Global Soluble Dietary Fibers Market Size, Share, And Business Benefits By Source (Fruits and vegetables, Cereals and grains, Nuts and seeds), By Type (Inulin, Polydextrose, Pectin, Beta-glucan, Others), By Application (Functional Foods and Beverages, Pharmaceuticals, Animal feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151583

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

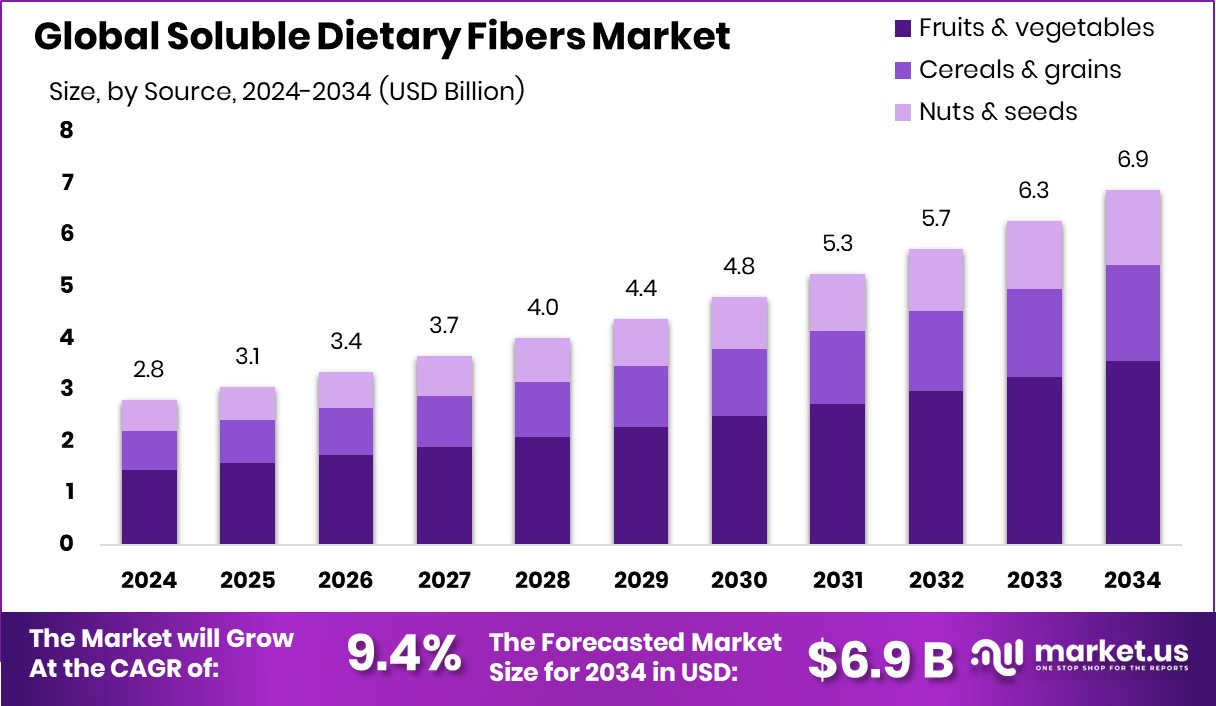

Global Soluble Dietary Fibers Market is expected to be worth around USD 6.9 billion by 2034, up from USD 2.8 billion in 2024, and grow at a CAGR of 9.4% from 2025 to 2034. High fiber awareness and urbanization helped Asia-Pacific reach a 47.9% market share.

Soluble dietary fibers are a type of carbohydrate that dissolves in water to form a gel-like substance in the digestive tract. They are found in foods such as oats, barley, legumes, apples, and psyllium husk. These fibers help slow down digestion, stabilize blood sugar levels, and lower cholesterol. Unlike insoluble fibers, which add bulk to the stool, soluble fibers are especially beneficial for heart health and glycemic control. They also promote the growth of healthy gut bacteria by acting as prebiotics.

The soluble dietary fibers market refers to the commercial sector focused on the production, extraction, and distribution of these fiber components for use in food, beverages, supplements, and pharmaceuticals. Soluble fibers are being widely used in low-calorie, sugar-reduced, and gluten-free products due to their health benefits and technological properties like thickening and water retention. For instance, India’s fruit and vegetable exports recorded a sharp 47.3% rise, supported by APEDA’s financial aid initiatives, reflecting a broader emphasis on functional produce and fiber-rich exports.

The growth of the soluble dietary fibers market is mainly supported by the growing health consciousness among consumers and increasing demand for clean-label products. Public health campaigns encouraging fiber intake have further increased product visibility. Moreover, the rise in lifestyle diseases such as obesity, diabetes, and high cholesterol has created greater awareness around fiber’s role in preventive health. Supporting this trend, startups such as Tight The Nut secured Rs 2 crore in seed funding, while Final Boss Sour raised $3 million, reflecting investor confidence in functional and health-oriented food sectors.

There is a rising demand from both the food and beverage industry as well as the nutraceutical sector. Consumers are actively seeking ingredients that support digestive comfort and immune function. Farmley, a full-stack nuts and dry fruits platform, secured $6 million in Series A funding, indicating strong momentum in the health-focused ingredients space. Simultaneously, Noquo Foods’ €3.25 million seed round to boost plant-based cheese innovation highlights the ongoing shift toward fiber-enhanced, plant-based alternatives.

Key Takeaways

- Global Soluble Dietary Fibers Market is expected to be worth around USD 6.9 billion by 2034, up from USD 2.8 billion in 2024, and grow at a CAGR of 9.4% from 2025 to 2034.

- In 2024, fruits and vegetables accounted for 51.9% of the Soluble Dietary Fibers Market share.

- Inulin held a leading position with 38.2%, driven by its prebiotic benefits and versatility.

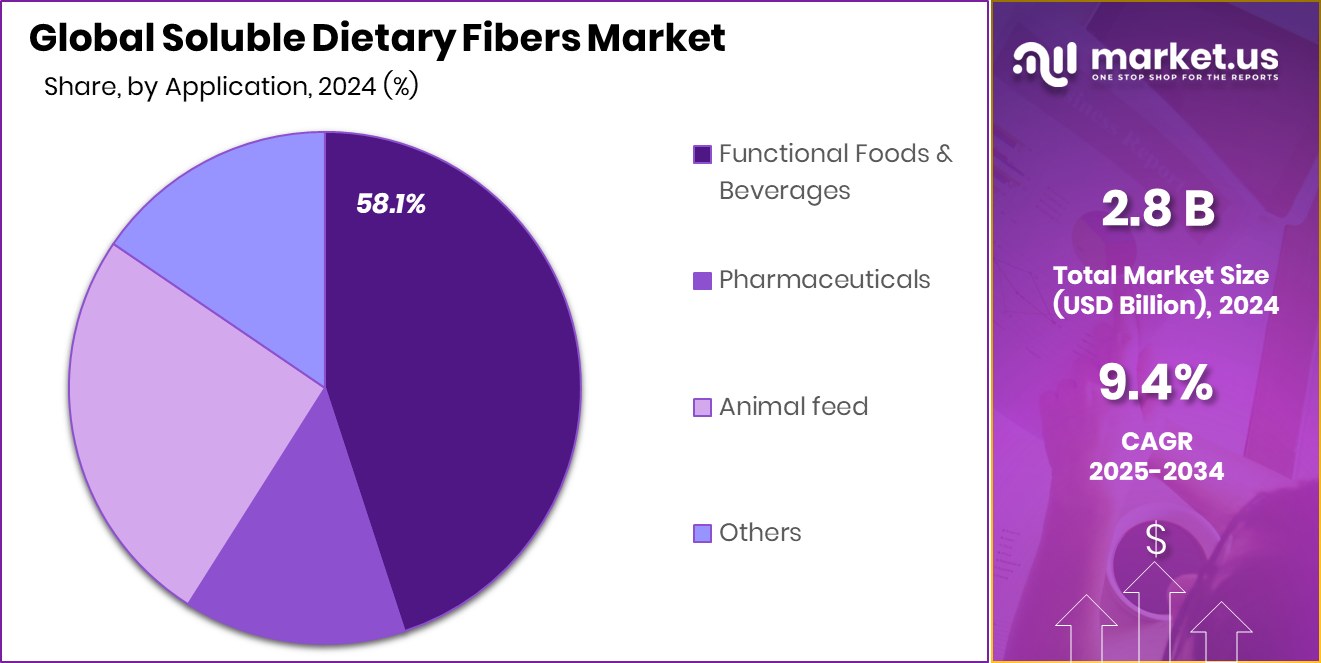

- Functional foods and beverages dominated usage, contributing 58.1% to the Soluble Dietary Fibers Market in 2024.

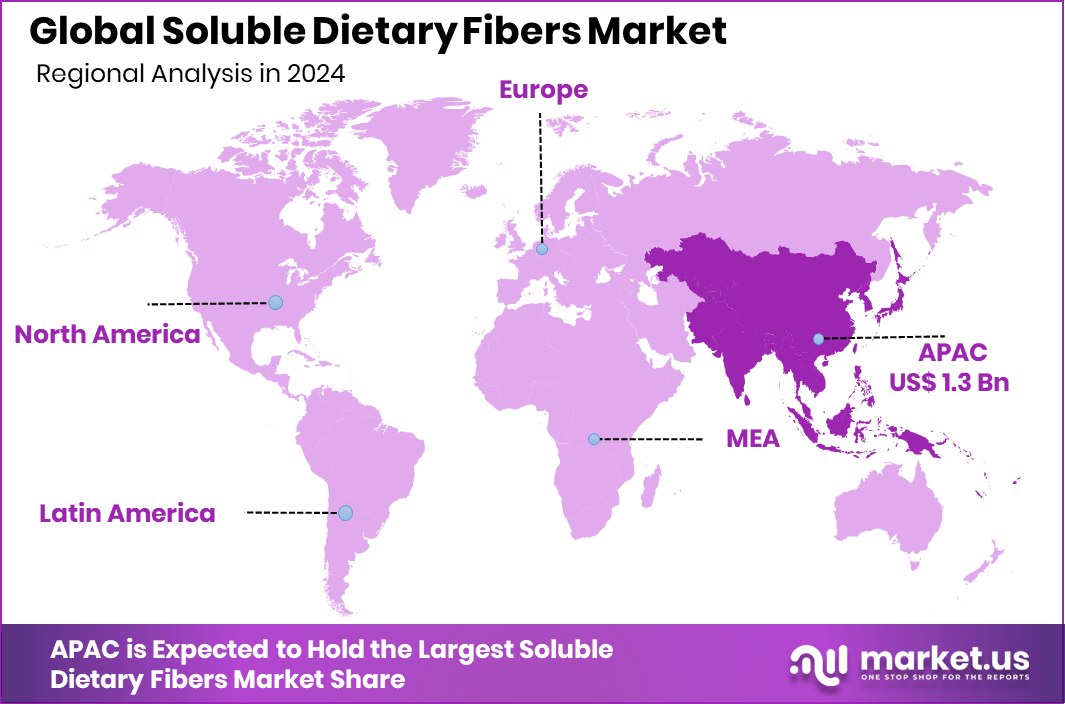

- The Asia-Pacific region recorded a total market value of USD 1.3 billion this year.

By Source Analysis

Fruits and vegetables dominate the Soluble Dietary Fibers Market with a 51.9% share.

In 2024, fruits and vegetables held a dominant market position in the By Source segment of the Soluble Dietary Fibers Market, with a 51.9% share. This significant share reflects the rising consumer inclination toward natural and easily recognizable sources of dietary fiber, particularly in health-conscious and functional food segments.

Fruits and vegetables are widely acknowledged for their rich content of soluble fibers such as pectin, inulin, and gums, which are associated with various health benefits, including cholesterol reduction, improved gut health, and better blood sugar control.

The dominance of this source category is also driven by the clean-label movement, where consumers are increasingly opting for ingredients that are plant-based and minimally processed.

Manufacturers have responded to this demand by incorporating fruit and vegetable-derived fibers into a variety of food and beverage applications, such as smoothies, nutrition bars, and yogurts. Additionally, the widespread availability of raw materials, supported by agricultural practices focused on fruit and vegetable cultivation, ensures a stable supply chain for fiber extraction.

By Type Analysis

Inulin leads the Soluble Dietary Fibers Market, holding a 38.2% market share.

In 2024, Inulin held a dominant market position in the By Type segment of the Soluble Dietary Fibers Market, with a 38.2% share. This leading position can be attributed to the growing popularity of inulin as a multifunctional ingredient, widely recognized for its health benefits and functional versatility.

Extracted mainly from chicory root and certain vegetables, inulin acts as a prebiotic that supports gut health by promoting the growth of beneficial intestinal bacteria. Its ability to improve digestive comfort and enhance calcium absorption has made it a preferred choice in nutritional formulations.

The food industry has increasingly adopted inulin in a range of products, including dairy, bakery, and beverages, due to its slightly sweet flavor and excellent solubility. Its natural origin aligns well with the rising demand for clean-label ingredients, particularly among health-conscious consumers seeking alternatives to synthetic additives. Moreover, inulin’s role in sugar reduction and fat replacement has gained traction in product reformulation efforts targeting calorie-conscious demographics.

By Application Analysis

Functional foods and beverages account for 58.1% of the Soluble Dietary Fibers Market.

In 2024, Functional Foods and Beverages held a dominant market position in the By Application segment of the Soluble Dietary Fibers Market, with a 58.1% share. This dominance reflects the increasing consumer preference for health-oriented food and drink products that offer added nutritional benefits beyond basic sustenance.

Soluble dietary fibers are being widely used in functional foods and beverages due to their ability to support digestive health, improve glycemic response, and enhance satiety—all of which align with current wellness trends.

Manufacturers are incorporating soluble fibers into products such as fortified juices, dairy alternatives, protein bars, and ready-to-drink health beverages. These applications are particularly appealing to health-conscious and aging populations seeking daily dietary solutions for better gut health and metabolic balance. In addition, the clean-label and plant-based product movement has further pushed the inclusion of natural fiber ingredients, such as inulin and pectin, into everyday consumables.

Key Market Segments

By Source

- Fruits and vegetables

- Cereals and grains

- Nuts and seeds

By Type

- Inulin

- Polydextrose

- Pectin

- Beta-glucan

- Others

By Application

- Functional Foods and Beverages

- Pharmaceuticals

- Animal feed

- Others

Driving Factors

Health Awareness Boosts Demand for Soluble Fibers

One of the main drivers of the soluble dietary fibers market is the growing awareness about health and nutrition. People are more informed today about the importance of fiber in their diets, especially for digestion, heart health, and blood sugar control. Soluble fibers help lower cholesterol and support gut health, which makes them a popular choice for people trying to manage weight, diabetes, or digestive issues.

Governments and health organizations are also promoting higher fiber intake in public guidelines, which has led to more demand for fiber-rich food and drinks. As consumers look for natural ways to stay healthy, food makers are adding soluble fibers into products like drinks, snacks, and cereals to meet this growing interest.

Restraining Factors

High Production Costs Limit Market Growth Potential

One key factor holding back the growth of the soluble dietary fibers market is the high production cost. Extracting and refining soluble fibers from natural sources like fruits, vegetables, and grains requires advanced processing methods, special equipment, and careful handling to preserve quality. These processes make the final ingredient more expensive, especially for small and mid-sized food producers.

As a result, many companies hesitate to add soluble fibers to their products due to increased manufacturing costs. This also affects the final price for consumers, making fiber-rich items more costly than regular products. In price-sensitive markets, this becomes a challenge for wider adoption.

Growth Opportunity

Rising Demand in Emerging Urban Health Markets

A significant growth opportunity for the soluble dietary fibers market lies in emerging urban health markets. Rapid urbanization in developing regions is leading to changing lifestyles and increased health awareness. As more people in cities become conscious of digestive wellness, cholesterol management, and blood sugar control, demand for functional food ingredients like soluble fibers is expected to surge.

These consumers are open to trying fortified products such as fiber-enriched snacks, beverages, and dairy alternatives. Food manufacturers can capitalize on this trend by introducing affordable, clean-label products that incorporate soluble fibers tailored to local tastes. Collaborations with local farmers and processing units would help lower costs and improve supply chain efficiency.

Latest Trends

Plant-Based Clean-Label Fibers Gain Popularity Quickly

A key latest trend in the soluble dietary fibers market is the growing preference for plant-based and clean-label ingredients. Consumers today are paying close attention to food labels and favor products made from plants without artificial additives or heavy processing. Soluble fibers from sources like chicory root, oats, and fruits are being highlighted for their natural origin and health benefits.

This trend has prompted food makers to reformulate items—such as cereals, snacks, and drinks—to include recognizable fiber sources, even proudly displaying phrases like “from plants” or “no artificial ingredients” on packaging. The shift reflects a consumer desire for transparency and simplicity, and in turn, the industry is steering toward more naturally-sourced fiber options.

Regional Analysis

In 2024, Asia-Pacific led the market with a 47.9% share, showing strong demand.

In 2024, Asia-Pacific emerged as the dominant region in the Soluble Dietary Fibers Market, capturing 47.9% of the global share and generating a market value of USD 1.3 billion. This strong position can be attributed to the rising health awareness among consumers, increasing urbanization, and growing preference for fiber-rich diets across countries such as China, India, Japan, and South Korea.

The expanding middle-class population and shift toward preventive healthcare have driven the demand for functional foods and beverages enriched with soluble fibers. Governments and health agencies in the region are also promoting balanced nutrition, encouraging the consumption of dietary fiber through national dietary guidelines and awareness campaigns.

In contrast, other regions such as North America and Europe continue to show steady demand but remain behind Asia-Pacific in overall market share. In the Middle East & Africa, and Latin America, the market is still in its emerging phase, supported by growing urban populations and an evolving food and health landscape.

However, Asia-Pacific’s clear lead in both value and volume terms is expected to remain stable, given the region’s ongoing shift toward natural and functional food solutions. The dominance of Asia-Pacific highlights its central role in shaping global trends in fiber-based nutrition.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Cargill Incorporated continued to strengthen its position in the soluble dietary fibers market through innovations in functional ingredients and expanded its fiber portfolio to meet growing demand for clean-label and digestive wellness products. The company focused on corn- and wheat-based fibers, particularly in bakery and beverage applications, where consumer interest in gut health and calorie reduction is accelerating.

Archer Daniels Midland Company (ADM) remained a key player by leveraging its vertically integrated supply chain and strong R&D capabilities. ADM strategically emphasized its Fibersol® range, which is known for enhancing fiber content without affecting taste or texture. ADM’s investment in expanding fiber manufacturing capacities in North America and its co-development with food processors positioned the firm to serve functional food and beverage sectors more competitively in 2024.

Südzucker AG, through its subsidiary Beneo, advanced its leadership in the inulin and oligofructose fiber segments. These chicory-root-based fibers gained traction in European and Asian markets due to their prebiotic properties and compatibility with sugar-reduction initiatives. In 2024, Südzucker’s focus remained on clinical validation of health benefits and regulatory approvals, aligning with rising demand from health-conscious consumers and food manufacturers.

Ingredion Incorporated emphasized plant-based innovation with its PROMITOR® soluble fiber line. The company prioritized high-fiber, low-sugar applications in snacks and dairy alternatives. In 2024, Ingredion expanded partnerships with CPG brands targeting fiber fortification and calorie control, aligning with growing interest in satiety and digestive health.

Top Key Players in the Market

- Cargill Incorporated

- Archer Daniels Midland Company

- Sudzucker AG Company

- Ingredion Incorporated

- Roquette Frères S.A.

- Tate & Lyle PLC

- Royal Cosun U.A.

- Nexira

- Kerry Group PLC

- Tereos

- SunOpta Inc

- FutureCeuticals

- Grain Millers Inc.

- Cosucra Groupe Warcoing

- Sudzucker

Recent Developments

- In January 2025, ADM published results of a groundbreaking pet‑health study showing that combining Fibersol®‑2 with a heat‑treated Bifidobacterium longum strain significantly improved intestinal health in adult cats. This soluble dietary fiber blend supports beneficial bacteria, reduces body fat, and controls odor, offering new opportunities in veterinary nutrition.

- In July 2024, at the Food Ingredients Europe 2024 event in Frankfurt, Cargill introduced Indulgence Redefined. This is a new confectionery alternative to chocolate, combining fiber-rich botanical ingredients with Cargill’s soluble fiber solutions. It promises major sustainability benefits—up to 67% lower carbon footprint—and achieved finalist status in the FiE 2024 Future Foodtech Innovation Award.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 6.9 Billion CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Fruits and vegetables, Cereals and grains, Nuts and seeds), By Type (Inulin, Polydextrose, Pectin, Beta-glucan, Others), By Application (Functional Foods and Beverages, Pharmaceuticals, Animal feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Incorporated, Archer Daniels Midland Company, Sudzucker AG Company, Ingredion Incorporated, Roquette Frères S.A., Tate & Lyle PLC, Royal Cosun U.A., Nexira, Kerry Group PLC, Tereos, SunOpta Inc, FutureCeuticals, Grain Millers Inc., Cosucra Groupe Warcoing, Sudzucker Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Soluble Dietary Fibers MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Soluble Dietary Fibers MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill Incorporated

- Archer Daniels Midland Company

- Sudzucker AG Company

- Ingredion Incorporated

- Roquette Frères S.A.

- Tate & Lyle PLC

- Royal Cosun U.A.

- Nexira

- Kerry Group PLC

- Tereos

- SunOpta Inc

- FutureCeuticals

- Grain Millers Inc.

- Cosucra Groupe Warcoing

- Sudzucker