos

- Smokeless Tobacco

- Next-Generation Products (HTP and e-cig)

By Product Type

- Boxes

- Bags & Pouches

- Films & Wraps

- Folding Cartons

- Others

Drivers

Rising Demand for Premium and Innovative Tobacco Packaging Designs Drives Market Growth

The tobacco packaging market is seeing strong growth due to rising demand for premium and creative packaging. Brands are focusing more on unique designs, bold colors, and high-end materials to attract attention and differentiate their products. This shift is not just about looks; it’s also about delivering a better unboxing experience to consumers.

Global trade in tobacco products is also fueling this trend. As tobacco companies expand to international markets, the need for packaging that meets different cultural and legal standards increases. This opens doors for packaging companies to offer tailored, region-specific solutions.

Flavored and alternative tobacco products like e-cigarettes and nicotine pouches are gaining popularity, especially among younger users. These new products often require specialized packaging that’s both eye-catching and compliant with safety standards. As a result, packaging innovation continues to grow in importance.

Additionally, organized retail and the rise of online tobacco sales are pushing brands to invest in durable and attractive packaging. E-commerce has created a need for packaging that can protect products in transit while still providing a strong visual impression when delivered.

Restraints

Stringent Anti-Smoking Regulations and Health Campaigns Restrain Market Growth

Strict government regulations and health awareness campaigns are slowing down the tobacco packaging market. Many countries have introduced plain packaging laws and banned flashy branding to discourage smoking. This limits design flexibility and reduces demand for premium packaging.

Consumers are also shifting toward nicotine-free alternatives like herbal products and wellness items. This change in behavior reduces the market size for traditional tobacco packaging, especially in health-conscious regions.

In developed countries, smoking rates are steadily declining due to strong public health policies. As fewer people smoke, the demand for cigarette and cigar packaging naturally drops, affecting the industry’s growth potential.

Sustainable packaging is gaining popularity, but using eco-friendly materials often comes with high operational costs. This adds financial pressure on manufacturers, especially smaller players, making it harder for them to compete and innovate.

Growth Factors

Development of Biodegradable and Recyclable Packaging Solutions Offers Growth Opportunities

Eco-friendly packaging solutions are creating new growth opportunities in the tobacco market. Companies are developing biodegradable and recyclable materials to meet consumer and regulatory demands for sustainability. This shift helps brands build a positive image and attract environmentally conscious customers.

Smart and personalized packaging is also opening up exciting possibilities. Technologies like NFC chips and custom print designs are being used to enhance user experience and build brand loyalty. These advanced packaging options can make a product stand out on shelves and online platforms.

The market for heat-not-burn and smokeless tobacco products is expanding. These products require different types of packaging with safety features, temperature control, and sleek design. As more consumers try these alternatives, packaging needs will continue to grow and evolve.

Emerging economies with more relaxed tobacco regulations offer major opportunities for market expansion. Countries in Asia, Africa, and Latin America are seeing rising demand for tobacco, giving packaging firms a chance to enter new markets with tailored products and solutions.

Emerging Trends

Adoption of Track-and-Trace Technologies to Combat Counterfeit Products Drives Market Trends

Track-and-trace technologies are becoming essential in the tobacco packaging industry to fight counterfeiting. By adding digital codes or unique identifiers, manufacturers can monitor products across the supply chain. This ensures authenticity and improves consumer trust.

Regulatory-compliant and minimalist designs are also trending. Governments are enforcing stricter rules on branding, pushing companies to adopt simpler and standardized packaging. While this limits creativity, it promotes transparency and aligns with health-focused messaging.

Augmented reality (AR) is gaining traction as a way to engage customers. Tobacco brands are using AR to create interactive experiences through packaging, offering users digital content such as promotions or educational messages when scanned with a smartphone.

Digital authentication features like QR codes are being widely adopted. These allow consumers to verify a product’s origin and get more information instantly. QR codes also provide brands with valuable consumer data, helping them refine marketing and product strategies.

Regional Analysis

Asia Pacific Dominates the Tobacco Packaging Market with a Market Share of 45.8%, Valued at USD 8.4 Billion

Asia Pacific holds the largest share in the tobacco packaging market, accounting for 45.8%, valued at USD 8.4 billion. The region’s dominance is driven by the high consumption rates in countries such as China and India, where tobacco use remains prevalent across rural and urban populations. Additionally, strong manufacturing infrastructure and low production costs contribute to the region’s market leadership. Rapid urbanization and rising disposable income are further fueling demand for innovative and compliant packaging solutions.

North America Tobacco Packaging Market Trends

North America is a significant player in the tobacco packaging market, supported by established regulatory frameworks and consumer demand for premium packaging formats. The region sees steady innovation in packaging design, materials, and labeling to align with evolving consumer preferences and legal mandates. Sustainability and anti-counterfeiting measures are central to market dynamics, with companies emphasizing environmentally responsible packaging solutions.

Europe Tobacco Packaging Market Trends

Europe’s tobacco packaging market is shaped by stringent regulatory requirements and public health initiatives aimed at reducing tobacco consumption. The market is increasingly influenced by plain packaging laws, graphic health warnings, and sustainability standards. Despite declining smoking rates in several countries, premium and alternative tobacco products are maintaining demand for advanced packaging formats across the region.

Middle East and Africa Tobacco Packaging Market Trends

The Middle East and Africa region presents moderate growth potential in the tobacco packaging market, driven by changing lifestyle patterns and steady tobacco consumption in key countries. While regulatory enforcement varies across nations, rising awareness and demand for quality packaging are prompting manufacturers to upgrade packaging materials and techniques. Growth is particularly observed in urban centers where packaged tobacco products are more common.

Latin America Tobacco Packaging Market Trends

Latin America exhibits a developing tobacco packaging market, supported by consistent demand across various tobacco categories. The region is gradually witnessing the influence of health warnings and packaging regulations, which is reshaping the packaging landscape. Economic fluctuations and policy shifts may pose challenges, but the growing population and cultural acceptance of tobacco sustain market activity in countries such as Brazil and Argentina.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tobacco Packaging Company Insights

In 2024, the global tobacco packaging market remains highly competitive, with several key players demonstrating strategic advancements in innovation, sustainability, and global reach. LLFlex continues to reinforce its leadership in providing high-barrier packaging materials, leveraging its experience in foil laminates and specialty substrates to meet the demands of premium tobacco brands seeking shelf differentiation and durability.

WestRock maintains a strong market presence through its integrated supply chain and sustainable paperboard solutions. Its commitment to circular packaging and investments in smart packaging technologies enhance its appeal to environmentally conscious consumers and manufacturers alike.

Sonoco remains a crucial player, offering diversified packaging formats including rigid paper containers and protective solutions tailored to tobacco products. Its emphasis on cost efficiency and product integrity underpins its consistent demand among large tobacco producers globally.

Stora Enso Oyj continues to drive growth through its renewable materials strategy, pushing the market toward fiber-based alternatives. Its innovations in biodegradable and recyclable packaging align with tightening global regulations and shifting consumer preferences, making it a forward-looking partner in the industry.

These companies are setting the tone for future developments in the tobacco packaging sector, particularly in light of evolving environmental regulations and the growing need for product differentiation. Their focus on sustainability, innovation, and customer-centric packaging solutions will likely influence the competitive dynamics of the market throughout 2024 and beyond.

Top Key Players in the Market

- LLFlex

- WestRock

- Sonoco

- Stora Enso Oyj

- Amcor Limited

- Innovia Films

- Mondi Group

- ITC Limited

- Smurfit Kappa

- Taghleef Industries

- Cigar Box Factory Estelí S.A.

- International Plastics Inc.

- Atlantic Packaging

Recent Developments

- In Mar 2025, the Ministry of Health and Population of Nepal passed a new directive. This mandates increasing the size of health warnings on tobacco packaging from 90% to 100%, making them the most prominent in the region.

- In April 2024, Oman implemented a significant public health policy by introducing plain packaging for tobacco products. This move positions Oman as a pioneer in tobacco control across the Gulf region.

- In Feb 2024, under the COTPA Act, 2003, cigarette packets in India must include health warnings. These warnings are mandated to cover 85% of the principal display area, reflecting ongoing efforts to deter tobacco use.

Report Scope

Report Features Description Market Value (2024) USD 18.5 Billion Forecast Revenue (2034) USD 26.9 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Paperboard, Paper, Others), By Packaging Type (Primary, Secondary), By Tobacco Type (Smoking Tobacco, Cigars and Cigarillos, Smokeless Tobacco, Next-Generation Products (HTP and e-cig)), By Product Type (Boxes, Bags & Pouches, Films & Wraps, Folding Cartons, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape LLFlex, WestRock, Sonoco, Stora Enso Oyj, Amcor Limited, Innovia Films, Mondi Group, ITC Limited, Smurfit Kappa, Taghleef Industries, Cigar Box Factory Estelí S.A., International Plastics Inc., Atlantic Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LLFlex

- WestRock

- Sonoco

- Stora Enso Oyj

- Amcor Limited

- Innovia Films

- Mondi Group

- ITC Limited

- Smurfit Kappa

- Taghleef Industries

- Cigar Box Factory Estelí S.A.

- International Plastics Inc.

- Atlantic Packaging