Global Sports Food Market Size, Share, And Enhanced Productivity By Product Type (Energy Bars, Functional Dairy Products, Breakfast Cereals, Meal Kit, Fruits and Nuts, Energy Snacks, Functional Bakery Products), By Category (Organic, Conventional), By Functionality (Energy, Muscle Growth, Recovery, Hydration, Cognitive Support, Weight Management, Others), By End User (Bodybuilders, Athletes, Recreational Sportsman), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Drug Stores/Pharmacies, Specialty stores/Fitness Centres, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172598

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Category Analysis

- By Functionality Analysis

- By End User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

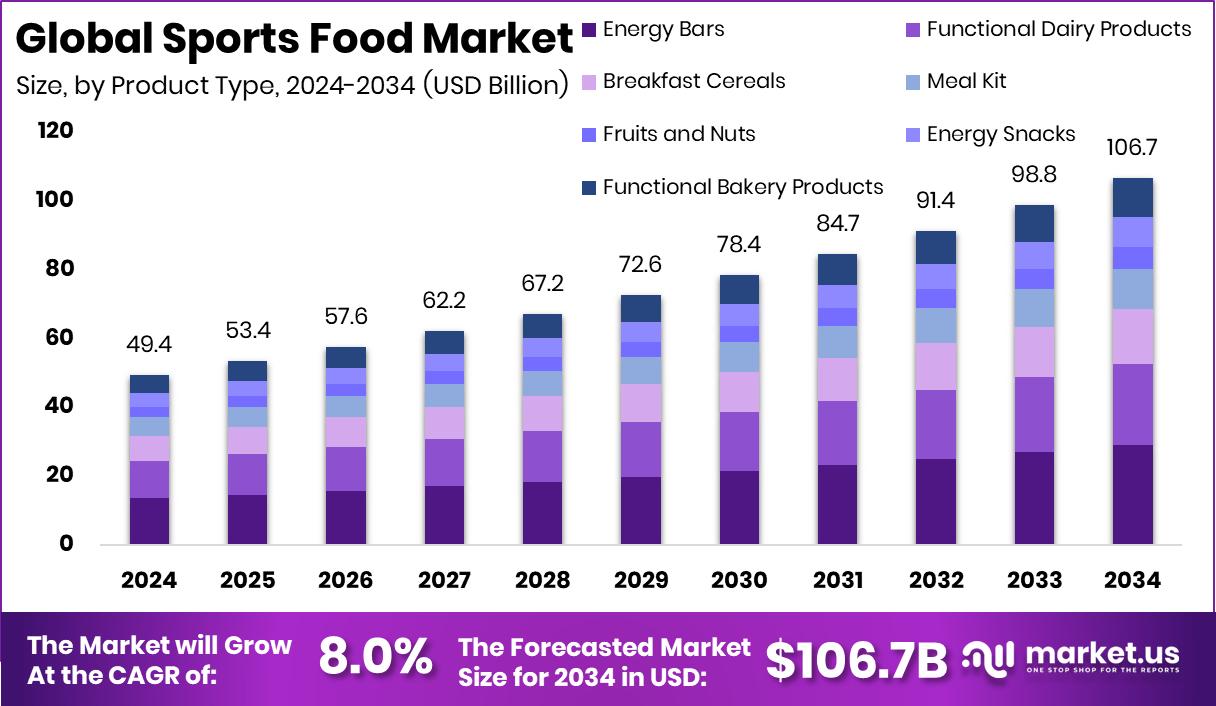

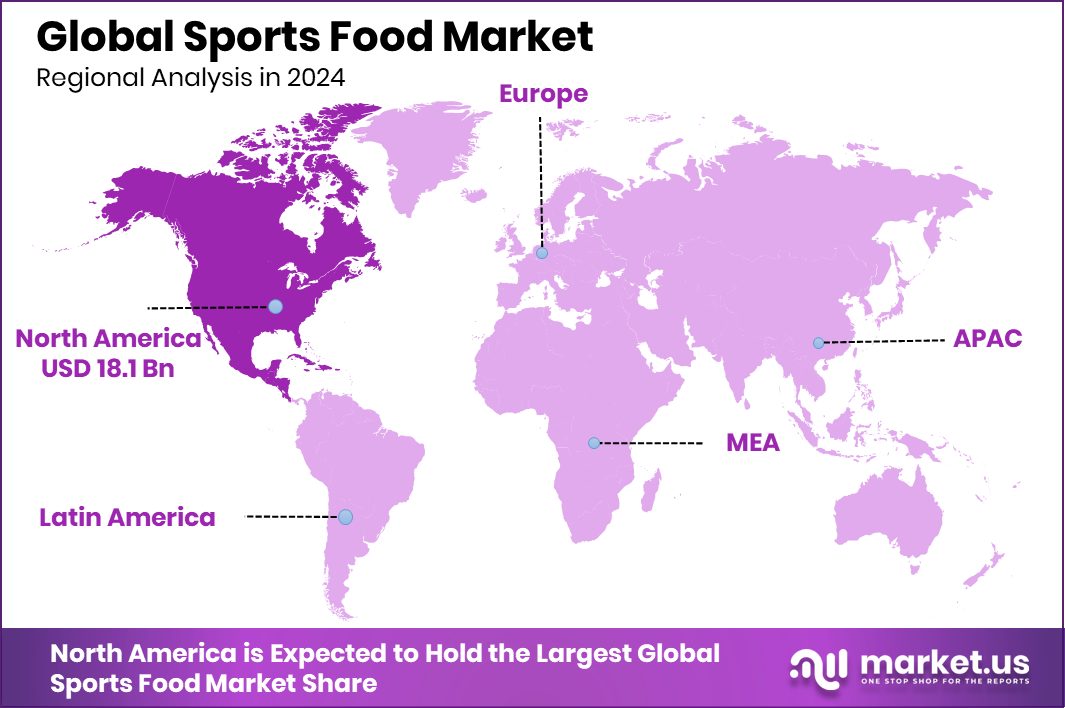

The Global Sports Food Market is expected to be worth around USD 106.7 billion by 2034, up from USD 49.4 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034. North America Sports Food Market stands at 36.70%, generating USD 18.1 Bn revenue.

Sports food refers to specially prepared foods designed to support physical activity, exercise performance, and recovery. These products provide energy, hydration, muscle support, and endurance through formats such as bars, snacks, powders, and ready-to-eat options. Sports food is not limited to professional athletes; it is widely used by gym-goers, runners, fitness enthusiasts, and people with active daily routines who need convenient nutrition around workouts.

The sports food market covers the production, distribution, and consumption of these performance-focused foods across retail, online, and specialty channels. It connects food innovation with fitness lifestyles, focusing on convenience, taste, and functional benefits. The market continues to evolve as consumers move away from traditional supplements and prefer food-based nutrition that fits easily into everyday diets.

One key growth factor is rising innovation supported by strong funding activity. Snack brand Phab raised $2 million in a seed round led by OTP Ventures, while caffeinated bar maker Verb Energy secured $3.5 million to expand operations. Quantum Energy Squares also raised $2.5 million, showing growing investor confidence in functional and energy-focused food formats.

Demand is driven by increasing health awareness and busy lifestyles. The Whole Truth raised Rs 133.3 crore in a Series C round and separately kicked off Series C with a 3.6X valuation surge, highlighting strong consumer interest in clean and transparent sports foods. Financing, such as ₹519 crore provided to First Energy Group and $50 million raised by AMPIN Energy, further supports nutrition-linked energy ecosystems.

The market opportunity lies in scaling access and innovation. With fresh capital flowing into functional snacks and energy foods, brands can expand product ranges, improve formulations, and reach new consumer groups seeking simple, effective sports nutrition solutions.

Key Takeaways

- The Global Sports Food Market is expected to be worth around USD 106.7 billion by 2034, up from USD 49.4 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034.

- In the sports food market, energy bars dominate product types with a 27.3% share globally.

- Within the sports food market, the conventional category leads strongly, accounting for 67.2% of total demand.

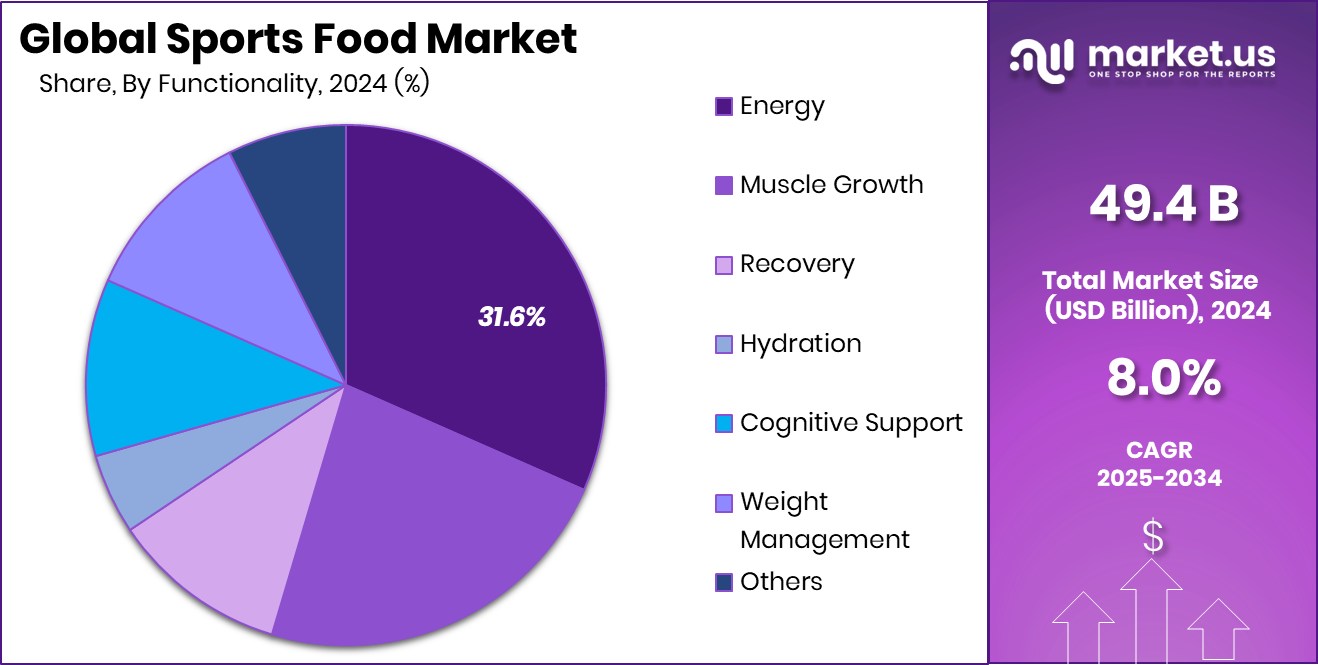

- Energy-focused functionality remains central in the sports food market, holding a significant 31.6% share overall.

- Athletes represent the primary end users in the sports food market, contributing 51.8% of the consumption share.

- Hypermarkets and supermarkets lead distribution channels in the sports food market, capturing 34.7% of sales value.

- Sports Food Market in North America accounts for 36.70%, reaching USD 18.1 Bn.

By Product Type Analysis

Energy bars dominate the sports food market product type, capturing 27.3% share.

In 2024, the Sports Food Market saw Energy Bars hold a 27.3% share by product type, reflecting their strong appeal among active consumers seeking convenience and quick nutrition. Energy bars fit easily into busy routines and offer a balanced mix of carbohydrates, proteins, and functional ingredients.

Athletes and fitness enthusiasts prefer them for pre-workout fuel and post-exercise recovery. Their long shelf life and portability also make them popular for travel, outdoor sports, and gym use. Brands continue to improve taste, texture, and ingredient quality, which helps expand consumption beyond professional athletes to everyday fitness users. As lifestyles become more fast-paced, energy bars remain one of the most practical sports food options.

By Category Analysis

Conventional products lead the sports food market category, accounting for 67.2% share.

In 2024, the Sports Food Market was dominated by the Conventional category, which accounted for 67.2% of total demand. Conventional products continue to attract a wide consumer base due to their affordability, familiar ingredients, and broad retail availability.

Many consumers still trust traditional formulations that focus on proven nutrition rather than niche or premium claims. This category benefits strongly from mass-market distribution and strong brand recognition built over the years. While organic and clean-label options are growing, conventional sports foods remain the first choice for beginners and regular gym users. Their price advantage and consistent performance keep them relevant, especially in emerging and cost-sensitive markets.

By Functionality Analysis

Energy functionality holds a strong position within the sports food market at 31.6%.

In 2024, Energy functionality led the Sports Food Market with a 31.6% share, highlighting the importance of stamina and endurance support. Consumers increasingly rely on sports foods to maintain energy levels during workouts, competitions, and physically demanding routines.

Products focused on energy typically contain fast-absorbing carbohydrates, electrolytes, and supportive nutrients that help delay fatigue. This functionality appeals not only to athletes but also to active professionals and recreational users. Energy-focused sports foods are widely consumed before and during exercise, making them essential for performance-driven users. As fitness participation rises globally, demand for reliable energy-boosting sports nutrition continues to grow steadily.

By End User Analysis

Athletes represent the largest end-user group in the sports food market, 51.8%.

In 2024, Athletes represented the largest end-user group in the Sports Food Market, accounting for 51.8% of consumption. Professional and semi-professional athletes rely heavily on sports foods to support training intensity, recovery, and performance consistency. Their structured nutrition plans often include energy bars, protein products, and functional supplements. This group values scientifically backed formulations and consistent quality, driving demand for trusted products.

Athletes also influence broader consumer trends, as fitness enthusiasts often follow their nutrition habits. As competitive sports and organized fitness activities expand, athletes remain the core consumers shaping innovation, credibility, and overall demand patterns within the sports food industry.

By Distribution Channel Analysis

Hypermarkets and supermarkets dominate the sports food market distribution channels with 34.7% share.

In 2024, Hypermarkets and Supermarkets led the Sports Food Market distribution landscape with a 34.7% share. These retail channels offer strong visibility, a wide product variety, and easy access for everyday consumers. Shoppers often prefer buying sports foods alongside regular groceries, making large retail stores a convenient option.

Promotional pricing, in-store displays, and brand comparisons further boost sales through this channel. Hypermarkets and supermarkets also help introduce sports foods to first-time buyers who may not shop online or in specialty stores. Their strong presence in urban and semi-urban areas continues to support high-volume sales and mainstream adoption.

Key Market Segments

By Product Type

- Energy Bars

- Functional Dairy Products

- Breakfast Cereals

- Meal Kit

- Fruits and Nuts

- Energy Snacks

- Functional Bakery Products

By Category

- Organic

- Conventional

By Functionality

- Energy

- Muscle Growth

- Recovery

- Hydration

- Cognitive Support

- Weight Management

- Others

By End User

- Bodybuilders

- Athletes

- Recreational Sportsman

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Specialty stores/Fitness Centres

- Online Retail

- Others

Driving Factors

Plant-Based Nutrition Innovation Driving Sports Food Demand

The sports food market is strongly driven by rapid innovation in plant-based and animal-free nutrition. Consumers today want performance foods that support energy, recovery, and muscle health without relying on traditional dairy ingredients. This shift is clearly supported by recent funding activity. Those Vegan Cowboys Milks secured $7.3M to launch animal-free casein by 2026, enabling high-performance protein options suitable for sports foods.

Similarly, Time-Travelling Milkman raised €2M to develop a sunflower-based ingredient that replicates dairy fat functionality, helping brands improve taste and texture in sports nutrition products. In parallel, Chobani Growth Capital backed this transition by securing $650M to fuel dairy growth, including alternative and functional nutrition expansion.

Together, these developments show how investment in next-generation ingredients is accelerating product innovation, making sports foods more accessible, sustainable, and appealing to performance-focused consumers seeking clean and effective nutrition.

Restraining Factors

High Cost and Slow Scaling Alternative Ingredients

One major restraining factor in the Sports Food Market is the high cost and slow commercial scaling of alternative protein and functional ingredients. While innovation is strong, turning new concepts into affordable sports food products takes time and heavy investment. France’s Nutropy raised $8M to target a 2027 launch of animal-free cheese, showing that commercialization timelines remain long.

Similarly, Greece’s Plan(e)t Foods secured €1.05M to scale functional plant-based ice cream, highlighting the early-stage nature of many functional ingredients. A big dairy-backed startup also raised $34M for animal-free whey proteins, yet large funding is still required to reach mass production. These long development cycles and high costs can limit product availability and keep prices higher, slowing wider adoption of sports foods among price-sensitive consumers.

Growth Opportunity

Expansion of Clean Label Functional Sports Foods

A major growth opportunity in the Sports Food Market lies in expanding clean-label and functional food options that combine performance benefits with everyday nutrition. Consumer interest in plant-based and better-for-you products is clearly supported by recent funding activity. India’s Goodmylk raised $1M to expand its vegan dairy range, opening new possibilities for dairy-free sports foods such as shakes and recovery snacks.

Melt&Marble secured $8.5M to launch animal-free fats for food and personal care, enabling better texture and energy delivery in performance foods without traditional fats. Meanwhile, Modern Baker, the startup behind Superloaf, raised $3.4M to develop healthier ultra-processed foods, aligning with demand for nutritious, functional sports snacks. These investments show strong momentum toward scalable, clean, and performance-focused food innovation.

Latest Trends

Clean Label Snacks Enter Sports Nutrition Space

A key latest trend in the Sports Food Market is the strong shift toward clean-label snacks that balance performance with everyday eating habits. Consumers now expect sports foods to look and feel like regular snacks, while still supporting energy and recovery needs. This trend is clearly reflected in recent funding activity. A clean-label cereal company raised $6 million to scale simple, transparent ingredient products, showing rising demand for trust-based nutrition.

Magic Spoon secured $5.5M in seed funding to reinvent the cereal category with better nutritional profiles, aligning well with sports and active lifestyles. At the same time, snack brand Farmley raised $40 Mn in a Series C funding round, highlighting strong investor confidence in healthy snack formats. Together, these developments show how sports food is moving closer to clean, familiar, and snack-style nutrition solutions.

Regional Analysis

North America leads the sports food market with 36.70% share, at USD 18.1 Bn.

North America dominates the Sports Food Market, holding a 36.70% share and generating USD 18.1 Bn, driven by a mature fitness culture, high sports participation, and strong consumer awareness around performance nutrition. The region benefits from widespread availability of sports foods across mainstream retail channels and a large base of athletes, gym users, and active lifestyle consumers. Strong brand presence and routine consumption habits make sports nutrition a regular part of daily diets rather than occasional supplements.

Europe follows as a well-established region where structured sports, recreational fitness, and endurance activities support steady demand for sports food products. Consumers across the region show strong interest in balanced nutrition and performance support, encouraging consistent usage among both professional athletes and regular fitness enthusiasts.

Asia Pacific represents a fast-developing landscape, supported by rising urbanization, growing gym memberships, and increasing interest in organized sports and fitness lifestyles. Expanding middle-class populations and exposure to global fitness trends are helping sports food products gain broader acceptance.

The Middle East & Africa market continues to grow gradually, supported by increasing health awareness, fitness club expansion, and lifestyle changes in urban areas. Latin America also shows steady progress, with sports food adoption rising alongside youth sports participation and improving access to modern retail channels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mondelez International Group plays a strategic role in the global Sports Food Market by leveraging its deep expertise in snack formulation, flavor science, and global distribution. The company’s strength lies in translating mainstream snacking habits into performance-oriented offerings that appeal to active consumers. Its scale allows efficient sourcing, consistent quality, and wide retail penetration, helping sports food products reach beyond niche athletes to everyday fitness users. Mondelez’s ability to balance taste, convenience, and energy-focused nutrition supports steady relevance in a highly competitive market.

MusclePharm Corporation remains closely aligned with performance-driven consumers, particularly athletes and serious fitness enthusiasts. The company is known for its focus on functionality, ingredient transparency, and sports-centric branding. In 2024, its positioning continues to emphasize strength, endurance, and recovery needs, reinforcing credibility among gym-focused users. MusclePharm’s product development approach reflects practical performance requirements rather than lifestyle snacking, allowing it to maintain a loyal consumer base despite shifting market trends.

Science in Sport stands out for its science-led approach and strong connection with endurance sports. The company prioritizes evidence-based formulations designed for energy delivery and hydration efficiency. In 2024, its clear focus on athletes, cyclists, and runners supports a premium, performance-first identity. This disciplined positioning helps Science in Sport maintain trust and differentiation within the global sports food landscape.

Top Key Players in the Market

- Mondelez International group.

- MusclePharm Corporation

- Science in Sport

- General Mills

- Nourish Organic Foods Pvt. Ltd.

- Kellanova

- Nestle S.A.

- Quest Nutrition

- Grenade

- Others

Recent Developments

- In March 2025, MusclePharm introduced a new MusclePharm Pro Series — a premium line of sports nutrition products. This product range was first made available in select Vitamin Shoppe stores (about 60% of outlets) and also launched online and internationally. These products aim to serve athletes and active consumers with higher-end performance nutrition options.

- In July 2024, Science in Sport plc successfully raised £8.5 million through a placing and retail offer. This capital raise was aimed at supporting ongoing operations, strengthening the balance sheet, and funding strategic growth plans for its sports nutrition brands, including SiS and PhD products across energy, hydration, and recovery segments.

Report Scope

Report Features Description Market Value (2024) USD 49.4 Billion Forecast Revenue (2034) USD 106.7 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Energy Bars, Functional Dairy Products, Breakfast Cereals, Meal Kit, Fruits and Nuts, Energy Snacks, Functional Bakery Products), By Category (Organic, Conventional), By Functionality (Energy, Muscle Growth, Recovery, Hydration, Cognitive Support, Weight Management, Others), By End User (Bodybuilders, Athletes, Recreational Sportsman), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Drug Stores/Pharmacies, Specialty stores/Fitness Centres, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mondelez International group., MusclePharm Corporation, Science in Sport, General Mills, Nourish Organic Foods Pvt. Ltd., Kellanova, Nestle S.A., Quest Nutrition, Grenade, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mondelez International group.

- MusclePharm Corporation

- Science in Sport

- General Mills

- Nourish Organic Foods Pvt. Ltd.

- Kellanova

- Nestle S.A.

- Quest Nutrition

- Grenade

- Others