Spinal Fusion Market By Product Type (Interbody Cages, Spinal Fusion Plates, and Pedicle Screws & Rods), By Procedure (Posterolateral Fusion & Interbody Fusion (Posterior Lumbar Interbody Fusion (PLIF), Transformational Lumbar Interbody Fusion (TLIF), Anterior Lumbar Interbody Fusion (ALIF), Extreme Lateral Interbody Fusion (XLIF), and Others)), By End-user (Hospitals, Ambulatory Surgical Centers, and Specialty Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132882

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Procedure Analysis

- End-user Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Top Key Players in the Spinal Fusion Market

- Report Scope

Report Overview

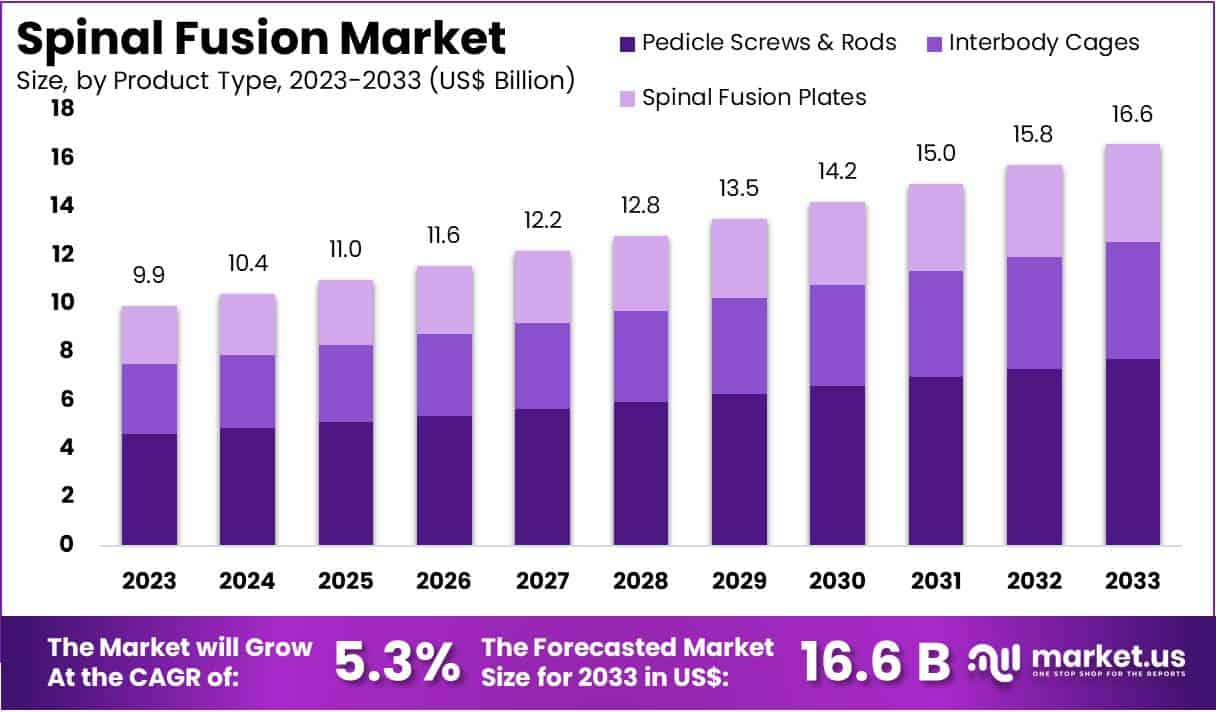

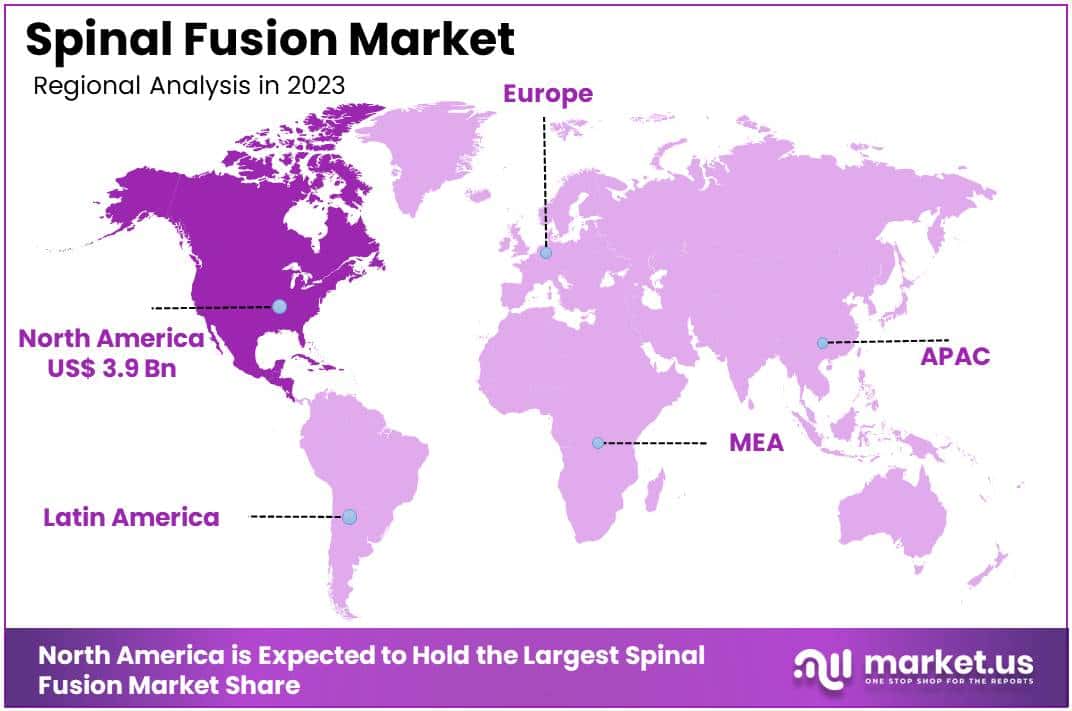

The Spinal Fusion Market size is expected to be worth around US$ 16.6 billion by 2033 from US$ 9.9 billion in 2023, growing at a CAGR of 5.3% during the forecast period 2024 to 2033. North America led the market by holding the largest revenue share at 39.7%. This dominance is attributed to advancements in surgical techniques and the rising incidence of spinal disorders like scoliosis and degenerative disc disease.

Rising prevalence of degenerative spinal disorders drives the spinal fusion market, as patients increasingly seek effective solutions for conditions such as herniated discs, spinal stenosis, and scoliosis. Spinal fusion procedures provide critical applications in stabilizing the spine, alleviating chronic back pain, and enhancing patient mobility. In August 2022, Wenzel Spine, Inc. introduced the S-LIF Procedure for Stand-alone Lumbar Interbody Fusion, utilizing the VariLift-LX device, the first FDA-approved single-level extendable anterior fusion device for lumbar interbody procedures.

Additionally, in June 2022, the FDA granted 510K approval for Aurora Spine’s DEXA SOLO-L posterior fusion device, further advancing innovation in lumbar spine fusion technology. These developments reflect a growing trend toward minimally invasive techniques and device customization, improving surgical outcomes and reducing recovery times.

Opportunities in the market emerge from the increasing adoption of biologics, such as bone graft substitutes, which enhance the fusion process and promote faster healing. Recent advancements also include 3D-printed implants tailored to individual patient anatomy, driving precision and efficacy in spinal fusion surgeries. With the rising demand for technologically advanced solutions, the market continues to offer significant growth potential.

Key Takeaways

- In 2023, the market for Spinal Fusion generated a revenue of US$ 9.9 billion, with a CAGR of 5.3%, and is expected to reach US$ 16.6 billion by the year 2033.

- The product type segment is divided into interbody cages, spinal fusion plates, and pedicle screws & rods, with pedicle screws & rods taking the lead in 2023 with a market share of 46.5%.

- Considering procedure, the market is divided into posterolateral fusion & interbody fusion. Among these, interbody fusion held a significant share of 57.8%.

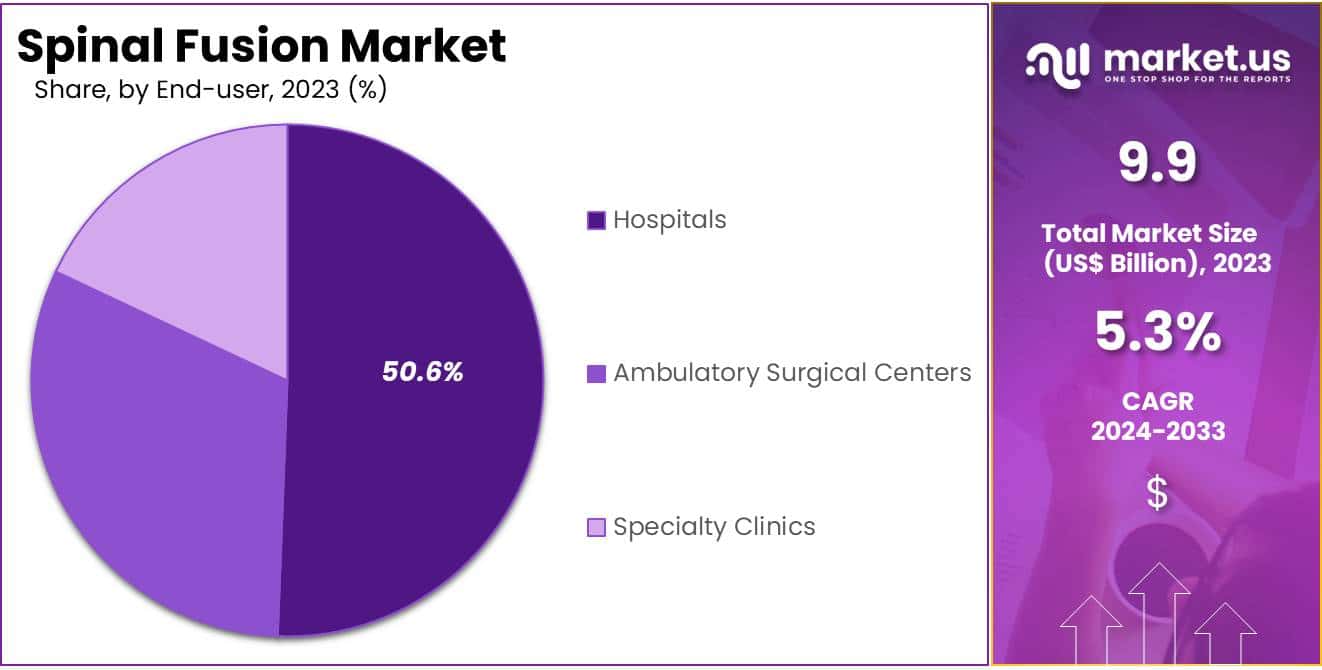

- Furthermore, concerning the end-user segment, the hospitals sector stands out as the dominant player, holding the largest revenue share of 50.6% in the Spinal Fusion market.

- North America led the market by securing a market share of 39.7% in 2023.

Product Type Analysis

The pedicle screws & rods segment led in 2023, claiming a market share of 46.5% owing to the critical role pedicle screws and rods play in providing stability during complex spinal fusion procedures. These devices effectively correct spinal deformities and enhance the structural integrity of the spine post-surgery, making them a preferred choice among surgeons.

The rising prevalence of spinal disorders, such as degenerative disc disease and scoliosis, further drives demand for this segment. Advancements in pedicle screw technology, including minimally invasive designs and materials that promote bone growth, are likely to enhance their adoption.

Increased surgical success rates and reduced recovery times associated with pedicle screws and rods also contribute to their growing market share. As the global population ages, the segment is projected to expand steadily.

Procedure Analysis

The interbody fusion held a significant share of 57.8% due to the procedure’s ability to provide superior spinal stability and maintain disc height, which improves long-term outcomes for patients with degenerative spinal conditions. Surgeons increasingly prefer interbody fusion due to its effectiveness in achieving higher fusion rates and reducing the risk of postoperative complications.

Technological advancements in interbody cages and the introduction of minimally invasive surgical techniques are anticipated to further boost the segment. Additionally, the rising prevalence of spinal disorders and the increasing number of spinal surgeries performed globally contribute to this growth. As healthcare providers focus on optimizing patient outcomes, the interbody fusion segment is likely to see robust expansion.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 50.6% owing to the comprehensive care hospitals provide, including access to advanced surgical technologies and specialized healthcare professionals. Hospitals handle a higher volume of complex spinal fusion procedures, making them a primary choice for patients with severe spinal conditions.

The availability of post-operative care and rehabilitation services further enhances patient outcomes, encouraging more procedures to be performed in hospital settings. Additionally, expanding healthcare infrastructure, particularly in emerging economies, supports the segment’s growth. Hospitals increasingly adopt advanced minimally invasive surgical techniques, which attract patients seeking high-quality care. As the demand for spinal fusion surgeries continues to rise, the hospitals segment is projected to remain a key player in the market.

Key Market Segments

By Product Type

- Interbody Cages

- Spinal Fusion Plates

- Pedicle Screws and Rods

By Procedure

- Posterolateral Fusion

- Interbody Fusion

- Posterior Lumbar Interbody Fusion (PLIF)

- Transformational Lumbar Interbody Fusion (TLIF)

- Anterior Lumbar Interbody Fusion (ALIF)

- Extreme Lateral Interbody Fusion (XLIF)

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centres

- Specialty Clinics

Drivers

Rising Geriatric Population

The rising geriatric population significantly drives growth in the spinal fusion market as older individuals face a higher risk of degenerative spinal conditions, such as spondylosis and spinal stenosis. Age-related wear and tear on the spine often necessitates surgical interventions, including fusion procedures, to alleviate chronic pain and improve mobility. According to World Health Organization estimates from May 2021, one in six people globally will be 60 or older by 2030, with the population in this age group expected to grow from 1 billion in 2020 to 1.4 billion by 2050.

This demographic shift increases the demand for spinal treatments, especially as aging individuals seek to maintain an active lifestyle. Advances in surgical techniques and implant technologies further support the market by enhancing patient outcomes and reducing recovery times. Healthcare systems worldwide are preparing to address the rising prevalence of age-related spinal disorders, bolstering the market’s growth potential. The expanding elderly population presents a critical driver for the sustained demand for spinal fusion procedures.

Restraints

High Cost of Spinal Fusion Surgery

The high cost of spinal fusion surgery significantly hampers the market, as many patients face financial barriers to accessing these procedures. Surgical expenses, which include hospital stays, surgeon fees, and advanced implants, contribute to the substantial overall cost. In the United States, spinal fusion surgeries account for approximately 400,000 procedures annually, with a projected total cost of $32 billion, according to research published in December 2021.

These costs place a heavy burden on healthcare systems and patients, particularly in regions with limited insurance coverage or underdeveloped reimbursement frameworks. Even in developed markets, out-of-pocket expenses can deter individuals from pursuing necessary surgeries. Rising healthcare costs further complicate access, limiting the adoption of spinal fusion as a treatment option. Addressing these financial challenges remains a critical concern, as high costs are anticipated to act as a restraint on market growth, especially in cost-sensitive regions.

Opportunities

Increasing Use of Lumbar Fusion Surgery

Increasing utilization of lumbar fusion surgery creates a promising opportunity for the spinal fusion market as this procedure becomes a standard treatment for various spinal disorders. Lumbar fusion effectively treats conditions such as herniated discs, spondylolisthesis, and chronic lower back pain, providing long-term relief and stability.

Based on research published in December 2021, fusion surgery ranks among the most frequently performed spinal procedures, with approximately 400,000 spinal fusions conducted annually in the United States. This widespread adoption highlights the procedure’s effectiveness and growing preference among both surgeons and patients.

Advancements in minimally invasive techniques and novel biomaterials further enhance the appeal of lumbar fusion by reducing recovery times and improving outcomes. The increasing number of lumbar fusion surgeries aligns with the rising prevalence of spinal disorders, especially among the aging population. As healthcare providers continue to adopt these procedures, the spinal fusion market is projected to experience significant growth driven by this opportunity.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the growth trajectory of the spinal fusion market. Economic expansion in developed regions boosts healthcare spending, driving demand for advanced surgical procedures and devices. However, economic instability and rising inflation in emerging markets limit patient access to high-cost surgeries, curbing market growth.

Geopolitical tensions and trade restrictions disrupt global supply chains, increasing the cost and delaying the delivery of critical medical devices. Additionally, stringent regulatory policies across different regions raise compliance costs and slow down product approvals. On the positive side, increasing awareness about spinal disorders and the availability of advanced healthcare infrastructure in developed economies foster market growth. Supportive government initiatives and ongoing technological advancements continue to create opportunities for innovation and expansion in this sector.

Latest Trends

Impact of Strategic Collaborations and Partnerships on the Spinal Fusion Market

Growing strategic collaborations and partnerships are projected to drive significant advancements in the spinal fusion market. These alliances enable companies to combine expertise, accelerate product development, and expand their market reach. In June 2022, Beijing Fule and Invibio Biomaterial Solutions leveraged their long-standing partnership to introduce an innovative interbody fusion device.

This development marked the launch of China’s first high-performance medical fusion cage, created using PEEK-OPTIMATM HA Enhanced polymers. Such collaborations enhance the adoption of advanced materials and technologies, improving surgical outcomes and patient care.

High demand for cutting-edge spinal solutions and increasing regulatory support for innovative devices further stimulate joint ventures. As partnerships foster innovation, the market is likely to witness accelerated growth and broader adoption of advanced spinal fusion techniques globally.

Regional Analysis

North America is leading the Spinal Fusion Market

North America dominated the market with the highest revenue share of 39.7% owing to advancements in surgical techniques and increasing prevalence of spinal disorders such as scoliosis and degenerative disc disease. The rise in demand for minimally invasive procedures has also contributed to market expansion, as these methods reduce recovery time and post-operative complications.

In October 2022, during the Scoliosis Research Society’s 57th annual meeting, Jennifer M. Bauer from Seattle Children’s Hospital presented research highlighting that a preoperative carbohydrate drink for pediatric spinal fusion patients significantly improved the recovery of intestinal motility post-surgery. Such innovations in patient care have enhanced surgical outcomes and increased adoption of spinal fusion procedures.

Furthermore, the aging population in North America has led to a higher incidence of age-related spinal issues, driving the demand for effective treatment solutions. Combined with increasing healthcare expenditure and favorable reimbursement policies, these factors have bolstered the market’s growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to an aging population and rising incidences of spinal deformities and injuries. According to a September 2022 report by JTC, Japan’s elderly population is noteworthy, with individuals over 75 years accounting for over 15% and those above 65 comprising 29.1% of the total population.

This demographic shift is anticipated to increase the demand for spinal surgeries, including fusion procedures. Improvements in healthcare infrastructure, particularly in developing economies like India and China, are likely to enhance access to advanced surgical interventions. Moreover, government initiatives aimed at improving healthcare access and the rising prevalence of osteoporosis and arthritis further support the growth of this market.

Collaborations between regional hospitals and global medical device manufacturers are expected to drive technological advancements, ensuring broader adoption of spinal fusion procedures across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Spinal Fusion market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the spinal fusion market drive growth by developing advanced surgical technologies, such as minimally invasive procedures and biologics, to improve patient outcomes.

Companies focus on expanding their product portfolios with innovative implants and instrumentation tailored to diverse patient needs. Strategic collaborations with research institutions and healthcare providers facilitate the development of cutting-edge solutions and clinical validation. Businesses also target emerging markets where demand for spinal treatments is rising due to aging populations and increased healthcare access. Robust marketing efforts and educational programs for surgeons enhance adoption and awareness of the latest techniques and products.

Recent Developments

- In August 2024: Zimmer Biomet announced the acquisition of OrthoGrid Systems, Inc., a company specializing in AI-driven surgical guidance for hip surgery. This acquisition includes over 40 patents and two orthopedic applications with FDA clearance, expanding Zimmer Biomet’s offerings in artificial intelligence-based surgical systems. The transaction is expected to close by the end of the fourth quarter of 2024.

- In April 2024: Stryker reported robust financial results for the first quarter of 2024. The company achieved a gross profit of $3.33 billion, representing a 10.5% increase from the previous year, with net earnings rising by 33.1% to $788 million. This financial performance underlines the company’s strong operational capabilities and strategic investments in technology and products for the spinal sector.

Top Key Players in the Spinal Fusion Market

- Zimmer Biomet Holdings, Inc.

- Wenzel Spine, Inc.

- Stryker Corporation, Inc.

- Spineart Geneva SA

- Medtronic Plc

- Johnson & Johnson Services

- Exactech, Inc.

- Centinel Spine, Inc.

Report Scope

Report Features Description Market Value (2023) US$ 9.9 billion Forecast Revenue (2033) US$ 16.6 billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Interbody Cages, Spinal Fusion Plates, and Pedicle Screws & Rods), By Procedure (Posterolateral Fusion & Interbody Fusion (Posterior Lumbar Interbody Fusion (PLIF), Transformational Lumbar Interbody Fusion (TLIF), Anterior Lumbar Interbody Fusion (ALIF), Extreme Lateral Interbody Fusion (XLIF), and Others)), By End-user (Hospitals, Ambulatory Surgical Centers, and Specialty Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet Holdings, Inc., Wenzel Spine, Inc., Stryker Corporation, Inc., Spineart Geneva SA, Medtronic Plc, Johnson & Johnson Services, Exactech, Inc., and Centinel Spine, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zimmer Biomet Holdings, Inc.

- Wenzel Spine, Inc.

- Stryker Corporation, Inc.

- Spineart Geneva SA

- Medtronic Plc

- Johnson & Johnson Services

- Exactech, Inc.

- Centinel Spine, Inc.