Global Styrene Butadiene Rubber Market By Type (Emulsion SBR, Solution SBR), By Application (Tire, Footwear, Construction, Polymer Modification, Adhesive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151705

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

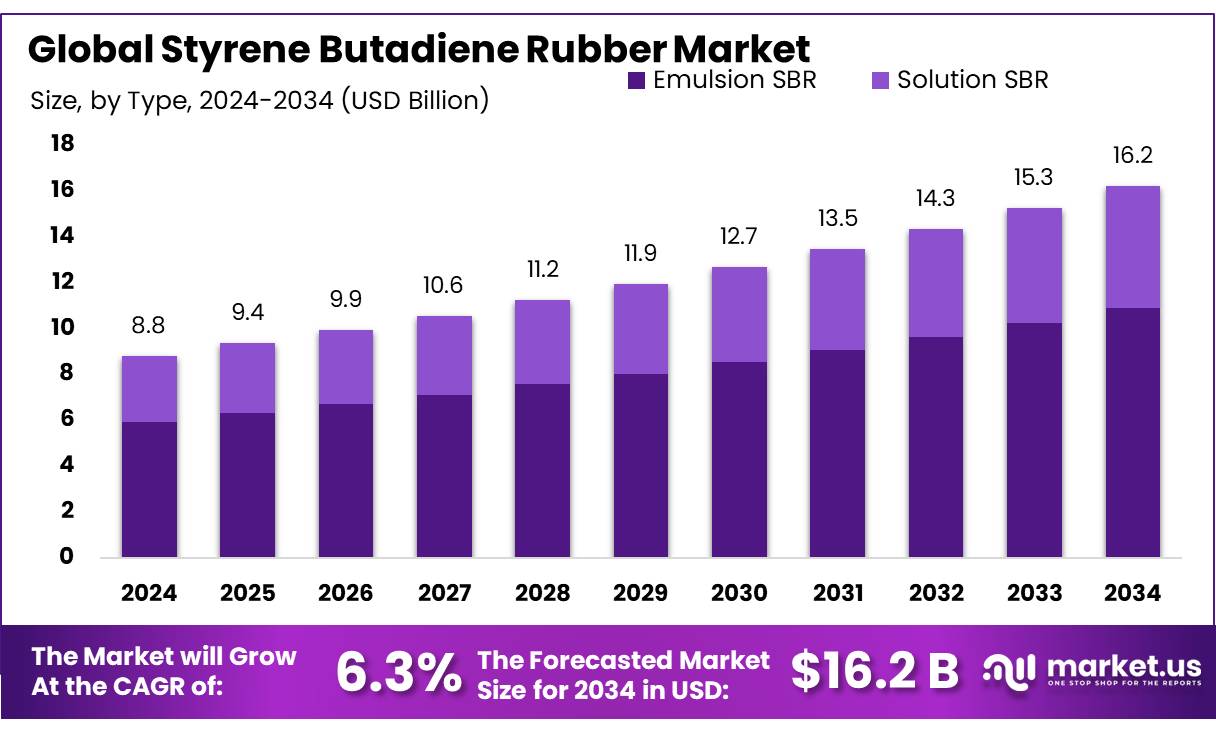

The Global Styrene Butadiene Rubber Market size is expected to be worth around USD 16.2 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Styrene Butadiene Rubber (SBR) Concentrates are synthetic elastomers derived from styrene and butadiene monomers, widely utilized in the automotive, construction, and footwear industries. SBR’s versatility stems from its excellent abrasion resistance, aging stability, and cost-effectiveness. In India, SBR is predominantly used in tire manufacturing, accounting for approximately 50% of the market share, with significant applications also in adhesives, sealants, and flooring materials.

Government frameworks have actively enhanced domestic rubber production infrastructure and occupational safety standards. For instance, in the early decades, the U.S. government’s strategic investment in SBR facilities established a resilient supply chain. Regulatory entities such as the U.S. EPA and NIOSH have implemented exposure standards; notably, SBR plant workers have experienced butadiene concentrations averaging 20 ppm in tank farm areas, with reduced exposures in other zones. EPA’s evaluation of 1,3 butadiene classified it as human carcinogen by inhalation, with a reference concentration of 0.002 mg/m³ to protect worker health.

In contemporary industrial scenarios, SBR holds the position as the most produced synthetic rubber globally, representing just over 50% of world synthetic rubber production. U.S. synthetic rubber production approximated 2.41 million metric tons in 1995—valued at approximately USD 4.5 billion—out of which SBR comprised the majority share. As of 2012, worldwide SBR processing exceeded 5.4 million tonnes, with nearly half of all automobile tires incorporating this elastomer.

Key Takeaways

- Styrene Butadiene Rubber Market size is expected to be worth around USD 16.2 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 6.3%.

- Emulsion Styrene Butadiene Rubber (Emulsion SBR) held a dominant market position, capturing more than a 67.3% share in the global SBR market.

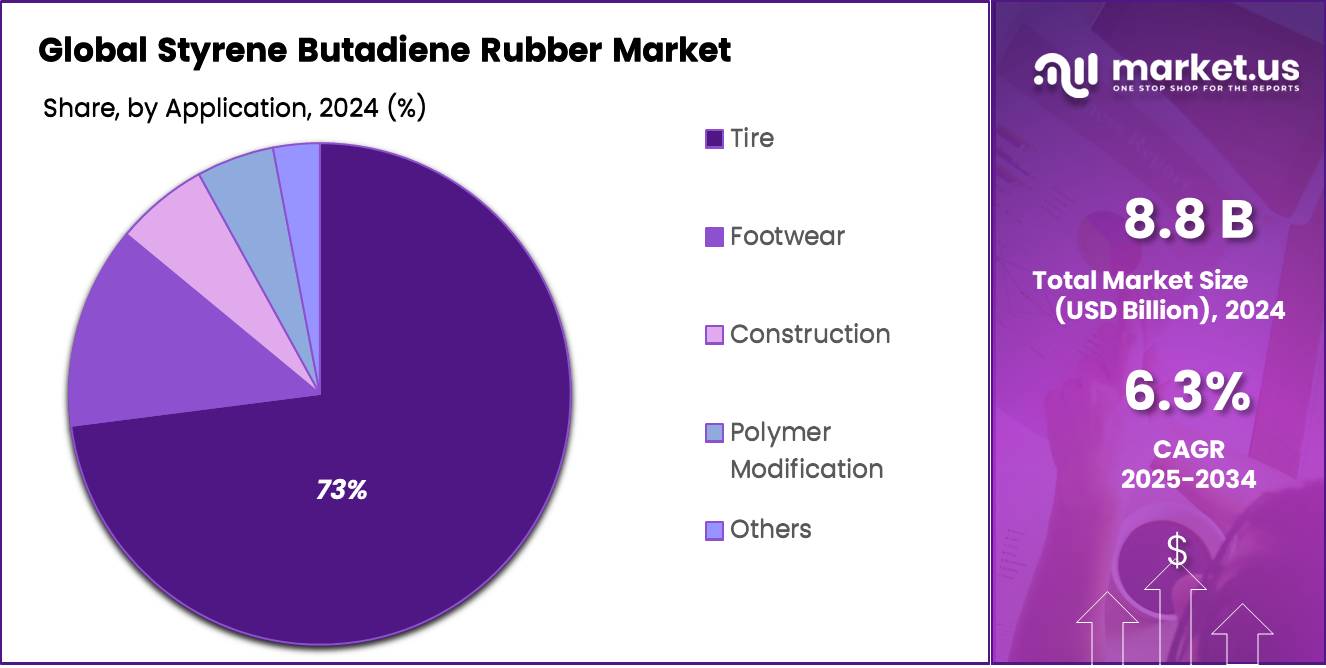

- Tire held a dominant market position, capturing more than a 73.9% share in the global Styrene Butadiene Rubber (SBR) market.

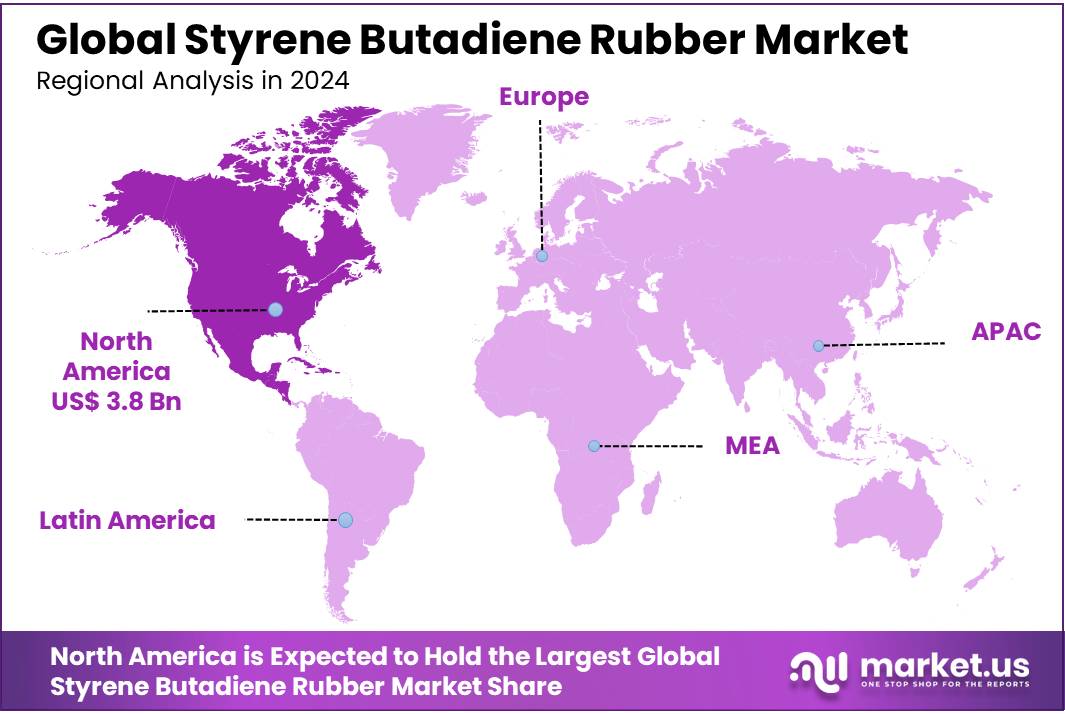

- North America stands as the leading region in the global Styrene Butadiene Rubber (SBR) market, commanding a substantial share of approximately 43.8%, equating to a market value of around USD 3.8 billion.

By Type

Emulsion SBR dominates with 67.3% share due to its versatile industrial use

In 2024, Emulsion Styrene Butadiene Rubber (Emulsion SBR) held a dominant market position, capturing more than a 67.3% share in the global SBR market. This dominance can be attributed to its wide application across industries, particularly in tire manufacturing, footwear, adhesives, and construction. Emulsion SBR is preferred due to its excellent processability, low production cost, and balanced properties such as abrasion resistance, tensile strength, and aging stability. These characteristics make it a reliable material for high-volume applications like car tires, conveyor belts, and molded goods.

By Application

Tire segment dominates with 73.9% share driven by global automotive demand

In 2024, Tire held a dominant market position, capturing more than a 73.9% share in the global Styrene Butadiene Rubber (SBR) market. This substantial share is mainly due to the essential role of SBR in tire manufacturing, where it is widely used in tread and sidewall components. The material’s excellent abrasion resistance, durability, and cost-effectiveness make it ideal for producing high-performance and long-lasting tires. Its ability to enhance traction and reduce rolling resistance also supports fuel efficiency, which aligns with growing regulatory and consumer preferences for energy-saving solutions.

Key Market Segments

By Type

- Emulsion SBR

- Solution SBR

By Application

- Tire

- Footwear

- Construction

- Polymer Modification

- Adhesive

- Others

Drivers

Increasing Demand for Tyre Manufacturing

The Styrene Butadiene Rubber (SBR) market is witnessing significant growth due to the rising demand from the tyre manufacturing sector. In recent years, the automotive industry has seen an increase in production and sales, particularly in emerging economies where the demand for vehicles is on the rise. SBR is a crucial material in the production of tyres, especially for passenger cars, trucks, and buses, owing to its superior wear resistance, high abrasion properties, and performance under extreme temperatures.

According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached 80 million units in 2023, marking a steady increase of 4.1% compared to the previous year. This surge in vehicle production directly translates to higher demand for tyres, thereby boosting the need for SBR. In particular, the tyre industry accounts for nearly 60% of the total consumption of synthetic rubber, with SBR being a dominant player.

Additionally, government regulations promoting fuel efficiency and the adoption of electric vehicles (EVs) further contribute to the demand for SBR. In the United States, the National Highway Traffic Safety Administration (NHTSA) introduced new fuel efficiency standards in 2022, which are expected to reduce carbon emissions and increase the performance requirements for tyres. These standards incentivize tyre manufacturers to improve tyre designs using advanced synthetic rubbers like SBR to achieve higher fuel efficiency while maintaining safety and durability.

Furthermore, several governmental initiatives in emerging markets, particularly in Asia Pacific, are focusing on improving the automotive and infrastructure sectors. For instance, India’s National Electric Mobility Mission Plan (NEMMP) 2020 and the Make in India campaign are set to increase demand for vehicles, including electric ones, further driving SBR consumption in the tyre manufacturing industry.

Restraints

Environmental Regulations and Sustainability Challenges

The Styrene Butadiene Rubber (SBR) market faces significant challenges due to stringent environmental regulations and growing sustainability concerns. SBR production involves the use of styrene and butadiene, both derived from petroleum, leading to concerns about volatile organic compound (VOC) emissions and non-biodegradable waste. These environmental issues have prompted regulatory bodies to implement stricter standards, impacting the production and adoption of SBR.

For instance, the U.S. Environmental Protection Agency (EPA) has identified rubber processing and tire manufacturing facilities as substantial sources of hazardous air pollutants (HAPs). This classification has led to the introduction of regulations under the Clean Air Act, requiring manufacturers to adopt best available control technologies to minimize emissions. Such regulatory measures increase operational costs and can limit the expansion of SBR production capacities.

In Europe, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes stringent requirements on the use of chemicals in manufacturing. SBR producers must comply with these regulations, which may involve costly testing and certification processes. Non-compliance can result in restricted market access and potential legal liabilities.

Opportunity

Expansion of Electric Vehicle (EV) Infrastructure

The Styrene Butadiene Rubber (SBR) market is poised for significant growth, driven by the global surge in electric vehicle (EV) adoption and the expansion of EV infrastructure. As nations intensify efforts to combat climate change, the automotive industry is undergoing a transformative shift towards sustainable transportation solutions. This transition is not only reshaping vehicle manufacturing but also creating new avenues for SBR applications.

In India, the government’s commitment to sustainable urban development is evident through initiatives like the Smart Cities Mission and the Pradhan Mantri Awas Yojana (PMAY). Under PMAY Urban 2.0, the government allocated INR 10 lakh crore (approximately USD 120.16 billion) to meet the housing needs of 1 crore urban poor and middle-class families. As of 2024-2025, the Smart Cities Mission has implemented over 5,100 projects worth INR 2,05,000 crore, positively impacting nearly 100 million citizens.

These large-scale infrastructure projects necessitate the use of durable and sustainable materials, leading to increased demand for SBR-based products such as adhesives, sealants, and waterproofing solutions. SBR’s versatility and performance characteristics make it an ideal choice for construction applications, further bolstering its market presence.

Trends

Rise of Sustainable and High-Performance SBR

The Styrene Butadiene Rubber (SBR) market is experiencing a significant shift towards sustainability and enhanced performance, driven by evolving consumer preferences and stringent environmental regulations. Manufacturers are increasingly focusing on developing eco-friendly SBR formulations that offer superior performance characteristics.

In addition to performance enhancements, there is a concerted effort to reduce the environmental impact of SBR production. Companies are exploring the use of bio-based and recycled materials in the manufacturing process. For instance, initiatives like the development of bio-butadiene, a renewable feedstock for SBR, are gaining momentum. The bio-butadiene market is expected to grow significantly during the forecast period from 2024 to 2029, driven by the increasing demand for sustainable materials in the production of SBR.

Government initiatives are also playing a pivotal role in promoting sustainable practices within the SBR industry. In India, for example, the government’s focus on infrastructure development and urbanization is driving the demand for SBR-based construction materials such as adhesives, sealants, and waterproofing solutions.

The Smart Cities Mission and the Pradhan Mantri Awas Yojana (PMAY) are key programs that are accelerating the adoption of SBR in construction applications. In Budget 2024-25, INR 10 lakh crore was allocated to PMAY Urban 2.0 to meet the housing needs of 1 crore urban poor and middle-class families. Additionally, over 5,100 projects worth INR 2,05,000 crore have been implemented under the Smart Cities Mission, positively impacting nearly 100 million citizens.

Regional Analysis

North America stands as the leading region in the global Styrene Butadiene Rubber (SBR) market, commanding a substantial share of approximately 43.8%, equating to a market value of around USD 3.8 billion. This dominance is attributed to the region’s robust automotive industry, ongoing infrastructure development, and the increasing demand for consumer goods, all of which drive the utilization of SBR across various applications.

The United States, in particular, plays a pivotal role in this market, bolstered by significant investments in infrastructure and the automotive sector. Government initiatives aimed at enhancing infrastructure, such as the allocation of substantial funds for urban development projects, have further propelled the demand for SBR in construction materials like adhesives, sealants, and waterproofing products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ARLANXEO is a global leader in synthetic rubber production, including Styrene Butadiene Rubber (SBR). The company specializes in high-performance rubber solutions for various industries such as automotive, construction, and industrial applications. With a strong commitment to sustainability, ARLANXEO focuses on innovations in production processes to reduce environmental impact. It has a significant presence in Europe, North America, and Asia, offering tailored products to meet customer-specific needs in the automotive and tire sectors.

ENEOS Corporation is a key player in the Styrene Butadiene Rubber market, primarily involved in producing and supplying synthetic rubbers for diverse applications, including automotive and industrial uses. ENEOS has a strong presence in the Asian market, leveraging advanced technologies to produce high-quality SBR products. The company focuses on improving energy efficiency and reducing the environmental impact of its operations, aligning with the increasing demand for sustainable and eco-friendly materials in the rubber industry.

Kemipex is a global distributor and supplier of specialty chemicals, including Styrene Butadiene Rubber (SBR). The company partners with leading manufacturers to offer high-quality SBR products used in applications such as tire manufacturing, footwear, and industrial goods. With a focus on providing solutions that meet customer needs, Kemipex offers customized products and services. The company is committed to delivering excellent technical support, ensuring that its SBR products meet the performance and regulatory standards across diverse regions.

Top Key Players in the Market

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation

- ENEOS Corporation

- Kemipex

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Sumitomo Chemical Asia Pte Ltd

- Synthos

- Trinseo

- Versalis SpA

Recent Developments

In February 2023, ARLANXEO inaugurated a polybutadiene production line in Brazil with an annual capacity of 65 kilotons, enhancing its position in the SBR supply chain.

In 2024 Asahi Kasei Corporation, implemented a price revision of ¥45/kg or more for its SBR products, including Asadene™, Tufdene™, and Asaprene™, effective from June 1, 2024. This adjustment was attributed to the sustained high costs of utilities and auxiliary materials, as well as increased maintenance expenses.

Report Scope

Report Features Description Market Value (2024) USD 8.8 Bn Forecast Revenue (2034) USD 16.2 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Emulsion SBR, Solution SBR), By Application (Tire, Footwear, Construction, Polymer Modification, Adhesive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ARLANXEO, Asahi Kasei Corporation, China Petrochemical Corporation, ENEOS Corporation, Kemipex, KUMHO PETROCHEMICAL, LANXESS, LG Chem, Sumitomo Chemical Asia Pte Ltd, Synthos, Trinseo, Versalis SpA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Styrene Butadiene Rubber MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Styrene Butadiene Rubber MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation

- ENEOS Corporation

- Kemipex

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Sumitomo Chemical Asia Pte Ltd

- Synthos

- Trinseo

- Versalis SpA