Global Tennis Shoes Market Size, Share, Growth Analysis By Playing Surface (Hard Court Tennis Shoes, Clay Court Tennis Shoes, Grass Court Tennis Shoes), By Application (Men, Women, Kids), By Distribution Channel (Specialty Stores, Supermarkets & Hypermarkets, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156869

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

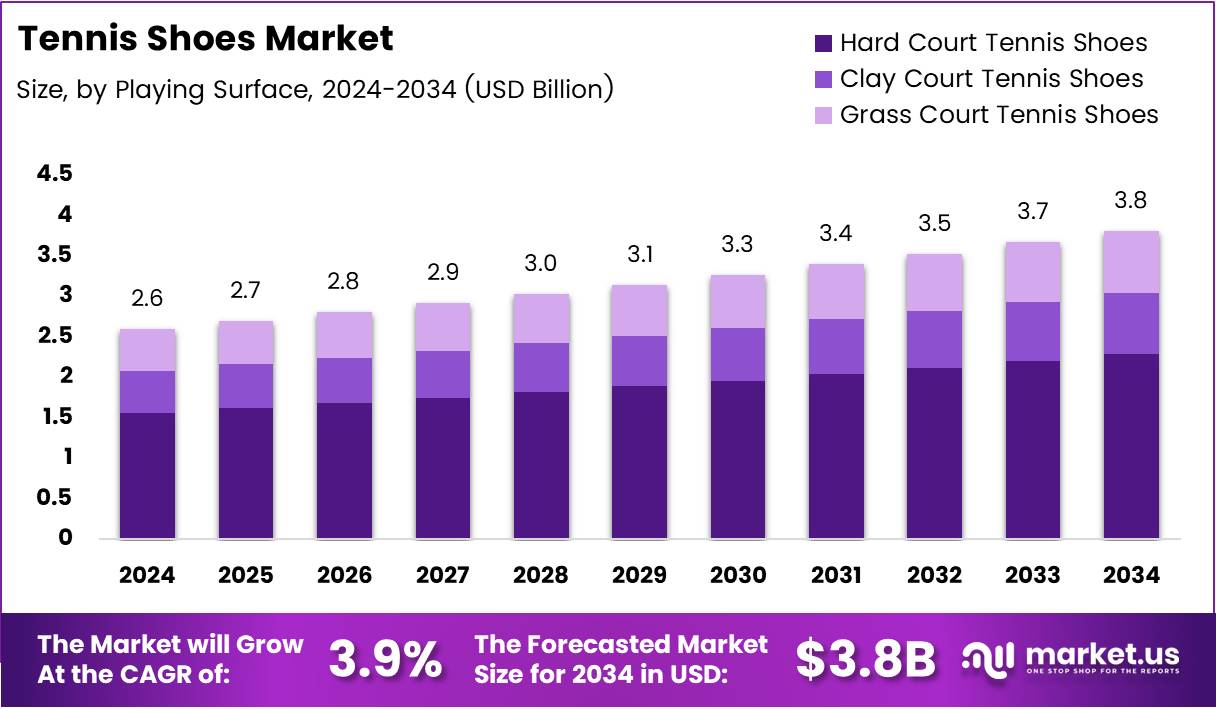

The Global Tennis Shoes Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

The Tennis Shoes Market refers to the segment of athletic footwear designed specifically for tennis players, focusing on durability, grip, and lateral support. It caters to both professional athletes and recreational users, bridging performance needs with lifestyle trends. This market is closely linked with sports participation, fashion appeal, and technological advancements in footwear manufacturing.

In recent years, the market has experienced steady growth, driven by increasing consumer awareness of specialized sports footwear. Rising interest in tennis as a recreational and professional activity has encouraged investments by leading footwear brands in advanced cushioning, lightweight materials, and sustainable production methods, shaping consumer preferences globally.

Furthermore, opportunities are expanding due to lifestyle changes and fitness adoption. Consumers are increasingly choosing sports shoes for daily wear, not just for courts. This crossover appeal enhances market penetration. Additionally, brands are targeting women and youth demographics through innovative designs and endorsements, broadening the consumer base significantly.

Government investments in sports infrastructure also play a critical role. Many countries are developing tennis academies and community programs to increase participation. Favorable regulations promoting sustainable and recyclable materials in footwear production are further reshaping product development, aligning market growth with environmental goals while enhancing brand value.

According to the International Tennis Federation (ITF), global tennis participation rose by 25.6%, from 84.4 million players in 2019 to 106 million players in 2024. This sharp increase reflects rising demand for tennis shoes. Similarly, a survey highlights that in the United States, participation hit 25.7 million players in 2024, representing 8.3% of the population, with 1.9 million new entrants.

Together, these figures indicate robust market prospects. Growing player participation, coupled with rising consumer inclination toward premium sports footwear, reinforces the outlook for the Tennis Shoes Market. Strong foundations in player growth and supportive investments position the industry for sustained expansion, making it a compelling segment for both manufacturers and investors.

Key Takeaways

- The Global Tennis Shoes Market is projected to reach USD 3.8 Billion by 2034, up from USD 2.6 Billion in 2024, at a 3.9% CAGR.

- In 2024, Hard Court Tennis Shoes dominated the Playing Surface segment with a 58.8% share, driven by durability and prevalence of hard courts.

- In 2024, Men accounted for a leading 51.3% share in the Application segment, supported by higher participation and spending power.

- In 2024, Specialty Stores captured a 44.2% share in the Distribution Channel segment, benefiting from expert guidance and exclusive offerings.

- North America led the global market in 2024 with a 43.7% share, valued at USD 1.1 Billion, backed by strong tennis culture and premium footwear demand.

Playing Surface Analysis

Hard Court Tennis Shoes dominate with 58.8% due to their versatility and wide adoption in professional and recreational play.

In 2024, Hard Court Tennis Shoes held a dominant market position in By Playing Surface Analysis segment of Tennis Shoes Market, with a 58.8% share. Their superior cushioning, reinforced outsole, and durability make them the preferred choice for most athletes. With the majority of global courts being hard surfaces, these shoes remain essential for players across all levels.

Clay Court Tennis Shoes followed, designed with unique herringbone patterns to enhance traction and prevent clay buildup. Though niche compared to hard court shoes, demand is consistent in regions with strong clay court traditions, particularly Europe and Latin America. Specialized performance attributes continue to sustain their relevance among professionals.

Grass Court Tennis Shoes represent a smaller share but remain important for traditional events like Wimbledon. Their nub-pattern soles ensure grip on slippery grass, though usage is limited due to fewer grass courts worldwide. Despite lower adoption, they cater to elite players and enthusiasts seeking specialized footwear for short grass seasons.

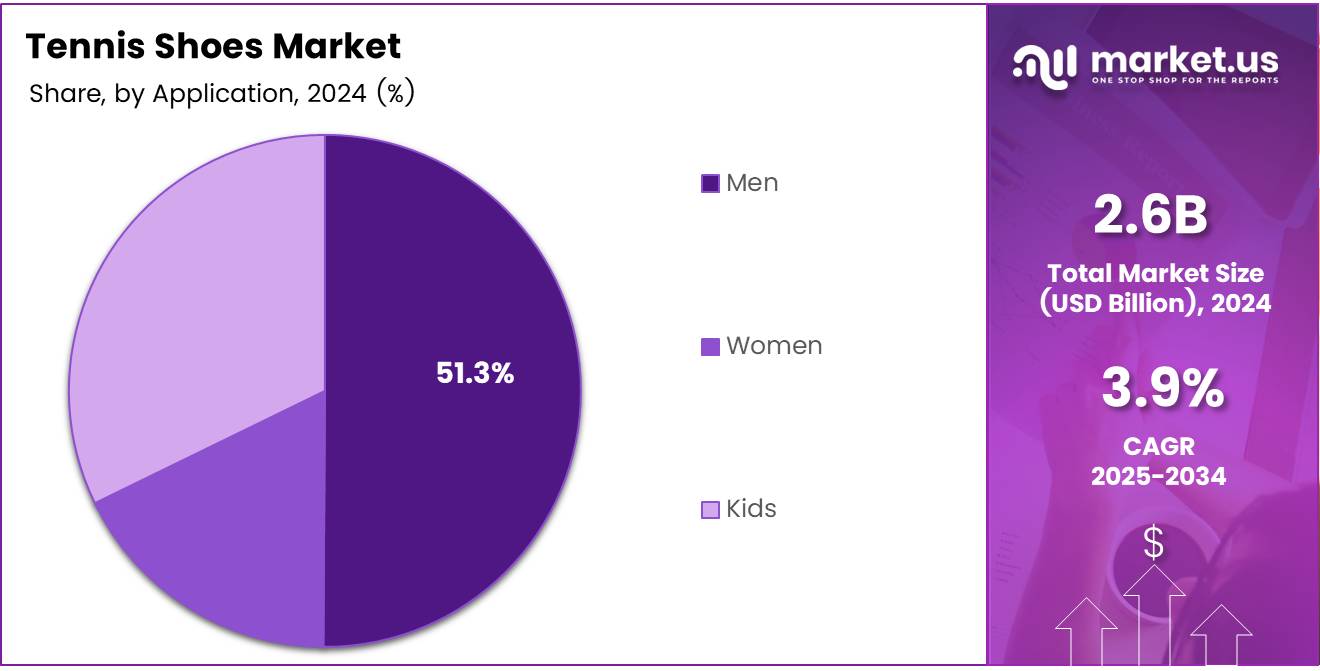

Application Analysis

Men dominate with 51.3% due to higher participation rates and spending on performance-driven footwear.

In 2024, Men held a dominant market position in By Application Analysis segment of Tennis Shoes Market, with a 51.3% share. The segment benefits from strong male participation in both professional and recreational tennis, with high spending capacity and preference for technologically advanced footwear driving sales.

Women represent a growing segment, supported by rising participation rates and increased visibility through global tournaments such as the WTA. Brands are actively expanding product ranges to address women-specific needs, offering improved designs and comfort tailored to different playing styles.

Kids form a significant emerging category, reflecting the increasing focus on youth sports development. Junior tournaments and training academies have spurred steady demand for lightweight, durable shoes that balance affordability with functionality. As parents invest more in early sports training, the kids’ segment is expected to expand further.

Distribution Channel Analysis

Specialty Stores dominate with 44.2% due to personalized services and strong brand-driven assortments.

In 2024, Specialty Stores held a dominant market position in By Distribution Channel Analysis segment of Tennis Shoes Market, with a 44.2% share. Consumers prefer these outlets for tailored recommendations, expert advice, and access to exclusive collections that strengthen brand loyalty.

Supermarkets & Hypermarkets follow with a focus on offering value-based assortments. Their reach in urban centers and promotional discounts attract casual players seeking affordability, though they lag behind specialty outlets in premium product availability.

Online Stores are experiencing strong growth, fueled by digital adoption, brand-owned e-commerce platforms, and global delivery options. Convenience, competitive pricing, and virtual try-on technologies make this channel increasingly attractive to younger demographics and digitally native shoppers.

Others, including sporting events and pop-up outlets, play a complementary role. These channels help boost seasonal demand and brand engagement, particularly during major tournaments where direct-to-consumer sales generate visibility and instant conversions.

Key Market Segments

By Playing Surface

- Hard Court Tennis Shoes

- Clay Court Tennis Shoes

- Grass Court Tennis Shoes

By Application

- Men

- Women

- Kids

By Distribution Channel

- Specialty Stores

- Supermarkets & Hypermarkets

- Online Stores

- Others

Drivers

Rising Popularity of Tennis and Racket Sports Participation Drives Market Growth

The rising popularity of tennis and other racket sports is a major driver for the tennis shoes market. Increasing participation among youth and adults across developed and emerging economies creates consistent demand for specialized footwear. National sports programs and school-level initiatives are further supporting this trend.

Another important driver is the growing focus on performance-enhancing footwear. Athletes are seeking shoes that improve speed, stability, and comfort during play. Companies are introducing advanced cushioning systems and shock absorption technologies, making tennis shoes more efficient for professional and recreational players. This continuous innovation is fueling market growth.

Sports sponsorships and endorsements are also expanding the market scope. Leading tennis players collaborating with global brands significantly influence consumer buying patterns. High-profile tournaments and brand endorsements create aspirational demand, driving consumers to purchase premium tennis shoes endorsed by professionals.

Additionally, the adoption of sustainable and eco-friendly materials in tennis shoe production is gaining attention. Manufacturers are increasingly using recycled fabrics, bio-based soles, and environmentally conscious packaging. This aligns with consumer demand for greener products, positioning sustainability as a long-term growth factor for the tennis shoes market.

Restraints

Fluctuations in Raw Material Prices Impacting Production Costs

The tennis shoes market faces challenges due to fluctuating raw material prices. Leather, rubber, and synthetic fabrics are core components, and their rising costs impact production margins. Global supply chain disruptions also contribute to unpredictable pricing, forcing brands to adjust product pricing strategies.

Competition from counterfeit and low-cost alternatives is another restraint affecting market performance. Unauthorized players often produce imitations at lower costs, targeting price-sensitive consumers. These products undermine the credibility of established brands and limit growth in emerging regions where cost plays a critical role.

Growth Factors

Expansion of E-Commerce Channels Creates Market Opportunities

E-commerce growth presents a strong opportunity for the tennis shoes market. Online platforms provide wider accessibility, convenience, and product variety, attracting global buyers. Direct-to-consumer models are also enabling brands to build stronger customer relationships.

Integration of smart wearable technologies into tennis shoes is opening new opportunities. Shoes with embedded sensors for movement tracking and performance analysis are gaining popularity among professionals and enthusiasts. This innovation enhances the appeal of premium tennis footwear.

Collaborations with professional athletes further stimulate market growth. Co-branded and limited-edition collections create aspirational value and drive strong consumer demand. Rising interest in gender-specific and customized shoe designs also adds opportunities for brands to diversify offerings.

Emerging Trends

Increasing Preference for Lightweight and Breathable Designs Shapes Market Trends

Lightweight and breathable shoe designs are becoming increasingly popular, driven by demand for comfort and performance. Players prefer footwear with mesh fabrics and advanced ventilation systems, improving agility during long matches.

The growth of athleisure is another strong trend. Consumers now use tennis shoes not only for sports but also for casual wear. This cross-functional usage boosts market size and strengthens brand recognition across demographics.

Limited-edition and designer collaborations are reshaping market dynamics. Exclusive collections attract fashion-conscious buyers, creating buzz around premium product launches. Brands benefit from heightened visibility and consumer loyalty.

Adoption of recyclable materials and circular economy practices is also shaping the market. Companies are incorporating recycled rubber soles and biodegradable fabrics to appeal to eco-conscious consumers, making sustainability an integral trend in tennis shoe development.

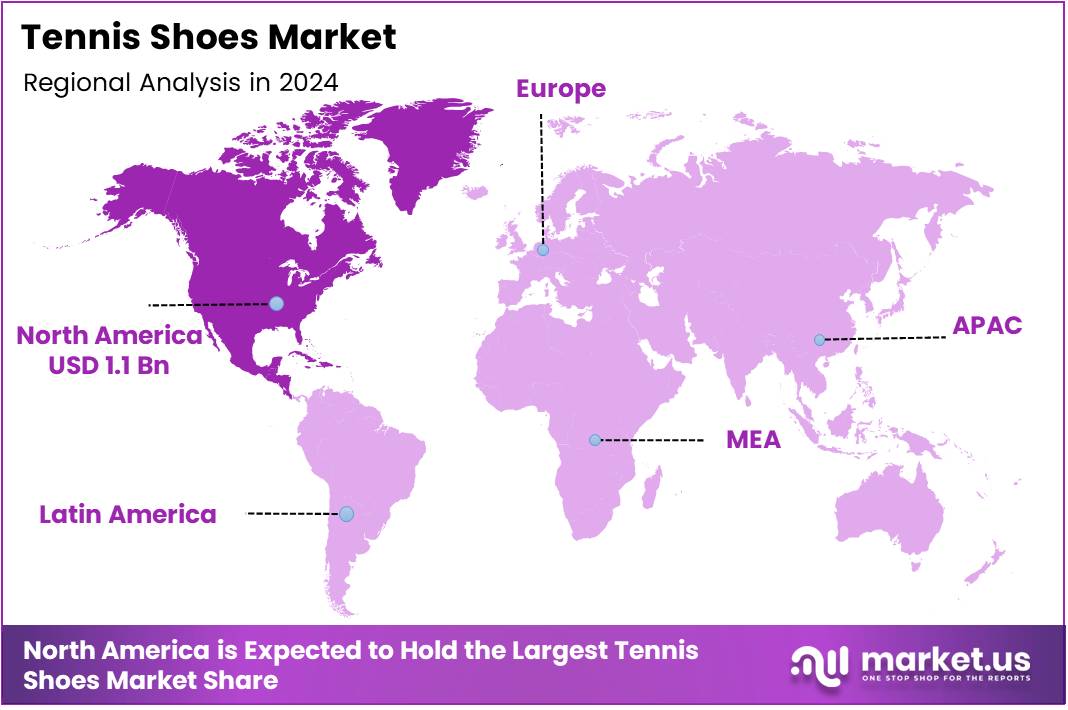

Regional Analysis

North America Dominates the Tennis Shoes Market with a Market Share of 43.7%, Valued at USD 1.1 Billion

North America accounted for a commanding 43.7% share of the tennis shoes market in 2024, reaching a value of USD 1.1 Billion. The region’s strong tennis culture, rising sports participation, and higher consumer spending on performance footwear drive this dominance. Additionally, widespread adoption of premium and eco-friendly shoes further strengthens market growth across the United States and Canada.

Europe Tennis Shoes Market Trends

Europe represents a significant market, supported by the presence of major tennis tournaments such as Wimbledon and Roland Garros. Growing participation in racket sports, coupled with consumer preference for sustainable materials, is driving steady demand. The region’s emphasis on performance-enhancing footwear and style-driven purchases adds momentum to overall market expansion.

Asia Pacific Tennis Shoes Market Trends

Asia Pacific is emerging as one of the fastest-growing regions due to the rising popularity of tennis among younger demographics. Countries like China, Japan, and Australia are witnessing increased investments in sports infrastructure. Expanding middle-class populations and growing awareness of fitness trends continue to fuel strong demand for tennis shoes.

Middle East and Africa Tennis Shoes Market Trends

The Middle East and Africa market is gradually expanding, with urban centers showing increasing adoption of sports and fitness activities. Rising awareness of international sports events and a growing retail presence of global athletic brands are supporting regional growth. Lifestyle-driven footwear demand is also gaining traction.

Latin America Tennis Shoes Market Trends

Latin America is experiencing steady development in the tennis shoes market, driven by growing sports participation and youth engagement in tennis. The region benefits from expanding e-commerce platforms and rising interest in branded sportswear. Countries such as Brazil and Mexico are expected to contribute significantly to future growth momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tennis Shoes Company Insights

In 2024, Adidas AG continued to strengthen its presence in the global tennis shoes market through advanced performance footwear and lifestyle-oriented collections. The company leveraged its strong brand equity and innovative designs to attract both professional athletes and recreational players, ensuring steady growth in diverse markets.

ANTA Sports Products Limited expanded its market influence by targeting cost-conscious consumers in Asia Pacific while increasingly entering international tennis markets. The brand’s ability to deliver affordable yet performance-driven tennis shoes helped it capture share among emerging middle-class consumers, particularly in China and Southeast Asia.

ASICS Corporation maintained a strong position with its technology-driven approach, focusing heavily on cushioning, stability, and player comfort. The brand remained highly popular among professional tennis athletes, with endorsement strategies reinforcing its credibility and driving demand among performance-oriented buyers across North America, Europe, and Asia.

Babolat, with its legacy in tennis equipment, capitalized on its deep integration in the sport to strengthen footwear offerings. Although relatively smaller compared to global footwear giants, the brand built loyalty through targeted launches designed for serious tennis players, aligning footwear with its racquet and string ecosystem for holistic player engagement.

These players together represent a blend of global giants and sport-specific specialists, shaping the competitive landscape. While Adidas and ASICS drive the premium segment, ANTA addresses affordability, and Babolat leverages niche expertise. Their combined strategies highlight a dynamic market where innovation, accessibility, and athlete trust remain critical for long-term leadership.

Top Key Players in the Market

- Adidas AG

- ANTA Sports Products Limited

- ASICS Corporation

- Babolat

- Diadora S.p.A. (Geox S.p.a)

- FILA Holdings Corp.

- Lotto Sport Italia S.p.A.

- Mizuno Corporation

- New Balance Inc.

- Nike Inc.

- Reebok International Limited (Authentic Brands Group LLC)

- Xtep International Holdings Limited

- Yonex Co. Ltd.

Recent Developments

- In May 2025, Skechers announced its acquisition by 3G Capital, marking a significant consolidation in the global footwear industry. The move is expected to strengthen 3G Capital’s consumer portfolio with Skechers’ strong athletic and lifestyle brand presence.

- In May 2025, Dick’s Sporting Goods revealed its agreement to acquire Foot Locker in a $2.4 billion deal. This strategic move aims to expand Dick’s retail footprint, diversify revenue streams, and capture a larger share of the athletic footwear and apparel market.

- In February 2024, Shoe Carnival completed the acquisition of Rogan’s Shoes, enhancing its retail reach across the Midwest. The deal strengthens Shoe Carnival’s market presence and aligns with its strategy to consolidate family footwear retail operations in key U.S. regions.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 3.8 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Playing Surface (Hard Court Tennis Shoes, Clay Court Tennis Shoes, Grass Court Tennis Shoes), By Application (Men, Women, Kids), By Distribution Channel (Specialty Stores, Supermarkets & Hypermarkets, Online Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Adidas AG, ANTA Sports Products Limited, ASICS Corporation, Babolat, Diadora S.p.A. (Geox S.p.a), FILA Holdings Corp., Lotto Sport Italia S.p.A., Mizuno Corporation, New Balance Inc., Nike Inc., Reebok International Limited (Authentic Brands Group LLC), Xtep International Holdings Limited, Yonex Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adidas AG

- ANTA Sports Products Limited

- ASICS Corporation

- Babolat

- Diadora S.p.A. (Geox S.p.a)

- FILA Holdings Corp.

- Lotto Sport Italia S.p.A.

- Mizuno Corporation

- New Balance Inc.

- Nike Inc.

- Reebok International Limited (Authentic Brands Group LLC)

- Xtep International Holdings Limited

- Yonex Co. Ltd.