Global Stretch and Shrink Films Market Size, Share, Growth Analysis By Material (Linear Low-Density Polyethylene (LLDPE), Low Density Polyethylene (LDPE), Polyvinyl Chloride (PVC), Others), By Product (Wraps, Hoods, Sleeves and labels, Others), By Application (Food & Beverage, Industrial Packaging, Consumer Goods, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161148

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

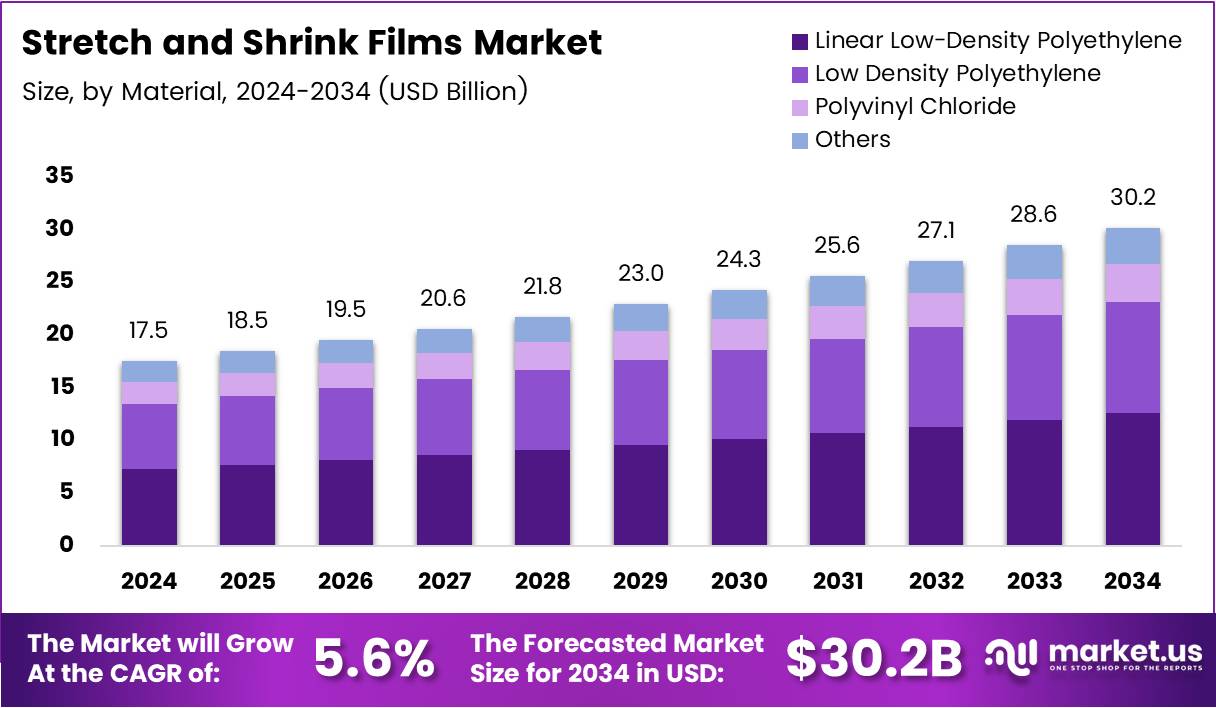

The Global Stretch And Shrink Films Market size is expected to be worth around USD 30.2 Billion by 2034, from USD 17.5 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Stretch and Shrink Films market continues to evolve as industries seek efficient and sustainable packaging solutions. These films, widely used in logistics, food, and consumer goods, provide superior product protection and load stability. Moreover, growing e-commerce activity and automation trends are accelerating the market’s transition toward smart and lightweight packaging materials.

Furthermore, sustainability goals are reshaping manufacturing priorities. Companies increasingly adopt recyclable and bio-based polymers to meet environmental regulations and brand commitments. This shift not only supports circular economy practices but also enhances brand reputation. Government incentives for green packaging and carbon reduction initiatives are further fueling technological innovation in stretch and shrink applications.

In addition, rapid industrial automation and digitalization present new opportunities. Manufacturers are integrating advanced film extrusion and wrapping systems to boost efficiency and reduce material waste. As industries modernize packaging lines, demand for intelligent stretch and shrink films with precise performance attributes continues to rise—supporting consistent, high-speed production across diverse end-user sectors.

From a regional perspective, Asia-Pacific lead adoption due to expanding logistics networks and consumer-driven markets. With governments investing in advanced packaging infrastructure and sustainable manufacturing policies, market players are strengthening local production capabilities. This strategic expansion enables better supply chain resilience and responsiveness to evolving customer needs.

According to an industry report, the U.S. parcel volume in 2024 reached 22.37 billion shipments, marking a 3.4% increase from 2023’s 21.65 billion, and is projected to hit 30 billion by 2030. Additionally, U.S. packaging machinery shipments totaled $10.9 billion in 2023 (+5.8% YoY).

Another industry survey found that among 118 brand owners, 68% prioritize automation for cost savings and 54% for waste reduction, highlighting rising adoption of stretch and shrink film optimization and connected packaging technologies.

Key Takeaways

- The global market size is projected to reach USD 30.2 Billion by 2034, up from USD 17.5 Billion in 2024, at a CAGR of 5.6% (2025–2034).

- Linear Low-Density Polyethylene (LLDPE) dominated the By Material segment in 2024 with a 48.3% share, driven by its superior stretchability and puncture resistance.

- Wraps led the By Product segment in 2024 with a 51.4% market share, due to their cost-effectiveness and efficiency in securing pallets.

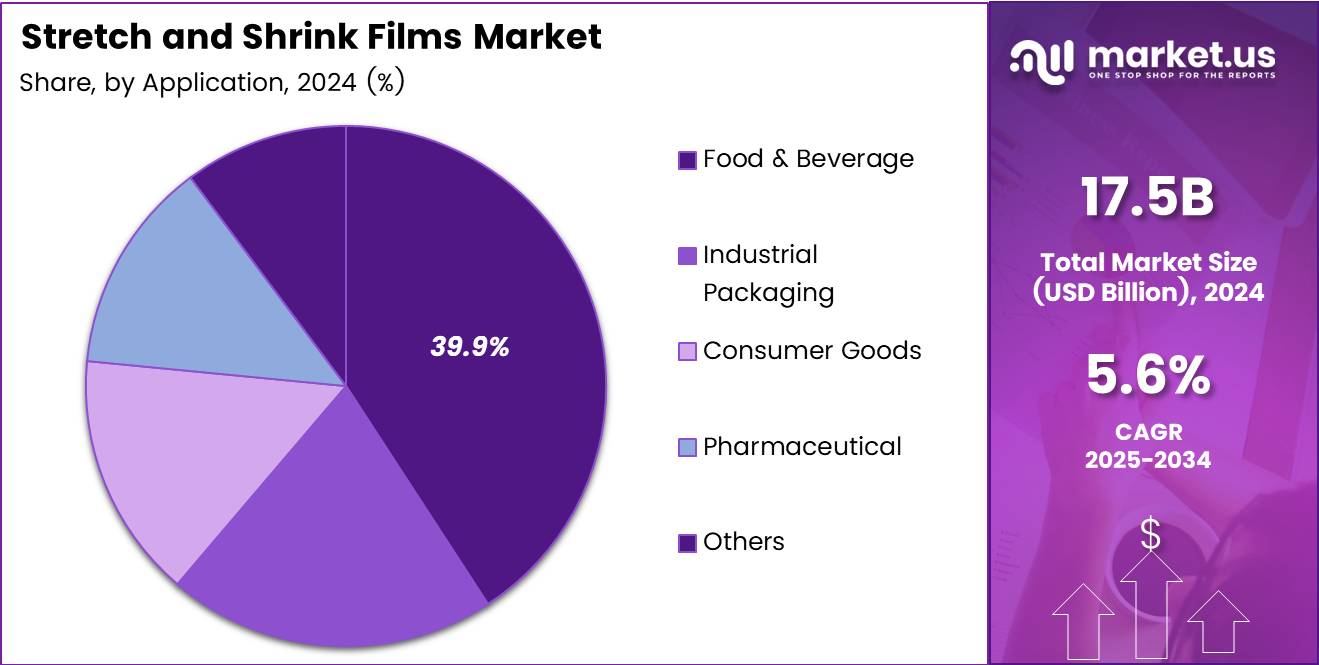

- The Food & Beverage industry held the top position in the By Application segment in 2024, accounting for 39.9% of total market share.

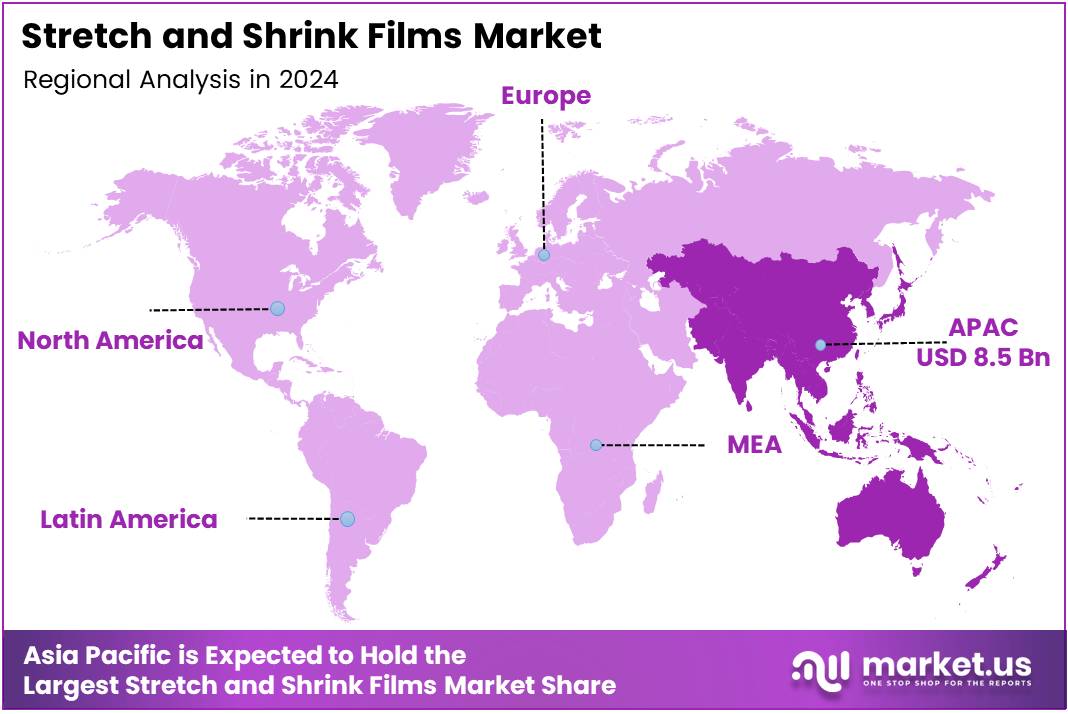

- The Asia Pacific region dominated globally with a 48.9% share (≈ USD 8.5 Billion), fueled by industrial expansion and rising e-commerce and food sector demand.

By Material Analysis

Linear Low-Density Polyethylene (LLDPE) dominates with 48.3% due to its superior flexibility, durability, and cost efficiency.

In 2024, Linear Low-Density Polyethylene (LLDPE) held a dominant market position in the By Material segment of the Stretch And Shrink Films Market, with a 48.3% share. Its exceptional stretchability, puncture resistance, and ability to conform tightly to irregularly shaped loads make it the preferred choice across diverse industries.

Low Density Polyethylene (LDPE) films continue to gain traction due to their excellent clarity and moisture resistance. LDPE is widely used for packaging consumer goods and food products where transparency and flexibility are vital. Its affordability and easy processability also support steady demand across both developed and emerging markets.

Polyvinyl Chloride (PVC) remains significant in the shrink film category, especially for labeling and wrapping applications. Its superior shrink ratio and glossy finish enhance visual appeal, making it popular in retail packaging. However, environmental concerns and recycling challenges are gradually encouraging a shift toward more sustainable alternatives.

The Others segment includes specialty polymers and bio-based materials offering unique mechanical and environmental benefits. These materials cater to niche applications focused on sustainability, recyclability, and high-performance barrier protection, reflecting growing industry awareness toward greener packaging options.

By Product Analysis

Wraps dominate with 51.4% due to their versatility and widespread use in industrial and retail packaging.

In 2024, Wraps held a dominant market position in the By Product segment of the Stretch And Shrink Films Market, with a 51.4% share. Their flexibility, cost-effectiveness, and ability to secure pallets efficiently make them indispensable across logistics, food, and manufacturing sectors globally.

Hoods are gaining steady demand due to their robust load stability and weather-resistant characteristics. These films provide an added layer of protection during transportation and storage, especially in outdoor environments where goods are exposed to dust and moisture.

Sleeves and labels are increasingly used for product identification and branding purposes. Their ability to conform tightly around containers of various shapes enhances visual appeal while maintaining product integrity. This sub-segment benefits from expanding beverage and personal care packaging needs.

The Others segment comprises niche products designed for specific industrial and consumer applications. These include customized shrink covers and specialty films that offer enhanced strength, clarity, or barrier properties, aligning with the demand for innovation and material optimization.

By Application Analysis

Food & Beverage dominates with 39.9% due to its extensive use in preserving product freshness and safety.

In 2024, Food & Beverage held a dominant market position in the By Application segment of the Stretch And Shrink Films Market, with a 39.9% share. The sector relies heavily on these films for efficient packaging, extended shelf life, and enhanced product presentation, driving consistent global consumption.

Industrial Packaging continues to see strong adoption as manufacturers seek reliable wrapping solutions for palletizing, warehousing, and shipping operations. Stretch and shrink films ensure load stability, minimize product damage, and streamline logistics, boosting overall operational efficiency.

The Consumer Goods segment benefits from growing e-commerce and retail distribution networks. These films offer protective wrapping, preventing contamination and ensuring tamper evidence, while also providing an appealing appearance for end consumers.

Pharmaceutical applications are expanding rapidly due to the films’ ability to provide secure, contamination-free, and tamper-proof packaging. The industry’s stringent safety standards encourage the use of high-performance materials for sensitive medical and healthcare products.

The Others segment includes agriculture, electronics, and specialty packaging uses. These applications utilize stretch and shrink films for product protection, bundling, and insulation, reflecting the material’s adaptability across diverse industries.

Key Market Segments

By Material

- Linear Low-Density Polyethylene (LLDPE)

- Low Density Polyethylene (LDPE)

- Polyvinyl Chloride (PVC)

- Others

By Product

- Wraps

- Hoods

- Sleeves and labels

- Others

By Application

- Food & Beverage

- Industrial Packaging

- Consumer Goods

- Pharmaceutical

- Others

Drivers

Rising Demand for Efficient Packaging Solutions in E-commerce and Retail Sectors

The stretch and shrink films market is witnessing steady growth due to the rising need for reliable and cost-effective packaging in e-commerce and retail industries. With the surge in online shopping, manufacturers are focusing on durable films that ensure product protection during transportation and handling. This demand has encouraged companies to innovate with flexible, lightweight, and high-strength films that reduce packaging waste and costs.

The food and beverage sector is another key growth driver, as it requires packaging that extends product shelf life while maintaining freshness. Stretch and shrink films offer excellent barrier properties against moisture, oxygen, and contaminants, making them ideal for perishable goods. The increasing consumption of packaged foods and ready-to-eat meals continues to strengthen market demand.

In manufacturing facilities, the adoption of automated packaging equipment is supporting film usage. Automated systems require films that are consistent in quality and stretchability, helping to improve productivity and minimize waste. This trend aligns with the industry’s push toward smart manufacturing and efficiency.

Additionally, the expansion of logistics and transportation networks has boosted the need for reliable packaging materials. Stretch and shrink films provide stability and protection to goods during long-distance transit, ensuring safety and reducing damage rates. Together, these factors highlight how evolving industrial and consumer demands are propelling the global stretch and shrink films market forward.

Restraints

Volatility in Raw Material Prices of Polyethylene and Polypropylene Resins

The stretch and shrink films market faces several challenges that may slow down its growth. One major restraint is the fluctuating prices of key raw materials like polyethylene and polypropylene resins. Since these materials are derived from petrochemicals, their costs are influenced by global crude oil price variations, making it difficult for manufacturers to maintain stable profit margins.

Environmental regulations on plastic waste management have also tightened across regions, pressuring manufacturers to adopt sustainable materials and recycling systems. Compliance with these regulations often increases production costs and limits the use of conventional plastic films, especially in regions with strict environmental laws.

Another major limitation is the high initial investment required for advanced film production machinery. Modern extrusion and wrapping systems are costly, which poses a challenge for small and medium-sized enterprises looking to enter the market or upgrade their operations.

Lastly, the limited biodegradability and recycling challenges of traditional films continue to restrict their market penetration. Although recycling infrastructure is improving, the process remains complex and costly, leading to lower adoption rates in environmentally conscious markets. These restraints underline the importance of innovation and sustainability in overcoming industry barriers.

Growth Factors

Development of Bio-Based and Compostable Stretch and Shrink Films

The stretch and shrink films market presents promising growth opportunities driven by increasing sustainability efforts. One key area of development is bio-based and compostable films, which address environmental concerns while offering similar performance to traditional plastics. Companies are investing in research to produce films made from renewable sources like starch, polylactic acid (PLA), and other biodegradable polymers.

Another opportunity lies in integrating smart and interactive packaging technologies. Features such as QR codes, temperature indicators, and freshness sensors are being incorporated into films to enhance consumer engagement and supply chain transparency. This innovation helps brands differentiate their products in a competitive marketplace.

Emerging economies are also providing fertile ground for market expansion. Rapid industrialization, urbanization, and rising disposable incomes in countries across Asia, Africa, and Latin America are boosting demand for packaged goods, thereby increasing film consumption.

Collaborations between film producers and sustainability-focused brands further create avenues for growth. Such partnerships aim to design eco-friendly packaging solutions that meet regulatory requirements while appealing to environmentally aware consumers. Together, these opportunities highlight the market’s shift toward greener, smarter, and more globally diversified solutions.

Emerging Trends

Shift Toward Lightweight and High-Performance Multilayer Film Structures

The stretch and shrink films market is evolving with several key trends shaping its future. One major trend is the growing shift toward lightweight, high-performance multilayer films that deliver superior strength, flexibility, and protection with reduced material use. These films help cut down transportation and material costs while enhancing sustainability.

The popularity of recyclable mono-material films is also rising in line with circular economy goals. Manufacturers are developing films made from a single polymer type to simplify recycling and reduce environmental impact. This transition supports global initiatives promoting eco-friendly packaging alternatives.

Technological advancements in film extrusion and printing have further revolutionized production processes. Improved extrusion technologies enable precise control over film thickness and quality, while modern printing methods enhance design possibilities and brand visibility. These innovations allow producers to meet diverse industry requirements with greater efficiency.

Moreover, the growing use of digital printing for custom branding and aesthetic designs is transforming packaging into a marketing tool. Brands are leveraging vivid graphics and personalized visuals to attract consumers and enhance shelf appeal. Overall, these trends reflect how the market is moving toward sustainability, performance, and visual innovation in packaging solutions.

Regional Analysis

Asia Pacific Dominates the Stretch and Shrink Films Market with a Market Share of 48.9%, Valued at USD 8.5 Billion

The Asia Pacific region holds the largest share of the global stretch and shrink films market, accounting for 48.9% of the total market value and reaching approximately USD 8.5 Billion. This dominance is attributed to the region’s booming industrial and packaging sectors, particularly in countries such as China, India, and Japan. Growing demand for sustainable, durable, and flexible packaging materials, coupled with the expansion of the e-commerce and food industries, continues to drive strong market growth across the region.

North America Stretch and Shrink Films Market Trends

North America exhibits steady growth in the stretch and shrink films market, supported by high demand from consumer goods, logistics, and industrial packaging sectors. The region benefits from strong technological advancements and increasing adoption of recyclable and bio-based film materials. Additionally, stringent regulations on packaging waste are encouraging innovation and the use of sustainable film solutions across industries.

Europe Stretch and Shrink Films Market Trends

Europe’s market growth is influenced by a well-established packaging industry and increasing emphasis on eco-friendly materials. The region’s focus on circular economy practices and sustainable manufacturing processes promotes the use of recyclable stretch and shrink films. Moreover, consumer preference for high-quality, visually appealing packaging in retail and food sectors fuels market demand.

Middle East and Africa Stretch and Shrink Films Market Trends

The Middle East and Africa region is witnessing gradual growth in the stretch and shrink films market, primarily driven by expanding food, beverage, and construction sectors. Rising investments in packaging infrastructure and a growing retail network are contributing to higher consumption. Economic diversification efforts and increasing export activities further enhance market prospects.

Latin America Stretch and Shrink Films Market Trends

Latin America shows moderate growth potential in the stretch and shrink films market, driven by growing demand in food packaging and industrial applications. The region’s emerging economies are experiencing rising consumption of packaged products, supporting the adoption of advanced packaging films. Efforts to improve manufacturing capabilities and reduce material waste are likely to further support market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Stretch And Shrink Films Company Insights

The global Stretch and Shrink Films Market in 2024 continues to be driven by innovation, sustainability initiatives, and expanding applications in packaging and logistics.

Sigma Plastics Group remains a dominant player with its wide portfolio of high-performance films tailored for industrial and consumer packaging. The company’s emphasis on recyclable materials and production efficiency strengthens its market leadership and aligns with global sustainability trends.

Paragon Films continues to focus on technological advancements, offering superior stretch films that enhance load stability while reducing material usage. Its investment in smart manufacturing and lean operations supports strong growth, particularly in North America and emerging export markets.

Millennium Packaging, Inc distinguishes itself through customer-centric solutions and its commitment to supplying eco-friendly packaging films. The company’s strategic collaborations with manufacturers allow it to deliver high-quality, cost-effective wrapping and bundling products that cater to diverse industry needs.

Sealed Air maintains a significant footprint in the global market, leveraging its expertise in packaging technologies and material science. The company’s focus on performance films with improved sustainability and durability provides it with a competitive edge amid growing environmental regulations.

Overall, these leading players are driving innovation in product performance, recyclability, and operational efficiency. The 2024 market trend emphasizes reducing waste, improving logistics efficiency, and enhancing shelf appeal for retail applications. Continuous R&D investment and regional expansion strategies are expected to further consolidate the market positions of these companies, fostering steady growth across key end-use sectors such as food, beverage, and industrial packaging.

Top Key Players in the Market

- Sigma Plastics Group

- Paragon Films

- Millennium Packaging, Inc

- Sealed Air

- HIPAC Spa

- Bollore Inc

- Amcor plc

- Italdibipack SpA

- LUBAN PACK

- A-Z Packaging

Recent Developments

- In June 2024, Sigma Plastics Group acquired polyethylene stretch-film assets from Stalwart Plastics, Inc. and Quantico Plastics Group, Inc., strengthening its production capacity and supply chain efficiency across North American packaging operations.

- In September 2025, Veritiv completed the acquisition of Subotnick Packaging, expanding its product portfolio in stretch film, strapping, tape, and packaging equipment, parts, and services, enhancing end-to-end packaging solutions.

- In June 2025, Trioworld entered into a joint venture with Filmtec to expand operations into the Indian packaging market, aiming to meet fast-growing regional demand for advanced and sustainable plastic film solutions.

- In January 2024, Cambridge-based sustainable materials startup Xampla raised €6.4 million to scale production of its biodegradable packaging materials designed to replace single-use plastics in consumer goods applications.

- In October 2024, London-based Notpla secured £20 million in funding to expand its compostable packaging alternatives, including seaweed-based films and coatings for food and beverage applications.

Report Scope

Report Features Description Market Value (2024) USD 17.5 Billion Forecast Revenue (2034) USD 30.2 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Linear Low-Density Polyethylene (LLDPE), Low Density Polyethylene (LDPE), Polyvinyl Chloride (PVC), Others), By Product (Wraps, Hoods, Sleeves and labels, Others), By Application (Food & Beverage, Industrial Packaging, Consumer Goods, Pharmaceutical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sigma Plastics Group, Paragon Films, Millennium Packaging, Inc, Sealed Air, HIPAC Spa, Bollore Inc, Amcor plc, Italdibipack SpA, LUBAN PACK, A-Z Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stretch and Shrink Films MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Stretch and Shrink Films MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sigma Plastics Group

- Paragon Films

- Millennium Packaging, Inc

- Sealed Air

- HIPAC Spa

- Bollore Inc

- Amcor plc

- Italdibipack SpA

- LUBAN PACK

- A-Z Packaging