Global Nicotine Pouches Market Size, Share, Growth Analysis By Product (Tobacco-derived Nicotine, Synthetic Nicotine), By Flavor (Flavored, Original/Unflavored), By Strength (Strong, Light, Normal, Extra Strong), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145283

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

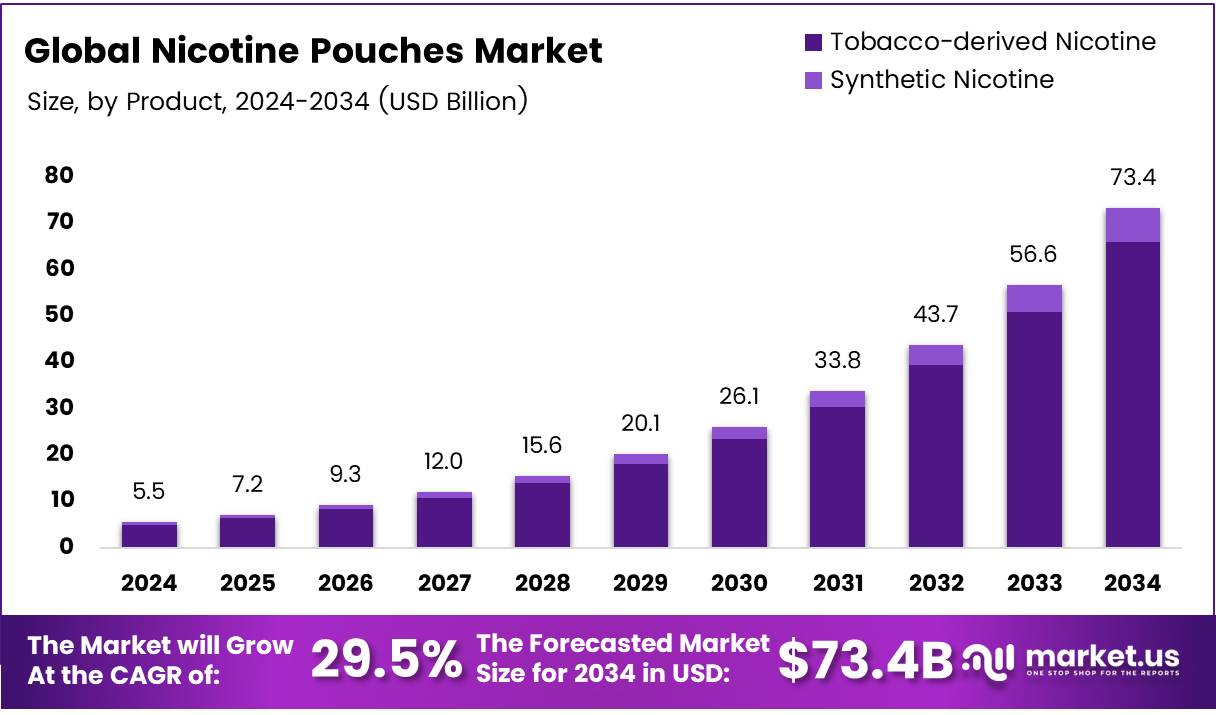

The Global Nicotine Pouches Market size is expected to be worth around USD 73.4 Billion by 2034, from USD 5.5 Billion in 2024, growing at a CAGR of 29.5% during the forecast period from 2025 to 2034.

The Nicotine Pouches Market refers to the segment of tobacco-free products that offer consumers a smokeless, vapor-free alternative to traditional nicotine delivery methods such as cigarettes and vaping. These pouches, which are typically placed between the gum and lip, contain nicotine extracted from tobacco alongside other ingredients to enhance flavor and shelf-life. As a discreet and less harmful alternative, nicotine pouches have gained popularity among individuals seeking to quit smoking or reduce their tobacco consumption.

The growth trajectory of the Nicotine Pouches Market is notably influenced by a shift in consumer preferences towards healthier lifestyle choices. According to data from Haypp, approximately 56% of nicotine pouch users began utilizing these products as a means to cease smoking. This statistic underscores the role of nicotine pouches in smoking cessation efforts, positioning them as a pivotal player in the market for alternative nicotine products.

Furthermore, the average consumer reportedly uses three cans of nicotine pouches per week, indicating a substantial rate of recurring use which supports sustained market growth.

Opportunities within the Nicotine Pouches Market are expanding, particularly in regions with stringent public health policies against smoking. Governments are increasingly investing in public health initiatives that encourage smoking cessation, which indirectly benefits the market for nicotine pouches.

Regulatory frameworks are also evolving to accommodate these products, often focusing on establishing standards for nicotine content and packaging to ensure consumer safety. These regulatory measures, while ensuring product safety and quality, also validate the market’s presence, providing a structured pathway for growth and expansion.

Market penetration is particularly high among younger demographics, with individuals aged 16–29 showing the highest usage rates. According to Folkhälsomyndigheten, as of 2024, 5% of the population reported using nicotine pouches daily, and the trend is rising both for nicotine pouches and e-cigarettes. This demographic trend highlights the market’s potential for long-term growth as these younger consumers continue to drive demand.

The increasing societal acceptance and accessibility of nicotine pouches are crucial factors propelling the market forward, making it an attractive sector for investors and new market entrants looking to capitalize on the shifting dynamics of nicotine consumption.

Key Takeaways

- The global nicotine pouches market is projected to reach USD 73.4 billion by 2034, growing at a CAGR of 29.5% from 2025 to 2034.

- Tobacco-derived nicotine held a dominant 95.6% market share in 2024, driven by established manufacturing processes and regulatory support.

- Flavored nicotine pouches led the market with a 90.1% share in 2024, due to consumer preference for diverse taste experiences.

- Strong (4-6 mg/pouch) nicotine variants held 43.6% of the market share in 2024.

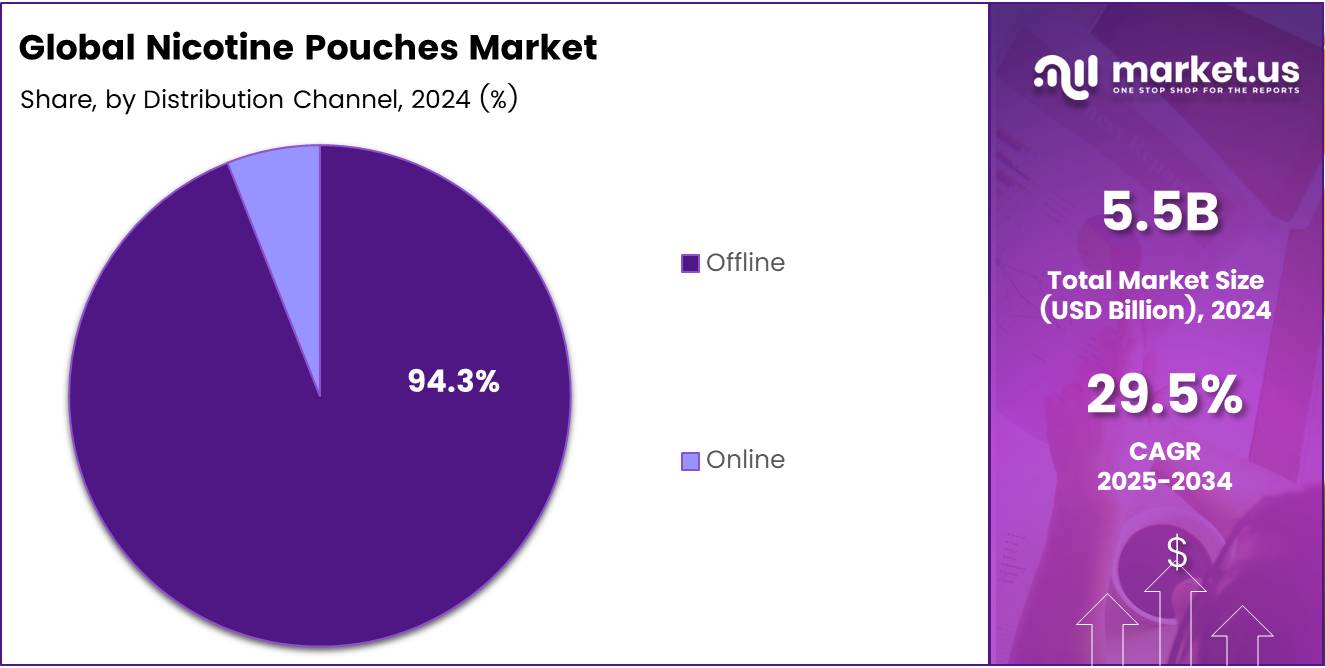

- Offline distribution channels dominated the market with a 94.3% share in 2024, attributed to consumer preference for direct product engagement.

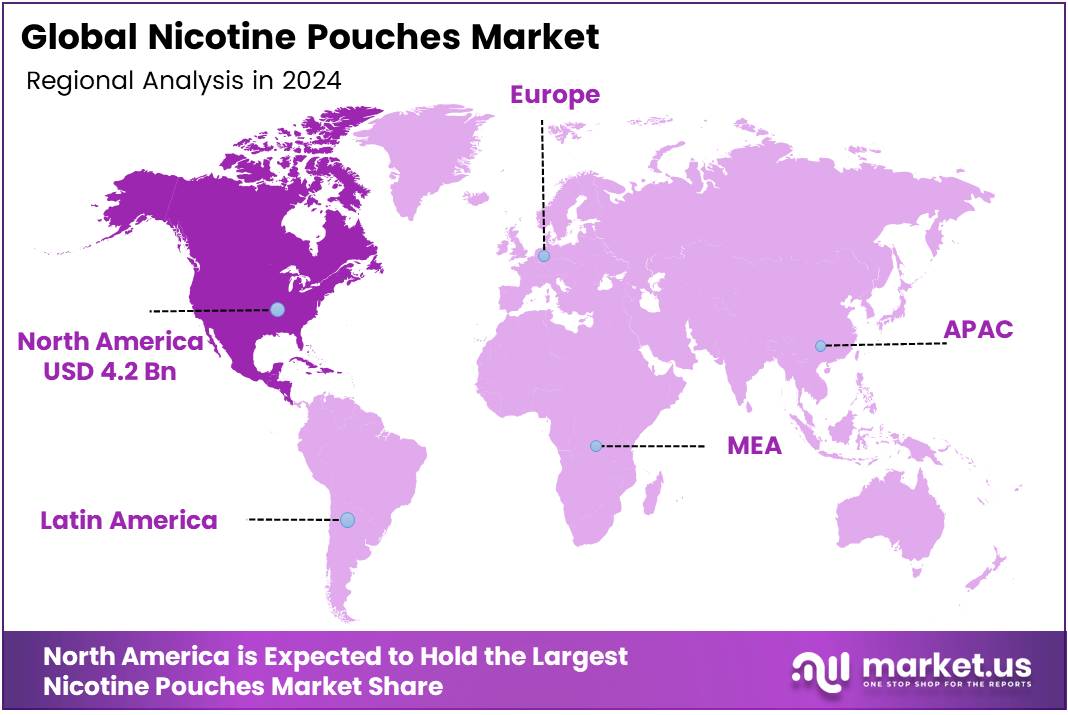

- North America accounted for 78.6% of the global market share in 2024, valued at USD 4.2 billion, driven by demand for healthier alternatives and stringent smoking regulations.

Product Analysis

Tobacco-Derived Nicotine Dominates with 95.6% Share Due to Traditional Production Methods and Regulatory Compliance

In 2024, the Nicotine Pouches Market witnessed tobacco-derived nicotine commanding a dominant position in the By Product Analysis segment, securing a 95.6% market share. This overwhelming prevalence can be attributed to its established manufacturing processes and its adherence to stringent regulatory frameworks, which have historically supported tobacco-based products.

The familiarity of tobacco-derived nicotine among consumers, combined with its widespread acceptance in regulatory circles, has bolstered its position as the primary choice in nicotine pouch formulations.

Conversely, synthetic nicotine, while emerging as a potential alternative, has captured a smaller segment of the market. This form of nicotine is created in a laboratory setting, offering a purer and potentially safer profile compared to its tobacco-derived counterpart.

However, the market penetration of synthetic nicotine has been relatively modest, hindered by higher production costs and less established regulatory pathways. As the market evolves, synthetic nicotine may gain traction, driven by innovations in production technology and shifting regulatory landscapes that could favor non-tobacco nicotine sources for reduced health risks associated with nicotine products.

Flavor Analysis

Flavored Nicotine Pouches Lead with Overwhelming 90.1% Market Share in 2024

In 2024, the By Flavor Analysis segment of the Nicotine Pouches Market was distinctly led by flavored varieties, holding an impressive 90.1% share. This dominance can be primarily attributed to consumer preferences for diverse taste experiences that align with their desire for a satisfying, smoke-free alternative to traditional tobacco products.

The flavored nicotine pouches, offering a plethora of options ranging from mint, fruit, to exotic blends, have significantly driven the product adoption, particularly among younger demographics seeking discreet and convenient nicotine solutions.

On the other hand, the original or unflavored nicotine pouches captured a minor segment of the market. Despite their appeal to consumers preferring a straightforward nicotine experience without added flavors, their market presence remains limited compared to their flavored counterparts.

The minimalistic appeal of unflavored pouches caters to a niche audience, focusing on delivering the nicotine effect without any taste distractions, yet the overwhelming preference for flavored options underscores market trends towards enhanced consumer experience through flavor innovation.

Strength Analysis

Strong Nicotine Pouches Lead with 43.6% Market Share Due to Optimal Strength Balance

In 2024, the By Strength Analysis segment of the Nicotine Pouches Market was prominently led by Strong (4-6 mg/pouch) variants, commanding a significant market share of 43.6%. This dominance can be attributed to their balanced nicotine content, which caters effectively to both habitual users seeking satisfactory nicotine intake and newcomers who prefer a moderate strength as an introduction to nicotine pouches.

In comparison, other strength categories such as Light (2 mg/pouch), Normal (3 mg/pouch), and Extra Strong (more than 8 mg/pouch) cater to more niche segments. Light pouches are typically favored by individuals who are either new to nicotine products or prefer a minimal nicotine hit.

Normal strength pouches serve as a stepping stone for users looking to moderate their nicotine consumption, whereas Extra Strong pouches are targeted at seasoned users requiring higher doses for satisfaction.

The market dynamics within the Nicotine Pouches sector reflect consumer preferences for products that provide a significant yet not overwhelming nicotine experience, positioning the Strong (4-6 mg/pouch) pouches as a preferred choice for a substantial portion of the market in 2024.

Distribution Channel Analysis

Offline channel dominates with 94.3% owing to immediate product access and consumer trust.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Nicotine Pouches Market, capturing a substantial 94.3% share. The prominence of offline distribution is primarily attributed to consumers’ preference for immediate product accessibility, tactile engagement, and direct product comparison facilitated by brick-and-mortar retail stores.

Convenience stores, supermarkets, hypermarkets, specialty tobacco outlets, and pharmacies played critical roles in driving offline sales, leveraging established trust and familiarity among consumers who prefer direct interactions and immediate purchase fulfillment.

Conversely, the Online distribution channel, although currently smaller, has demonstrated significant growth potential driven by rising digitalization, increased e-commerce penetration, and changing consumer buying behaviors.

Younger demographics, particularly millennials and Gen Z, are increasingly turning towards online platforms for nicotine pouch purchases due to convenience, privacy, attractive promotions, and broader product variety.

Online platforms offer benefits such as product reviews, subscription models, and discreet delivery services, significantly enhancing consumer experience and contributing to steady growth prospects. Despite offline’s current dominance, continuous innovation and expanding digital infrastructure indicate robust growth opportunities for online channels in the forthcoming years, potentially reshaping the market dynamics.

Key Market Segments

By Product

- Tobacco-derived Nicotine

- Synthetic Nicotine

By Flavor

- Flavored

- Original/Unflavored

By Strength

- Strong (4-6 mg/pouch)

- Light (2 mg/pouch)

- Normal (3 mg/pouch)

- Extra Strong (More than 8 mg/pouch)

By Distribution Channel

- Offline

- Online

Drivers

Rising Awareness of Smoking Alternatives Boosts Nicotine Pouch Demand

The growing awareness about the harmful effects of smoking has encouraged more consumers to explore alternatives, driving the popularity of nicotine pouches. Unlike traditional smoking, these pouches offer a smokeless experience that is seen as less harmful to health, which has made them an attractive option for those looking to quit or reduce smoking.

Additionally, nicotine pouches are appealing due to their discreet usage; users can consume nicotine without drawing attention, making them a preferred choice for those who want to avoid the stigma of smoking or vaping in public.

Another key driver of the market is the constant innovation in flavors and packaging, which not only enhances the user experience but also attracts younger generations who are more inclined toward trying new and fun products.

The availability of different flavors and easy-to-use, portable packaging has made nicotine pouches more appealing to diverse consumer groups. This combination of health consciousness, discreet usage, and product variety is creating strong momentum for the nicotine pouches market, catering to a growing demand for safer and more convenient nicotine consumption options.

Restraints

Health Concerns Surrounding Nicotine Pouches Impact Market Growth

Although nicotine pouches are marketed as a safer alternative to traditional smoking, health concerns continue to limit their acceptance and growth. Many users worry about the addictive nature of nicotine, which can lead to long-term dependency, even if the product itself doesn’t involve harmful tobacco combustion.

Additionally, the long-term health effects of using nicotine pouches are still not fully understood, leaving consumers and health professionals cautious. This uncertainty has caused some public health organizations to question the safety of nicotine pouches and to warn against their widespread use, particularly among non-smokers or young people. These concerns create a barrier for manufacturers trying to expand their customer base, as they face increased scrutiny and negative perceptions.

Moreover, the market is also restrained by government regulations, as certain countries have imposed strict controls on all nicotine-containing products, including pouches. These regulations aim to protect public health but may hinder market penetration and growth in regions with heavy restrictions.

As a result, manufacturers must adapt to changing regulatory landscapes, which could include limits on advertising, packaging, or even product formulation, further slowing market development. Therefore, while nicotine pouches show potential for growth, the ongoing health concerns and regulatory pressures pose significant challenges.

Growth Factors

Strategic Partnerships and Product Innovation Open New Doors for the Nicotine Pouches Market

The nicotine pouches market is seeing substantial growth, with significant opportunities driven by strategic partnerships and product innovation. Collaborations with lifestyle and beverage companies present a chance to expand product visibility and appeal to a wider audience.

These partnerships can help nicotine pouch brands tap into established consumer bases, especially those interested in alternatives to traditional smoking products. Additionally, product diversification plays a critical role in catering to the evolving needs of consumers.

By developing nicotine pouches with various nicotine strengths and unique formulations, companies can attract different user segments, from those seeking a mild experience to those looking for stronger alternatives.

A focus on harm reduction also presents a major opportunity in this market, as consumers become increasingly health-conscious and seek safer alternatives to smoking and vaping. Positioning nicotine pouches as a less harmful option compared to traditional tobacco products could significantly boost their appeal, particularly in regions where there’s a rising demand for safer nicotine consumption methods.

Emerging Trends

Health-Conscious Consumers Fueling the Demand for Nicotine Pouches

The nicotine pouches market is seeing significant growth, driven by several key trends. One of the most notable factors is the rising health-consciousness among consumers. As more individuals become aware of the health risks associated with traditional smoking, there is an increasing demand for tobacco-free alternatives like nicotine pouches. These products offer a discreet and less harmful way to consume nicotine, attracting health-conscious consumers.

Additionally, social media marketing has played a vital role in boosting brand awareness, especially among younger demographics who are more active on platforms like Instagram and TikTok. Companies are leveraging these platforms to create engaging content and foster a strong brand presence.

Another emerging trend is the demand for environmentally sustainable products, as consumers are increasingly seeking ethically produced and eco-friendly options. This shift has encouraged manufacturers to focus on sustainable packaging and ingredient sourcing.

Finally, nicotine pouches are finding their place in various lifestyle segments, including fitness and wellness communities, where consumers are looking for convenient ways to consume nicotine without disrupting their active lifestyles. These combined factors suggest a promising future for the nicotine pouches market, with growing interest from a wide range of consumers looking for healthier, more sustainable alternatives to smoking.

Regional Analysis

North America Leads Nicotine Pouches Market with 78.6% Share valued USD 4.2 Billion

The Nicotine Pouches Market is experiencing significant growth across various regions, driven by shifting consumer preferences and increasing awareness of smoking cessation alternatives. North America stands as the dominating region, holding 78.6% of the global market share, valued at USD 4.2 billion.

The region’s dominance is attributed to the rising demand for healthier alternatives to traditional tobacco products and stringent government regulations on smoking. Moreover, the growing adoption of nicotine pouches among the younger population, coupled with the increasing trend of tobacco harm reduction, further strengthens North America’s market position.

Regional Mentions:

In Europe, the market is also witnessing substantial growth, supported by a strong regulatory framework promoting smoking alternatives. The European region is expected to continue growing steadily, with countries like Sweden leading the way, where nicotine pouches are widely popular due to the prevalence of smokeless tobacco alternatives.

The Asia Pacific region, though at a nascent stage compared to North America and Europe, shows promising growth potential. The region is slowly adopting nicotine pouches, primarily driven by increasing health consciousness, rising disposable incomes, and changing cultural attitudes towards smoking. While the market is relatively small, it is expected to grow at a robust rate, with Japan and South Korea being the primary contributors.

Latin America and the Middle East & Africa are also witnessing gradual increases in demand for nicotine pouches, though they currently hold a smaller share of the global market. Factors such as changing lifestyles, increasing awareness about smoking-related health issues, and the introduction of international nicotine pouch brands are expected to boost market growth in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global nicotine pouches market is experiencing strong competition and growth, driven by a variety of key players that are diversifying their product offerings to meet shifting consumer preferences for tobacco alternatives. Notable companies, such as Altria Group, Inc., GN Tobacco Sweden AB, and Japan Tobacco International, are focusing on expanding their market share through innovation and strategic partnerships.

Altria Group, Inc., a dominant player in the U.S. market, has been exploring opportunities in the smokeless nicotine product segment. Its investments in nicotine pouches are aligned with its broader strategy to transition towards reduced-risk products, capitalizing on the growing preference for smokeless alternatives among health-conscious consumers.

GN Tobacco Sweden AB, a leader in the European market, continues to leverage its strong brand presence with premium nicotine pouches under brands like Zyn. By focusing on flavor variety and product quality, the company is well-positioned to appeal to a broad consumer base, particularly in markets where regulatory frameworks are supportive of nicotine alternatives.

Japan Tobacco International (JTI), known for its global presence and commitment to innovation, is focusing on expanding its product portfolio in the nicotine pouch sector. Through acquisitions and strategic launches, JTI is enhancing its footprint in the growing smokeless tobacco market.

Smaller yet significant players like Skruf Snus AB and NIQO Co. (Swedish Match AB) also contribute to the competition, offering distinctive nicotine pouch options that cater to regional tastes and preferences. Meanwhile, British American Tobacco PLC is increasingly focusing on building its portfolio of non-cigarette products, tapping into the trend of health-conscious consumers who are migrating away from traditional tobacco.

Top Key Players in the Market

- Altria Group, Inc.

- GN Tobacco Sweden AB

- Japan Tobacco International

- Skruf Snus AB

- NIQO Co. (Swedish Match AB)

- Tobacco Concept Factory

- Swisher

- SnusCentral

- Nicopods ehf.

- British American Tobacco PLC

Recent Developments

- In September 2024, UW-CTRI (University of Wisconsin Center for Tobacco Research and Intervention) was awarded a $3.8 million grant to conduct a study testing the effectiveness of nicotine pouches as a potential alternative to smoking.

- In June 2024, Dr. Reddy’s Laboratories announced its decision to acquire the nicotine gum business of a UK company for Rs 5,000 crore, marking a significant expansion in the global tobacco harm-reduction market.

- In October 2024, Dr. Reddy’s Laboratories successfully completed the acquisition of Nicotinell and related brands, further strengthening its portfolio of smoking cessation products.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 73.4 Billion CAGR (2025-2034) 29.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tobacco-derived Nicotine, Synthetic Nicotine), By Flavor (Flavored, Original/Unflavored), By Strength (Strong, Light, Normal, Extra Strong), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Altria Group, Inc., GN Tobacco Sweden AB, Japan Tobacco International, Skruf Snus AB, NIQO Co. (Swedish Match AB), Tobacco Concept Factory, Swisher, SnusCentral, Nicopods ehf., British American Tobacco PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Altria Group, Inc.

- GN Tobacco Sweden AB

- Japan Tobacco International

- Skruf Snus AB

- NIQO Co. (Swedish Match AB)

- Tobacco Concept Factory

- Swisher

- SnusCentral

- Nicopods ehf.

- British American Tobacco PLC