Global Telecom Power System Market Size, Share, And Industry Analysis Report By Power Source (Diesel-Battery, Diesel-Solar, Diesel-Wind, Multiple Sources), By Component (Rectifier, Inverter, Converter, Controller, Heat Management Systems, Generators), By Grid Type (On Grid, Off Grid), By Application (Data Communication, Fixed Line, Data Center, Internet and Broadband Access), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167951

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

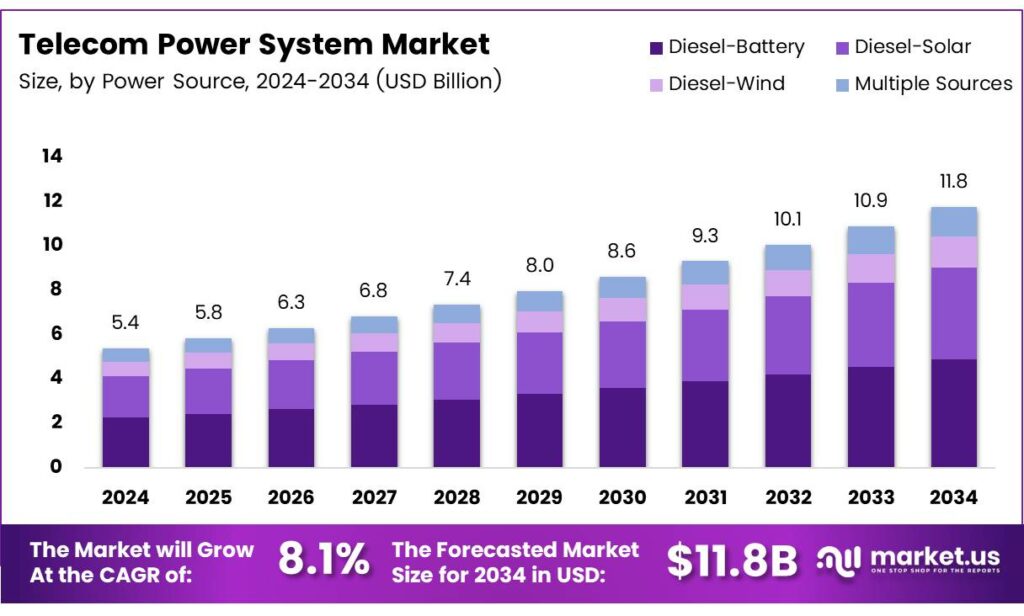

The Global Telecom Power System Market size is expected to be worth around USD 11.8 billion by 2034, from USD 5.4 billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The Telecom Power System Market covers solutions that supply reliable, continuous electricity to telecom networks, towers, and data transmission infrastructure. It includes rectifiers, converters, battery backups, generators, and intelligent control systems. Importantly, these systems ensure network uptime, power quality, and energy efficiency across mobile, broadband, and fiber deployments, enabling modern digital communication services.

The Telecom Power System Market is evolving as telecom operators expand 5G, fiber networks, and rural connectivity. Consequently, demand grows for resilient power architectures supporting remote and urban sites. As data traffic rises, operators increasingly prioritize efficient power conversion, reduced operating costs, and scalable energy management solutions across distributed telecom assets.

- Energy efficiency plays a central role in modern telecom power design. Advanced telecom rectifiers operate efficiently across a load range from 25% to 90%, delivering very high conversion efficiency. For high-output systems, this efficiency translates into substantial electrical energy savings, directly reducing operational expenses over long deployment lifecycles.

Equally important, intelligent control systems enhance reliability. Automated control systems monitor mains voltage deviations. When supply falls below 10% or rises above 6%, standby engine generator plants start automatically. Once stable operating conditions are achieved, the load seamlessly transfers to the generator output, ensuring continuity.

The Telecom Power System Market represents a critical backbone for telecom infrastructure reliability. Growth is driven by network expansion, efficiency-driven upgrades, and regulatory support. Opportunities arise from smart power systems, energy-efficient rectifiers, and automated backup solutions, positioning telecom power technologies as essential investments for long-term network resilience and operational stability.

Key Takeaways

- The Global Telecom Power System Market is projected to grow from USD 5.4 billion in 2024 to USD 11.8 billion by 2034, registering a CAGR of 8.1%.

- Diesel-battery systems lead the By Power Source segment with a market share of 47.9%, driven by reliability and backup flexibility.

- Rectifiers dominate the By Component segment, accounting for a share of 32.8% due to their role in power conversion.

- Off-grid solutions hold a dominant 59.3% share in the By Grid Type segment, supported by rural and remote telecom deployments.

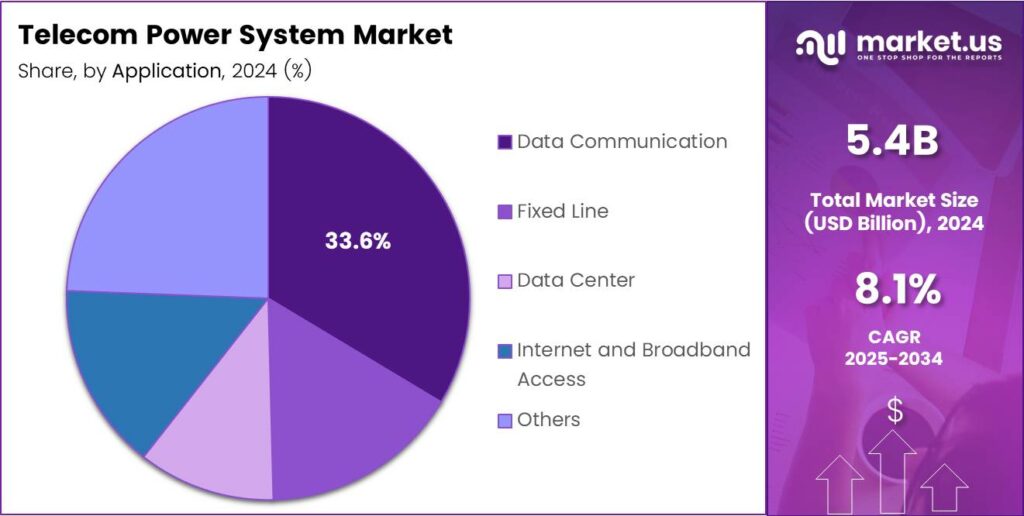

- Data Communication applications lead the market with a share of 33.6%, reflecting rising mobile and broadband data usage.

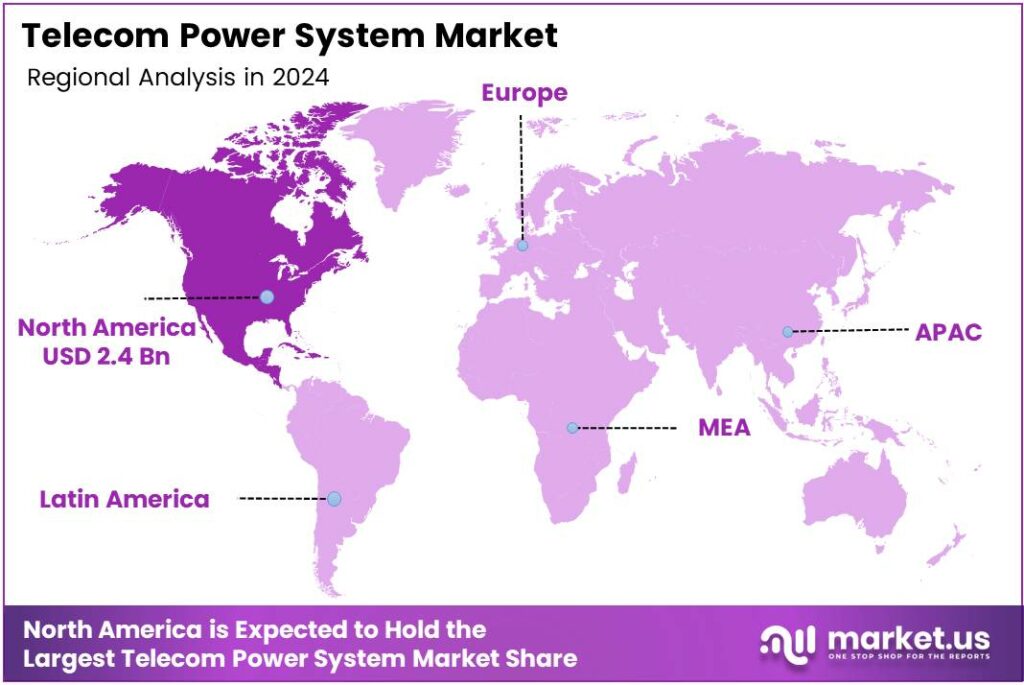

- North America is the leading region with a market share of 45.9%, valued at USD 2.4 billion in 2024.

By Power Source Analysis

Diesel-Battery dominates with 47.9% due to its balance of reliability and operational flexibility.

In 2024, Diesel-Battery held a dominant market position in the By Power Source Analysis segment of the Telecom Power System Market, with a 47.9% share. This configuration ensures uninterrupted telecom operations by combining diesel backup with battery storage. As a result, operators benefit from stable power during grid failures.

Transitioning to Diesel-Solar, this segment is gaining attention as telecom companies seek lower fuel dependency. It supports daytime energy needs using solar input while retaining diesel for backup. Therefore, it offers a practical step toward efficiency without compromising network uptime in remote locations.

Moving forward, Diesel-Wind systems are being adopted in select regions with consistent wind availability. These systems diversify energy input and reduce diesel runtime. Consequently, operators experience improved sustainability while maintaining reliable telecom power in geographically favorable areas.

By Component Analysis

Rectifier leads with 32.8% due to its critical role in power conversion.

In 2024, Rectifier held a dominant market position in the By Component Analysis segment of the Telecom Power System Market, with a 32.8% share. Rectifiers efficiently convert AC to DC power, ensuring stable energy for telecom equipment. Therefore, they remain essential in both urban and remote telecom installations.

Next, Inverter systems support power stability by converting DC back to AC when required. They are vital for maintaining compatibility across telecom infrastructure. As a result, inverters help manage load variation and improve system reliability.

Meanwhile, Converter units regulate voltage levels across telecom networks. They ensure safe power distribution among sensitive components. Consequently, converters contribute to longer equipment life and smoother network performance.

By Grid Type Analysis

Off-grid dominates with 59.3% driven by rural and remote telecom deployments.

In 2024, Off Grid held a dominant market position in the By Grid Type Analysis segment of the Telecom Power System Market, with a 59.3% share. Off-grid solutions are critical for telecom towers located beyond reliable grid access. As a result, they support network expansion into underserved regions.

In contrast, on-grid systems operate in areas with stable electricity infrastructure. They rely mainly on grid supply while using backup systems for continuity. Therefore, on-grid solutions are suitable for urban and semi-urban telecom installations.

By Application Analysis

Data Communication leads with 33.6% reflecting rising mobile data demand.

In 2024, Data Communication held a dominant market position in the By Application Analysis segment of the Telecom Power System Market, with a 33.6% share. Continuous power is vital for handling large data volumes. Hence, robust telecom power systems support seamless data transmission.

Subsequently, fixed-line applications depend on stable power to maintain legacy communication networks. Although mature, this segment still requires reliable power infrastructure to avoid service disruptions. At the same time, Data Center applications demand consistent and high-quality power. Telecom power systems ensure uptime and equipment safety. Thus, they play a key role in supporting digital infrastructure.

Key Market Segments

By Power Source

- Diesel-Battery

- Diesel-Solar

- Diesel-Wind

- Multiple Sources

By Component

- Rectifier

- Inverter

- Converter

- Controller

- Heat Management Systems

- Generators

- Others

By Grid Type

- On Grid

- Off Grid

By Application

- Data Communication

- Fixed Line

- Data Center

- Internet and Broadband Access

- Others

Emerging Trends

Shifting to Renewables: Powering Telecom Towers with Sun and Wind

The telecom world, it’s amazing how those cell towers keep us connected no matter where we are—whether you’re chatting with family across the country or streaming a show in the middle of nowhere. But keeping them running eats up a ton of energy, often from dirty sources like diesel generators that guzzle fuel and pump out smoke.

- Government regulations and international sustainability standards are shaping production practices. Producers are investing in better farming methods and waste reduction to meet compliance needs. The national grid is improving, total electricity generation (including renewables) rose to 1,739.091 BU from 1,624.465 BU in the previous year — a 7.06% increase.

Governments are stepping in with real support. In India, the Department of Telecommunications has pilots under the Universal Service Obligation Fund to hook up remote towers with solar and wind, cutting diesel use and emissions while boosting rural coverage. Over in the EU, the Green Deal pushes for renewable mandates that have data hubs in places like Frankfurt running almost fully on clean power.

Drivers

Rapid Expansion of Mobile Networks and Data Usage Drives Telecom Power System Market Growth

The growing use of smartphones, mobile internet, and digital services is a major driver for the Telecom Power System Market. Telecom operators are expanding network coverage to meet rising voice and data demand. This expansion increases the need for reliable power systems to keep networks running without interruption.

- Telecom infrastructure annually consumes roughly 70 TWh of electricity — a huge load. A typical telecom tower might consume between 1–4 kW (for a regular base-station) and up to 5–6 kW when shared among operators. Rural and remote area connectivity further supports market growth. Many telecom towers in these locations face an unstable grid supply. As a result, operators rely on diesel generators, batteries, and hybrid power solutions to ensure uptime.

In addition, the rapid growth of data centers used for telecom traffic processing increases power demand. Telecom power systems help manage energy loads efficiently and maintain service availability. Together, network expansion, higher data usage, and reliability needs continue to drive steady demand for telecom power systems globally.

Restraints

High Operational and Maintenance Costs Restrain Telecom Power System Market Growth

One of the main restraints in the Telecom Power System Market is the high cost of installation and maintenance. Power systems such as generators, batteries, and cooling units require significant upfront investment, which can be challenging for smaller telecom operators. Fuel dependency, especially on diesel generators, adds to operating costs.

Fuel price fluctuations directly impact telecom companies’ expenses, especially in off-grid and rural areas where generators are used frequently. Regular maintenance is another challenge. Batteries need periodic replacement, and generators require servicing to operate efficiently. Poor maintenance can lead to system failures, increasing downtime and repair costs.

Environmental regulations also act as a restraint. Governments are placing strict rules on emissions and noise from diesel generators. Meeting these regulations often requires additional investment in cleaner technologies. Lastly, grid instability in developing regions increases the burden on backup power systems. Continuous switching between grid and backup sources can reduce equipment lifespan, making long-term operations costly for telecom providers.

Growth Factors

Integration of Renewable and Hybrid Power Solutions Creates New Growth Opportunities

The shift toward renewable energy presents strong growth opportunities in the Telecom Power System Market. Telecom companies are increasingly adopting solar-based and hybrid power systems to reduce fuel costs and emissions. Hybrid systems combining solar, batteries, and diesel generators offer better energy efficiency.

These systems reduce dependence on fuel while ensuring an uninterrupted power supply, especially in remote areas with limited grid access. Energy-efficient rectifiers and smart power management systems are also gaining attention. These solutions help optimize energy use, lower losses, and improve overall network performance.

Government support for green energy further strengthens opportunities. Incentives for renewable installations encourage telecom operators to upgrade power infrastructure using sustainable technologies. The expansion of telecom services in emerging markets opens new demand. As networks grow in rural and semi-urban areas, the need for reliable and cost-effective power systems increases.

Regional Analysis

North America Dominates the Telecom Power System Market with a Market Share of 45.9%, Valued at USD 2.4 billion

North America leads the Telecom Power System Market due to early 5G rollouts, dense data traffic, and strong investment in resilient network infrastructure. In 2024, the region accounted for a dominant 45.9% share, reaching a value of USD 2.4 billion. High focus on grid reliability, backup power integration, and energy-efficient telecom sites continues to support steady system upgrades. Growing edge data centers and rural broadband expansion further strengthen demand.

Europe shows stable growth driven by telecom modernization and stricter energy-efficiency regulations. Operators are increasingly adopting hybrid power systems to reduce energy losses and meet carbon targets. Renewed investment in fiber networks and dense urban telecom infrastructure supports consistent demand. In addition, the replacement of aging power units is creating long-term upgrade opportunities.

Asia Pacific is witnessing rapid expansion due to rising mobile subscribers and large-scale network expansion. Emerging economies are investing in off-grid and hybrid power solutions to support telecom towers in remote areas. Strong urbanization and digital inclusion programs are increasing base station installations. Cost-sensitive system designs remain a key focus for operators in this region.

The Middle East and Africa market is shaped by demand for reliable power in regions with unstable grid access. Telecom operators rely heavily on backup and hybrid systems to ensure network uptime. Infrastructure development, smart city projects, and rising mobile penetration are supporting gradual adoption. Energy resilience remains a central buying factor across this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Telecom Power System Market in 2024 is shaped by rising mobile data traffic, 5G rollout, and the need for reliable, energy-efficient power at telecom sites. Operators are upgrading power architectures to reduce downtime, cut fuel use, and support hybrid energy setups. Against this backdrop, a few established players continue to influence technology direction and operational standards.

Vertiv remains a key participant due to its deep focus on critical digital infrastructure for telecom networks. In 2024, its strength lies in integrated power, thermal, and monitoring solutions that help telecom operators improve site reliability and manage energy more efficiently. This positions Vertiv well for both urban and remote telecom deployments.

Emerson Network Power, leveraging its legacy in telecom energy systems, continues to emphasize high-efficiency power conversion and smart monitoring. Its solutions support stable network operations and predictable performance, which is crucial as telecom sites become more complex. The brand’s engineering depth supports long-term network expansion strategies.

Schneider Electric plays an important role through its strong expertise in power management and automation. In the telecom power system space, it focuses on digitalized energy control, safety, and sustainability. This approach aligns well with operators seeking lower operating costs and improved visibility across distributed telecom assets.

Eaton Corporation contributes with a broad portfolio of power quality, backup power, and energy management solutions. In 2024, its telecom-focused offerings support grid-challenged regions and mission-critical sites. Eaton’s emphasis on electrical safety and system resilience adds value for operators concerned about outages and regulatory compliance.

Top Key Players in the Market

- Vertiv

- Emerson Network Power

- Schneider Electric

- Eaton Corporation

- Huawei Technologies

- Delta Electronics

- KEC International

- Nexans

- Wärtsilä

- Siemens Energy

- General Electric (GE)

Recent Developments

- In 2024, Schneider Electric’s telecom power solutions emphasize modular DC systems, battery integration, and grid-tied inverters for hybrid telecom towers. Recent developments reflect strong growth from AI/data center synergies, though directly telecom-focused updates are tied to broader power management.

- In 2024, Eaton will provide resilient DC power systems for telecom, including rectifiers, inverters, and UPS for BTS sites. Developments center on modular enclosures and edge analytics for telecom reliability. Pre-integrated modular power enclosures serving telecom communications markets.

Report Scope

Report Features Description Market Value (2024) USD 5.4 billion Forecast Revenue (2034) USD 11.8 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Source (Diesel-Battery, Diesel-Solar, Diesel-Wind, Multiple Sources), By Component (Rectifier, Inverter, Converter, Controller, Heat Management Systems, Generators, Others), By Grid Type (On Grid, Off Grid), By Application (Data Communication, Fixed Line, Data Center, Internet and Broadband Access, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Vertiv, Emerson Network Power, Schneider Electric, Eaton Corporation, Huawei Technologies, Delta Electronics, KEC International, Nexans, Wärtsilä, Siemens Energy, General Electric (GE) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Telecom Power System MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Telecom Power System MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vertiv

- Emerson Network Power

- Schneider Electric

- Eaton Corporation

- Huawei Technologies

- Delta Electronics

- KEC International

- Nexans

- Wärtsilä

- Siemens Energy

- General Electric (GE)