Global Soy Protein Market Size, Share and Future Trends Analysis Report By Type (Isolate, Concentrate, Textured Soy Protein), By Form (Powder, Bars, Ready-to-Drink, Capsules and Tablets, Others), By Nature (Organic, Conventional), By End User (Food and Beverages, Animal Feed, Supplements, Others), By Distributional Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148603

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

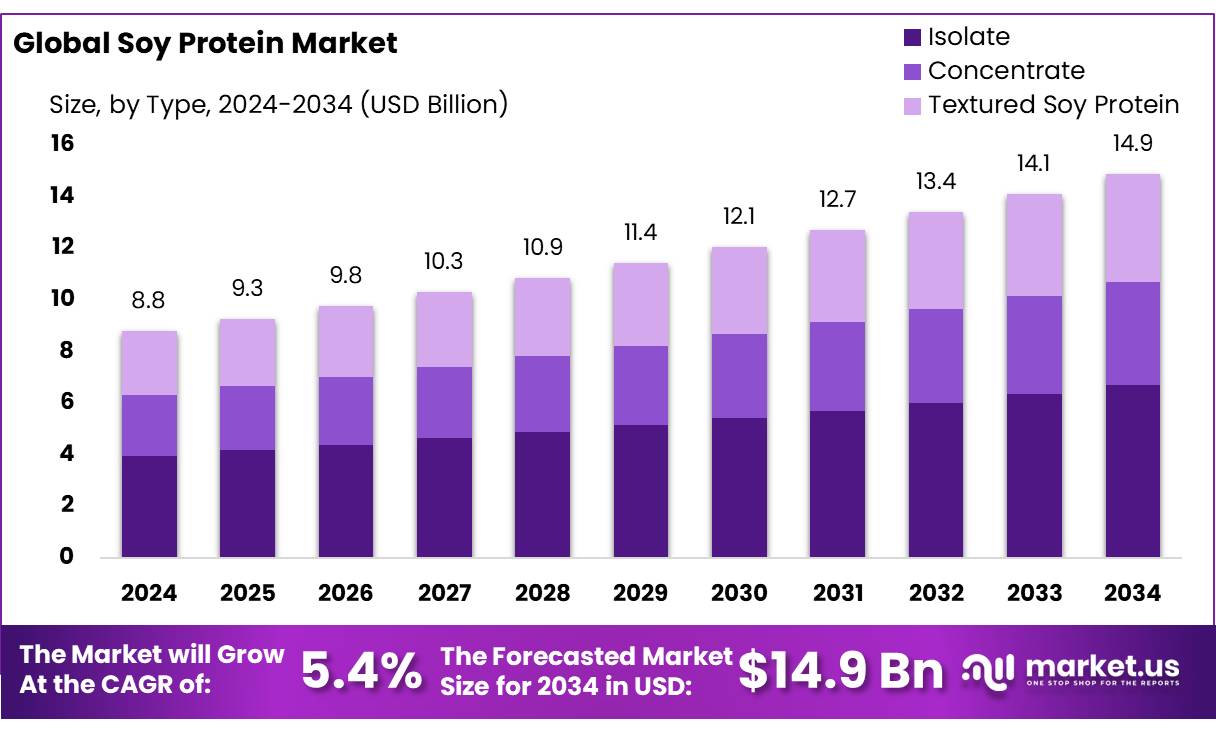

The Global Soy Protein Market size is expected to be worth around USD 14.9 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Soy protein concentrate (SPC) is a high-protein ingredient derived from defatted soybeans, typically containing at least 65% protein on a dry basis. It is produced by removing most of the soluble carbohydrates and non-protein components, resulting in a product rich in essential amino acids. SPC is widely used in food products, animal feed, and industrial applications due to its functional properties such as emulsification, water and fat absorption, and texturizing capabilities.

Government initiatives worldwide are supporting the growth of the SPC market. For instance, the European Union allocated €90 million in 2023 for alternative protein research, including SPCs. In India, the government launched the India Smart Protein Innovation Challenge in collaboration with The Good Food Institute to promote innovation in plant-based foods. Similarly, the Japanese government is advocating for the use of meat alternatives to reduce carbon emissions and achieve a decarbonized society by 2050 .

In the animal feed sector, SPC is gaining traction as a sustainable and efficient protein source. In 2022, swine feed accounted for approximately 48% of global SPC consumption, with China’s swine industry alone utilizing over 1.2 million metric tons annually. The aquaculture industry is also increasingly incorporating SPC, as it can replace up to 50% of fishmeal in salmonid diets, addressing concerns over fishmeal sustainability and cost.

Government initiatives are supporting the growth of the SPC industry. In India, the Ministry of Agriculture reported soybean production of 12 million tons in 2023. Furthermore, the government has incentivized soy product exports through schemes like the Merchandise Exports from India Scheme (MEIS), leading to soy protein exports reaching 1.8 million tons by the first quarter of 2024. These measures have bolstered India’s position in the global soy protein market.

Key Takeaways

- Soy Protein Market size is expected to be worth around USD 14.9 Billion by 2034, from USD 8.8 Billion in 2024, growing at a CAGR of 5.4%.

- Isolate held a dominant market position, capturing more than a 44.9% share in the Soy Protein market.

- Powder held a dominant market position, capturing more than a 74.6% share in the Soy Protein market.

- Conventional held a dominant market position, capturing more than a 72.4% share in the Soy Protein market.

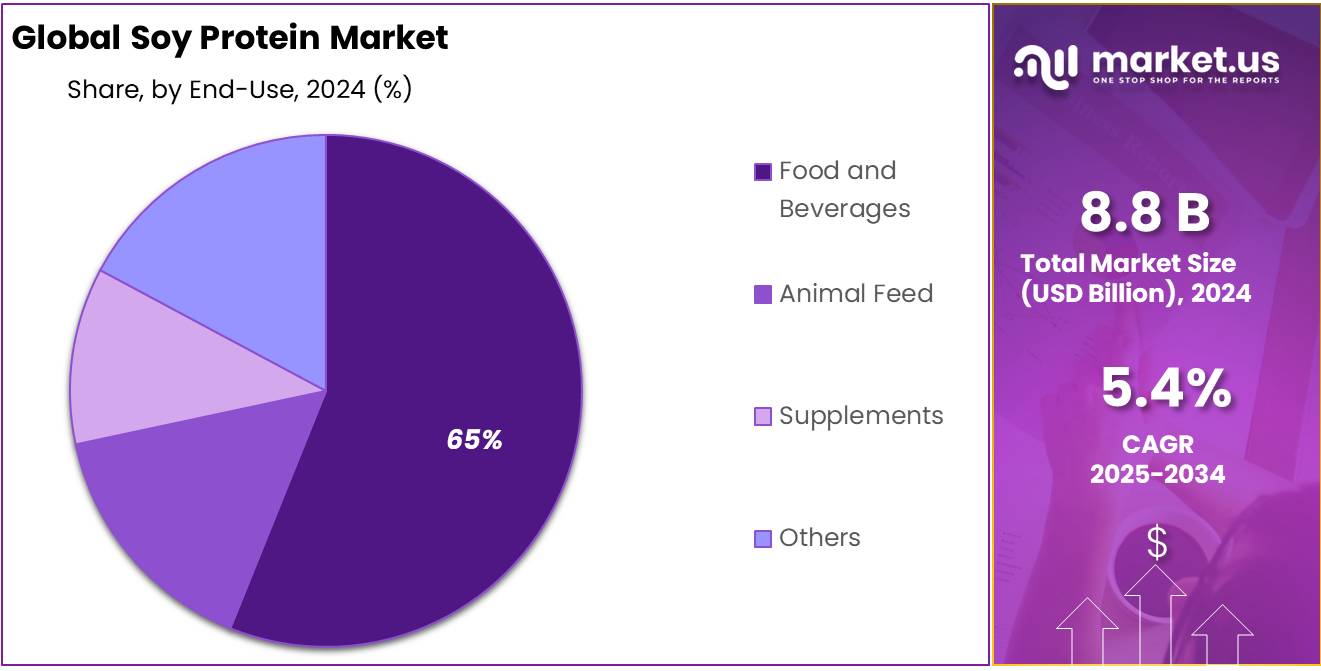

- Food and Beverages held a dominant market position, capturing more than a 65.3% share in the Soy Protein market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 73.9% share in the Soy Protein market.

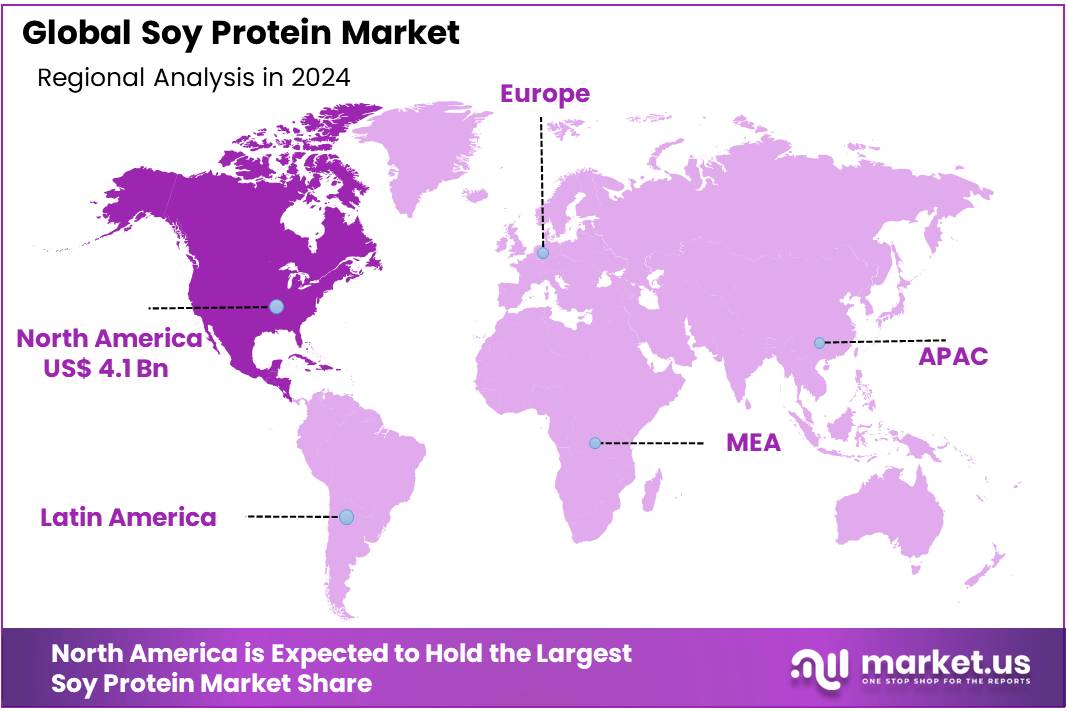

- North America held a dominant position in the global soy protein market, capturing 47.3% of the market share, equivalent to a valuation of approximately USD 4.1 billion.

By Type

Soy Protein Isolate Leads with 44.9% Market Share, Owing to Nutritional Benefits and Versatility

In 2024, Isolate held a dominant market position, capturing more than a 44.9% share in the Soy Protein market. The growing demand for high-protein content products among health-conscious consumers has significantly driven the popularity of soy protein isolates. Known for its superior protein concentration and low-fat content, it is widely utilized in nutritional supplements, protein bars, and sports nutrition products. Additionally, its increasing application in dairy alternatives and meat analogs has further solidified its market position. With rising consumer awareness about plant-based nutrition, the segment is anticipated to maintain its leadership in 2025, driven by ongoing innovations in food processing and expanding product portfolios.

By Form

Soy Protein Powder Dominates with 74.6% Share, Driven by Widespread Application in Supplements

In 2024, Powder held a dominant market position, capturing more than a 74.6% share in the Soy Protein market. The surge in health-conscious consumers seeking high-protein dietary supplements has propelled the demand for soy protein powder. This form is favored for its versatility in formulations, allowing manufacturers to incorporate it into shakes, smoothies, and meal replacements. Additionally, the rising popularity of vegan and plant-based diets has further bolstered its demand, positioning powder as a staple in sports nutrition and functional foods. As the focus on protein-rich diets continues to grow, the segment is expected to retain its leadership in 2025, driven by product innovations and expanding distribution networks.

By Nature

Conventional Soy Protein Leads with 72.4% Share, Catering to Cost-Conscious Consumers

In 2024, Conventional held a dominant market position, capturing more than a 72.4% share in the Soy Protein market. The cost-effectiveness and widespread availability of conventional soy protein have contributed to its significant market penetration. Its extensive application in processed foods, beverages, and nutritional supplements has further solidified its position, particularly among price-sensitive consumers. Additionally, the preference for conventional soy protein in emerging markets, where affordability drives purchasing decisions, has bolstered its market share. In 2025, the segment is anticipated to maintain its leading stance as demand continues to rise in cost-sensitive consumer segments and mass-market food products.

By End User

Food and Beverages Segment Commands 65.3% Share, Boosted by Rising Plant-Based Product Demand

In 2024, Food and Beverages held a dominant market position, capturing more than a 65.3% share in the Soy Protein market. The increasing incorporation of soy protein in dairy alternatives, meat substitutes, and functional foods has driven substantial demand in this segment. Manufacturers are leveraging soy protein’s nutritional profile to develop high-protein snacks, beverages, and ready-to-eat meals, catering to health-conscious consumers and plant-based diet adopters. Additionally, the rising trend of protein fortification in processed foods is expected to further enhance market penetration in 2025, as the segment continues to dominate the end-user landscape in the soy protein industry.

By Distributional Channel

Supermarkets/Hypermarkets Secure 73.9% Share, Driven by Extensive Consumer Reach and Product Visibility

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 73.9% share in the Soy Protein market. The broad reach and extensive shelf space offered by these retail outlets have significantly contributed to the widespread availability of soy protein products. Consumers increasingly prefer supermarkets and hypermarkets for their convenient access to diverse soy protein offerings, including powders, bars, and ready-to-drink shakes. Additionally, strategic product placements and promotional campaigns in these retail settings have further fueled sales, establishing supermarkets and hypermarkets as primary distribution channels. In 2025, the segment is poised to maintain its lead, driven by expanding retail networks and growing consumer awareness of plant-based protein options.

Key Market Segments

By Type

- Isolate

- Concentrate

- Textured Soy Protein

By Form

- Powder

- Bars

- Ready-to-Drink

- Capsules and Tablets

- Others

By Nature

- Organic

- Conventional

By End User

- Food and Beverages

- Bakery

- Beverages

- Breakfast Cereals

- Condiments/Sauces

- Dairy and Dairy Alternative Products

- Others

- Animal Feed

- Supplements

- Baby Food and Infant Formula

- Elderly Nutrition and Medical Nutrition

- Sport/Performance Nutrition

- Others

- Others

By Distributional Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Others

Drivers

Health Benefits Drive Soy Protein Market Growth

One of the key factors propelling the soy protein market is its recognized health benefits, particularly in promoting heart health and reducing cholesterol levels. Numerous studies have demonstrated that incorporating soy protein into the diet can lead to significant health improvements.

For instance, research published in the Journal of the American Heart Association indicates that soy protein consumption is associated with a reduction in LDL cholesterol levels, which is a major risk factor for heart disease. Additionally, the U.S. Food and Drug Administration (FDA) acknowledges that 25 grams of soy protein daily, as part of a diet low in saturated fat and cholesterol, may reduce the risk of heart disease.

Beyond heart health, soy protein is a complete protein, meaning it contains all nine essential amino acids necessary for human nutrition. This makes it an excellent protein source for vegetarians and vegans. Moreover, soy foods are rich in isoflavones, compounds that have been linked to various health benefits, including potential reductions in the risk of certain cancers and improved bone health.

The growing awareness of these health benefits has led to increased consumer demand for soy-based products, such as tofu, soy milk, and soy protein isolates. This trend is further supported by dietary guidelines and health organizations that recommend plant-based proteins as part of a balanced diet.

Restraints

Allergen Concerns Limit Soy Protein Market Expansion

One significant factor restraining the growth of the soy protein market is the prevalence of soy allergies among consumers. Soy is recognized as one of the eight major food allergens, accounting for approximately 0.3% of food allergies in the general population . This prevalence necessitates careful consideration by manufacturers and consumers alike.

In the United States, the Food Allergen Labeling and Consumer Protection Act (FALCPA) mandates that food products containing soy must clearly indicate its presence on labels . This requirement aims to protect consumers with soy allergies by ensuring transparency in food labeling. However, the presence of soy in various processed foods, including baked goods, sauces, and meat substitutes, poses challenges for individuals with soy sensitivities. Even trace amounts can trigger allergic reactions, ranging from mild symptoms like hives to severe anaphylaxis .

The risk of cross-contamination during food processing further complicates the issue. Shared equipment and facilities can inadvertently introduce soy proteins into products that are otherwise soy-free, increasing the risk for allergic individuals. This concern necessitates stringent manufacturing practices and thorough cleaning protocols, which can increase production costs and limit the appeal of soy protein products to manufacturers.

Moreover, the growing awareness of food allergies has led some consumers to seek alternative protein sources perceived as less allergenic, such as pea or rice proteins. This shift in consumer preference can impact the demand for soy protein products, particularly in markets where allergy prevalence is high.

Opportunity

Government Initiatives Fuel Soy Protein Market Growth

One of the major growth opportunities for the soy protein market lies in the increasing support from governments worldwide to promote plant-based proteins as sustainable and nutritious alternatives to animal-based products.

In India, the government has recognized the potential of soy protein in addressing nutritional deficiencies and promoting food security. Initiatives such as the India Smart Protein Innovation Challenge, launched in collaboration with The Good Food Institute (GFI) India, aim to foster innovation in plant-based and cultivated foods. This program encourages students, researchers, and entrepreneurs to develop sustainable protein sources, including soy-based products. Such initiatives not only support the growth of the soy protein market but also align with the country’s goals of improving public health and reducing environmental impact.

Furthermore, the Indian government’s efforts to promote plant-based diets are evident in its support for research and development in this sector. By providing funding and resources for the development of soy protein products, the government is facilitating the expansion of the market. These measures are particularly significant given India’s large vegetarian population and the increasing demand for high-quality, plant-based protein sources.

Globally, other governments are also taking steps to support the plant-based protein industry. For example, the U.S. Food and Drug Administration (FDA) acknowledges that 25 grams of soy protein daily, as part of a diet low in saturated fat and cholesterol, may reduce the risk of heart disease . Such endorsements from reputable health organizations further bolster consumer confidence in soy protein products.

Trends

Innovative Technologies and AI Integration Propel Soy Protein Market Forward

A significant trend shaping the soy protein market is the adoption of advanced technologies, particularly artificial intelligence (AI), to enhance product development and sustainability. Companies are leveraging AI to analyze phytonutrients, aiming to improve the nutritional profile of soy-based products and meet the growing consumer demand for health-conscious options.

One notable example is the use of AI-driven platforms like CropOS, which assist in developing high-yield soy crops with improved protein content. This technology not only boosts crop productivity but also supports eco-friendly agricultural practices by reducing resource consumption.

Furthermore, the integration of AI in processing techniques allows for the optimization of soy protein extraction, resulting in higher purity and better functional properties. These advancements contribute to the creation of soy protein products that cater to various dietary needs, including gluten-free and allergen-free options.

The emphasis on technological innovation aligns with the broader industry goal of promoting sustainable and nutritious plant-based proteins. As consumer preferences continue to evolve, the soy protein market is expected to benefit from these technological strides, offering products that are both healthful and environmentally responsible.

Regional Analysis

In 2024, North America held a dominant position in the global soy protein market, capturing 47.3% of the market share, equivalent to a valuation of approximately USD 4.1 billion. This leadership is primarily attributed to the United States, which accounts for about 84% of the regional market value. The U.S. dominance is driven by its robust food and beverage industry, particularly in the meat and dairy alternatives sector, which constitutes around half of the market share.

Soy protein isolates are the most sought-after form in North America, commanding approximately 44% of the market share in 2024. Their popularity stems from their versatile applications across multiple industries, including meat alternatives, dairy substitutes, and nutritional supplements.

The food and beverages segment dominates the North American soy protein market, holding about 53% of the market share in 2024. Within this segment, meat alternatives stand out, accounting for nearly 46% of the food and beverages application share. The rising consumer demand for plant-based diets and sustainable protein sources has significantly contributed to this trend.

Canada and Mexico also play vital roles in the regional market. Canada, as the seventh-largest soy producer globally, has a strong demand in the food and beverage segment, driven by the growing plant-protein industry and a significant flexitarian population. Mexico, on the other hand, is experiencing rapid growth, particularly in the food and beverages segment, with a projected CAGR of approximately 7% from 2024 to 2029. This growth is fueled by innovations in meat alternatives and increasing consumer awareness of sustainable and healthy protein options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company is a leading player in the soy protein market, renowned for its vast portfolio of protein ingredients. ADM’s soy protein products cater to the food, beverage, and nutrition industries, offering solutions for meat alternatives, dairy substitutes, and protein fortification. With significant investments in research and development, ADM focuses on sustainable soy sourcing and innovation. The company’s expansive global network ensures consistent supply, meeting the growing demand for high-quality plant-based proteins.

Bunge Limited is a key player in the soy protein market, leveraging its global presence to supply soy protein ingredients to food manufacturers. Known for its integrated supply chain, Bunge processes soybeans into protein concentrates and isolates, catering to the food and beverage sectors. The company focuses on sustainable sourcing practices, particularly in North and South America. Bunge’s emphasis on quality assurance and innovation supports the production of high-protein foods, catering to the plant-based and functional food markets.

Cargill Incorporated is a prominent player in the soy protein market, offering a wide range of soy-based ingredients for the food and beverage industry. The company’s soy protein products include isolates, concentrates, and textured soy proteins, widely used in meat substitutes and nutritional supplements. Cargill’s commitment to sustainable sourcing and advanced processing techniques enhances product quality. The company’s strategic collaborations and innovation centers help develop customized protein solutions for global customers.

Top Key Players in the Market

- Archer Daniels Midland Company

- Bunge Limited

- Cargill Incorporated

- CHS Inc

- Costantino & C. spa

- Crown Soya Protein Group

- Dupont

- Fuji Oil Co. Ltd.

- Gushen Biological Technology Group Co. Ltd.

- Ingredion

- Sonic Biochem Extractions Pvt. Ltd

- Wilmar International Ltd.

- The Scoular Company

Recent Developments

In 2024 CHS reported consolidated revenues of $39.3 billion, with net income of $1.1 billion, underscoring its robust presence in the agricultural sector. The company has focused on enhancing its soybean processing capabilities, notably completing a $105 million expansion of its export facility in Myrtle Grove, Louisiana..

In 2024, Cargill Incorporated solidified its position in the soy protein market through strategic investments and a commitment to sustainability. The company reported revenues of $160 billion for the fiscal year, reflecting its expansive operations across the agricultural sector.

Report Scope

Report Features Description Market Value (2024) USD 8.8 Bn Forecast Revenue (2034) USD 14.9 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Isolate, Concentrate, Textured Soy Protein), By Form (Powder, Bars, Ready-to-Drink, Capsules and Tablets, Others), By Nature (Organic, Conventional), By End User (Food and Beverages, Animal Feed, Supplements, Others), By Distributional Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Bunge Limited, Cargill Incorporated, CHS Inc, Costantino & C. spa, Crown Soya Protein Group, Dupont, Fuji Oil Co. Ltd., Gushen Biological Technology Group Co. Ltd., Ingredion, Sonic Biochem Extractions Pvt. Ltd, Wilmar International Ltd., The Scoular Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- Bunge Limited

- Cargill Incorporated

- CHS Inc

- Costantino & C. spa

- Crown Soya Protein Group

- Dupont

- Fuji Oil Co. Ltd.

- Gushen Biological Technology Group Co. Ltd.

- Ingredion

- Sonic Biochem Extractions Pvt. Ltd

- Wilmar International Ltd.

- The Scoular Company